Engineering, Construction & Building Products M&A Trends: Winter 2024

Published January 25, 2024

Key Insights

- Continued Momentum in Backlog and M&A Activity, 2024 Confidence Remains High

- 2024 Construction Advances: Prefabrication, Robotics, & Innovative Technologies

- ENC&BP M&A Commentary

- MC Plumbing Acquired by SEER Group

- Industry Spotlight – AEC Services

Construction backlog remained steady throughout H2 2023, providing contractors with a cautiously optimistic outlook heading into 2024 as anticipated Federal Reserve rate cuts may begin as early as Q1 in the new year. M&A activity is expected to continue in the new year as investors seek exposure across specific markets including engineering services, renewables, and critical infrastructure.

ENC&BP Market Insights

Continued Momentum in Backlog and M&A Activity, 2024 Confidence Remains High

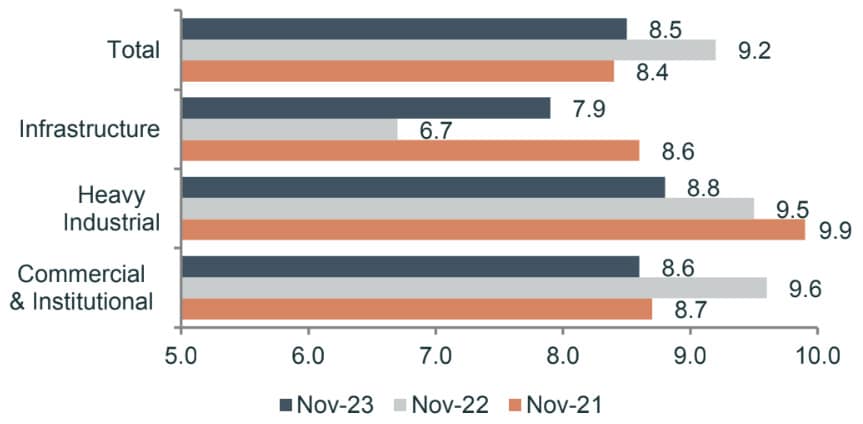

- Construction backlog remained steady throughout H2 2023, providing contractors with a cautiously optimistic outlook heading into 2024 as anticipated Federal Reserve rate cuts may begin as early as Q1 in the new year.

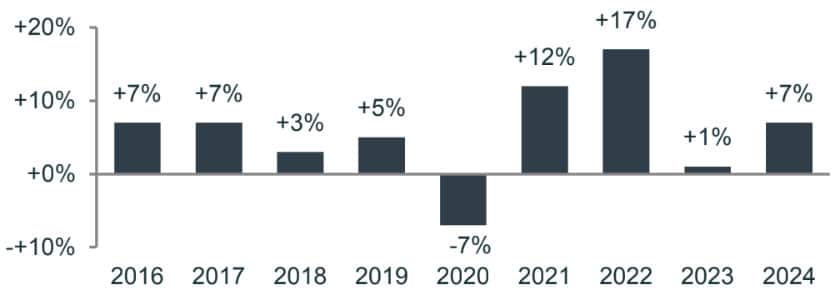

- According to the Dodge Construction Starts Forecast, the overall value of construction starts is expected to increase 7% in 2024 after only a 1% gain in 2023. Infrastructure activity across transportation, highways, and bridge construction is expected to rise 16% in 2024 across 38 states.

- ABC Construction’s Confidence Index for sales, profit margins, and staffing metrics exceed 55 through H2 2023, indicating expectations of continued growth in 2024.

- Construction wages are expected to increase again in 2024 as the industry continues to face a labor shortage. Construction wages have risen more than 15% since March 2020 (U.S. BLS).

- M&A activity is expected to continue in the new year as investors seek exposure across specific markets including engineering services, renewables, and critical infrastructure.

Historical & Projected Dollar Volume Starts (2016A-2024P)

Construction Backlog Indicator by Industry (Months)

