Food & Agribusiness M&A Trends: Winter 2023

Published January 9, 2023

KEY INSIGHTS

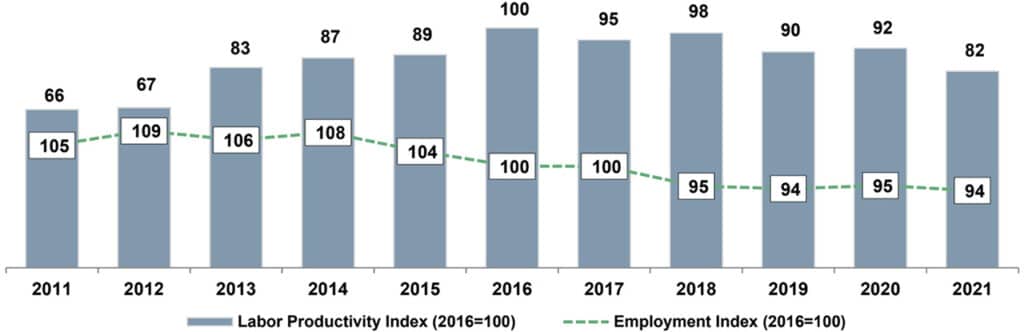

- Labor: Continued shortages of agricultural labor has driven growers to increase their recruitment of H-2A workers and accelerate mechanization.

- Contract Manufacturers: As supply chain, inflation, and labor shortage pains impact traditional food & beverage manufacturers, there has been a drastic increase in the number and quantity of products being produced by contract manufacturers on behalf of their branded customers.

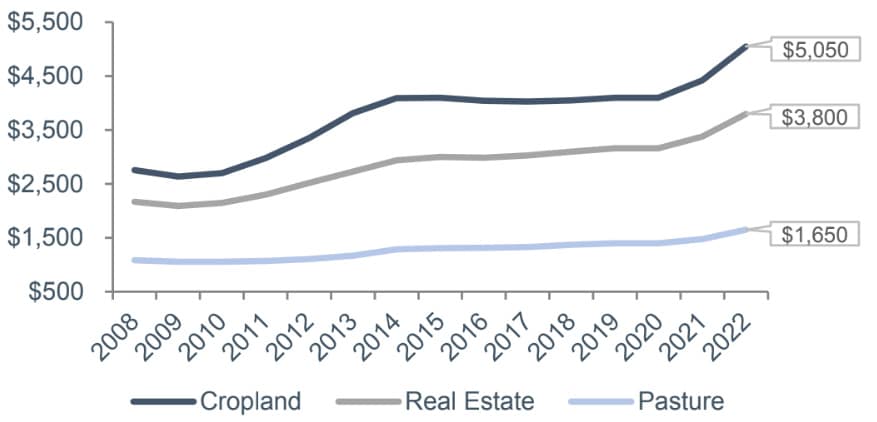

- Farmland: Macroeconomic forces, including higher commodity prices, new urban construction, and government subsidies have driven farmland values up in 2022.

Amidst interest rate hikes, lingering supply chain constraints, and geopolitical tensions in Ukraine, food & agriculture M&A faced increased pressure and transactional challenges through H2 2022. With rising input costs and ESG considerations, M&A activity in the FoodTech and AgTech verticals remains higher. Investors are seeking greater interest in innovative agricultural products, carbon capture products, prepackaged and plant-based food products. In 2023, middle market M&A dealmakers will chase a stronger pipeline as producers and processors compete for market share amidst continued consolidation by grower/packer networks.

Food & Agribusiness Market Insight

Implementing Mechanization in Response to Labor Challenges

- Continued shortages of agricultural labor has driven growers to recruit workers on H-2A visas to fill seasonal jobs.

- To alleviate labor shortages, many producers have implemented mechanization practices such as new automated technology, piece-rate wages, and increased use of H-2A foreign workers.

- Reduced productivity may further cause supply side constraints, in conjunction with inflationary pressures predominately driven by increasing input costs.

Contract Manufacturers Enjoy Stronger Positions In The Post-COVID Era

- As supply chain, inflation, and labor shortage pains impact traditional food & beverage manufacturers, there has been a drastic increase in the number and quantity of products being produced by contract manufacturers on behalf of their branded customers.

- Some contract manufacturers reported 40% or more spikes in business, with many having to turn down business or displace lower volume customers as legacy food and CPG companies continue shedding assets. Build vs. buy calculations continue to favor outsourcing, and some products may never return to internal production levels.

