Technology M&A Trends: Spring 2022

Published May 9, 2022

KEY INSIGHTS: ARTIFICIAL INTELLIGENCE & MACHINE LEARNING

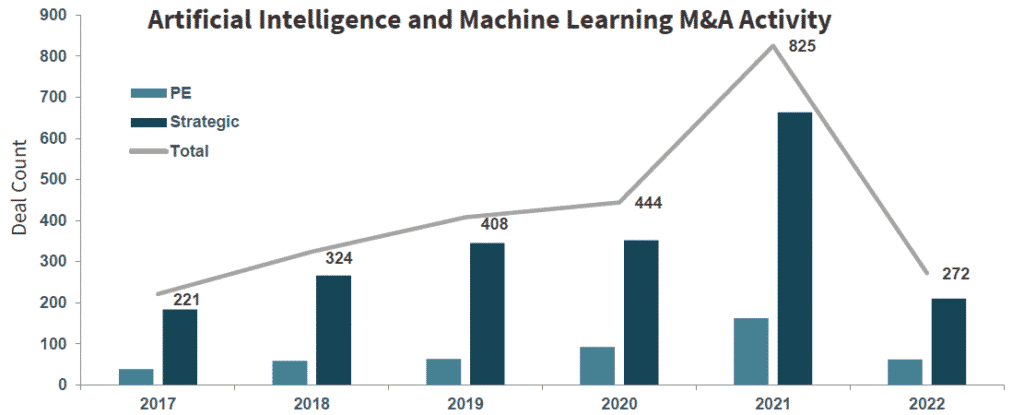

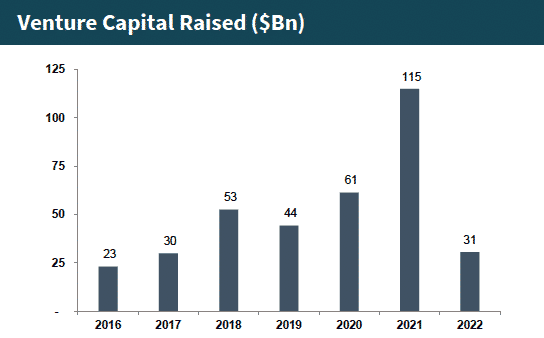

- 2021 was a banner year for companies with AI-based offerings, both M&A activity and venture capital raised nearly doubled from 2020 and 2022 shows no signs of slowing down.

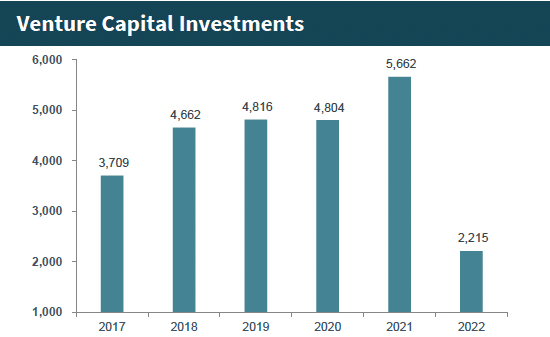

- In 2021 venture capital deals grew at a fraction of capital raised as investments continued to concentrate on more mature companies; there were four funding rounds worth $500M or more in 2020 and 15 in 2021.

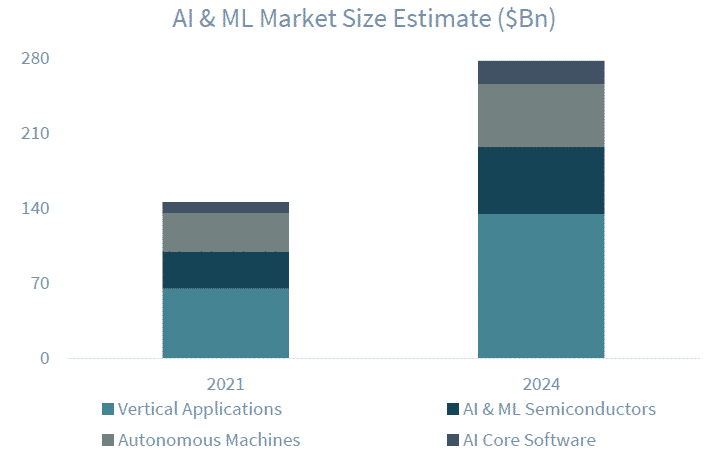

- The current AI & ML market is estimated to be $145.8 billion and is forecast to nearly double by 2024, driven by vertical applications.