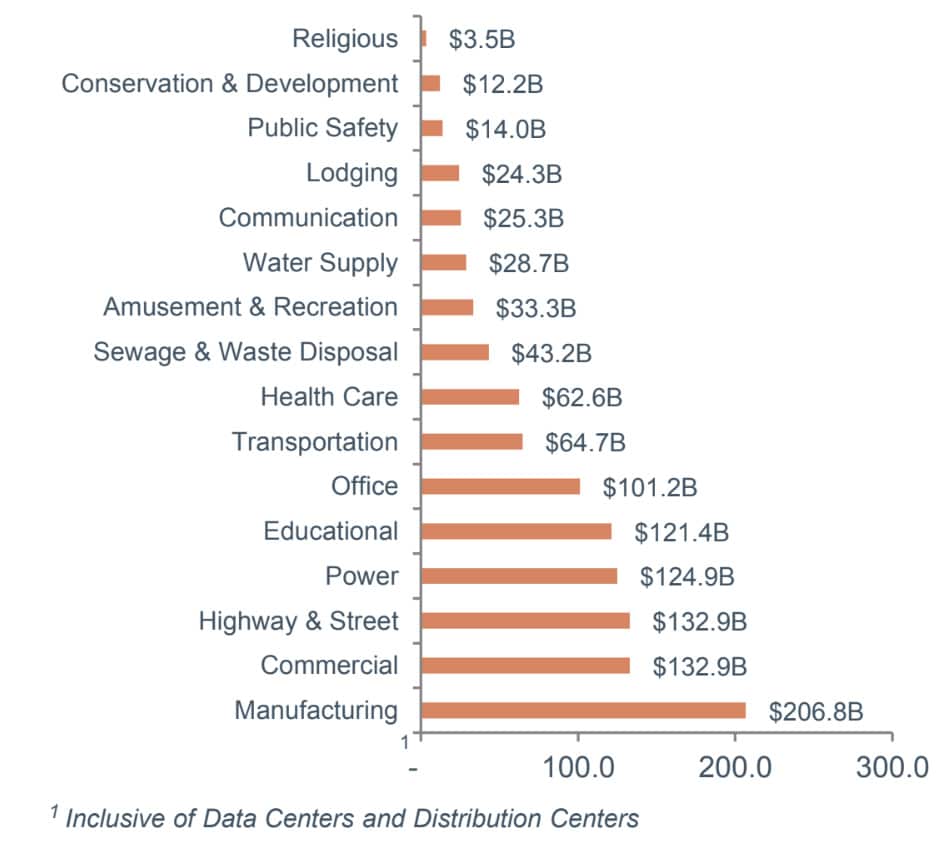

2023 Nonresidential Construction Spend by End-Market

2024 Construction Advances: Prefabrication, Robotics, & Innovative Technologies

- The use of prefabricated materials is expected to grow in 2024 as a strategy to increase efficiency, reduce labor costs, and align well with green and sustainability initiatives.

- Robotics usage in construction is forecasted to expand as the increased use of automation mitigates staffing shortages both by reducing the number of people needed on-site and removing undesirable parts of the job, improving recruitment, safety, and reduction of downtime after accidents.

- Sustainable construction is a key trend in 2024 as firms leverage high-performance building materials and energy-efficient systems, invest in a digital foundation with BIM and robotics, and explore applications of emerging technologies, such as generative AI, for enhanced efficiency.

Source: Association of General Contractors, Engineering News Record (“ENR”), Construction Dive, Dodge Construction Network, BD+C Network, Global New Wire, BDC Network, PitchBook Data, Mergermarket, Company Press Releases, and Meridian Research