Farmers Competing with Institutional Investors for Farmland

- Macroeconomic forces, including higher commodity prices, new urban construction, and government subsidies have driven farmland values up in 2022.

- Farm real estate assets are forecasted to increase to $3.19T in 2022, a 4% inflation-adjusted increase from 2021.

- In 2022, United States cropland values reached an unprecedented $5,000 per acre, up 14.3% from 2021. Farm real estate value, averaged $3,800 per acre in 2022, up 12.4% from 2021. Pasture value averaged $1,650 per acre in 2022, up 11.5% from 2021.

- As farmland values continue to surge in 2023, farmers will face continued competition from institutional investors in finding affordable land to purchase or lease.

U.S. Farmland Asset Value

U.S. Agricultural Land Values Per Acre

Sources: Company press releases, company websites, Pitchbook, Mergermarket, Meridian research, USDA, Economic Research Service, FarmIncome and Wealth Statistics, Contract Packaging Association

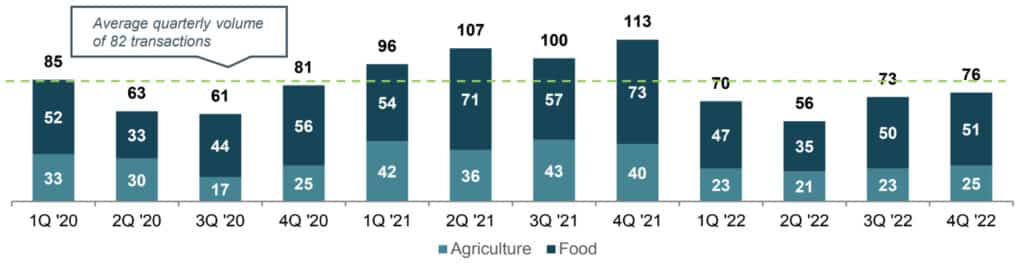

Food & Agribusiness Middle Market M&A Activity

Food and Agriculture M&A Activity

- Amidst interest rate hikes, lingering supply chain constraints, and geopolitical tensions in Ukraine, food & agriculture M&A faced increased pressure and transactional challenges through H2 2022.

- With rising input costs and ESG considerations, M&A activity in the FoodTech and AgTech verticals remains higher. Investors are seeking greater interest in innovative agricultural products, carbon capture products, pre-packaged and plant-based food products.

- In 2023, middle market M&A dealmakers will chase a stronger pipeline as producers and processors compete for market share amidst continued consolidation by grower/packer networks.

Recent Transaction Case Studies

Description:

Humic Growth Solutions is a developer of humic acid products used to enhance metabolic activity in soil.

Rationale:

The acquisition builds on Paine Schwartz Partners’ longstanding track record in investing in the upstream segments of crop productivity & sustainability.

Description:

Lipari Foods is a full-service, value-add manufacturer and distributor of a variety of specialty, “perimeter-of-the-store” food products.

Rationale:

Littlejohn & Co. will use its experience building and scaling distribution businesses to fuel additional organic & inorganic growth for Lipari.

Description:

Processor of freeze-dried products including fruits & vegetables, proteins, pet treats, probiotics, enzymes, and prepared meals.

Rationale:

The acquisition will expand Thrive’s manufacturing capabilities and add to the company’s geographic footprint throughout the United States.

Description:

VegPro International is a grower and packer of baby greens and is the largest producer of fresh vegetables in Canada.

Rationale:

Vision Ridge Partners invests in real assets, with a focus on sustainability across energy, transportation, and agriculture.

Sources: Company press releases, company websites, Pitchbook, Mergermarket, Meridian research, The Produce News

