Technology M&A Update: Fall 2018

Published November 5, 2018

Key Trends in Technology & SaaS for 2018

With 20+ years of experience in complex corporate finance and M&A challenges, Meridian Capital serves as a trusted advisor to leading middle market companies. We have over $6B in transaction experience, which offers us deep industry insight and a holistic industry coverage. Our seasoned professionals focus on businesses with $20M to $400M+ in enterprise value.

Meridian Capital publishes its Technology M&A Update which focuses on the Software-as-a-Service (SaaS) sector.

Meridian’s Technology Expertise

- Cloud Technology Solutions

- Consulting & Staffing

- Digital Media & Marketing

- E-commerce

- Fintech

- Healthcare IT

- IT Infrastructure

- Software

- SaaS

- Enterprise Solutions

- Tech-Enabled Business Services

- Telecommunications

Technology M&A Trends

The M&A market for SaaS companies remains robust, supported by the high growth profile and positive outlook for the industry as SaaS continues to become the standard for software delivery. The industry as a whole is on pace to generate $73.6 billion in revenue by the end of 2018 and is expected to continue this growth to $117.1 billion by 2021,1 representing a three year CAGR of 16.7%. Additionally, 73% of organizations say nearly all their apps will be a SaaS model by 2020.2

New Industry Entrants Through Acquisition

- The M&A market has experienced new entrants on the buy-side from legacy on-premise software providers and non-software acquirers purchasing SaaS capabilities.

- Spending on off-premises cloud IT infrastructure is expected to grow at a five-year CAGR of 12.0%, reaching $51.9 billion in 2021. During the same period, spending on on-premise software is projected to decline at a 2.7% CAGR.3 Many legacy software providers are recognizing the need to innovate and capitalize on the industry momentum through acquisition. Over the past few years, Oracle has been a prime example of a company that has utilized this strategy, having already made three substantial SaaS acquisitions during 2018.

- Additionally, non-traditional software companies have become acquisitive in the space in order to promote cross-selling opportunities and realize cost synergies with their existing business lines. This trend was illustrated by German industrial engineering giant Siemens’ acquisition of Mendix in early October 2018 for $730 million, as well as Cisco Systems’ acquisition of Broadsoft in February 2018 for $1.9 billion. Other noteworthy transactions by non-software acquirers include the August 2018 AT&T acquisition of AlienVault and Broadcom’s July 2018 announcement of an agreement to acquire CA Technologies.

Increasing Demand for Vertically-focused SaaS

- Vertically-focused SaaS companies have remained attractive targets as companies are realizing the increased benefits of specialization. Due to a targeted customer base, vertical SaaS companies realize 8x less expensive customer acquisition costs, on average than horizontal SaaS platforms. Further, vertically-focused SaaS providers are able to more easily adapt to the demands of their user base by developing tailored features for a specific industry. Ultimately, this flexibility translates into decreased churn and the ability for further upsell opportunities to existing customers.

- As of November 2018, vertically-focused public SaaS companies trade at 6.6x EV / REV compared to 5.1x for horizontal SaaS (based on an index of representative companies). The healthcare vertical followed by the financial services vertical have seen the most M&A activity, comprising 21%and 13% of total vertical SaaS deal volume, respectively during the first half of 2018.4

- Recent transactions include Allscripts Healthcare’s acquisition of HealthGrid Corp, a provider of a mobile patient engagement platform for the healthcare vertical, and Invesco’s acquisition of IntelliFlo, a practice management software for the financial services vertical.

Private Equity Firms Continue to seek Investment in SaaS Providers

- Due to their highly recurring revenue models, potential for rapid growth, ability to scale, and tendency to have automated marketing and sales strategies, SaaS companies are very attractive investment opportunities for financial investors.

- Private equity and venture capital firms have continued to raise record high levels of committed capital, giving them well over $1 trillion in dry powder that is ready to be deployed over the coming years.5

- According to Pitchbook, there have been 125 PE buyouts of SaaS companies in the first half of 2018, putting 2018 PE buyouts on pace to exceed the 2017 and 2016 totals of 242 and 182, respectively.