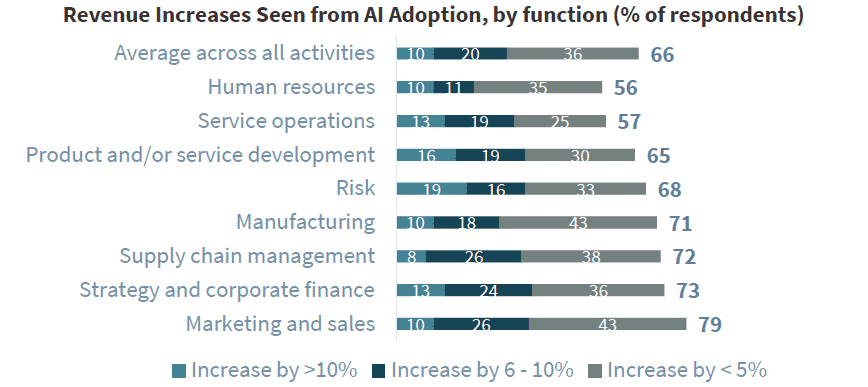

Revenue Increases Seen from AI Adoption

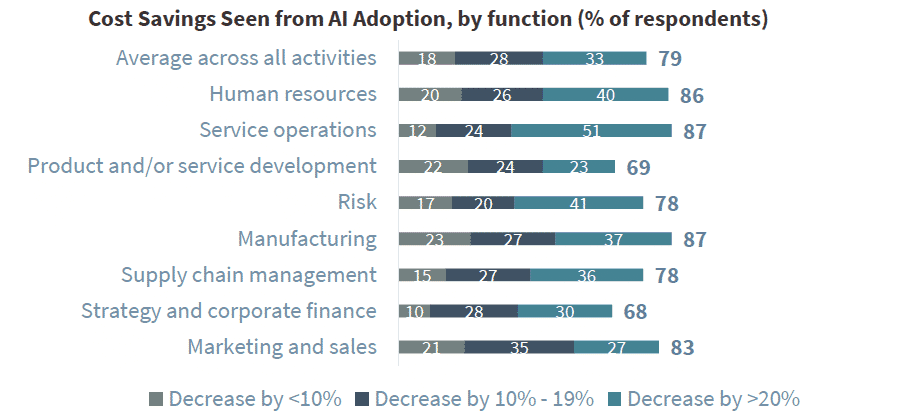

In its global survey, The State of AI in 2021, McKinsey asked over 1,800 respondents about their organization’s use of AI; 56% of respondents, up from 50% in 2020, reported that their organizations have already adopted AI and their responses inform the below. Considering the pandemic, the use of AI in the 2021 survey showed an increased ability of AI to lower costs than a year prior and 27% of respondents cited that more than 5% of their organizations’ EBIT is attributable to AI, up from 22%.

Recently, private equity investors have realized the supercharge growth that AI can add to portfolio companies and have come to understand the value of investing in AI — leading to dedicated investing platforms.

AI Market Insights

Artificial Intelligence in 2022

- 2021 was a banner year for companies with AI-based offerings, both M&A activity and venture capital raised nearly doubled from 2020.

- In 2021 venture capital deals grew at a fraction of capital raised as investments continued to concentrate on more mature companies; there were four funding rounds worth $500M or more in 2020 and 15 in 2021.

- AI is also decreasing in cost and showing improved performance, both of which pave the way for greater commercial adoption of AI.

- Per Stanford, the cost to train an image classification system has deceased by 63.6% since 2018, while a 94.4% improvement was seen in training times.

- The current AI & ML market is estimated to be $145.8 billion and is forecast to nearly double by 2024, driven by vertical applications.

- Research has shown that AI adopted by companies can have an impact on the bottom line, both by increasing revenue and improving costs.

- With AI poised for widespread adoption, the next page details areas in which companies currently using AI have seen impacts on the P&L.

