Food & Beverage M&A Update: Winter 2019

Published February 27, 2019

Key Trends in Food and Beverage

With over two decades of experience in complex corporate finance and M&A transactions, Meridian Capital serves as a trusted advisor to leading middle market companies. We have over $6B in transaction experience, which offers us deep industry insight and a holistic industry coverage. Our seasoned professionals focus on businesses with $20M to $400M+ in enterprise value. Meridian Capital’s Food & Beverage M&A Update focuses on healthy snacks, specialty coffee and beverages.

Meridian Capital Overview

Exceptional Results Delivered

- Over $5B in transaction experience

- Trusted advisor to leading middle market companies

- Focus on businesses with $20M to $500M+ in enterprise value

- 20+ years experience with complex corporate finance and M&A challenges

- 18 seasoned professionals with finance, operational and legal backgrounds

Transaction Expertise

- M&A

- Equity/Debt Capital Raises

- Strategic Advisory

Customized Approach

- High Touch Approach

- Multidisciplinary Deal Team

- End-to-end Service

Deep Industry Insights

- Dedicated industry teams

- Holistic industry coverage

- Deep buyer relationships

Consumer Experience

Food & Beverage M&A Trends for 2018

Plant-based Protein Garnering Strong Investment Interest

- The market for healthier snacks continues to evolve at a rapid pace as consumers display increased demand for products that satisfy more holistic health needs. Driven by the growing need for convenient food items alongside health and environmental concerns, global sales of healthy snacks are forecasted to reach $32.8B by 2025. To capitalize on this growing market, many brands have sought to differentiate themselves by introducing functional ingredients; focusing on natural, healthy, and organic ingredients; introducing reimagined, portable and better-for-you snacks; using innovative packing; and emphasizing stronger ecommerce capabilities.

- From an M&A perspective, the snack space continues to be highly active with a broad base of both domestic and international acquirers and investors.

- Notable transactions include Unilever’s acquisition of Mae Terra, PepsiCo’s $200M acquisition of Bare Foods and of Health Warrior, Hershey’s acquisition of Pirate Brands, Lotus Bakeries’ acquisition of Kiddylicious, and Conagra’s $250M acquisition of Angie’s Artisan Treats (Boomchickapop).

CPG Companies Shifting Core Value Propositions

- The specialty coffee segment remains an active sector, buoyed by a wave of investment activity in 2018 that exceeded $22B in reported transaction value1. Investments have been made across the industry’s supply chain, ranging from independent roasters and wholesalers to publicly traded, multi-national retailers. The robust level of investor activity continues to reshape the coffee landscape as newer entrants seek capital to fuel growth and as mature CPG conglomerates seek to diversify their portfolio of legacy brands with higher-growth specialty coffee assets.

- Notable transactions include TSG Consumer’s private placement in 300-unit coffee retailer Dutch Bros, Lavazza’s $650M acquisition of Mar’s coffee division, Kraft Heinz’s acquisition of specialty coffee wholesaler Ethical Bean, and Coca-Cola’s $5.1B acquisition of 4,000-unit coffee retailer Costa Coffee.

Growing Momentum in the Cannabis Industry

- In 2018, M&A activity in the non-alcoholic beverage segment centered around the current health and wellness movement mainly driven by millennial consumers. Consumer tastes continue to shift towards a desire for “better-for-you”, natural, authentic, and high-quality products that provide a unique experience or purpose. Throughout the course of 2018, 34 transactions were completed in the better-for-you beverage space1.

- The market has seen producers of non-alcoholic craft beverages and natural teas targeted by large industry operators, even those that have traditionally operated solely in the alcoholic beverage segment. Many acquirers are targeting companies that fill a niche in their product portfolio and will pay a premium to compete with other potential buyers.

- Notable transactions include PepsiCo’s $3.2B acquisition of sparkling water developer SodaStream, Cavu’s $20M investment in organic herb-infused coconut milk beverage Rebbl, and Coca-Cola’s minority stake in premium sports beverage BodyArmor.

- Other transactions of interest include Molson Coors’ acquisition of an organic and light kombucha producer Clearly Kombucha, Dunn’s River Brands acquisition of BFY whole-root turmeric beverages Temple Turmeric, and All Market’s (Vita Coco) acquisition of RUNA, a producer of guayusa-based organic energy drinks.

Select Case Studies

Deal size is listed in millions of dollars.

- Deal Size: $1000

- EV/Rev: 4.3x

- EV/EBITDA: 19.9x

- Target Description: Supplier of non-GMO and allergen-free snack products.

- Investment Rationale: The acquisition will add to Hershey’s portfolio of snack brands and is expected to facilitate growth, cost synergies, and margin expansion.

