IT Services M&A Trends: Spring 2024

Published March 25, 2024

Despite the economic turbulence marked by inflation and escalating interest rates in 2023, the IT services sector has shown remarkable tenacity. Valuations have remained strong, underscoring continued investor conviction in the sector’s potential. Industry leaders such as Accenture, Deloitte, Cognizant, and NTT Data, along with private equity firms, have been actively seeking M&A opportunities, with focus on high-growth areas such as cloud computing and data analytics.

One of the defining trends of the year was the rise in cloud-related acquisitions, with hyperscale providers like AWS, Azure, and Google Cloud Platform catalyzing a 20% increase in deal volume. These giants continue to bolster their positions through strategic deals, expanding their capabilities and reach. In parallel, the escalating concerns around cybersecurity is driving M&A activity as industry leaders aim to enhance their capabilities by integrating smaller, specialized firms with advanced security solutions to counteract the evolving cyber threat landscape.

IT Services 2023 Recap

Despite the economic turbulence marked by inflation and escalating interest rates in 2023, the IT services sector has shown remarkable tenacity. Valuations have remained strong, underscoring continued investor conviction in the sector’s potential. Industry leaders such as Accenture, Deloitte, Cognizant, and NTT Data, along with private equity firms, have been actively seeking M&A opportunities, with focus on high-growth areas such as cloud computing and data analytics.

One of the defining trends of the year was the rise in cloud-related acquisitions, with hyperscale providers like AWS, Azure, and Google Cloud Platform catalyzing a 20% increase in deal volume. These giants continue to bolster their positions through strategic deals, expanding their capabilities and reach. In parallel, the escalating concerns around cybersecurity is driving M&A activity as industry leaders aim to enhance their capabilities by integrating smaller, specialized firms with advanced security solutions to counteract the evolving cyber threat landscape.

IT Services 2024 Outlook

Robust Partner Ecosystem:

Building on the momentum of the past year, the partner ecosystem in 2024 remains actively seeking opportunities to implement emerging technologies within vertical markets. Concurrently, technology providers are committed to refining their partner programs to align with the demands of a rapidly changing and unpredictable business environment. A notable trend that is expected to persist in 2024 is the shift away from tier-based programs, traditionally labeled with metals like bronze, silver, gold, and platinum. For example, the new Microsoft Cloud Partner Program replaces the previous Microsoft Partner Network’s silver and gold levels, expanding business model coverage to include Independent Software Vendors (ISVs).

Supporting a Broader Ecosystem:

Partner programs are taking a new approach by acknowledging partners’ needs to collaborate with multiple vendors for solving customer issues. JFrog’s departure from tiered structures aims to simplify partner relationships, allowing them to engage with various vendors easily. This shift is particularly beneficial in DevOps and cybersecurity, where software delivery toolchains and security solutions involve multiple vendors.

Continued Emphasis on Cloud Cost Optimization:

Enterprises made cost optimization a top priority in 2023, amid economic challenges and tight budgets. While some factors such as inflation appear to be easing, industry executives believe organizations will keep a close watch over their IT investments next year. Business leaders in recent years have become mindful of conscious and careful cloud spending, but the current economic climate compels them to pay even more attention to cloud cost management.

Investment in Artificial Intelligence (AI):

Swift advancements in AI will significantly influence the business outlook for consulting firms, MSPs, and systems integrators. AI holds the potential to deliver new capabilities in shorter timeframes, meeting C-Suite demand for a rapid return on investment. According to a survey of technology industry executives, 80% of respondents plan to increase their investment in AI over the next year.

Source: PitchBook, Meridian Research, Tech Target IT Channel

IT Services Selected M&A Activity

Highlighted IT Consulting M&A Transaction

Wipro Acquires Aggne

Feb 2024

EV

$110M

EV/Revenue

6.15x

Target Description: Aggne is a leading consulting and managed services company serving insurance and Insurtech industries. The Company’s services include IP-led consulting, implementation, and managed services with a strong focus on the Duck Creek platform – a full suite of cloud-based, low-code products that enable P&C insurers to fast-track product development.

Investment Rationale: Aggne’s deep expertise and experience in implementing Duck Creek products, combined with Wipro’s scale, insurance industry acumen, and global reach, will greatly benefit their customers.

