Consumer M&A Trends: Fall 2022

Published September 19, 2022

Key Insights

- Sector trends in personal care & wellness

- Increasing demand for sustainability and transparency

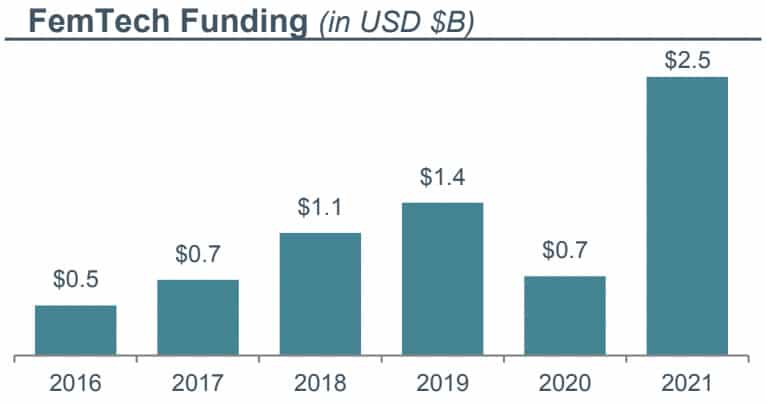

- FemTech continues to gain momentum and draw investor interest…$7B+ since 2016

Outlook Remains Positive for U.S. Personal Care Expenditures

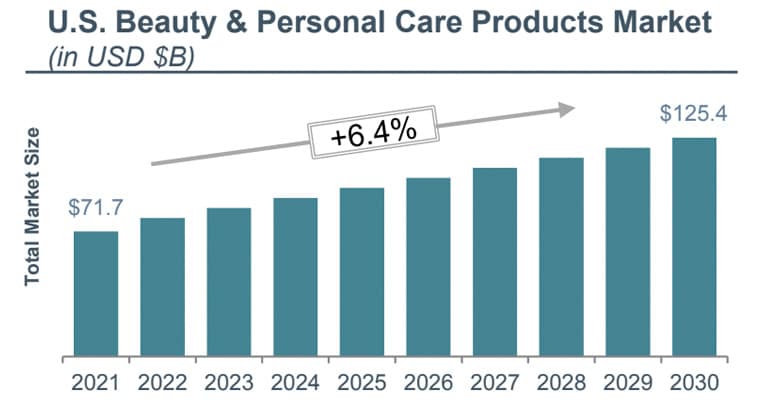

Overall category spending exceeded $70B in 2021 and is expected to continue to grow to $125B+ by 2030. Consumer behavior (and circumstances) have largely driven a channel shift from brick-and mortar to Ecommerce and online retail. Personal care brands have been required to navigate challenging supply chain environments against rising demand in new channels. Companies that have been quick to implement price changes and normalize margins will be well positioned to capitalized on stabilized demand in future years.

Personal Care & Wellness Market Insights

Sector Trends in Personal Care & Wellness

Over the last several years, the personal care sector has seen an increase in focus on ingredient transparency and sustainability, production domicile and capacity (due to global supply chain disruptions), cost control, and brand inclusivity.

Increasing Demand for Sustainability and Transparency

Consumers are more aware than ever of where source ingredients come from – Increased access to information via social media and other mediums has accelerated demand for products free of parabens, sulfates, artificial colors, fragrances and other researched inputs. A recent NPD study1 indicated 68% of consumers seek brands that use clean ingredients. Industry participants are cognizant of this transition and are active in their efforts to keep up with demand. In search of high growth, global strategic investors are turning to emerging brands with loyal customer bases to capitalize on these trends and behavioral shifts as highlighted by P&G’s April 2022 acquisition of Tula, a personal care products company founded on clean, transparent ingredients and sustainable practices.

Consumers are more willing to spend on sustainable packaging options – A recent survey2 indicated 25% of consumers only buy beauty products that are eco-friendly, even at an increased price. Pressure from multiple sources is motivating global brands to commit to major initiatives to reduce negative environmental and carbon footprints. Estée Lauder recently announced an effort to make 75%-100% of packaging to be recyclable, refillable, reusable, or recoverable by 2025.

FemTech Continues to Gain Momentum and Draw Investor Interest…$7B+ Since 2016

FemTech, defined as tech-enabled, consumer-centric companies focused exclusively on women’s health, has grown rapidly since the term was coined in 2016, with annual funding growing over 5x through 2021.

While the original focus was on services and improving healthcare for women, now more than 50% of FemTech start-ups are focused on products and devices, broadening the category and creating new opportunity.

