Engineering, Construction & Building Products M&A Trends: Summer 2024

Published July 16, 2024

Key Insights

- Continued Momentum in Backlog and M&A Activity, 2024 Confidence Remains High

- Modular Construction Reshaping Efficiency & Building Products Consolidation

- ENC&BP M&A Commentary

- Industry Spotlight – Construction TIC

- Select M&A Activity

Architecture, engineering, and consulting (“AEC”) firms continue to bolster themselves via M&A, driven mostly by a focus on geographical expansion and an expansion of firm portfolio offerings.

ENC&BP Market Insights

Continued Momentum in Backlog and M&A Activity, 2024 Confidence Remains High

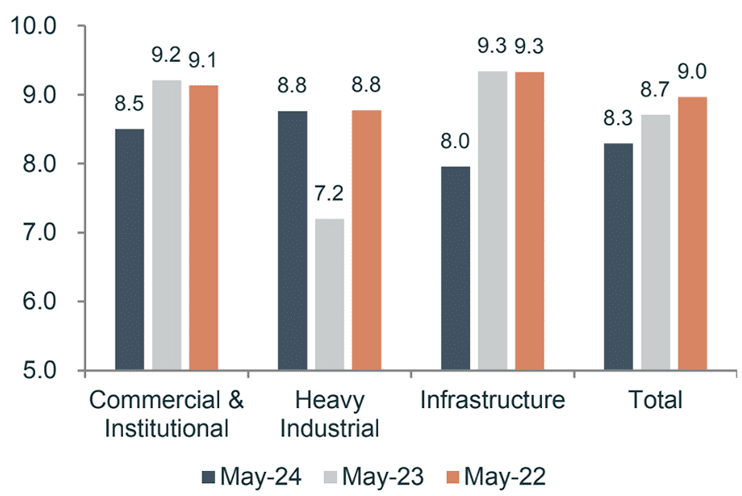

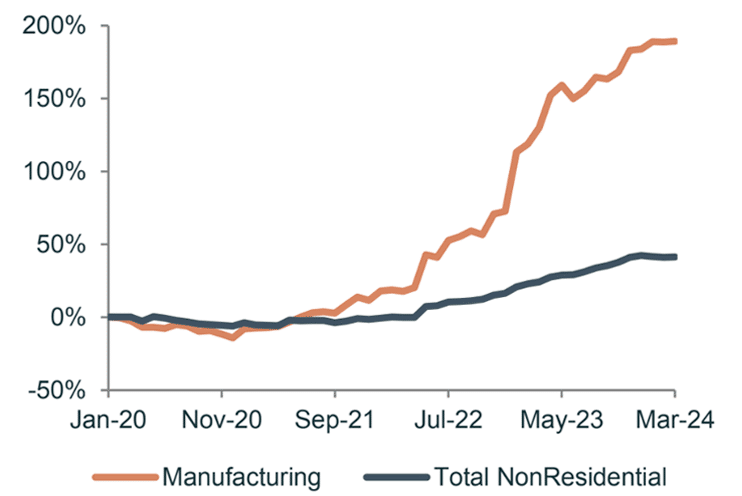

- The nonresidential sector of U.S. engineering and construction is expected to maintain its robust growth trajectory in 2024, with nonbuilding structures leading the surge. Overall spending is projected to increase by 5%, following a 7% rise in 2023.

- Momentum continues to build in anticipation of significant growth investment from both public and private funding across key end-markets, such as data centers, semiconductor manufacturing facilities, public safety, highways and roads, healthcare, and waste treatment / disposal.

- Projections indicate that each industrial and public segment will experience a 10% minimum increase in investment compared to 2023, driven by overall confidence in backlog.

- Construction materials prices dipped 0.9% in May, the first decrease in 2024 due to declining energy prices and slowing inflation. Overall, materials costs remain elevated when compared to 2023.

- The U.S. semiconductor sector leads the world with 48% of chip use and related sales but represents only 6% of global manufacturing capacity. With over $100B of committed funding in the Southwest alone, the U.S. plans to expeditiously gain market share and narrow the manufacturing capacity gap.

Construction Backlog Indicator by Industry (Months)

Cumulative % Change in Annualized Monthly Spend

Modular Construction Reshaping Efficiency & Building Products Consolidation

- Demand for prefab and modular construction continues to grow rapidly due to the speed and efficiency provided to customers.

