Healthtech M&A Trends: Fall 2022

Published October 11, 2022

KEY INSIGHTS:

- Big tech invested $3.6 Bn in healthcare in 2021 alone and has shown no sign of diminished interest in 2022 though there are increasing signs that their buying power may be limited.

- Healthtech’s meteoric rise was certainly helped by COVID 19 however, as economic pressures due to the pandemic and long-term effects of it continue, healthtech and healthcare overall have been shown to not be fully insulated.

- Administrative applications are where AI based healthtech solutions have seen the greatest traction and produced the greatest savings over manual efforts in claims processing, revenue cycle management, and medical records management, among others.

Healthtech M&A Commentary:

Year to date, middle market healthtech M&A has come down from the pandemic fueled high of 2021 lagging the same time period by ~20%, but showing growth to 2020 on a run rate basis. Within this market, Private Equity investments have grown faster than the whole, showing deal activity down only 10 from the same period last year and already above 2020 ’s entire deal count. Mental health investments were the darling of 2021 and interest here has carried over into 2022 as well as the strong interest in AI in healthcare, which currently is focused on administrative tasks and the associated cost savings and efficiencies, especially beneficial now in this time of increasing cost pressures and macroeconomic headwinds.

Healthtech Market Insights: What We’re Watching

Big Tech’s Continued Interest in Healthcare; is Buying Power Limited?

- Big tech invested $3.6Bn in healthcare in 2021 alone and has shown no sign of diminished interest in 2022, though there are increasing signs that their buying power may be limited

- Since Amazon’s 2018 acquisition of PillPack, it is clear that healthcare is of great interest to the company, though their 2022 decision to shut down the internal Amazon Care platform underscores that its mastery of healthcare is not yet complete

- Amazon recently agreed to acquire One Medical, the leading subscription-based, technology-enabled primary care provider, for $3.9Bn, highlighting increasing consumer adoption and maturation of healthtech

- The FTC is investigating this acquisition and antitrust concerns surround Amazon and healthcare. Similarly, antitrust concerns over UnitedHealth’s Optum purchasing Change Healthcare for $13Bn, as announced in January 2021, took until September 2022 for a federal judge to allow to go forward

- Conversely, Alphabet’s healthtech arm, Verily, has shown it is adept at building solutions, having received FDA approval this summer for the Zio Watch, a continuous monitoring solution for atrial fibrillation, and just this September, Verily raised $1Bn in capital to further its focus on precision medicine, now under the direction of a newly appointed CEO

- Building rather than buying is one way to avoid antitrust scrutiny, as is focusing on acquisitions under the HSR threshold, which is likely to make middle market companies increasingly attractive acquisition targets

Healthcare is not Immune to Economic Pressures

- Healthtech’s meteoric rise was certainly helped by COVID-19, however, as economic pressures due to the pandemic and long-term effects of it continue, healthtech and healthcare overall have been shown to not be fully insulated

- Innovaccer, a digital healthcare Unicorn, has recently laid off about 8% of its workforce, citing economic conditions and a focus on maintaining profitability during its rapid growth

- Furthermore, healthcare at large is facing severe economic conditions, with Lisa Goldstein, SVP at Kaufman Hall, stating that “hospitals stand to lose billions of dollars in 2022…it will be the worst year since the start of the pandemic”

- This can be traced to a tight labor economy, specifically within the healthcare Industry

- Mike Slubowski, president and CEO of Trinity Health stated that there are currently nearly 4,000 vacant positions for nurses within his organization and a 14% clinical support staff vacancy rate

- Hospitals are unable to use 25% of the beds they have, and nearly half of operating rooms and diagnostic services are inoperable due to staffing shortages

Is Healthtech the Answer? A Real-Life Case Study

- Administrative applications are where AI-based healthtech solutions have seen the greatest traction and produced the greatest savings over manual efforts in claims processing, revenue cycle management, and medical records management, among others

