Healthcare & Technology M&A Trends: Spring 2020

Published April 23, 2020

Healthcare Technology & Telemedicine Market Update

KEY INSIGHTS

- Telemedicine is at a major inflection point as the traditional healthcare delivery system is upended

- Healthcare services deemed essential but not immune to downturn

- Adoption of technology and telehealth solutions are accelerating rapidly

- Healthcare technology company valuations positioned favorably

The current health crisis and economic shake-up will change the way that we access healthcare. Although the infrastructure for large scale telemedicine has existed in large part for some time, adoption of the technology has been slow. That is, until now. As the New York Times recently noted, telemedicine has come to the forefront with “10 years of change in one week.”

At Meridian Capital, we cover the healthcare IT industry in which telemedicine will be an increasingly important segment. Private equity and strategic buyers are taking note of this fundamental shift in provider, payer, and patient behavior, and business owners and CEOs in the space are facing a critical strategic moment. Those who have a clear strategy for customer acquisition and growth initiatives will likely have access to capital to achieve their goals, as well as opportunities to grow through acquisition.

Introduction

The current health crisis and the economic shake up that has now begun will change the way that we all do business. Telemedicine is at a major inflection point as the current

health crisis has delivered a massive exogenous shock to the system. Although the infrastructure for large scale telemedicine has existed in large part for some time, there has been slow adoption of the technology for four simple reasons: providers were reluctant to offer it, patients did not demand it, payers did not fully cover it, and employers did not encourage it. This has now changed in a dramatic way and, as the New York Times noted, telemedicine has come to the forefront with “10 years of change in one week.”

At Meridian Capital, we cover the healthcare IT industry in which telemedicine will be an increasingly important segment in the coming months and years. Private equity and strategic buyers are taking note of this fundamental shift in provider, payer, and patient behavior, and business owners and CEOs in the space are facing a critical strategic moment as the spotlight has been thrust upon their industry. Those who have a clear strategy of customer acquisition and that can prioritize the right growth initiatives will likely have access to capital to do so, as well as opportunities to grow inorganically through acquisition.

What We’re Reading

Telemedicine Arrives in the U.K.: ‘10 Years of Change in One Week’, The New York Times

Takeaway: Surge in demand has been created as consumers previously hesitant to adopt telemedicine have flocked to the service due to COVID-19.

Amazon Care, Amazon.com

Takeaway: Major employers, such as Amazon, are piloting programs that push telemedicine to their employees. With the scale of an Amazon behind this shift, we see benefit from providers getting engaged, a large demand from Amazon employees, and an opportunity for telemedicine companies to build better products and sell those products directly to employers.

Trump Administration Makes Sweeping Regulatory Changes to Help U.S. Healthcare System Address COVID-19 Patient Surge, Center for Medicare and Medicaid Services

Takeaway: Coverage is key to telemedicine adoptions and it seems likely that a shift in stance by Medicare and Medicaid to pay for more telemedicine services is likely here to stay for the long term.

Feds OK Interstate Licensing, Paving Way for Telehealth Expansion, mHealth Intelligence

Takeaway: Regulatory hurdles that impeded telemedicine adoption will continue to be relaxed allowing doctors to practice across state lines and support effected areas remotely.

Adaptive Biotech’s Deal with Amgen Influenced by Belief That COVID-19 May return Seasonally, Like Flu, GeekWire

Takeaway: Healthcare technology has an opportunity to innovate and create new solutions. In the short run, creating a way to treat COVID-19 and prepare for potential seasonal returns will be big, and longer term, investors will be increasingly active.

How the COVID-19 Pandemic Has Already Changed Healthcare Technology, and What’s Next, GeekWire

Takeaway: COVID-19 has long-term impacts on the types of healthcare technology funding goes into.

