Food & Agribusiness M&A Trends: Summer 2022

Published July 18, 2022

KEY INSIGHTS

- Food & Agricultural inputs continue to elevate food production costs

- Growers leading the way with sustainability efforts

- Strong U.S. demand drives up U.S. import value forecast

- Food and Agribusiness M&A market update

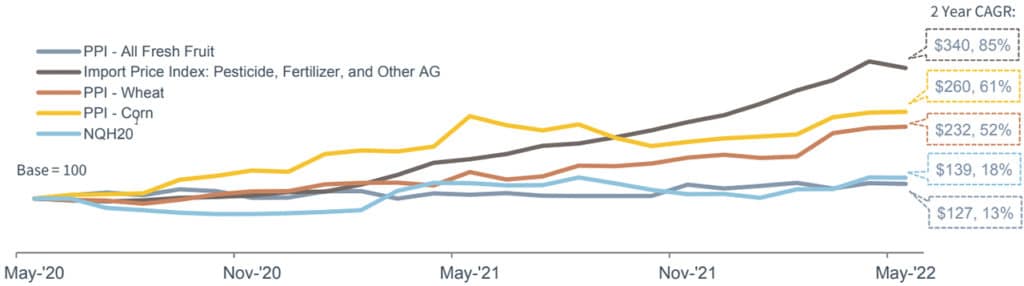

The war in Ukraine, alongside strong U.S. demand, has presented additional challenges for food and crop input prices, notably fertilizer and fuel. Russia and Ukraine account for 28% of all U.S. fertilizer imports. U.S. cultivators of wheat and corn suffered the largest price increases over the past two years due to the large requirement for fertilizer. U.S. producers of specialty tree fruit managed through smaller price increases comparatively, as a result of lower fertilizer requirements and water prices increasing at more modest rates.

Food and Ag Market Insights

Food & Agricultural Inputs Continue to Elevate Food Production Costs

The war in Ukraine, alongside strong U.S. demand, has presented additional challenges for food and crop input prices, notably fertilizer and fuel. Russia and Ukraine account for 28% of all U.S. fertilizer imports. U.S. cultivators of wheat and corn suffered the largest price increases over the past two years due to the large requirement for fertilizer. U.S. producers of specialty tree fruit managed through smaller price increases comparatively, as a result of lower fertilizer requirements and water prices increasing at more modest rates.

1) Nasdaq Veles California Water Index (NHQ20)

Growers Leading the Way with Sustainability Efforts. Will Consumers Pay?

While the consumer market continues to reward growers that produce sustainable goods, only 7% of growers feel that they are being adequately compensated for the extra costs incurred with efforts in implementing sustainable practices. Growers believe consumers drive the demand for sustainable goods, however when asked who they felt is most responsible for leading and promoting sustainability practices, 45% of respondents said that growers were most responsible.

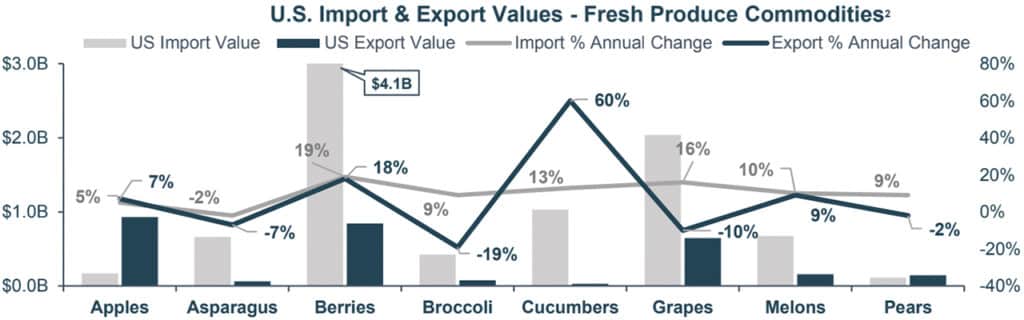

Strong U.S. Demand Drives Up U.S. Import Value Forecast

- With rising import volumes and tighter global supplies, the USDA forecasts U.S. agricultural imports from October 2021 through September 2022 to reach a record of $180.5B.

- U.S. imports of fresh fruit from May 2021 through April 2022 totaled $18.7B, up 17% from the prior year. U.S. imports of fresh vegetables totaled $10.8B, up 4.9% from the prior year.