Highlighted Cybersecurity M&A Transaction

SentinelOne Acquires PingSafe

Jan 2024

EV

$100M

EV/Revenue

NA

Target Description: PingSafe is an operator of a cloud security platform intended to analyze critical vulnerabilities on the cloud and seal them before attackers can take advantage of the weaknesses.

Investment Rationale: SentinelOne’s incorporation of PingSafe extends its reach in cloud security, merging superior cloud workload protection, AI, and analytics with an advanced, full-featured CNAPP.

Highlighted Cloud Computing Services M&A Transaction

Insight Acquires SADA

Dec 2023

EV

$800M

EV/Revenue

NA

Target Description: SADA is a Google Cloud Premier Partner with 10 Google Cloud Specializations, including security, infrastructure, cloud migration, data analytics, application development, location intelligence and machine learning.

Investment Rationale: The acquisition bolsters Insight’s role as a global provider of cloud, data, AI, cybersecurity, and intelligent edge solutions within leading hyperscale ecosystems like Microsoft Azure, Google Cloud, and Amazon Web Services (AWS).

Source: PitchBook Data, Mergermarket, Company Press Releases, Meridian Research

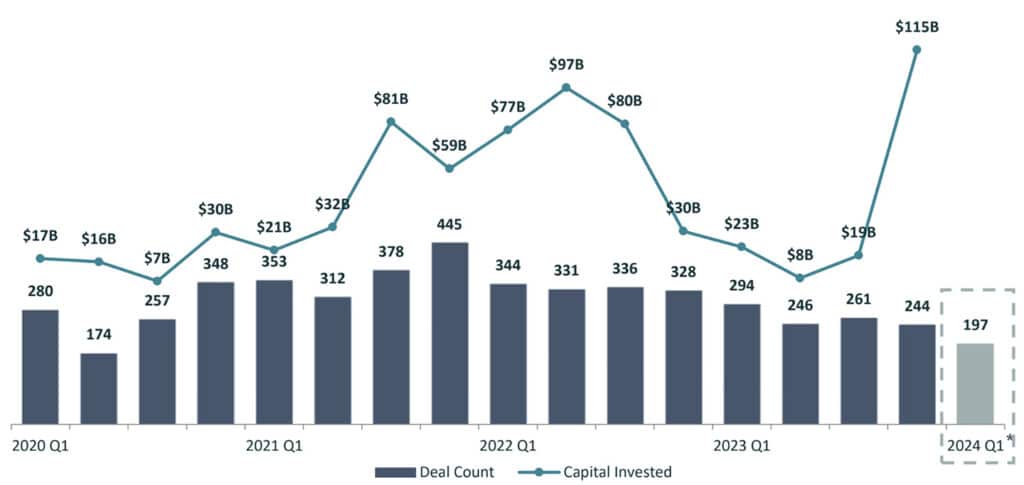

IT Services U.S. M&A Activity

IT Services Public Valuation Multiples and Metrics

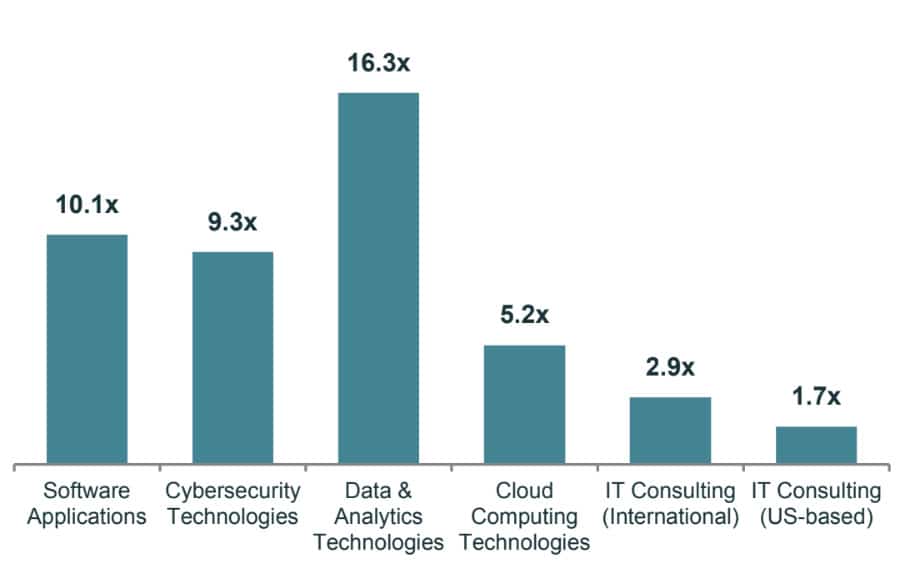

EV / Revenue FY2024E

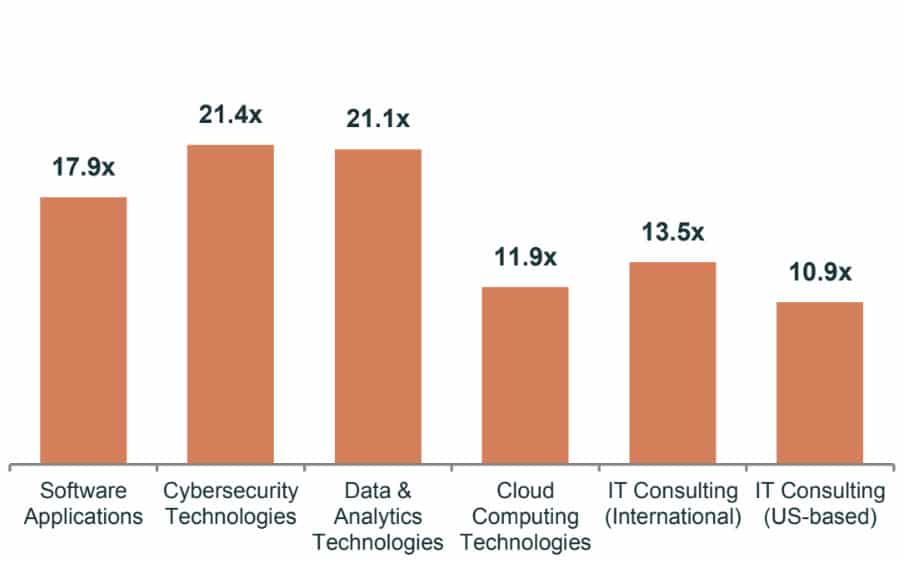

EV / EBITDA FY2024E

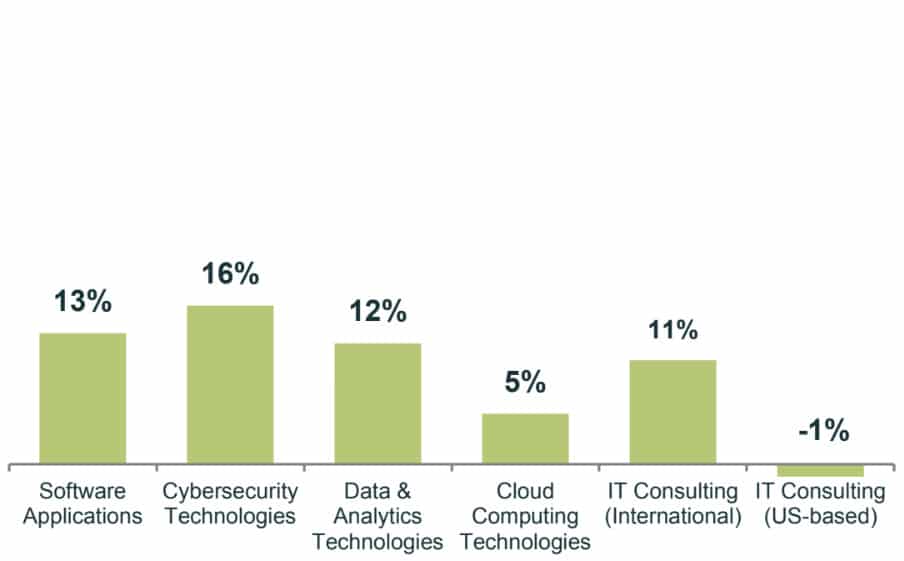

TTM Revenue Growth

