Diversified Industrials M&A Trends: Winter 2023

Published November 17, 2022

KEY INSIGHTS

- Supply chains receive relief, while production costs are still on the rise.

- Overall M&A activity in the industrial sector has remained strong in H1 22 with average quarterly transaction volume in line with the historical average over the past three and a half years.

- Labor costs continue to rise amidst a historically tight job market.

- Security services growth trends.

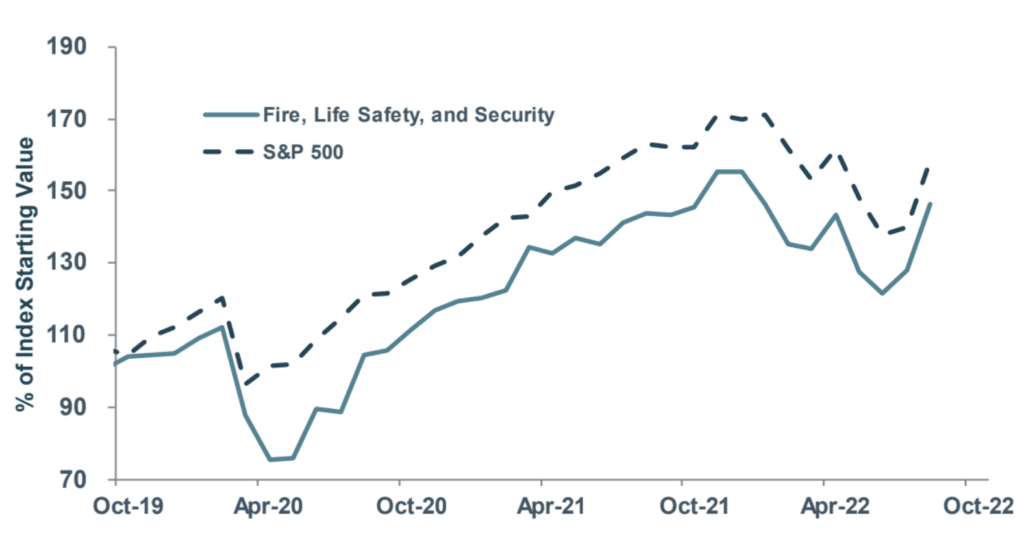

The Fire & Life Safety (“F&LS”) and Security Services sectors have continued to see M&A and consolidation activity in 2022. Recession resiliency and the recurring nature of these sectors’ revenue represent attractive investments for financial investors. The global Security Services market is projected to grow at a CAGR of 3.6% between 2022 and 2024 with the global market expected to reach $220B by 2024. The continuous growth of the market has been driven by a pandemic fueled acceleration of property crime and security surveillance spending, systems integration, and market competition for service competencies as companies work to respond to an evolving social environment. With valuation multiples in the sector continuing to show strength, 2021 and 2022 has seen some of the largest private equity platforms in fire & life safety and security services change ownership.

Diversified Industrials Market Insight

Supply Chains Receive Relief, While Production Costs Are Still On The Rise

- Supply chains for goods are receiving some relief due to softening global demand. Ocean freight rates have begun to ease and are expected to continue to decline through the end of the year and into 2023.1

- Companies are reshoring production to improve transportation and logistics costs and lead times. According to a Thomasnet survey, 83% of North American manufacturers surveyed are likely to reshore some level of production.

- Labor costs continue to rise amidst a historically tight job market. In October, the Bureau of Labor Statistics reported that compensation costs for private industry workers increased 5.2% over the 12-month period ending Sept-22. Industrials firms’ employment has continued to trend upwards, with the manufacturing sector adding 22,000 jobs in September, led by durable goods.