- Prefab and modular methods build 60-90% of individual structures in off-site factories, leading to faster completion times, lower costs, and less waste. This trend is expected to address housing shortages and benefit other sectors such as healthcare, hospitality, and K-12 education.

- The construction industry is embracing a new wave of eco-friendly building methods, leading to a surge in advanced materials. Innovations like 3D-printed concrete and graphene offer superior strength, reduced environmental impact, and improved energy efficiency in buildings.

- Building products companies expect to see an increase in M&A activity in the 2H of 2024, as acquirers look to resume their geographic and market expansion following macroeconomic headwinds in 2023.

- Key building products platforms leading consolidation in 2024 include Builders FirstSource, Kodiak Building Partners, US LBM, and ABC Supply Co.

Source: Association of General Contractors, Engineering News Record (“ENR”), Construction Dive, Dodge Construction Network, BD+C Network, OpenAsset, BDC Network, PitchBook Data, Mergermarket, Company Press Releases, and Meridian Research

ENC&BP Middle Market M&A Activity and Trends

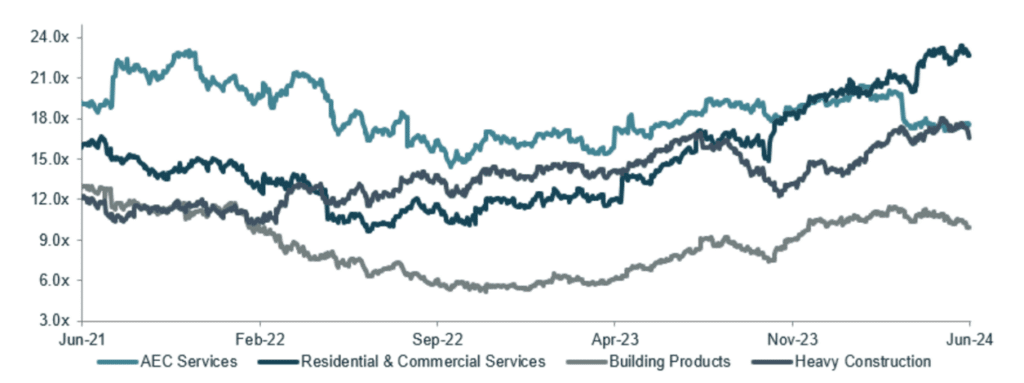

Public Market Valuations (EV/EBITDA)

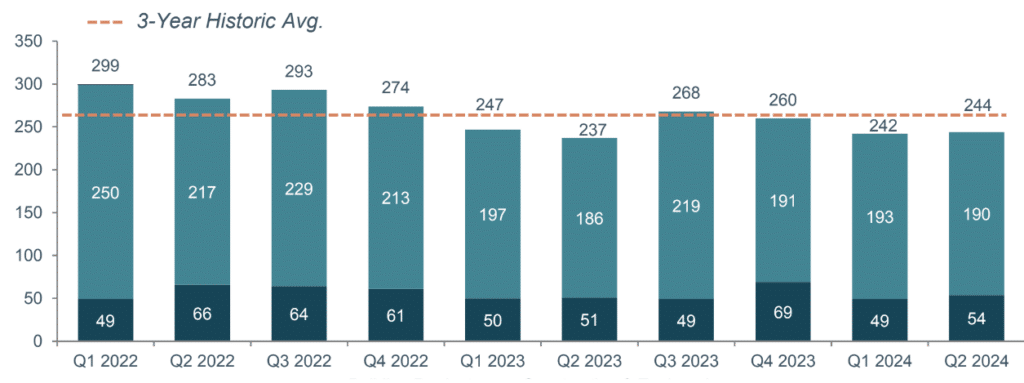

U.S. ENC&BP M&A Activity

ENC&BP M&A Commentary

- Architecture, engineering, and consulting (“AEC”) firms continue to bolster themselves via M&A, driven mostly by a focus on geographical expansion and an expansion of firm portfolio offerings.

- The largest strategic and PE-backed strategic AEC firms continue to lead consolidation in the industry. The top nine firms made over 60+ acquisitions in 2023 alone, making up approximately 10% of all M&A activity in the AEC space for 2023.

- The civil infrastructure sector continues to see significant momentum and is expected to see increased M&A activity in the back half of 2024, as investors continue to position themselves to capture the tail winds, through M&A, from the IIJA, CHIPS, and other state and local funding bills.