- U.S. exports of fresh fruit from May 2021 through April 2022 totaled $4.4B, up 1% from the prior year. U.S. exports of fresh vegetables totaled $2.7B, up 5.5% from the prior year.

Source: Pitchbook, and Meridian Research, USDA 2

2) U.S. imports and exports of fresh produce from May 2021 to April 2022, with a percent change from a year ago

Food and Ag Market Activity

Food and Agribusiness M&A Market Update

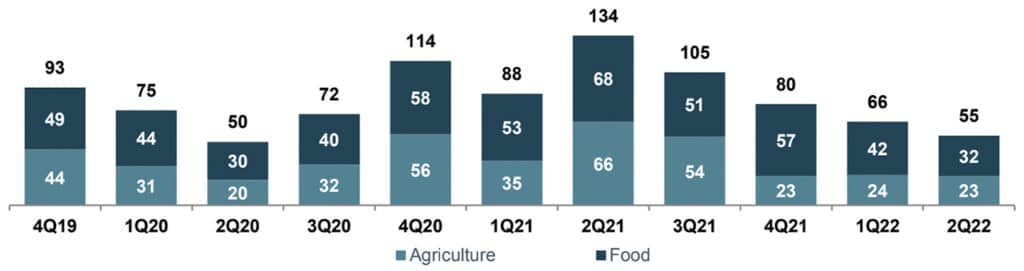

- A softening of the debt markets along with higher equity risk premiums have slowed down M&A activity in the first half of 2022.

- 1H 2022 Food & Agribusiness M&A was down 45% YOY, while the broader M&A market was down nearly 25%. 1H 2021 data is difficult to compare against, as these were record quarters for Food and Agribusiness M&A. Overall, 1H 2022 Food & Agribusiness M&A was on par with 2018-2020 M&A levels.

- With record levels of dry powder amongst PE firms in the U.S. ($975B+), M&A activity is expected to rebound in the latter half of the year and in 2023.

- Investors continue to appreciate the long-term demand drivers in the food and agribusiness segment. Investors are focusing their M&A efforts on businesses that are of scale and who can weather the supply chain disruptions and inflation pressures most businesses are currently facing.

2022 1H M&A Down to Pre-Pandemic Levels

Recent Transaction Spotlights

Description: California-based premier foodservice distributor of fresh produce and dairy serving the Coachella Valley market.

Rationale: The acquisition will strengthen Worldwide Produce’s presence in the Coachella Valley market and across the West Coast. VFS will benefit from Worldwide’s scale, focus on operational excellence, and grower relationships.

Description: Western Milling is one of the oldest and largest industrial providers of mixed grain cattle feed products to the dairy industry in California, which accounts for approximately 20% of all U.S. dairy output.

Rationale: The transaction emphasizes how feed mill and fertilizer operations will complement Viserion International’s existing grain-handling and commodity trading offerings.

Description: Fresh produce companies that provide fruits and vegetables sourced primarily from Mexico and the US. The companies currently operate in Arizona, Texas, California, and Mexico.

Rationale: The acquisition will enable Produce Connection to utilize GrubMarket’s innovative and proprietary SaaS platform to provide food industry wholesalers and distributors with seamless financial management and online ordering features.

Source: Pitchbook, and Meridian Research

Publicly-Traded Food and Agribusiness Companies

Agriculture Inputs

| Company Name | Market Cap | Net Debt | EV | Revenue | Adj. EBITDA | EBITDA % | EV/ Rev | EV / EBITDA |

|---|---|---|---|---|---|---|---|---|

| The Mosaic Co. | $16,094 | $3,734 | $19,980 | $13,983 | $4,408 | 31.5% | 1.43x | 4.53x |

| CF Industries Holdings, Inc. | 17,437 | 1,085 | 21,273 | 8,358 | 4,734 | 56.6% | 2.55x | NM |

| FMC Corporation | 13,047 | 3,408 | 16,478 | 5,200 | 1,372 | 26.4% | 3.17x | 12.01x |

| The Toro Company | 8,240 | 907 | 9,147 | 4,120 | 580 | 14.1% | 2.22x | 15.78x |

| AGCO Corporation | 7,097 | 1,465 | 8,561 | 11,445 | 1,288 | 11.3% | 0.75x | 6.65x |

| The Scotts Company LLC | 4,502 | 3,793 | 8,294 | 4,592 | 715 | 15.6% | 1.81x | 11.59x |