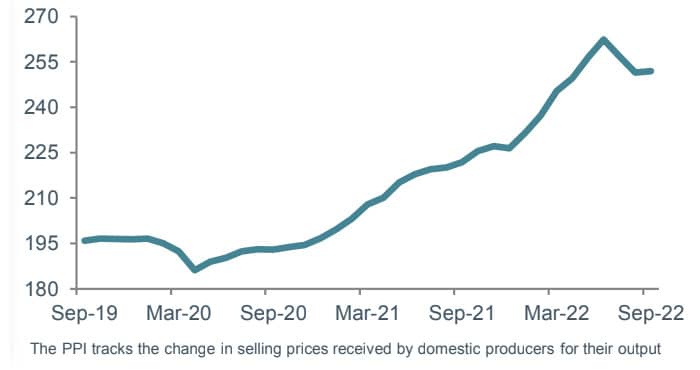

- Raw materials and input costs also continue to put additional pressure on the industry. The Manufacturing Producer Price Index grew at an annual rate of 13.6% as of September 2022.

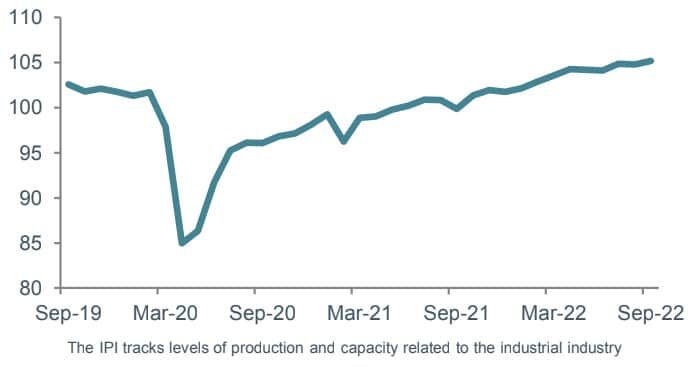

Industrial Production Index

Producer Price Index – Manufacturing

Diversified Industrial M&A Commentary

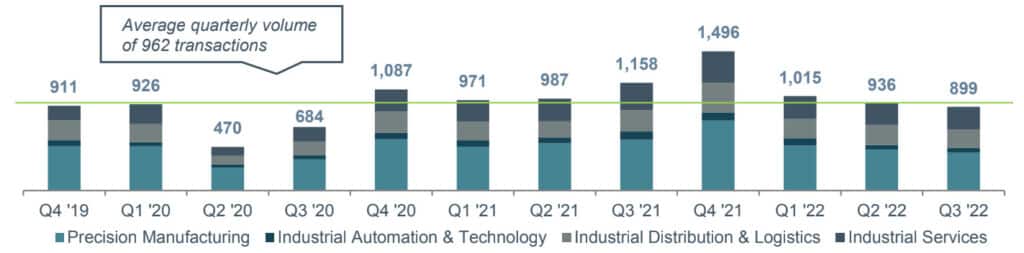

- Overall M&A activity in the industrial sector has remained strong in H1-22 with average quarterly transaction volume in line with the historical average over the past three and a half years.

- The industrial services sector has become increasingly active for M&A since 2019, accounting for 25% of overall diversified industrials2 deal activity so far in 2022, as compared to 16% in H1-19. Strong demand and recurring customer dynamics have made industrial service companies attractive investment opportunities for private equity firms with many looking to execute on roll-up strategies in verticals including landscape management, fire and life safety, commercial kitchen services, and HVAC services, among others.

- The industrial automation and technology sector has also experienced an uptick in M&A as the sector has benefited from the accelerated movement to automation as a result of ongoing tight labor market and rising wages. Since Q4-20, the sector has averaged over 70 transactions per quarter compared to ~48 per quarter from Q4-19 through Q3-20.

- Sectors more impacted by macroeconomic factors have experienced a slowdown in M&A activity as strategic buyers have turned their focus internally and private equity has looked to more insulated assets to deploy capital.

