Food & Agribusiness M&A Trends: Fall 2023

Published October 24, 2023

Key Insights

- Food & Agribusiness Middle Market M&A Activity

- Continued Consolidation in the Pacific Northwest Tree Fruit Industry

- Global Shift to Regenerative Agriculture as Demand for Sustainability Increases

- Private Label Growth within Retail Markets

Food & Agribusiness Market Insight

Continued Consolidation in the Pacific Northwest Tree Fruit Industry

- Following a challenging 2022 crop and condensed 2023 cherry harvest, the Pacific Northwest tree fruit industry has faced a challenging pricing market for growers, packers, and distributors alike.

- Smaller operators have begun to look towards larger well-funded or private equity-backed players, driving further industry consolidation. Most notably, in September 2023, Starr Ranch Growers / Oneonta Trading Co. joined the CMI Orchard platform, bringing with it over 8M boxes of premium tree fruit.

- Relief is on the horizon. The Washington State Tree Fruit Association estimates that the 2023 apple crop will exceed last year’s harvest by as much as 29% and 5% above the historical six-year production average, with quality and varietal mix also improving. It is expected this improvement will help orchards and packing houses achieve better profitability levels in 2024 compared to 2022 and 2023.

Global Shift to Regenerative Agriculture as Demand for Sustainability Increases

- Growers, producers, and ag companies worldwide are contending with climate variability as soil erosion, decarbonization, and risks to biodiversity have impacted land productivity, creating a global shift to regenerative agriculture.

- Many growers have been proactive in implementing regenerative practices over recent years that promote soil fertility and biodiversity.

- Regenerative agriculture is the process of restoring eroded soils, building organic biodiversity, and maintaining agricultural resilience in healthier, productive soil. Common key themes and initiatives include promoting soil fertility and biodiversity through minimizing physical and chemical disturbance, maximizing soil water-reservation capacity, and rotational livestock grazing.

- The agricultural activator adjuvants market is a key sector impacted by these trends, projected to reach $3.5 billion by 2028, representing a 2023-2028 CAGR of 6.0%. These regenerative solutions, such as chemical adjuvants and bio-enhancements, enable growers to boost herbicide performance, improve water conditioning, and achieve more with fewer resources.

Private Label Growth within Retail Markets

- A significant number of consumers have flocked to private-label brands due to inflationary pressures. As inflationary pressures were the catalyst for consumers to pivot towards purchasing white-label brands, most consumers plan to continue purchasing private-label brands over brand name products even when prices normalize.

- When thinking about what drives consumers to private label brands, consumers have listed price, value, quality, and taste attracts them to purchasing private label brands.

- Purchase volumes of private label brands directly correlate to an increase in production from contract manufacturers. Meridian expects contract manufacturers to continue to see revenue tailwinds in 2024 and 2025.

- Financial and Strategic buyers continue to add to their portfolios of contract manufacturing investments, to capitalize on the expected longer-term consumer shift to private-label brands.

Sources: Pitchbook, Mergermarket, Meridian research, World Economic Forum, Regenerational International, Sygenta, Noble Research Institute, The Packer, Washington Tree Fruit Association