- Multiple hallmark deals occurred in the building products sector in the 1H of 2024. In January, MITER acquired PGT Innovations at a 60% premium to its stock price, and a month later, Owens Corning acquired Masonite at a 38% premium to its stock price.

Source: U.S Census Bureau, FRED, PitchBook Data, ProBuilder, MergerMarket, Company Press Releases, and Meridian Research

Industry Spotlight – Construction TIC

Construction Testing, Inspection, and Consulting Industry Trends

The Construction Testing, Inspection,

and Consulting industry continues to

see rapid, ongoing consolidation as

financial and strategic buyers seek to

expand turnkey service offerings,

broaden geographic reach, and

diversify core end-markets ranging

from transportation and infrastructure

to healthcare and education.

Construction TIC Solutions

- Non-Destructive Materials Testing

- Construction Materials Laboratories

- Construction QA/QC Inspection

- Validation and Certification

- Lifecycle Analysis & Project Monitoring

- Mechanical Testing & Inspection

- Construction Testing and Inspection services are pivotal to ensure each step of the construction process, from materials to installation, meet the highest quality standards while adhering to regulatory requirements.

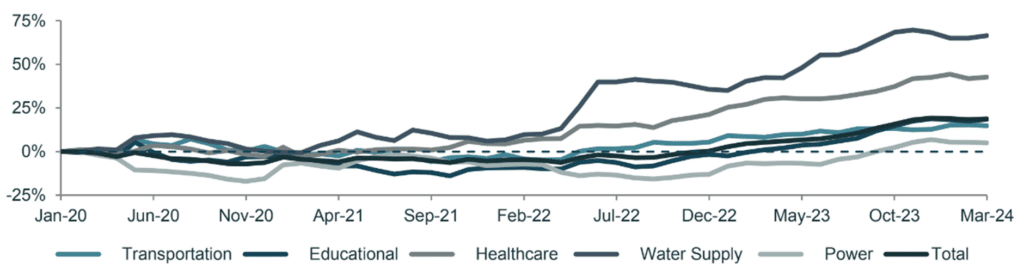

Cumulative % Change in Annualized Monthly Spend by TIC End-Markets

- Construction companies are driving steady increases in demand for critical, non-discretionary TIC services in 2024, with particular focuses on materials testing, quality assurance inspection, and project monitoring service.

- Investments in infrastructure, transportation, healthcare, education, and renewable energy are hitting new highs, driving robust M&A activity as investors seek market share and expand service portfolios.

Notable Platforms

# of Acquisitions: 45+

# of Acquisitions: 36+

# of Acquisitions: 13+–

# of Acquisitions: 14+

# of Acquisitions: 19+

# of Acquisitions: 15+

Source: ENR, U.S. Census Bureau, Mordor Intelligence, American Society of Civil Engineers, Company Press Releases, and Meridian Research

ENC&BP Select M&A Activity

SRS Distribution Acquired by The Home Depot (NYS: HD)

Jun. 2024

$18.3B

Enterprise Value

16.1x

EV / EBITDA

The Home Depot, the largest home improvement specialty retailer, acquired SRS Distribution, a distributor of building products primarily for residential construction contractors.

The acquisition will expand The Home Depot’s penetration of professional and commercial customer segments and increase its capabilities to serve complex projects within the renovation and remodel sector.

Masonite (NYS: DOOR) Acquired by Owens Corning (NYS: OC)

May 2024

$3.9B

Enterprise Value

8.6x

EV / EBITDA

Owens Corning, a manufacturer and distributor of roofing and insulation products, acquired Masonite, a manufacturer of interior and exterior doors.

The acquisition expands Owens Corning’s product portfolio of branded high-value building products and offers significant cross selling opportunities. The deal signals a continued M&A focus outside of the Company’s core catalog of roofing and insulation products.

Surdex Corporation Acquired by Bowman Consulting Group (NAS: BWMN)

Apr. 2024

$44M

Enterprise Value

NA

EV / EBITDA

Bowman Consulting Group, a national engineering services firm acquired Surdex, a geospatial and engineering services firm providing digital orthoimagery, advanced high-resolution LiDAR, intelligent digital mapping, 3D hydrography, and disaster mapping.

The acquisition expands adds state-of-the-art, high-altitude services to Bowman’s extensive array of terrestrial and low-altitude capabilities.

J&S Mechanical Contractors Acquired by Comfort Systems USA (NYSE: FIX)

Feb. 2024

$121M

Enterprise Value

~8x+

EV / EBITDA

Comfort Systems USA, a leading provider of commercial and industrial HVAC, plumbing, and electrical services, acquired J&S Mechanical, a provider of mechanical construction services across the Mountain West.