Sources: Company press releases, company websites, Pitchbook, Mergermarket, Meridian research, St. Louis Federal Reserve, PWC, The POWERS Company, Deloitte, EY, Bain & Company, IBIS World, U.S. Bureau of Labor Statistics, Thomasnet

Footnote 1: The Wall Street Journal. Footnote 2: Diversified Industrial Sector as tracked by Meridian Capital

Diversified Industrials Middle Market M&A Activity

Diversified Industrials M&A Activity

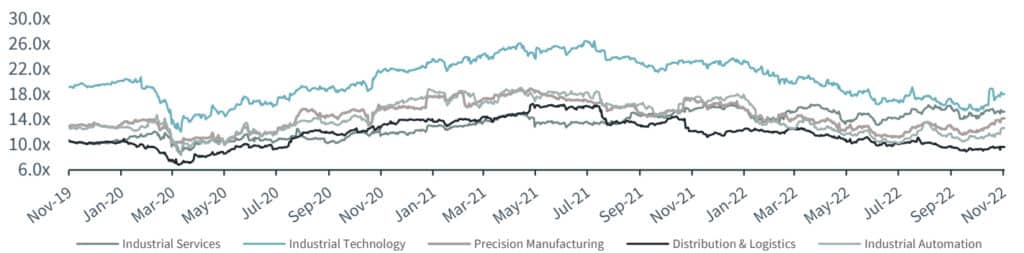

Public Market Valuations (EV/EBITDA)

Recent Transaction Case Studies

Description:

TEK Express is a provider of repair services, preventative maintenance and installation for commercial cooking and refrigeration equipment.

Rationale:

The acquisition will allow Tech24 to enter the New York City market and extend services to a broader set of customers. This represents the 14th acquisition for Tech24 under HCI ownership.

Description:

Provider of commercial refrigeration, lighting, and misting system installation and maintenance services across Washington state.

Rationale:

Arcticom was acquired by Ares at the start of 2022, and has since completed three acquisitions as it looks to expand its service offerings and geographic coverage.

Description:

Turf Masters Lawn Care Services provides recurring lawn, tree, and shrub care services to over 100,000 customers annually.

Rationale:

Turf Masters was created via the combination of three lawn care services businesses by Center Oak Partners. The Company plans to fuel growth through organic strategic initiatives and add-on acquisitions.

Description:

Smart Care Equipment solutions is a leading provider of maintenance services for commercial kitchen equipment.

Rationale:

The acquisition will allow both businesses to focus on growth through new and existing customers, expansion of geographic reach, and executing strategic acquisitions.

Sources: Company press releases, company websites, Pitchbook, Mergermarket, Meridian research

Industry Spotlight – Security Services

Security Services Growth Trends

The Fire & Life Safety (“F&LS”) and Security Services sectors have continued to see M&A and consolidation activity in 2022. Recession resiliency and the recurring nature of these sectors’ revenue represent attractive investments for financial investors.

The global Security Services market is projected to grow at a CAGR of 3.6% between 2022 and 2024 with the global market expected to reach $220B by 2024. The continuous growth of the market has been driven by a pandemic-fueled acceleration of property crime and security surveillance spending, systems integration, and market competition for service competencies as companies work to respond to an evolving social environment.

- With valuation multiples in the sector continuing to show strength, 2021 and 2022 has seen some of the largest private equity platforms in fire & life safety and security services change ownership. Fresh ownership in the sector is expected to bolster consolidation activity as private equity firms look to complete add-on acquisitions to average down their buy-in multiples.

- Recently acquired PE platforms include Endeavor Fire Protection acquired by Building Industry Partners (Aug 2022), Summit Companies acquired by Blackrock (Jan 2022), Altus Fire and Life Safety acquired by AE Industrial Partners (May 2021) and Sciences Building Solutions acquired by The Carlyle Group (December 2021).

- Hybrid work environments have created opportunity for the commercial services sector due to more volatile occupation levels. Security integrators are seeing strong interest for incremental access control, video security, and other building automation products and services.

