Telecom M&A Trends: Q1 2020 Update

Published March 14, 2020

Exploring Key Trends in Telecommunications

2019 was an exciting year for Meridian’s telecom practice and 2020 continues to build on several key trends that we have been tracking. As markets experience massive disruption, understanding the key underlying trends and tracking toward long-term goals becomes ever more important. Looking back, just before the end of the year, we closed another successful deal, representing QC Data in a sale to EN Engineering, a Kohlberg & Company, LLC portfolio company. QC Data is a leading provider of outsourced engineering and infrastructure data management services to the telecom and utilities industries; see details in the press release below. Two exciting topics we’re tracking are the 5G rollout and WISPs; we enjoyed attending a few conferences last year in support of our research: Wispapalooza and MWC/CTIA. We shared a look into both trends via the links at the bottom. We are starting 2020 off with terrific momentum and would be happy to connect with you soon.

Meridian’s Telecommunications Expertise

- Network Infrastructure

- Cellular and Wireless Services

- Operations Support Systems

- Software Vendors

- Consulting and Staffing

- Cable and Program Distribution

Market Overview – Fiber Market Bolstered by 5G Buildout

5G Spending is Accelerating

- U.S. 5G infrastructure spending is expected to grow at a 78%CAGR from 2020 to 2025

- Global spending on 5G and 5G-related infrastructure will grow from $528 million in 2018 to $26 billion by 2022, a 118% CAGR

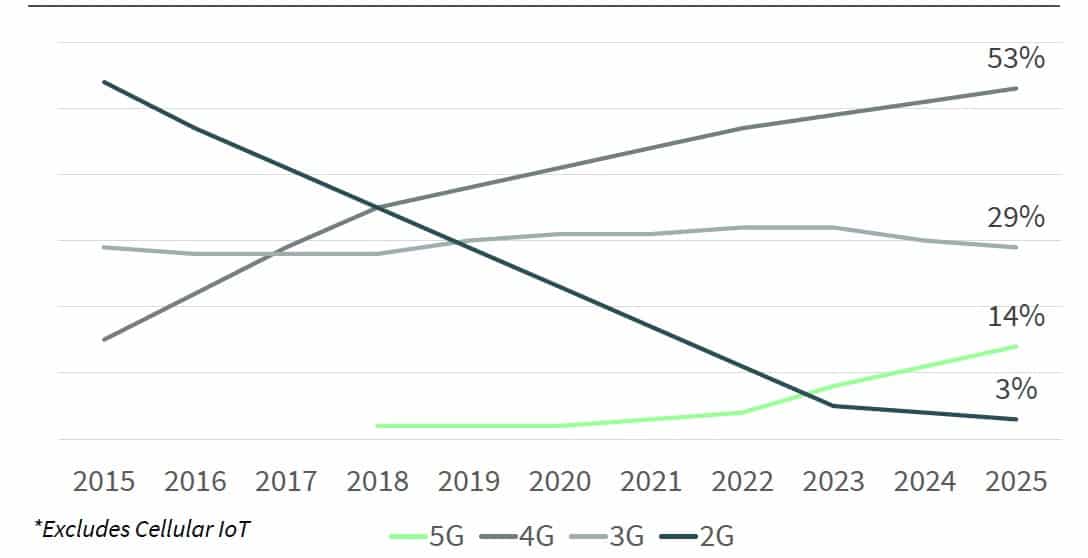

5G Buildout will Continue for Years to Come

- Despite there being a predicted 1 billion users of 5G by 2023, today’s infrastructure is far from ready to fully host 5G networks

- Only one in seven mobile connections worldwide will be 5G by 2025 (49% in the US), meaning ten years from now, providers will still be rolling out 5G4

