Digital Commerce M&A Trends: Summer 2023

Published July 18, 2023

Key Insights

- Digital Commerce Activity Continues to Grow in Functionality and Across More Industries

- Merchants are Continually Seeking to Improve and Expand their Omnichannel Sales Strategies

- AI and Social Commerce are Helping to Accelerate Adoption

- Modern Payment Technologies and Streamlined Checkout Experiences are Critical for Success

The digital commerce ecosystem and technologies have grown significantly as businesses from different industries have increasingly adopted these platforms. This growth is expected to continue, driven by factors such as the expansion of ecommerce, widespread mobile device usage, advancements in technology, and the growing demand for omnichannel sales.

Digital Commerce Activity and Trends

The digital commerce ecosystem and technologies have grown significantly as businesses from different industries have increasingly adopted these platforms. This growth is expected to continue, driven by factors such as the expansion of ecommerce, widespread mobile device usage, advancements in technology, and the growing demand for omnichannel sales.

AI and Personalization: By gathering data on customers’ shopping habits, AI enables brands to offer tailored experiences that match individual preferences. As consumers increasingly are seeking more personalized shopping experiences, ecommerce retailers are offering customized recommendations, targeted ads, and personalized email marketing

Social Commerce: Major social media platforms such as Facebook, Instagram, and Pinterest are rapidly becoming key players in ecommerce. Their integration of shopping features enables users to make purchases without leaving the platform

Augmented Reality (AR) and Virtual Reality (VR): AR and VR are transforming online shopping by enabling customers to virtually see products such as trying on clothes and visualizing furniture in their homes

Streamlined & 1-Click Checkout Experiences: Modern checkouts and wallets are revolutionizing the way merchants combat cart abandonment and enhance the ease of purchases, reducing friction and maximizing convenience for customers. By leveraging advanced technologies and user-friendly interfaces, these solutions aim to deliver an Amazon-esque shopping experience to all merchants, fostering higher conversion rates and customer satisfaction

Headless Commerce: Driving ecommerce innovation through flexible front-end experiences and seamless integration with diverse channels and technologies

Pricing Pressure: As customers can easily compare prices, there has been an increase in commoditization. Differentiated products can demand higher value pricing

Data and Privacy: According to Gartner, by the end of 2024, approximately 75% of the global population will have their personal data protected by modern privacy regulations

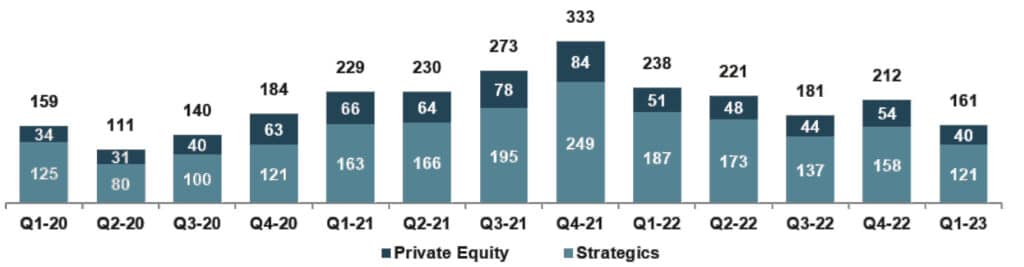

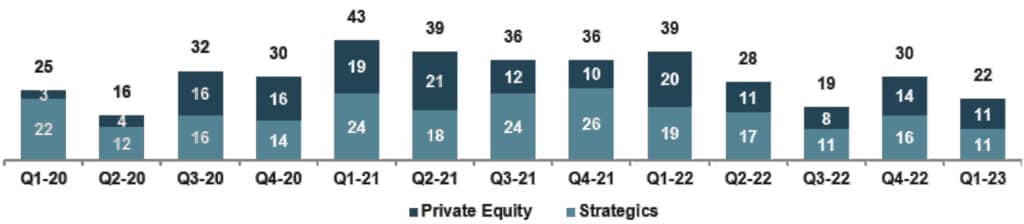

M&A Activity (Deal Count) – Digital Commerce

2023A: As of July 10, 2023

Sources: PitchBook, Meridian Research, Forbes, Sprout Social, Gartner

Sector Highlight: Digital Commerce & Order Management Platforms

Streamlined Checkout Processes: Businesses are optimizing the checkout experience to enhance efficiency and convenience for customers in the fast-paced world of ecommerce

Social Commerce: Leveraging social media platforms, businesses are capitalizing on the seamless shopping experience offered by social commerce, tapping into a vast and engaged audience

Headless Commerce: The adoption of flexible architecture allows businesses to deliver personalized customer experiences by decoupling the front-end and back-end of their ecommerce systems

Subscription Feature Support: The ecommerce industry is witnessing a rapid acceleration and expansion of feature support for subscriptions. Businesses are increasingly incorporating in-house features and leveraging external plugins to enable seamless subscription management and recurring revenue models in the digital commerce space.

