Technology Market Update: Summer 2022

Published August 11, 2022

Summer 2022 | Tech M&A Remains Resilient

Meridian Capital’s Technology team is pleased to provide their Summer 2022 market update. Our team’s deep, relevant relationships with private equity and strategic buyers allow us to keep our fingers on the pulse of the industry.

Key Market Update Insights:

- Despite public market volatility, technology M&A activity remains robust

- Significant PE dry powder should continue to support Technology M&A

- Advice for clients navigating uncertainty

Despite Public Market Volatility, Technology M&A Activity Remains Robust

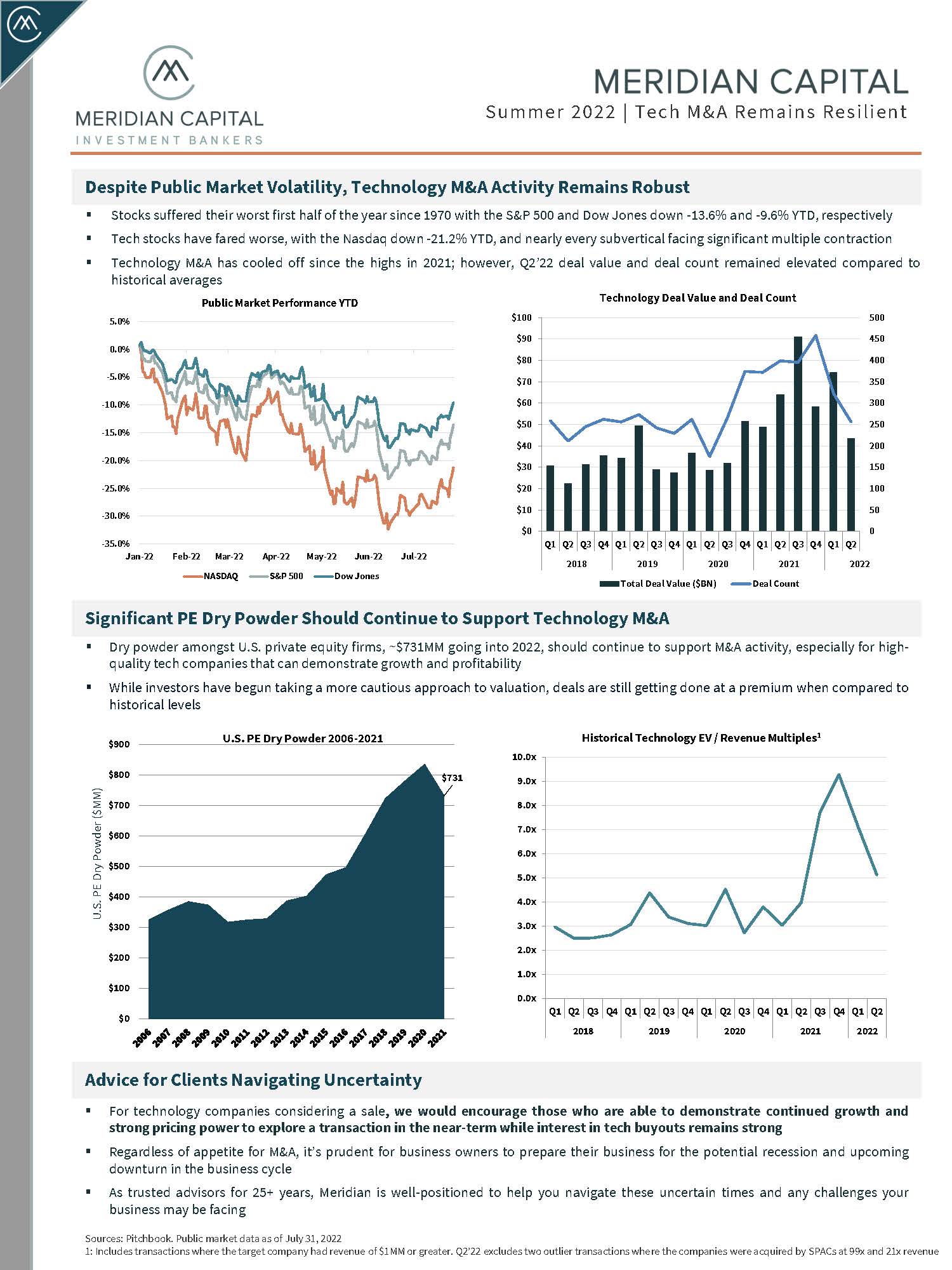

- Stocks suffered their worst first half of the year since 1970 with the S&P 500 and Dow Jones down -13.6% and -9.6% YTD, respectively