| SiteOne Landscape Supply, Inc. | 5,473 | 732 | 6,205 | 3,631 | 449 | 12.4% | 1.71x | 13.81x |

| Lindsay Corporation | 1,460 | 44 | 1,504 | 734 | 104 | 14.1% | 2.05x | 14.51x |

| CVR Partners LP | 920 | 412 | 1,332 | 695 | 331 | 47.7% | 1.92x | NM |

| Titan Machinery, Inc. | 489 | 193 | 682 | 1,800 | 124 | 6.9% | 0.38x | 5.50x |

| Titan International, Inc. | 833 | 440 | 1,271 | 1,933 | 166 | 8.6% | 0.66x | 7.68x |

| Intrepid Potash, Inc. | 555 | (58) | 497 | 303 | 103 | 34.0% | 1.64x | 4.82x |

| Ceres Global Ag Corp. | $78 | 133 | 211 | 980 | 35 | 3.6% | 0.22x | 6.04x |

| AgroFresh Solutions, Inc. | $86 | 208 | 454 | 167 | 60 | 35.8% | 2.72x | 7.60x |

| Mean | $5,451 | $6,849 | 22.8% | 1.66x | 9.21x | |||

| Median | $2,981 | $3,855 | 14.8% | 1.76x | 7.64x |

Agriculture Producers

| Company Name | Market Cap | Net Debt | EV | Revenue | Adj. EBITDA | EBITDA % | EV/ Rev | EV / EBITDA |

|---|---|---|---|---|---|---|---|---|

| Darling Ingredients Inc. | $9,176 | $1,781 | $11,027 | $5,061 | $1,238 | 24.5% | 2.18x | 8.90x |

| Pilgrim’s Pride Corp. | 7,272 | 3,030 | 10,315 | 15,744 | 1,562 | 9.9% | 0.66x | 6.60x |

| Sanderson Farms, Inc. | 4,776 | (808) | 3,968 | 5,624 | 1,382 | 24.6% | 0.71x | NM |

| Cal-Maine Foods, Inc. | 2,472 | (95) | 2,377 | 1,534 | 72 | 4.7% | 1.55x | NM |

| Fresh Del Monte Produce Inc. | 1,495 | 713 | 2,278 | 4,301 | 180 | 4.2% | 0.53x | 12.66x |

| Mission Produce, Inc. | 1,034 | 193 | 1,227 | 979 | 61 | 6.2% | 1.25x | 20.11x |

| Adecoagro S.A. | 878 | 1,152 | 2,069 | 1,156 | 459 | 39.7% | 1.79x | 4.50x |

| Calavo Growers, Inc. | 756 | 107 | 864 | 1,164 | 16 | 1.4% | 0.74x | NM |

| AppHarvest LLC | 432 | 64 | 497 | 12 | (116) | NM | NM | NM |

| Farmland Partners Inc | 697 | 447 | 1,276 | 54 | 32 | 59.5% | NM | NM |

| Limoneira Company | 248 | 139 | 410 | 169 | 4 | 2.1% | 2.43x | NM |

| Alico, Inc. | 266 | 100 | 371 | 104 | 21 | 19.9% | 3.57x | 17.98x |

| Mean | $2,459 | $3,057 | 17.9% | 1.54x | 11.80x | |||

| Median | $956 | $1,672 | 9.9% | 1.40x | 10.78x |

Food Inputs

| Company Name | Market Cap | Net Debt | EV | Revenue | Adj. EBITDA | EBITDA % | EV/ Rev | EV / EBITDA |

|---|---|---|---|---|---|---|---|---|

| Archer Daniels Midland Company | $40,639 | $13,012 | $53,946 | $90,006 | $5,165 | 5.7% | 0.60x | 10.44x |

| International Flavors & Fragrances Inc | 30,435 | 11,785 | 42,353 | 12,417 | 2,596 | 20.9% | 3.41x | 16.31x |

| McCormick & Company, Inc. | 22,386 | 5,032 | 27,436 | 6,339 | 1,185 | 18.7% | 4.33x | 23.16x |

| Kerry Group plc | 17,380 | 2,444 | 19,824 | 7,926 | 1,136 | 14.3% | 2.50x | 17.45x |