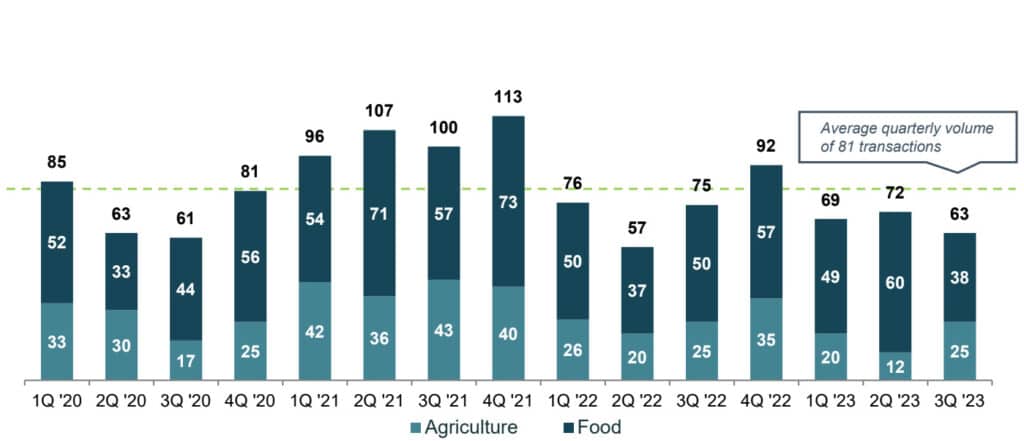

Food & Agribusiness Middle Market M&A Activity

Food & Agriculture M&A Activity

- In Q3 2023, M&A volume fell short of historical averages by ~20% as interest rate hikes, elevated inflation, persistent supply chain constraints, and ongoing international conflict have increased transactional hurdles and challenges.

- Despite softer YTD 2023 M&A volume, M&A activity this year continues to remain at healthy levels, comparable to the 2018-2020 period. High quality assets are experiencing competitive processes, while more troubled assets are facing significant uncertainty.

- M&A activity in YTD 2023 continues to be primarily driven by a substantial volume of food product transactions, while the activity in the agriculture sector has maintained a consistent pace. During the second quarter of 2023, there was a noteworthy disparity between the number of deals in the agriculture and food sectors, with the latter outpacing the former by a factor of five in terms of deal volume.

Closed $1.7B Fund

Investor Interest in Food and Agribusiness

- In September 2023, Paine Schwartz Partners announced the closing of the firm’s sixth fund at $1.7 billion, exceeding the funding goal of $1.5 billion.

- The Company’s fund is now the largest fund focused on investments in the food and agribusiness sector and a 17% increase compared to the Company’s last capital raise.

- Paine Schwartz intends to invest in themes of productivity and sustainability, and health and wellness.

- The outstanding outcome of Fund VI represents continued investor interest in food and agribusiness investments and a testament to impressive returns in the sector.

Sources: Pitchbook, Mergermarket, Meridian research, World Economic Forum, Regenerational International, Sygenta, Noble Research Institute, The Packer, Washington Tree Fruit Association

Featured Food & Agribusiness M&A Transactions

Biotrop to be Acquired by Biobest Group

Pending

$713B

Enterprise Value

18.2x

EV / EBITDA

Biobest, a developer and producer of pollination and biological agricultural inputs, has agreed to acquire Biotrop, a Brazilian producer of biostimulants, biofertilizers, and innoculants.

The acquisition expands Biobest’s ability to serve to the highly productive South American agricultural sector.

Costa Group to be Acquired by Paine Schwartz Partners

Pending

$938M

Enterprise Value

6.5x

EV / EBITDA

Paine Schwartz Partners, a private equity firm focused on sustainable food supply chain investments, has agreed to acquire Costa Group, the largest grower, packer, and distributor of fresh produce in Australia.

The take-private transaction will create significant opportunity for Costa Group to pursue opportunities outside of Australia and provide for additional growth capital expenditures in incremental end markets.

SunOpta Frozen Fruit Assets Acquired by Nature’s Touch

Oct. 2023

$141M

Enterprise Value

9.4x

EV / EBITDA

Nature’s Touch, a producer of frozen fruits and vegetables, acquired SunOpta’s frozen fruits assets.

The divestiture of the frozen fruit business of SunOpta allows for the Company to run a more capital efficient business model, strengthen its balance sheet, and focus on other attractive growth opportunities.

IFF Flavor Specialty Ingredients Business Acquired by Exponent

Aug. 2023

210M

Enterprise Value

2.2x

EV / EBITDA

Exponent, a London-based private equity firm, acquired the Flavor Specialty Ingredients (FSI) division of IFF, a manufacturer of specialty aromas and natural extracts.

The acquisition enables Exponent to support FSI’s growth ambitions, both organically and through acquisitions.

