FinTech M&A Trends: Spring 2020

Published May 19, 2020

Resiliency

Arguably, no industry underpins the “how” in how business gets done more than FinTech; it is a far-reaching tech industry comprised of numerous subsegments, each with distinctive business models and idiosyncratic COVID-19 risk. As this unprecedented situation has unfolded, the theme of resiliency has continued to reverberate around the market. The FinTech industry will be no different from many other industries, in that firms that do not provide an operationally critical service will struggle in the near term.

What is compelling about FinTech during this period is two-fold: first, there is inherent resilience in many of the companies in this sector, and second, FinTech companies help facilitate resilience for the businesses and consumers it serves. For many FinTech companies, contractual, recurring revenue business models provide steady, high-visibility revenue streams, and expenses follow revenues, providing two layers of insulation during downturns. The resilience FinTech firms provide their users differ for businesses and consumers. For businesses, FinTech provides support, helping one to get paid faster, stay on top of expenses, reduce friction when seeking capital, or manage financial infrastructure. FinTech can also give smaller businesses a benefit, such as fraud protection, which helps them be more resilient. For consumers, FinTech provides access to financial products and solutions from any location, so that consumers can connect to bank accounts, alternative payment plans, or investment accounts, and securely shop online, while sheltering in place.

At Meridian Capital, we cover the Technology industry in which FinTech will see continued adoption and growth in the near term. Investors are continuing to back FinTech companies, recognizing that this unprecedented situation will accelerate the use of and need for many FinTech services moving forward. We expect to see well-capitalized businesses taking advantage of their strength in this downturn to make solid acquisitions at more favorable prices.

What We’re Reading

Google Has Reportedly Added A Smart Debit Card to Its Fintech Plans, Techspot

Takeaway: Major players in tech including Apple and Google have recognized the opportunity within FinTech and have large plans on the horizon

Takeaway: Fintech players including PayPal and Square are proactively working with the government to assist in aiding small businesses during the COVID-19 pandemic and argue their tech-enabled systems allow them to distribute funds more efficiently

FIS Accelerates Innovation with $150 Million of New Capital for Venture Investments, PitchBook

Takeaway: Despite shaken markets, investors see vast potential in FinTech for the long-term and are actively seeking to deploy capital into FinTech startups

Against All Odds, Fintech Companies Like Square and Stripe Are Thriving Right Now, Marker

Takeaway: Tech-enabled loan and payment services can ride broader consumer behavior as a result of COVID-19

How Will The Coronavirus Impact The Banking Ecosystem?, The Financial Brand

Takeaway: The broader banking ecosystem will see greater collaboration of FinTech with traditional banks and rising importance of the role data and analytics play in FinTech

Market Impacts of COVID-19 On FinTech Sector

Point-of-Sale (POS) and Most Payment Technologies Will Struggle

- Substantially decreased transaction volumes will hurt payment companies reliant on interchange fees in the near term but the longer-term demand for digital, cashless payment options has been expedited

- The capital intensively of point-of-sale hardware combined with significantly decreased restaurant and retail traffic will be difficult to overcome

eCommerce Enablers Will Thrive

- Traditionally brick and mortar businesses will need digital platforms that allow them to quickly shift to online retail operations

- Payment processors with more exposure to online sales will be better positioned

Accelerated Digital Transformation of Financial Services Companies

- Increased demand from consumers for remote/digital banking and investments will increase strain on infrastructure technology

- Legacy financial institutions will be forced to fast track digital transformation efforts to adapt and survive