ENC&BP Middle Market M&A Activity and Trends

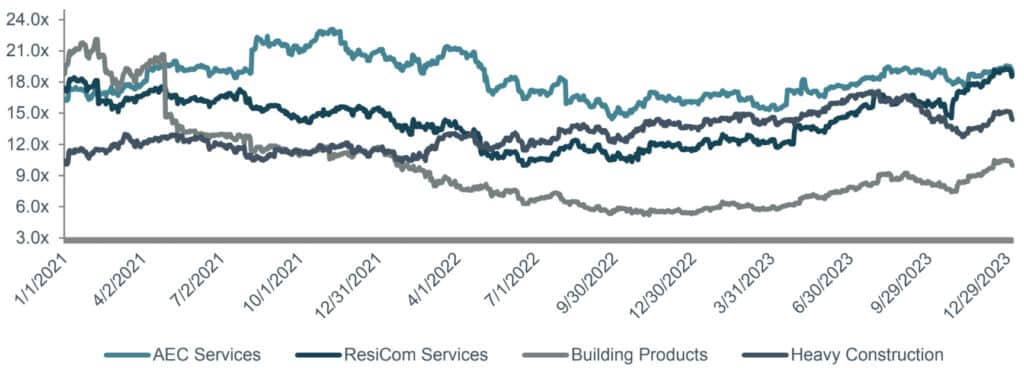

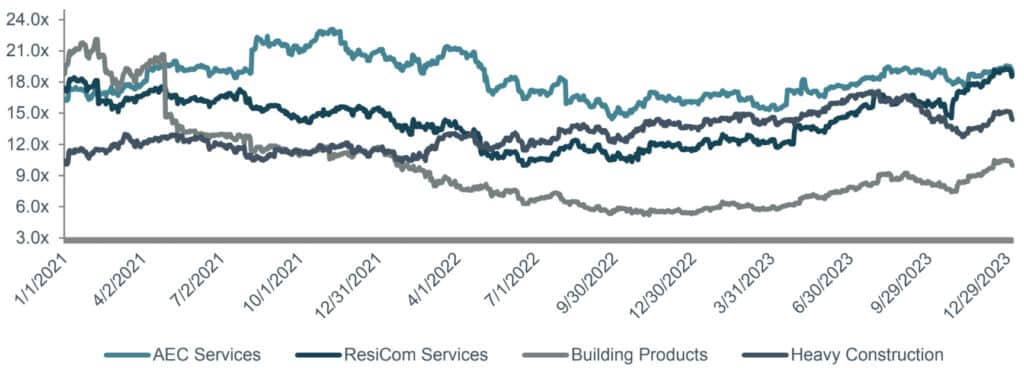

Public Market Valuations (EV/EBITDA)

U.S. ENC&BP M&A Activity

ENC&BP M&A Commentary

- 2023 ENC&BP M&A activity declined 20% compared to 2022, largely due to economic uncertainty and rising interest rates.

- Despite the decline, levels remained only slightly below 5-Year averages, indicating relief is on the horizon as dealmakers remain confident in more favorable M&A conditions heading into 2024.

- Many deals in the heavy construction and building products sectors were characterized by broken processes, delays, and increased due diligence as investors became more selective in identifying opportunities to pursue.

- M&A activity in certain sectors, such as Architecture, Engineering, and Construction Services (“AEC”), and Residential and Commercial Services, led by HVAC / Plumbing and Roofing / Exterior, have seen a notable uptick in Q4 2023, which is expected to continue through 2024.

Source: PitchBook Data, MergerMarket, Company Press Releases, and Meridian Research

MC Plumbing Acquired by SEER Group

Meridian Capital LLC (“Meridian”), a Seattle-based leading middle market investment bank and M&A advisory firm is pleased to announce the successful acquisition of its client, Mike Counsil Plumbing, Inc. (“MC Plumbing” or the “Company”) by The SEER Group (“SEER”).

Founded in 1994, MC Plumbing is a family-owned plumbing and rooter provider based in San Jose, California. Known for its professional service and dedicated team of plumbing technicians, the Company offers a broad range of residential plumbing solutions, including repairs, installations, and maintenance. With a commitment to customer satisfaction and community involvement, MC Plumbing has established itself as a trusted name in the South Bay Area plumbing industry over the past three decades.

MC Plumbing will continue to further grow and operate under its recognized brand and reputation in the South Bay Area while leveraging The SEER Group’s operational and marketing resources to accelerate growth. MC Plumbing customers will continue to receive best-in-class plumbing services throughout the South Bay Area. Mike Counsil, President and Owner of MC Plumbing will remain as a leader and shareholder of the business.

“I am incredibly thrilled to be joining The SEER Group,” said Mike Counsil, “The values and culture of SEER perfectly match ours, which made this decision a no-brainer. This decision was one I put a lot of thought into as this Company and my team have been my passion for my entire career. This partnership with SEER continues the legacy of Mike Counsil Plumbing and ensures my team is taken care of for the future.”

Mike added, “Finding a business partner is an exhilarating yet arduous journey. Navigating the intricate negotiations, financial scrutiny, and emotional attachments can be overwhelming. Through this process, Meridian Capital emerged as an invaluable guiding light, orchestrating the process with unparalleled expertise, unwavering support, and an astute understanding of our unique journey.”

Brandon Leyert, Vice President at Meridian stated, “Mike Counsil and the MC Plumbing team have built an incredible company that is a leading provider in their South Bay Area markets. It was an honor to work with Mike, Sean, Patty, Lynn, and the entire MC Plumbing team, and we’re excited to see the Company’s continued growth with SEER as a partner for years to come.”

Meridian Capital served as the exclusive financial advisor to MC Plumbing on the transaction while M&A Counsel, Inc. and Stone Law Offices, Ltd. provided legal advisory services.

Industry Spotlight – AEC Services

Architecture, Engineering, and Construction Services Industry Trends

The Architecture, Engineering, and Construction (“AEC”) Services sector remains largely fragmented and is currently experiencing consolidation by select strategic and private equity-backed platforms. Expansion of service offerings and end market diversification are the primary drivers of M&A activity in this sector.