Market Impacts of COVID-19 on Healthcare Technology Sector

Healthcare Services Deemed Essential, But Not Immune to Downturn

- Healthcare services are deemed essential and can continue operations, though some are limited in scope

- Large impacts are felt across the sector and patient community as procedures deemed non-emergency are postponed or paused

Accelerating Adoption of Technology as Healthcare Becomes Focal Point

- COVID-19 has shined a light on the importance of healthcare services and preparation and allowed for some long-sought changes to the industry, hoped to be permanent

- Regulation changes allow interstate licensing for doctors, opening the door for telehealth solutions

- Medicare beneficiaries have been given expanded telehealth benefits

- Healthcare technology likely to see boost long-term as providers seek efficiency and reliability

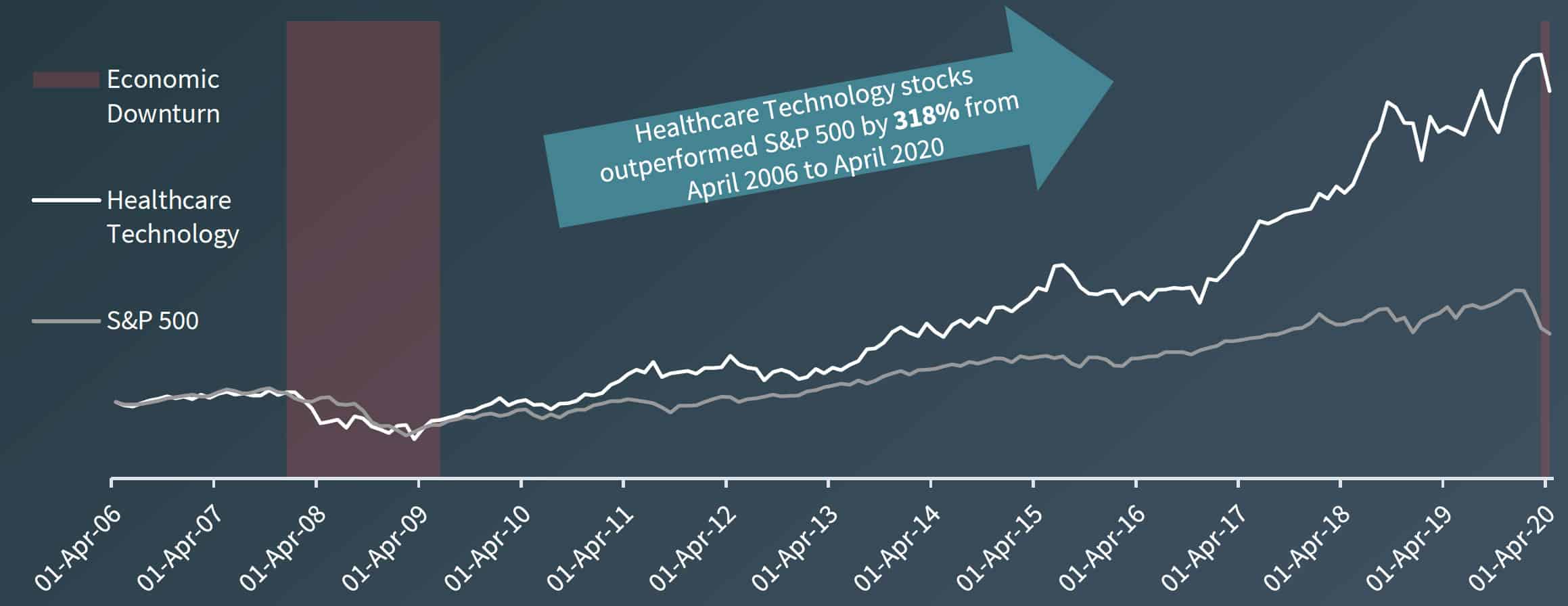

Historical Performance Indicates Strong Comeback Highly Probable

Healthcare Technology Index Metrics

| Company | 52 wk. High | 52 wk. Low | Enterprise Value | TTM Revenue | TTM EBITDA | Enterprise Value / TTM Revenue | Enterprise Value / TTM EBITDA |