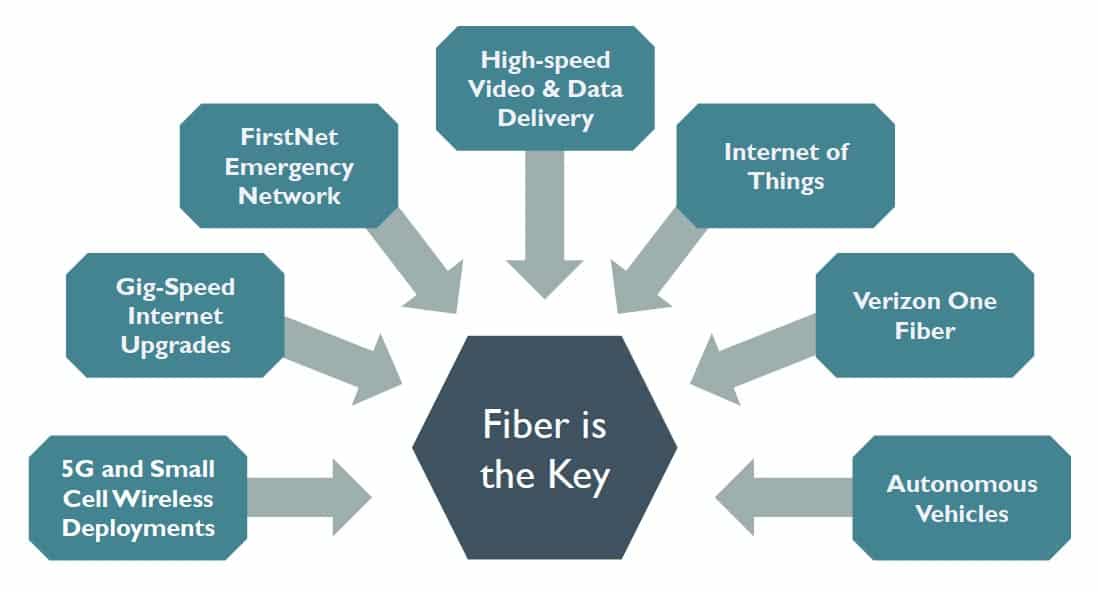

Fiber providers will see the Benefit

- Historically, Competitive Local Exchange Carriers (“CLECs”) were mostly competing directly with carriers for customers. However, today’s fiber providers serve a large community of retail customers, varying service providers, content providers, and enterprises. Additionally, there is a robust wholesale market, generated by service providers’ needs to fulfill network coverage, bandwidth, and pricing requirements for their customers.

Global Mobile Adoption by Technology, Share of Mobile Connections*

Market Overview –Industry Dynamics Driving M&A

Record Deal Activity Expected to Continue

- By the end of the first half of 2019, global Technology, Media, and Telecommunications deal count reached 2,772, up 8.6% from the previous year

- M&A activity is expected to remain strong and could increase even further in 2020 as the entire industry is set to be impacted by the implementation of 5G technology

- 58% of telecommunications executives see their M&A pipelines growing and deal completions rising in 20202

Fiber Infrastructure Proving to be an Attractive M&A Market

- Cable companies own much of the fiber network infrastructure that will play a role in the implementation of 5G and there may be increased M&A activity from those companies as they increasingly seek to compete in the wireless space and as wireless companies continue to build out their own network infrastructure

- The M&A market, where buyers were principally other fiber network and traditional phone companies, has expanded to two additional areas – private equity investors; and tower owning companies who follow a real estate model of building infrastructure and then renting space on their towers

2018/2019 Sample Strategic Fiber Buyers

Recent Private Equity Deals

| Date | Target | Buyer | EV ($ in M) | EV / Rev | EV / EBITDA |

|---|---|---|---|---|---|

| Dec-19 | North State Communications | Lumos Networks (EQT Partners) | $240.00 | – | – |

| Nov-19 | Beanfield Metroconnect | Digital Colony | $130.00 | – | – |

| Sep-19 | Bluebird Network | Macquarie Asset Management | $319.00 | – | – |

| Aug-19 | Voneus | Macquarie Asset Management | – | – | – |

| May-19* | Zayo Group (NYS: ZAYO) | Digital Colony and EQT Partners | $14,300.00 | 7.9x | 17.6x |

| Sep-18 | Everstream Solutions | AMP Capital Investors | – | – | – |

| Jul-18 | FirstLight Fiber | Antin Infrastructure Partners | $1,000.00 | – | – |

| Jun-18 | Horizon Telcom | Novacap Investments | $220.00 | 4.0x | 10.7x |

| Apr-18 | Spirit Communications | Lumos Networks (EQT Partners) | – | – | – |

Fiber Network Provider Transactions

| Date | Target | Buyer Description | Enterprise Value ($ in M) | EV / Revenue | EV / EBITDA |

|---|---|---|---|---|---|

| Dec-19 | North State Communications | Lumos Networks (EQT Partners) Operator of network and provider of communications and IT services in large metro markets, including the Piedmont Triad region of North Carolina. | $240.00 | – | – |