- Commercial security businesses are seeing higher valuations and deal volume relative to the more consolidated residential security sector. Investors are seeking opportunities to expand services and align cyber and physical security with new platforms. As of October 2022, there were 28 security solutions M&A deals, compared to 15 over the same period in 2021.

Notable Transactions

Sources: Company press releases, company websites, Pitchbook, Mergermarket, Meridian research

CM Heating Acquired by Air Pros USA

In August 2022, Meridian Capital LLC (“Meridian”), a Seattle-based leading middle market investment bank and M&A advisory firm assisted its client, CM Heating Inc. (“CM” or the “Company”), in its successful sale to Air Pros USA (“Air Pros”).

Founded in 1983 and headquartered in Everett, Washington, CM Heating is a top-rated HVAC services provider in Washington, providing installation, maintenance, and repair services across Snohomish, Skagit, and King Counties. The Company has proudly built an established customer base of over 25,000+ residential customers and prides itself in providing the best quality service, top-rated products, and comprehensive HVAC expertise.

CM Heating will continue to further grow and operate under its recognized brand and reputation in Washington State while leveraging Air Pros’ operational and sales resources to accelerate growth. CM customers will continue to receive best-in-class HVAC services throughout the North Puget Sound. Co-owners John and James will remain as leaders of the business.

James Garner, President and Co-owner of CM, shared, “The partnership with Air Pros is an exciting next step for CM’s continued growth, allows us to further our growth opportunities, and continue to do right by our customers and employees.”

“Our customers trust us with their homes and comfort, so finding the right culture fit in a partner was a critical element for us,” said John Giacomi, Co-owner and General Manager of CM Heating. “We had a number of different choices of strategic partners, and we felt Air Pros will be able to best support our customers and our people.”

James and John commented, “As a multi-generational business that puts its people first, it was of utmost importance to find a partner that not only maintains and aligns with our culture, but also brings resources to accelerate growth. Meridian did an exceptional job identifying potential partners that were strongly aligned with CM’s culture and strategy, and ultimately helping us navigate a transaction with Air Pros that achieved all of our objectives.”

James Rothenberger, Managing Director at Meridian stated, “James, John, and the management team at CM Heating have built an incredible company that is the leading brand and provider north of Seattle. As part of the Air Pros platform, CM Heating will continue its strategic growth plans for many years to come. We are excited for what the future holds for CM Heating and Air Pros. Overall, HVAC M&A volume continues to be quite robust for providers of any scale; for those of scale, like CM, the valuation multiples and activity are attractive.”

Public Diversified Industrials Trading Metrics

Industrial Services

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| WM Intellectual Property Holdings (NYS: WM) | $64,921 | $78,849 | $19,441 | $5,272 | 4.1x | 15.0x | 27% | -3% |

| Cintas Corporation, Inc. (NAS: CTAS) | $45,072 | $48,167 | $8,124 | $2,035 | 5.9x | 23.7x | 25% | 1% |

| Quanta Services, Inc. (NYS: PWR) | $20,645 | $24,597 | $16,581 | $1,370 | 1.5x | 18.0x | 8% | 22% |

| Comfort Systems USA, Inc. (NYS: FIX) | $4,348 | $4,772 | $3,879 | $306 | 1.2x | 15.6x | 8% | 21% |

| ABM Industries, Inc. (NYS: ABM) | $2,964 | $4,227 | $7,491 | $434 | 0.6x | 9.7x | 6% | -8% |

| NV5 Global, Inc (NAS: NVEE) | $2,296 | $2,337 | $786 | $119 | 3.0x | 19.6x | 15% | 35% |

| Median | $12,496 | $14,684 | $7,808 | $902 | 2.2x | 16.8x | 12% | 11% |

| Average | $23,374 | $27,158 | $9,384 | $1,589 | 2.7x | 16.9x | 15% | 11% |

Industrial Distribution

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Fastenal Company (NAS:FAST) | $29,669 | $30,246 | $6,817 | $1,597 | 4.4x | 18.9x | 23% | -15% |