|---|---|---|---|---|---|---|---|

| Veeva Systems Inc. | $177 | $118 | $25,583 | $1,104 | $308 | 23.2x | 83.0x |

| Cerner Corporation | $81 | $53 | $21,480 | $5,693 | $1,319 | 3.8x | 16.3x |

| Teladoc Health, Inc. | $176 | $49 | $12,864 | $553 | NM | 23.2x | NM |

| Livongo Health, Inc. | $46 | $15 | $7,259 | $170 | NM | 21.3x | NM |

| Omnicell, Inc. | $95 | $54 | $2,989 | $897 | $142 | 3.3x | 21.0x |

| Allscripts Healthcare Solutions, Inc. | $12 | $5 | $1,880 | $1,772 | $66 | 1.1x | 28.4x |

| Tabula Rasa HealthCare, Inc. | $70 | $33 | $1,475 | $285 | $2 | 5.2x | 906.7x |

| Health Catalyst, Inc. | $50 | $17 | $969 | $155 | NM | 6.3x | NM |

| Vocera Communications, Inc. | $36 | $16 | $688 | $181 | NM | 3.8x | NM |

| Evolent Health, Inc. | $15 | $4 | $774 | $846 | NM | 0.9x | NM |

| HealthStream, Inc. | $30 | $20 | $725 | $254 | $46 | 2.9x | 15.8x |

| Computer Programs & Systems, Inc. | $36 | $17 | $439 | $276 | $38 | 1.6x | 11.5x |

| Median | 1,678 | $419 | $66 | 3.8x | 21.0x | ||

| Average | 6,427 | $1,015 | $275 | 8.0x | 154.7x |

Notable Healthcare Technology Acquisitions

Recent Healthcare Technology Transactions

| Date | Target | Buyer | Description | EV ($ in M) | EV/ Revenue |

|---|---|---|---|---|---|

| Mar-20 | Carie Health, LLC | Emerald Organic Products | Developer of a mobile health booking platform designed to connect users with a network of U.S. board-certified doctors | ||

| Mar-20 | Care Voice, Inc. | HTD Health | Provider of healthcare platform intended to streamline healthcare arrangements. | ||

| Mar-20 | DeepHealth, Inc. | RadNet | Developer of an online platform designed to connect doctors with patients. | $18 | |

| Mar-20 | YouScript Inc. | Invitae | Provider of a comprehensive software solution designed for safer, more targeted prescribing for health patients. | $79 | |

| Mar-20 | eCaring, Inc. | EC Acquisition Holding | Developer of an icon-based population health management system designed to offer personal health record | ||

| Mar-20 | HealthEdge Software, Inc. | The Blackstone Group | Dmeavnealogepemr eonf t.a Core Administrative Processing Systems (CAPS) platform based in Burlington, Massachusetts. | $730 | |

| Mar-20 | NurseGrid | HealthStream | Developer of staffing, communication and schedule management tools designed for nurses.` | $25 | |

| Feb-20 | Wellpepper, Inc. | Caravan Health, VSS | Developer of a patient engagement platform for digital patient treatment plans. | ||

| Feb-20 | Able Health Inc. | Health Catalyst | Developer of a data and analytics software for physician organizations designed to manage value-based programs. | $27 | |

| Feb-20 | XIFIN, Inc. | Avista Capital Partners | Developer of a cloud-based software dedicated to optimizing the economics of healthcare for diagnostic services market. | ||

| Feb-20 | NantHealth (Connected Care Solutions) | Masimo | Developer of medical device and software catering to hospitals based in Culver City, California. | $47 | |

| Jan-20 | Wellinks, Inc. | Convexity Scientific | Developer of a wearable health monitoring application designed to treat musculoskeletal conditions. | ||

| Jan-20 | SCI Solutions, Inc. | R1 RCM | Provider of SaaS-based scheduling and patient access platform designed to build engagement. | $190 | |

| Jan-20 | InTouch Technologies, Inc. | Teladoc Health | Developer of virtual care platform designed to provide high-quality, patient-centric virtual care for every use case. | $600 | 7.1x |