| Nov-19 | Beanfield Metroconnect | Digital Colony Owner and operator of private fiber optic network based in Toronto, Canada. The company provides its services to enterprise, carrier and multi-dwelling units (“MDU”) markets. | $130.00 | – | – |

| Nov-19 | Ritter Communications | Grain Management Provider of 3,000-route mile regional broadband fiber network that touches 11 states. | – | – | – |

| Sep-19 | Bluebird Network | Uniti Group, Macquarie Asset Owner and operator of 178,000 fiber strand miles in the Midwest across Missouri, Kansas, Illinois, and Management Oklahoma. | $319.00 | – | – |

| Aug-19 | Voneus | Macquarie Asset Management Provider of broadband network connections in both rural and metro areas intended to getting high-speed broadband installed in more rural locations. | – | – | – |

| Aug-19 | Agile Networks | InSite Wireless Group Provider of fiber-based wireless network designed to support the data needs and offer connectivity without limitations. | – | – | – |

| Aug-19 | InterCarrier Networks | Grain Management, Great Plains High-capacity, fiber-optic network carrier with 2,037 route miles in Illinois, Indiana, the St. Louis metro Communications area, and Kentucky. | – | – | – |

| May-19* | Frontier Communications (Assets in WA, OR, ID, and MT) | Wave Telecom assets serving more than 350,000 residential and commercial customers located in Washington, Oregon, Idaho, and Montana. | $1,350.00 | 2.2x | 5.0x |

| May-19* | Zayo Group | Digital Colony and EQT Partners Zayo owns about 130,000 route miles of fiber, which underlies most of its business and is in over 400 markets throughout the U.S., Canada, and Europe. | $14,300.00 | 7.9x | 17.6x |

| May-19 | Southern Fibernet | Uniti Group The company offers fiber to the home (“FTTH”), internet, and video content services, providing customers with an unparalleled fiber internet and TV experience. | $6.00 | – | – |

| Jan-19* | NTS Communications | Vast Broadband Provider of fiber-based communications intended to be the premier internet and application provider in West Texas. | – | – | – |

| Jan-19 | Clearwave Communications | Cable ONE Provider of telecommunications services to meet the demand for connectivity in the rural markets. | $357.00 | – | – |

| Dec-18 | Windstream (Minnesota and Nebraska Fiber Network) | Arvig Enterprises Provider of advanced network communications and technology services mid-market, enterprise, and wholesale customers in Minnesota and Nebraska. | $61.00 | – | – |

| Sep-18 | Everstream Solutions | AMP Capital Investors Provider of fiber-based services designed for providing internet network. | – | – | – |

| Aug-18 | Hudson Fiber Network | ExteNet Systems Data transport services for businesses offering high-bandwidth, low-latency networking solutions, purpose-built networks, direct internet access, gigabit ethernet, optical wave solutions, and more. | – | – | – |

| Jul-18 | FirstLight Fiber | Antin Infrastructure Partners Engaged in designing, building, and maintaining fiber-based communications networks as well as fiber optic data, internet, colocation, and voice services for enterprise and carrier customers. | $1,000.00 | – | – |

| Jul-18 | Hawaiian Telcom Holdco | Cincinnati Bell Provider of telecommunications services intended to bring comprehensive and advanced technology, entertainment, and connectivity in Hawaii. | $650.00 | 1.7x | 7.5x |

| Jun-18 | Horizon Telcom | Novacap Investments Provider of advanced broadband services intended to serve residents and businesses throughout Ohio and bordering states. | $220.00 | 4.0x | 10.7x |

| Apr-18 | Spirit Communications | Lumos Networks (EQT Partners) Provider of fiber-based data and broadband services. | – | – | – |

| Apr-18 | Network USA | Conterra Ultra (Court Square Provider of fiber optics telecommunication services. Capital) | – | – | – |

| Mar-18 | TPx Communications (Fiber assets) | Uniti Group A portfolio of fiber equipment. The portfolio comprises of 650 route miles of fiber network in California, Massachusetts, Nevada, and Texas. | $95.00 | – | – |

| Feb-18 | Spread Networks | Zayo Group Provider of telecommunication networks, including wavelengths, dark fiber, ultra low-latency services, and wireless networks, enabling clients to get long haul route connecting New York and Chicago. | $127.00 | 5.6x | 16.9x |

