IT Services M&A Trends: Fall 2023

Published October 18, 2023

Key Insights

-

IT Services Market Overview & M&A Activity

-

IT Services Trends and Sub-sector Overviews on: Application Partners, Cybersecurity Services, Managed Service Providers, Public Cloud Partners, and Software Development

-

IT Services Public Valuation Multiples and Metrics

IT Services Market Overview

Market Commentary

- Global IT spending is anticipated to reach $4.7 trillion in 2023 as CIOs face ongoing difficulty in securing IT talent, they emphasize technologies which promote automation and efficiency to enable scalable growth with a reduced workforce

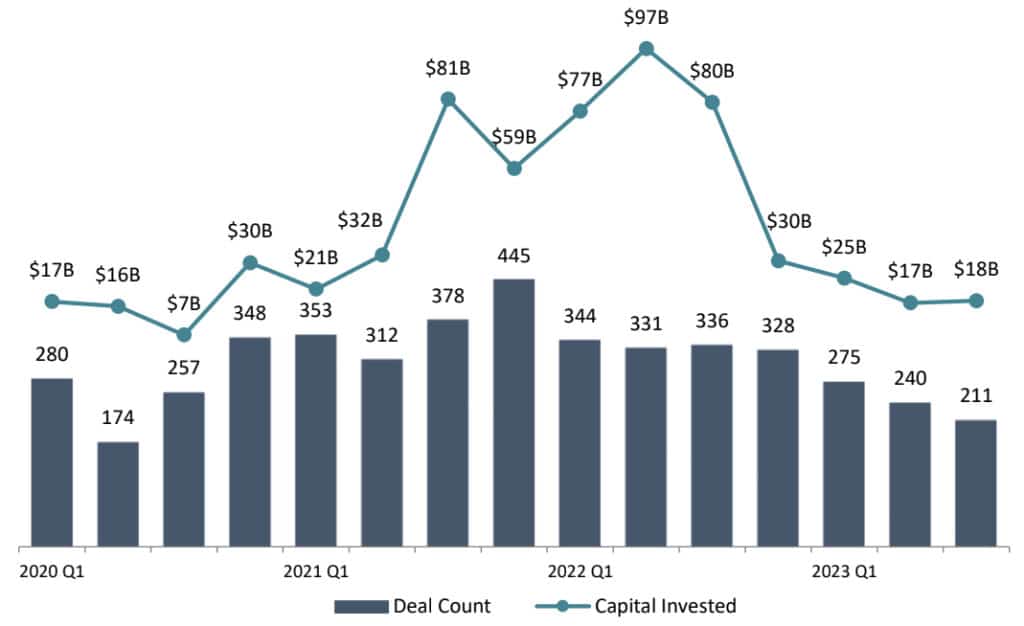

- Historical transaction volumes in 2021 and 2022 were largely driven by private equity establishing platform investments and executing roll-up strategies amidst a low interest rate backdrop. Among strategic buyers, there was an uptick in both first-time acquirers and the number of companies making multiple acquisitions within a single year

- Caution among buyers in response to macroeconomic factors and reduced spending forecasts is apparent in lower 2023 M&A activity. Though buyers are being more selective in their acquisitions, there is continued interest in high-quality assets despite the ongoing economic slowdown

IT Services U.S. M&A Activity

Key IT Services Trends

Growing Security Risks

With high risks from cyberattacks that lead to substantial financial and reputational harm for businesses, cybersecurity plays a critical role

Modernized Systems

The rapid evolution of technology demands a highly-prioritized modernization of legacy infrastructure

Cloud Maturation

Cloud-based data platforms and workflow management tools are critical to business agility operations

Consolidation in MSP

The MSP and MSSP subsegment, which is highly fragmented among approximately 50,000 regional players in the USA, is undergoing rapid consolidation

Application Partner Ecosystem

High demand for new age competencies in cloud services, enterprise software, and cybersecurity ecosystems

Source: Pitchbook, MordorIntelligence,Gartner, EY Tech Insights Series

IT Services Subsectors Overview

Application Partners

Companies offering support and customization services for enterprise software applications like Atlassian, SAP, and Oracle, including resale and implementation

Cybersecurity Services

Companies offering managed security services, managed detection and response, as well as governance, risk, and compliance solutions

Managed Service Providers

MSPs oversee the design, implementation, and maintenance of network, application, infrastructure, and security for enterprises

Public Cloud Partners

Companies focused on the implementation, optimization, and maintenance of cloud capabilities supporting cloud providers such as AWS, Microsoft Azure, and Google Cloud

Software Development

Companies providing outsourced software development and product engineering services delivered both on and offshore