Select Case Studies: Vertical SaaS

Target Description: Seattle-based provider of cloud software solutions for governments to transform data into actionable insights.

Investment Rationale: With this acquisition, Tyler will help local government understand procedural bottlenecks and create predictive models to assist in improving government operations.

Buyer Quote: “We are especially excited about accelerating and advancing our long-term Connected Communities vision through the data sharing and analytical capabilities of the robust Socrata platform.” – Lynn Moore, President of Tyler Technologies

Target Description: Developer of cutting-edge software intended to improve effectiveness and efficiency of higher education fundraising efforts.

Investment Rationale: Acquisition will enable Blackbaud to offer its customers enhanced benchmarking capabilities and drive more effective fundraising.

Buyer Quote: “This is one more way Blackbaud is delivering on our commitment…[of] helping institutions ensure that their individual fundraisers are as effective as possible…” – Mike Gianoni, President and CEO of Blackbaud

Select Case Studies: Horizontal SaaS

Target Description: Developer of management solutions that provide control over IT spending and budgets.

Investment Rationale: The acquisition allows Apptio to further extend its leadership of the $6 billion Technology Business Management (TBM) market.

Buyer Quote: “We are invested in the ongoing success of Digital Fuel customers and our combined customer base will have access to the most advanced innovation in TBM” – Sunny Gupta, CEO of Apptio

Target Description: Seattle-based developer of profile and directory management software.

Investment Rationale: The acquisition combines two of the fastest growing and most exciting companies in the Microsoft ecosystem. Their technologies will enable LiveTiles to deliver organizations the most advanced intelligent workplace platforms.

Buyer Quote: “Hyperfish software will enable us to expand the LiveTiles Intelligent Workplace platform to deliver exciting new capabilities to…customers.” – Karl Redenbach, CEO of LiveTiles

Notable Recent Vertical SaaS M&A

| Date | Target | Buyer | Vertical | EV ($M) | EV/Rev |

|---|---|---|---|---|---|

| Oct-18 | Trafficware Group | Cubic (NYS: CUB) | Transportation | $236 | – |

| Oct-18 | Omnify Software | Arena, JMI Equity | Manufacturing | – | – |

| Oct-18 | OnShift | Clearlake Capital, Health Velocity Capital, Link-age | Healthcare | – | – |

| Oct-18 | Bricsys | Hexagon (STO: HEXA B) | Design | – | – |

| Oct-18 | Premiere Digital Services | Clarion Capital Partners | Media and Ent. | – | – |

| Oct-18 | DistroKid | Silversmith Capital Partners, Spotify (NYS: SPOT) | Music | – | – |

| Oct-18 | Connexeo | Great Hill Partners, Vanco Payment Solutions | Education | – | – |

| Oct-18 | Social Tables | Cvent, Vista Equity Partners | Hospitality | – | – |

| Oct-18 | Talentoday | Medix Staffing Solutions | Professional Services | – | – |

| Oct-18 | Noona Healthcare | Varian Medical Systems (NYS: VAR) | Oncology | – | – |

| Oct-18 | OpCity | News Corp (NAS: NWSA) | Real Estate | $210 | – |

| Oct-18 | AllTrails | Spectrum Equity | Travel | $75 | – |

| Oct-18 | Sunray Technology Ventures | HotSpot International | Hospitality | – | – |

| Oct-18 | NuPark | Passport | Hospitality | – | – |

| Oct-18 | F&I Express | Cox Automotive | Automobile | – | – |

| Sep-18 | Upstream Commerce | Flipkart | Retail | – | – |

| Sep-18 | Zimfly | Procore Technologies | Construction | – | – |

| Oct-18 | CosmoLex Cloud | Fidus Investment, Thompson Street | Legal | – | – |

| Oct-18 | Oasis Collections | Vacasa | Hospitality | – | – |

| Oct-18 | QBIS Insurance Solutions | Patra Corporation | Insurance | – | – |

| Oct-18 | RedQuarry | eVestment Alliance | Financial Services | – | – |

| Oct-18 | Charles River Systems | State Street (NYS: STT) | Financial Services | $2,600 | – |