Public Food & Agribusiness Trading Metrics

| Agricultural Inputs | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| CF Industries Holdings, Inc. (NYS: CF) | $16,776 | $20,483 | $11,118 | $6,164 | 1.8x | 3.3x | 55% | 21% |

| FMC Corporation (NYS: FMC) | $15,738 | $18,949 | $5,594 | $1,179 | 3.4x | 16.1x | 21% | 14% |

| The Mosaic Co. (NYS: MOS) | $14,780 | $18,584 | $18,485 | $5,909 | 1.0x | 3.1x | 32% | 10% |

| The Toro Company (NYS: TTC) | $11,780 | $12,662 | $4,515 | $697 | 2.8x | 18.2x | 15% | 13% |

| AGCO Corporation (NYS: AGCO) | $10,343 | $12,055 | $11,908 | $1,255 | 1.0x | 9.6x | 11% | 20% |

| SiteOne Landscape Supply, Inc. (NYS: SITE) | $5,368 | $6,066 | $3,930 | $463 | 1.5x | 13.1x | 12% | -51% |

| The Scotts Company LLC (NYS: SMG) | $2,696 | $5,879 | $3,924 | ($342) | 1.5x | nm | -9% | -70% |

| Lindsay Corporation (NYS: LNN) | $1,828 | $1,850 | $771 | $112 | 2.4x | 16.6x | 14% | 9% |

| CVR Partners LP (NYS: UAN) | $1,059 | $1,489 | $812 | $374 | 1.8x | 4.0x | 46% | 21% |

| Titan International, Inc. (NYS: TWI) | $968 | $1,303 | $2,147 | $270 | 0.6x | 4.8x | 13% | 41% |

| Titan Machinery, Inc. (NAS: TITN) | $905 | $1,290 | $2,134 | $167 | 0.6x | 7.7x | 8% | 18% |

| Intrepid Potash, Inc. (NYS: IPI) | $387 | $335 | $343 | $140 | 1.0x | 2.4x | 41% | -33% |

| AgroFresh Solutions, Inc. (NAS: AGFS) | $157 | $552 | $169 | $41 | 3.3x | 13.6x | 24% | 49% |

| Ceres Global Ag Corp. (TSE: CRP) | $50 | $137 | $1,113 | ($6) | 0.1x | nm | -1% | -63% |

| Median | $2,262 | $3,865 | $3,036 | $322 | 1.5x | 8.7x | 15% | 14% |

| Average | $5,917 | $7,260 | $4,783 | $1,173 | 1.6x | 9.4x | 20% | 0% |

| Agriculture Producers | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Darling Ingredients Inc. (NYS: DAR) | $9,980 | $13,405 | $6,074 | $1,344 | 2.2x | 10.0x | 22% | -10% |

| Pilgrim’s Pride Corp. (NAS: PPC) | $5,609 | $8,473 | $17,380 | $1,744 | 0.5x | 4.9x | 10% | -16% |

| Cal-Maine Foods, Inc. (NAS: CALM) | $2,602 | $2,222 | $2,120 | $432 | 1.0x | 5.1x | 20% | 44% |

| Fresh Del Monte Produce Inc. (NYS: FDP) | $1,262 | $1,959 | $4,420 | $191 | 0.4x | 10.3x | 4% | -4% |

| Adecoagro S.A. (NYS: AGRO) | $903 | $2,145 | $1,310 | $465 | 1.6x | 4.6x | 35% | 7% |

| Mission Produce, Inc. (NAS: AVO) | $830 | $1,012 | $1,046 | ($3) | 1.0x | nm | 0% | -25% |

| Farmland Partners Inc (NYS: FPI) | $678 | $1,200 | $59 | $41 | 20.2x | 29.2x | 69% | 4% |

| Calavo Growers, Inc. (NAS: CVGW) | $522 | $587 | $1,191 | $15 | 0.5x | 39.2x | 1% | -31% |

| Limoneira Company (NAS: LMNR) | $222 | $356 | $185 | $12 | 1.9x | 28.8x | 7% | -16% |

| Alico, Inc. (NAS: ALCO) | $181 | $296 | $92 | $31 | 3.2x | 9.4x | 34% | -36% |

| AppHarvest LLC (NAS:APPH) | $61 | $212 | $13 | ($158) | 16.2x | nm | -1205% | -85% |

| Median | $830 | $1,200 | $1,191 | $41 | 1.6x | 10.0x | 10% | -16% |

| Average | $2,077 | $2,897 | $3,081 | $374 | 4.4x | 15.7x | -91% | -15% |

| Food Inputs | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Archer Daniels Midland Co (NYS: ADM) | $51,154 | $60,119 | $98,707 | $6,308 | 0.6x | 9.5x | 6% | 38% |

| International Flavors & Fragrances Inc. (NYS: IFF) | $26,802 | $37,787 | $12,627 | ($9) | 3.0x | nm | 0% | -30% |

| McCormick & Company, Inc. (NYS: MKC) | $22,556 | $27,591 | $6,385 | $1,152 | 4.3x | 24.0x | 18% | -13% |

