Food & Agribusiness M&A Trends: Spring 2022

Published March 11, 2022

KEY INSIGHTS

- Rising inflation in food & agribusiness

- Fresh fruits are forecasted to grow at a 5.5% CAGR from 2022 to 2026 due to consumer health mindfulness, eating pattern intervals, and the short-term inflationary environment

- Fertilizer, a major food cost input, driving growing costs up

- Crop rotations towards less fertilizer intensive plantings are likely to impact food commodity prices in 2022

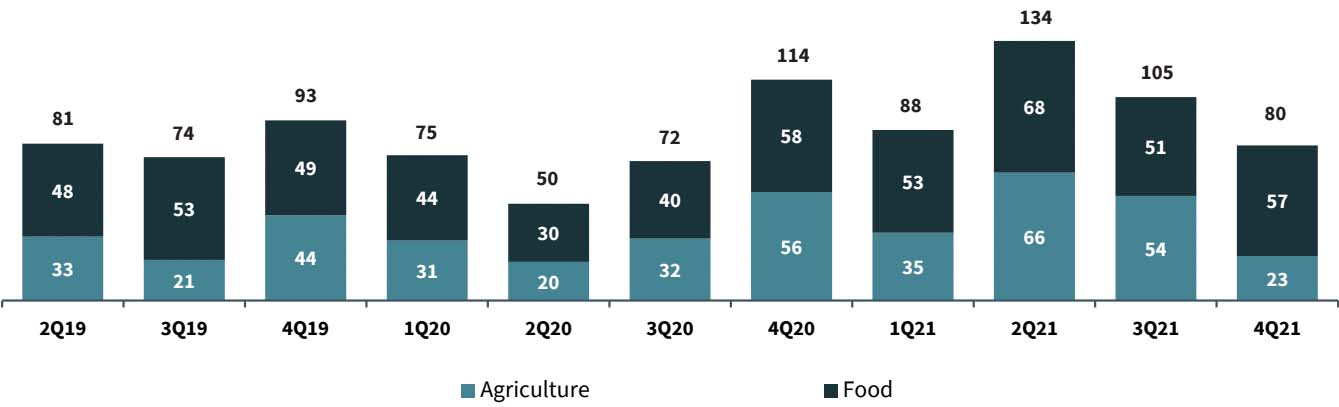

Notable M&A Activity: 2021 M&A activity remained high due to a strong surge in strategic and financial buyers. 2022 is expected to continue to be a strong M&A year for food agribusiness companies. Buyers and investors are targeting more control over their supply chain and supporting the necessary investments in scale and technology that will allow the industry to scale at a lower per unit cost. Investors are also looking to acquisitions to secure water and land rights for new and existing operations as water restrictions continue to increase in the Western United States.