| Symrise AG | 15,713 | 1,512 | 17,298 | 4,523 | 951 | 21.0% | 3.82x | 18.19x |

| The Middleby Corporation | 6,974 | 2,473 | 9,447 | 3,487 | 703 | 20.2% | 2.71x | 13.43x |

| Darling Ingredients Inc. | 9,176 | 1,781 | 11,027 | 5,061 | 1,238 | 24.5% | 2.18x | 8.90x |

| IMCD N.V. | 7,723 | 262 | 7,987 | 4,061 | 478 | 11.8% | 1.97x | 16.71x |

| Ingredion Inc. | 5,801 | 1,924 | 7,815 | 7,172 | 902 | 12.6% | 1.09x | 8.66x |

| Balchem Corp | 4,233 | 73 | 4,307 | 842 | 187 | 22.2% | 5.11x | 23.08x |

| Olam International Limited | 4,155 | 9,163 | 13,323 | 34,971 | 1,542 | 4.4% | 0.38x | 8.64x |

| Glanbia plc | 3,000 | 818 | 3,827 | 4,962 | 432 | 8.7% | 0.77x | 8.86x |

| Sensient Technologies Corporation | 3,412 | 505 | 3,918 | 1,376 | 239 | 17.4% | 2.85x | 16.40x |

| MGP Ingredients, Inc. | 2,203 | 218 | 2,420 | 714 | 163 | 22.8% | 3.39x | 14.88x |

| Mean | $12,374 | $16,066 | 16.1% | 2.51x | 14.65x | |||

| Median | $7,348 | $10,237 | 18.0% | 2.61x | 15.60x |

Food Producers

| Company Name | Market Cap | Net Debt | EV | Revenue | Adj. EBITDA | EBITDA % | EV/ Rev | EV / EBITDA |

|---|---|---|---|---|---|---|---|---|

| Nestlé S.A. | $326,362 | $35,641 | $362,644 | $95,675 | $22,173 | 23.2% | 3.79x | 16.36x |

| The Kraft Heinz Company | 46,759 | 18,772 | 65,731 | 25,693 | 7,043 | 27.4% | 2.56x | 9.33x |

| General Mills Inc. | 45,515 | 11,156 | 56,917 | 18,993 | 3,897 | 20.5% | 3.00x | 14.61x |

| The Hershey Company | 45,365 | 4,976 | 50,340 | 9,342 | 2,407 | 25.8% | 5.39x | 20.91x |

| Hormel Foods Corporation | 26,222 | 2,417 | 28,644 | 12,459 | 1,511 | 12.1% | 2.30x | 18.95x |

| Kellogg’s Co. | 24,580 | 7,641 | 32,721 | 14,269 | 2,485 | 17.4% | 2.29x | 13.17x |

| Associated British Foods Plc | 14,779 | 2,226 | 17,117 | 21,199 | 2,357 | 11.1% | 0.81x | 7.26x |

| Conagra Brands, Inc. | 16,695 | 9,079 | 25,852 | 11,365 | 2,050 | 18.0% | 2.27x | 12.61x |

| The J.M.Smucker Co., LLC | 14,062 | 4,437 | 18,499 | 7,999 | 1,659 | 20.7% | 2.31x | 11.15x |

| Campbell Soup Company | 14,536 | 4,552 | 19,090 | 8,448 | 1,634 | 19.3% | 2.26x | 11.68x |

| Lamb Weston Holdings, Inc. | 10,621 | 2,324 | 12,945 | 3,953 | 649 | 16.4% | 3.27x | 19.94x |

| Post Holdings, Inc. | 5,076 | 5,170 | 10,562 | 6,033 | 991 | 16.4% | 1.75x | 10.66x |

| Simply Good Foods | 3,791 | 346 | 4,137 | 1,154 | 258 | 22.3% | 3.58x | 16.04x |

| The Hain Celestial Group, Inc. | 2,144 | 859 | 3,003 | 1,885 | 223 | 11.8% | 1.59x | 13.48x |

| TreeHouse Foods, Inc. | 2,391 | 1,869 | 4,260 | 4,411 | 345 | 7.8% | 0.97x | 12.36x |

| B&G Foods, Inc. | 1,718 | 2,306 | 4,024 | 2,084 | 353 | 17.0% | 1.93x | 11.39x |

| Sovos Brands Intermediate, Inc. | 1,554 | 431 | 1,985 | 740 | 113 | 15.2% | 2.68x | 17.60x |