The acquisition will deepen Comfort System USA’s geographic footprint throughout Utah and Nevada and expand the Company’s commercial and industrial technical service capabilities.

Source: PitchBook, MergerMarket, Company Press Releases, Meridian Research

Public Company Valuations

AEC Services

| Company Name | Ticker | Market Cap | EV | LTM Rev | LTM EBITDA | EV / LTM Rev | EV / LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|

| Quanta Services, Inc. | NYS: PWR | $37,195.8 | $40,681.9 | $21,485.2 | $2,002.1 | 1.9x | 20.3x | 9.3% | 29 % |

| WSP Global, Inc. | TSE: WSP | $19,388.6 | $22,314.9 | $10,770.1 | $2,632.1 | 2.1x | 8.5x | 24.4% | 18 % |

| Jacobs Solutions Inc | NYS: J | $17,493.5 | $20,893.6 | $16,903.7 | $1,403.3 | 1.2x | 14.9x | 8.3% | 18 % |

| Aecom Technology Corporation | NYS: ACM | $11,998.3 | $13,709.5 | $15,349.7 | $1,018.4 | 0.9x | 13.5x | 6.6% | 4 % |

| Tetra Tech, Inc. | NAS: TTEK | $10,939.1 | $11,890.1 | $4,949.4 | $504.9 | 2.4x | 23.6x | 10.2% | 25 % |

| Stantec, Inc. | TSE: STN | $9,535.9 | $10,971.6 | $4,937.0 | $640.2 | 2.2x | 17.1x | 13.0% | 28 % |

| Parsons Corporation | NYS: PSN | $8,692.0 | $9,770.5 | $5,805.0 | $503.6 | 1.7x | 19.4x | 8.7% | 70 % |

| MasTec, Inc. | NYS: MTZ | $8,501.3 | $11,421.4 | $12,098.1 | $644.4 | 0.9x | 17.7x | 5.3% | (9)% |

| Fluor Corporation | NYS: FLR | $7,455.3 | $6,288.3 | $15,456.0 | $547.0 | 0.4x | 11.5x | 3.5% | 47 % |

| Colliers International Group Inc. | TSE: CIGI | $5,749.2 | $8,466.6 | $4,371.2 | $599.1 | 1.9x | 14.1x | 13.7% | 14 % |

| Arcadis N.V. | AMS: ARCAD | $5,698.8 | $6,682.9 | $5,414.0 | $527.8 | 1.2x | 12.7x | 9.7% | 52 % |

| Worley Limited | ASX: WOR | $5,256.2 | $6,304.8 | $7,965.6 | $579.4 | 0.8x | 10.9x | 7.3% | (5)% |

| John Wood Group | LON: WG. | $1,792.5 | $2,941.6 | $5,900.7 | $412.5 | 0.5x | 7.1x | 7.0% | 53 % |

| NV5 Global, Inc. | NAS: NVEE | $1,501.1 | $1,717.5 | $890.7 | $138.9 | 1.9x | 12.4x | 15.6% | (16)% |

| DMC Global Inc. | NAS: BOOM | $289.0 | $543.6 | $701.7 | $92.7 | 0.8x | 5.9x | 13.2% | (19)% |

| Median | $8,501.3 | $9,770.5 | $5,900.7 | $579.4 | 1.2x | 13.5x | 9 % | 18 % | |

| Average | $10,099.1 | $11,639.9 | $8,866.5 | $816.4 | 1.4x | 14.0x | 10 % | 21 % |

Residential & Commercial Services

| Company Name | Ticker | Market Cap | EV | LTM Rev | LTM EBITDA | EV / LTM Rev | EV / LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|

| Trane Technologies | NYS: TT | $74,454.1 | $78,506.1 | $18,227.2 | $3,558.5 | 4.3x | 22.1x | 19.5% | 72 % |

| Carrier Global Corp | NYS: CARR | $56,835.9 | $73,267.9 | $23,007.0 | $3,736.0 | 3.2x | 19.6x | 16.2% | 27 % |

| Lennox International Inc | NYS: LII | $19,057.1 | $20,656.7 | $4,979.6 | $1,020.0 | 4.1x | 20.3x | 20.5% | 64 % |