AI’s Impact on the P&L

- In its global survey, The State of AI in 2021, McKinsey asked over 1,800 respondents about their organization’s use of AI; 56% of respondents, up from 50% in 2020, reported that their organizations have already adopted AI and their responses inform the below.

- Considering the pandemic, the use of AI in the 2021 survey showed an increased ability of AI to lower costs than a year prior and 27% of respondents cited that more than 5% of their organizations’ EBIT is attributable to AI, up from 22%.

- Within the above functions, the activities that were most likely to drive revenue increases include inventory and parts optimization, pricing and promotion, customer service analytics, and sales and demand forecasting.

- Within the above functions, the activities that were most likely to produce cost savings include: optimization of talent management, automation of contact-centers, and warehouse automation.

Recent Transaction Spotlights

Description: Microsoft Corp acquired Nuance Communications Inc. (Nasdaq: NUAN), a leader in conversational AI and ambient intelligence.

Rationale: With this acquisition, Microsoft can enable Nuance technology in its offerings, with an aim of allowing its customers to realize greater productivity and financial performance and of introducing natural language processing to its products.

Description: Siemplify, a leading security orchestration, automation, and response (“SOAR”) company based in Israel, has been acquired by Google.

Rationale: Google will add Siemplify’s SOAR capabilities into its Google Cloud security offering, strengthening the offering.

Description: Yum! Brands, Inc. the operator of global fast food chains KFC, Pizza Hut, and Taco Bell, has acquired the Australia-based, creator of an AI-based kitchen software program.

Rationale: The acquisition looks to support the scaling of Dragontail’s offer throughout Yum! Brands’ portfolio, boosting automation and efficiency of the kitchen flow.

Notable Private Equity Investors Creating AI & ML Platforms

Recently, private equity investors have realized the supercharge growth that AI can add to portfolio companies and have come to understand the value of investing in AI — leading to dedicated investing platforms.

Symphony AI

Description: Investment firm that builds packaged AI solutions to serve the world’s largest industries.

Headquarters: Los Altos, CA

Investments: Five investments since 2019

Investment Thesis: Building a leading enterprise AI company that provides SaaS solutions for revenue and profit growth, servicing businesses across all key vertical sectors.

Recent Investments

THL

Description: Private equity firm that seeks to invest in middle-market growth companies operating in the financial services, healthcare, technology and business solutions sectors.

Headquarters: Boston, MA

Investments: Six investments since 2019

Investment Thesis: Raised a $900 million fund focused solely on automation. The team seeks to create step-function change through automation as the driver, and to support management teams in accelerating growth through access to capital and automation experts.

Recent Investments

Battery Ventures

Description: American technology-focused investment firm that makes venture-capital and private-equity investments in markets across the globe.

Headquarters: Boston, MA

Acquisitions: Three investments since 2018Investment Thesis: Believes ML observability will produce more value to AI investments and is building out an AI powered applications platform.

Recent Investments

Notable Transactions

| Date | Acquirer/Investor | Target | Target Description | EV ($Ms) | EV/ Rev |

|---|---|---|---|---|---|

| 3-May | LexisNexis Risk Solutions | BehavioSec | Developer of a behavioral biometric software platform | nd | nd |

| 28-Apr | Somatus | Lumiata | Developer of health analytics platform designed to make predictions | nd | nd |

| 27-Apr | Boathouse Capital, Keiretsu Forum, Mediafly | ExecVision | Developer of a conversation intelligence platform | nd | nd |

| 25-Apr | Databricks | Cortex Labs | Developer of a serverless computing platform | nd | nd |

| 25-Apr | Advent International, Assembly | PipeCandy | Provider of a market intelligence platform | nd | nd |

| 21-Apr | Ripcord | LearningPal | Developer of an AI-based enterprise platform designed to digitize paper documents | nd | nd |

| 18-Apr | Great Hill Partners, Ten Coves Capital, Versapay | DadeSystems | Developer of a SaaS-based accounts receivable automation technology platform | nd | nd |

| 11-Apr | Clever RX | Predictive Health Partners | Developer of a healthcare platform to predict and prevent avoidable healthcare costs | nd | nd |