| W.W. Grainger, Inc. (NYS: GWW) | $29,636 | $32,257 | $14,785 | $2,321 | 2.2x | 13.9x | 16% | 21% |

| J.B. Hunt Transport, Inc. (NAS:JBHT) | $19,196 | $20,355 | $14,661 | $1,986 | 1.4x | 10.2x | 14% | -7% |

| WESCO International, Inc. (NYS: WCC) | $6,718 | $12,196 | $20,714 | $1,502 | 0.6x | 8.1x | 7% | -4% |

| MSC Industrial Direct Co., Inc. (NYS: MSM) | $4,758 | $5,587 | $3,692 | $539 | 1.5x | 10.4x | 15% | 0% |

| XPO Logistics, Inc. (NYS: XPO) | $4,542 | $7,722 | $13,108 | $1,714 | 0.6x | 4.5x | 13% | -15% |

| DNOW L.P. (NYS:DNOW) | $1,416 | $1,174 | $2,021 | $139 | 0.6x | 8.4x | 7% | 30% |

| MRC Global, Inc. (NYS: MRC) | $967 | $1,845 | $3,180 | $136 | 0.6x | 13.6x | 4% | 38% |

| Median | $5,738 | $9,959 | $9,962 | $1,550 | 1.0x | 10.3x | 13% | -2% |

| Average | $12,113 | $13,923 | $9,872 | $1,242 | 1.5x | 11.0x | 12% | 6% |

Precision Manufacturing

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Stryker Corporation (NYS: SYK) | $84,878 | $96,140 | $17,948 | $3,662 | 5.4x | 26.3x | 20% | -14% |

| Illinois Tool Works (NYS: ITW) | $69,556 | $76,411 | $15,640 | $4,112 | 4.9x | 18.6x | 26% | -5% |

| Emerson Electric Co. (NYS: EMR) | $56,434 | $70,956 | $19,216 | $5,159 | 3.7x | 13.8x | 27% | -1% |

| Parker-Hannifin Corporation (NYS: PH) | $39,622 | $53,075 | $16,332 | $2,439 | 3.2x | 21.8x | 15% | -6% |

| Ingersoll Rand (NYSE: IR) | $22,396 | $23,792 | $5,711 | $1,149 | 4.2x | 20.7x | 20% | -6% |

| Berry Global (NYSE: BERY) | $6,806 | $7,929 | $3,340 | $610 | 2.4x | 13.0x | 18% | -21% |

| AptarGroup (NYSE: ATR) | $6,514 | $15,922 | $14,743 | $2,034 | 1.1x | 7.8x | 14% | -24% |

| Gibraltar Industries (NASDAQ: ROCK) | $2,523 | $3,298 | $1,341 | $358 | 2.5x | 9.2x | 27% | 11% |

| EnPro Industries (NYS: NPO) | $1,627 | $1,745 | $1,411 | $149 | 1.2x | 11.7x | 11% | -29% |

| NN (NASDAQ: NNBR) | $85 | $348 | $491 | $37 | 0.7x | 9.4x | 8% | -66% |

| Median | $14,601 | $19,857 | $10,227 | $1,592 | 2.9x | 13.4x | 19% | -10% |

| Average | $29,044 | $34,962 | $9,617 | $1,971 | 2.9x | 15.2x | 19% | -16% |

Industrial Technology

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Danaher Corp (NYSE:DHR) | $197,278 | $213,051 | $31,250 | $10,618 | 6.8x | 20.1x | 34% | -10% |

| Siemens AG (ETR: SIE) | $100,253 | $139,214 | $77,535 | $8,662 | 1.8x | 16.1x | 11% | -27% |