| Comfort Systems USA, Inc. | NYS: FIX | $10,863.7 | $11,062.6 | $5,569.1 | $578.5 | 2.0x | 19.1x | 10.4% | 85 % |

| Mohawk Industries, Inc. | NYS: MHK | $7,254.2 | $9,658.7 | $11,008.3 | $1,426.4 | 0.9x | 6.8x | 13.0% | 10 % |

| SPX Corporation | NYS: SPXC | $6,571.2 | $7,325.1 | $1,806.6 | $312.8 | 4.1x | 23.4x | 17.3% | 67 % |

| Brink’s Incorporated | NYS: BCO | $4,552.9 | $7,406.4 | $4,925.3 | $894.9 | 1.5x | 8.3x | 18.2% | 51 % |

| Alarm.com Holdings, Inc. | NAS: ALRM | $3,189.0 | $3,006.1 | $895.2 | $160.4 | 3.4x | 18.7x | 17.9% | 23 % |

| Star Group, L.P. | NYS: SGU | $374.9 | $620.4 | $1,761.2 | $136.9 | 0.4x | 4.5x | 7.8% | (22)% |

| Solar Alliance Energy, Inc. | TSX: SOLR | $10.2 | $10.4 | $6.1 | ($0.1) | 1.7x | nm | -1.8% | (31)% |

| Median | $6,912.7 | $8,532.6 | $4,952.5 | $736.7 | 2.6x | 19.1x | 17 % | 39 % | |

| Average | $18,316.3 | $21,152.0 | $7,218.6 | $1,182.4 | 2.5x | 15.9x | 14 % | 35 % |

Building Products & Materials

| Company Name | Ticker | Market Cap | EV | LTM Rev | LTM EBITDA | EV / LTM Rev | EV / LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|

| Builders FirstSource, Inc. | NYS: BLDR | $16,893.9 | $20,442.6 | $17,105.4 | $2,268.1 | 1.2x | 9.0x | 13.3% | 2 % |

| Owens-Corning Inc | NYS: OC | $15,054.0 | $17,152.0 | $9,646.0 | $2,391.0 | 1.8x | 7.2x | 24.8% | 33 % |

| Masco Corporation | NYS: MAS | $14,683.7 | $17,796.7 | $7,914.0 | $1,412.0 | 2.2x | 12.6x | 17.8% | 16 % |

| Floor and Decor Outlets of America, Inc. | NYS: FND | $10,778.2 | $12,384.7 | $4,389.1 | $524.5 | 2.8x | 23.6x | 12.0% | (4)% |

| Trex Company, Inc. | NYS: TREX | $8,056.3 | $8,301.5 | $1,229.8 | $407.3 | 6.8x | 20.4x | 33.1% | 13 % |

| Simpson Manufacturing Company, Inc. | NYS: SSD | $7,238.9 | $7,397.8 | $2,210.0 | $563.6 | 3.3x | 13.1x | 25.5% | 22 % |

| UFP Industries, Inc. | NAS: UFPI | $6,916.4 | $6,357.3 | $7,034.9 | $788.3 | 0.9x | 8.1x | 11.2% | 15 % |

| Beacon Roofing Supply, Inc. | NAS: BECN | $5,755.7 | $8,903.5 | $9,299.9 | $919.7 | 1.0x | 9.7x | 9.9% | 9 % |

| Armstrong World Industries, Inc. | NYS: AWI | $4,955.2 | $5,523.8 | $1,311.3 | $445.0 | 4.2x | 12.4x | 33.9% | 54 % |

| Gibraltar Industries, Inc. | NAS: ROCK | $2,088.7 | $1,975.8 | $1,377.0 | $213.5 | 1.4x | 9.3x | 15.5% | 9 % |

| Quanex Building Products Corp | NYS: NX | $915.6 | $980.0 | $1,100.5 | $158.5 | 0.9x | 6.2x | 14.4% | 3 % |

| Median | $7,238.9 | $8,301.5 | $4,389.1 | $563.6 | 1.8x | 9.7x | 16 % | 13 % | |

| Average | $8,485.2 | $9,746.9 | $5,692.5 | $917.4 | 2.4x | 12.0x | 19 % | 16 % |