| Oct-18 | Eze Software | SS&C Technologies (NAS: SSNC) | Financial Services | $1,450 | – |

| Sep-18 | Otobots | Wrench | Automobile | – | – |

| Sep-18 | FITECH Consultants | FitechGelb | Real Estate | – | – |

| Sep-18 | Aries Systems | Elsevier | Publishing | – | – |

| Sep-18 | Alegeus Technologies | Vista Equity Partners | Healthcare | $750 | – |

| Sep-18 | Juicer | SaaS.group | Social Media | – | – |

| Sep-18 | CaseloadPRO | Tyler Technologies (NYS: TYL) | Criminal Justice | – | – |

| Aug-18 | Flight Plan | Garmin (NAS: GRMN) | Commercial Aviation | – | – |

| Aug-18 | Videology | Amobee | Advertising | $119 | – |

| Aug-18 | Predikto | United Technologies (NYS: UTX) | Transportation | – | – |

| Aug-18 | LandlordStation | Priority Payment Systems (NAS: PRTH) | Real Estate | – | – |

| Aug-18 | AppNexus | AT&T (NYS: T) | Advertising | $2,000 | – |

| Aug-18 | MetaPack | Stamps.com (NAS: STMP) | E-commerce | $220 | – |

| Aug-18 | Avid AI | Fite | Sports | – | – |

| Aug-18 | Ipreo | IHS Markit | Capital Markets | $1,855 | – |

| Aug-18 | DrillingInfo | Genstar Capital | Oil and Gas | – | – |

| Aug-18 | LeaseLabs | RealPage (NASDAQ: RP) | Real Estate | $117 | 5.9x |

| Aug-18 | Leisure Corp | Ebix, Inc.(NASDAQ: EBIX) | Hotels & Leisure | – | – |

| Aug-18 | BlueStrata HER | Mediware Information Systems | Healthcare | – | – |

| Jul-18 | TMC Bonds | Intercontinental Exchange (NYSE: ICE) | Financial Services | $685 | – |

| Jul-18 | Charles River Systems | State Street | Financial Services | $2,600 | – |

| Jul-18 | Blue Software | Esko | Label and Artwork | – | – |

| Jul-18 | ELEAD1ONE | CDK Global | Automotive Dealers | – | – |

| Jul-18 | The Gordian Group | Fortive | Construction | $775 | 6.0x |

| Jul-18 | Viewpoint | Trimbe (NASDAQ: TRMB) | Construction | $1,200 | 6.0x |

| Jun-18 | Magento Commerce | Adobe Systems | Merchant | $1,700 | 11.3x |

| May-18 | Practice | Instructure, Inc.(NYSE: INST) | Education | $30 | – |

| May-18 | GoGuardian | Sumeru Equity Partners | Education | – | – |

| May-18 | RIA in a Box | Aquiline Capital Partners | Financial Services | – | – |

| May-18 | Grapeshot | Oracle (NYSE: ORCL) | AdTech | $400 | – |

| May-18 | Baker | TILT Holdings | Cannabis | – | – |

| May-18 | Reeher | Blackbaud (NASDAQ: BLKB) | Education | $43 | 3.4x |

| Apr-18 | Vocado | Oracle (NYSE: ORCL) | Financial Aid | – | – |

| Apr-18 | Promax Unlimited | SNH Capital Partners(John Bauer) | Automotive Dealers | – | – |

