Consumer M&A Trends: Summer 2023

Published September 7, 2023

Key Insights

- Branded Food and Beverage M&A Remains Strong Despite Slowed Deal Activity

- Specialty and Better-For-You Categories Continue to Standout

- Consumer Spending Habits Shift Among Rising Prices and Inflation

Branded Food & Beverage Market Insights

Branded Food and Beverage M&A Remains Strong Despite Slowed Deal Activity

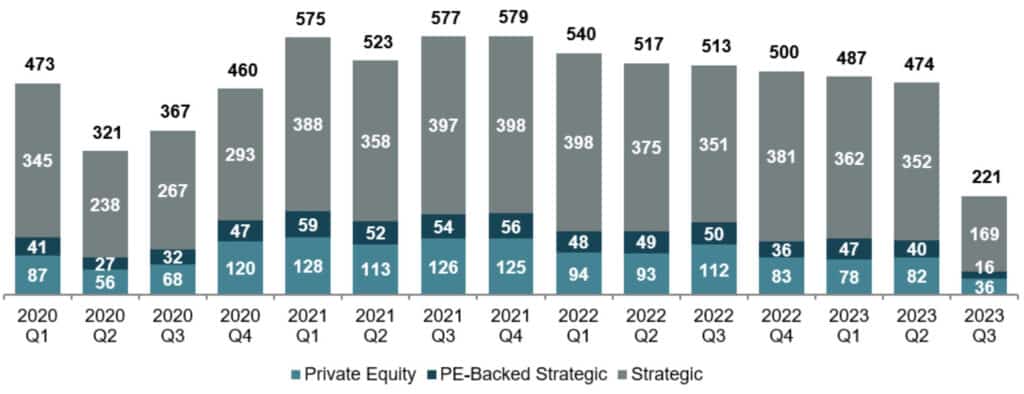

- Overall deal activity in branded food and beverage is down 11% YoY with 1,970 deals completed in the trailing twelve-month period ending in Q2 2023

- Inorganic growth and product expansion appetites drove acquisition activity with over 80% of acquisitions completed by strategic and private equity-backed companies

- Frozen food represented one of the most active sectors so far in 2023 with more than 20 transactions completed in the first six months of the year

Specialty and Better-For-You Categories Continue to Standout

- In the recent inflationary and ‘brink of recession’ environment, dairy alternatives, better-for-you sweeteners, and canned/dry soup have been top-selling categories

- Organic food and beverage category sales have nearly doubled since 2014, surpassing the $50B mark, representing a sustained, 10-year shift in consumer spending habits

- As showcased earlier this year at Expo West, emerging categories gaining traction with consumers include plant-based products, products focused on digestive health, alternatives to alcoholic beverages, and functional products including supplements, healthier soft drinks, and all things ‘biotics’ pre, post, and pro

- The specialty food market, encompassing products such as chips, pretzels, and snacks, continues to be popular with consumers, and with ~7% YoY growth, is outpacing food and beverage personal consumption

Consumer Spending Habits Shift Among Rising Prices and Inflation

- Shoppers concerned about rising prices continue to search for deals to stretch spending as weekly grocery spend increases

- According to FMI’s 2023 US Grocery Shopper Spend Report, 32% of consumers indicated they were buying fewer items at the grocery store

- With the decrease in items purchased, 78% of consumers surveyed still reported they were spending more due to rising prices in general and on specific items

Food and Beverage Personal Consumption (in USD $B)

Spending on food and beverage products has increased 10% since Q2 2021, largely attributed to inflation elevating prices

Sources: PitchBook, Progressive Grocer, Food Business News, FMI US Grocery Shopper Trends, Bureau of Economic Analysis, and Meridian Proprietary Research

Branded Food & Beverage Middle Market M&A Activity & Trends

Recent Transaction Activity (M&A Deal Count)

Recent Transaction Spotlights

Description: Kevin’s Natural Foods is a manufacturer of health-forward food products, specializing in vacuum-chilled meat, vegetable snacks, and a complementary line of sauces.

Rationale: Mars’ acquisition of Kevin’s Natural Foods aligns with Mars’ strategy to grow into a delicious and healthier food segment. This acquisition will complement Mars’ core portfolio and recent product innovations, helping them gain market share in the broader food sector.

Description: Manufacturer of frozen Asian food products based in Tualatin, Oregon. Lucky’s products include spring rolls, gluten-free food, Korean and fusion sauces, bbq sauces, ginger, pancakes and other related products.

Rationale: Daesang completed its Los Angeles factory last year. With the acquisition of Lucky Foods, Daesang plans to utilize the added capacity to expand its business in core categories including Kimchi, sauces and home meal replacement products.

Description: First Place Foods, located in Garland, Texas, is a producer of fresh pickles, fermented pickles, relish, and other pickled vegetables primarily for the foodservice and institutional channels.

Rationale: “The First Place Foods acquisition is a transformative opportunity allowing Patriot Pickle to expand geographically, capitalize on national sales opportunities, and provide our customers with dual source manufacturing”, said Bill McEntee, CEO of Patriot Pickle.