| Kerry Group plc (DUB: KRZ) | $16,133 | $18,538 | $8,814 | $1,332 | 2.1x | 13.9x | 15% | -29% |

| Symrise AG (ETR: SY1) | $15,331 | $17,666 | $4,705 | $982 | 3.8x | 18.0x | 21% | -26% |

| Darling Ingredients Inc. (NYS: DAR) | $9,980 | $13,405 | $6,074 | $1,344 | 2.2x | 10.0x | 22% | -10% |

| IMCD N.V. (AMS: IMCD) | $8,260 | $9,101 | $4,594 | $561 | 2.0x | 16.2x | 12% | -34% |

| The Middleby Corporation (NAS: MIDD) | $7,268 | $9,885 | $3,868 | $756 | 2.6x | 13.1x | 20% | -31% |

| Ingredion Inc. (NYS: INGR) | $6,436 | $8,656 | $7,714 | $928 | 1.1x | 9.3x | 12% | 2% |

| Olam International Limited (SES:VC2) | $4,123 | $13,198 | $38,687 | $1,468 | 0.3x | 9.0x | 4% | -17% |

| Balchem Corp (NAS: BCPC) | $3,958 | $4,378 | $923 | $197 | 4.7x | 22.2x | 21% | -27% |

| Glanbia PLC (DUB: GL9) | $3,415 | $4,231 | $5,612 | $413 | 0.8x | 10.2x | 7% | -9% |

| Sensient Technologies Corporation (NYS: SXT) | $3,106 | $3,629 | $1,429 | $248 | 2.5x | 14.6x | 17% | -26% |

| MGP Ingredients Inc (NAS: MGPI) | $2,382 | $2,573 | $758 | $183 | 3.4x | 14.1x | 24% | 27% |

| Median | $7,764 | $11,542 | $5,843 | $842 | 2.4x | 13.9x | 16% | -21% |

| Average | $12,922 | $16,483 | $14,350 | $1,133 | 2.4x | 14.2x | 14% | -13% |

| Food Producers | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Nestlé S.A. (SWX: NESN) | $320,803 | $371,669 | $97,938 | $16,042 | 3.8x | 23.2x | 16% | -16% |

| The Kraft Heinz Company (NAS: KHC) | $49,830 | $69,098 | $25,813 | $3,601 | 2.7x | 19.2x | 14% | 13% |

| General Mills Inc. (NYS: GIS) | $49,751 | $61,098 | $19,367 | $4,374 | 3.2x | 14.0x | 23% | 25% |

| The Hershey Company | $47,836 | $52,722 | $10,093 | $2,391 | 5.2x | 22.1x | 24% | 21% |

| Hormel Foods Corporation (NYS: HRL) | $24,868 | $27,174 | $12,459 | $1,575 | 2.2x | 17.2x | 13% | -7% |

| Kellogg’s Co. (NYS: K) | $24,391 | $31,749 | $14,902 | $2,582 | 2.1x | 12.3x | 17% | 11% |

| Conagra Brands, Inc. (NYS: CAG) | $18,581 | $27,628 | $11,787 | $1,391 | 2.3x | 19.9x | 12% | 14% |

| Campbell Soup Company (NYS: CPB) | $16,983 | $21,707 | $8,901 | $1,568 | 2.4x | 13.8x | 18% | 30% |

| The J.M.Smucker Co., LLC (NYS: SJM) | $16,909 | $21,591 | $8,169 | $1,373 | 2.6x | 15.7x | 17% | 17% |

| Associated British Foods Plc (LON: ABF) | $15,045 | $17,134 | $21,698 | $2,588 | 0.8x | 6.6x | 12% | -29% |

| Lamb Weston Holdings, Inc. (NYS: LW) | $12,792 | $15,071 | $4,240 | $731 | 3.6x | 20.6x | 17% | 40% |

| Post Holdings, Inc. (NYS: POST) | $5,301 | $11,035 | $5,851 | $1,593 | 1.9x | 6.9x | 27% | 22% |

| Simply Good Foods USA Inc (NAS: SMPL) | $3,865 | $4,207 | $1,169 | $198 | 3.6x | 21.2x | 17% | -9% |

| TreeHouse Foods, Inc. (NYS: THS) | $2,742 | $4,755 | $4,656 | $258 | 1.0x | 18.4x | 6% | 21% |