Highlighted Subsectors – Application Partners

Market Commentary

- Partner ecosystems are networks of 3rd party companies that have been designated by a technology platform as a preferred partner for customers to use as providers of integration, consulting, or implementation services for their products

- Top-tier enterprise software companies depend on partner networks to market, implement their products, and guarantee customer success through the provision of professional services

- M&A activity within the IT services space is being driven by an increase in “partner ecosystem” consolidation

- Private equity-backed portfolio companies have been leading consolidation in the space through acquisitions as they acquire designated service partners to immediately establish or expand an offering in a particular technology or end market

Representative Ecosystems

| Company | 2022 Revenue ($M) | # of Ecosystem Partners | # of Elite Designated Partners |

|---|---|---|---|

| $42,440 | 25,000+ | 18 | |

| $32,562 | 500+ | 70+ |

| $31,352 | 1,900+ | No Segmentation |

| $7,245 | 800+ | No Segmentation | |

| $2,803 | 500+ | 30+ | |

Select M&A Transactions

| Date | Acquirer | Target | Target Description |

|---|---|---|---|

| Sep-23 |  |  | Atlassian Platinum partner with a proven track record of helping clients achieve enterprise agility |

| Sep-23 |  | IT consultancy specializing in enriching the Salesforce platform for its clients | |

| Sep-23 |  | Solution provider building partnerships with vendors, including Cisco, VMWare, and NetApp | |

| Jul-23 |  |  | Provider of Oracle Cloud and PeopleSoft solutions |

| Jun-23 |  | One of Germany’s largest Atlassian Platinum and Enterprise Solution Partners | |

| Jun-23 |  | Leading Salesforce consultancy and data analytics company in the US and India | |

Source: Pitchbook

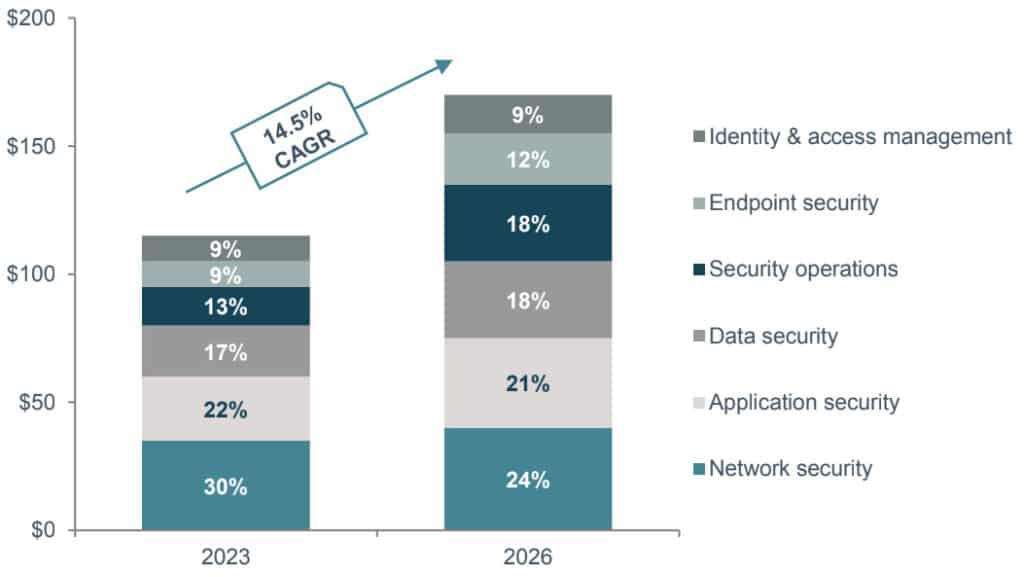

Highlighted Subsectors – Cybersecurity Services

Market Commentary

- Cybersecurity is a rapidly developing space in which customer needs can change quickly, driven by emerging threats and external factors, such as the March 2023 SEC proposal to force financial firms to significantly bolster their cybersecurity protection & reporting standards

- There has been an approximately 150% increase in deal volume for Cybersecurity and Managed Security Service Providers (MSSP) compared to 2020. This exponential growth is primarily fueled by MSSPs looking to broaden their presence in various regions or acquire talent in rapidly expanding sectors like XDR (Extended Detection and Response)

- Cyberattacks in 2022 increased by 38%, and it is projected that the annual financial impact of these cyberattacks is expected to reach around $11 trillion by 2025

Infosec Software Market Size Estimate ($B)