Food and Ag Market Insights

Rising Inflation in Food & Agribusiness

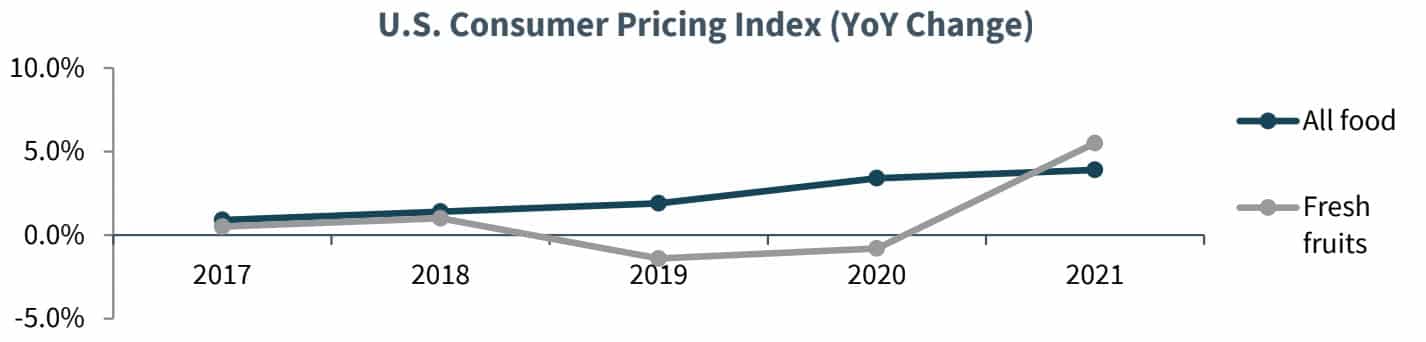

- The Consumer Price Index (CPI) recorded a 3.9% YoY increase in all food prices in 2021 marking the highest single year increase since 2008. Catalysts include strong domestic and international demand, labor shortages, supply chain disruptions, and high feed and other input costs.

- Fresh fruit prices outgrew the broader food category recording a 5.5% YoY increase marking the highest single year increase since 2000. Drivers for growth include rising growing costs, healthier eating patterns, and more stringent shopping habits due to higher inflation.

- Fresh fruits are forecasted to grow at a 5.5% CAGR from 2022 to 2026 due to consumer health mindfulness, eating pattern intervals, and the short-term inflationary environment.

Fertilizer, A Major Food Cost Input, Driving Growing Costs Up

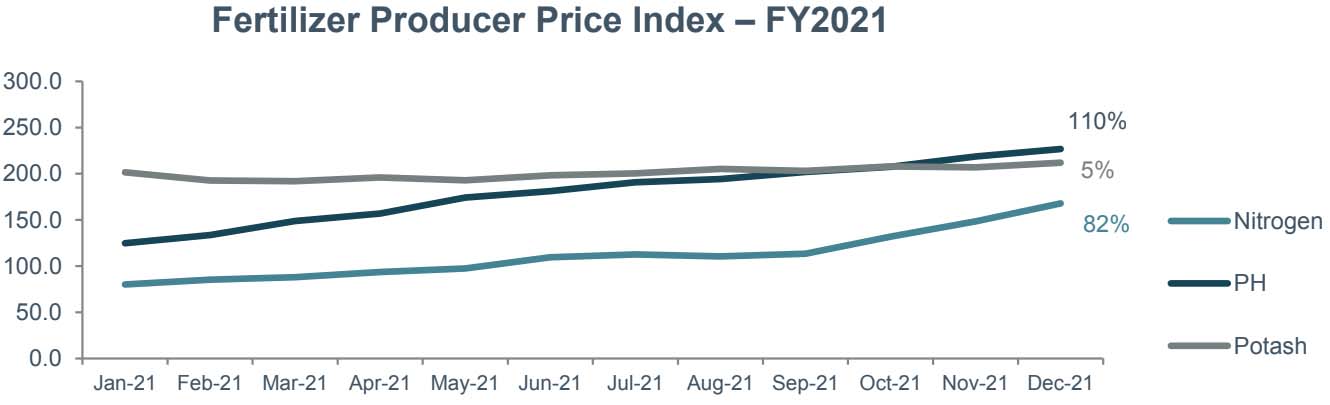

- Comprising ~15% of total cash costs in the U.S., growers and distributors are looking for creative ways to manage their fertilizer costs, including minimizing waste, securing key suppliers, and increasing use of automation for fertilizer application. Autonomous sprayer pre-orders have increased to near record levels.

- Compounding factors including increased competition for natural gas, global supply chain delays, and growing international demand have driven all three major fertilizer components to multi-year highs.

- Crop rotations towards less fertilizer intensive plantings are likely to impact food commodity prices in 2022 and will require crop input service providers and distributors to adapt to plant nutrition needs.

Source: Pitchbook, and Meridian Research, Federal Reserve Bank of St. Louis

Food and Ag Market Activity

Notable M&A Activity

- 2021 M&A activity remained high due to a strong surge in strategic and financial buyers. 2022 is expected to continue to be a strong M&A year for food & agribusiness companies.