- Home healthcare has also been shown to offer savings over traditional hospital care, as in a Johns Hopkins trial that found the cost of the former to be 32% less than the latter

- Advances in medical equipment and devices are what often makes home care possible, as one of us experienced with the February 2021 birth of her daughter, who had nearly severe jaundice as a newborn; without the modern innovation of mobile phototherapy units, readmission to the hospital would have been required

Source: McKinsey Company, Deloitte, E&Y, CBInsights, PitchBook Data, Mergermarket, Company Press Releases, Meridian Research

Healthtech M&A Activity and Trends

Recent Middle Market Transaction Activity

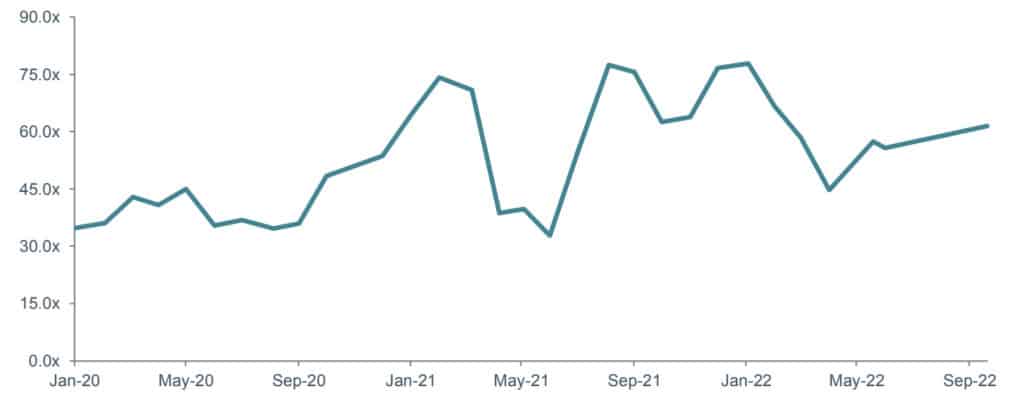

Public Market Valuations (EV/EBITDA)

Healthtech M&A Commentary

- Year-to-date, middle market healthtech M&A has come down from the pandemic-fueled high of 2021, lagging the same time period by ~20%, but showing growth to 2020 on a run-rate basis

- Within this market, Private Equity investments have fared better than the whole, showing deal activity down only ~10% from the same period last year and already above 2020’s entire deal count

- Across the board, known transaction values are also decreasing from 2021 as M&A focuses on smaller companies within the middle market as healthtech innovation expands

- Enterprise Systems lead in terms of total healthtech investments, given the lack of FDA approval and insurance coverage required as well as growing consumer comfort with, if not preference for, interacting both directly and indirectly with technology in all areas of life

- Mental health investments were the darling of 2021 and interest here has carried over into 2022, as well as the strong interest in AI in healthcare, which currently is focused on administrative tasks and the associated cost savings and efficiencies, especially beneficial now in this time of increasing cost pressures and macroeconomic headwinds

2022: As of October 7, 2022

Source: PitchBook Data, Mergermarket, Company Press Releases, Meridian Research

Office Ally Has Been Acquired by Francisco Partners

Deal Represents How Service Software Solutions are Transforming Healthtech

Meridian Capital LLC (“Meridian”), a leading West Coast middle market investment bank and M&A advisory firm, is pleased to announce the successful acquisition of one of its clients, Office Alley (the “Company”) by Francisco Partners (“Francisco”). Meridian served alongside Lazard as a financial advisor to Office Ally on the transaction.

Office Ally is a leading provider of electronic clearinghouse services, revenue cycle management, and healthcare software solutions to payers and office-based physicians in the U.S. Since 2000, Office Ally’s comprehensive product portfolio of mission-critical solutions has enabled its customers to drive better operational results and streamline administrative workflows. Today, Office Ally processes approximately 25 million claims monthly for more than 720,000 providers and 4,000 payers nationwide.