Select M&A Transactions

| Date | Acquirer | Target | Target Description |

|---|---|---|---|

| Sep-23 |  |  | Developer of a platform to simplify local networks, cloud infrastructures, and business applications |

| Aug-23 |  | Provider of cybersecurity services to support the federal government and private industries | |

| Aug-23 |  | Provider of cybersecurity consulting services | |

| Jul-23 |  | Provider of cybersecurity services based on military intelligence experience | |

| Jul-23 |  |  | Provider of managed security services intended to serve healthcare and other industries |

| Jun-23 |  |  | Provider of cyber security services intended for digital operations of businesses |

Source: Pitchbook, EY Tech Insights Series, Health IT Security

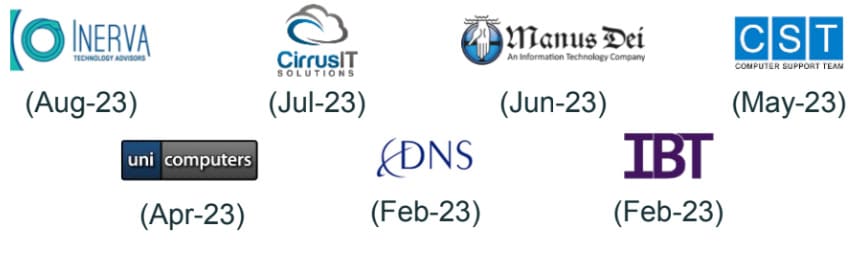

Highlighted Subsectors – Managed Service Providers

Market Commentary

- The MSP subsector continues to be one of the hottest spaces in IT services

- According to Pitchbook, there have been 111 M&A events related to managed service provides through the first nine months of 2023

- M&A activity is being driven primarily by tuck-in acquisitions as established platforms look to expand geographic reach, customer niches, or scale

Acquirer Spotlight – The 20 MSP

Year Founded: 2013

Headquarters: Plano, TX

Acquisitions to Date: 30+

Description: The 20 MSP acquires managed service providers and operates them under their own brand while providing them with additional resources for success

The 20 MSP Acquisitions – 2023 YTD

Select M&A Transactions

| Date | Acquirer | Target | Target Description |

|---|---|---|---|

| Jul-23 |  |  | Provider of managed IT services for the healthcare sector |

| Jul-23 |  |  | Provider of managed IT services, networking services, and cloud services |

| Jul-23 |  | Provider of managed customer and technology support services and security solutions | |

| Jun-23 |  | Provider of IT services and cybersecurity solutions to Midwest enterprises | |

| Jun-23 |  | Peak Capital Associates | Provider of IT and cloud services for mid-size organizations |

Source: Pitchbook

Highlighted Subsectors – Public Cloud Partners

Market Commentary

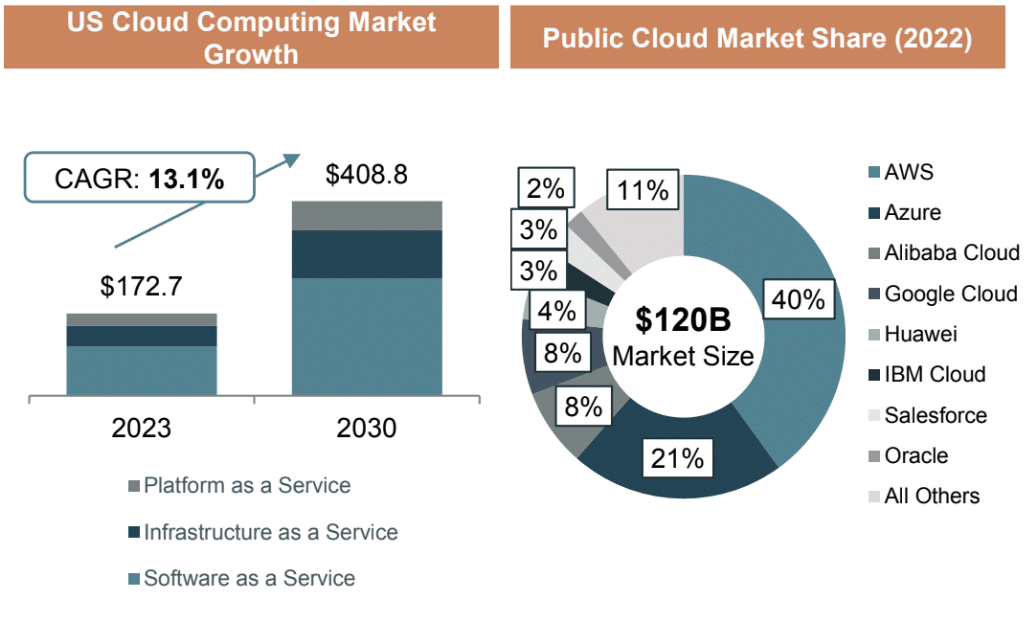

- The US cloud computing services market is expected to reach $409B by 2030, growing at a CAGR of 13.1%