- Buyers and investors are targeting more control over their supply chain and supporting the necessary investments in scale and technology that will allow the industry to scale at a lower per unit cost.

- Investors are also looking to acquisitions to secure water and land rights for new and existing operations as water restrictions continue to increase in the Western United States.

Recent Transaction Spotlights

Description: A Canadian family-owned business that supplies high volume, high quality, raw and cooked meat & seafood, to the foodservice, restaurant and retail channels.

Rationale: The acquisition will diversify and expand Gordon Food Service’s customer offerings through new food categories and new retailers.

Description: Coastal Farm & Ranch is the largest independent Pacific Northwest based farm and ranch retailer, serving a growing population of farm and ranch operators.

Rationale: Nolan Capital seeks to grow Coastal to be one of the leading retail brands in the West and leverage the expertise of Coastal’s current CEO.

Description: Monte Vista specializes in the growing, packaging, and marketing of California-grown almonds that are packed in recycled packaging, thereby offering sustainably grown and processed almonds.

Rationale: The transaction will provide capital for Monte Vista to focus on future expansion and investment in the almond industry and strengthen its balance sheet.

Source: Pitchbook, and Meridian Research

Landmark Irrigation Joins TriCal Group

Meridian Capital LLC (“Meridian”), a Seattle-based leading middle market investment bank and M&A advisory firm is pleased to announce the successful acquisition of its client, Landmark Irrigation (“Landmark” or “Company”), a portfolio company of Prospect Partners (“Prospect”), by TriCal Soil Solutions, Inc. (“TriCal”), a member of the TriCal Group.

Founded in 1990, Landmark is a leading, full-service provider of custom agricultural irrigation systems and related orchard supply services in the Western United States. Through its 7 growing retail locations in California and Arizona, Landmark upholds its renowned reputation through its commitment to delivering high quality products and services while exceeding client expectations for irrigation system performance.

The Company’s key offerings include designed custom piping, sprinklers, pumps, filters, related orchard supply products and a private label AgTech platform.

Russ Spain, CEO and co-owner of Landmark, shared, “The TriCal [Group] platform is exciting to be a part of and will provide a lot of opportunities for our employees to grow with the Company.”

Gene Blocher, President and co-owner of Landmark, added, “Teaming up with [the] TriCal [Group] is certainly a positive for Landmark in providing an even better level of service for our customers.”

Russ and Gene further commented, “Meridian’s leadership through this transaction was so helpful, their whole team was outstanding to work with. Meridian really made it easy for us to work through this process and we appreciate all of their efforts.”

Russ and Gene and the entire Landmark team will continue to lead and operate Landmark as part of the TriCal Portfolio of Companies.

The TriCal Group is a privately held family of companies with a global presence as a leading provider of fertigation, fumigation, and soil & plant management services. As one of the first to mechanize soil fumigation, the TriCal Group has established a trusted network of companies across the Americas, Western Europe, Australia, New Zealand, Africa, and developments in Japan, China, and Southeast Asia.

Publicly-Traded Food and Agribusiness Companies

Agriculture Inputs

| Company Name | Market Cap | Net Debt | EV | Revenue | Adj. EBITDA | EBITDA % | EV/ Rev | EV / EBITDA |

|---|---|---|---|---|---|---|---|---|

| The Mosaic Co. | $22,036 | $3,636 | $25,816 | $12,357 | $3,542 | 28.7% | 2.09x | 7.29x |

| CF Industries Holdings, Inc. | 18,917 | 2,088 | 23,835 | 6,538 | 3,180 | 48.6% | 3.65x | 7.50x |

| FMC Corporation | 15,245 | 3,330 | 18,594 | 5,045 | 1,324 | 26.2% | 3.69x | 14.04x |

| The Toro Company | 9,437 | 980 | 10,417 | 4,019 | 586 | 14.6% | 2.59x | 17.77x |