The investment by Francisco Partners will provide Office Ally with a new partner to help capitalize on its current momentum and continue to drive product innovation and growth, with a strong continued focus on supporting its customers.

Gloria Chung, Office Ally COO, stated, “For many of us, this was our first experience in a sale process and the Meridian Capital team’s hands-on approach helped get the deal to the finish line successfully. They worked tirelessly alongside us, providing guidance and support every step of the way. I am excited for our next chapter of growth with Francisco Partners and the opportunity this acquisition provides for our customers and our team.”

Patrick Ringland, Managing Director and Head of the Technology Practice at Meridian stated, “Working with the Office Ally team has been an absolute pleasure. This transaction is a testament to the strength of the platform the Company has built over the past 21 years. We are excited about the Company’s next phase of growth offered through this investment by Francisco.”

Office Ally is a healthcare technology company that offers cloud-based solutions to healthcare providers, independent physician associations (IPAs) and health plans. Office Ally’s platform supports both the management of care and facilitates payments between providers, health plans and patients.

Office Ally’s platform is paired with a clearinghouse that enables the secure exchange of healthcare information including claims, remits, and eligibility information between covered entities and across the healthcare market.

Health Perspectives Group Receives Majority Investment From 424 Capital

Deal Represents How Healthcare Technology is Transforming the Tech Industry

Meridian Capital LLC (“Meridian”), a leading West Coast middle market investment bank and M&A advisory firm, is pleased to announce that one of its clients, Health Perspectives Group (“HPG” or the “Company”) has sold a majority stake to 424 Capital (“424”). Meridian Capital served as the exclusive financial advisor to HPG on the transaction.

Headquartered in Seattle, Washington, Health Perspectives Group provides patient engagement services and technology solutions to biopharmaceutical companies, transforming the ways in which healthcare companies think and interact with patients. Core solutions include technology-enabled platforms to capture and promote the healthcare consumer perspective – making compliant, patient-centered action possible.

Health Perspectives Group was founded by Robin Shapiro and is headed by CEO Cheryl Lubbert. The Company is led by a seasoned management team with deep biopharmaceutical industry experience and a unique vision for shaping healthcare around client and patient needs.

Through its two key technological platforms, Advocate Resource Center™ (ARC 2.0) and CareConcierge™, HPG paves the way for pharmaceutical companies to manage patient engagement programs effectively and efficiently. The Company has engaged patients across more than 450 disease areas for 22 of the largest 30 biopharmaceutical companies in the world.

Cheryl Lubbert, CEO of Health Perspectives Group shared, “Meridian provided their expertise and advice from our initial valuation all the way through a successful investment over many years. Their guidance helped ensure a successful outcome.”

Patrick Ringland, Managing Director and Head of the Technology Practice at Meridian stated, “We’re very happy with the outcome for Cheryl, Robin, and the HPG team. The investment represents an exciting opportunity for all parties and provides HPG with additional capabilities and resources that will accelerate the execution of its growth objectives and continued expansion of its platform.”

These transactions represent continued momentum for Meridian’s Technology practice.

Healthtech Selected M&A Activity

Highlighted Tech-enabled Healthcare Services M&A Transaction

Under FTC Review

Amazon Acquires One Medical

July 2022

EV

$3,900M

EV/Revenue

4.0x

Target Description: One Medical is a membership-based and technology-powered primary care platform with seamless digital health and inviting in-office care, convenient to where people work, shop, live, and click.

Investment Rationale: The acquisition will enable Amazon to expand its telehealth and primary care services reach, allowing for the integration of Amazon’s other healthcare and adjacent offerings, including grocery and pharmacy.

Highlighted Medical Equipment & Devices M&A Transaction

Senzime Acquires Respiratory Motion

April 2022

EV

$44M

EV/Revenue

NA

Target Description: Respiratory Motion is a developer of respiratory monitoring systems designed to monitor patients’ breathing volume and real-time breathing frequency. Its system has been validated on over 6,000 patients in more than 30 scientific publications.