- Market growth is driven by factors such as the ability of cloud solutions to improve business performance and large companies quickly adopting cloud services due to on-demand availability

- Key players such as AWS, Microsoft Azure, and Google Cloud continue to expand their service offerings, with cloud services now representing a substantial portion of each company’s overall business

- The implementation and management of cloud computing technology is highly technical, with firms becoming increasingly reliant on 3rd-parties to create and support infrastructure

Market Growth and Share ($B)

Select M&A Transactions

| Date | Acquirer | Target | Target Description |

|---|---|---|---|

| Sep-23 |  | AWS Premier Partner focused on providing IT consulting and cloud management services | |

| Sep-23 |  |  | Microsoft Cloud Partner that provides managed cloud information services |

| Aug-23 | Developer of cloud-based business management solutions | ||

| Jul-23 |  |  | Microsoft Cloud Partner offering cybersecurity, strategy, and cloud solutions |

| Jul-23 |  | Provider of cloud, IT, and security services | |

| Jun-23 | AWS Premier Partner focused on cloud-native innovation and predictive analytics | ||

Source: Pitchbook, Grand View Research

Highlighted Subsectors – Software Development

Market Commentary

- Software development services are seeing an increase in interest as outsourcing software development is often more flexible, faster, and cost-effective than in-house development

- Also driving market growth is the demand for software applications that accelerate, simplify, and automate business operations using IoT and cloud-based solutions

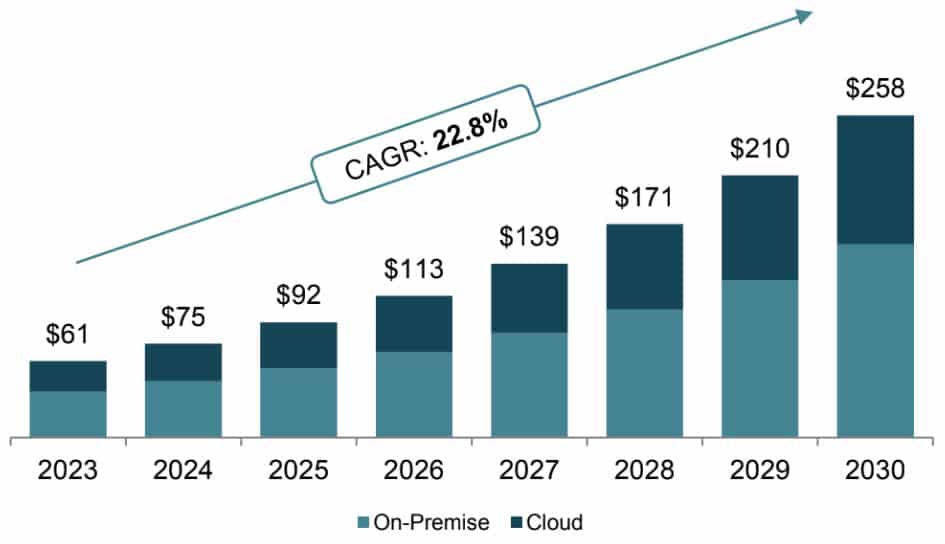

- The US application software development market is expected to grow at a CAGR of 22.8% between 2023 and 2030, reaching a total market size of $257.6B

- Private equity-backed firms and strategic acquirers alike continue to deploy capital to acquire software development firms, with $28.6B being spent on deals in 2023 as of September

US Application Software Development Market ($B)

Select M&A Transactions

| Date | Acquirer | Target | Target Description |

|---|---|---|---|

| Sep-23 |  | Developer of enterprise software and business consultancy services | |

| Sep-23 |  |  | Operator of technology and consulting firm focused on application development |

| Sep-23 |  |  | Provider of advanced analytic, data science, and application development services |

| Aug-23 |  |  | Provider of digital engineering and information services to assist with software development |

| Aug-23 |  | Professional services firm specializing in designing and developing software | |

| Aug-23 |  | Provider of software product development and generative AI services | |