| The Hain Celestial Group, Inc. (NAS: HAIN) | $1,453 | $2,410 | $1,876 | $155 | 1.3x | 15.5x | 8% | -62% |

| Sovos Brands Intermediate, Inc. (NAS: SOVO) | $1,415 | $1,834 | $806 | $26 | 2.3x | 69.6x | 3% | -7% |

| B&G Foods, Inc. (NYS: BGS) | $805 | $3,236 | $2,112 | $160 | 1.5x | 20.3x | 8% | -63% |

| Median | $16,909 | $21,591 | $8,901 | $1,568 | 2.3x | 18.4x | 16% | 13% |

| Average | $36,081 | $43,772 | $14,814 | $2,389 | 2.5x | 19.8x | 15% | 1% |

| Food Supply Chain | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Sysco Corporation (NYS: SYY) | $38,940 | $50,076 | $71,306 | $3,337 | 0.7x | 15.0x | 5% | -2% |

| Aramark Corp. (NYS: ARMK) | $10,729 | $18,194 | $16,327 | $1,152 | 1.1x | 15.8x | 7% | 13% |

| Performance Food Group, Inc. (NYS: PFGC) | $9,175 | $13,917 | $55,227 | $964 | 0.3x | 14.4x | 2% | 28% |

| US Foods, Inc. (NYS: USFD) | $7,700 | $13,024 | $33,181 | $923 | 0.4x | 14.1x | 3% | -2% |

| AmeriCold Logistics LLC (NYS: COLD) | $7,689 | $11,145 | $2,910 | $386 | 3.8x | 28.9x | 13% | -13% |

| United Natural Foods, Inc. (NYS: UNFI) | $2,345 | $6,073 | $29,463 | $739 | 0.2x | 8.2x | 3% | -20% |

| The Chefs’ Warehouse, Inc (NAS: CHEF) | $1,259 | $1,762 | $2,380 | $109 | 0.7x | 16.2x | 5% | -1% |

| SpartanNash Company (NAS: SPTN) | $1,090 | $1,880 | $9,427 | $187 | 0.2x | 10.0x | 2% | 20% |

| HF Foods Group Inc (NAS: HFFG) | $214 | $214 | $715 | $38 | 0.3x | 5.6x | 5% | -53% |

| Amcon Distributing Co (ASE: DIT) | $115 | $236 | $2,011 | $27 | 0.1x | 8.6x | 1% | -5% |

| Median | $5,017 | $8,609 | $12,877 | $563 | 0.3x | 14.3x | 4% | -2% |

| Average | $7,926 | $11,652 | $22,295 | $786 | 0.8x | 13.7x | 5% | -4% |

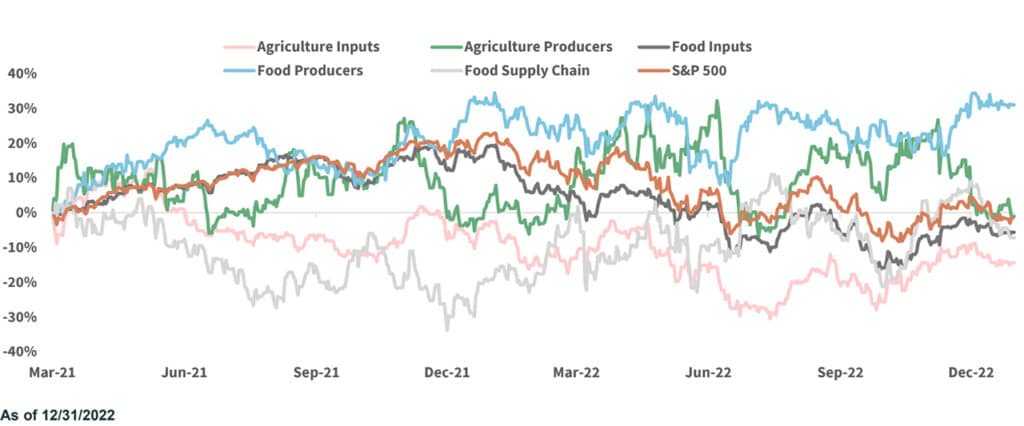

Stock Index Performance

Sources: Company press releases, company websites, Pitchbook, Mergermarket, Meridian research

Meridian Transaction: Athena Ag Acquires Athena Manufacturing

Meridian Capital LLC (“Meridian”), a leading Seattle-based middle market investment bank and M&A advisory firm, is pleased to announce the successful acquisition of Athena Manufacturing Group by one of its clients, Athena Ag (“the “Company”).