| ABB Asea Brown Boveri (NYS: ABB) | $64,268 | $73,240 | $20,166 | $3,771 | 3.6x | 19.4x | 19% | -6% |

| Eaton Corporation PLC (NYS: ETN) | $57,656 | $63,398 | $29,189 | $6,096 | 2.2x | 10.4x | 21% | -5% |

| Roper Technologies (NYSE: ROP) | $46,489 | $51,254 | $6,142 | $2,249 | 8.3x | 22.8x | 37% | -10% |

| AMETEK (NYS: AME) | $31,888 | $33,935 | $6,029 | $1,779 | 5.6x | 19.1x | 30% | -1% |

| Teledyne Technologies (NYS: TDY) | $19,357 | $22,934 | $5,416 | $1,316 | 4.2x | 17.4x | 24% | -7% |

| Median | $57,656 | $63,398 | $20,166 | $3,771 | 4.2x | 19.1x | 24% | -7% |

| Average | $73,884 | $85,289 | $25,104 | $4,927 | 4.7x | 17.9x | 25% | -9% |

Industrial Automation

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Industrial Automation | ||||||||

| Honeywell International (NAS:HON) | $143,023 | $152,673 | $34,937 | $8,419 | 4.4x | 18.1x | 24% | -4% |

| Schneider Electric SE (PAR:SU) | $78,746 | $92,304 | $35,145 | $6,615 | 2.6x | 14.0x | 19% | -19% |

| Rockwell Automation (NYS:ROK) | $31,413 | $35,397 | $7,760 | $1,431 | 4.6x | 24.7x | 18% | -18% |

| Mitsubishi Electric Corporation (TKS:6503) | $20,233 | $18,462 | $37,596 | $3,428 | 0.5x | 5.4x | 9% | -29% |

| Teradyne (NAS:TER) | $15,001 | $14,359 | $3,308 | $1,015 | 4.3x | 14.1x | 31% | -35% |

| Omron Corporation (TKS:6645) | $10,385 | $9,770 | $6,468 | $815 | 1.5x | 12.0x | 13% | -48% |

| Applied Industrial Technologies (NYS:AIT) | $4,892 | $5,394 | $3,981 | $440 | 1.4x | 12.3x | 11% | 21% |

| Median | $20,233 | $18,462 | $7,760 | $1,431 | 2.6x | 14.0x | 18% | -19% |

| Average | $43,385 | $46,908 | $18,457 | $3,166 | 2.8x | 14.4x | 18% | -19% |

Select Diversified Industrials M&A Transactions

Industrial Services

| Date | Target | Buyer | Description |

|---|---|---|---|

| Oct-22 | Mercurio’s | TurnPoint Services | Provider of air conditioning, heating, and cooling services |

| Oct-22 | Toscalito Tire and Automotive | SunAuto Tire & Service | Provider of automotive repair and maintenance services |

| Oct-22 | Survivor Fire & Safety | Pye Barker Fire Safety | Provider of fire and life safety services and equipment |

| Oct-22 | Great Lakes Cleaning | New Image Building Services | Provider of commercial cleaning services |

| Oct-22 | H2O Engineering | Newterra | Provider of water treatment services |

| Oct-22 | Coyne Pest Control | Bug Busters USA | Provider of pest control services |

| Oct-22 | Central Cariboo Disposal | Environmental 360 Solutions | Provider of waste and recycling services |

| Sep-22 | Blanton and Associates | ICF International | Provider of a broad range of environmental consulting, planning, and project management services |

| Sep-22 | Greenridge Landscape | Juniper Landscape | Provider of landscape management services |

| Sep-22 | Rays Trash Service | Waste Management | Provider of waste and recycling services |

| Sep-22 | LS Systems | Sciens Building Solutions | Provider of fire, life safety, and security services |

| Aug-22 | Northwest Polymers | Atkore International | Provider of plastic recycling services |

| Aug-22 | Bem Systems | Bernhard Capital Partners | Provider of environmental engineering consulting services |