Recent Investment Spotlight

Description: Cart.com, an Austin-based company providing end-to-end ecommerce services, raised $60M Series C round of funding to push its valuation to $1.2B

Rationale: The company plans to utilize the fresh funding to address rising demand from corporate and B2B customers, expedite global growth, and enhance product development across its software offerings

M&A Activity (Deal Count) – Order Management Software

Order Management Platform Landscape

Sources: PitchBook, Meridian Research, Straits Research, Future Market Insights, Grandview Research

Sector Highlight: Payment Processors & Technologies

Ecommerce Growth: The rise of online shopping has increased the demand for reliable payment gateways to process transactions securely

1-Click Checkout: Revolutionizes payment processing by enabling customers to make purchases with a single click, streamlining the checkout experience

Digital Payment Adoption & More Choices: The increasing demand for flexible, decentralized, and convenient payment methods has driven the growing popularity of alternative digital payments like “Buy-Now-Pay-Later” (BNPL) and cryptocurrency

Buy-Now-Pay-Later Unproven, But Highly Active: The popularity of BNPL solutions has surged, but concerns persist about stability and risks. Instant gratification may encourage irresponsible spending. Additional regulations and consumer protections are needed for fair practices. Consumers should exercise caution, understand terms, and make informed financial decisions

The Rise of Payment Orchestration: With payment orchestration, companies can integrate multiple payment methods, providers, and channels into a unified platform, simplifying the complexities of payment management

On-Prem, Contactless Digital Payments: On-prem, contactless digital payments offer a seamless and efficient experience, eliminating the need for physical cash or card swiping. This trend has been accelerated by the global pandemic, as it promotes safety and reduces the risk of virus transmission

AI, Security & Fraud Prevention: Payment gateways play a pivotal role in ensuring secure transactions, fostering trust in online transactions, and promoting their adoption by businesses. The transformative potential of advancements like blockchain and AI further enhances payment gateways by boosting productivity and strengthening security, particularly in fraud prevention

Recent Transaction Spotlight

Description: Nuvei acquired Paya, a leading provider of integrated payment solutions, enhancing payment acceptance, expedited money receipt, and operational efficiencies

Rationale: The acquisition of Paya amplifies Nuvei’s existing growth strategy and expands its reach into new underpenetrated and non-cyclical verticals where Nuvei’s proprietary technology is well positioned to accelerate customer growth

Recent Investment Spotlight

Description: Square Inc. acquired Afterpay, a leading payment platform which allows users to make payments in installments

Rationale: The acquisition aligns with Block’s goals for Square and Cash App, advancing their ecosystems. Square and Afterpay enable merchants to offer BNPL options, and Afterpay users can manage payments through Cash App

Payment Gateway & Processor Platform Landscape

Sector Highlight: Marketing & Sales Automation

Marketing automation spend is expected to increase as companies focus continued marketing efforts in email, social media, and paid advertising, the integration of machine learning and data analysis, the prominence of chatbots in customer engagement, RPA, the focus on social media marketing, and the end of 3rd-party cookies

Email and Social Media Management are the primary areas where marketers currently use marketing automation, with an increasing focus on automation for paid advertising. According to a survey by Ascend2, 40% of marketers expect increased utilization of automation for paid advertising in 2023, compared to 26% in 2022

Machine Learning will play a role in content creation and distribution, enhancing engagement accuracy. User and behavioral data from ad clicks will be leveraged by machine learning systems for future campaigns

Robotic Process Automation (RPA) will enter the realm of marketing automation in 2023. Bots will be used to automate repetitive tasks, including PPC bidding, data analysis, technical reporting, and lead nurturing processes

Social Media Marketing will be intelligently automated to target the right audience with the right messages. The creator economy will continue to flourish, and brands will optimize their social media budgets for higher engagement and conversions. The growing Gen Z population and their online presence will necessitate targeted social strategies