Source: Pitchbook, Grand View Research

IT Services Public Valuation Multiples and Metrics

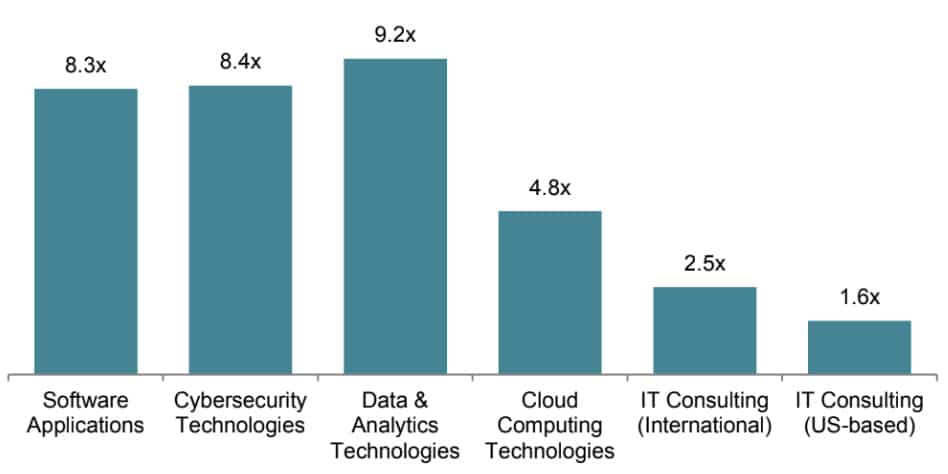

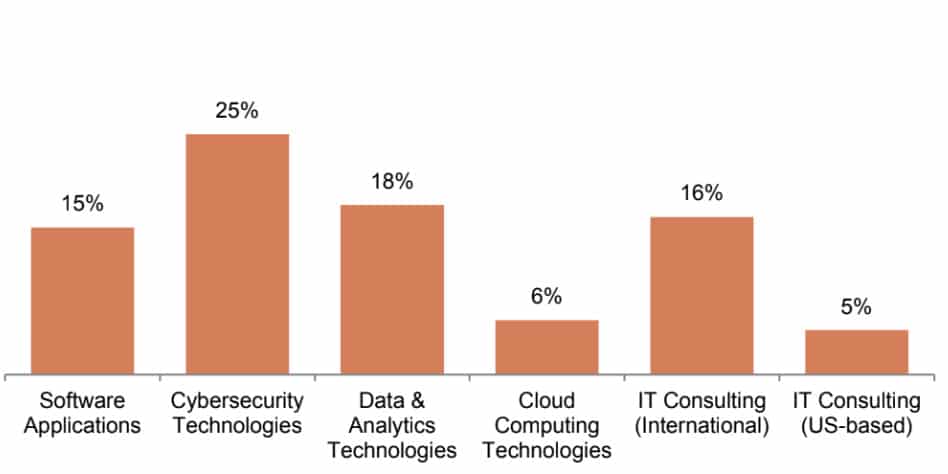

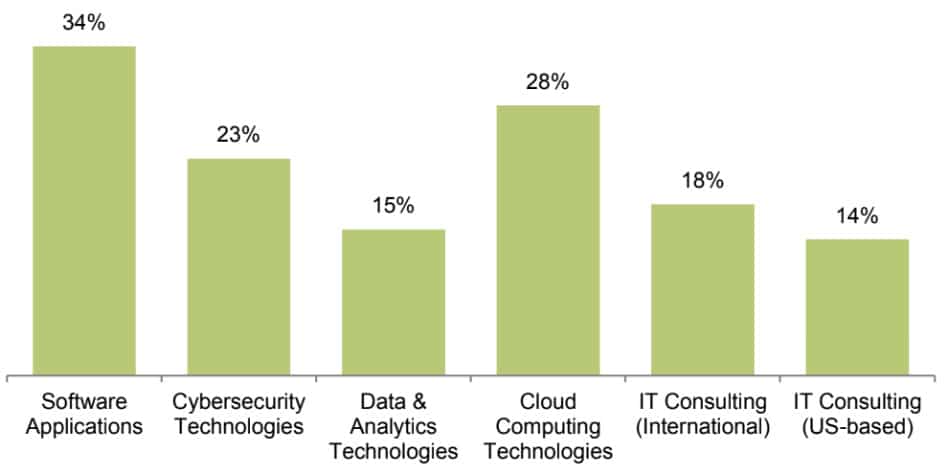

EV / Revenue FY2023E

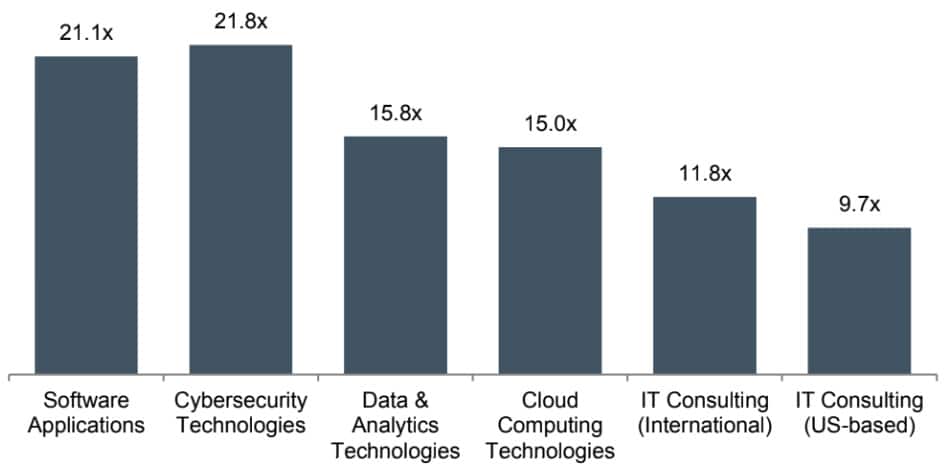

EV / EBITDA FY2023E

YoY Revenue Growth FY2023E

EBITDA Margin FY2023E

Source: Pitchbook as of 10/5/2023

IT Services Public Comps

| Software Applications | Ticker | 5-Oct-23 Share Price | E/V | YoY Rev Growth | EBITDA Margin | FY 2023E Rev | FY 2023E EBITDA | EV / FY 2023E Rev | EV / FY2023E EBITDA |

|---|---|---|---|---|---|---|---|---|---|

| Oracle | NYS: ORCL | $108 | $378,613 | 15% | 47% | $49,856 | $24,024 | 7.6x | 15.8x |

| Salesforce | NYS: CRM | $202 | $200,393 | 13% | 37% | $30,966 | $9,787 | 6.5x | 20.5x |

| SAP | ETR: SAP | $128 | $148,317 | 9% | 33% | $33,705 | $9,198 | 4.4x | 16.1x |

| ServiceNow | NYS: NOW | $547 | $109,233 | 21% | 31% | $7,249 | $2,240 | 15.1x | NM |

| Workday | NAS: WDAY | $205 | $49,896 | 18% | 24% | $6,203 | $1,566 | 8.0x | 31.9x |

| Mean | $238 | $177,290 | 15% | 34% | $25,596 | $9,363 | 8.3x | 21.1x | |

| Median | $202 | $148,317 | 15% | 33% | $30,966 | $9,198 | 7.6x | 18.3x |

| Cybersecurity Technologies | Ticker | 5-Oct-23 Share Price | E/V | YoY Rev Growth | EBITDA Margin | FY 2023E Rev | FY 2023E EBITDA | EV / FY 2023E Rev | EV / FY2023E EBITDA |

|---|---|---|---|---|---|---|---|---|---|