| Aug-22 | Pueblo Mechanical & Controls | OMERS Private Equity | Provider of heating, ventilation, and air conditioning (HVAC), plumbing, and controls repair services |

| Aug-22 | Valley Fire Protection Systems | Building Industry Partners | Provider of fire protection systems’ repairs and maintenance services |

| Aug-22 | Water Metrics | Performance Systems Integration | Provider of residential/commercial backflow and gauge services |

| Aug-22 | Hired Killers Pest Control | Rockit Pest | Provider of pest control services |

| Aug-22 | Water Metrics West | Performance System Integrators | Provider of fire system equipment and services |

| Aug-22 | C. M. Heating | Air Pros | Provider of installation, maintenance, and repair HVAC services |

| Aug-22 | Bug House Pest Control | Rollins | Provider of pest control |

| Aug-22 | ExperiGreen Lawn Care | Huron Capital | Provider of lawn care services |

| Aug-22 | Solutions Management | TrueSource | Provider of facilities maintenance services |

| Aug-22 | Patriot Environmental Services | Heritage-Crystal Clean | Provider of hazardous waste management and industrial cleaning services |

| Jul-22 | Summit Service Group | The Facilities Group | Provider of janitorial and facility maintenance services |

| Jun-22 | BK Systems | Altus Fire and Life Safety | Provider of fire and alarm systems and services |

Precision Manufacturing

| Date | Target | Buyer | Description |

|---|---|---|---|

| Oct-22 | Precision Surfacing Solutions | Bison Capital Asset Management | Manufacturer of precision surfacing equipment |

| Oct-22 | Benton Steel Fabrication | Morton Industries | Manufacturer of steel fabrication products |

| Oct-22 | Triad Tooling | Stellar Industrial Supply | Manufacturer of machine tool accessories |

| Oct-22 | Peltier Manufacturing | Prince & Izant | Manufacturer of metal microstamping |

| Oct-22 | Pacific Pulp Molding | Specialized Packaging Group | Designer and manufacturer of molded products |

| Jul-22 | RoboVent | Nederman Holding | Provider of industrial ventilation and filtration systems |

| Jul-22 | Universal Instruments | Delta International Holding | Manufacturer and supplier of circuit board assembly equipment |

| Jul-22 | Ceres Technologies | Atlas Copco | Manufacturer of gas and vapor delivery equipment |

| Jul-22 | MedTorque | Arch Medical | Manufacturer of surgical parts and equipment |

| Jul-22 | Formtex Plastics | Good Natured Products | Manufacturer of plastic packaging products |

| Jul-22 | Coherent | II-VI | Coherent Inc supplies photonics-based solutions |

| Jul-22 | Orange County Label | Steven Label | Manufacturer and supplier of labels, specialty die-cut and adhesive products |

| Jul-22 | Elkay | Zurn Water Solutions | Manufacturer of plumbing and cabinetry products |

| Jun-22 | Airex | Allied Motion | Designer and manufacturer of precision and specialty controlled motion products |

| Jun-22 | Artel | Advanced Instruments | Manufacturer of liquid handling, calibration and verification systems |

| Jun-22 | Scholle IPN | SIG Group | Developer and manufacturer of packaging material and equipment |

| May-22 | Fronti Fabrications | Chart Industries | Provider of engineering and fabrication services |