| Apr-18 | Socrata | Tyler Technologies (NYS: TYL) | Government | $150 | 6.0x |

| Apr-18 | Avvo | Internet Brands (KKR Backed) | Legal Services | – | – |

| Apr-18 | Booker | MINDBODY, Inc. (NASDAQ: MB) | Wellness | $150 | 6.0x |

| Mar-18 | CloudCraze | Salesforce (NYS: CRM) | E-commerce | – | – |

| Feb-18 | Chalkup | Microsoft (NAS: MSFT) | Education | – | – |

Notable Recent Horizontal SaaS M&A

| Date | Target | Buyer | Horizontal | EV ($M) | EV/REV |

|---|---|---|---|---|---|

| Oct-18 | GitHub | Microsoft (NAS: MSFT) | Software Development | $7,500.00 | – |

| Oct-18 | Relayr | Munich Re (ETR: MUV2) | IoT | $298.00 | – |

| Oct-18 | Alinean | Boathouse Capital, Mediafly | Marketing | – | – |

| Oct-18 | Dome9 Security | Check Point Software Technologies (NAS: CHKP) | Cybersecurity | $175.00 | – |

| Oct-18 | Meetingbird | Front | Scheduling | – | – |

| Oct-18 | Blue Vision Labs | Lyft | Map | $72.00 | – |

| Oct-18 | Aquiire | Coupa (NAS: COUP) | Payment | – | – |

| Oct-18 | Cloud Lending Solutions | Q2 Holdings (NYS: QTWO) | Cloud Infrastructure | $105.00 | – |

| Oct-18 | Zhilabs | Samsung Electronics (KRX: 005930) | Operations | – | – |

| Oct-18 | tCell | Rapid7 (NAS: RPD) | Cybersecurity | – | – |

| Oct-18 | RedLock | Palo Alto Networks (NYS: PANW) | Cybersecurity | $173.00 | – |

| Oct-18 | Tresata | GCP Capital Partners | Analytics | $50.00 | – |

| Oct-18 | EmaginePOS | Spot On Networks | Point of Sale | – | – |

| Oct-18 | Apttus | Thoma Bravo | Revenue Management | $1,000.00 | – |

| Oct-18 | Ambassador | Apollo Global Management (NYS: APO), West | Marketing | – | – |

| Oct-18 | FreedomPay | TPG Capital | Payment | – | – |

| Oct-18 | Mendix | Siemens | Application Development | $730.00 | – |

| Oct-18 | Duo Security | Cisco Systems (NAS: CSCO) | Cybersecurity | $2,350.00 | – |

| Oct-18 | OpsGenie | Atlassian (NAS: TEAM) | Scheduling | $295.00 | – |

| Oct-18 | MobileEyes | Tyler Technologies (NYS: TYL) | Safety | – | – |

| Oct-18 | Conversable | LivePerson (NAS: LPSN) | Communication | – | – |

| Sep-18 | Federated Payments | EVO Payments International (NAS: EVOP) | Payment | – | – |

| Sep-18 | Quorum Software | Thoma Bravo | ERP | $740.00 | – |

| Sep-18 | TEAM Software | Accel-KKR | Management | – | – |

| Sep-18 | TAKE Supply Chain | ESW Capital | Supply Chain | – | – |

| Sep-18 | iCIMS | Vista Equity Partners | Human Resources | – | – |

| Sep-18 | Teem | WeWork | Human Resources | $100.00 | – |

| Sep-18 | Base (Sales Platform) | Zendesk (NYS: ZEN) | CRM | – | – |

| Sep-18 | Iota | Solbright Group (PINX: SBRT) | Communication | – | – |

| Sep-18 | SpringCM | DocuSign (NAS: DOCU) | Contract Management | $220.00 | – |

| Sep-18 | Tintri | DataDirect Networks | Cloud | $28.00 | – |

| Sep-18 | DCR Workforce | Coupa Software (NAS: COUP) | Vendor Management | – | – |

