Engineering, Construction & Building Products M&A Trends: Summer 2023

Published July 11, 2023

Key Insights

- Backlog and M&A Activity Continue as Inflation, Labor, and Material Costs Stabilize

- The Evolving Landscape of the US Aggregates Market

- Revolutionizing Construction: How Technology Transforms the Industry

- Industry Spotlight – Roofing Services

Construction activity remained robust during the first half of 2023, led by the manufacturing and infrastructure sectors. For the trailing 12-month period ending May 2023, total construction starts rose 9% when compared to the same period ending May 2022. M&A activity saw a noticeable uptick towards the end of Q2 as inflation began to show signs of easing and the Federal Reserve paused interest rate hikes – demonstrating increased investor confidence. M&A is expected to remain a key strategic focus for ENC&BP financial investors and strategics through the second half of 2023. Construction aggregates M&A activity remains strong as established strategics continue to expand offerings and geographic presence through consolidation.

ENC&BP Market Insights

Backlog and M&A Activity Continue as Inflation, Labor, and Material Costs Stabilize

- Construction activity remained robust during the first half of 2023, led by the manufacturing and infrastructure sectors. For the Trailing 12-Month period ending May 2023, total construction starts rose 9% when compared to the same period ending May 2022.

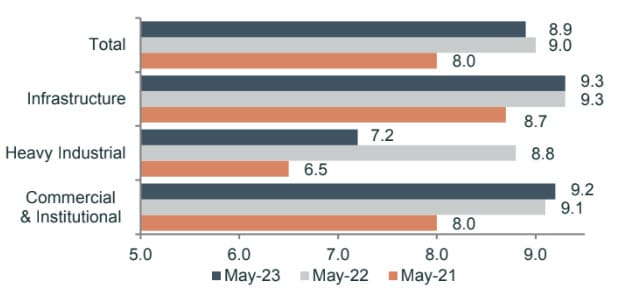

- According to Engineering News-Record, the industry maintains an average backlog of nine months, indicating sustained activity, particularly in infrastructure and commercial & institutional projects.

- Construction employment increased in 64% of metro areas between May 2022 and May 2023, bringing the construction unemployment rate down to 3.5%.

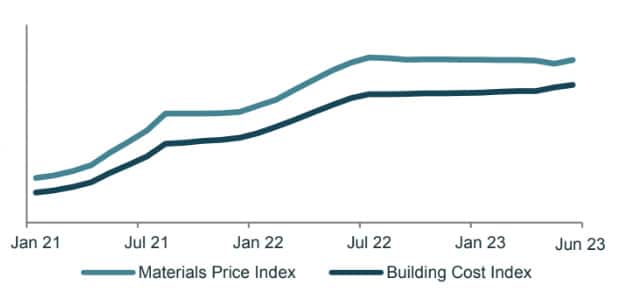

- Construction materials prices have stabilized in 1H 2023 as expected, though contractors must continue to focus on materials management as pricing holds at historical highs.

- ABC Construction’s Confidence Index reading for sales, profit margins, and staffing all remain above the threshold of 50 through 1H 2023, indicating expectations of growth through the end of the year.

Construction Backlog Indicator by Industry (Months)

Construction Costs & Materials Cost Index

The Evolving Landscape of the US Aggregates Market

- The US aggregates market is thriving due to rising demand for infrastructure development, construction activities, urbanization, and growth in residential, commercial, and infrastructure projects.

- Due to the rise of construction activity, the construction aggregate market is estimated to grow at a compound annual growth rate of 4.9% annually through 2033. Meanwhile, the demand for infrastructure simultaneously fuels a similar growth rate for road aggregates alone.

- Technological advancements in the extraction and processing of construction aggregates have improved efficiency, reduced costs, and increased production in the US market.

- Construction aggregate companies are utilizing M&A to consolidate operations, expand market presence and geographic footprint, and achieve competitive advantages in the industry.

- Knife River’s divestiture from MDU Resources establishes itself as a stand-alone and vertically integrated construction materials business.

- As an independent company, Knife River gains the autonomy to double down on its existing acquisition thesis of acquiring aggregates-based businesses and adding vertical integration.

- Knife River remains focused on expanding its footprint across major metropolitan areas.