Heavy Construction

| Company Name | Ticker | Market Cap | EV | LTM Rev | LTM EBITDA | EV / LTM Rev | EV / LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|

| EMCOR Group Inc. | NYS: EME | $17,182.5 | $16,688.3 | $13,124.7 | $1,118.8 | 1.3x | 14.9x | 8.5% | 98 % |

| Dycom Industries, Inc. | NYS: DY | $4,909.8 | $5,823.5 | $4,272.5 | $522.2 | 1.4x | 11.2x | 12.2% | 48 % |

| Sterling Infrastructure, Inc. | NAS: STRL | $3,652.4 | $3,570.1 | $2,009.0 | $269.5 | 1.8x | 13.2x | 13.4% | 112 % |

| Granite Construction Inc. | NYS: GVA | $2,736.0 | $2,922.5 | $3,621.3 | $291.9 | 0.8x | 10.0x | 8.1% | 56 % |

| Primoris Services Corporation | NYS: PRIM | $2,676.1 | $3,838.0 | $5,871.1 | $400.3 | 0.7x | 9.6x | 6.8% | 64 % |

| MYR Group Inc. | NAS: MYRG | $2,275.2 | $2,349.8 | $3,647.9 | $190.5 | 0.6x | 12.3x | 5.2% | (2)% |

| Tutor Perini Corp. | NYS: TPC | $1,138.7 | $1,577.8 | $4,152.9 | $93.2 | 0.4x | 16.9x | 2.2% | 205 % |

| Aecon Group Inc. | TSE: ARE | $771.7 | $614.9 | $3,248.4 | $70.4 | 0.2x | 8.7x | 2.2% | 33 % |

| Orion Group Holdings, Inc. | NYS: ORN | $312.5 | $422.7 | $713.3 | $32.0 | 0.6x | 13.2x | 4.5% | 238 % |

| Matrix Service Co. | NAS: MTRX | $271.2 | $223.1 | $744.6 | ($8.0) | 0.3x | nm | -1.1% | 69 % |

| Median | $2,475.7 | $2,636.2 | $3,634.6 | $230.0 | 0.6x | 12.3x | 6 % | 66 % | |

| Average | $3,592.6 | $3,803.1 | $4,140.6 | $298.1 | 0.8x | 12.2x | 6 % | 92 % |

(US$ in millions)

As of June 30, 2024

Source: PitchBook, MergerMarket, Company Press Releases, Meridian Research

Select ENC&BP M&A Transactions

Building Products & Materials

| Date | Target | Acquirer | Description | HQ |

|---|---|---|---|---|

| Jun-24 | Carter Concrete Products | Alcrete Industries | Provider of concrete building materials and products | Boaz, KY |

| Jun-24 | ELM Home & Building Solutions | Great Day Improvements (Littlejohn & Co.) | Provider of home improvement materials | East Brunswick, NJ |

| Jun-24 | Saeman Lumber | Zuern Building Products | Provider of construction building products and materials | Cross Plains, WI |

| Jun-24 | Rebar Solutions | HD Supply (Clayton, Dubilier & Rice) | Provider of steel rebar products | Mount Crawford, VA |

| Jun-24 | Truss Systems Hawaii | HPMHawaii.com | Provider of wooden, metal, and structural trusses | Puunene, HI |

| Jun-24 | Trachte | nVent Electric (NYS: NVT) | Provider of modularized metal buildings | Oregon, WI |

| Jun-24 | Rock Ridge Materials | Miles Ahead Brands | Manufacturer of commercial construction materials | Titusville, FL |

| Jun-24 | Hardscape (Florida) | SiteOne Landscape Supply (NYS: SITE) | Manufacturer of porcelain pavers | Boca Raton, FL |

| Jun-24 | Krieger Specialty Products | Allegion (NYS: ALLE) | Manufacturer of custom doors and windows | Pico Rivera, CA |

| Jun-24 | Raks Building Supply | US LBM | Provider of manufactured building components | Los Lunas, NM |

| Jun-24 | NVO Construction Components | Truckee-Tahoe Lumber | Manufacture of floor and roof trusses | Reno, NV |

| Jun-24 | Dayton Superior | White Cap (CDR) | Manufacturer and distributor of metal accessories | Miamisburg, OH |

| May-24 | Better Built Truss | US LBM | Manufacturer of trusses and roofing supports | Ripon, CA |

| Apr-24 | 3form | Armstrong World Industries | Designer and manufacturer of architectural resins | Salt Lake City, UT |

| Apr-24 | Fence & Deck Direct | Decks & Docks | Provider of outdoor residential building products | Halethorpe, MD |

| Apr-24 | Excelsior Lumber | Decks & Docks | Distributor of outdoor building products | Newark, NJ |

| Apr-24 | Willow Creek | Outdoor Living Supply (Trilantic) | Landscaping materials firm | Rome, GA |

| Apr-24 | Sandwich Materials | Dunaway Brothers Inc. | Manufacturer of custom windows and doors | Sugar Grove, IL |

| Mar-24 | Harvey Building Products | Cornerstone Building Brands (CD&R) | Building products manufacturer | Waltham, MA |

| Mar-24 | Homestead Building Systems | US LBM | Specialty building products distributor | New Holland, PA |