Publicly Traded Fiber Network Providers

| Company | Market Value of Debt | Market Value of Equity | Enterprise Value | 1 Yr Rev Growth % | TTM / Revenue | TTM / EBITDA | Enterprise Value / TTM Revenue | Enterprise Value / TTM EBITDA |

|---|---|---|---|---|---|---|---|---|

| AT&T Inc | $187,464 | $281,243 | $473,397 | 11% | $182,365 | $58,754 | 2.6x | 8.1x |

| Verizon Communications, Inc. | $130,772 | $254,309 | $383,452 | 1% | $131,374 | $36,055 | 2.9x | 10.6x |

| ATC IP LLC | $28,407 | $93,872 | $122,056 | 11% | $7,789 | $1,425 | 15.7x | 85.7x |

| Crown Castle International Corp. | $23,626 | $55,360 | $78,804 | 11% | $5,837 | $3,378 | 13.5x | 23.3x |

| CenturyLink In | $36,895 | $14,315 | $49,806 | 11% | $22,609 | $6,666 | 2.2x | 7.5x |

| Altice USA, Inc. | $24,328 | $16,742 | $41,121 | 3% | $9,741 | $4,287 | 4.2x | 9.6x |

| Zayo Group, LLC | $6,526 | $8,142 | $14,414 | -1% | $2,576 | $1,279 | 5.6x | 11.3x |

| GTT Communications, Inc. | $3,543 | $593 | $4,096 | 37% | $1,759 | $454 | 2.3x | 9.0x |

| Shenandoah Telecommunications Company | $1,134 | $1,938 | $2,974 | 2% | $634 | $250 | 4.7x | 11.9x |

| Median | $49,806 | 11% | $7,789 | $3,378 | 4.2x | 10.6x | ||

| Mean | $130,013 | 9% | $40,520 | $12,505 | 6.0x | 19.7x |

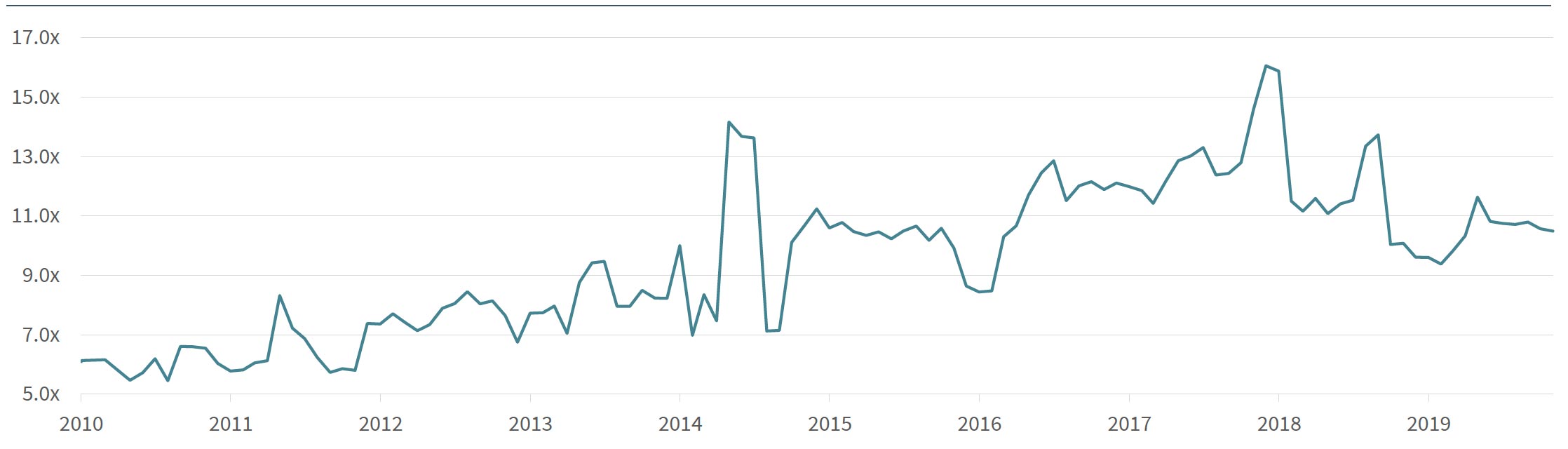

Fiber Network Provider Median Enterprise Value / EBITDA Multiple