| Aug-18 | Frame | Nutanix (NAS: NTNX) | Cloud | $165.00 | – |

| Aug-18 | AlienVault | AT&T (NYS: T) | Cybersecutiry | $118.00 | – |

| Aug-18 | Alchemy Systems | Intertek (LON: ITRK) | Training | $480.00 | 7.3x |

| Aug-18 | StorReduce | Pure Storage (NYS: PSTG) | Cloud | – | – |

| Aug-18 | Mattersight | NICE Systems (NAS: NICE) | Behavioral Analytics | $81.00 | 1.6x |

| Aug-18 | My Benetech | NexgenRx (TSX: NXG) | Administrative | – | – |

| Aug-18 | Vidpresso | Facebook (NAS: FB) | Interconnectivity | – | – |

| Aug-18 | Exactuals | City National Bank | Payment | – | – |

| Aug-18 | Prevoty | Imperva (NAS: IMPV) | Cybersecurity | $140.00 | – |

| Aug-18 | Treasure Data | ARM | Data Analytics | $600.00 | – |

| Aug-18 | SecurView | RAG-Stiftung | Cybersecurity | – | – |

| Aug-18 | Adaptive Insights | Workday (NAS: WDAY) | Corporate Finance | $1,556.00 | 13.6x |

| Aug-18 | Inocybe Technologies | Kontron | Open Networking | – | – |

| Aug-18 | Celergo | Automatic Data Processing (NAS: ADP) | Payroll | – | – |

| Jul-18 | Solebit | Mimecast (NASDAQ: MIME) | Cybersecurity | $90.00 | – |

| Jul-18 | Beeline.com | New Mountain Capital | Human Resource Management | – | – |

| Jul-18 | HipChat | Slack | Communications | – | – |

| Jul-18 | PeopleDoc | The Ultimate Software Group (NASDAQ: ULTI) | Human Resource Management | $300.00 | – |

| Jul-18 | Butter.ai | Box (NYSE: BOX) | Big Data | – | – |

| Announced | CA Technologies (NAS: CA) | Broadcom (NAS: AVGO) | ERP | $19,000.00 | 4.4x |

| Jul-18 | Trusted Metrics | HarbourVest Partners | Cybersecurity | – | – |

| Jun-18 | Flowroute | West | Communications | – | – |

| Jun-18 | Radisys | Reliance Industries (NSE: RELIANCE) | Infrastructure | $75.00 | 0.6x |

| Jun-18 | References-Online | Upland Software (NASDAQ: UPLD) | Sales | $13.00 | – |

| Jun-18 | Return Magic | Shopify (TSX: SHOP) | E-commerce/Retail | – | – |

| Jun-18 | Velocity Mail | Descartes (Logistics) (TSX: DSG) | Network Management | $26.00 | – |

| Jun-18 | Registrar Corp | Bertram Capital Management | FDA Compliance | – | – |

| Jun-18 | Empirical Systems | Tableau Software (NYSE: DATA) | Big Data | – | – |

| Jun-18 | Scribe Software | TIBCO Software | CRM | – | – |

| Jun-18 | Brand Protection Agency | Ansira Partners (Advent International) | Communications | – | – |

| May-18 | Hyperfish | LiveTiles (ASX: LVT) | Directory | $7.00 | 22.0x |

| May-18 | Birch Communications | Fusion Télécommunications (NAS: FSNN) | Communications | $739.00 | – |

| May-18 | Imagine Software (USA) | Mountaingate Capital | Revenue Cycle Management | – | – |

| May-18 | Meta SaaS | Flexera | Organization | – | – |

| May-18 | MuleSoft (NYSE: MULE) | Salesforce (NYSE: CRM) | Application Integration | $6,607.00 | 22.3x |

| May-18 | Datascience.com | Oracle (NYS: ORCL) | Data Science | – | – |

| Apr-18 | VendorHawk | ServiceNow (NYSE: NOW) | Organization | – | – |

| Apr-18 | Bizible | Marketo (Vista Equity Partners) | Marketing | – | – |

| Apr-18 | Vocado | Oracle (NYSE: ORCL) | Financial Aid | $139.00 | – |

| Apr-18 | Callidus Software | SAP (NYSE: SAP) | CRM | $2,400.00 | 8.9x |

| Apr-18 | Jive Communications | LogMe In (NASDAQ: LOGM) | Communications | $357.00 | – |