March 2020 Global FinTech Deal Metrics

- $4.4B Financing Volume

- 57 M&A Transactions

- > $36B M&A Volume

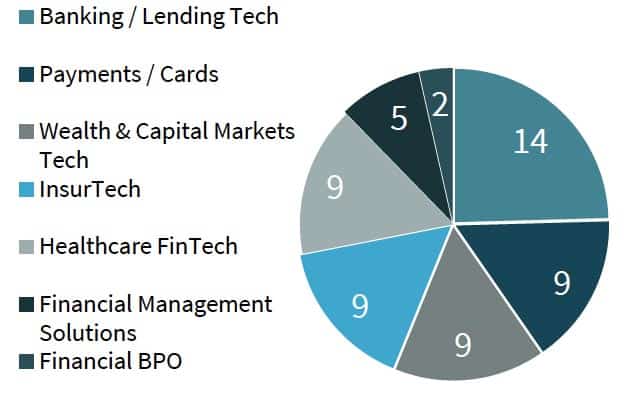

Transaction Activity by Subsector

FinTech Public Comps

| Company | 52 wk. High | 52 wk. Low | Enterprise Value | TTM Revenue | TTM EBITDA | Enterprise Value / TTM Revenue | Enterprise Value / TTM EBITDA |

|---|---|---|---|---|---|---|---|

| Visa Inc. | $214.00 | $134.00 | $376,600.00 | $23,525.00 | $16,406.00 | 16.0x | 23.0x |

| PayPal Holdings, Inc. | $124.00 | $82.00 | $132,780.00 | $17,772.00 | $3,828.00 | 7.5x | 34.7x |

| Fidelity National Information Services, Inc. | $158.00 | $92.00 | $94,492.00 | $10,333.00 | $3,194.00 | 9.1x | 29.6x |

| Intuit, Inc. | $307.00 | $188.00 | $66,335.00 | $7,127.00 | NM | 9.3x | NM |

| Square, Inc. | $87.00 | $32.00 | $26,934.00 | $4,714.00 | $542.00 | 5.7x | 49.7x |

| SS&C Technologies, Inc. | $68.00 | $30.00 | $20,301.00 | $4,633.00 | $1,712.00 | 4.4x | 11.9x |

