Food & Agribusiness M&A Trends: Spring 2023

Published May 18, 2023

Key Insights

- Fresh Blueberry Pricing and Volume Predictions to Drive Industry Consolidation

- Crop Inputs M&A YTD in 2023 on Pace with Recent Highs

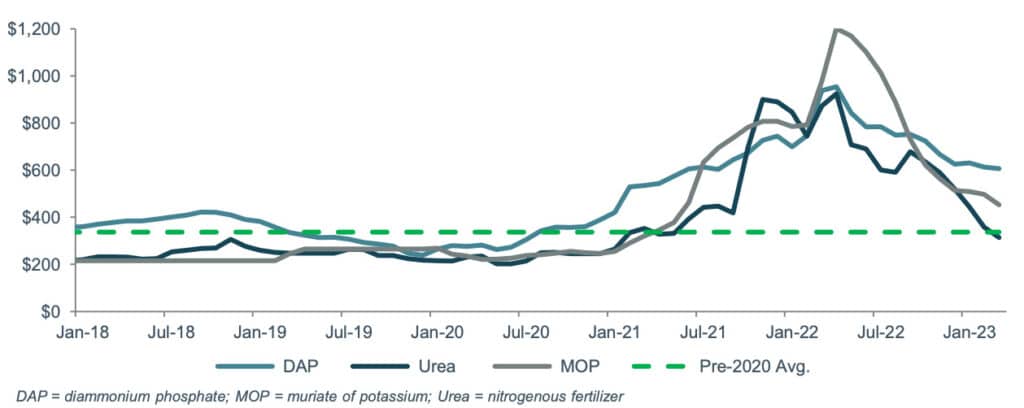

- Fertilizer Prices are Easing After Hitting Historical Highs in 2022

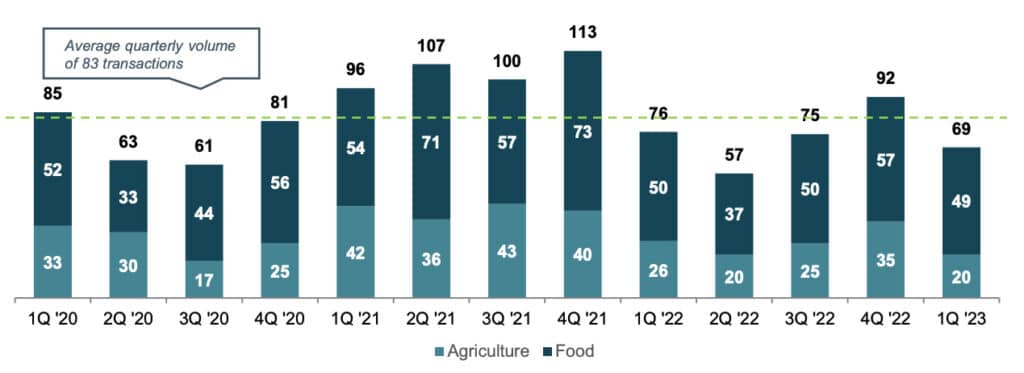

In Q1 2023, M&A volume fell short of historical averages by ~15% as interest rate hikes, elevated inflation, persistent supply chain constraints, and ongoing international conflict have increased transactional hurdles and challenges.

Despite softer YTD 2023 M&A volume, M&A activity this year continues to remain at healthy levels, comparable to the 2018-2020 period. High quality assets are experiencing competitive processes, while more troubled assets are facing significant uncertainty.

Food & Agribusiness Market Insight

Fresh Blueberry Pricing and Volume Predictions to Drive Industry Consolidation

- As we head into the 2023/2024 season, the fresh blueberry market is expected to experience record-high volume, fueled by a significant surge in blueberry production and exports from countries such as Mexico, Peru, Chile, and Argentina.

- The increased supply of blueberries is expected to put downward pressure on prices for fresh, frozen / IQF, and processed blueberries producers over the near/intermediate term.

- Growers and packers that experienced windfalls in 2018-2022 have an imperative to optimize costs, enhance mechanization, and streamline supply chains in the next 12-36 months.