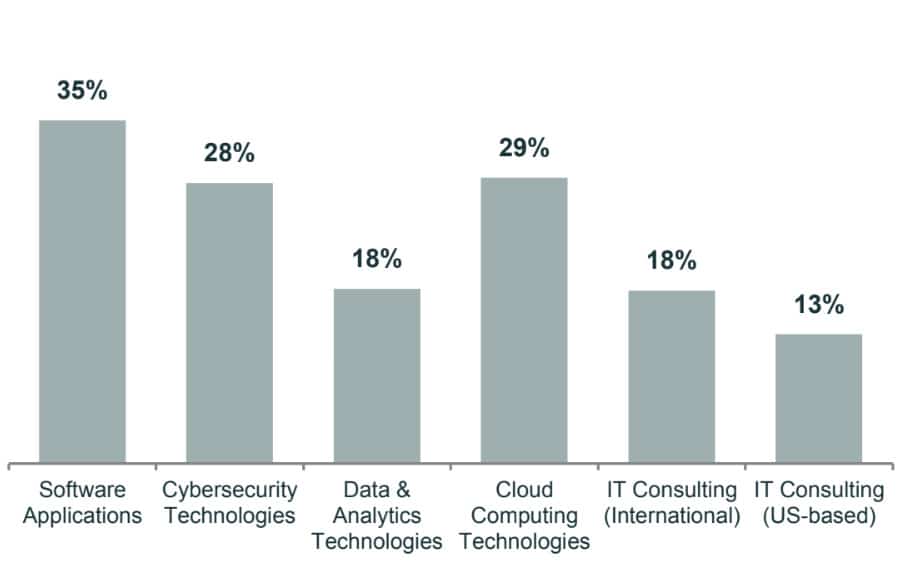

EBITDA Margin FY2024E

As of Mar 20, 2024

Source: PitchBook Data, Mergermarket, Company Press Releases, Meridian Research

Select IT Services M&A Transactions

| Deal Date | Companies | Investors | Description | EV ($ in M) | EV/ Rev | EV / EBITDA |

|---|---|---|---|---|---|---|

| Feb-24 | GalaxE.Solutions | Endava | Provider of IT consulting and security services | $405 | 0.8x | nd |

| Feb-24 | Veritas Technologies (Data Protection Business) | Cohesity | Operator of a data protection business | $3,000 | nd | nd |

| Feb-24 | Aggne | Wipro | Provider of IT consulting services and several proprietary solutions | $110 | 6.2x | nd |

| Feb-24 | Computer Design & Integration | AHEAD (Berkshire Partners) | Provider of IT infrastructure consulting and managed services | $705 | nd | nd |

| Feb-24 | Sophos Solutions | GFT Technologies | Provider of software development and technology consulting services | $95 | nd | nd |

| Jan-24 | Spalding Consulting | Saalex | Provider of Information Technology services | $75 | 1.0x | nd |

| Jan-24 | Cyxtera Technologies | Evoque Data Center Solutions (Brookfield Infrastructure Partners) | Provider of data center colocation and interconnection services | $775 | nd | nd |

| Jan-24 | Thompson Software Solutions | Lynx Software Technologies (OceanSound Partners) | Provider of information technology consulting services | $32 | nd | nd |

| Dec-23 | SADA Systems | Insight Enterprises | Provider of business and cloud technology consulting services | $800 | nd | nd |