| Mean | $35,422 | $42,263 | 17.8% | 2.52x | 13.97x | |||

| Median | $14,536 | $18,499 | 17.4% | 2.30x | 13.17x |

Food Supply Chain

| Company Name | Market Cap | Net Debt | EV | Revenue | Adj. EBITDA | EBITDA % | EV/ Rev | EV / EBITDA |

|---|---|---|---|---|---|---|---|---|

| Sysco Corporation | $43,214 | $11,054 | $54,301 | $65,816 | $3,682 | 5.6% | 0.83x | 14.75x |

| Aramark Corp. | 7,848 | 7,732 | 15,589 | 14,341 | 1,057 | 7.4% | 1.09x | 14.75x |

| US Foods, Inc. | 7,050 | 5,017 | 12,601 | 30,990 | 1,112 | 3.6% | 0.41x | 11.33x |

| AmeriCold Logistics LLC | 8,348 | 3,445 | 11,803 | 2,786 | 442 | 15.9% | 4.24x | NM |

| Performance Food Group, Inc. | 7,152 | 4,806 | 11,957 | 45,609 | 873 | 1.9% | 0.26x | 13.70x |

| United Natural Foods, Inc. | 2,290 | 3,619 | 5,908 | 28,390 | 805 | 2.8% | 0.21x | 7.34x |

| The Chefs’ Warehouse, Inc | 1,497 | 481 | 1,978 | 1,978 | 21 | 1.0% | 1.00x | NM |

| SpartanNash Company | 1,088 | 733 | 1,822 | 9,037 | 201 | 2.2% | 0.20x | 9.06x |

| HF Foods Group Inc | 286 | 133 | 423 | 715 | 47 | 6.6% | 0.59x | 8.97x |

| AMCON Distributing Co. | 97 | 57 | 153 | 1,704 | 22 | 1.3% | 0.09x | 7.13x |

| Mean | $7,887 | $14,775 | 4.8% | 0.89x | 10.88x | |||

| Median | $4,670 | $11,880 | 3.2% | 0.50x | 10.20x |

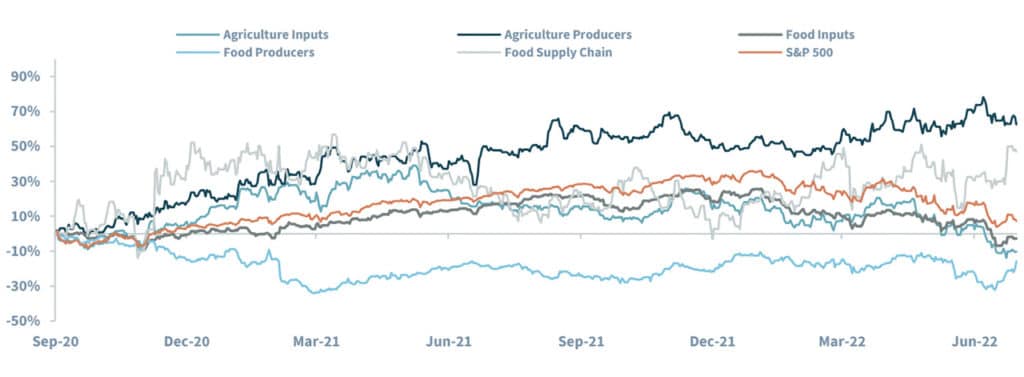

Stock Index Performance

Notable Transactions: Food

| Date | Target | Buyer | Target Description |

|---|---|---|---|

| Pending | Sanderson Farms | Cargill | Produces fresh, frozen, and prepared chicken products |

| Pending | Macgregors Meat & Seafood | Gordon Food Service | Manufacturer of cooked and prepared foods |

| Pending | TreeHouse Foods (Meal-Prep Division) | Investindustrial | Operator of a meal preparation business intended to serve retail, food service and industrial customers |

| Jul-22 | Graves Food | GS Foods Group | Provider of full-line wholesale food distributor services intended for Missouri, Oklahoma, Kansas, and Arkansas |

| Jul-22 | General Mills (Helper Main Meals) | Eagle Family Foods Group | Manufacturer and marketer of branded consumer foods |

| Jun-22 | Clif Bar & Company | Modelez International | Producer of organic energy and nutritional foods and drinks based in Emeryville, California |

| Jun-22 | Grain Craft | Redwood Capital Investments, LLC | Largest Independent milling company in the U.S. |