| Apr-18 | Unified Messaging Systems | Everbridge (NASDAQ: EVBG) | Alert Software | $32.00 | – |

| Mar-18 | Mozy | Carbonite (NASDAQ: CARB) | Database | $146.00 | – |

| Mar-18 | Openwave Mobility | Enea (STO: ENEA) | Database | – | – |

| Mar-18 | Wombat Security Technologies | Proofpoint (NASDAQ: PFPT) | Cybersecurity | $225.00 | – |

| Feb-18 | Barracuda | Thoma Bravo | Cybersecurity | $1,600.00 | 3.8x |

| Feb-18 | Cedexis | Citrix Systems (NASDAQ: CTXS) | Application Delivery | – | – |

| Feb-18 | LiquidHub | Capgemini (PAR: CAP) | Media and Information | $494.00 | 2.3x |

| Feb-18 | BroadSoft | Cisco Systems (NASDAQ: CSCO) | Communications | $1,900.00 | 4.2x |

| Feb-18 | Digital Fuel | Apptio (NASDAQ: APTI) | Financial Software | $43.00 | – |

| Jan-18 | SingleHop | Internap (NASDAQ: INAP) | Infrastructure/Cloud Computing | $132.00 | – |

| Jan-18 | Converse.AI | Smartsheet (NYSE: SMAR) | Communications | – | – |

| Jan-18 | Niddel | Verizon | Cybersecurity | – | – |

Source:PressReleases, Pitchbook, CapitalIQ

Select Public Vertical SaaS Companies

| Company | Gross margin | 1 Year Revenue Growth % | Market Cap | Net Debt | Enterprise Value | Revenue | EBITDA | EBITDA Margin | EV / Revenue |

|---|---|---|---|---|---|---|---|---|---|

| Veeva Systems Inc. (NYS:VEEV) | 69.8% | 23.5% | $12,739 | -$1,010 | $11,728 | $766 | $198 | 25.8% | 15.3x |

| Guidewire Software, Inc. (NYSE:GWRE) | 55.1% | 28.5% | $6,902 | -$762 | $6,140 | $661 | $29 | 4.4% | 9.3x |

| RealPage, Inc. (NAS:RP) | 60.6% | 26.7% | $4,848 | $225 | $5,074 | $774 | $136 | 17.5% | 6.6x |

| athenahealth, Inc. (NAS:ATHN) | 53.6% | 11.7% | $5,011 | $42 | $5,053 | $1,287 | $282 | 21.9% | 3.9x |

| Medidata Solutions, Inc. (NAS:MDSO) | 75.7% | 16.0% | $4,310 | -$109 | $4,201 | $611 | $96 | 15.8% | 6.9x |

| Elie Mae, Inc. (NYS:ELLI) | 58.3% | 19.2% | $2,347 | -$272 | $2,074 | $477 | $89 | 18.7% | 4.3x |

| Castlight Health, Inc. (NYS:CSLT) | 60.8% | 26.0% | $332 | -$70 | $262 | $146 | -$48 | N/A | 1.8x |