- The reduced blueberry pricing will concurrently cause CPG companies to incrementally demand blueberries as a substitute for comparable products, increasing revenue growth rates for suppliers to CPG businesses.

Crop Inputs M&A YTD in 2023 on Pace with Recent Highs

- Crop inputs continue to be an attractive investment segment for agribusiness investors, and volumes within the segment have maintained a healthy pace.

- The sector’s supply chain fragmentation and consumable nature of products and services, combined with its critical role as a backbone to food production’s productivity, efficiency, and sustainability, are key themes that make it an attractive investment area.

- Many companies servicing this segment benefit from any sort of underlying commodity price volatility. When commodity prices are low, producers are forced to prioritize efficiency, which crop inputs often address. When commodity prices are high, growers have more financial ability to expand production and its related need for crop inputs and services.

- Fertilizer prices are easing after hitting historical highs in 2022 which drove a surge in returns for fertilizer producers. Although prices have normalized, fertilizer producers are seeing sustained profitability due to the aforementioned efficiency benefits and some scarcity issues resulting from US sanctions on Russia and Belarus.

Historical Fertilizer Prices (per metric ton)

Sources: Pitchbook, Mergermarket, Meridian research, USDA, U.S. Highbush Blueberry Council, Natural Agricultural Statistics Service, WorldBank, UN Comtrade, Bloomberg, University of Illinois, AgWeb, Purdue University, Farm Week Now

Food & Agribusiness Middle Market M&A Activity

Food & Agriculture M&A Activity

- In Q1 2023, M&A volume fell short of historical averages by ~15% as interest rate hikes, elevated inflation, persistent supply chain constraints, and ongoing international conflict have increased transactional hurdles and challenges.

- Despite softer YTD 2023 M&A volume, M&A activity this year continues to remain at healthy levels, comparable to the 2018-2020 period. High quality assets are experiencing competitive processes, while more troubled assets are facing significant uncertainty.

Global Agribusiness Investor Conference Recap

In April, Meridian Capital participated in the 2023 Global Agribusiness Investor Conference held in New York, which set a new attendance record this year. The conference drew investors from all over the world who are involved in various aspects of the Agribusiness supply chain and provided a platform for them to discuss the latest trends related to commodities, value-added processing, packing, and distribution of those products.

Notable themes included:

- There is more committed capital from institutional investors to the Agribusiness vertical than ever before, both domestically and globally.

- Deal flow has been light for agribusiness investors in the YTD 2023 period, creating more competitive processes for the high-quality assets that have tested the market.

- Optimism remains for investors in the supply chain. Despite commodity price volatility, those able to differentiate on quality, service, and value-added capabilities yield attractive cash flow investments for investors.

Sources: Company press releases, company websites, Pitchbook, Mergermarket, Meridian research, The Produce News

Featured Food & Agribusiness M&A Transactions

Gelnex Acquired by Darling Ingredients

Apr. 2023

$1.2B

Enterprise Value

16.0x+

EV / EBITDA

Darling Ingredients, a developer and manufacturer of natural food ingredients, acquired Gelnex, a leading producer of gelatin and collagen peptides.

The acquisition expands Darling’s capacity to serve the growing needs of the gelatin market.

AgroFresh Acquired by Paine Schwartz Partners

Apr. 2023

$495M

Enterprise Value

8.1x

EV / EBITDA

Paine Schwartz Partners, a private equity firm focused on sustainable food supply chain investments, acquired AgroFresh, developer of technologies to extend the shelf life and quality of fresh produce.

The sale will create significant opportunity for AgroFresh to pursue additional growth opportunities and expansion initiatives with a more sustainable leverage profile.

Stoller Group Acquired by Corteva Agriscience

Mar. 2023

$1.2B

Enterprise Value

12.0x

EV / EBITDA

Corteva Agriscience, a leading manufacturer of crop protection products including herbicides, fungicides, and insecticides, acquired Stoller Group, a producer of agricultural biostimulant solutions for plant health and resilience.

The acquisition expands and accelerates the size and coverage of Corteva’s biologicals business to one of the largest players in the industry.