| Jun-22 | KB Ingredients | Eurogerm | Baking ingredients producer |

| Jun-22 | Maytag Dairy Farms | AgCertain Industries | Manufacturer and marketer of Maytag Blue Cheese as well as other specialty artisanal food and beverage products |

| Jun-22 | Valley Food Services | Worldwide Produce | Distributor of fresh produce and dairy to the Coachella Valley region |

| Jun-22 | Cardenas Markets | Apollo Global Management | Hispanic-focused grocery retailer |

| Jun-22 | Syracuse Sausage | Standard Meat Company | Manufacturer of cooked and fresh sausage products intended to serve national restaurant chains, grocery stores, and commercial food manufacturers |

| Jun-22 | Hydrofresh | Universal Pure Holdings | Provider of high-pressure processing services intended for food and beverage manufacturers |

| May-22 | TNT Crust | General Mills | Manufacturer of frozen crusts that supplies to regional and national pizza chains and foodservice distributors |

| May-22 | Allied Sales & Distribution | Capitol Food Co. | Specialty bakery ingredient distributor and importer focused on industrial manufacturing supply, service, and support |

| May-22 | Sweetener Solutions | Batory Foods | Company specializing in custom sweetener formulation, precision blending, and specialty portion packaging |

| Apr-22 | Chef’s Choice Produce | Worldwide Produce (Sole Source Capital) | Foodservice distributor of fresh produce and dairy |

| Apr-22 | Second Nature Brands | CapVest Partners | Creator of premium, nutritional, and better for you snacks and treats |

| Apr-22 | Ricolino | Mondelez International | Mexican producer of confectionery products |

| Apr-22 | Farm Ridge Foods | Patriot Pickle (Swander Pace Capital) | Distributes pickled products into the retail channel, private label, and 3rd party brands |

| Apr-22 | Regatta Tropicals | GrubMarket | Fresh fruit provider |

| Mar-22 | Bentilia | Global Foods and Ingredients Inc. | Lentil-based pasta manufacturer |

| Mar-22 | Novelty Cone Co. | Joy Baking | Manufacturer of ice cream cones in the Northeastern US |

| Mar-22 | Stonewall Kitchen | TA Associates | Leading specialty food, home goods, and personal care producer |

| Feb-22 | Ziyad Brothers | Exsisting Management, Peak Rock Capital | Distributor of food products focused on the middle east and mediterranean authentic foods |

| Feb-22 | Larry’s All Natural | WP Strategic Holdings | Producer of Mexican cooking sauces and salsas |

| Feb-22 | Florida Food Service | Ben E.Keith Foods | Provider of ingredients in Gainesville, Florida |

| Feb-22 | Hutt Trucking Co | RLS Logistics | Cold storage warehousing and trucking services |

| Feb-22 | 4505 Meats | Benestar Brands | Manufacturer of pork rinds, tortilla chips, and pretzel bread products |

| Feb-22 | Catalina Finer Foods | Midwest Growth Partners | Producer of food products focused on Cuban and Caribbean cuisine |

| Jan-22 | Natural Beverages and Grains (J. M. Smucker Company) | Nexus Capital Management | Producer of beverages and grains |

| Jan-22 | Seven Stars (assets) | South Mill Champs Mushrooms | Provide (IQF) to canning, blanching, blending, and roasting mushrooms and other vegetables |

| Jan-22 | Baldinger Bakery and Sons | C.H. Guenther | Producer of bakery items intended for the foodservice industry The company offers a variety of baked goods such as buns, rolls, cakes, cookies, and bread |

| Jan-22 | Sol Cuisine | PlantPlus Foods Canada | Manufactures frozen and fresh food products |

| Jan-22 | RightRice | Planting Hope | Producer of vegetable rice grain products |

| Jan-22 | Lone Star Cold Storage | Vertical Cold Storage | Cold storage warehousing |

| Dec-21 | Panzani SAS | CVC Capital | Manufacturer of ethnic Italian food for retail and private label channels |