The Implementation of New Regulation Around the Use of 3rd-party Cookies has significantly changed how marketers leverage AdTech to track users across the web. It has become increasingly important for a merchant to receive customer consent and begin conducting 1st-party data collection in order to successfully market to known customers

Recent Transaction Spotlight

Description: Intuit (NAS: INYU) acquired Mailchimp, a global customer engagement and marketing platform for growing small and mid-market businesses

Rationale: Intuit’s acquisition of Mailchimp will advance Intuit’s mission of increasing prosperity across the globe and help accelerate its strategy of being an AI driven platform. Together, the two companies will work to deliver on the vision of an innovative, end-to-end customer growth platform for small and mid-market businesses

Marketing Automation & Sales Landscape

Sources: PitchBook, Meridian Research, WebEngage, Ascend2

Sector Highlight: Ecommerce Logistics & Fulfillment Trends

Increased Customer Expectations for Fast Shipping: The evolution of multiple purchase options has driven up expectations from customers for seamless and expedited shipping experiences

Inventory Management: Advances in technology like AI and Machine Learning are pushing the evolution of inventory management by allowing real time tracking of inventory nationwide

Process Automation: Due to the increase in order volume over the last few years, it requires more labor and infrastructure to keep up with demand. With the adoption of automation, robotics, and new technology, the fulfillment process has accelerated

Integrated & Turnkey Fulfillment Tools: Platforms, such as Shipstation, can be easily integrated with core platforms such as Shopify. Shopify currently uses 8 premium 3PL (3rd -party logistics) partners providing seamless integration within the Shopify store

Recent Transaction Spotlights

Description: Shopify (NYSE: SHOP) acquired Deliverr, a provider of ecommerce fulfillment and order storage services, offering millions of independent businesses an end-to-end logistics platform

Rationale: Shopify’s acquisition of Deliverr will offer merchants a one-stop shop for all their logistics needs. Benefits include multichannel inventory management, greater alignment between inventory supply and demand, and a more flexible, independent logistics service

Description: Flexport has acquired Deliverr and Shopify Logistics from Shopify. The transaction will enable Flexport to become a one-stop shop logistics provider for its customers

Rationale: Flexport’s acquisition of Deliverr will help level the playing field for small businesses. Flexport’s customers will have end-to-end supply chain planning, visibility, and execution to help reduce out-of-stocks, cost, and decrease the impact of the movement of goods

Description: Ryder System, Inc. (NYSE: R) has acquired both Dotcom Distribution and Whiplash in the last 16 months to create Ryder Ecommerce, an omnichannel fulfillment platform catering to ecommerce, retail, and wholesale customers

Rationale: Ryder’s acquisition of Whiplash in January 2022 allowed the Company to significantly expand its automation capabilities and broader fulfillment network. Ryder’s acquisition of Dotcom Distribution in November 2022 further builds on to Ryder Ecommerce and will expand Ryder’s services by providing best-in-class omnichannel fulfillment and distribution services

Sources: PitchBook, MergerMarket, Company Press Releases, Meridian Research

Select Digital Commerce Transactions

| Date Announced | Target | Acquirer | Transaction Type | Target Description | EV | Rev | EBITDA |

|---|---|---|---|---|---|---|---|

| Jun-23 | Cart.com | Multiple Investors | Capital Raise | Provider of e-commerce-as-a-service intended to scale businesses online | $1,600.0 | NA | NA |

| May-23 | Rize | Fifth Third Bank | M&A | Developer of customer-centric financial applications | NA | NA | NA |

| May-23 | GrowthZone | Lead Edge Capital | M&A | Developer of a cloud-based management software specializing in marketing automation | $140.0 | NA | NA |

| May-23 | Deliverr | Flexport | M&A | Provider of tech-enabled ecommerce fulfillment services to facilitate affordable, hassle-free fulfillment | NA | NA | NA |

| Mar-23 | Box Out Marketing | Keap | M&A | Provider of marketing automation solutions | NA | NA | NA |

| Feb-23 | Amware Fulfillment | Staci | M&A | Provider of third-party logistics services | $200.0 | NA | NA |

| Feb-23 | Paya | Nuvei | M&A | Leading provider of integrated payment and frictionless commerce solutions | $1,300.0 | 4.6x | 17.5x |

| Jan-23 | Bynder | Thomas H. Lee Partners | M&A | Developer of digital asset management platform intended for ecommerce businesses | $605.0 | NA | NA |