| Nov-23 | Nomios | Keensight Capital | Provider of digital infrastructure security and management services | $751 | nd | nd |

| Nov-23 | Cyxtera Technologies | Brookfield Infrastructure Partners, Digital Realty | Provider of data center colocation and interconnection services | $1,300 | nd | nd |

| Nov-23 | Symbio | Aussie Broadband, Superloop | Provider of software development services | $332 | nd | nd |

| Oct-23 | RTX | Blackstone | Provider of information technology services | $1,300 | nd | nd |

| Oct-23 | Compass Datacenters | Brookfield Infrastructure Partners | Developer of data-centers | $5,500 | nd | nd |

| Sep-23 | Bluware | Computer Modelling Group | Provider of technology consulting and development services | $22 | nd | nd |

| Sep-23 | Net@Work | Barings BDC | Provider of business consultancy and IT services | $130 | nd | nd |

| Aug-23 | Sealing Technologies | Parsons | Provider of cyber security services | $200 | nd | nd |

| Aug-23 | ProCom Consulting | Amdocs | Operator of information technology services | $37 | nd | nd |

| Aug-23 | Computer Task Group | Cegeka (Gimv, Noshaq) | Provider of information technology services | $151 | 0.5x | 16.7x |

| Jul-23 | Scalian | Wendel Group | Provider of IT consulting services | $1,066 | 2.0x | nd |

| May-23 | Accuris | Kohlberg Kravis Roberts | Operator of an engineering data and technology company | $975 | 2.0x | nd |

| Apr-23 | Arroyo Consulting | BGSF | Provider of on-shore technology services | $17 | 1.0x | nd |