Sources: Pitchbook, Mergermarket, Meridian research, World Economic Forum, Regenerational International, Sygenta, Noble Research Institute, The Packer, Washington Tree Fruit Association

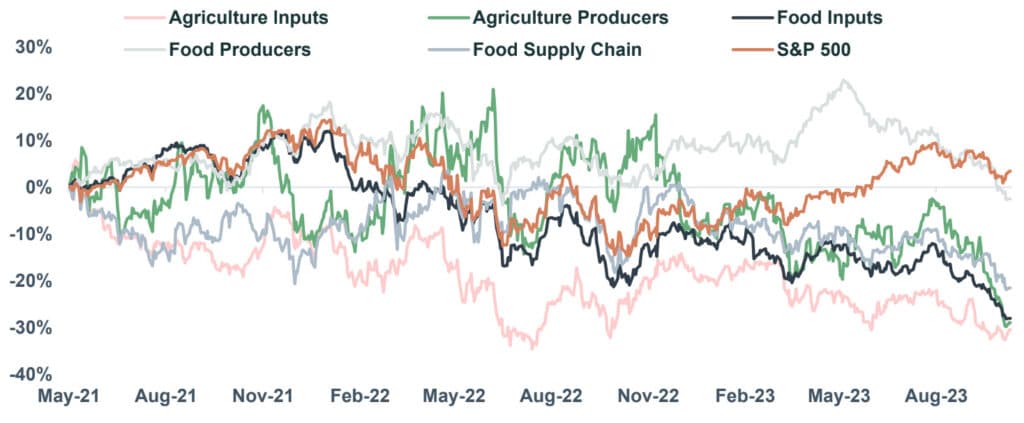

Public Food & Agribusiness Trading Metrics

Stock Index Performance

Agricultural Inputs

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| CF Industries Holdings, Inc. (NYS: CF) | $16,408 | $19,149 | $8,716 | $4,350 | 2.2x | 4.3x | 50% | (13%) |

| The Mosaic Co. (NYS: MOS) | $12,009 | $15,369 | $16,828 | $3,826 | 0.9x | 3.7x | 23% | (23%) |

| AGCO Corporation (NYS: AGCO) | $9,047 | $10,976 | $14,177 | $1,719 | 0.8x | 6.3x | 12% | 12% |

| The Toro Company (NYS: TTC) | $8,790 | $9,823 | $4,742 | $625 | 2.1x | 12.6x | 13% | (9%) |

| FMC Corp. (NYS: FMC) | $7,717 | $11,483 | $5,358 | $1,209 | 2.1x | 9.2x | 23% | (44%) |

| SiteOne Landscape Supply, Inc. (NYS: SITE) | $6,973 | $7,731 | $4,184 | $394 | 1.8x | 18.2x | 9% | 53% |

| The Scotts Company LLC (NYS: SMG) | $2,636 | $5,688 | $3,671 | $44 | 1.5x | 15.9x | 1% | 9% |

| Lindsay Corp. (NYS: LNN) | $1,256 | $1,248 | $697 | $121 | 1.8x | 10.3x | 17% | (23%) |

| CVR Partners LP (NYS: UAN) | $880 | $1,361 | $778 | $343 | 1.7x | 4.0x | 44% | (31%) |

| Titan International, Inc. (NYS: TWI) | $819 | $1,058 | $2,070 | $239 | 0.5x | 4.3x | 12% | 6% |

| Titan Machinery, Inc. (NAS: TITN) | $578 | $1,271 | $2,464 | $191 | 0.5x | 6.7x | 8% | (17%) |

| Intrepid Potash, Inc. (NYS: IPI) | $288 | $271 | $309 | $72 | 0.9x | 3.4x | 23% | (45%) |

| Ceres Global Ag Corp. (TSE: CRP) | $48 | $105 | $1,037 | $5 | 0.1x | 7.3x | 0% | (13%) |