Custom Produce Sales Acquired by GrubMarket

Mar. 2023

GrubMarket, a developer of food supply chain technologies, acquired Custom Produce Sales, a wholesale distributor of fresh fruits and vegetables based in California.

The sale will further expand GrubMarket’s presence on the West Coast and add to the Company’s comprehensive product portfolio.

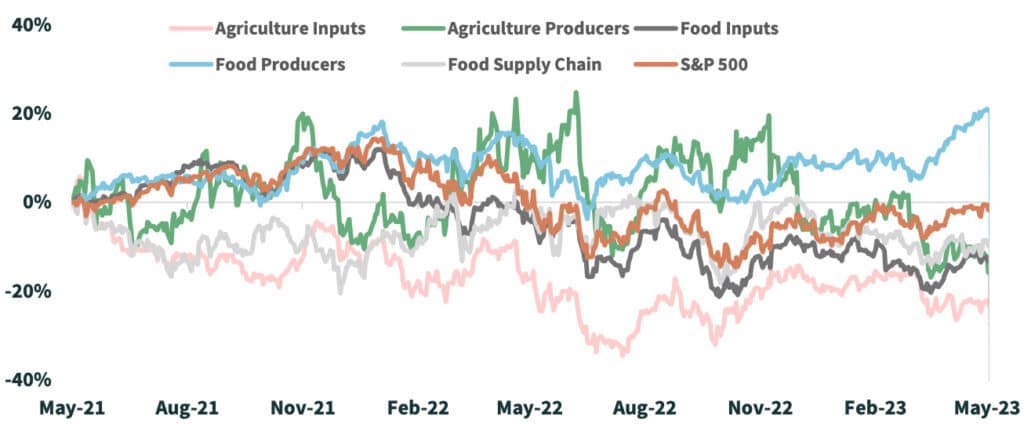

Public Food & Agribusiness Trading Metrics

Stock Index Performance

Agricultural Inputs

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| FMC Corp. (NYS: FMC) | $15,488 | $19,229 | $5,802 | $1,305 | 3.3x | 13.6x | 22% | -6% |

| The Mosaic Co. (NYS: MOS) | $14,476 | $17,688 | $19,125 | $5,714 | 0.9x | 2.9x | 30% | -30% |

| CF Industries Holdings, Inc. (NYS: CF) | $14,100 | $17,164 | $11,186 | $6,216 | 1.7x | 2.6x | 56% | -25% |

| The Toro Company (NYS: TTC) | $10,983 | $11,977 | $4,731 | $752 | 2.5x | 15.9x | 16% | 30% |

| AGCO Corporation (NYS: AGCO) | $9,328 | $10,127 | $12,651 | $1,390 | 0.8x | 7.1x | 11% | -3% |

| SiteOne Landscape Supply, Inc. (NYS: SITE) | $6,655 | $7,366 | $4,015 | $437 | 1.8x | 15.9x | 11% | 4% |

| The Scotts Company LLC (NYS: SMG) | $3,944 | $7,325 | $3,885 | ($371) | 1.9x | 14.7x | -10% | -34% |

| Lindsay Corp. (NYS: LNN) | $1,339 | $1,370 | $747 | $132 | 1.8x | 10.4x | 18% | -10% |

| CVR Partners LP (NYS: UAN) | $969 | $1,518 | $836 | $403 | 1.8x | 3.8x | 48% | -38% |

| Titan Machinery, Inc. (NAS: TITN) | $708 | $1,081 | $2,209 | $164 | 0.5x | 6.6x | 7% | 30% |

| Titan International, Inc. (NYS: TWI) | $621 | $915 | $2,169 | $275 | 0.4x | 3.2x | 13% | -29% |

| Intrepid Potash, Inc. (NYS: IPI) | $343 | $320 | $338 | $131 | 0.9x | 2.3x | 39% | -66% |

| Ceres Global Ag Corp. (TSE: CRP) | $56 | $146 | $1,091 | ($13) | 0.1x | 9.2x | -1% | -55% |