Investment Rationale: The acquisition will enable Senzime to expand its product portfolio and accelerate the market penetration of its TetraGraph system with evident sales and margin synergies. The transaction supports Senzime’s mission of becoming a global market leader in vital sign monitoring.

Highlighted Patient / Provider Software M&A Transaction

Telemedicine EV/Rev multiples of 10-12x seen in 2020

Patient Square Capital Acquires SOC Telemed

April 2022

EV

$302.5M

EV/Revenue

2.8x

Target Description: SOC Telemed is one of largest national providers of acute care telemedicine services and technology to U.S. hospitals and healthcare systems based on number of clients.

Investment Rationale: The public-to-private LBO will enable SOC Telemed to have more flexibility and resources to continue investing in its clinical capabilities, innovating its offering, and expanding its footprint.

Source: PitchBook Data, Mergermarket, Company Press Releases, Meridian Research

Public Company Valuations

| Medical Equipment & Devices / Robotics | Ticker | Market Cap | EV | LTM Rev | LTM EBITDA | LTM EBITDA Margin | EV/Rev | EV/EBITDA | 52-Week |

|---|---|---|---|---|---|---|---|---|---|

| ShockWave Medical, Inc. | NAS:SWAV | $10,246 | $10,069 | $364 | $63 | 17.4% | 27.7x | nm | 40 % |

| iRhythm Technologies, Inc. | NAS:IRTC | 4,107 | 4,033 | 362 | (111) | – | 2.3x | – | (80)% |

| Stevanato Group S.p.a. | NYS:STVN | 4,770 | 4,655 | 1,006 | 246 | 24.5% | 4.6x | 18.9x | (27)% |

| Axonics, Inc. | NAS: AXNX | 3,763 | 3,559 | 217 | (68) | – | 2.3x | – | (80)% |

| PROCEPT BioRobotics Corp | NAS: PRCT | 1,839 | 1,623 | 50 | (60) | – | 2.3x | – | (80)% |

| Cytek Biosciences, Inc. | NAS: CTKB | 2,065 | 1,730 | 148 | 3 | 2.3% | 11.7x | nm | (29)% |

| Butterfly Network, Inc. | NYS:BFLY | 980 | 701 | 68 | (108) | – | 2.3x | – | (80)% |

| Cue Health Inc. | NAS:HLTH | 489 | 185 | 678 | 15 | 2.2% | 0.3x | 12.4x | (67)% |

| Vicarious Surgical Inc. | NYS:RBOT | 432 | 307 | 0 | 18 | nm | nm | 1.8x | (68)% |

| LumiraDx Limited | NAS:LMDX | 312 | 593 | 398 | (229) | – | 2.3x | – | (80)% |

| Median | $1,952 | $1,677 | $290 | ($28) | 9.8% | 2.3x | 12.4x | ($0.7) | |

| Average | $2,900 | $2,746 | $329 | ($23) | 11.6% | 6.2x | 11.0x | ($0.5) |

| Insurance and Payment Services | Ticker | Market Cap | EV | LTM Rev | LTM EBITDA | LTM EBITDA Margin | EV/Rev | EV/EBITDA | 52-Week |

|---|---|---|---|---|---|---|---|---|---|

| Change Healthcare Inc | NAS:CHNG | $9,025 | $13,491 | $3,497 | $795 | 22.7% | 3.9x | 17.0x | 32 % |

| MultiPlan Corporation | NYS: MPLN | 1,892 | 6,456 | 1,175 | 907 | 77.2% | 5.5x | 7.1x | (43)% |

| Oscar Health Inc. | NYS:OSCR | 1,033 | (1,028) | 3,052 | (573) | – | 2.3x | – | (80)% |

| Clover Health Investments, Corp. | NAS:CLOV | 826 | 344 | 2,580 | (397) | – | 2.3x | – | (80)% |