| Median | $2,636 | $5,688 | $3,671 | $343 | 1.5x | 6.7x | 13% | (13%) |

| Average | $5,188 | $6,579 | $5,002 | $1,011 | 1.3x | 8.2x | 18% | (11%) |

Agriculture Producers

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Darling Ingredients Inc. (NYS: DAR) | $7,196 | $11,911 | $7,064 | $1,604 | 1.7x | 7.3x | 23% | (39%) |

| Pilgrim’s Pride Corp. (NAS: PPC) | $5,581 | $8,851 | $17,070 | $792 | 0.5x | 9.6x | 5% | 10% |

| Cal-Maine Foods, Inc. (NAS: CALM) | $2,400 | $1,788 | $2,947 | $884 | 0.6x | 2.0x | 30% | (18%) |

| Fresh Del Monte Produce Inc. (NYS: FDP) | $1,225 | $1,806 | $4,402 | $294 | 0.4x | 7.0x | 7% | 1% |

| Adecoagro S.A. (NYS: AGRO) | $1,142 | $2,395 | $1,407 | $518 | 1.7x | nm | 37% | 30% |

| Mission Produce, Inc. (NAS: AVO) | $624 | $891 | $934 | ($9) | 1.0x | 15.9x | (1%) | (42%) |

| Farmland Partners Inc (NYS: FPI) | $513 | $1,039 | $59 | $44 | 17.6x | 31.3x | 75% | (19%) |

| Calavo Growers, Inc. (NAS: CVGW) | $443 | $545 | $974 | $19 | 0.6x | 18.8x | 2% | (21%) |

| Limoneira Company (NAS: LMNR) | $261 | $319 | $178 | $25 | 1.8x | nm | 14% | 19% |

| Alico, Inc. (NAS: ALCO) | $188 | $314 | $40 | ($6) | 7.8x | nm | (14%) | (14%) |

| Median | $883 | $1,414 | $1,191 | $169 | 1.3x | 9.6x | 10% | (16%) |

| Average | $1,957 | $2,986 | $3,508 | $416 | 3.4x | 13.1x | 18% | (9%) |

Food Inputs

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Archer Daniels Midland Co (NYS: ADM) | $39,012 | $47,751 | $99,884 | $6,087 | 0.5x | 7.7x | 6% | (13%) |

| International Flavors & Fragrances Inc (NYS: IFF) | $16,339 | $27,133 | $11,863 | ($424) | 2.3x | 13.0x | (4%) | (27%) |

| McCormick & Company, Inc. (NYS: MKC) | $15,974 | $20,618 | $6,605 | $1,140 | 3.1x | 17.2x | 17% | (19%) |

| Kerry Group plc (DUB: KRZ) | $14,241 | $16,142 | $9,245 | $1,233 | 1.7x | 11.4x | 13% | (9%) |

| Symrise AG (ETR: SY1) | $13,736 | $16,439 | $4,993 | $768 | 3.3x | 18.7x | 15% | 1% |

| Darling Ingredients Inc. (NYS: DAR) | $7,196 | $11,911 | $7,064 | $1,604 | 1.7x | 7.3x | 23% | (39%) |

| IMCD N.V. (AMS: IMCD) | $7,094 | $7,745 | $4,783 | $575 | 1.6x | 12.9x | 12% | 11% |

| The Middleby Corporation (NAS: MIDD) | $6,458 | $9,059 | $4,072 | $828 | 2.2x | 11.1x | 20% | (5%) |

| Ingredion Inc. (NYS: INGR) | $6,034 | $8,287 | $8,216 | $1,100 | 1.0x | 7.4x | 13% | 11% |

| Glanbia PLC (DUB: GL9) | $4,219 | $4,793 | $5,613 | $456 | 0.9x | 9.7x | 8% | 36% |

| Balchem Corporation (NAS: BCPC) | $4,009 | $4,367 | $941 | $199 | 4.6x | 21.2x | 21% | (2%) |

| Olam International Limited (SES:VC2) | $2,892 | $12,497 | $37,471 | $1,512 | 0.3x | 7.7x | 4% | (11%) |