| Median | $3,944 | $7,325 | $3,885 | $403 | 1.7x | 7.1x | 16% | -25% |

| Average | $6,078 | $7,402 | $5,291 | $1,272 | 1.4x | 8.3x | 20% | -18% |

Agricultural Producers

| Company Name | Market Cap | EV | LTM Rev | EV/LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Darling Ingredients Inc. (NYS: DAR) | $9,435 | $12,971 | $6,532 | $1,414 | 2.0x | 8.9x | 22% | -22% |

| Pilgrim’s Pride Corp. (NAS: PPC) | $5,277 | $8,657 | $17,394 | $1,213 | 0.5x | 6.7x | 7% | -24% |

| Cal-Maine Foods, Inc. (NAS: CALM) | $2,292 | $1,645 | $3,051 | $1,060 | 0.5x | 1.6x | 35% | -13% |

| Fresh Del Monte Produce Inc. (NYS: FDP) | $1,374 | $2,164 | $4,442 | $234 | 0.5x | 9.5x | 5% | 12% |

| Adecoagro S.A. (NYS: AGRO) | $913 | $2,065 | $1,348 | $465 | 1.5x | 3.7x | 35% | -26% |

| Mission Produce, Inc. (NAS: AVO) | $828 | $1,052 | $1,043 | $7 | 1.0x | 16.1x | 1% | -8% |

| Farmland Partners Inc (NYS: FPI) | $567 | $1,120 | $61 | $35 | 18.3x | 32.7x | 58% | -28% |

| Calavo Growers, Inc. (NAS: CVGW) | $565 | $645 | $1,143 | $16 | 0.6x | 23.1x | 1% | -11% |

| Limoneira Company (NAS: LMNR) | $305 | $359 | $183 | $45 | 2.0x | 51.5x | 25% | 46% |

| Alico, Inc. (NAS: ALCO) | $180 | $309 | $87 | $21 | 3.5x | 25.7x | 24% | -40% |

| AppHarvest LLC (NAS:APPH) | $74 | $311 | $15 | ($158) | 21.3x | nm | -1081% | -87% |

| Median | $828 | $1,120 | $1,143 | $45 | 1.5x | 12.8x | 22% | -22% |

| Average | $1,982 | $2,845 | $3,209 | $396 | 4.7x | 17.9x | -79% | -18% |

Food Inputs

| Company Name | Market Cap | EV | LTM Rev | EV/LTM EBITDA | EV/LTM EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Archer Daniels Midland Co (NYS: ADM) | $42,373 | $53,361 | $101,978 | $6,504 | 0.5x | 8.2x | 6% | -13% |

| International Flavors & Fragrances (NYS: IFF) | $24,670 | $35,897 | $12,440 | ($110) | 2.9x | 14.7x | -1% | -20% |

| McCormick & Company, Inc. (NYS: MKC) | $23,712 | $28,579 | $6,394 | $1,147 | 4.5x | 24.4x | 18% | -10% |

| Kerry Group plc (DUB: KRZ) | $18,607 | $21,004 | $9,223 | $1,125 | 2.3x | 17.4x | 12% | -5% |

| Symrise AG (ETR: SY1) | $16,843 | $19,301 | $4,856 | $812 | 4.0x | 20.9x | 17% | 2% |

| Darling Ingredients Inc. (NYS: DAR) | $9,435 | $12,971 | $6,532 | $1,414 | 2.0x | 8.9x | 22% | -22% |

| IMCD N.V. (AMS: IMCD) | $8,531 | $9,069 | $4,838 | $602 | 1.9x | 14.5x | 12% | 0% |

| The Middleby Corporation (NAS: MIDD) | $7,674 | $10,259 | $4,033 | $791 | 2.5x | 13.3x | 20% | -8% |

| Ingredion Inc. (NYS: INGR) | $7,015 | $9,520 | $7,946 | $982 | 1.2x | 9.5x | 12% | 24% |

| Olam International Limited (SES:VC2) | $4,598 | $13,368 | $39,812 | $1,582 | 0.3x | 8.2x | 4% | -2% |

| Balchem Corp (NAS: BCPC) | $4,222 | $4,612 | $946 | $194 | 4.9x | 22.7x | 21% | 7% |