AEC Services Subsectors:

- Architecture Services

- Assessment & Permitting

- Construction Services

- Design Planning

- Engineering Services

- Environmental Services

- Geotechnical Services

- Geomatics, GIS, Mapping

- Land Surveying

- Testing & Inspection Services

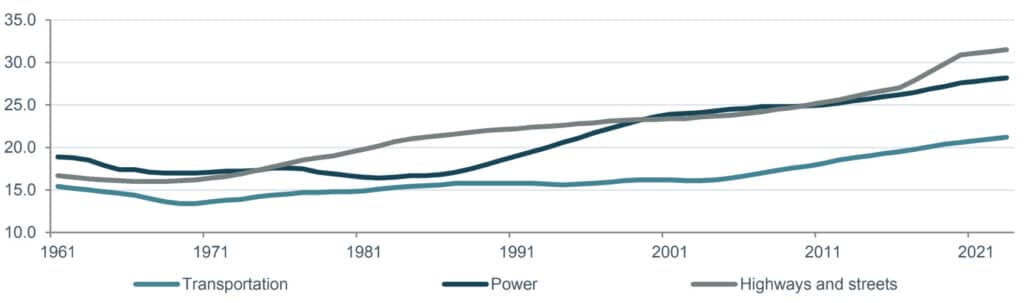

Average Age of Public and Government Structures

- The Construction and AEC Services industry is expected to receive over $2.2T of Federal funding over the next 5 – 7 years with an estimated additional $2T in unfunded investment needs for infrastructure improvements in the coming years.

- Increasing safety and compliance standards for building and construction projects have also created the need for additional testing and compliance capabilities that are natural add-on opportunities for established players and platforms looking to expand.

- The combination of fragmented industry dynamics, highly synergistic add-on opportunities, and expected sector tailwinds have led to increased M&A interest from private equity investors and large strategic platforms alike.

Source: ENR, U.S. Census Bureau, American Society of Civil Engineers, Company Press Releases, and Meridian Research

ENC&BP Middle Market Selected M&A Activity

Highlighted Residential & Commerical M&A Transaction

FirstService Acquires Roofing Corp of America

December 2023

Target Description: Roofing Corp of America is a platform created by Soundcore Capital Partners and Two Roads Partners that acquires roofing contractors across the United States.

Investment Rationale: As one of the largest commercial roofing enterprises in the United States, Roofing Corp of America is highly complementary to FirstService’s existing portfolio of market-leading essential property service brands, adding to its capabilities in property, repair, maintenance, and restoration.

Highlighted Engineering Services M&A Transaction

SAM Companies Acquires AXIS Geospatial

June 2023

Target Description: AXIS Geospatial is an aerial imaging and geospatial data company intended for civil engineering and land surveying.

Investment Rationale: To fortify its market position and stay ahead of industry consolidation, the SAM Companies, backed by Peak Rock Capital acquired AXIS, expanding its capabilities in geospatial civil engineering data collection.

Highlighted Building Products M&A Transaction

Armstrong World Industries Acquires BOK Modern

July 2023

Target Description: BOK Modern is an architectural metal systems manufacturer intended for interior and exteriors of commercial and residential properties.

Investment Rationale: This acquisition advances Armstrong World Industries’ portfolio of offerings to include niche manufacturing capabilities in the metal materials space. As we see AEC Services continue to be an active space for acquisition Armstrong makes a move into the building products side of this space.

Highlighted Architecture Services M&A Transaction

Grace Herbert Curtis Acquires BSSW Architects Inc

July 2023

Target Description: BSSW is a provider of architectural services intended for commercial and residential markets.

Investment Rationale: Grace Herbert Curtis Architects (GHC), backed by Bernhard Capital Partners, completed its third acquisition of 2023 by acquiring BSSW. This acquisition bolsters GHC’s goal of becoming one of the nation’s leading AEC services platforms focusing on architectural services.

Source: PitchBook, MergerMarket, Company Press Releases, Meridian Research

Public Company Valuations

AEC Services

| Company Name | Ticker | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|

| Quanta Services, Inc. | NYS: PWR | $29,080.2 | $33,031.1 | $19,514.9 | $1,846.9 | 1.7x | 17.9x | 9.5% | 39 % |

| WSP Global, Inc. | TSE: WSP | $17,367.2 | $20,469.8 | $10,572.7 | $1,454.1 | 1.9x | 14.1x | 13.8% | 9 % |

| Jacobs Solutions Inc | NYS: J | $16,476.7 | $19,807.2 | $16,352.4 | $1,435.8 | 1.2x | 13.8x | 8.8% | 10 % |

| Aecom Technology Corporation | NYS: ACM | $11,886.6 | $13,549.5 | $14,378.5 | $963.9 | 0.9x | 14.1x | 6.7% | 2 % |

| Stantec, Inc. | TSE: STN | $8,988.6 | $10,349.3 | $4,728.8 | $613.4 | 2.2x | 16.9x | 13.0% | 56 % |

| Tetra Tech, Inc. | NAS: TTEK | $8,625.6 | $9,546.1 | $4,522.6 | $481.1 | 2.1x | 19.8x | 10.6% | 11 % |

| Parsons Corporation | NYS: PSN | $6,833.5 | $7,700.0 | $5,051.6 | $435.0 | 1.5x | 17.7x | 8.6% | 55 % |