Heavy Construction

| Date | Target | Acquirer | Description | HQ |

|---|---|---|---|---|

| Jun-24 | Laux Construction | Rival Holdings | Provider of general contracting services | Mason, MI |

| Jun-24 | Bigfork Rentals | Kinderhook Industries | Provider of heavy equipment and machinery rentals | Bigfork, MT |

| Jun-24 | EagleLIFT | Cortec Group | Provider of foundation repair and construction | Rancho Cucamonga, CA |

| Jun-24 | The Birch Co | ATWEC Technologies | Provider of general construction services | Tulsa, OK |

| Jun-24 | Visionary Homes | Misawa Homes Company | Provider of home building and construction services | Logan, UT |

| Jun-24 | Nello Industries | Main Street Capital (NYS: MAIN) | Manufacturer of galvanized steel towers | South Bend, IN |

| Jun-24 | Newport Construction | Vinci (PAR: DG) | Provider of heavy highway civil construction services | Nashua, NH |

| Jun-24 | Evans Design and Build | Home Love Construction | Provider of general construction services | Clearwater, FL |

| Jun-24 | Hudson Paving | Construction Partners (NAS: ROAD) | Provider of asphalt repair and laying services | Rockingham, NC |

| Jun-24 | American Civil Constructors | Orion Group Holdings (NYS: ORN) | Provider of civil construction services | Littleton, CO |

| Jun-24 | Lupini Construction | Valcourt Group | Provider of construction and restoration services | Utica, NY |

| May-24 | St. Laurent and Son Excavation | Gendron and Gendron | Provider of general construction services | Lewiston, ME |

| May-24 | Southland Engineering | Goodwyn Mills Cawood | Provider of general construction services | Cartersville, GA |

| May-24 | Baker Constructors | C.W. Matthews Contracting | Provider of general construction services | Pooler, GA |

| May-24 | The CGC Group Florida | Stellargc | Provider of construction management services | Sarasota, FL |

| May-24 | Brother’s Construction | Nabholz | Provider of general construction services | Van Buren, AR |

| May-24 | Subfloor Systems | Kent Companies | Provider of subfloor construction services | Bedford, TX |

| May-24 | Utility Services Group | Blue Marlin Partners | Provider of underground infrastructure construction | Camp Hill PA |

| Apr-24 | Lewistown Rental | H&E Equipment Services | Provider of rental heavy machinery | Lewistown, MT |

| Apr-24 | Eggemeyer Land Clearing | SiteOne Landscape Supply (NYS: SITE) | Provider of large-scale land clearing services | New Braunfels, TX |

AEC Services

| Date | Target | Acquirer | Description | HQ |

|---|---|---|---|---|

| Jun-24 | Consulting Services Incorporated | UES (BDT Capital Partners, Palm Beach Capital) | Provider of AEC and TICC services | Lexington, KY |

| Jun-24 | NSL Analytical Services | Levine Leichtman Capital | Provider of TICC services | Cleveland, OH |

| Jun-24 | Brailsford & Dunlavey | Bernhard Capital | Provider of construction services | Washington, DC |

| Jun-24 | EBV | Heritage Environmental Services | Provider of environmental consultancy services | Joplin, MO |

| Jun-24 | Biscayne Engineering | Atwell | Provider of engineering and surveying services | Miami, FL |

| Jun-24 | Infrastructure Services Group | Azuria Water Solutions (New Mountain Capital) | Provider of water inspection and treatment solutions | Greenville, SC |

| Jun-24 | Oxbow Construction | Azuria Water Solutions (New Mountain Capital) | Provider of water treatment solutions | Troutdale, OR |

| Jun-24 | Larson Incitti Architects | HED | Provider of AEC services | Denver, CO |

| May-24 | T&R Environmental | Momentum Environmental (Nonantum Capital) | Provider of environmental consultancy services | Bath, NY |

| May-24 | Creighton Manning Engineering | GAI Consultants (Comvest Partners) | Provider of AEC services to the transportation industry | Albany, NY |