| AGCO Corporation | 9,678 | 737 | 10,443 | 11,138 | 1,248 | 11.2% | 0.94x | 8.37x |

| The Scotts Company LLC | 7,681 | 3,227 | 10,908 | 4,742 | 701 | 14.8% | 2.30x | 15.57x |

| SiteOne Landscape Supply, Inc. | 7,488 | 553 | 8,042 | 3,476 | 416 | 12.0% | 2.31x | 19.34x |

| Lindsay Corporation | 1,507 | 22 | 1,529 | 625 | 84 | 13.4% | 2.44x | 18.18x |

| CVR Partners LP | 1,177 | 501 | 1,678 | 533 | 222 | 41.7% | 3.15x | 7.55x |

| Titan Machinery, Inc. | 639 | 229 | 869 | 1,641 | 92 | 5.6% | 0.53x | 9.42x |

| Titan International, Inc. | 770 | 404 | 1,172 | 1,780 | 135 | 7.6% | 0.66x | 8.70x |

| Intrepid Potash, Inc. | 949 | (24) | 924 | 247 | 51 | 20.5% | 3.74x | 18.25x |

| Ceres Global Ag Corp. | $128 | 117 | 244 | 914 | 32 | 3.5% | 0.27x | 7.71x |

| AgroFresh Solutions, Inc. | $101 | 221 | 477 | 162 | 50 | 30.8% | 2.95x | 9.58x |

| Mean | $6,839 | $8,210 | 19.9% | 2.24x | 12.09x | |||

| Median | $4,498 | $4,860 | 14.7% | 2.38x | 9.50x |

Agriculture Producers

| Company Name | Market Cap | Net Debt | EV | Revenue | Adj. EBITDA | EBITDA % | EV/ Rev | EV / EBITDA |

|---|---|---|---|---|---|---|---|---|

| Darling Ingredients Inc. | $12,210 | $1,553 | $13,830 | $4,741 | $1,202 | 25.3% | 2.92x | 11.51x |

| Pilgrim’s Pride Corp. | 5,514 | 3,144 | 8,670 | 14,777 | 1,315 | 8.9% | 0.59x | 6.60x |

| Sanderson Farms, Inc. | 4,007 | (662) | 3,346 | 5,218 | 1,086 | 20.8% | 0.64x | 3.08x |

| Cal-Maine Foods, Inc. | 2,202 | (83) | 2,119 | 1,431 | 30 | 2.1% | 1.48x | NM |

| Fresh Del Monte Produce Inc. | 1,266 | 686 | 2,023 | 4,252 | 199 | 4.7% | 0.48x | 10.16x |

| Mission Produce, Inc. | 937 | 129 | 1,066 | 892 | 91 | 10.3% | 1.20x | 11.66x |

| Adecoagro S.A. | 1,183 | 956 | 2,176 | 1,033 | 534 | 51.7% | 2.11x | 4.07x |

| Calavo Growers, Inc. | 770 | 107 | 878 | 1,056 | 24 | 2.3% | 0.83x | NM |

| Farmland Partners Inc | 572 | 481 | 1,188 | 52 | 33 | 63.4% | NM | NM |

| Limoneira Company | 264 | 133 | 420 | 166 | 7 | 4.1% | 2.53x | NM |

| Alico, Inc. | 252 | 134 | 391 | 110 | 27 | 24.6% | 3.55x | 14.42x |

| Mean | $2,653 | $3,282 | 19.8% | 1.63x | 8.79x | |||

| Median | $1,183 | $2,023 | 10.3% | 1.34x | 10.16x |

Food Inputs

| Company Name | Market Cap | Net Debt | EV | Revenue | Adj. EBITDA | EBITDA % | EV/ Rev | EV / EBITDA |

|---|---|---|---|---|---|---|---|---|

| Archer Daniels Midland Company | $46,547 | $9,638 | $56,475 | $85,249 | $4,792 | 5.6% | 0.66x | 11.79x |

