Construction Tech M&A Update: Winter 2024

Published February 6, 2024

Key Insights:

- Construction Industry Spending Sees Continued Momentum

- Investment Drives Demand for Increased Efficiency Through Digital Technologies

- Key Technology Trends in the Construction Industry

- Market and Valuation Trends

Investment in Construction Tech is driven by several factors, including the deploying of technology to address the shortage of skilled labor positions, historical underinvestment in tech solutions compared to tangential industries (~1.7% IT budget as a percent of revenue compared to ~2.3% for energy and ~2.1% for manufacturing), supply chain management considerations, and lackluster productivity across the industry.

Construction Tech Activity and Trends

Construction Industry Spending Sees Continued Momentum

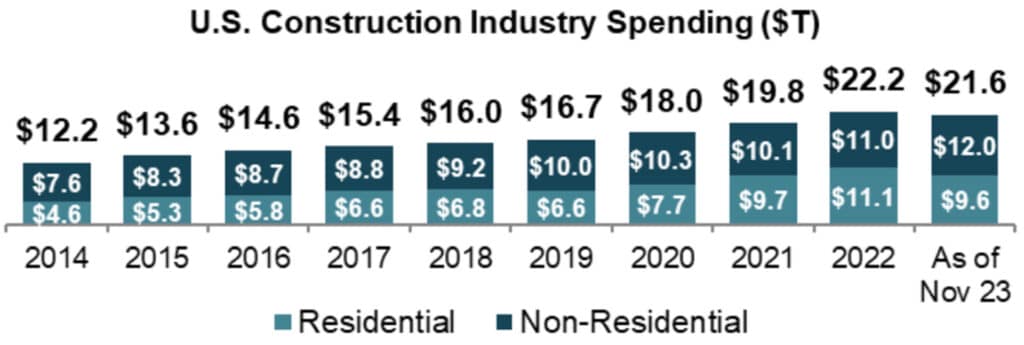

Construction industry spending in the United States has grown at a CAGR of ~6% from 2014 – 2022. The percentage of non-residential construction spending as a percent of the total, as of Nov 2023, has been driven by the influx of investment in infrastructure such as new roads, EV battery facilities, and chip manufacturing plants

Investment Drives Demand for Increased Efficiency Through Digital Technologies

- Investment in Construction Tech is driven by several factors, including the deploying of technology to address the shortage of skilled labor positions, historical underinvestment in tech solutions compared to tangential industries (~1.7% IT budget as a percent of revenue compared to ~2.3% for energy and ~2.1% for manufacturing), supply chain management considerations, and lackluster productivity across the industry

- Global demand for long-term construction remains strong, as evidenced by the signing of the United States’ $1.2T Infrastructure Investment and Jobs Act in 2021 and Europe’s NextGenerationEU in 2020

- Strategic acquirers such as Trimble, Procore, and Autodesk have been actively pursuing construction tech investments, highlighting a willingness and ability to pay a premium for high-quality businesses

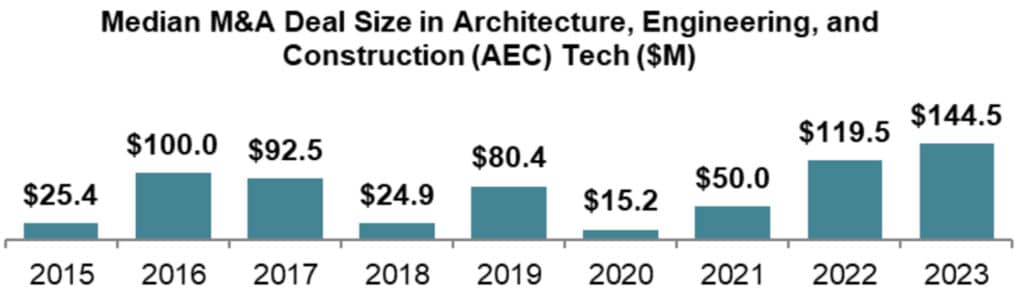

The accelerated growth of AEC tech is reflected by the increased median deal size of AEC tech M&A transactions, which has increased 470% since 2015

Key Technology Trends in the Construction Industry

Augmented reality (AR) improving training and safety

AR combines interactive elements with real-world objects via technology such as a smartphone camera. AR can be used to improve the training process and increase safety and efficiency across jobsites

Wearable technology and connected workstreams to streamline processes

Connected jobsites have become the norm, with contractors implementing connected devices to assess worker safety, create worksite efficiencies, and be able to better manage jobsites

Virtual reality (VR) for risk mitigation

Contractors are able to view jobsites virtually before they physically exist, allowing contractors to identify key focus areas and drive on-the-job efficiency

Building information modeling (BIM) for planning and design

BIM tools can help identify potential conflicts and errors in the design phase, which mitigates the risk of rework during a project

Sources: PitchBook, Meridian Research, FRED Economic Data, ABC Supply, McKinsey, Deloitte