The Company produces a variety of liquid, soluble, and dry fertilizer products for delivery through fertigation systems, which is more efficient than traditional fertilizing spraying techniques. As a result of the Company’s rapidly growing operations, Athena needed to acquire one of its contract manufacturers to add capacity and improve the efficiency of the overall operation.

Meridian Transaction: Private Manufacturer Acquired by Confidential Buyer

Meridian Capital LLC is pleased to announce the successful acquisition of select assets and division (“the “Division”) of its client, Project Measure (the “Company”) by a confidential buyer. The Division is comprised of certain assets used in the manufacture of sensors and software for usage by environmental research and commercial agriculture. The divestiture of the Division enables the Company to focus exclusively on its food and horticulture divisions while supporting the expansion of the Division.

Fresh Innovations Acquired by Peterson Farms

Peterson Farms, a Michigan-based fruit processing company, acquired Fresh Innovations California, a Stockton, California-based provider of tart and sweet cherries, fresh-cut apple slices, and blueberries to the K-12 and retail markets.

Fresh Innovations was previously owned by Arable Capital, a Bellevue, Washington-based private equity firm. The sale will allow both companies to bolster their fresh-cut processing and distribution capabilities for customers throughout the U.S. The transaction marks the first exit for Arable since its formation in 2017.

Select Food & Agribusiness M&A Transactions

Agriculture Production & Inputs

| Date | Target | Buyer | Description |

|---|---|---|---|

| Pending | AgroFresh Solutions | Paine Schwartz Partners | Creator of agricultural technologies that preserve the quality and value of fresh produce and flowers |

| Dec-22 | MightyVine | Plant Agricultural Systems | 30-acre hydroponic tomato farm |

| Dec-22 | Peterson Farms | Mubadala Capital | Processor of fresh-cut apples, frozen fruit produce, and non-concentrate juice |

| Nov-22 | Athena Manufacturing Group | Athena Ag | Provider of liquid, soluble and dry fertilizer products for delivery through fertigation systems |

| Nov-22 | FarmersWeb | Full Harvest | SaaS farm inventory management platforn |

| Oct-22 | Costa Group | Paine Schwartz Partners | Grower, packer, and marketer of fresh fruit and vegetables |

| Oct-22 | Blazer Wilkinson | Arable Capital Partners | Producer and packager of strawberries |

| Oct-22 | SunWest Fruit Company | Fowler Packing | Apple and cherry packer |

| Oct-22 | Columbia Fruit Packers | Goldman Sachs Asset Management | Packer of fruits and provider of warehouse services |

| Oct-22 | Gavilon | Viterra | Distributor of grains, feed ingredients, and fertilizer |

| Sep-22 | Northampton Growers Produce Sales | Wyco Produce | Grower and packer of squash, beans, cabbage, corn and eggplant |

| Sep-22 | Central Texas Tree care | SavATree | General tree care and plant health care for homeowners and commercial clients |

| Sep-22 | Xylem | Sterling Investment Partners | Leading provider of vegetation management and emergency storm response services |

| Sep-22 | Agvnt | Summit Nutrients | Provider of liquid fertilizers and nano-technologies for crop production and yield improvement |

| Aug-22 | Lannate | Tessenderlo Kerley | Product line of Corteva Agriscience, specialty pest control chemicals |

| Aug-22 | Cape Cod Stone | SiteOne Landscape Supply | Distributor of hardscape products |

| Aug-22 | Barrett’s Tree Service | SavATree | Shrub and landscape provider |

| Aug-22 | Subsole | Frutura | Chilean fruit exporter, grower, and packer |

| Jul-22 | RainSweet | Scenic Fruit Company | IQF processor and co-packer of blueberries, blackberries, stawberries, and vegetables |

| Jul-22 | VegPro International | Vision Ridge Partners | Grower and packer of baby lettuce & largest fresh vegetable producer in Canada |

| Jul-22 | Lecoq Cuisine | Groupe Le Duff | Frozen pastry wholesaler |

| Jul-22 | River Valley Horticulture | SiteOne Landscape Supply | Wholesale distributor of landscape supplies |

| Jul-22 | Gladstone Land | Resource Land Holdings | 1,317 gross acres of vineyard farmland across Washington and Oregon |