| International Flavors & Fragrances Inc | 31,454 | 11,473 | 43,067 | 11,656 | 2,454 | 21.1% | 3.69x | 17.55x |

| McCormick & Company, Inc. | 27,681 | 5,037 | 32,733 | 6,318 | 1,282 | 20.3% | 5.18x | 25.52x |

| Kerry Group plc | 19,458 | 2,312 | 21,770 | 7,926 | 1,136 | 14.3% | 2.75x | 19.16x |

| Symrise AG | 16,520 | 1,741 | 18,333 | 4,300 | 911 | 21.2% | 4.26x | 20.13x |

| The Middleby Corporation | 9,336 | 2,257 | 11,593 | 3,251 | 679 | 20.9% | 3.57x | 17.08x |

| Darling Ingredients Inc. | 12,210 | 1,553 | 13,830 | 4,741 | 1,202 | 25.3% | 2.92x | 11.51x |

| IMCD N.V. | 8,653 | 262 | 8,917 | 4,061 | 478 | 11.8% | 2.20x | 18.65x |

| Ingredion Inc. | 5,686 | 1,915 | 7,690 | 6,894 | 889 | 12.9% | 1.12x | 8.65x |

| Balchem Corp | 4,534 | 15 | 4,549 | 799 | 179 | 22.4% | 5.69x | 25.41x |

| Olam International Limited | 4,985 | 8,551 | 13,567 | 30,861 | 1,444 | 4.7% | 0.44x | 9.40x |

| Glanbia plc | 3,394 | 787 | 4,190 | 4,802 | 497 | 10.4% | 0.87x | 8.42x |

| Sensient Technologies Corporation | 3,333 | 486 | 3,818 | 1,380 | 232 | 16.8% | 2.77x | 16.43x |

| MGP Ingredients, Inc. | 1,764 | 222 | 1,986 | 627 | 133 | 21.2% | 3.17x | 14.93x |

| Mean | $13,968 | $17,323 | 16.3% | 2.81x | 16.05x | |||

| Median | $8,994 | $12,580 | 18.6% | 2.84x | 16.75x |

Food Producers

| Company Name | Market Cap | Net Debt | EV | Revenue | Adj. EBITDA | EBITDA % | EV/ Rev | EV / EBITDA |

|---|---|---|---|---|---|---|---|---|

| Nestlé S.A. | $348,433 | $35,641 | $384,715 | $95,675 | $22,173 | 23.2% | 4.02x | 17.35x |

| The Kraft Heinz Company | 48,754 | 18,370 | 67,278 | 26,042 | 7,320 | 28.1% | 2.58x | 9.19x |

| General Mills Inc. | 41,090 | 11,651 | 53,584 | 18,608 | 3,813 | 20.5% | 2.88x | 14.05x |

| The Hershey Company | 43,680 | 5,047 | 48,726 | 8,971 | 2,250 | 25.1% | 5.43x | 21.66x |

| Hormel Foods Corporation | 28,067 | 2,689 | 30,762 | 11,386 | 1,391 | 12.2% | 2.70x | 22.11x |

| Kellogg’s Co. | 22,046 | 7,443 | 29,984 | 14,181 | 2,511 | 17.7% | 2.11x | 11.94x |

| Associated British Foods Plc | 18,056 | 1,898 | 20,068 | 18,892 | 2,357 | 12.5% | 1.06x | 8.52x |

| Conagra Brands, Inc. | 16,502 | 9,316 | 25,895 | 11,223 | 2,096 | 18.7% | 2.31x | 12.35x |

| The J.M.Smucker Co., LLC | 14,510 | 4,243 | 18,753 | 7,885 | 1,626 | 20.6% | 2.38x | 11.54x |

| Campbell Soup Company | 13,744 | 4,978 | 18,724 | 8,372 | 1,656 | 19.8% | 2.24x | 11.31x |

| Lamb Weston Holdings, Inc. | 8,425 | 2,129 | 10,553 | 3,894 | 567 | 14.6% | 2.71x | 18.61x |