| Median | 60.6% | 23.5% | $4,848 | -$109 | $5,053 | $661 | $96 | 18.1% | 6.6x |

| Mean | 62.0% | 21.7% | $5,213 | -$280 | $4,933 | $675 | $112 | 17.3% | 6.9x |

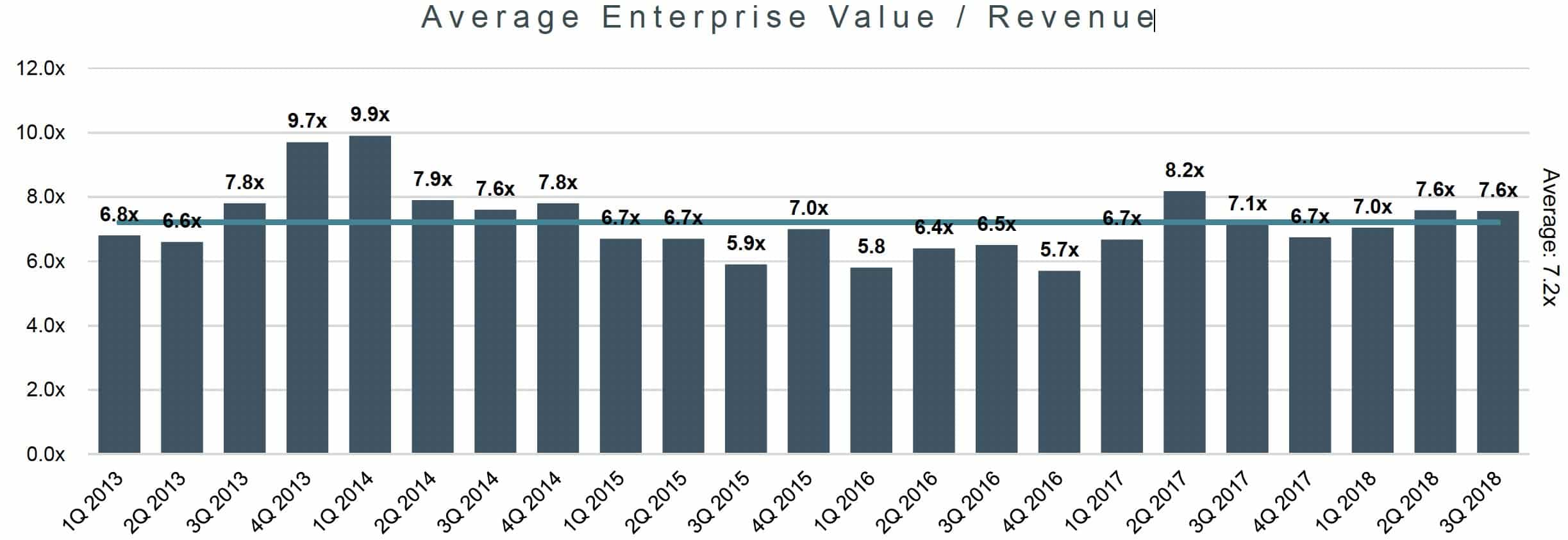

Vertical SaaS Valuation Multiples

Select Public Horizontal SaaS Companies

| Company | Gross margin | 1 Year Revenue Growth % | Market Cap | Net Debt | Enterprise Value | Revenue | EBITDA | EBITDA Margin | EV / Revenue |

|---|---|---|---|---|---|---|---|---|---|

| Salesforce (NYS:CRM) | 74.0% | 25.6% | $100,013 | $971 | $100,984 | $11,818 | $1,681 | 14.2% | 8.5x |

| Workday, Inc. (NYS:WDAY) | 70.6% | 30.7% | $27,780 | -$1,808 | $25,972 | $2,428 | -$161 | N/A | 10.7x |

| Zendesk, Inc. (NYS:ZEN) | 70.1% | 39.0% | $5,696 | -$238 | $5,458 | $508 | -$89 | N/A | 10.7x |

| RingCnetral, Inc. (NYS:RNG) | 76.2% | 31.4% | $5,662 | -$207 | $5,455 | $532 | $4 | 0.6% | 9.4x |

| HubSpot, Inc. (NYS:HUBS) | 80.2% | 38.6% | $4,995 | -$242 | $4,753 | $441 | -$29 | N/A | 10.8x |

| LogMeIn, Inc. (NAS:LOGM) | 77.4% | 45.9% | $4,355 | $32 | $4,387 | $1,170 | $367 | 31.3% | 3.8x |