| Glanbia PLC (DUB: GL9) | $4,088 | $4,712 | $5,932 | $405 | 0.8x | 9.5x | 7% | 27% |

| Sensient Technologies Corporation (NYS: SXT) | $3,200 | $3,881 | $1,437 | $249 | 2.7x | 15.7x | 17% | -11% |

| MGP Ingredients Inc (NAS: MGPI) | $2,145 | $2,341 | $782 | $167 | 3.0x | 14.0x | 21% | 7% |

| Median | $8,102 | $11,615 | $6,163 | $802 | 2.4x | 14.3x | 15% | -3% |

| Average | $12,651 | $16,348 | $14,796 | $1,133 | 2.4x | 14.4x | 13% | -2% |

Food Producers

| Company Name | Market Cap | EV | LTM Rev | EV/LTM EBITDA | EV/LTM EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Nestlé S.A. (SWX: NESN) | $341,344 | $393,585 | $99,264 | $16,617 | 4.0x | 19.2x | 17% | -1% |

| The Hershey Company (NYS: HSY) | $56,486 | $61,050 | $10,741 | $2,527 | 5.7x | 22.5x | 24% | 27% |

| General Mills Inc. (NYS: GIS) | $52,492 | $63,710 | $19,955 | $4,276 | 3.2x | 15.5x | 21% | 29% |

| Kraft Heinz Foods Co (NAS: KHC) | $48,785 | $68,007 | $26,485 | $4,793 | 2.6x | 11.2x | 18% | -5% |

| Kellogg’s Co. (NYS: K) | $24,257 | $31,563 | $15,315 | $1,860 | 2.1x | 12.4x | 12% | 5% |

| Hormel Foods Corporation (NYS: HRL) | $22,206 | $24,895 | $12,385 | $1,552 | 2.0x | 16.0x | 13% | -22% |

| Associated British Foods Plc (LON: ABF) | $19,124 | $22,382 | $22,636 | $2,482 | 1.0x | 7.9x | 11% | 22% |

| Conagra Brands, Inc. (NYS: CAG) | $18,227 | $27,484 | $12,214 | $1,636 | 2.3x | 11.8x | 13% | 12% |

| The J.M.Smucker Co., LLC (NYS: SJM) | $16,746 | $21,046 | $8,328 | $1,537 | 2.5x | 13.3x | 18% | 16% |

| Campbell Soup Company (NYS: CPB) | $16,360 | $20,774 | $9,177 | $1,597 | 2.3x | 11.9x | 17% | 16% |

| Lamb Weston Holdings, Inc. (NYS: LW) | $16,347 | $18,917 | $4,809 | $1,030 | 3.9x | 17.0x | 21% | 70% |

| Post Holdings, Inc. (NYS: POST) | $5,390 | $10,991 | $6,080 | $1,730 | 1.8x | 11.4x | 28% | 25% |

| Simply Good Foods USA Inc (NAS: SMPL) | $3,663 | $4,011 | $1,188 | $219 | 3.4x | 15.9x | 18% | -9% |

| TreeHouse Foods, Inc. (NYS: THS) | $3,035 | $4,584 | $3,454 | $190 | 1.3x | 17.0x | 6% | 73% |

| Sovos Brands Intermediate (NAS: SOVO) | $1,757 | $2,118 | $878 | $1 | 2.4x | 17.7x | 0% | 14% |

| The Hain Celestial Group, Inc. (NAS: HAIN) | $1,607 | $2,534 | $1,854 | $144 | 1.4x | 15.1x | 8% | -46% |

| B&G Foods, Inc. (NYS: BGS) | $1,178 | $3,591 | $2,163 | $203 | 1.7x | 11.2x | 9% | -36% |

| Median | $16,746 | $21,046 | $9,177 | $1,597 | 2.3x | 15.1x | 17% | 14% |

| Average | $38,177 | $45,956 | $15,113 | $2,494 | 2.6x | 14.5x | 15% | 11% |

Food Supply Chain

| Company Name | Market Cap | EV | LTM Rev | EV/LTM EBITDA | EV/LTM EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| ($US in millions) | Market | EV | LTM | EV/LTM | LTM Margin | 52-Week | ||