Construction Tech: M&A Trends and Key Takeaways

M&A Activity (Deal Count) – Construction Tech

Construction Tech Index1

Key Commentary: Market and Valuation Trends

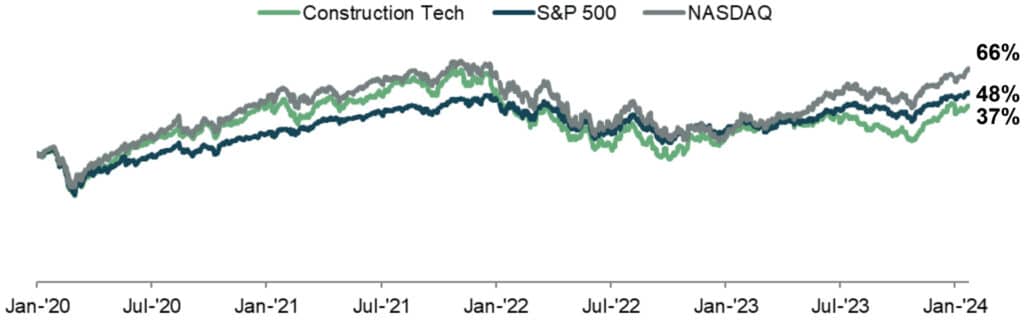

Although M&A activity has been down compared to post-COVID highs, valuations in both the private and public markets continue to rise with Construction Tech public valuations increasing 37%since January 2020

Recent commitments to infrastructure development as seen in the US’s $1.2T Infrastructure Investment and Jobs Act and record levels of dry powder available to private equity firms will increase interest and speed up deal activity in the Construction Tech space in 2024

The Construction Tech market remains highly fragmented, with opportunities for platform creation via a buy-and-build strategy or through organic market share capture

Sources: PitchBook Data, Meridian Research, McKinsey

1. Illustrative of the public companies found on pg. 6

Construction Tech Selected M&A Activity

Highlighted Construction Software M&A Transaction

Pamlico Invests in Beck Technology

Nov 2023

Target Description: Beck Technology is the leading preconstruction platform for contractors. Beck develops a construction estimating software intended to fundamentally rework the commercial construction conceptual modeling and estimating process

Investment Rationale: This investment allows Pamlico, which has significant operating expertise with founder-owned software businesses, to assist Beck with its next phase of growth in the expansion of its product platform and build a best-in-class, integrated preconstruction solution

Highlighted Workplace Management Software M&A Transaction

Johnson Controls Acquires FM:Systems

July 2023

EV

$455M

Target Description: FM:Systems is an all-in-one developer of workspace management software intended for facilities and real estate buildings. The company’s cloud-based platform offers computer-aided facility management that improves the maintenance, leases, property reservation, and strategic planning

Investment Rationale: The acquisition adds a complementary cloud-based SaaS digital workplace management capability to Johnson Controls’ leading OpenBlue digital buildings software portfolio that will improve building efficiency and reduce operational costs

Highlighted Building Information Modeling M&A Transaction

Asite Acquires 3D Repo

April 2023

Target Description: 3D Repo is a SaaS platform for Building Information Modeling coordination. 3D Repo is transforming how construction projects are designed and delivered by mitigating risk and reducing complexity for architects, engineers, and contractors

Investment Rationale: This acquisition strengthens Asite’s position as a digital engineering market leader. Additionally, it is part of Asite’s ongoing expansion strategy and highlights its commitment to innovation and technology in the construction industry

Sources: PitchBook Data, Mergermarket, Company Press Releases, Meridian Research

Construction Tech Market Map

Public Company Valuations

| Company Name | Ticker | 01/25/2024 Share Price | Equity Market Cap | Debt | EV | Gross Margin % | LTM EBITDA % | LTM Revenue | EV / LTM EBITDA | EV / LTM Rev | EV / LTM EBITDA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Schneider Electric | PAR: SU | $199 | $112,545 | $17,240 | $126,344 | 41% | 22% | $41,108 | $8,302 | 3.4x | 15.2x |

| Dassault Systemes | PAR: DSY | $52 | $69,367 | $3,165 | $68,967 | 84% | 40% | $7,055 | $2,520 | 11.0x | 27.4x |

| Roper Technologies | NAS: ROP | $552 | $59,161 | $6,878 | $65,739 | 70% | 46% | $6,658 | $2,736 | 10.9x | 24.0x |

| Autodesk | NAS: ADSK | $252 | $54,521 | $2,648 | $55,215 | 91% | 42% | $5,821 | $2,225 | 10.2x | 24.8x |

| Hexagon | STO: HEXA B | $11 | $29,811 | $4,526 | $33,847 | 65% | 41% | $6,282 | $2,366 | 5.8x | 14.3x |

| Ansys | NAS: ANSS | $339 | $29,655 | $854 | $29,869 | 88% | 52% | $2,483 | $1,129 | 13.8x | 26.5x |

| Fortive | NYS: FTV | $74 | $26,470 | $2,732 | $28,487 | 59% | 29% | $6,349 | $1,768 | 4.7x | 16.1x |

