Telecommunications Thought Leadership: Summer 2021

Published July 2, 2021

Meridian Capital is pleased to announce the release of a new white paper, “The Art & Science of Valuing a Communications Service Provider.”

Communication today is delivered via multiple facilities-based and non-facilities-based mediums – fiber, wireless, cable, copper, satellite, ISP, resellers, and tower companies. There are many common qualities that sophisticated buyers review in determining the valuation for any individual communications service provider (“CSP”). How the service provider stacks up against these qualities is the ultimate measure of that CSP’s value.

The white paper, written by 43-year telecom veteran banker and operator, Pete Sokoloff, lists a matrix of multiple qualities affecting valuation, “We wrote the paper from the perspective of both an operator and investor. Operators especially should find the matrix useful in evaluating different elements of their own CSP operation. Our hope is that this information will provide insights to improve the business’ outlook for better future valuation.”

The Art & Science of Valuing a Communications Service Provider

By Pete Sokoloff, Senior Advisor, Telecommunications, Meridian Capital

Classic business valuation, as taught in every business school, is a dry mathematical equation. It consists of a spreadsheet that applies a discount factor to anticipated future cash flows. The discount factor is tied to a premium above the cost of funds for an acquirer. The net present value of those future cash flows is posited as the current value of the business.

That’s the science. The art of valuation comes from evaluating the numerous assumptions and risks behind the forecasted cash flows. Asset values, customer lists, area growth, historical performance are just a few of the assumptions that go into a comprehensive valuation approach. Each assumption is weighed against the impact it will have on future cash flows and the risks incurred if the assumption is wrong.

Over time, every industry builds up a shorthand approach to valuation based upon actual transactions. These are stated simply as multiples of EBITDA or Sales. Multiples come in a broad range across the CSP space. A small ISP with a dwindling customer base may sell for less than 3x EBITDA. A large nationwide fiber operator, exclusively with FTTH, or Fiber to the Home, customers may sell for 25x EBITDA. An ILEC with copper, fiber, cable TV and wireless customers would have a blended valuation, as each service has a different cash flow future.

Likewise, a review of comparable transactions can reveal a rough understanding of how buyers, sellers and the investment community tend to value CSPs.

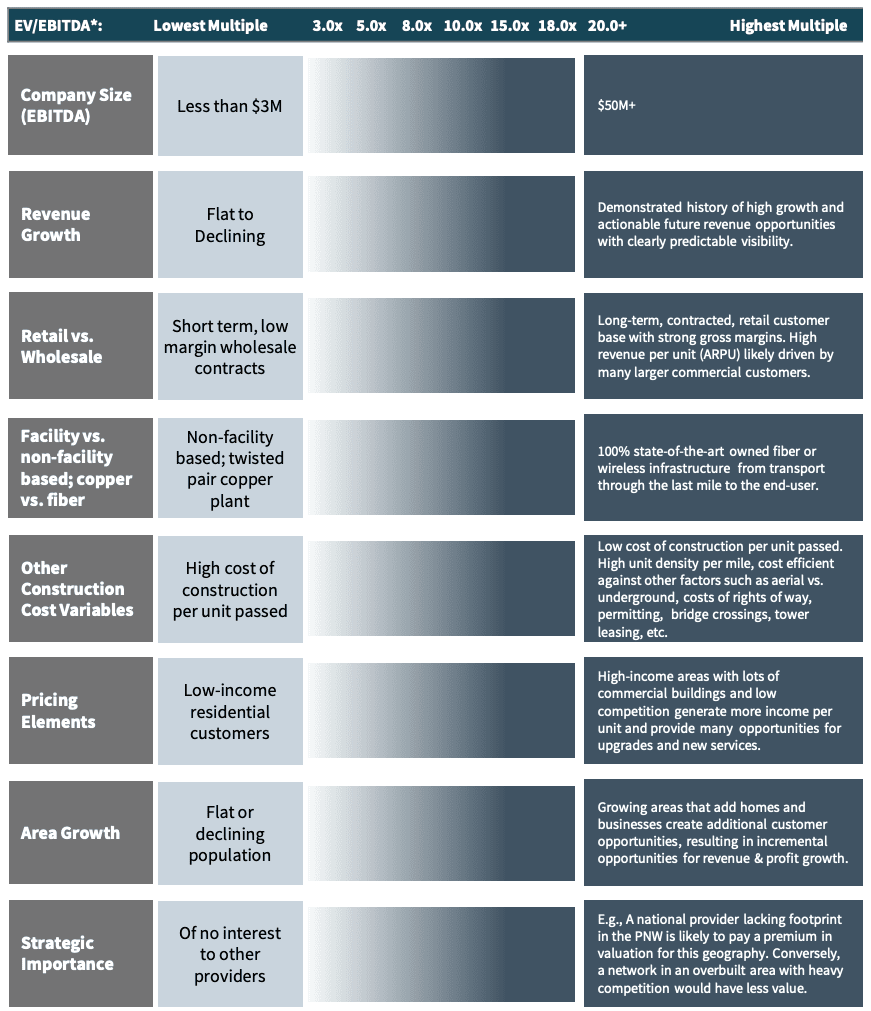

The chart on the next page features a series of factors that someone valuing any CSP would typically incorporate into establishing a valuation. This list is, by no means, complete. It shows that certain variables, when negative, will lower the valuation; when positive, will increase it. Taking the time and effort to fully understand the target business is a necessity for any serious seller or buyer.