| Post Holdings, Inc. | 6,401 | 6,307 | 13,018 | 6,412 | 1,023 | 15.9% | 2.03x | 12.73x |

| Simply Good Foods | 3,925 | 392 | 4,317 | 1,056 | 243 | 23.0% | 4.09x | 17.77x |

| The Hain Celestial Group, Inc. | 3,140 | 746 | 3,886 | 1,875 | 241 | 12.8% | 2.07x | 16.14x |

| TreeHouse Foods, Inc. | 2,014 | 1,780 | 3,793 | 4,328 | 389 | 9.0% | 0.88x | 9.75x |

| B&G Foods, Inc. | 2,004 | 2,302 | 4,306 | 2,056 | 367 | 17.9% | 2.09x | 11.73x |

| Sovos Brands Intermediate, Inc. | 1,182 | 753 | 1,935 | 692 | 113 | 16.3% | 2.80x | 17.16x |

| Mean | $36,587 | $43,547 | 18.1% | 2.61x | 14.35x | |||

| Median | $14,510 | $18,753 | 17.9% | 2.38x | 12.73x |

Food Supply Chain

| Company Name | Market Cap | Net Debt | EV | Revenue | Adj. EBITDA | EBITDA % | EV/ Rev | EV / EBITDA |

|---|---|---|---|---|---|---|---|---|

| Sysco Corporation | $43,113 | $10,469 | $53,614 | $60,738 | $3,354 | 5.5% | 0.88x | 15.98x |

| Aramark Corp. | 9,240 | 7,990 | 17,238 | 13,300 | 921 | 6.9% | 1.30x | 18.72x |

| US Foods, Inc. | 8,125 | 5,326 | 13,985 | 29,487 | 1,057 | 3.6% | 0.47x | 13.23x |

| AmeriCold Logistics LLC | 7,510 | 3,338 | 10,856 | 2,715 | 448 | 16.5% | 4.00x | 24.21x |

| Performance Food Group, Inc. | 8,033 | 4,947 | 12,980 | 39,732 | 714 | 1.8% | 0.33x | 18.18x |

| United Natural Foods, Inc. | 2,459 | 3,613 | 6,070 | 27,274 | 803 | 2.9% | 0.22x | 7.55x |

| The Chefs’ Warehouse, Inc | 1,203 | 427 | 1,630 | 1,746 | 21 | 1.2% | 0.93x | NM |

| SpartanNash Company | 1,185 | 710 | 1,895 | 8,931 | 188 | 2.1% | 0.21x | 10.06x |

| HF Foods Group Inc | 321 | 133 | 457 | 715 | 47 | 6.6% | 0.64x | 9.70x |

| AMCON Distributing Co. | 102 | 70 | 173 | 1,690 | 21 | 1.2% | 0.10x | 8.32x |

| Mean | $8,129 | $15,100 | 7.0% | 1.17x | 13.91x | |||

| Median | $4,984 | $11,918 | 4.6% | 0.76x | 13.23x |

Notable Transactions: Food

| Date | Target | Buyer | Target Description |

|---|---|---|---|

| Pending | Macgregors Meat & Seafood | Gordon Food Service | Manufacturer of cooked and prepared foods |

| Pending | Sanderson Farms | Cargill | Produces fresh, frozen, and prepared chicken products |

| Feb-22 | Larry’s All Natural | WP Strategic Holdings | Producer of Mexican cooking sauces and salsas |

| Feb-22 | Florida Food Service | Ben E.Keith Foods | Provider of ingredients in Gainsville, Florida |

| Feb-22 | Hutt Trucking Co | RLS Logistics | Cold storage warehousing and trucking services |

| Feb-22 | Catalina Finer Foods | Midwest Growth Partners | Producer of food products focused on Cuban and Caribbean cuisine |

| Jan-22 | Seven Stars (assets) | South Mill Champs Mushrooms | Provide (IQF) to canning, blanching, blending, and roasting mushrooms and other vegetables |