| TriNet Group, Inc. (NYS:TNET) | 18.9% | 6.1% | $3,369 | $143 | $3,512 | $3,434 | $305 | 8.9% | 1.0x |

| Box, Inc. (NYS:BOX) | 72.7% | 22.5% | $2,475 | -$111 | $2,365 | $555 | -$105 | N/A | 4.3x |

| Paylocity Holding Corporation (NAS:PCT) | 60.5% | 25.8% | $3,361 | -$1,363 | $1,998 | $378 | $47 | 12.4% | 5.3x |

| LivePerson, Inc. (NAS:LPSN) | 74.60% | 8.40% | $1,314 | -$70 | $1,244 | $234 | $0 | 0.10% | 5.3x |

| Carbonite, Inc. (NAS:CARB) | 71.40% | 19.60% | $1,106 | $124 | $1,230 | $265 | $26 | 9.70% | 4.6x |

| Upland Software, Inc. (NAS:UPLD) | 67.00% | 47.00% | $653 | $140 | $793 | $121 | $12 | 9.90% | 6.5x |

| Zix Corporation (NAS:ZIXI) | 79.00% | 6.80% | $362 | -$24 | $338 | $69 | $11 | 15.60% | 4.9x |

| ChannelAdvisor Corporation (NYS:ECOM) | 79.00% | 6.60% | $320 | -$49 | $271 | $121 | -$4 | N/A | 2.1x |

| Brightcove Inc. (NAS:BCOV) | 59.00% | 5.90% | $287 | -$27 | $260 | $162 | -$7 | N/A | 1.6x |

| Amber Road, Inc. (NYS:AMBR) | 54.10% | 7.40% | 245 | $14 | $259 | $82 | -$4 | N/A | 3.2x |

| Median | 72.10% | 24.00% | 2,918 | -$38 | $2,182 | $409 | $2 | 9.90% | 5.1x |

| Mean | 67.80% | 23.00% | $10,125 | -$170 | $9,955 | $1,395 | $128 | 11.40% | 5.8x |

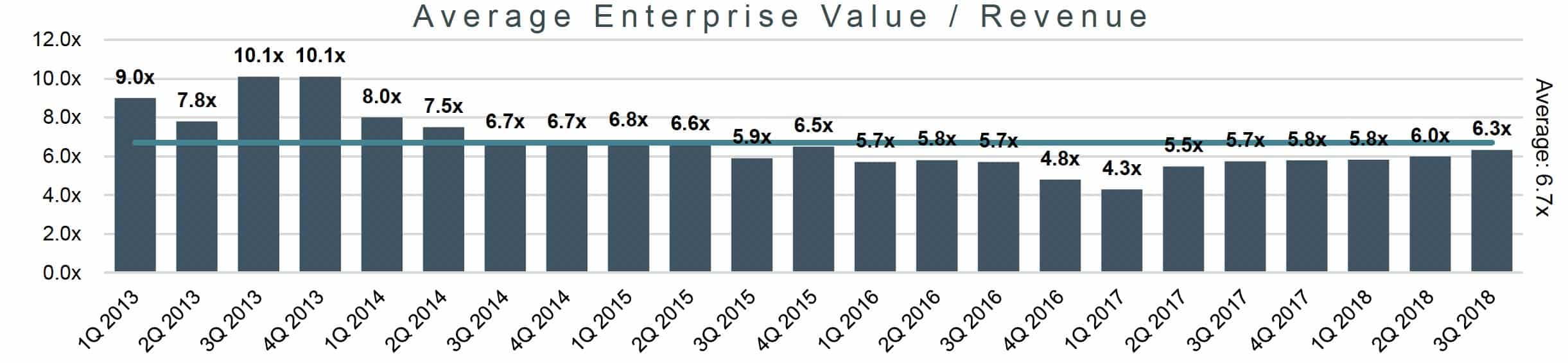

Horizontal SaaS Valuation Multiples

References

1 Gartner

2 Bettercloud

3 International Data Corporation

4 Software Equity Group

5 Pitchbook