| Company Name | Cap | Rev | EBITDA | Rev | EBITDA | EBITDA | Change | |

| Sysco Corporation (NYS: SYY) | $38,994 | $50,317 | $73,580 | $3,193 | 0.7x | 13.3x | 4% | -10% |

| Performance Food Group, Inc. (NYS: PFGC) | $9,685 | $14,517 | $56,287 | $1,068 | 0.3x | 11.5x | 2% | 23% |

| Aramark Corp. (NYS: ARMK) | $9,087 | $17,319 | $16,979 | $1,212 | 1.0x | 13.5x | 7% | -4% |

| US Foods, Inc. (NYS: USFD) | $8,858 | $14,492 | $34,057 | $988 | 0.4x | 11.3x | 3% | 0% |

| AmeriCold Logistics LLC (NYS: COLD) | $7,825 | $11,369 | $2,915 | $410 | 3.9x | 24.5x | 14% | 12% |

| United Natural Foods, Inc. (NYS: UNFI) | $1,609 | $4,946 | $29,863 | $679 | 0.2x | 6.2x | 2% | -37% |

| The Chefs’ Warehouse, Inc (NAS: CHEF) | $1,285 | $1,963 | $2,613 | $124 | 0.8x | 12.0x | 5% | -13% |

| SpartanNash Company (NAS: SPTN) | $863 | $1,622 | $9,643 | $164 | 0.2x | 7.0x | 2% | -26% |

| HF Foods Group Inc (NAS: HFFG) | $208 | $419 | $1,170 | $32 | 0.4x | 12.7x | 3% | -32% |

| Amcon Distributing Co (ASE: DIT) | $115 | $261 | $2,347 | $32 | 0.1x | 9.0x | 1% | 13% |

| Median | $4,717 | $8,157 | $13,311 | $544 | 0.4x | 11.8x | 3% | -7% |

| Average | $7,853 | $11,722 | $22,946 | $790 | 0.8x | 12.1x | 4% | -7% |

Select Food & Agribusiness M&A Transactions

| Date | Target | Buyer | Target Description |

|---|---|---|---|

| Pending | Dole (Fresh Vegetables Division) | Chiquita Fresh Express | Processor of lettuce, broccoli, onions, cabbage and other fresh produce. |

| Pending | Berry People | AgriFORCE (NAS: AGRI) | Grower and distributor of berries. |

| Pending | MightyVine | Plant-Ag | Hydroponic grower of tomatoes. |

| May-23 | Mr. Greens (Shoreline Equity Partners) | Sterling Investment Partners | Value-added distributor of produce, dairy, and dry goods. |

| May-23 | Testa Produce | FreshEdge (Wind Point Partners) | Distributor of produce and specialty foods. |

| May-23 | Hardie’s Fresh Foods | The Chefs’ Warehouse (NAS: CHEF) | Provider of fresh produce for the foodservice industry. |

| May-23 | Macspred | Syngenta | Manufacturer and distributor of herbicide solutions. |

| May-23 | Above Food | Bite Acquisiton Corp (NYSE: BITE) | Supplier of grains, legumes, and branded plant-based foods. |

| Apr-23 | FE Ingredients | Fulcrum Capital Partners | Distributor of baking supplies and food ingredients. |

| Apr-23 | Greentastic (Magnum Capital) | Solum Partners | Producer of fruit and vegetables. |

| Apr-23 | Hosh International | Brothers International Food (Benford Capital Partners) | Supplier of fruit and vegetable juice concentrates and purees. |

| Apr-23 | Mighty Grow | Grow Generation (NAS: GRWG) | Distributor of gardening supplies. |

| Apr-23 | Solevo (Helios Partners, Temasek) | DEG, Development Partners, FMO | Distributor of inputs for the agricultural and food sectors. |

| Apr-23 | Community Garden & Greenhouse | Grow Generation (NAS: GRWG) | Provider of hydroponic and garden supplies. |

| Apr-23 | Gelnex | Darling Ingredients (NYSE: DAR) | Producer of gelatin and collagen peptides. |

| Apr-23 | Interagro | Nichino Europe Co. | Manufacturer of adjuvants and biostimulants for the agricultural sector. |