| Sensient Technologies Corporation (NYS: SXT) | $2,251 | $2,916 | $1,453 | $246 | 2.0x | 12.0x | 17% | (23%) |

| MGP Ingredients Inc (NAS: MGPI) | $2,131 | $2,447 | $802 | $168 | 3.0x | 14.4x | 21% | (2%) |

| Median | $6,776 | $10,485 | $6,109 | $798 | 1.9x | 11.7x | 14% | (7%) |

| Average | $10,113 | $13,722 | $14,500 | $1,107 | 2.0x | 12.3x | 13% | (6%) |

Food Producers

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Nestlé S.A. (SWX: NESN) | $306,217 | $368,421 | $101,702 | $17,545 | 3.6x | 16.9x | 17% | 4% |

| The Hershey Company (NAS: HSY) | $38,368 | $43,201 | $10,858 | $2,574 | 4.0x | 16.0x | 24% | (16%) |

| Kraft Heinz Company (NAS: KHC) | $37,844 | $57,094 | $27,096 | $5,600 | 2.1x | 9.2x | 21% | (14%) |

| General Mills Inc. (NYS: GIS) | $35,766 | $47,811 | $20,281 | $3,912 | 2.4x | 11.6x | 19% | (21%) |

| Associated British Foods Plc (LON: ABF) | $18,520 | $21,778 | $22,636 | $2,482 | 1.0x | 7.7x | 11% | 64% |

| Hormel Foods Corporation (NYS: HRL) | $17,854 | $20,479 | $12,195 | $1,457 | 1.7x | 14.1x | 12% | (27%) |

| Kellanova Co (NYS: K) | $16,645 | $23,923 | $15,873 | $1,741 | 1.5x | 9.3x | 11% | (28%) |

| Conagra Brands, Inc. (NYS: CAG) | $12,728 | $21,979 | $12,277 | $1,977 | 1.8x | 9.2x | 16% | (22%) |

| Lamb Weston Holdings, Inc. (NYS: LW) | $12,188 | $15,498 | $5,890 | $1,280 | 2.6x | 14.4x | 22% | 0% |

| The J.M.Smucker Co., LLC (NYS: SJM) | $11,391 | $15,182 | $8,461 | $643 | 1.8x | 9.0x | 8% | (21%) |

| Campbell Soup Company (NYS: CPB) | $11,340 | $16,120 | $9,357 | $1,699 | 1.7x | 9.2x | 18% | (24%) |

| Post Holdings, Inc. (NYS: POST) | $4,874 | $10,862 | $6,625 | $1,127 | 1.6x | 9.9x | 17% | (8%) |

| Simply Good Foods USA Inc (NAS: SMPL) | $3,200 | $3,498 | $1,196 | $219 | 2.9x | 13.7x | 18% | (0%) |

| Sovos Brands Intermediate, Inc. (NAS: SOVO) | $2,264 | $2,593 | $941 | $57 | 2.8x | 18.8x | 6% | 59% |

| TreeHouse Foods Inc (NYS: THS) | $2,186 | $3,937 | $3,610 | $273 | 1.1x | 12.1x | 8% | (17%) |

| The Hain Celestial Group, Inc. (NAS: HAIN) | $917 | $1,793 | $1,797 | ($33) | 1.0x | 11.4x | (2%) | (37%) |

| B&G Foods, Inc. (NYS: BGS) | $563 | $2,833 | $2,133 | $225 | 1.3x | 8.3x | 11% | (48%) |

| Median | $12,188 | $16,120 | $9,357 | $1,457 | 1.8x | 11.4x | 16% | (17%) |

| Average | $31,345 | $39,824 | $15,466 | $2,516 | 2.1x | 11.8x | 14% | (9%) |

Food Supply Chain

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Sysco Corporation (NYS: SYY) | $31,654 | $42,108 | $76,325 | $3,701 | 0.6x | 10.3x | 5% | (15%) |