| Fortinet | NAS: FTNT | $58 | $43,801 | 31% | 30% | $4,428 | $1,287 | 9.9x | 34.0x |

| CrowdStrike Holdings | NAS: CRWD | $165 | $36,947 | 44% | 21% | $2,229 | $421 | 16.6x | NM |

| Splunk | NAS: SPLK | $147 | $25,831 | 26% | 21% | $3,476 | $531 | 7.4x | NM |

| F5 Networks | NAS: FFIV | $156 | $9,004 | 5% | 30% | $2,808 | $940 | 3.2x | 9.6x |

| Rapid7 | NAS: RPD | $46 | $3,372 | 19% | 11% | $680 | $45 | 5.0x | NM |

| Mean | $114 | $23,791 | 25% | 23% | $2,724 | $645 | 8.4x | 21.8x | |

| Median | $147 | $25,831 | 26% | 21% | $2,808 | $531 | 7.4x | 21.8x |

| Data & Analytics Technologies | Ticker | 5-Oct-23 Share Price | E/V | YoY Rev Growth | EBITDA Margin | FY 2023E Rev | FY 2023E EBITDA | EV / FY 2023E Rev | EV / FY2023E EBITDA |

|---|---|---|---|---|---|---|---|---|---|

| Snowflake | NYS: SNOW | $150 | $45,139 | 49% | 6% | $2,053 | $121 | 22.0x | NM |

| Informatica | NYS: INFA | $21 | $7,004 | 1% | 26% | $1,510 | $355 | 4.6x | 19.7x |

| Teradata | NYS: TDC | $45 | $4,835 | (3%) | 19% | $1,777 | $410 | 2.7x | 11.8x |

| MicroStrategy | NAS: MSTR | $323 | $6,362 | (1%) | 17% | $498 | $93 | 12.8x | NM |

| Alteryx | NYS: AYX | $37 | $3,206 | 42% | 9% | $834 | $35 | 3.8x | NM |

| Mean | $115 | $13,309 | 18% | 15% | $1,334 | $203 | 9.2x | 15.8x | |

| Median | $45 | $6,362 | 1% | 17% | $1,510 | $121 | 4.6x | 15.8x |

| Cloud Computing Technologies | Ticker | 5-Oct-23 Share Price | E/V | YoY Rev Growth | EBITDA Margin | FY 2023E Rev | FY 2023E EBITDA | EV / FY 2023E Rev | EV / FY2023E EBITDA |