| May-24 | WET Solutions | Water Engineering (Nolan Capital) | Provider of water treatment solutions | Schaumburg, IL |

| Apr-24 | Moore Consulting Engineers | Bowman Consulting Group | Provider of AEC services | Shamong, NJ |

| Apr-24 | P2S | Legence (Blackstone) | Provider of construction management and engineering | Long Beach, CA |

| Apr-24 | CT Consultants | Verdantas (Round Table Capital) | Provider of engineering, planning, and science services | Mentor, OH |

| Mar-24 | DEC | Gannett Fleming (OceanSound) | Provider of engineering and infrastructure solutions | Houston, TX |

| Mar-24 | Fluhrer Reed | NV5 (NAS: NVEE) | Provider of structural engineering services | Raleigh, NC |

| Mar-24 | Smith Consulting Architects | Stengil Hill Architecture (Godspeed Capital) | Provider of architectural design and interior design | San Diego, CA |

| Feb-24 | Chastain-Skillman | DCCM (White Wolf Capital) | Provider of engineering and land surveying services | Lakeland, FL |

| Feb-24 | Speece Lewis Engineers | Bowman | Provider of engineering services | Lincoln, NE |

| Feb-24 | AE Engineering | WSB (GHK Capital Partners) | Provider of infrastructure planning services | Jacksonville, FL |

Residential & Commercial Services

| Date | Target | Acquirer | Description | HQ |

|---|---|---|---|---|

| Jun-24 | Matvey Foundation Repair | Groundworks (Cortec Group) | Provider of exterior restoration and remodeling services | SeaTac, WA |

| Jun-24 | Insight Pest Solutions | Greenix Pest Control (Riata Capital) | Provider of pest control solutions nationwide | Morrisville, NC |

| Jun-24 | Cut Above Enterprises | Landscape Workshop (Carousel Capital) | Provider of commercial landscaping services | Taylors, SC |

| Jun-24 | Nature Coast Landscape Services | Landscape Workshop (Carousel Capital) | Provider of commercial landscaping services | New Port Richey, FL |

| Jun-24 | Air Care Heating and Cooling | Leap Partners (Concentric Equity Partners) | Provider of HVAC services | Shawnee, KS |

| Jun-24 | Cohen & Cohen Natural Stone | SiteOne Landscape Supply | Provider of landscape decorations and design services | Ottawa, Ontario, Canada |

| Jun-24 | Wright Commercial Floors | Diverzify (ACON investments) | Provider of residential and commercial flooring solutions | Pittsburgh, PA |

| Jun-24 | Floors Maintenance Group | Diverzify (ACON investments) | Provider of residential and commercial flooring solutions | Colombus, OH |

| Jun-24 | Continental Floors | Diverzify (ACON investments) | Provider of residential and commercial flooring solutions | Atlanta, GA |

| Jun-24 | Executive Landscaping | Fairwood Brands (Crane Group) | Provider of landscaping services | Pensacola, FL |

| Jun-24 | West Orange Roofing | Roofing Services Solutions (Dunes Point) | Provider of re-roofing and building exterior services | Tavares, FL |

| Jun-24 | Renuity | Greenbriar Equity Group | Provider of home improvement services | Coral Gables, FL |

| Jun-24 | Dynamic Air Solutions | Flow Service Partners (RLJ Equity) | Provider of HVAC and plumbing services | Louisville, KY |

| May-24 | O’Hara’s Son Roofing | Angeles Equity Partners | Provider of commercial and residential roofing services | Chicago, IL |

| May-24 | Quality Home First Improvement | Hudson Glade | Provider of residential home services | Citrus Heights, CA |

| May-24 | DynaServ Florida | Monarch Landscape (Audax) | Provider of commercial landscaping services | Davie, FL |

| May-24 | Certus Pest Control | Liberty Mutual Investments | Provider of pest control solutions | Tampa, FL |

| May-24 | Ken’s Parkhill Roofing | Infinity Home Services | Provider of residential and commercial roofing services | Euclid, OH |

| May-24 | Carter’s Plumbing | Sila Services (Morgan Stanley) | Provider of plumbing services | White Lake, MI |

| May-24 | Sylvester & Cockrum | NexCore (Trinity Hunt) | Provider of commercial HVAC services | Winston-Salem, NC |

Source: PitchBook, MergerMarket, Company Press Releases, Meridian Research