Outlook Remains Positive for U.S. Personal Care Expenditures

Overall category spending exceeded $70B in 2021 and is expected to continue to grow to $125B+ by 2030. Consumer behavior (and circumstances) have largely driven a channel shift from brick-and-mortar to Ecommerce and online retail. Personal care brands have been required to navigate challenging supply chain environments against rising demand in new channels. Companies that have been quick to implement price changes and normalize margins will be well positioned to capitalized on stabilized demand in future years.

1 NPD, ‘The Evolving Skincare Consumer;

2 Clarkston Consulting, ‘2022 Beauty + Personal Care Trends

Other sources: McKinsey Insights & Pitchbook, Nielsen, Aptean, Cohn Reznick, We Are Social

Personal Care Middle Market M&A Activity & Trends

Recent Transaction Activity (USD $B)

Recent Transaction Spotlights

Description: JAFRA is a vertically integrated manufacturer and distributor of beauty and personal care products with more than 1,200 SKUs.

Rationale: The acquisition will enable BetterWare de México to broaden its beauty and personal care products portfolio and extend its geographic reach.

Description: Mondi’s Personal Care business unit manufactures a range of components for everyday life including diapers, feminine care, adult incontinence, wipes and femcare products.

Rationale: The acquisition allows Nitto to speed up efforts in innovation within its ‘human life domain’ and more actively take the lead in environmental initiatives and infrastructure in Europe.

Description: Crème Shop offers cruelty-free skincare, makeup and personal protective equipment items such as face wash, liners, headbands, razors, facemasks and sanitizers.

Rationale: The acquisition helps LG Household & Health Care further expand its beauty and personal care division and solidify its presence in the North American market.

Good Clean Love Receives Growth Capital from Corbel Capital Partners

Based in Eugene, Oregon, Good Clean Love is the #1 best-selling natural sexual wellness and vaginal health brand providing a revolutionary line of science-backed, non-toxic feminine hygiene and sexual wellness products for women of all ages and stages of life. GCL pioneers the industry as a woman-owned B corporation alongside its biotech research and IP company, Vaginal Biome Science. The Company’s organic personal care products are sold internationally and endorsed by over 10,000 physicians nationwide for their safe and nontoxic ingredients.

Good Clean Love

Select Active Investors & Platforms

Proctor & Gamble Acquires Three Personal Care & Beauty Brands in Two Months

In January 2022, Proctor & Gamble (P&G) announced the acquisition of Tula Skincare, which reportedly generated $150M in revenue in 2021. The acquisition of Tula is P&G’s third in just two months.

In late 2021, P&G acquired Ouai, a hair care company, and Farmacy Beauty, a skincare solutions provider.

The three acquisitions expand P&G’s portfolio of premium and prestige brands, which already includes SK-II and First Aid Beauty.

Yellow Wood Partners Creates Sexual Wellness Platform

In March 2022, Yellow Wood Partners announced the formation of sexual wellness platform, Beacon Wellness Brands, following the acquisition of multiple brands from Clio, including PlusOne. Beacon Wellness Brands sells sexual wellness products under the PlusOne and Deia brands to large retailers including Target, Walmart, CVS, and Walgreens.

The platform also has a personal care division and manufactures facial skincare and grooming products sold under the Plum Beauty™, palmperfect, beautytrim, mowbie, and protrim brands.

Unilever Continues M&A Momentum with Acquisition of Nutrafol

In June 2022, Unilever announced a majority investment in Nutrafol. Nutrafol sells hair growth products for men and women with thinning hair. Its patented Synergen Complex® contains a blend of medical-grade nutraceutical ingredients that accelerate hair growth and improve hair health.

In June 2021, TA Associates, announced the signing of a definitive agreement to sell Paula’s Choice, a leading digital-led skin care brand, to Unilever.

In October 2021, Unilever announced that it will provide a majority stake investment in Welly Health PBC (“Welly”). Welly provides bandages, ointments, and first aid essentials.

Source: PitchBook Data, Company Press Releases, and Meridian Research

Public Company Valuations

| Company Name | Equity Market Cap | EV | 3 Yr Rev Growth CAGR | FY 2022E Rev | FY 2022E EBITDA | EV/Rev | EV/FY2022E EBITDA |

|---|---|---|---|---|---|---|---|

| Johnson & Johnson | $431,036 | $431,065 | 5.5% | $94,449 | $32,536 | 4.6x | 13.2x |

| L’Oreal | $188,437 | $193,669 | 7.7% | $36,616 | $8,983 | 5.3x | 21.6x |

| The Estée Lauder Companies | $92,823 | $96,511 | 6.1% | $17,638 | $4,212 | 5.5x | 22.9x |

| Colgate-Palmolive | $65,998 | $73,126 | 4.7% | $17,443 | $4,426 | 4.2x | 16.5x |