| Fluor Corporation | NYS: FLR | $6,251.1 | $5,348.1 | $15,364.0 | $343.0 | 0.3x | 15.6x | 2.2% | 6 % |

| Worley Limited | ASX: WOR | $5,434.0 | $6,629.5 | $7,612.9 | $554.6 | 0.9x | 12.0x | 7.3% | (5)% |

| Colliers International Group Inc. | TSE: CIGI | $5,344.3 | $8,376.0 | $4,322.4 | $599.3 | 1.9x | 14.0x | 13.9% | 11 % |

| MasTec, Inc. | NYS: MTZ | $5,225.2 | $8,637.7 | $11,724.2 | $258.5 | 0.7x | 33.4x | 2.2% | (28)% |

| Arcadis N.V. | AMS: ARCAD | $4,746.1 | $6,055.1 | $4,875.4 | $433.4 | 1.2x | 14.0x | 8.9% | 23 % |

| NV5 Global, Inc. | NAS: NVEE | $1,653.5 | $1,850.1 | $836.1 | $133.0 | 2.2x | 13.9x | 15.9% | (22)% |

| John Wood Group PLC | LON: WG. | $1,473.9 | $2,456.0 | $5,857.7 | $473.9 | 0.4x | 5.2x | 8.1% | 20 % |

| DMC Global Inc. | NAS: BOOM | $335.0 | $652.9 | $720.2 | $98.9 | 0.9x | 6.6x | 13.7% | (20)% |

| Median | $6,251.1 | $8,376.0 | $5,857.7 | $481.1 | 1.2x | 14.1x | 9 % | 10 % | |

| Average | $8,648.1 | $10,297.2 | $8,429.0 | $675.0 | 1.4x | 15.3x | 10 % | 11 % |

Residential & Commercial Services

| Company Name | Ticker | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|

| Trane Technologies plc | NYS: TT | $55,621.8 | $59,505.0 | $17,327.3 | $3,268.0 | 3.4x | 18.2x | 18.9% | 46 % |

| Carrier Global Corp | NYS: CARR | $49,454.1 | $55,120.1 | $22,101.0 | $3,039.0 | 2.5x | 18.1x | 13.8% | 31 % |

| Lennox International Inc | NYS: LII | $15,393.3 | $16,957.6 | $4,920.9 | $926.6 | 3.4x | 18.3x | 18.8% | 86 % |

| Comfort Systems USA, Inc. | NYS: FIX | $7,230.1 | $7,331.2 | $4,966.4 | $457.5 | 1.5x | 16.0x | 9.2% | 76 % |

| Mohawk Industries, Inc. | NYS: MHK | $6,352.9 | $8,860.0 | $11,173.5 | $1,138.1 | 0.8x | 7.8x | 10.2% | (10)% |

| SPX Corporation | NYS: SPXC | $4,469.0 | $5,042.0 | $1,701.1 | $220.0 | 3.0x | 22.9x | 12.9% | 40 % |

| Brink’s Incorporated | NYS: BCO | $3,640.6 | $6,517.4 | $4,819.9 | $802.3 | 1.4x | 8.1x | 16.6% | 31 % |

| Alarm.com Holdings, Inc. | NAS: ALRM | $3,056.8 | $2,935.6 | $863.6 | $147.3 | 3.4x | 19.9x | 17.1% | 20 % |

| Star Group, L.P. | NYS: SGU | $399.3 | $597.9 | $1,952.9 | $96.9 | 0.3x | 6.2x | 5.0% | (12)% |

| Solar Alliance Energy, Inc. | TSX: SOLR | $13.2 | $13.0 | $3.9 | ($1.2) | 3.3x | nm | -29.9% | (28)% |

| Sunworks, Inc. | NAS: SUNW | $11.3 | $15.3 | $154.9 | ($34.0) | 0.1x | nm | -22.0% | (90)% |

| Median | $4,469.0 | $6,517.4 | $4,819.9 | $457.5 | 2.5x | 18.1x | 13 % | 31 % | |

| Average | $13,240.2 | $14,808.6 | $6,362.3 | $914.6 | 2.1x | 15.1x | 6 % | 17 % |