|---|---|---|---|---|---|---|---|---|---|

| Microsoft | NAS: MSFT | $319 | $2,334,967 | 7% | 52% | $211,548 | $103,381 | 11.0x | 22.6x |

| Alphabet | NAS: GOOGL | $135 | $1,653,725 | 4% | 38% | $282,140 | $110,144 | 5.9x | 15.0x |

| Amazon.com | NAS: AMZN | $126 | $1,372,521 | 11% | 16% | $510,346 | $70,602 | 2.7x | 19.4x |

| Alibaba Group | HKG: 09988 | $10 | $165,149 | 5% | 21% | $126,233 | $23,992 | 1.3x | 6.9x |

| International Business Machines | NYS: IBM | $142 | $173,719 | 1% | 13% | $60,043 | $15,361 | 2.9x | 11.3x |

| Mean | $146 | $1,140,016 | 6% | 28% | $238,062 | $64,696 | 4.8x | 15.0x | |

| Median | $135 | $1,372,521 | 5% | 21% | $211,548 | $70,602 | 2.9x | 15.0x |

| IT Consulting (International) | Ticker | 5-Oct-23 Share Price | E/V | YoY Rev Growth | EBITDA Margin | FY 2023E Rev | FY 2023E EBITDA | EV / FY 2023E Rev | EV / FY2023E EBITDA |

|---|---|---|---|---|---|---|---|---|---|

| Tata Consultancy Services | NSE: TCS | $43 | $152,572 | 17% | 27% | $28,078 | $7,341 | 5.4x | 20.8x |

| Infosys | NSE: INFY | $18 | $71,992 | 8% | NA | $18,212 | $4,560 | 4.0x | 15.8x |

| HCL Technologies | NSE: HCLTECH | $15 | $38,138 | 17% | 24% | $12,635 | $3,005 | 3.0x | 12.7x |

| Capgemini | PAR: CAP | $171 | $34,738 | 13% | 16% | $23,126 | $3,609 | 1.5x | 9.6x |

| Wipro | NSE: WIPRO | $5 | $23,723 | 11% | 19% | $11,269 | $2,204 | 2.1x | 10.8x |

| NTT Data | TKS: 9613 | $13 | $28,981 | 45% | 15% | $25,780 | $3,934 | 1.1x | 7.4x |

| Atos | PAR: ATO | $6 | $4,254 | 3% | 7% | $11,924 | $1,072 | 0.4x | 4.0x |

| Mean | $39 | $50,628 | 16% | 18% | $18,718 | $3,675 | 2.5x | 11.6x | |

| Median | $15 | $34,738 | 13% | 18% | $18,212 | $3,609 | 2.1x | 10.8x |

| IT Consulting (US based) | Ticker | 5-Oct-23 Share Price | E/V | YoY Rev Growth | EBITDA Margin | FY 2023E Rev | FY 2023E EBITDA | EV / FY 2023E Rev | EV / FY2023E EBITDA |

|---|---|---|---|---|---|---|---|---|---|

| Accenture | NYS: ACN | $310 | $192,390 | 7% | 19% | $64,180 | $12,679 | 3.0x | 15.2x |

| Cognizant Technology Solutions | NAS: CTSH | $68 | $34,015 | 1% | 19% | $19,374 | $3,564 | 1.8x | 9.5x |

| EPAM Systems | NYS: EPAM | $238 | $12,446 | 8% | 18% | $4,823 | $859 | 2.6x | 14.5x |

| DXC Technology | NYS: DXC | $21 | $8,655 | (10%) | 5% | $14,708 | $2,269 | 0.6x | 3.8x |

| ASGN | NYS: ASGN | $79 | $4,947 | 6% | 12% | $4,568 | $558 | 1.1x | 8.9x |

| Kyndryl Holdings | NYS: KD | $15 | $6,170 | NA | 12% | $16,921 | $1,941 | 0.4x | 3.2x |

| Huron Consulting Group | NAS: HURN | $101 | $2,448 | 25% | 12% | $1,101 | $128 | 2.2x | 19.1x |

| ThoughtWorks | NAS: TWKS | $4 | $1,597 | 1% | 15% | $1,292 | $249 | 1.2x | 6.4x |

| Rackspace Technology | NAS: RXT | $2 | $4,034 | (0%) | 15% | $3,111 | $583 | 1.3x | 6.9x |

| Mean | $93 | $29,634 | 5% | 14% | $14,453 | $2,537 | 1.6x | 9.7x | |

| Median | $68 | $6,170 | 3% | 15% | $4,823 | $859 | 1.3x | 8.9x |

($ in millions)