| ULTA Beauty | $22,322 | $23,744 | 9.7% | $8,593 | $1,534 | 2.8x | 15.5x |

| Church & Dwight Company | $20,752 | $22,919 | 7.8% | $5,168 | $1,200 | 4.4x | 19.1x |

| Kao | $20,667 | $20,518 | (0.5%) | $12,321 | $2,012 | 1.7x | 10.2x |

| Shiseido Company | $15,262 | $16,775 | (2.9%) | $9,055 | $968 | 1.9x | 17.3x |

| Olaplex Holdings | $9,252 | $9,718 | nd | $589 | $396 | 16.5x | 24.5x |

| Coty | $6,264 | $10,826 | (5.5%) | $5,280 | $900 | 2.1x | 12.0x |

| KOSE | $5,444 | $4,693 | nd | $1,926 | nd | 2.4x | nd |

| Inter Parfums | $2,507 | $2,474 | 11.5% | $880 | $103 | 2.8x | 24.0x |

| Edgewell Personal Care | $2,121 | $3,367 | 0.4% | $2,066 | $363 | 1.6x | 9.3x |

| Nu Skin Enterprises | $2,087 | $2,223 | (1.6%) | $2,679 | $365 | 0.8x | 6.1x |

| E.L.F. Cosmetics | $2,050 | $2,092 | 15.9% | $378 | $72 | 5.5x | 28.9x |

| Amorepacific Group | $1,970 | $975 | (6.7%) | $4,101 | $546 | 0.2x | 1.8x |

| Revlon | $378 | $664 | (6.5%) | $2,109 | $301 | 0.3x | 2.2x |

| Marc Anthony Cosmetics | $19 | $139 | (2.8%) | $106 | $17 | 1.3x | 8.2x |

| Mean | $49,411 | $50,861 | 2.7% | $12,300 | $3,467 | 2.8x | 16.0x |

| Median | $7,758 | $10,272 | 2.6% | $4,634 | $900 | 2.6x | 15.5x |

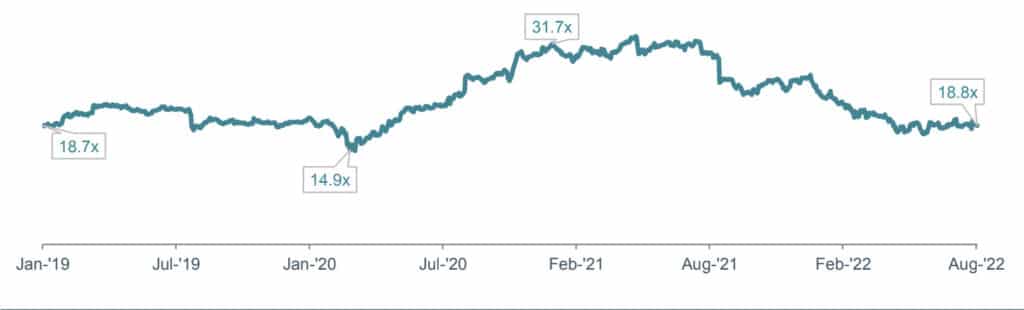

Public Market Valuations (EV/EBITDA)

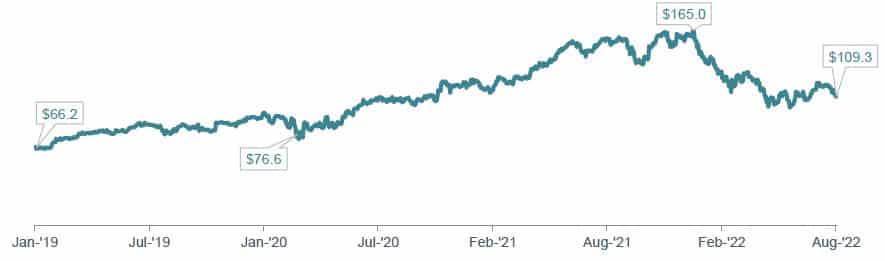

U.S. Personal Care & Wellness Market Capitalization (in $USD B)