Building Products & Materials

| Company Name | Ticker | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|

| Builders FirstSource, Inc. | NYS: BLDR | $20,305.3 | $24,131.6 | $17,304.0 | $2,910.7 | 1.4x | 8.3x | 16.8% | 137 % |

| Masco Corporation | NYS: MAS | $15,108.9 | $18,043.9 | $8,008.0 | $1,440.0 | 2.3x | 12.5x | 18.0% | 40 % |

| Owens-Corning Inc | NYS: OC | $13,131.3 | $15,071.3 | $9,658.0 | $2,255.0 | 1.6x | 6.7x | 23.3% | 70 % |

| Floor and Decor Outlets of America, Inc. | NYS: FND | $10,981.0 | $12,567.1 | $4,413.8 | $586.4 | 2.8x | 21.4x | 13.3% | 29 % |

| Trex Company, Inc. | NYS: TREX | $8,665.9 | $8,745.4 | $1,091.2 | $327.7 | 8.0x | 26.7x | 30.0% | 64 % |

| Simpson Manufacturing Company, Inc. | NYS: SSD | $7,729.3 | $7,773.7 | $2,187.7 | $580.6 | 3.6x | 13.4x | 26.5% | 89 % |

| UFP Industries, Inc. | NAS: UFPI | $7,060.2 | $6,488.0 | $7,607.7 | $857.1 | 0.9x | 7.6x | 11.3% | 36 % |

| Beacon Roofing Supply, Inc. | NAS: BECN | $5,324.9 | $8,276.7 | $8,789.7 | $891.4 | 0.9x | 9.3x | 10.1% | 58 % |

| Armstrong World Industries, Inc. | NYS: AWI | $4,324.4 | $4,905.2 | $1,287.4 | $424.0 | 3.8x | 11.6x | 32.9% | 34 % |

| Gibraltar Industries, Inc. | NAS: ROCK | $2,427.3 | $2,358.7 | $1,362.8 | $207.6 | 1.7x | 11.4x | 15.2% | 64 % |

| Quanex Building Products Corp | NYS: NX | $1,012.2 | $1,070.1 | $1,130.6 | $159.6 | 0.9x | 6.7x | 14.1% | 28 % |

| Median | $7,729.3 | $8,276.7 | $4,413.8 | $586.4 | 1.7x | 11.4x | 17 % | 58 % | |

| Average | $8,733.7 | $9,948.3 | $5,712.8 | $967.3 | 2.5x | 12.3x | 19 % | 59 % |

Heavy Construction

| Company Name | Ticker | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|

| EMCOR Group Inc. | NYS: EME | $10,302.3 | $10,214.7 | $12,093.5 | $895.5 | 0.8x | 11.4x | 7.4% | 52 % |

| Dycom Industries, Inc. | NYS: DY | $3,317.3 | $4,342.5 | $4,140.6 | $494.2 | 1.0x | 8.8x | 11.9% | 18 % |

| Sterling Infrastructure, Inc. | NAS: STRL | $2,405.4 | $2,416.4 | $1,934.9 | $241.1 | 1.2x | 10.0x | 12.5% | 148 % |

| MYR Group Inc. | NAS: MYRG | $2,374.4 | $2,438.0 | $3,503.7 | $192.0 | 0.7x | 12.7x | 5.5% | 49 % |

| Granite Construction Inc. | NYS: GVA | $2,007.8 | $1,993.5 | $3,364.7 | $244.9 | 0.6x | 8.1x | 7.3% | 16 % |

| Primoris Services Corporation | NYS: PRIM | $1,772.6 | $3,022.4 | $5,528.9 | $370.9 | 0.5x | 8.1x | 6.7% | 34 % |

| Aecon Group Inc | TSE: ARE | $630.9 | $573.2 | $3,540.9 | $86.2 | 0.2x | 6.6x | 2.4% | 31 % |

| Tutor Perini Corp. | NYS: TPC | $433.3 | $1,050.6 | $3,765.4 | ($129.2) | 0.3x | nm | -3.4% | (3)% |

| Matrix Service Co. | NAS: MTRX | $256.1 | $262.9 | $784.2 | ($19.3) | 0.3x | nm | -2.5% | 19 % |

| Orion Group Holdings, Inc. | NYS: ORN | $178.1 | $299.5 | $706.4 | $12.2 | 0.4x | 24.6x | 1.7% | 84 % |

| Median | $1,890.2 | $2,205.0 | $3,522.3 | $216.6 | 0.6x | 9.4x | 6 % | 32 % | |

| Average | $2,367.8 | $2,661.4 | $3,936.3 | $238.9 | 0.6x | 11.3x | 5 % | 45 % |