- Buyer Quote: “The acquisition is an important step in our journey to becoming an innovative snacking powerhouse as together it will enable us to bring scale and category management capabilities to a key sub-segment of the warehouse snack aisle.” – Michele Buck, CEO of Hershey Company

- Deal Size: –

- EV/Rev: –

- EV/EBITDA: –

- Target Description: Provider of plant-based frozen meals, burritos, breakfast sandwiches, and chilled plant-based burgers and proteins.

- Investment Rationale: The acquisition gives Nestle instant access into the rapidly growing plant-based foods segment.

- Buyer Quote: “In the US, we’re experiencing a consumer shift toward plant-based proteins. In fact, as many as 50 percent of consumers now are seeking more plant-based foods in their diet.”– Paul Grimwood, Nestle USA CEO

- Deal Size: $250

- EV/Rev: –

- EV/EBITDA: –

- Target Description: Maker of BOOMCHICKAPOP, a gluten free, non-GMO, whole grain popcorn snack.

- Investment Rationale: The deal adds to a series of acquisitions aimed at expanding Conagra’s portfolio of healthy snacks.

- Buyer Quote: “Angie’s BOOMCHICKAPOP business is a leader in the fast-growing, better-for-you snacking segment. It will be a great complement to our growing snack business.” – Sean Connolly, President and CEO of Angie’s

- Deal Size: $120

- EV/Rev: 3.2x

- EV/EBITDA: –

- Target Description: Leading manufacturer and brand of premium grain-based ‘meat’ and vegan cheese products.

- Investment Rationale: The acquisition of Field Roast, along with Lightlife Foods acquired in early 2017, positions Maple Leaf as the leader in the U.S. retail market for plant-based proteins.

- Buyer Quote: “This acquisition advance Maple Leaf’s vision to be the most sustainable protein company on earth.” – Maple Leaf Press Release

Notable Recent M&A Transactions

- Median Deal Size (M): $264

- Average Deal Size (M): $1,516

- Median EV/ Revenue: 2.7x

- Average EV/ Revenue: 16.5x

- Median EV/ EBITDA: 2.6x

- Average EV/ EBITDA: 15.5x

| Date | Target | Description | Buyer | Deal Size (M) | EV/ Revenue | EV/ EBITDA |

|---|---|---|---|---|---|---|

| Feb-18 | Mann Packing Co., Inc. | Vegetables | Fresh Del Monte Produce Inc. (NYSE:FDP) | 361 | 0.7x | – |

| Feb-18 | Blue Buffalo (NAS:BUFF) | Pet Food | General Mills | 8000 | 6.2x | 25.9x |

| Jan-18 | Amplify Snack Brands, Inc. | Snack Foods | The Hershey Company (NYSE:HSY) | 1536 | 4.3x | 19.9x |

| Jan-18 | Dr. Pepper Snapple Group (NYS:DPS) | Sodas and Juices | Keurig Green Mountain | 23000 | 3.9x | 16.9x |

| Jan-18 | Field Roast Grain Meat Co., Inc. | Meat Products | Maple Leaf Foods Inc. (TSX:MFI) | 120 | 3.2x | – |

| Dec-17 | Northern Harvest Sea Farms Inc. | Salmon and Seafood | Marine Harvest ASA (OB:MHG) | 247 | – | – |

| Dec-17 | Sandwich Bros. of Wisconsin | Sandwiches | Conagra Brands, Inc. (NYSE:CAG) | 87 | – | – |

| Dec-17 | Galaxy Nutritional Foods, Inc. | Cheese Products | GreenSpace Brands Inc. (TSXV:JTR) | 17 | 1.0x | – |

| Dec-17 | Snyder’s-Lance, Inc. (NasdaqGS:LNCE) | Snack Foods | Campbell Soup Company (NYSE:CPB) | 6136 | 2.7x | 19.9x |

| Dec-17 | Pendleton Whisky Brands | Distillers | Becle, S.A.B. de C.V. (BMV:CUERVO *) | 205 | – | – |

| Nov-17 | Richelieu Foods Inc. | Frozen Pizza and Sauces | Freiberger USA Inc. | 435 | 1.3x | – |

| Nov-17 | Tazo Tea Company | Teas and Herbs | Unilever United States, Inc. | 384 | 3.4x | – |

| Nov-17 | Betin, Inc | Goat Cheese | Saputo Inc. (TSX:SAP) | 264 | 2.3x | – |

| Oct-17 | Columbus Manufacturing, Inc. | Salamis and Deli Meats | Hormel Foods Corporation (NYSE:HRL) | 850 | 2.8x | – |

| Oct-17 | Inventure Foods, Inc. | Specialty Snacks | Utz Quality Foods, LLC | 143 | 0.5x | – |

| Oct-17 | Chicago Bar Company LLC | Protein Bars | Kellogg Company (NYSE:K) | 600 | – | – |