Source: PitchBook Data, Company Press Releases, Meridian Research

Select Personal Care & Wellness M&A Transactions

| Date | Target | Acquirer | Target Description | EV | Rev | EV/Rev | EV/EBITDA |

|---|---|---|---|---|---|---|---|

| Pending | Evonik Industries | Kensing | Provider of specialty additives, smart materials, nutrition and care, and performance materials | nd | nd | nd | nd |

| Pending | Ouai | Procter & Gamble | Manufacturer of haircare products | nd | nd | nd | nd |

| Pending | The Crème Shop | LG H&H | Manufactures and markets cosmetics, skincare, and beauty products | $184.6 | nd | nd | nd |

| Sep-22 | Hero | Church & Dwight | Manufacturer of cosmetic products intended for acne-prone skin | $630.0 | 5.5x | 14.0x | |

| Sep-22 | Tata Harper Skincare | Amorepacific Group | Luxury skincare brand | nd | nd | nd | nd |

| Sep-22 | Wellington Fragrance | IBTM | Provider bath supplies and scented accessories | nd | nd | nd | nd |

| Aug-22 | Bergstrom Nutrition | Balchem | Manufacturer and supplier of dietary and healthcare supplements | nd | nd | nd | nd |

| Aug-22 | Contract Filling | Arizona Natural Resources | Contract manufacturer of alcohol-based personal care products | nd | nd | nd | nd |

| Aug-22 | Barefoot Scientist | Topsin Consumer Partners | Producer of body and foot care products designed to prevent and treat conditions related to the feet | nd | nd | nd | nd |

| Aug-22 | Fraîcheur Ice Globes | Orbio World | Manufacturer of facial rollers intended for the upkeep of skin health | nd | nd | nd | nd |

| Jul-22 | Youtheory | Jamieson Vitamins | Manufacturer of health and wellness products intended to inspire wellness | $210.0 | $114.0 | 1.8x | 10.0x |

| Jul-22 | Best Formulations | Sirio Pharma | Operator of a diversified nutraceutical and pharmaceutical firm intended to develop nutritional supplements | nd | nd | nd | nd |

| Jul-22 | Nutrafol | Unilever | Manufacturer of hair growth products | $1,000.0 | nd | nd | nd |

| Jun-22 | Good Clean Love | Corbel Capital Partners | Manufacturer of natural or organic intimacy products intended to provide sustainable sexual solutions for healthy relationships | Confidential | Confidential | Confidential | Confidential |

| Jun-22 | Mondi | Nitto | Manufacturer of diapers, feminine care, adult incontinence, wipes and femcare products | $660.2 | nd | nd | 14.6x |

| Apr-22 | Briogeo | Wella | Provides clean and natural hair care products | nd | nd | nd | nd |

| Apr-22 | Blush Wellness | Wellness Brands | Offers personal and beauty care products for women | nd | nd | nd | nd |

| Apr-22 | Innovative Fragrances | Phoenix Aromas and Essential Oils | Offers fragrances for personal care, candles, soaps and detergents, fabric softeners and air fresheners | nd | nd | nd | nd |

| Apr-22 | Jafra | BetterWare | Manufacturer of skin and body care products | $255.0 | nd | nd | 5.5x |

| Mar-22 | Mitchell-Vance Laboratories | Alliance Pharma | Manufacturer of over-the-counter scar treatment products | $19.4 | nd | nd | nd |

| Mar-22 | PlusOne | Yellow Wood Partners | Comprises a sexual device manufacturing business | nd | nd | nd | nd |

| Mar-22 | Joanna Vargas | SuperOrdinary | Provides skincare products for wellness and overall health | nd | nd | nd | nd |

| Feb-22 | Alechemee | Taro | Offers non-prescription acne treatment products | nd | nd | nd | nd |

| Feb-22 | Sterling Technology | Glanbia | Manufacturers solutions serving the nutritional needs of the food, natural product, and animal health industries | $60.0 | nd | nd | nd |

| Feb-22 | Nicole + Brizee | Channel Op | Manufactures and distributes personal care products including shampoo and body wash | nd | nd | nd | nd |

| Feb-22 | COVER FX Skin Care | AS Beauty Group | Provides foundation makeup, cover up cosmetics, and skincare products | nd | nd | nd | nd |

| Feb-22 | Orgain | Netsle Health Sciences | Provider of protein powders, shakes, bars, and plant-based supplements | $2,000.0 | $400.0 | 5.0x | nd |

| Jan-22 | Chantecaille Beaute | Beiersdorf AG | Provider of skin care and cosmetics products | $615.0 | nd | nd | nd |

| Jan-22 | Violet Grey | Farfetch | Provides beauty care products through physical stores and online | $44.4 | nd | nd | nd |

| Jan-22 | Anacapa | Argentum Medical | Provides antimicrobial skin and wound care products | nd | nd | nd | nd |

| Jan-22 | TULA Life | Procter & Gamble | Manufactures skincare products for hydrating, cleaning, and exfoliating | nd | $150.0 | nd | nd |

| Jan-22 | Apollo Healthcare Corp. | Anjac Health and Beauty | Canada-based manufacturer of personal care products | $262.7 | $252.7 | 1.0x | nd |

| Jan-22 | Fresh Heritage | BRANDED Group | Offers grooming products for men | nd | nd | nd | nd |

Source: PitchBook Data, Company Press Releases, Meridian Research