| Accolade, Inc. | NAS: ACCD | 889 | 874 | 336 | (378) | – | 2.3x | – | (80)% |

| eHealthInsurance Services, Inc. | NAS:EHTH | 106 | 258 | 463 | (166) | – | 2.3x | – | (80)% |

| Median | $961 | $609 | $1,877 | ($272) | 50.0% | 2.3x | 12.0x | ($0.8) | |

| Average | $2,295 | $3,399 | $1,851 | $31 | 50.0% | 3.1x | 12.0x | ($0.5) |

| Patient / Provider Software | Ticker | Market Cap | EV | LTM Rev | LTM EBITDA | LTM EBITDA Margin | EV/Rev | EV/EBITDA | 52-Week |

|---|---|---|---|---|---|---|---|---|---|

| McKesson Corporation | NYS:MCK | $50,934 | $56,665 | $268,446 | $3,226 | 1.2% | 0.2x | 17.6x | 75 % |

| IQVIA Holdings Inc. | NYS:IQV | 35,901 | 47,435 | 14,136 | 2,855 | 20.2% | 3.4x | 16.6x | (23)% |

| Veeva Systems, Inc. | NYS:VEEV | 26,766 | 23,910 | 2,001 | 521 | 26.0% | 11.9x | 45.9x | (39)% |

| Doximity, Inc. | NYS: DOCS | 6,135 | 5,370 | 362 | 118 | 32.6% | 14.9x | 45.6x | (60)% |

| Teladoc Health, Inc | NYS:TDOC | 4,370 | 5,077 | 2,234 | (9,632) | – | 2.3x | – | (80)% |

| 1Life Healthcare, Inc. | NAS:ONEM | 3,344 | 3,636 | 890 | (283) | – | 2.3x | – | (80)% |

| GoodRx Holdings, Inc. | NAS:GDRX | 2,015 | 1,984 | 803 | 80 | 10.0% | 2.5x | 24.8x | (88)% |

| Allscripts Healthcare Solutions, Inc. | NAS:MDRX | 1,752 | 1,471 | 1,055 | 308 | 29.2% | 1.4x | 4.8x | 8 % |

| Phreesia, Inc. | NYS:PHR | 1,361 | 1,133 | 245 | (157) | – | 2.3x | – | (80)% |

| American Well Corporation | NYS:AMWL | 1,113 | 520 | 264 | (219) | – | 2.3x | – | (80)% |

| DocGo Inc | NAS:DCGO | 1,072 | 896 | 435 | 52 | 12.0% | 2.1x | 17.2x | 8 % |

| Health Catalyst, Inc. | NAS:HCAT | 580 | 425 | 265 | (99) | – | 2.3x | – | (80)% |

| Dialogue Technologies Inc. | TSE:CARE | 122 | 77 | 63 | (21) | – | 2.3x | – | (80)% |

| Median | $2,015 | $1,984 | $803 | $52 | 20.2% | 2.3x | 17.6x | ($0.8) | |

| Average | $10,420 | $11,431 | $22,400 | ($250) | 18.7% | 3.8x | 24.6x | ($0.5) |

Select Healthtech M&A Transactions

| Date | Target | Acquirer | Target Description | EV ($ in M) | EV/Rev | EV/EBITDA |

|---|---|---|---|---|---|---|

| Oct-22 | Rendia | Balance Point Capital | Developer of engagement software designed for doctors to have conversations with their patients every day | nd | nd | nd |

| Oct-22 | Change Healthcare | Optum | Provider of a spinoff of various healthcare processing and consulting services | $12,911 | 3.7x | 16.3x |

| Oct-22 | GenDx | Eurobio Scientific | Provider of molecular diagnostics tools intended for solid organ and stem cell transplantation | $134 | nd | nd |

| Sep-22 | Intellis | e4 Services | Developer of revenue cycle management software for hospitals, outpatient providers and physician practices | nd | nd | nd |

| Sep-22 | Onpodio | Recess | Developer of fitness platform for independent fitness instructors | nd | nd | nd |