Source: PitchBook Data, Company Press Releases, and Meridian Research

Select Active Investors & Platforms

Swander Pace Progresses with Active Add-on Acquisitions Through Patriot Pickle

In early 2021, Swander Pace Capital acquired Patriot Pickle which offers a wide range of pickles including kosher dill, half-sour, full sour, sweet horseradish, and sweet candied pickles. In the last 18 months, Patriot Pickle also acquired Farm Ridge Foods and First Place Foods, enhancing the product breadth and strengthening the position in the category.

As the platform looks to M&A priorities for the next few years, CEO Bill McEntee said, “We will continue to look for interesting investment opportunities within the fermented foods and pickled vegetable category to further establish Patriot Pickle as a leading fermented foods platform”.

KKR Continues to be an Active Investor in the Global Beverage Space

In April 2023, KKR invested in Raskik, a producer of fusion beverages intended to offer healthy refreshment alternatives, via its platform Reliance Retail. KKR initially invested into Reliance in 2020 and has since added 12 companies to the platform.

In late 2022, KKR also invested in Tru Blu Beverages, the third largest non-alcoholic, non-dairy beverage manufacturer in Australia. The acquisition of Tru Blu accelerates growth and expands the range of products while also entering new categories. The addition of Tru Blu strengthens and expands Refresco’s global footprint within the broader Australian market.

Pernod Ricard Continues to Expand Portfolio with Unique Brands

In March of 2023, French producer of wines and spirits, Pernod Ricard, announced that it acquired a majority stake in Skrewball, a super-premium peanut butter-flavored American whiskey brand, based in San Diego, CA.

In October 2022, Pernod Ricard also acquired a majority stake in Código 1530 Tequila, a Colorado-based ultra premium tequila brand.

These acquisitions represent Pernod’s continued focus on consumer preference for flavored and unique liquors and spirits while adding to Pernod’s portfolio of iconic brands.

Source: PitchBook Data, Company Press Releases, and Meridian Research

Public Company Valuations

($millions)

| Company Name | Equity Market Cap | EV | 3 Yr Rev Growth CAGR | FY 2023E Rev | FY 2023E EBITDA | EV/FY 2023E Rev | EV/FY 2023E EBITDA |

|---|---|---|---|---|---|---|---|

| Coca-Cola | $259,902 | $285,833 | 8.7% | $45,027 | $13,519 | 6.3x | 21.1x |

| Pepsico | $246,241 | $283,408 | 10.0% | $85,309 | $15,150 | 3.3x | 18.7x |

| Mondelez International | $97,947 | $118,183 | 9.7% | $31,135 | $6,074 | 3.8x | 19.5x |

| Keurig Dr Pepper | $47,798 | $61,685 | 8.9% | $14,038 | $4,047 | 4.4x | 15.2x |

| Hershey | $44,259 | $49,091 | 11.0% | $10,343 | $2,700 | 4.7x | 18.2x |

| General Mills | $40,677 | $52,039 | 4.5% | $20,232 | $4,006 | 2.6x | 13.0x |

| Kraft Heinz | $40,601 | $59,651 | 2.2% | $26,360 | $5,911 | 2.3x | 10.1x |

| McCormick & Company | $22,149 | $26,885 | 6.3% | $6,422 | $1,175 | 4.2x | 22.9x |

| Hormel Foods | $21,203 | $23,824 | 8.0% | $12,551 | $1,557 | 1.9x | 15.3x |

| Kellogg’s | $21,088 | $28,110 | 5.6% | $15,145 | $2,301 | 1.9x | 12.2x |

| The J.M. Smucker Co. | $15,252 | $19,044 | 1.9% | $8,473 | $1,607 | 2.2x | 11.8x |

| Conagra Brands | $14,363 | $23,695 | 3.6% | $12,309 | $2,350 | 1.9x | 10.1x |

| Campbell Soup | $12,427 | $16,963 | 3.5% | $9,351 | $1,747 | 1.8x | 9.7x |

| Post Holdings | $5,921 | $11,899 | 5.0% | $5,928 | $938 | 2.0x | 12.7x |

| Flowers Foods | $5,026 | $6,388 | 5.5% | $4,826 | $507 | 1.3x | 12.6x |

| Lancaster Colony | $4,540 | $4,481 | 11.0% | $1,849 | $226 | 2.4x | 19.8x |

| J&J Snack Foods | $3,127 | $3,234 | 11.9% | $1,364 | $119 | 2.4x | 27.2x |

| B&G Foods | $919 | $3,189 | 5.1% | $2,123 | $292 | 1.5x | 10.9x |

| Mean | $50,191 | $59,867 | 6.8% | $17,377 | $3,568 | 2.8x | 15.6x |

| Median | $21,146 | $25,355 | 6.0% | $11,326 | $2,024 | 2.3x | 14.1x |

Public Market Valuations (TTM – EV/EBITDA)

U.S. Branded Food and Beverage Market Capitalization (in $USD B)

Source: PitchBook Data, Company Press Releases, Meridian Research. Market data as of 31-Aug-2023