Looking through the lens of this chart a buyer can quickly discern why one fiber or wireless operator would be so much more valuable than another similar business. A seller can consider its own prospects, and perhaps see paths to increasing valuation over time, by moving operations closer to one or more elements on the right side of the chart.

Calvin Swartley, Managing Director of Valuations at Moss Adams, an accounting, consulting, and wealth management firm, sees CSP valuations evolving as market forces impact the sector. “We continue to see robust deal activity in the communications sector, with valuations steady to rising based on continued historically low interest rates and competition in the marketplace. The science behind valuations hasn’t changed, but the art of projecting future cash flows and the expectations around returns continue to evolve along with greater competition. As always, we continue to advise that clients follow a well-reasoned valuation approach that utilizes a combination of time-tested methodologies, including discounted cash flow, asset-based, and market comparable analyses.”

Interest rates are a factor that must not be overlooked in valuation. The Prime Rate, the interest charged by banks to their best borrowers, is literally half of what it was before the market meltdown at the end of 2008. In an attempt to forestall a deep recession, the Federal Reserve cut interest rates drastically. This lowered the cost of funds for buyers, which has equated to lower “discount factors” as described in the first paragraph of this white paper. The lower the discount factor, the higher the valuation, as represented by the net present value of projected cash flows.

While the Fed had suggested that interest rates will remain near zero until 2024, real world factors are in play that recently moved the Fed to imply rate increases in 2023. These factors include a post-Covid booming economy, supercharged with stimulus money, that is raising inflation expectations. The Fed’s response to inflation has always been to raise interest rates, and when this happens, market valuations may decrease as discount factors follow interest rates to higher ground.

Meridian Capital is a FINRA-registered investment bank providing strategic merger and acquisitions (M&A) advisory and corporate finance services. The firm has an industry-focused coverage model serving nine different industry verticals, including telecommunications. Pete Sokoloff leads Meridian’s telecom practice. Pete has 40+ years of service to the telecom industry and is always happy to talk with fellow telecom professionals.

Communications Service Providers Value Drivers Matrix

Select Telecommunications M&A Transactions

| Date | Target | Acquirer | Target Description | EV ($M) | EV/Revenue | EV/EBITDA |

|---|---|---|---|---|---|---|

| May-21 | Hargray Communications Group | Sparklight (Cable One) | Advanced communication and entertainment services. | $2,200 | – | 17.2x |

| Apr-21 | Gibson Technical Services | Orbital Energy Group | Optic telecommunication services. | $48 | 1.2x | 8.7x |

| Apr-21 | Morris Broadband | Altice USA | Internet service provider. | $310 | – | – |

| Apr-21 | Otelco | Oak Hill Capital | Telecommunication service provider. | $105 | 1.7x | 5.1x |

| Jan-21 | SkyWave Broadband Internet | Nextlink Internet | Wireless high-speed internet provider. | – | – | – |

| Dec-20 | DERYtelecom | Cogeco Communications | Space-based cellular broadband operator. | $313 | 3.0x | 7.1x |

| Nov-20 | Sunrise Communications | Liberty Global | Internet service and broadband operator. | $5,427 | 2.6x | 8.5x |

| Sep-20 | Windstream | Elliot Management | Phone and broadband services. | – | – | – |

| Oct-20 | Paxio | Columbia Capital | Provider of fiber optic internet. | $15 | 2.6x | – |

| Jul-20 | Boost Mobile | Dish Network | Wireless communication services. | $1,346 | – | – |

| May-20 | North State Communications | EQT | Telecommunication network services. | $240 | – | – |

| May-20 | Ziply Fiber | British Columbia Investment Management | Fiber optic internet services. | $2,000 | – | – |

| Mar-20 | nexVortex, Inc. | BCM One | Cloud communication services. | $40 | – | – |

| Mar-20 | Cincinnati Bell | Ares Management | Telecommunication service provider. | $4,959 | 3.2x | 13.5x |

| Mar-20 | Zayo Group, LLC | Ardian | Communications infrastructure. | $20,019 | 7.7x | 17.1x |

| Jan-20 | Summit Broadband, Inc. | Grain Management | Broadband communication services. | $333 | 6.1x | 21.0x |

| Jan-20 | Arrow Business Comm. Ltd. | MML Capital Partners | Communication services. | $65 | 2.3x | – |