Food Inputs & Production

| Date | Target | Buyer | Description |

|---|---|---|---|

| Pending | Gelnex | Darling Ingredients Inc. | Global prducer of collagen prducts |

| Dec-22 | Milk Specialties Global | Butterfly Equity | Ingredient manufacturer focused on processing raw dairy inputs |

| Dec-22 | Vertullo Imports | Sandy Hills Investors | Leading specialty food imports business |

| Dec-22 | Fresh Innovations | Peterson Farms | Supplier of organic and conventional fresh-cut apple slices to schools |

| Dec-22 | Southwest Spice | Gulf Pacific | Value-added packager and processor of dry edible beans and spice blends |

| Dec-22 | Gulf Pacific | Eos Partners | Value-add processor of high-quality specialty foods and ingredients |

| Dec-22 | Seviroli Foods | Mill Point Capital | Manufacturer of frozen pasta and other food products |

| Dec-22 | TriOak Foods | JBS USA | Pork processor and producer |

| Dec-22 | Liberty Fruit | Russ Davis Wholesale | SQF-certified produce distribution and processing facility |

| Nov-22 | Imperial Sugar | United States Sugar | Processor and marketer of refined sugar |

| Nov-22 | Owensboro Grain Company | Cargill | Fully integrated soy processing facility |

| Nov-22 | MTC Distributing | Harbor Wholesale Foods | California-based distributor of foods |

| Nov-22 | Teton Waters Ranch, Sun Ranch | Sunrise Strategic Partners | Providers of grass fed beef, boxed beef, and case-ready products |

| Nov-22 | Lombardi Brothers Meats | Founders Group of Food Companies | Specialty meat processor and distributor |

| Nov-22 | Saratoga Food Specialities | Solina | Seasoning and sauce manufacturer |

| Oct-22 | Lipari Foods | Littlejohn & Co | Distributor and value-add manufacturer of speciality foods |

| Oct-22 | Left Coast Food Company | Worldwide Produce | Distributor of produce, dry goods and frozen goods |

| Oct-22 | NW Foodservice Distribution, Inc. | Harbor Foodservice | Broadline foodservice distributor servicing Southwest Washington and Northwest Oregon |

| Oct-22 | Off the Dock Seafood | Fortune International | Seafood, meat, poultry, and gourmet food processor |

| Oct-22 | Sunrise Produce | Investcorp | Wholesale produce distribution company |

| Oct-22 | Fresh Edge | Wind Point Partners | Fresh food disrtibution company with 830 trucks and 25 facilities over 795K sqft |

| Oct-22 | Denali Ingredients | Orkla | Ice cream ingredient provider |

| Oct-22 | Rainfield Marketing Group | GrubMarket | Provider of hiqh quality fruts, vegetables, and Asian specialty items |

| Oct-22 | TruFood Manufacturing | Mubadala Investment Company | Snack food contract manufacturing |

| Oct-22 | Culinary Intenational | Ruiz Food Products | Manufacturer of ready-to-eat frozen and refrigerated Mexican foods |

| Oct-22 | FreshEdge | Wind Point Partners | Fresh food distribution company |

| Oct-22 | TreeHouse Foods (Meal-Prep Division) | Investindustrial | Operator of a meal preparation business intended to serve retail, food service and industrial customers |

| Sep-22 | Gulf Pacific | Capital Southwest BDC | Rice processing and merchandising |

| Sep-22 | Jensen’s Blue Ribbon Processing | HFP Capital Markets | Meat processing and packaging |

| Sep-22 | Spice Chain Company | iSpice Foods | Importer and processor of spices |

| Sep-22 | Humic Growth Solutions | Paine Schwartz Partners | Developer of humic acid products |

| Sep-22 | Keystone Natural Holdings | House Foods Group | Packaged food manufacturer of tofu and meat alternatives |

| Sep-22 | Scelta Products | McCain Foods | Frozen-food based in the Netherlands |

| Sep-22 | Bell Carter Foods | Aceitunas Guadalquivir | Manufacturer of table olives |

| Sep-22 | Sokol & Company | Burlington Capital Partners | Contract manufacturer of sauces, glazes, and marinades |

| Sep-22 | Water Lillies Food | Blue Point Capital Partners | Manufacturer and distributor of premium frozen Asian-inspired cuisine |

Sources: Company press releases, company websites, Pitchbook, Mergermarket, Meridian research