Source: Pitchbook as of 10/5/2023

Select IT Services M&A Activity

| Deal Date | Companies | Investors | Description | EV ($ in M) | EV/Rev | EV/EBITDA |

|---|---|---|---|---|---|---|

| Jul-23 | Scalian | Wendel Group | Provider of IT consulting services | $1,066 | 2.0x | nd |

| May-23 | Accuris | Kohlberg Kravis Roberts | Operator of an engineering data and technology company intended to deliver holistic workflow solutions | $975 | 2.0x | nd |

| Apr-23 | Arroyo Consulting | BGSF | Provider of on-shore technology services | $17 | 1.0x | nd |

| Mar-23 | American Virtual Cloud Technologies | Skyvera | Provider of private & hybrid data centers, enterprise networking solutions, and managed services | nd | nd | nd |

| Mar-23 | Mobica | Cognizant Technology Solutions | Provider of integration software engineering and development services through TaaS to businesses | $325 | 4.0x | 21.2x |

| Jan-23 | Amyx | Tetra Tech | Provider of technology support services catering to federal customers and business partners | $121 | 40.3x | nd |

| Dec-22 | Switch | DigitalBridge Group (IFM Investors) | US-based technology infrastructure company | $10,959 | 16.4x | 16.8x |

| Oct-22 | Ameex | Perficient | Provider of digital technology solutions | $36 | 1.9x | nd |

| Sep-22 | AHEAD | Berkshire Partners | Provider of consulting and enterprise cloud services intended to create a platform for digital business | $3,000 | 1.2x | 13.0x |

| Sep-22 | ManTech International | The Carlyle Group | Provider of technology solutions and services | $4,153 | 1.6x | 16.3x |

| Aug-22 | Stratus Technologies | SMART Global Holdings | Provider of fault-tolerant server platforms and support solutions | $275 | 1.6x | nd |

| Jul-22 | GlideFast Consulting | ASGN | Provider of IT consulting and development services intended for commercial and government clients | $350 | 3.7x | nd |

| Jul-22 | Business IT Source | Computacenter | Provider of IT consulting and equipment services intended for mid-to-large companies | $76 | 0.3x | nd |

| Jun-22 | Datto | Temasek Holdings (Insight Partners) | Provider of cloud-based software and technology solutions | $6,009 | 9.3x | 53.5x |

| May-22 | CynergisTek | Clearwater Compliance (Altaris Capital Partners) | Provider of cybersecurity, privacy, and compliance services | $16 | 1.0x | nd |

| May-22 | Rizing | Wipro | Provider of SAP functional and technical consulting services intended for commercial enterprises | $540 | 2.8x | nd |

| May-22 | Zaact Consulting | Altigen Communications | Provider of networking business solutions | $5 | 0.9x | nd |

| Apr-22 | Convergence Acceleration Solutions | Wipro | Provider of consulting and program management services | $80 | 2.9x | nd |

| Apr-22 | Creative Breakthroughs | Converge Technology Solutions | Provider of IT risk management services | $47 | 0.5x | 6.5x |

| Mar-22 | NetFortris | Sangoma Technologies | Provider of unified communications as a service and managed IT network services | $80 | 1.6x | nd |

| Mar-22 | CyrusOne | Global Infrastructure Partners (KKR) | Provider of corporate colocation services | $14,654 | 12.2x | 25.1x |

| Mar-22 | Linode | Akamai Technologies | Provide cloud hosting services intended to serve the domestic and international market | $899 | 9.0x | nd |

| Mar-22 | iOLAP | Elixirr International | Provider of information technology services | $40 | 1.8x | 9.5x |

| Mar-22 | Network and Simulation Technologies | Saalex | Provider of IT and tech support services intended to serve government and commercial customers | $30 | 0.3x | nd |

| Mar-22 | Computex Technology Solutions | Calian Group | Provider of managed IT and cybersecurity services | $34 | 0.5x | nd |

| Mar-22 | Data Glove | Persistent Systems | Provider of information technology consulting services | $91 | 1.9x | nd |

| Feb-22 | Blue.cloud | Hudson Hill Capital, Ocean Avenue Capital Partners | Provider of cloud technology services intended to simplify, modernize, digitalize and transform businesses | $120 | 5.0x | nd |

| Jan-22 | Paragon Development Systems | Converge Technology Solutions | Provider of information technology services | $56 | 0.3x | 6.2x |

| Mean | $1,632 | 4.7x | 18.7x | |||

| Medium | $120 | 1.9x | 16.3x |

($ in millions)

Source: Pitchbook