| Oct-17 | Angie’s Artisan Treats, LLC | Snack Foods | Conagra Brands, Inc. (NYSE:CAG) | 250 | – | – |

| Oct-17 | Omega Protein Corporation | Nutritional Foods | Cooke Inc. | 509 | 1.4x | 8.1x |

| Sep-17 | Sweet Earth Natural Foods | Plant-based Food Products | Nestle USA | – | – | – |

| Sep-17 | Sager Creek Vegetable Company, Inc. | Canned Vegetables | McCall Farms, Inc. | 55 | – | – |

| Sep-17 | Bob Evans Farms, Inc. | Frozen Foods | Post Holdings, Inc. (NYSE:POST) | 1757 | 3.8x | 16.5x |

| Sep-17 | Rader Farms Inc. and Willamette Valley Fruit LLC | Berries | Oregon Potato Co. | 50 | – | – |

| Aug-17 | Fells Point Wholesale Meats, Inc. | Meat Products | The Chefs’ Warehouse, Inc. (NasdaqGS:CHEF) | 45 | – | – |

| Aug-17 | Boyd Coffee Company, Inc. | Coffees and Teas | Farmer Bros. Co. (NasdaqGS:FARM) | 59 | 0.6x | – |

| Aug-17 | Back to Nature Foods Company, LLC | Snack Foods | B&G Foods, Inc. (NYSE:BGS) | 163 | – | – |

| Aug-17 | Capitol Wholesale Meats, Inc. | Meat Products | Hormel Foods Corporation (NYSE:HRL) | 425 | – | – |

| Aug-17 | Preferred Brands International Inc. | Ready-to-eat Asian Entrees | Effem Holdings Ltd. | 173 | – | – |

| Jul-17 | Daiya Foods Inc. | Plant-based food and Bev | Otsuka Pharmaceutical Co., Ltd. | 323 | 4.5x | NA |

| Jul-17 | Creekstone Farms Premium Beef, LLC | Premium Beef | Marubeni Corporation (TSE:8002) | 170 | 0.3x | NA |

| Jul-17 | East Balt, Inc. | Breads | Grupo Bimbo, S.A.B. de C.V. (BMV:BIMBO A) | 650 | 1.6x | 9.3x |

| Jul-17 | French’s Food companies and Tigers Milk LLC | Packaged Food | McCormick & Company, Incorporated (NYSE:MKC) | 4200 | 7.5x | NA |

| Jul-17 | Albertville Quality Foods, Inc. | Protein | OK Foods, Inc. | 140 | 0.5x | NA |

| Jul-17 | H&N Distribution, Inc. | Food and Ingredients | United 1 International Laboratories LLC | 19 | NA | NA |

| Jul-17 | L.B. Maple Treat Corporation | Maple Syrup | Lantic Inc. | 124 | 1.0x | 8.7x |

| Jul-17 | Pacific Foods of Oregon, Inc. | Natural and Organic Foods | Campbell Investment Company | 700 | 3.2x | – |

| Jul-17 | Stonyfield Farm, Inc. | Organic Yogurt | Groupe Lactalis S.A. | 875 | 2.8x | – |

Select Public Food and Beverage Companies

| Company | Gross Margin | 1 Yr Revenue Growth | Market Cap | Net Debt | Enterprise Value | Revenue | EBITDA | EV / Revenue | EV / EBITDA |

|---|---|---|---|---|---|---|---|---|---|

| B&G Foods, Inc. (NYSE:BGS) | 29% | 22% | $1,842 | $1,830 | $3,672 | $1,608 | $293 | 2.3x | 12.5x |

| Campbell Soup Company (NYSE:CPB) | 38% | -1% | $12,941 | $3,298 | $16,247 | $7,849 | $1,678 | 2.1x | 9.7x |

| Conagra Brands, Inc. (NYSE:CAG) | 30% | -5% | $14,476 | $3,444 | $18,008 | $7,821 | $1,277 | 2.3x | 14.1x |

| Dean Foods Company (NYSE:DF) | 24% | 2% | $790 | $922 | $1,713 | $7,878 | $300 | 0.2x | 5.7x |

| Dr Pepper Snapple Group, Inc. (NYSE:DPS) | 60% | 4% | $20,895 | $4,418 | $25,313 | $6,690 | $1,563 | 3.8x | 16.2x |

| Flowers Foods, Inc. (NYSE:FLO) | 49% | 0% | $4,368 | $833 | $5,201 | $3,921 | $310 | 1.3x | 16.8x |

| General Mills, Inc. (NYSE:GIS) | 35% | -2% | $28,765 | $8,765 | $38,682 | $15,568 | $3,399 | 2.5x | 11.4x |

| Hormel Foods Corporation (NYSE:HRL) | 22% | -4% | $17,190 | -$194 | $17,000 | $9,168 | $1,411 | 1.9x | 12.0x |