| Jan-22 | Sol Cuisine | PlantPlus Foods Canada | Manufactures frozen and fresh food products |

| Jan-22 | Mercer Foods | Entrepreneurial Equity | Contract manufacturer of fruits and vegetables |

| Jan-22 | Lone Star Cold Storage | Vertical Cold Storage | Cold storage warehousing |

| Dec-21 | Panzani SAS | CVC Capital | Manufacturer of ethnic Italian food for retail and private label channels |

| Dec-21 | T & L Creative Salads | MamaMancini’s Holdings | Manufacturer and supplier of prepared sandwich wraps, burritos, and salads |

| Dec-21 | George Weston (Bakery Business) | Hearthside Food Solutions | Contract manufacturing for bars, fresh and frozen entrees, and food packaging |

| Dec-21 | Giraffe Foods | Symrise AG | Private label manufacturer of sauces, marinades, dressings, and dips |

| Dec-21 | Flavor Infusion International | ADM | A full-range provider of flavor and specialty ingredient solutions for customers |

| Dec-21 | RW Garcia | Utz Brands | Manufacturer of tortilla chips and crackers |

| Dec-21 | Conagra Brands (Dickson Manufacturing Operations) | Monogram Food Solutions | Manufacturer of private label food products |

| Nov-21 | Pancho’s Mexican Foods | Sabrosura Foods | Manufacturer of Mexican-style queso dips |

| Nov-21 | Carrix | Blackstone | Offers warehousing, cold storage, and transportation services |

| Nov-21 | Frigoservice | International Cold Logistics Group | Cold storage for frozen foods |

| Nov-21 | Maid-Rite Specialty Foods | Premium Brands | Manufacturer of frozen and prepared food products |

| Nov-21 | Kantaro | Lineage Logistics Holdings | Provider of cold storage warehousing |

| Nov-21 | Perishable Shipping Solutions | Lineage Logistics Holdings | Offers cold storage, fulfillment services and shipping |

| Oct-21 | Norish (Cold Storage Division) | Nichirei | Operator of a cold storage division |

| Oct-21 | Weston Foods Fresh and Frozen Businesses | FGF Brands | Manufacturer and private label producer of fresh and frozen bakery goods |

| Oct-21 | PacMoore Products (Contract Manufacturing Operations) | MSI Express | Contract manufacturer of snack foods and ingredients |

| Oct-21 | Alexandra Foods Company | Salt Creek Capital | Produces frozen Eastern European foods |

| Sep-21 | Mateos Gourmet Salsas | Sauer Brands | Manufacturer of Mexican-style salsa and sauces |

| Sep-21 | Valeo Foods | Bain Capital | Manufacturer of private-label snacks |

| Sep-21 | Cher-Make Sausage | Lakeside foods | Manufacturer of frozen, canned and prepared foods |

| Sep-21 | Kerry Group (Meats and Meals business) | Pilgrim’s Pride | Manufacturer of private label meats, snacks, and to-go food products |

| Sep-21 | Firebird Artisan Mills | Ardent Mills | Grain and pulse milling company that produces flour ingredients |

| Sep-21 | Teeny Foods Corporation | CenterGate Capital | Manufacturer of frozen bakery snacks and prepared foods |

| Jul-21 | Mama Lupe’s Tortilla Products | Flagship Food Group | Producer and supplier of tortillas, chips, and salsa |

| Jul-21 | Signature Breads | Rich Products | Operator of a bakery specializing in par-baked bread for restaurants and supermarkets |