| Nov-22 | ChannelAdvisor | CommerceHub | M&A | Provider of SaaS platform to enable integration and management of merchandise sales across multiple online channels | $575.9 | 3.3x | 29.7x |

| Nov-22 | Dotcom Distribution | Ryder | M&A | Provider of ecommerce third-party logistics services catered to the health, beauty, and apparel industries | NA | NA | NA |

| Sep-22 | Watasale | Amazon | M&A | Developer of mobile payment and ecommerce platform | NA | NA | NA |

| Aug-22 | Klaviyo, Inc. | Shopify | Capital Raise | Provider of marketing automation and email platform | $100.0 | NA | NA |

| Jul-22 | Deliverr | Shopify | M&A | Provider of tech-enabled ecommerce fulfillment services to facilitate affordable, hassle-free fulfillment | $2,100.0 | NA | NA |

| May-22 | Delivery Solutions | UPS | M&A | Developer of SaaS based white-label delivery management and orchestration platform | $115.0 | NA | NA |

| Mar-22 | Corduro | Exela Technologies | M&A | Developer of a mobile payment platform | NA | NA | NA |

| Mar-22 | Veeqo | Amazon | M&A | Provider of an inventory and shipping platform intended to manage orders and inventory across distribution channels | NA | NA | NA |

| Jan-22 | Afterpay | Square (Block) | M&A | Operator of payment platform allowing consumers to pay later in installments | $27,960.0 | NA | NA |

| Jan-22 | Whiplash | Ryder | M&A | Provider of ecommerce fulfillment solutions | $481.5 | NA | NA |

| Dec-21 | Quiet Logistics | American Eagle Outfitters | M&A | Provider of third-party logistics services to ecommerce companies | $360.6 | NA | NA |

| Dec-21 | Packlink | ShipStation (Auctane) | M&A | Operator of online shipping platform intended to provide package delivery services | NA | NA | NA |

| Nov-21 | Mailchimp | Intuit | M&A | Global customer engagement and marketing platform for growing small and mid-market businesses | $12,000.0 | 12.0x | NA |

| Oct-21 | Shopsync | MailChimp | M&A | Developer of software platform to integrate between Mailchimp’s email platform and Shopify’s ecommerce platform | NA | NA | NA |

| Sep-21 | IPG Group | Mint Payments | M&A | Developer of a customizable white-label ecommerce payment gateway | NA | NA | NA |

| Sep-21 | SharpSpring | Constant Contact | M&A | Provider of cloud-based marketing technology | $234.0 | 8.0x | NA |

| Jul-21 | Ingram Micro | Platinum Equity | M&A | Provider of technology and supply chain services intended for technology and ecommerce ecosystems | $7,200.0 | 0.2x | NA |

| Feb-21 | Constant Contact | Clearlake Capital | M&A | Developer of digital marketing platform | $1,380.0 | NA | NA |

| Dec-20 | ShopRunner | FedEx | M&A | Operator of a shipping payment ecommerce network intended to connect retailers with customers | $225.0 | NA | NA |

| Feb-18 | FactSpring | Accel-KKR | M&A | Operator of an ecommerce store management and online payments platform | $77.9 | 3.1x | NA |

| Average | $3,147.5 | 5.2x | 23.6x | ||||

| Median | $528.7 | 4.0x | 23.6x |

Public Company Valuations

Digital Commerce and Order Management Platforms

| Company Name | Ticker | 10-Jul-23 Share Price | Equity Market Cap | Debt | Net Debt | EV | EV / FY 2022E Rev | EV / FY2022E EBITDA |

|---|---|---|---|---|---|---|---|---|

| Amazon.com | NAS: AMZN | $127 | $1,300,921 | $141,351 | $76,946 | $1,377,867 | 2.7x | 19.5x |

| Adobe | NAS: ADBE | $496 | $230,058 | $4,113 | ($2,488) | $227,570 | 12.9x | 26.3x |

| Shopify | NYS: SHOP | $62 | $78,858 | $1,399 | ($3,464) | $75,394 | 13.7x | (2,117.9x) |

| Block | NYS: SQ | $69 | $41,032 | $5,655 | ($4,231) | $36,801 | 2.1x | 40.0x |

| BigCommerce | NAS: BIGC | $10 | $742 | $350 | $68 | $809 | 2.9x | (16.3x) |

| Mean | $153 | $330,322 | $30,574 | $13,366 | $343,688 | 6.9x | (409.7x) | |

| Median | $69 | $78,858 | $4,113 | ($2,488) | $75,394 | 2.9x | 19.5x |

Payment Processors

| Company Name | Ticker | 10-Jul-23 Share Price | Equity Market Cap | Debt | Net Debt | EV | EV / FY 2022E Rev | EV / FY2022E EBITDA |