¹COVID Date as of 19-Feb-2020

Select Branded Food & Beverage M&A Transactions

($millions)

| Date Announced | Target | Acquirer | Target Description | EV | EV/Rev | EV/EBITDA |

|---|---|---|---|---|---|---|

| Announced | Berry People | AgriFORCE | Producer of branded organic and conventional berries. | $28.0 | 0.8x | – |

| Aug-23 | Superior Foods | Viru Group | Producer of canned vegetables. | – | – | – |

| Aug-23 | Breckenridge Brewery | Tilray | Producer of alcoholic beverages. | – | – | – |

| Aug-23 | Bazooka Candy Brands | Apax Partners | Manufacturer of a confectionery company | – | – | – |

| Aug-23 | Hiball | Tilray | Producer of organic energy drinks. | – | – | – |

| Aug-23 | Sovos Brands | Campbell Soup | Operator of a brands including pasta and pizza sauce. | – | – | – |

| Jul-23 | Nature’s One | Bobbie | Producer of organic baby nutrition products. | – | – | – |

| Jul-23 | Kevin’s Natural Foods | Mars | Manufacturer and supplier of health-forward food products. | $800.0 | – | – |

| Jul-23 | Bang Energy | Monster Beverage | Producer of sports nutrition drinks. | $362.0 | 0.07x | – |

| Jul-23 | Nu Brewery | Brickyard Hollow Brewing | Producer of beer intended to scale markets. | – | – | – |

| Jun-23 | Nuvo Sparkling Liqueur | Lucas Bols | Producer of sparkling liqueur. | $5.7 | – | – |

| Jun-23 | Theo Chocolate | American Licorice | Manufacturer of organic chocolate candies. | – | – | – |

| Jun-23 | Sapientia Technology | Superlatus | Producer of plant-based food products. | $10.0 | – | – |

| Jun-23 | Alaska Seafood Company | Tlingit Haida | Provider of canned food products. | – | – | – |

| Jun-23 | Heartland Waffles | Arbor Investments | Producer of waffle and pancake mixes | – | – | – |

| Jun-23 | Lucky Foods | Daesang | Manufacturer of frozen Asian food. | $29.6 | – | – |

| Jun-23 | Nona Lim | DayDayCook | Producer of organic packaged food products | – | – | – |

| Jun-23 | Holy Cow Foods Inc. | Undisclosed | Producer of food products. | $0.8 | – | – |

| Jun-23 | Yasso | Unilever | Producer of frozen Greek yogurt. | – | – | – |

| Jun-23 | Festive Foods | Bernatello’s | Manufacturer of thin crust pizzas, sandwiches, and fruit pies | – | – | – |

| Jun-23 | Pear’s Snacks | Marathon Ventures (Promise Holdings) | Producer of premium nuts, seeds, grains, fruits and pulses. | – | – | – |

| May-23 | Emerald Nuts | Flagstone Foods (Atlas Holdings) | Producer of almonds, salted and unsalted walnuts. | – | – | – |

| May-23 | First Place Foods | Patriot Pickle (Swander Pace Capital) | Producer of fresh pickles, and other pickled vegetables. | – | – | – |

| May-23 | Savory Solutions | PAI Partners | Provider of food products. | $900.0 | 1.9x | 14.1x |

| May-23 | Williams Sausage Company | Tyson Foods | Provider of branded sausage, bacon and sandwiches. | – | – | – |

| May-23 | Furlani Foods | Entrepreneurial Equity Partners | Producer of bread, breadsticks, garlic toast, rolls, and biscuits. | – | – | – |

| Apr-23 | Raskik | KKR | Producer of fusion beverages. | – | – | – |

| Mar-23 | Kerry Group (Sweet Ingredients Portfolio) | IRCA Group (Advent International) | Manufacturer of sweet and cereal products. | $540.0 | 1.2x | 12.2x |

| Mar-23 | Skrewball | Pernod Ricard | A super-premium peanut butter flavored whiskey brand. | – | – | – |

| Mar-23 | R.M. Palmer | Union Capital | Producer of branded chocolates, candies and other products. | – | – | – |

| Mar-23 | Good Karma Foods | Kellogg’s | Producer of flax-based health drinks. | $200.0 | – | – |

| Feb-23 | Tofurky | Morinaga Nutritional Foods | Producer of vegan food products. | $50.0 | – | – |

| Feb-23 | Yucatan Foods | BlackRock | Producer of packaged avocado-based food products. | $17.5 | – | – |

| Jan-23 | Wells Enterprises | Ferrero International | Manufacturer of ice cream and specialty frozen desserts. | – | – | – |

| Jan-23 | Frieda’s Branded Produce | Legacy Farm (Silver Oak Services Partners) | Retailer of organic and packaged fruits and vegetables. | – | – | – |

| Jan-23 | Back To Nature Foods | Barilla Group | Producer of organic and healthy foods. | – | – | – |

| Average | $226.8 | 1.3x | 13.1x | |||

| Median | $29.6 | 1.2x | 13.1x |

Source: PitchBook Data, Company Press Releases, Meridian Research