| Mar-23 | American Virtual Cloud Technologies | Skyvera | Provider of enterprise networking solution and managed services | nd | nd | nd |

| Mar-23 | Mobica | Cognizant Technology Solutions | Provider of integration software engineering and development services | $325 | 4.0x | 21.2x |

| Jan-23 | Amyx | Tetra Tech | Provider of technology support services | $121 | 40.3x | nd |

| Dec-22 | Switch | DigitalBridge Group (IFM Investors) | US-based technology infrastructure company | $10,959 | 16.4x | 16.8x |

| Oct-22 | Ameex | Perficient | Provider of digital technology solutions | $36 | 1.9x | nd |

| Sep-22 | AHEAD | Berkshire Partners | Provider of consulting and enterprise cloud services | $3,000 | 1.2x | 13.0x |

| Sep-22 | ManTech International | The Carlyle Group | Provider of technology solutions and services | $4,153 | 1.6x | 16.3x |

| Aug-22 | Stratus Technologies | SMART Global Holdings | Provider of fault-tolerant server platforms and support solutions | $275 | 1.6x | nd |

| Jul-22 | GlideFast Consulting | ASGN | Provider of IT consulting and development services | $350 | 3.7x | nd |

| Jul-22 | Business IT Source | Computacenter | Provider of IT consulting and equipment services | $76 | 0.3x | nd |

| Jun-22 | Datto | Temasek Holdings (Insight Partners) | Provider of cloud-based software and technology solutions | $6,009 | 9.3x | 53.5x |

| May-22 | CynergisTek | Clearwater Compliance (Altaris Capital Partners) | Provider of cybersecurity, privacy, and compliance services | $16 | 1.0x | nd |

| May-22 | Rizing | Wipro | Provider of SAP functional and technical consulting services | $540 | 2.8x | nd |

| Apr-22 | Convergence Acceleration Solutions | Wipro | Provider of consulting and program management services | $80 | 2.9x | nd |

| Apr-22 | Creative Breakthroughs | Converge Technology Solutions | Provider of IT risk management services | $47 | 0.5x | 6.5x |

| Mar-22 | NetFortris | Sangoma Technologies | Provider of managed IT network services | $80 | 1.6x | nd |

| Mar-22 | CyrusOne | Global Infrastructure Partners (KKR) | Provider of corporate colocation services | $14,654 | 12.2x | 25.1x |

| Mar-22 | Linode | Akamai Technologies | Provide cloud hosting services | $899 | 9.0x | nd |

| Mean | $1,695 | 5.5x | 21.1x | |||

| Medium | $328 | 2.0x | 16.8x |

IT Services Public Valuations

Software Applications

| Company Name | Ticker | 19-Mar-24 Share Price | EV | YoY Rev Growth | EBITDA Margin | FY 2024E Rev | FY 2024E EBITDA | EV / FY 2024E Rev | EV / FY2024E EBITDA |

|---|---|---|---|---|---|---|---|---|---|

| Oracle | NYS: ORCL | $129 | $441,520 | 9% | 48% | $49,856 | $24,024 | 8.9x | 18.4x |

| Salesforce | NYS: CRM | $301 | $295,021 | 11% | 39% | $34,800 | $14,130 | 8.5x | 20.9x |

| SAP | ETR: SAP | $188 | $219,310 | 6% | 29% | $33,823 | $9,680 | 6.5x | 22.7x |

| ServiceNow | NYS: NOW | $757 | $153,027 | 24% | 32% | $8,938 | $2,981 | 17.1x | NM |

| Workday | NAS: WDAY | $273 | $67,969 | 17% | 26% | $7,254 | $1,951 | 9.4x | NM |

| Mean | $330 | $235,369 | 13% | 35% | $26,934 | $10,553 | 10.1x | 17.9x | |

| Median | $273 | $219,310 | 11% | 32% | $33,823 | $9,680 | 8.9x | 18.4x |

Cybersecurity Technologies

| Company Name | Ticker | 19-Mar-24 Share Price | EV | YoY Rev Growth | EBITDA Margin | FY 2024E Rev | FY 2024E EBITDA | EV / FY 2024E Rev | EV / FY2024E EBITDA |

|---|---|---|---|---|---|---|---|---|---|

| Cisco Systems | NAS: CSCO | $49 | $186,769 | 8% | 36% | $56,844 | $20,399 | 3.3x | 9.2x |