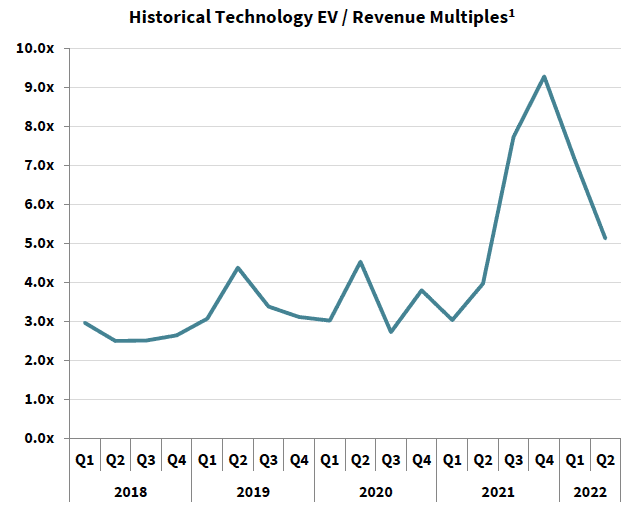

- Tech stocks have fared worse, with the Nasdaq down -21.2% YTD, and nearly every subvertical facing significant multiple contraction

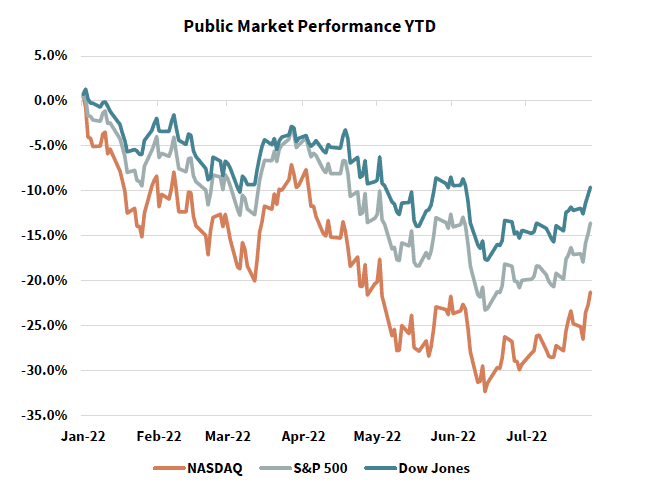

- Technology M&A has cooled off since the highs in 2021; however, Q2’22 deal value and deal count remained elevated compared to historical averages

Significant PE Dry Powder Should Continue to Support Technology M&A

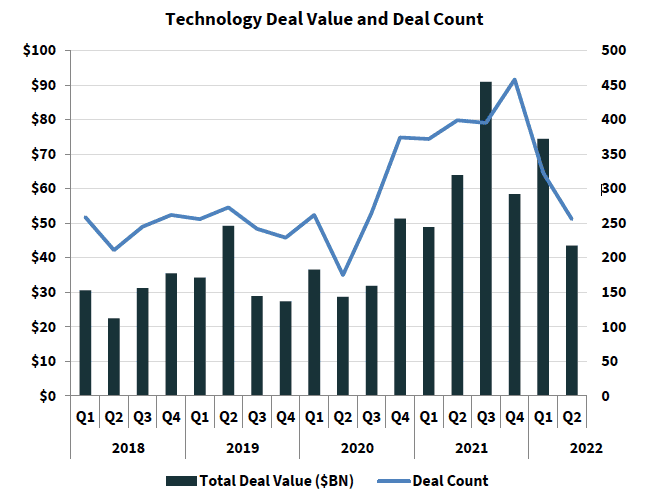

- Dry powder amongst U.S. private equity firms, ~$731MM going into 2022, should continue to support M&A activity, especially for high-quality tech companies that can demonstrate growth and profitability

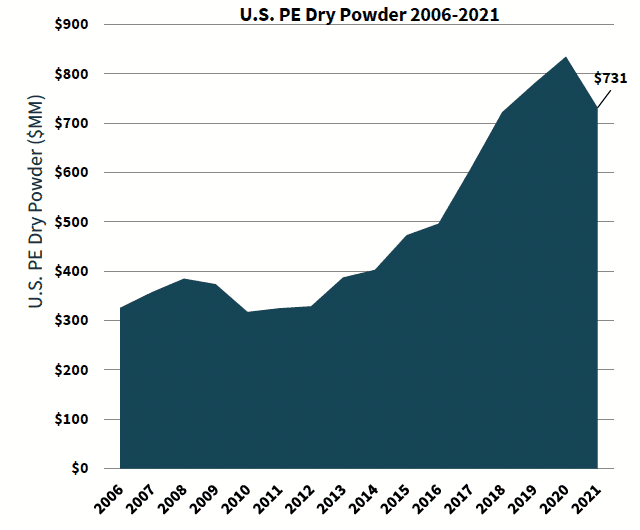

- While investors have begun taking a more cautious approach to valuation, deals are still getting done at a premium when compared to historical levels

Advice for Clients Navigating Uncertainty

- For technology companies considering a sale, we would encourage those who are able to demonstrate continued growth and strong pricing power to explore a transaction in the near-term while interest in tech buyouts remains strong

- Regardless of appetite for M&A, it’s prudent for business owners to prepare their business for the potential recession and upcoming downturn in the business cycle

- As trusted advisors for 25+ years, Meridian is well-positioned to help you navigate these uncertain times and any challenges your business may be facing

Sources: Pitchbook. Public market data as of July 31, 2022

1: Includes transactions where the target company had revenue of $1MM or greater. Q2’22 excludes two outlier transactions where the companies were acquired by SPACs at 99x and 21x revenue