Notable Transactions: AG

| Date | Target | Buyer | Target Description |

|---|---|---|---|

| Pending | Gavilon | Viterra | Distributor of grains, feed ingredients, and fertilizer |

| Pending | Western Milling | Viserion Milling | Manufacturer of nutrients for plants and animals intended for farmers and growers |

| Jun-22 | OPTIfarm | AGCO | UK-based company engaged in precision livestock farming |

| Jun-22 | Little Leaf Farms | The Rise Fund (TPG) | Packaged lettuce sustainably grown through controlled environment agriculture |

| May-22 | Spring Valley | GrubMarket | Producer of fresh fruits and vegetables |

| May-22 | Produce Connection | GrubMarket | Provide fruits and vegetables sourced primarily from Mexico and the US |

| May-22 | Agro Vision | Credit Suisse | Grower, packer, and shipper of fruits and vegetables from farms in Peru intended to serve global markets |

| Apr-22 | Monson Fruit Co. | Tiverton | 3rd largest grower and packer of fresh sweet cherries in the U.S. and leading grower and packer of apples |

| Mar-22 | JK Enterprise Landscape Supply | SiteOne Landscape Supply | Distributor and supplier of compost, topsoils, wood chips, and natural stones |

| Mar-22 | Clearwater Irrigation Supply | Orchard & Vineyard Supply | Agricultural irrigation company which helps growers pumps and filters to field materials |

| Feb-22 | Verdesian Life Sciences | AEA Investors | Develops patented biological, nutritional, fertilizer enhancers, and seed treatments |

| Feb-22 | Geoflow | CAST Environmental | Developer of subsurface drip irrigation systems |

| Jan-22 | Horticultural Rep Group | GrowGeneration | Agency for indoor and greenhouse horticultural companies |

| Jan-22 | True Liberty Bags | Hawthorne Gardening | Provider of liners and storage solutions to dry and cure plant products |

| Jan-22 | Luxx Lighting | Hawthorne Gardening | Designer and manufacturer of cultivation lighting products that facilitate indoor farming |

| Jan-22 | Landmark Irrigation | TriCal Group | Agricultural irrigation systems and related orchard supply services |

| Jan-22 | Mercer Foods | Entrepreneurial Equity | Producer of freeze-dried fruits, vegetables, and other ingredients |

| Jan-22 | Temp Farm Equipment | S3 Enterprises | Provider of farm machinery and equipment |

| Jan-22 | Fairbank Equipment, Inc. | Pfingsten Partners, LLC | Distributor of tools and equipment intended for agricultural, nutrient, equipment and farm dealers |

| Jan-22 | Maury Island Farm | West Coast Copacker | Producer and seller of jams |

| Jan-22 | Koosah Vineyard | Résonance | Operator of a vineyard |

| Jan-22 | Beewise | Insight Partners (Series C) | Developer of autonomous beehives intended to increase yield and reduce colony loss |

| Jan-22 | United Fresh Produce | International Fresh Produce Association | Trade association for farmers, distributors, and retailers |

| Dec-21 | Coastal Farm & Ranch | Nolan Capital | Northwest leading ranch and country lifestyle retailer |

| Dec-21 | Adidana | RDF Group , ROCA Investments | Distributor of chemical fertilizers to the agriculture industry |

| Dec-21 | Coastal Farm & Ranch | Nolan Capital | Provider of gardening, farm, fences, home, outdoor supplies/products |

| Dec-21 | Rotam CropSciences | Albaugh | Manufacturer of agricultural chemicals |

| Dec-21 | Arkansas Farmland | Chess Ag Full Harvest | 2,400 acres of farmland in Arkansas |

| Dec-21 | Orbit Irrigation | Husqvarna Group | Manufacturer of irrigation systems and related products |

| Dec-21 | Hazeldenes | BGH Capital | Owner and operator of a poultry farm |

| Nov-21 | BFG Supply | Pamplona Capital Management | Distributor of horticulture products to professional growers and garden centers |

| Nov-21 | Dole Food Company, Inc. | Total Produce | Producer and marketer of fresh fruit and vegetables |

| Nov-21 | Deerland Probiotics & Enzymes | ADM | Contract manufacturer of probiotic, prebiotic, and enzyme-based ingredients |

| Nov-21 | Insight Sensing | Sentera | Offer remote sensing technology designed for agronomists |

| Oct-21 | Atlantic Blue | Hortifrut | Producer of berries and cherries intended to serve the food industry |

| Oct-21 | Florikan | Profile Products | Manufacturer and distributor of controlled-release fertilizers |

| Oct-21 | Shank’s Extracts | Universal Corporation | Producer of ingredients, extracts, flavors and colors for the food and beverage industry |

Source: Pitchbook and Meridian Research