| CrowdStrike Holdings | NAS: CRWD | $321 | $75,491 | 36% | 25% | $3,050 | $756 | 24.7x | NM |

| Fortinet | NAS: FTNT | $68 | $51,984 | 20% | 30% | $5,302 | $1,562 | 9.8x | 33.3x |

| F5 Networks | NAS: FFIV | $189 | $10,807 | 4% | 35% | $2,808 | $943 | 3.8x | 11.5x |

| Rapid7 | NAS: RPD | $51 | $3,734 | 14% | 16% | $774 | $118 | 4.8x | 31.7x |

| Mean | $136 | $65,757 | 16% | 28% | $13,756 | $4,755 | 9.3x | 21.4x | |

| Median | $68 | $51,984 | 14% | 30% | $3,050 | $943 | 4.8x | 21.6x |

Data & Analytics Technologies

| Company Name | Ticker | 19-Mar-24 Share Price | EV | YoY Rev Growth | EBITDA Margin | FY 2024E Rev | FY 2024E EBITDA | EV / FY 2024E Rev | EV / FY2024E EBITDA |

|---|---|---|---|---|---|---|---|---|---|

| Snowflake | NYS: SNOW | $158 | $48,103 | 41% | 6% | $2,794 | $289 | 17.2x | NM |

| MicroStrategy | NAS: MSTR | $1,418 | $25,679 | (1%) | 16% | $505 | $84 | 50.9x | NM |

| Informatica | NYS: INFA | $35 | $10,914 | 6% | 30% | $1,582 | $457 | 6.9x | 23.9x |

| Teradata | NYS: TDC | $38 | $4,063 | 2% | 21% | $1,832 | $438 | 2.2x | 9.3x |

| Alteryx | NYS: AYX | $48 | $3,984 | 13% | 16% | $957 | $132 | 4.2x | 30.2x |

| Mean | $339 | $18,549 | 12% | 18% | $1,534 | $280 | 16.3x | 21.1x | |

| Median | $48 | $10,914 | 6% | 16% | $1,582 | $289 | 6.9x | 23.9x |

Cloud Computing Technologies

| Company Name | Ticker | 19-Mar-24 Share Price | EV | YoY Rev Growth | EBITDA Margin | FY 2024E Rev | FY 2024E EBITDA | EV / FY 2024E Rev | EV / FY2024E EBITDA |

|---|---|---|---|---|---|---|---|---|---|

| Microsoft | NAS: MSFT | $421 | $3,153,218 | 12% | 56% | $211,548 | $103,381 | 14.9x | NM |

| Alphabet | NAS: GOOGL | $147 | $1,788,104 | 9% | 38% | $306,237 | $122,556 | 5.8x | 14.6x |

| Amazon.com | NAS: AMZN | $176 | $1,894,374 | 12% | 19% | $570,873 | $105,893 | 3.3x | 17.9x |

| Alibaba Group | HKG: 09988 | $9 | $123,903 | 7% | 21% | $126,233 | $23,992 | 1.0x | 5.2x |

| Dell Technologies | NYS: DELL | $108 | $98,422 | (13%) | 11% | $88,286 | $9,946 | 1.1x | 9.9x |

| Mean | $172 | $1,411,604 | 5% | 29% | $260,636 | $73,154 | 5.2x | 11.9x | |

| Median | $147 | $1,788,104 | 9% | 21% | $211,548 | $103,381 | 3.3x | 12.2x |

IT Consulting (International)

| Company Name | Ticker | 19-Mar-24 Share Price | EV | YoY Rev Growth | EBITDA Margin | FY 2024E Rev | FY 2024E EBITDA | EV / FY 2024E Rev | EV / FY2024E EBITDA |

|---|---|---|---|---|---|---|---|---|---|

| Tata Consultancy Services | NSE: TCS | $48 | $170,715 | 10% | 27% | $28,078 | $7,368 | 6.1x | 23.2x |

| Infosys | NSE: INFY | $19 | $76,342 | 3% | NA | $18,212 | $4,560 | 4.2x | 16.7x |

| HCL Technologies | NSE: HCLTECH | $19 | $50,341 | 11% | 24% | $12,635 | $3,005 | 4.0x | 16.8x |

| Capgemini | PAR: CAP | $242 | $46,197 | 2% | 16% | $24,371 | $3,984 | 1.9x | 11.6x |