|---|---|---|---|---|---|---|---|---|

| PayPal Holdings | NAS: PYPL | $69 | $79,568 | $10,481 | ($166) | $79,402 | 2.9x | 11.7x |

| Adyen | AMS: ADYEN | $1,618 | $50,222 | $218 | ($6,703) | $43,519 | 29.5x | 48.4x |

| Block | NYS: SQ | $69 | $41,032 | $5,655 | ($4,231) | $36,801 | 2.1x | 40.0x |

| Toast | NYS: TOST | $23 | $11,791 | $92 | ($858) | $10,933 | 4.0x | (91.5x) |

| Shift4 Payments | NYS: FOUR | $68 | $6,118 | $1,769 | $1,025 | $7,142 | 9.9x | 25.9x |

| Flywire | NAS: FLYW | $30 | $3,214 | $2 | ($325) | $2,889 | 10.9x | 193.1x |

| Payoneer | NAS: PAYO | $5 | $1,708 | $32 | ($513) | $1,195 | 1.9x | 28.0x |

| Paysafe | NYS: PSFE | $11 | $690 | $2,642 | $2,420 | $3,111 | 2.1x | 7.6x |

| Mean | $237 | $24,293 | $2,611 | ($1,169) | $23,124 | 7.9x | 32.9x | |

| Median | $49 | $8,954 | $993 | ($419) | $9,038 | 3.5x | 26.9x |

Marketing Automation and Sales Enablement

| Company Name | Ticker | 10-Jul-23 Share Price | Equity Market Cap | Debt | Net Debt | EV | EV / FY 2022E Rev | EV / FY2022E EBITDA |

|---|---|---|---|---|---|---|---|---|

| Adobe | NAS: ADBE | $496 | $230,058 | $4,113 | ($2,488) | $227,570 | 12.9x | 26.3x |

| GoDaddy | NYS: GDDY | $77 | $12,189 | $3,967 | $3,074 | $15,263 | 3.7x | 14.4x |

| Wix.com | NAS: WIX | $75 | $4,354 | $1,119 | ($42) | $4,311 | 3.1x | (97.1x) |

| Squarespace | NYS: SQSP | $31 | $4,320 | $623 | $384 | $4,704 | 5.5x | 34.9x |

| Ryder System | NYS: R | $85 | $4,206 | $7,033 | $6,780 | $10,986 | 0.9x | 3.4x |

| Exela Technologies | NAS: XELA | $5 | $2 | $1,146 | $1,136 | $1,138 | 1.0x | 7.6x |

| Mean | $128 | $42,521 | $3,000 | $1,474 | $43,995 | 4.5x | (1.7x) | |

| Median | $76 | $4,337 | $2,556 | $760 | $7,845 | 3.4x | 11.0x |

Fulfillment, Logistics, and Returns

| Company Name | Ticker | 10-Jul-23 Share Price | Equity Market Cap | Debt | Net Debt | EV | EV / FY 2022E Rev | EV / FY2022E EBITDA |

|---|---|---|---|---|---|---|---|---|

| United Parcel Service of America | NYS: UPS | $181 | $158,029 | $26,395 | $16,997 | $175,026 | 1.7x | 10.3x |

| FedEx | NYS: FDX | $252 | $64,873 | $38,088 | $32,715 | $97,588 | 1.1x | 10.3x |

| SPS Commerce | NAS: SPSC | $181 | $6,705 | $16 | ($217) | $6,487 | 14.4x | 49.7x |

| Freshworks | NAS: FRSH | $17 | $4,756 | $33 | ($1,117) | $3,639 | 7.3x | (279.2x) |

| VTEX | NYS: VTEX | $5 | $874 | $6 | ($225) | $649 | 4.1x | (17.4x) |

| Pitney Bowes | NYS: PBI | $4 | $628 | $2,483 | $1,956 | $2,584 | 0.7x | 7.0x |

| Mean | $106 | $39,311 | $11,170 | $8,351 | $47,662 | 4.9x | (36.6x) | |

| Median | $99 | $5,730 | $1,258 | $869 | $5,063 | 2.9x | 8.7x |

US Digital Commerce Performance Index

As of July 10, 2023

Source: PitchBook Data, Meridian Research