| Q2 Holdings, Inc. | $94.00 | $47.00 | $6,634.00 | $315.00 | NM | 10.5x | NM |

| Blackline, Inc. | $74.00 | $38.00 | $3,590.00 | $289.00 | NM | 12.4x | NM |

| Bill.com, Inc. | $64.00 | $24.00 | $3,062.00 | $109.00 | NM | 28.1x | NM |

| Blucora, Inc. | $37.00 | $9.00 | $955.00 | $718.00 | NM | 1.3x | NM |

| FinVolution Group | $6.00 | $1.00 | $288.00 | $747.00 | NM | 0.4x | NM |

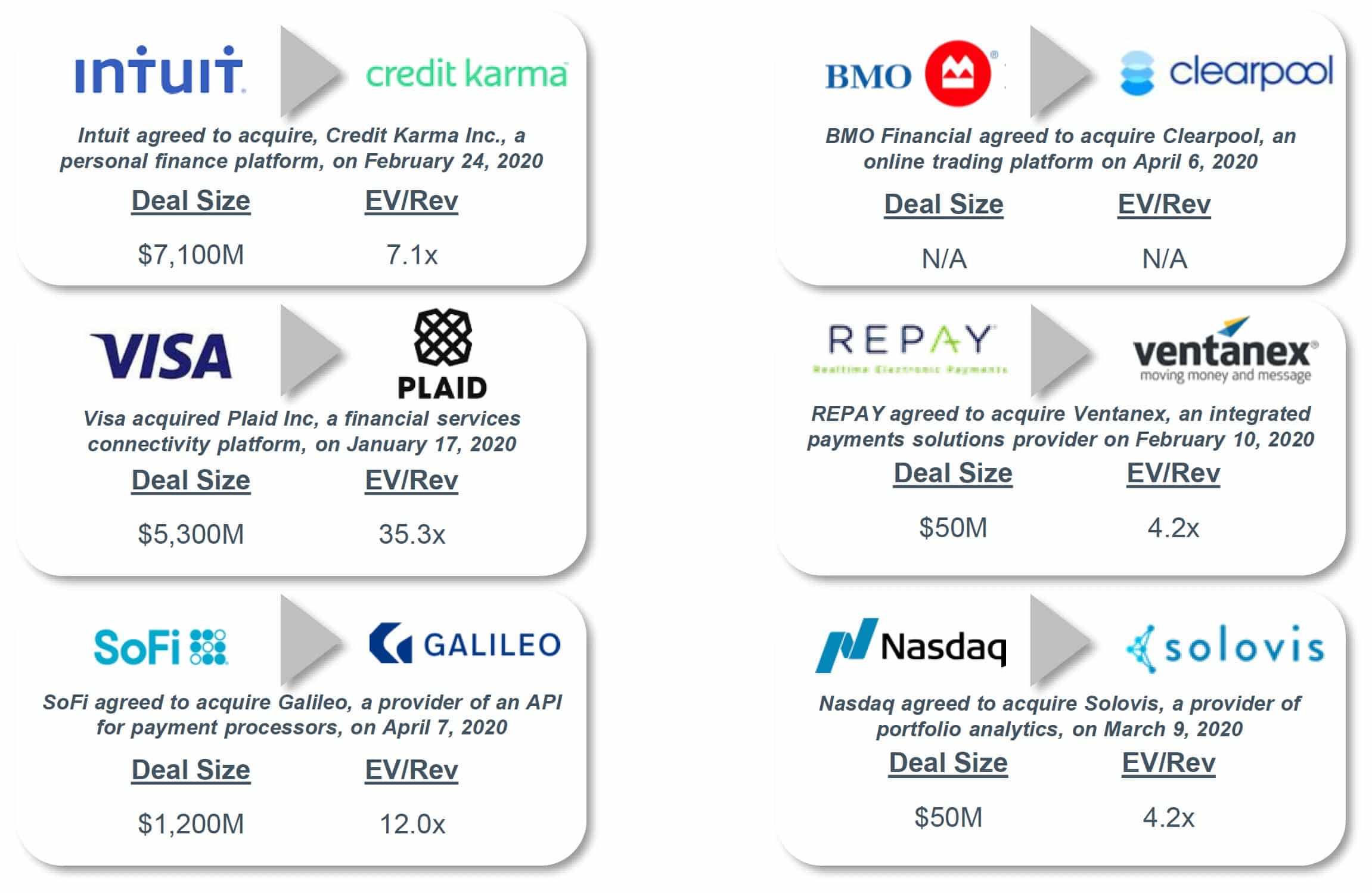

Notable FinTech Acquisitions

Recent FinTech Transactions

| Date | Target | Buyer | Description | EV ($ in M) | EV / Revenue |

|---|---|---|---|---|---|

| Apr-20 | Galileo | SoFI | Provider of API enabling payment processors tu customize their systems to fit customer needs. | $1,200.00 | 12.0x |

| Apr-20 | Clearpool Execution Services, LLC | BMO Financial Group | Provider of an electronic trading software designed to develop technologies for the modern market microstructure. | ||

| Apr-20 | Gold Coast Bancorp, Inc. | Investors Bancorp | Provider of personal and business banking products. | $64.00 | |

| Mar-20 | CashBet Alderney Limited | Greentube | Provider of a blockchain-powered i-gaming platform intended to elevate the online gambling experience. | ||

| Mar-20 | Solovis, Inc. | NASDAQ | Provider of a multi-asset class portfolio management, | ||

| Mar-20 | Online Brokerage Services, Inc. | AssetMark | Provider of investment and operations outsourcing services. | $20.00 | |

| Feb-20 | Credit Karma, Inc. | Intuit | Developer of financial education and recommendation platform intended to offer free credit scores and reports. | $7,100.00 | 7.1x |

| Feb-20 | CDT Technologies, Ltd. | Realtime Electronic Payments | Developer of a cloud-based transaction management platform. | $50.00 | 4.2x |

| Jan-20 | Plaid Inc. | Visa | Data network programming platform that connect fintech applications with traditional bank accounts. | $5,300.00 | 35.3x |

| Jan-20 | Procentia, Inc. | BT Pension Scheme | Developer of pension software based in Palatine, Illinois. | ||

| Jan-20 | Merkle Data Inc. | Anchorage | Developer of digital asset platform that provides accurate and actionable analytics for blockchain companies. |