| 11-Apr | NuWave Solutions | ProModel | Developer of a simulation-based decision-making platform | nd | nd |

| 6-Apr | Clip Automation | Sapphire Automation | Developer of automation software for tools, material handling and factory automation | nd | nd |

| 5-Apr | SilverSky | Cybraics | Developer of cyber analytics platform | nd | 1.1x |

| 2-Apr | Thomas H. Lee Partners | Carpe Data | Developer of predictive scoring and data products insurance platform. | nd | nd |

| 1-Apr | MasterCard | Dynamic Yield | Developer of an AI-powered customer personalization platform | $320 | nd |

| 30-Mar | Tailwind | Replier.ai | Developer of an artificial intelligence customer review platform | nd | nd |

| 21-Mar | American Robotics | Ardenna | Developer of infrastructure inspection software | nd | nd |

| 10-Mar | Paradigm Governance, Principal Technologies | Vision Surgery AI | Operator of computer vision and AI technology to aid surgeons. | nd | nd |

| 22-Mar | Shippit | Premonition | Developer of artificial intelligence-based logistics platform | $21 | nd |

| 21-Mar | Akamai Technologies | Linode | Provide cloud hosting services | $900 | nd |

| 4-Mar | Microsoft | Nuance Communications | Developer of conversational AI platforms | $20,000 | 14.0x |

| 2-Mar | Snowflake | Streamlit | Developer of an open-source application framework | $800 | nd |

| 28-Feb | Oribi | Developer of a marketing analytics tool | $85 | nd | |

| 18-Feb | Advent International, Definitive Healthcare | Analytical Wizards | Developer of a business analytics platform | $65 | nd |

| 18-Feb | Proteus Cambridge | Sharktower | Developer of an AI-driven project management software | $14 | nd |

| 16-Feb | Moxi Works, Vector Capital | ActivePipe | Developer of a cloud-based email marketing platform | $82 | nd |

| 16-Feb | Vinco Ventures | AdRizer | Provider of marketing analytics services | $108 | nd |

| 14-Feb | CredAvenue | Spocto | Developer of a SaaS-based debt recovery platform | $53 | nd |

| 13-Feb | CITIC Capital Acquisition | Quanergy Systems | Quanergy Systems Inc offers a high-performance AI-powered LiDAR platform | $1,400 | nd |

| 9-Feb | Tricentis | Testim | Developer of a testing automation platform | $150 | nd |

| 1-Feb | MTS AI | VisionLabs | Developer of a visual recognition technology | $91 | nd |

| 20-Jan | Power & Digital Infrastructure Acquisition | Core Scientific | Core Scientific Inc is engaged in Blockchain and AI Infrastructure | $190 | nd |

| 18-Jan | Mayfair Equity Partners | LoopMe | Developer of a brand advertising mobile platform | $120 | nd |

| 18-Jan | Marlin Equity Partners | Silobreaker | Developer of an intelligence platform intended to tackle the proliferation of data. | $96 | nd |

| 5-Jan | Providence Equity Partners, Smartly.io | Ad-Lib.io | Developer of an AI-based business platform | $133 | nd |

| 5-Jan | Alphabet | Siemplify | Developer of holistic security operations platform | $500 | nd |

| 23-Dec | Rocket Companies | Truebill | Developer of a finance management application | $1,200 | nd |

| 22-Dec | Global SPAC Partners | Gorilla | Developer of cloud-based video-centric and content management applications | $169 | nd |

| 21-Dec | Workday | VNDLY | Developer of a vendor management platform | $510 | nd |

| 1-Dec | Genesys | Exceed.ai | Developer of a conversational marketing platform | $35 | nd |

| 22-Nov | Outbrain | Video Intelligence | Developer of a contextual video platform | $55 | nd |

| 17-Nov | Alpha Capital Acquisition Company | Semantix | Developer of a big data and artificial intelligence platform | $230 | nd |

Sources: Stanford Human-Centered Artificial Intelligence, 2022 AI Index Report; Pitchbook, 2021 Annual Artificial Intelligence & Machine Learning Report, Q1 2022; McKinsey, The State of AI in 2021, December 2021; McKinsey, The State of AI in 2020, November 2020; Pitchbook; Meridian Research; CapIQ