Source: Pitchbook and Meridian Research

Notable Transactions: Ag

| Date | Target | Buyer | Target Description |

|---|---|---|---|

| Pending | Sanderson Farms | CGC | Poultry processing company |

| Pending | Gavilon | Viterra | Distributor of grains, feed ingredients, and fertilizer |

| Feb-22 | Geoflow | CAST Environmental | Developer of subsurface drip irrigation systems |

| Jan-22 | Horticultural Rep Group | GrowGeneration | Agency for indoor and greenhouse horticultural companies |

| Jan-22 | Mercer Foods | Entrepreneurial Equity | Producer of freeze-dried fruits, vegetables and other ingredients |

| Jan-22 | Temp Farm Equipment | S3 Enterprises | Provider of farm machinery and equipment |

| Jan-22 | Maury Island Farm | West Coast Copacker | Producer and seller of jams |

| Jan-22 | Koosah Vineyard | Résonance | Operator of a vineyard |

| Jan-22 | United Fresh Produce | International Fresh Produce Association | Trade association for farmers, distributors, and retailers |

| Dec-21 | Coastal Farm & Ranch | Nolan Capital | Northwest leading ranch and country lifestyle retailer |

| Dec-21 | Arkansas Farmland | Chess Ag Full Harvest | 2,400 acres of farmland in Arkansas |

| Dec-21 | Orbit Irrigation | Husqvarna Group | Manufacturer of irrigation systems and related products |

| Dec-21 | Hazeldenes | BGH Capital | Owner and operator of a poultry farm |

| Nov-21 | Dole Food Company, Inc. | Total Produce | Producer and marketer of fresh fruit, vegetables |

| Nov-21 | Deerland Probiotics & Enzymes | ADM | Contract manufacturer of probiotic, prebiotic and enzyme-based ingredients |

| Nov-21 | Insight Sensing | Sentera | Offer remote sensing technology designed for agronomists |

| Oct-21 | Atlantic Blue | Hortifrut | Producer of berries and cherries intended to serve the food industry |

| Oct-21 | Florikan | Profile Products | Manufacturer and distributor of controlled-release fertilizers |

| Oct-21 | Shank’s Extracts | Universal Corporation | Producer of ingredients, extracts, flavors and colors for the food and beverage industry |

| Oct-21 | &ever | Kalera | Operator of vertical farms intended to cultivate pesticide-free plants indoors |

| Sep-21 | Deligusti | PAI Partners | Producer of marinated fish and seafood products |

| Sep-21 | Rose Acre Farms (soybean crushing facility) | Benson Hill | Soybean crushing facility for processing soy located in Indiana, United States |

| Sep-21 | Summit Seed Coatings | Tide Rock Holdings | Producer of seed coatings intended to enhance seed productivity and yield |

| Sep-21 | Agronomic Solutions | Deveron | Provides EC mapping, soil sampling, smart grid zone, nitrogen, and manure management |

| Sep-21 | Lawson Grains | Alberta Investment Management | Producer of wheat, barley, and canola |

| Sep-21 | Grow Compost of Vermont | Casella Waste Systems | Manufacturer of compost intended to offer healthy soils for gardens and farmlands |

| Aug-21 | Pure Green Farms | Taylor Farms | Grower, packer, and shipper of hydroponic-grown lettuce |

| Aug-21 | WRK Enterprises | Organics By Gosh | Manufacturer of compost and soil products intended to serve landscaping needs |

| Aug-21 | Monta Vista Farming | Solum Partners | Growing, packaging, and marketing of California-grown almonds |

| Aug-21 | Bear Flag Robotics | Deere | Developer of self-driving tractors designed to lower the cost of farming |

| Aug-21 | Furst-McNess | Easy Bio | Manufacturer of animal feed intended for the North American livestock industry |

| Aug-21 | JM Swank, LLC | Brenntag SE | Supplier of spices, dairy, grain, sweeteners, fats & oils, starches, and cocoa |

| Jul-21 | Green Triangle Forest Products | AXA IM | Operator of a plantations estate and forestry management business |

| Jul-21 | Terminal Produce | GrubMarket | Distributor and importer of tropical fruits, vegetables and fish |

| Jul-21 | Ametza | Wilbur-Ellis Nutrition | Producer for forage pellets intended to serve the livestock and companion animal farmers |

Source: Pitchbook and Meridian Research