| Sep-22 | GrowthPlug | Greater Sum Ventures | Developer of a practice marketing platform for healthcare practices | nd | nd | nd |

| Sep-22 | Medidee | Accelmed | Provider of clinical compliance services | nd | nd | nd |

| Sep-22 | Happy Not Perfect | Neopets | Developer of an application designed to help stress less, sleep better, and find a calmer positive mindset | nd | nd | nd |

| Sep-22 | Life Image | Ardan Equity | Developer of a medical evidence and image exchange platform | nd | nd | nd |

| Sep-22 | Rimasys | AO Foundation | Developer of a surgical training medical algorithm and device | nd | nd | nd |

| Sep-22 | SanoPass | MedLife | Digital medical platform designed to digitize and customize the health benefits offered by companies | nd | nd | nd |

| Sep-22 | Amplion | BioInformatics | Business intelligence platform designed to accelerate the realization of precision medicines | nd | nd | nd |

| Sep-22 | Blue Zinc | Aquiline Capital Partners | Developer of clinic and patient management software | nd | nd | nd |

| Sep-22 | Caresharing | ZorgDomein | A Dutch digitel healthcare platform | nd | nd | nd |

| Sep-22 | Forefront TeleCare | SOC Telemed | Provider of virtual behavioral healthcare intended to serve seniors with telepsychiatry and teletherapy care | nd | nd | nd |

| Aug-22 | Affera | Medtronic | Developer of a medical device designed to treat heart rhythm disorders | $655 | nd | nd |

| Aug-22 | Springstone | Apollo Global Management | Operator of psychiatric hospitals | $250 | nd | nd |

| Aug-22 | GenDx | Eurobio Scientific | Provider of molecular diagnostics tools intended for solid organ and stem cell transplantation | $138 | nd | nd |

| Aug-22 | Diameter Health | Availity | Developer of a clinical analytics platform | nd | nd | nd |

| Aug-22 | Stratasan | Madison Dearborn Partners | Developer of healthcare data analytics software | nd | nd | nd |

| Jul-22 | One Medical | Amazon | Membership-based and technology-enabled primary care platform | $3,552 | 4.4x | nm |

| Jul-22 | Respiratory Motion | Senzime | Developer of respiratory monitoring systems | $44 | nd | nd |

| Jun-22 | Traverse Vascular | Teleflex | Developer of a next-generation microcatheter | nd | nd | nd |

| Jun-22 | Cerner | Oracle | Supplier of healthcare information technology solutions and tech-enabled services | $27,419 | 4.7x | 18.9x |

| Jun-22 | Polymedco | RoundTable Healthcare Partners | Manufacturer of clinical diagnostic test kits and devices specialized in hematology and cancer | nd | nd | nd |

| Jun-22 | 1-800MD | One80 Intermediaries | Operator of a network of telemedicine physicians across the United States | nd | nd | nd |

| May-22 | Jvion | Healthcare Growth Partners | Developer of software designed to predict and prevent patient-level disease and financial losses | nd | nd | nd |

| May-22 | IntriCon | Altaris Capital Partners | Joint development manufacturer of micromedical components, sub-assemblies and final devices | $220 | 1.7x | 51.2x |

| May-22 | Specific | BioMérieux | Developer of diagnostic equipment | 370 | nd | nd |

| May-22 | Intersect ENT | Medtronic | Commercial drug delivery company committed to improving the quality of life for patients with ear, nose and throat conditions | $1,049 | 10.1x | nd |

| May-22 | Momentum Healthware | Civica | Developer of information technology software designed for the healthcare industry | nd | nd | nd |

| May-22 | Ivenix | Fresenius Kabi | Developer of an infusion management platform | $240 | nd | nd |

| May-22 | Nanoview Biosciences | The Carlyle Group | Developer of a medical technology intended for the detection and multiparametric characterization of extracellular vesicles | nd | nd | nd |

As of October 7, 2022

Source: PitchBook Data, Mergermarket, Company Press Releases, Meridian Research