Industrial Distribution & Logistics

| Date | Target | Buyer | Description |

|---|---|---|---|

| Oct-22 | Hodges Fastener | Lakeshore Fastener Group | Distributor of nuts, bolts and screws |

| Oct-22 | B&I Auto Supply | Factory Motor Parts | Distributor of auto parts and accessories |

| Oct-22 | Distributors | Core & Main | Distributor of fire protection products |

| Oct-22 | Mobile Janitorial & Paper | Imperial Dade | Distributor of janitorial sanitation and food service products |

| Oct-22 | Rios Containers | Inmark | Distributor of plastic and metal bottles, cans, drums, lids and other rigid packaging products |

| Sep-22 | Ironwood Electronics | HEICO | Distributor of electronic connectors and custom solutions |

| Sep-22 | M&D Distributors | Gridiron Capital | Distributor of aftermarket parts and components for diesel-powered engines |

| Sep-22 | Western Steel and Plumbing | Dakota Supply Group | Distributor and wholesaler of plumbing and HVAC products |

| Aug-22 | Buettner Brothers Lumber Company | Southeast Building Supply Interests | Manufacturer and supplier of building materials and home supplies |

| Aug-22 | Campbell Tool and Metal Supply | Industrial Metal Supply | Distributor of metals |

| Aug-22 | Controlled Temp Supply | Ed’s Supply Company | Distributor and supplier of heating, ventilation and air conditioning parts |

| Aug-22 | MedServ Plus | Prestige Medical Imaging | Distributor of medical diagnostic imaging equipment |

| Aug-22 | Evron Industries | Cevin Industries | Distributer of personal care products |

| Aug-22 | Belt Power | Platte River Equity | Distributor and fabricator of lightweight conveyor systems |

| Aug-22 | Fischer Process Industries | Tencarva Machinery | Distributor of fluid handling equipment |

| Aug-22 | Alarm Installers | B Safe Security | Distributor of residential and commercial security products |

| Aug-22 | Flotech | Floworks | Distributor of industrial valves and automation services |

| Aug-22 | New England Drives & Controls | Shingle & Gibb Automation | Distributor of automation supplies |

| Aug-22 | Tower Fasteners | MSC Industrial Supply | Distributor of original equipment manufacturer (OEM) fasteners and components |

| Aug-22 | First Source Electrical | Winsupply | Distributor of electrical supplies |

Industrial Technology & Automation

| Date | Target | Buyer | Description |

|---|---|---|---|

| Oct-22 | Dynamic Design Solutions | Kaho Partners | Designer of custom robotic automation systems |

| Oct-22 | RobotWorx | Tennessee Industrial Electronics | Distributor of new and used industrial robots for industrial automation |

| Oct-22 | Panacea Technologies | CXV Global | Manufacturer of automation machinery products |

| Sep-22 | Professional Control Corporation | Genuine Cable Group | Manufacturer and distributor of industrial automation and control products |

| Aug-22 | AGR Automation | Convergix Automation Solutions | Provider of custom automation design and systems integration |

| Aug-22 | Eclipse Automation | Accenture | Manufacturer of custom automated engineering equipment |

| Aug-22 | Innovative Products and Equipment | Eckhart | Manufacturer of automated equipment |

| Aug-22 | HTSE | Gray Matter Systems | Developer of automation and machine control systems |

| Jul-22 | Telesis Technologies | Hitachi Industrial Equipment Systems | Manufacturer of traceability systems and laser equipment |

| Jul-22 | Parata System | Becton, Dickinson and Company | Developer of automation technology intended for pharmacies |

| Jul-22 | Hudson Robotics | Art Robbins Instruments | Provider of robotic automation services |

| Jul-22 | CM3 Building Solutions | Daikin Applied | Provider of building solutions intended to sustain comfortable, safe and energy-efficient environments |

| Jul-22 | The Integration Group of Americas | Tetra Tech | Provider of systems integration and engineering services |

| Jun-22 | Double E Company | Industrial Growth Partners | Manufacturer of advanced industrial handling components and accessories |

| Jun-22 | Select Technologies | EVAPCO | Provider of controls and automation integration services |

| May-22 | Savioke | Relay Robotics | Developer of autonomous robots |

| Mar-22 | Control Design and Manufacturing | Columbia Machine | Manufacturer of factory automation systems |

| Mar-22 | Horlick Company | SJE | Manufacturer of custom industrial control panels and motor generator sets for industrial automation market |