| US Foods, Inc. (NYS: USFD) | $8,869 | $13,431 | $34,987 | $1,317 | 0.4x | 9.2x | 4% | 36% |

| Performance Food Group, Inc. (NYS: PFGC) | $8,323 | $13,055 | $57,255 | $1,263 | 0.2x | 9.5x | 2% | 20% |

| Americold Logistics, Inc. (NYS: COLD) | $7,421 | $11,200 | $2,805 | $361 | 4.0x | 21.9x | 13% | 21% |

| Aramark Corp. (NYS: ARMK) | $6,709 | $14,335 | $18,343 | $1,691 | 0.8x | 10.3x | 9% | 7% |

| United Natural Foods, Inc. (NYS: UNFI) | $881 | $4,110 | $30,272 | $442 | 0.1x | 6.7x | 1% | (60%) |

| SpartanNash Company (NAS: SPTN) | $788 | $1,603 | $9,825 | $187 | 0.2x | 6.9x | 2% | (26%) |

| The Chefs’ Warehouse, Inc (NAS: CHEF) | $707 | $1,567 | $3,055 | $135 | 0.5x | 8.9x | 4% | (40%) |

| HF Foods Group Inc (NAS: HFFG) | $205 | $381 | $1,179 | $17 | 0.3x | 20.2x | 1% | 5% |

| Amcon Distributing Co (ASE: DIT) | $110 | $287 | $2,493 | $32 | 0.1x | 9.5x | 1% | (4%) |

| Median | $3,795 | $7,655 | $14,084 | $402 | 0.4x | 9.5x | 3% | 1% |

| Average | $6,567 | $10,208 | $23,654 | $915 | 0.7x | 11.3x | 4% | (6%) |

($US in millions)

Sources: Pitchbook, Mergermarket, Meridian research, World Economic Forum, Regenerational International, Sygenta, Noble Research Institute, The Packer, Washington Tree Fruit Association

Select Food & Agribusiness M&A Transactions

| Date | Target | Acquirer | Target Description |

|---|---|---|---|

| Pending | BioTrop | Biobest Group | Provider of biological agricultural products for healthy food production |

| Pending | Costa Group | Paine Schwartz Partners | Australian fresh produce provider |

| Oct-23 | SunOpta (frozen fruit assets) | Nature’s Touch | Supplier of organic, specialty, and natural food and ingredients |

| Oct-23 | J&K Ingredients | SK Capital | Manufacturer of baked goods ingredients |

| Oct-23 | Punto Verde | American Vanguard | Agricultural input provider in Ecuador |

| Oct-23 | Advanced Organic Materials | Kensing (One Rock) | Manufacturer of derived vitamin E, plant sterols, and surfactants |

| Oct-23 | Sugar Foods Corporation | Pritzker Private Capital | California based food ingredients provider |

| Sep-23 | Sahale Snacks | Send Nature Brands (CapVest Partners) | Branded CPG snack foods producer |

| Sep-23 | Commercial Bakeries Corp | Graham Partners | Manufacturer of private label CPG goods |

| Sep-23 | Douglas Partners | Brightstar Capital Partners | Specialty agriculture inputs company based in Missouri |

| Sep-23 | Hostess Brands | J.M Smucker | Industry leader in CPG desserts and snacks |

| Aug-23 | Spaco Agricola | Tepeyac | Brazil based agricultural input provider |

| Aug-23 | La Fiesta Food Products | Chef Merito Seasonings | Provider of spices, herbs, and sauces |

| Aug-23 | Cache Creek Foods | Severn Peanuts | Producer of private label tree nut butters and powders |

| Aug-23 | Sovos Brands | Campbell Soup | Producer of Rao’s pasta sauces and other jarred products |

| Aug-23 | IFF (FSI division) | Exponent | Flavor specialty ingredients producer for food and cosmetic industry |

| Aug-23 | London Fruit | GrubMarket | Family-owned wholesale fruit distribution company |

| Aug-23 | Univar Solutions | Apollo Funds | Global leading chemical and ingredient manufactuer |