As of January 18, 2023

Select ENC&BP M&A Transactions

AEC Services

| Date | Target | Acquirer | Description |

|---|---|---|---|

| Jan-24 | MOREgroup | Wind Point Partners | Provider of architecture and engineering consulting |

| Jan-24 | Barr GeoSpatial Solutions | PNC Riverarch | Provider of geospatial services for critical infrastructure |

| Jan-24 | Flatwoods Consulting | Verdantas (Round Table Equity) | Provider of environmental planning, permitting, other services |

| Jan-24 | Bridge & Stream Engineering | LJB | Provider of water resource engineering services |

| Dec-23 | GRP Engineering Inc | Verdantas LLC | Provider of electrical engineering and utility consulting services |

| Dec-23 | Environmental Mgmt & Planning Solutions | AECOM | Provider of environmental consulting services |

| Dec-23 | BSSW Architects Inc. | Grace Herbert Curtis | Provider of architectural services |

| Nov-23 | Westland Resources | Ardian Capital | Provider of environmental planning and consulting services |

| Nov-23 | Environmental Consulting & Design | Barge Design Solutions | Provider of environmental / land planning and geospatial services |

| Nov-23 | High Mesa Consulting Group | Bowman Consulting | Provider of civil engineering services |

| Nov-23 | JL Architects | PM Design | Provider of architectural services |

| Nov-23 | Watcon Consulting | RTC Partners | Provider of civil engineering services |

| Nov-23 | Arredondo | Ardurra Group | Provider of civil engineering services |

| Nov-23 | Davis Brody Bond | Page | Provider of architectural services |

| Nov-23 | Pfeiler Associates | Psomas | Provider of surveying services |

| Nov-23 | Wellston Associates Land Surveyors | SAM Companies | Provider of aerial imaging and geospatial surveying |

| Nov-23 | Hahnfeld Hoffer & Stanford | Grace Herbert Curtis | Provider of architectural services |

| Oct-23 | Makovich & Pusti Architects | CPL Team | Provider of architectural services |

| Oct-23 | Inwood Consulting Engineers | Ardurra Group | Provider of engineering consultancy services |

| Oct-23 | Excellence Engineering | Bowman Consulting | Provider of engineering design and construction |

Residential & Commercial Services

| Date | Target | Acquirer | Description |

|---|---|---|---|

| Dec-23 | McCurdy-Walden | Core Roofing Systems (Shoreline Equity Partners) | Provider of commercial roofing services |

| Dec-23 | Royalty Roofing | Six Pillars Partners | Provider of commercial and residential roofing services |

| Dec-23 | Pink’s Windows Services | ResiBrands | Provider of home and commercial exterior windows |

| Dec-23 | S&H Building Material | Beacon Roofing Supply (NAS: BECN) | Provider of roofing, siding, railing, and windows |

| Dec-23 | Upstate Roofing & Painting | Roofed Right America (Great Range Capital) | Provider of commercial reroofing, painting, and repair |

| Dec-23 | SMC Roofing Solutions | Saw Mill Capital | Provider of re-roofing and exterior services solutions |

| Nov-23 | OnTime Service | USA Hometown Experts (MSouth Equity Partners) | HVAC services provider based in Hoover, Alabama |

| Nov-23 | C&C Service | Crete Mechanical Group (PNC Erieview Capital) | HVAC services provider based in Stamford, CT |

| Nov-23 | Kennon Heating & Air Conditioning | HomeTown Services (CenterOak Partners) | HVAC services provider based in Cumming, Georgia |

| Nov-23 | Suntuity Renewables | Beard Energy Transition Acquistion (NYS:BRD) | Designer and manufacturer of solar panels |

| Nov-23 | Allphase Restoration | HighGroud (Trivest Partners) | Provider of restoration and roofing services |

| Nov-23 | Patriot Services | Leap Service Partners (Concentric Equity Partners) | Provider of plumbing and HVAC services |

| Nov-23 | Multi Mechanical | AMPAM Parks Mechanical (Gemspring Capital) | HVAC services provider for multifamily homes |

| Nov-23 | Triangle Heating | Sila Services (Morgan Stanley) | Central Pennsylvania-based HVAC services company |

| Nov-23 | Rocky Mountain Custom Landscapes | Mariani Enterprises (CI Capital Partners | Provider of residential and commercial landscaping |

| Nov-23 | MC Plumbing | SEER Group | Provider of plumbing services |

| Sep-23 | Roofing Corp of America | FirstService (TSE: FSV) | Provider of roofing services across the United States |

| Sep-23 | Project Hyperion | Altus Power (NYS: AMPS) | Provider of solar energy services in Seattle, Washington |

| Sep-23 | Unico Solar Investors | Altus Power (NYS: AMPS) | Provider of solar energy services in South Carolina |

| Sep-23 | Tree Amigos Outdoor Services | Ruppert Landscape (Knox Lane) | Provider of residential landscaping services |

| Aug-23 | Noland’s Roofing | Dunes Point Capital | Provider of re-roofing and building exterior services |