| Wipro | NSE: WIPRO | $6 | $30,524 | 8% | NA | $11,269 | $2,204 | 2.7x | 13.8x |

| NTT Data | TKS: 9613 | $16 | $35,932 | 37% | 14% | $25,780 | $3,934 | 1.4x | 9.1x |

| Atos | PAR: ATO | $2 | $3,850 | 3% | 7% | $11,924 | $1,072 | 0.3x | 3.6x |

| Mean | $50 | $59,129 | 11% | 18% | $18,895 | $3,733 | 2.9x | 13.5x | |

| Median | $19 | $46,197 | 8% | 16% | $18,212 | $3,934 | 2.7x | 13.8x |

IT Consulting (US based)

| Company Name | Ticker | 19-Mar-24 Share Price | EV | YoY Rev Growth | EBITDA Margin | FY 2024E Rev | FY 2024E EBITDA | EV / FY 2024E Rev | EV / FY2024E EBITDA |

|---|---|---|---|---|---|---|---|---|---|

| Accenture | NYS: ACN | $378 | $237,244 | 4% | 18% | $64,180 | $12,679 | 3.7x | 18.7x |

| Cognizant Technology Solutions | NAS: CTSH | $75 | $36,378 | (0%) | 19% | $19,349 | $3,322 | 1.9x | 11.0x |

| EPAM Systems | NYS: EPAM | $296 | $15,540 | (3%) | 17% | $4,671 | $825 | 3.3x | 18.8x |

| Kyndryl Holdings | NYS: KD | $22 | $7,532 | (4%) | 14% | $16,921 | $1,941 | 0.4x | 3.9x |

| ASGN | NYS: ASGN | $103 | $5,935 | (3%) | 12% | $4,430 | $514 | 1.3x | 11.5x |

| DXC Technology | NYS: DXC | $21 | $7,995 | (7%) | 3% | $14,708 | $2,269 | 0.5x | 3.5x |

| Huron Consulting Group | NAS: HURN | $95 | $2,229 | 21% | 12% | $1,365 | $168 | 1.6x | 13.3x |

| Rackspace Technology | NAS: RXT | $2 | $3,585 | (5%) | 13% | $2,952 | $385 | 1.2x | 9.3x |

| ThoughtWorks | NAS: TWKS | $2 | $994 | (13%) | 10% | $1,142 | $129 | 0.9x | 7.7x |

| Mean | $110 | $35,270 | -1% | 13% | $14,413 | $2,470 | 1.7x | 10.9x | |

| Median | $75 | $7,532 | -3% | 13% | $4,671 | $825 | 1.3x | 11.0x |

($ in millions)

Note: “NM” indicates companies with evolving profitability; excluded from average EBITDA calculations to avoid misleading results

As of Mar 19, 2024

Source: PitchBook Data, Mergermarket, Company Press Releases, Meridian Research

Case Study: Meridian Capital Advises Accelalpha On Its Recapitalization By Century Park Capital Partners

Utilizing a Multi-phase Process in Response to Strategic Interest

Meridian Capital LLC, a leading middle market capital sourcing and M&A advisory firm is excited to announce the successful recapitalization of its client, Accelalpha, Inc. (“Accelalpha”) by Century Park Capital Partners (“Century Park”).

Accelalpha is a premier business and IT consulting firm providing services across a breadth of industries including retail, technology, automotive, and aerospace and defense. The Company primarily focuses on providing end-to-end enterprise solution implementation services. With offices in the U.S., India, and Europe, Accelalpha has established a market-leading position across multiple practice areas serving blue-chip clients around the world.

Patrick Ringland, Managing Director and Head of the Technology Practice at Meridian Capital, stated, “Working with Ganesh and the Accelalpha team has been an absolute pleasure. They have built out deep practice areas and executed their strategic initiatives brilliantly, earning them a deserved, market-leading position. We’re thrilled with the outcome for the shareholders and look forward to seeing what the Company can achieve in its next chapter.”

“Meridian Capital has served as a valuable advisor over the past few years and played a critical role in attaining a successful result. The team remained unwavering in its dedication to achieve the best outcome for shareholders. Their experience navigating and negotiating the details and complexities of the transaction proved invaluable. We are very proud of what we have achieved up to this point and look forward to the next phase of our Company’s growth story alongside Century Park.”

Nat Ganesh, CEO and Founder

Accelalpha