| Kellogg Company (NYSE:K) | 39% | -1% | $22,889 | $8,334 | $31,239 | $12,923 | $2,411 | 2.4x | 13.0x |

| Pepsico, Inc. (NYSE:PEP) | 55% | 1% | $157,525 | $17,985 | $175,510 | $63,591 | $12,718 | 2.8x | 13.8x |

| Pinnacle Foods Inc. (NYSE:PF) | 28% | 4% | $6,422 | $2,841 | $9,264 | $3,119 | $557 | 3.0x | 16.6x |

| Company | Gross Margin | 1 Yr Revenue Growth | Market Cap | Net Debt | Enterprise Value | Revenue | EBITDA | EV / Revenue | EV / EBITDA |

|---|---|---|---|---|---|---|---|---|---|

| Post Holdings, Inc. (NYSE:POST) | 30% | 8% | $5,207 | $5,590 | $10,807 | $5,409 | $635 | 2.0x | 17.0x |

| Seneca Foods Corporation (NasdaqGS:SENE.A) | 7% | 2% | $289 | $446 | $736 | $1,315 | $46 | 0.6x | 15.9x |

| The Coca-Cola Company (NYSE:KO) | 62% | -12% | $184,372 | $21,743 | $206,148 | $37,307 | $7,924 | 5.5x | 26.0x |

| The Hain Celestial Group, Inc. (NasdaqGS:HAIN) | 20% | 1% | $3,614 | $628 | $4,242 | $2,915 | $195 | 1.5x | 21.8x |

| The Hershey Company (NYSE:HSY) | 46% | 1% | $20,682 | $2,540 | $23,239 | $7,515 | $1,471 | 3.1x | 15.8x |

| J&J Snack Foods Corp (NASDAQ: JJSF) | 30% | 13% | $2,509 | -$129 | $2,380 | $1,124 | $124 | 2.1x | 19.2x |

| The J. M. Smucker Company (NYSE:SJM) | 38% | -2% | $14,348 | $5,077 | $19,425 | $7,335 | $1,421 | 2.6x | 13.7x |

| The Kraft Heinz Company (NasdaqGS:KC) | 37% | -1% | $81,721 | $29,907 | $111,841 | $26,232 | $7,800 | 4.3x | 14.3x |

| Treehouse Foods, Inc. (NYSE:THS) | 17% | 2% | $2,147 | $2,399 | $4,546 | $6,307 | -$115 | 0.7x | NM |

| Tyson Foods, Inc. (NYSE:TSN) | 13% | 6% | $27,336 | $9,393 | $36,748 | $39,307 | $3,673 | 0.9x | 10.0x |

| Average | 34% | 2% | $30,016 | $6,194 | $36,284 | $13,091 | $2,338 | 2.3x | 14.8x |

| Median | 30% | 1% | $14,348 | $3,298 | $17,000 | $7,515 | $1,411 | 2.3x | 14.2x |

$ in Mil

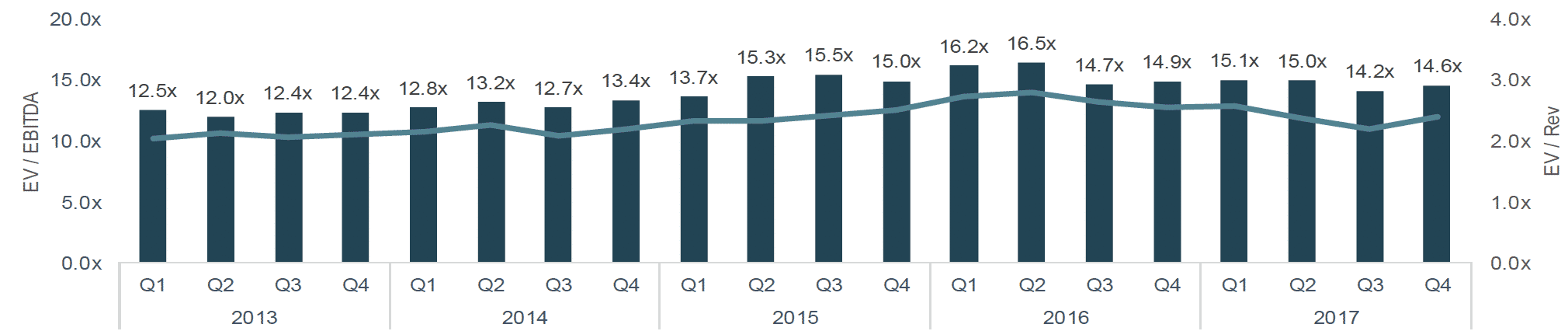

Valuation Multiples

2) Multiples represent company set presented above

References

No items found