| Apr-23 | Tarter Farm and Ranch Equipment | Platinum Equity | Manufacturer of ranch and farm equipment for the husbandry sector. |

| Apr-23 | AgroFresh (NAS: AGFS) | Paine Schwartz Partners | Developer of post-harvest products, equipment, and technology to improve supply chain freshness. |

| Mar-23 | Stoller Group | Corteva Agriscience (NYS: CTVA) | Producer of agricultural biostimulant solutions. |

| Mar-23 | Custom Produce Sales | GrubMarket | Grower and packer of melons, grapes, tree fruit, and berries. |

| Feb-23 | Cosmocel | Rovensa (Partners Group, Bridgepoint Advisers) | Manufacturer and distributor of biostimulants, fungicides, and fertigation solutions. |

| Feb-23 | Milk Specialties Global | Butterfly Equity | Ingredient manufacturer focused on processing raw dairy inputs. |

| Jan-23 | Limoneira Company | PGIM Agricultural Investments | Select lemon orchard assets. |

| Jan-23 | Worldwide Produce | Ridgemont Equity Partners | Distributor of fresh produce, dairy, and specialty foods. |

| Jan-23 | Frieda’s | Legacy Farms (Silver Oak Services Partners) | Distributor and retailer of specialty produce. |

| Jan-23 | FBSciences | Valent BioSciences | Producer of agricultural biostimulant products. |

| Jan-23 | Great Lakes Foods | SpartanNash (NAS: SPTN) | Supplier of groceries, meat, dairy, and bakery products. |

| Jan-23 | DeTemporada Farms | Pure Flavor | Producer of green bell peppers in Ontario. |

| Jan-23 | Stadelman Fruit Company (Apple Division) | Sixth Street Partners | Grower, packer, and shipper of high-quality tree fruit. |

| Jan-23 | Bandwagon Brokerage | Wholesale Produce Supply (Cross Rapids Capital) | Producer and supplier of specialty produce. |

| Jan-23 | W.A. Imports | Forever Cheese | Importer and manufacturer of premium Japanese food products and ingredients. |

| Jan-23 | New Fruit Group | Organto Foods (TSX: OGO) | Vertically-integrated grower of bananas, avocados, and mangos. |

| Dec-22 | Fresh Origins | Sun Capital Partners | Grower of microgreens and edible flowers. |

| Dec-22 | Perricone Juices | Trivest Partners | Producer of premium craft juices. |

| Dec-22 | Titan Frozen Fruit | Vestar Capital Partners | Processor of frozen berries and food ingredients. |

| Dec-22 | Fresh Innovations | Peterson Farms (Mubadala Capital) | Supplier of organic and conventional fresh-cut apple slices to schools. |

| Dec-22 | Southwest Spice | Gulf Pacific (Eos Partners) | Value-added packager and processor of dry edible beans and spice blends. |

| Dec-22 | Liberty Fruit | Russ Davis Wholesale | Wholesale produce distributor and processing facility. |

| Nov-22 | Seviroli Foods | Mill Point Capital | Manufacturer of frozen pasta and other food products. |

| Nov-22 | St. Louis Hydroponic Company | Grow Generation (NAS: GRWG) | Distributor of hydroponic gardening equipment and supplies. |

| Nov-22 | Devansoy | Akoya Capital | Manufacturer of soy, oat, and pea protein ingredients. |

| Oct-22 | Safra Rica | Nutrien (TSE: NTR) | Manufacturer and distributor of fertilizer products. |

| Oct-22 | Monterey Mushrooms | Paine Schwartz Partners | Producer of mushrooms for grocery stores and restaurants. |

| Oct-22 | Rainfield Ranches | GrubMarket | Grower of green onions, broccoli, cilantro, and other produce. |

| Oct-22 | FreshEdge | Wind Point Partners | Distributor of fresh produce and specialty foods. |

| Oct-22 | Columbia Fruit Packers, Frosty Packing | Goldman Sachs Asset Management | Grower and packer of apples and cherries. |

Sources: Company press releases, company websites, Pitchbook, Mergermarket, Meridian research