| Bentley Systems | NAS: BSY | $50 | $16,604 | $1,632 | $18,169 | 78% | 40% | $1,362 | $479 | 13.6x | 38.0x |

| Sage Group | LON: SGE | $15 | $15,408 | $1,534 | $16,093 | 93% | 29% | $3,085 | $764 | 5.9x | 21.1x |

| Trimble | NAS: TRMB | $52 | $12,867 | $3,158 | $15,808 | 61% | 28% | $3,844 | $1,027 | 4.2x | 15.4x |

| Nemetschek Group | ETR: NEM | $94 | $10,873 | $104 | $10,714 | 58% | 35% | $1,022 | $314 | 12.1x | 34.1x |

| Procore Technologies | NYS: PCOR | $70 | $9,834 | $85 | $9,293 | 81% | 14% | $1,126 | $122 | 10.6x | 76.2x |

| Altair Engineering | NAS: ALTR | $86 | $6,864 | $340 | $6,772 | 79% | 25% | $668 | $150 | 11.5x | 45.0x |

| Glodon | SHE: 002410 | $2 | $3,282 | $14 | $2,932 | 84% | 22% | $1,129 | $218 | 3.1x | 13.5x |

| Mean | $32,662 | $3,208 | $34,875 | 74% | 33% | $6,285 | $1,723 | 8.6x | 28.0x | ||

| Median | $21,537 | $2,140 | $23,328 | 79% | 32% | $3,465 | $1,078 | 10.4x | 24.4x |

($ in millions)

As of January 24, 2024

Source: PitchBook Data, Meridian Research

Select Construction Tech Transactions

| Date | Target | Acquirer | Target Description | EV / Value ($M) | EV / Revenue | EV / EBITDA |

|---|---|---|---|---|---|---|

| Dec-23 | Treetop | ECI Software Solutions | Developer of construction software designed to connect business processes | – | – | – |

| Dec-23 | busybusy | ToolWatch (The Riverside Company) | Developer of construction time tracking software | – | – | – |

| Nov-23 | Beck Technology | Pamlico Capital | Developer of construction estimating software | – | – | – |

| Oct-23 | 4PS Construction Solutions | Hilti | Developer of construction software | – | – | – |

| Sep-23 | Unearth | Procore | Operator of a cloud-based construction project management platform | – | – | – |

| Aug-23 | DataStreet | Clearstory | Developer and provider of project management software | – | – | – |

| Jul-23 | Buildup | TCQS Applications | Developer of construction communication platform | – | – | – |

| Jul-23 | FM:Systems | Johnson Controls | Digital workplace management and Internet of Things solutions provider | $455 | – | – |

| Jun-23 | Mobile-Punch | JDM Technology Group | Developer of time management application to manage projects in real-time | – | – | – |

| Jun-23 | Cityzenith | TwinUp | Developer of digital twin software for building projects | – | – | – |

| Jun-23 | ReACT Technologies | GDI Integrated Facility Services | Provider of productivity software to serve the construction industry | – | – | – |

| May-23 | AnchoRock Solutions | KPA (CIVC Partners) | Developer of mobile-first construction software application | – | – | – |

| May-23 | Data-Basics | Constellation Software | Provider of field services and construction management software | – | – | – |

| May-23 | Corecon Technologies | Sage | Construction software for small and mid-sized businesses | – | – | – |

| May-23 | Data-Basics | Constellation Software | Construction management software | – | – | – |

| May-23 | AboutTime Technologies | Foundation Software | Provider of mobile resource management for construction | – | – | – |

| Apr-23 | 3D Repo | Asite Solutions | Developer of a cloud-based digital platform for building information modeling | – | – | – |

| Mar-23 | UNIFI Labs | Autodesk | Provider of comprehensive BIM content life cycle solutions | – | – | – |

| Mar-23 | Vertical Market Software | Jonas Software | Enterprise software for construction and energy industries | – | – | – |

| Mar-23 | WorkflowMax | Xero | Developer of project management software | – | – | – |

| Feb-23 | SiteTrace | BuildCentrix | Developer of an online construction productivity platform | – | – | – |

| Jan-23 | Projectmates | Hexagon | Construction project management software | – | – | – |

| Jan-23 | Flexcavo | Trackunit | Construction management software | – | – | – |

| Dec-22 | COINS | The Access Group | Enterprise software for construction industry | – | – | – |

| Oct-22 | Avvir | Hexagon | Construction verification and progress monitoring | – | – | – |

| Oct-22 | SenseHawk | Reliance Industries | Infrastructure intelligence platform | $25 | 17.5x | – |

| Sep-22 | B2W Software | Trimble | Software for heavy civil construction | $332 | – | – |

| Dec-21 | SokoPro | IBinder | Cloud-based document management platform | $51 | 7.8x | – |

| Nov-21 | Fieldwire | Hilti | Jobsite management platform and mobile app | $300 | – | – |

| Median | $300 | 12.7x | – | |||

| Average | $233 | 12.7x | – |

Source: PitchBook Data, Mergermarket, Company Press Releases, Meridian Research