Building Products & Materials

| Date | Target | Acquirer | Description |

|---|---|---|---|

| Dec-23 | Kamco Supply | Gypsum Management & Supply (NYS: GMS) | Supplier of commercial and residential building materials |

| Dec-23 | Eastern Architectural Systems | Clayton, Dubliner, & Rice (Cornerstone) | Manufacturer of building products based in Florida |

| Dec-23 | Distributor Service | Hood Industries | Manufacturer of architectural wood and building products |

| Dec-23 | Trimco Millwork | Woodgrain Millwork | Distributor of molding, exterior doors, and building products |

| Dec-23 | PGT Innovations (NYS: PGTI) | Masonite (NYS: DOOR) | Manufacturer of impact-resistant windows and doors |

| Dec-23 | Component Manufacturing | Mead Lumber | Manufacturer of wooden trusses |

| Dec-23 | Holderness Supplies | US LBM Holdings (Bain Capital) | Manufacturer and supplier of roof truss and lumber products |

| Nov-23 | Harwood Rubber Products | M7 Holdings | Manufacturer of industrial rubber building materials |

| Dec-23 | Ideal Steel | Ambassador Supply | Manufacturer of pre-engineered metal building products |

| Nov-23 | Rock Materials | AustralianSuper (Berkshire Partners) | Supplier of stone and rock building products |

| Nov-23 | Corpus Cristi Sand & Gravel | Jarco Aggregates | Manufacturer of aggregate building materials |

| Nov-23 | Westland Distributing | Style Crest | Distributor of manufactured housing supplies |

| Nov-23 | Contractors Building Supply | The Building Centre | Provider of building products |

| Oct-23 | Big Lake Lumber | Star Equity Holdings (NAS: STRR) | Supplier of building products like windows and siding |

| Oct-23 | Manning Building Supplies | US LBM Holdings (Bain Capital) | Manufacturer of building materials and wooden trusses |

| Oct-23 | A&D Supply | Foundation Building Materials (American Securities) | Manufacturer of commercial building products |

| Oct-23 | Brockway-Smith | Boise Cascade (NYS: BCC) | Distributor of building materials, doors, and windows |

| Oct-23 | Hadlock Building Supply | Henery Hardware | Retailer of hardware supplies in Washington |

| Sep-23 | City Lumber | Spahn & Rose Lumber | Manufacturer of building products and lumber products |

| Aug-23 | Stone Truss | West Coast Lumber (Building Industry Partners) | Manufacturer and provider of roof and floor truss systems |

Heavy Construction

| Date | Target | Acquirer | Description |

|---|---|---|---|

| Jan-24 | Albert Frei & Sons | Martin Marietta Materials (NYSE: MLM) | Producer of aggregates based in Colorado |

| Dec-23 | Penhall Company | H.I.G Capital | Provider of concrete construction services |

| Dec-23 | Waupaca Foundry | Monomy Capital Partners | Manufacturer of cast and machined iron casting |

| Dec-23 | US Steel (NYS: X) | Nippon Steel (TKS: 5401) | Steel manufacturer based in Pittsburgh, PA |

| Dec-23 | Epiroc | STANLEY Infrastructure | Manufacturer of excavators and hydraulic tools |

| Dec-23 | Culy Contracting | Aegion | Provider of construction contracting and pipe infrastructure |

| Dec-23 | Dynetek Solutions | Thayer Power (Calera Capital) | Provider of horizontal directional drilling services |

| Dec-23 | Lehman-Roberts Company | Granite Construction (NYS: GVA) | Operator of a large-scale roadway asphalt paving company |

| Dec-23 | Memphis Stone & Gravel | Granite Construction (NYS: GVA) | Provider of stone, gravel, and aggregates |

| Nov-23 | Advanced Infrastructure Technologies | C Change Group | Supplier of advanced composite materials and infrastructure |

| Nov-23 | United Fiberglass of America | Hill & Smith | Manufacturer of industrial plastic products |

| Nov-23 | Grace Pacific | Nan, Inc | Provider of construction and asphalt paving contracting |

| Nov-23 | Critica Infrastructure | Henkel (ETN: HEN3) | Manufacturer of infrastructure construction and repair |

| Oct-23 | Authentic Drilling | Kalbot Holding Company | Provider of drilling services |

| Oct-23 | Dennis Corp | Bowman Consulting (NAS: BWMN) | Provider of engineering and management services |

| Oct-23 | Woodland Tilt-Up | Turnerbrothers | Provider of construction contracting services |

| Oct-23 | TowerNorth | Berkshire Partners | Provider of telecommunication infrastructure services |

| Sep-23 | PRO-DIG | Quick Attach (Dominus Capital) | Manufacturer of drilling and piling equipment |

| Sep-23 | Ditesco | Barings | Provider of engineering and construction services |

| Sep-23 | Kleinfelder | Lindsay Goldberg | Operator of a full-service construction consultancy |

| Aug-23 | Bigham Cable Construction | Dycom Industries (NYS: DY) | Provider of telecommunications construction services |

Source: PitchBook, MergerMarket, Company Press Releases, Meridian Research