| Jul-23 | Gilette Citrus | Kings River Packing | Citrus grower based in San Joaquin Valley |

| Jul-23 | Henry Broch Foods | JDM Food Group | Co-packer of tailored spice formulations and seasonings |

| Jul-23 | Tessara | AgroFresh | Food waste and freshness solutions provider |

| Jul-23 | Murry’s | Entrepreneurial Equity Partners | Producer of private label frozen food products |

| Jun-23 | Upper Crust Food Service | Copley Equity Partners | Contract food service management company |

| Jun-23 | Groneweg | Thrive Foods | Utah based freeze-dried and air-dried fruit and vegetables provider |

| Date | Target | Acquirer | Target Description |

|---|---|---|---|

| Jun-23 | Vindara | Sandton Capital Partners | Developer of seeds designed for use in vertical indoor farm environments |

| May-23 | Harvest Food Group | Industrial Opportunity Group | Contract manufacturer, supplier, and distributor of frozen foods |

| May-23 | Macspred | Syngenta | Manufacturer and distributor of herbicide solutions |

| May-23 | Above Food | Bite Acquisition Corp (NYSE: BITE) | Supplier of grains, legumes, and branded plant-based foods |

| Apr-23 | FE Ingredients | Fulcrum Capital Partners | Distributor of baking supplies and food ingredients |

| Apr-23 | Solevo (Helios Partners, Temasek) | DEG, Development Partners, FMO | Distributor of inputs for the agricultural and food sectors |

| Apr-23 | Legacy Bakehouse | Benford Capital Partners | Producer of private label snack products |

| Apr-23 | Gelnex | Darling Ingredients (NYSE: DAR) | Producer of gelatin and collagen peptides |

| Apr-23 | Interagro | Nichino Europe Co. | Manufacturer of adjuvants and biostimulants for the agricultural sector |

| Apr-23 | AgroFresh (NAS: AGFS) | Paine Schwartz Partners | Developer of post-harvest products, equipment, and technology to improve supply chain freshness |

| Mar-23 | Stoller Group | Corteva Agriscience (NYS: CTVA) | Producer of agricultural biostimulant solutions |

| Feb-23 | Cosmocel | Rovensa (Partners Group, Bridgepoint Advisers) | Manufacturer and distributor of biostimulants, fungicides, and fertigation solutions |

| Feb-23 | Milk Specialties Global | Butterfly Equity | Ingredient manufacturer focused on processing raw dairy inputs |

| Jan-23 | FBSciences | Valent BioSciences | Producer of agricultural biostimulant products |

| Dec-22 | Southwest Spice | Gulf Pacific (Eos Partners) | Value-added packager and processor of dry edible beans and spice blends |

| Oct-22 | Safra Rica | Nutrien (TSE: NTR) | Manufacturer and distributor of fertilizer products |

| Oct-22 | TruFood Manufacturing | Mubadala Investment Company | Contract manufacturer of snack food products |

| Oct-22 | PUR Projet | Bregal Investments | Provider of regenerative environmental services to fight climate change |

| Oct-22 | Gavilon | Viterra | Distributor of grains, feed ingredients, and fertilizer |

| Sep-22 | Sokol & Company | Burlington Capital Partners | Contract manufacturer of sauces, glazes, and marinades |

| Sep-22 | Agvnt | Summit Nutrients | Provider of liquid fertilizers and nano-technologies for crop production |

| Apr-22 | Oakbank Game & Conservation | Velcourt | Provider of farming and crop regeneration services |

| Jan-22 | Mercer Foods | Entrepreneurial Equity Partners | Contract manufacturer of fruits and vegetables |

| Dec-21 | George Weston (Bakery) | Hearthside Food Solutions | Contract manufacturer of bars, entrees, and food packaging |

As of 10/15/2023

Sources: Pitchbook, Mergermarket, Meridian research, World Economic Forum, Regenerational International, Sygenta, Noble Research Institute, The Packer, Washington Tree Fruit Association