Source: Association of General Contractors, Engineering News Record (“ENR”), Construction Dive, Dodge Construction Network, BD+C Network, Global New Wire, BDC Network, PitchBook Data, Mergermarket, Company Press Releases, and Meridian Research

Revolutionizing Construction: How Technology Transforms the Industry

- AI technologies enable the application of augmented reality (AR), virtual reality (VR), and digital twin models in construction. These solutions provide real-time visualization, allowing stakeholders to assess the progress of construction projects and make adjustments as necessary.

- The rise of artificial intelligence, combined with IoT technologies, has fueled the growth of startups specializing in Water Tech solutions, enabling intelligent water monitoring and optimization of capital planning and treatment.

- Drones are being extensively utilized in the US construction industry for surveying, inspection, and delivery purposes. They offer benefits such as improved safety, cost reduction, and accelerated project timelines.

- Construction Technology continues to evolve rapidly, with advancements in AI, IoT, drones, BIM, and reality capture technologies. These innovations are driving industry transformation, promoting efficiency, cost reduction, and improved safety throughout the project lifecycle.

Meridian’s Leading Construction Tech Practice & Western Presence

Matt Rechtin

Managing Director

Meridian Capital LLC (“Meridian”) is pleased to announce the addition of Matt Rechtin as Managing Director within our Construction Tech, Technology, Telecom, and Tech-Enabled Services team. Matt is based in San Francisco, and will work collectively with Meridian’s team in Seattle, Salt Lake City, and Portland.

Matt has over 14 years of experience serving middle market clients in M&A. Over the course of his career as an investment banker, Matt has advised clients across an assortment of sub-industries within tech including construction, software, internet, hardware, systems, and semiconductors.

He has successfully advised businesses on a variety of sell-side and buy-side, recapitalization, growth equity, and strategic advisory assignments up to $100B in value.

Prior to joining Meridian, Matt led the U.S. software investment banking practice at EY in San Francisco and worked as an investment banker in the technology practices at Wells Fargo, Lazard, and RBC Capital Markets in San Francisco.

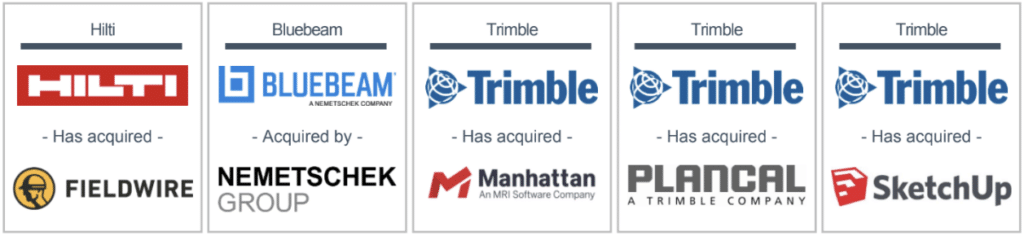

Select Construction Technology Transactions

Source: Association of General Contractors, Engineering News Record (“ENR”), PitchBook Data, Mergermarket, Company Press Releases, Meridian Research and Includes transactions completed by Meridian bankers while at previous firms

ENC&BP Middle Market M&A Activity and Trends

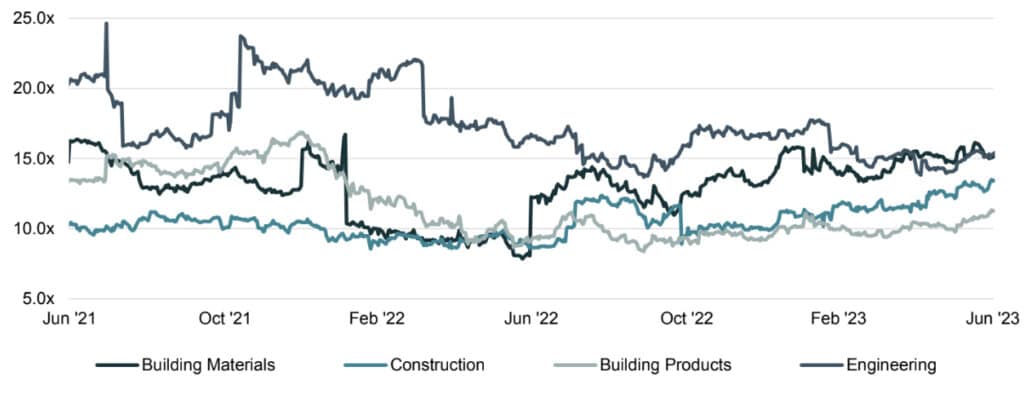

Public Market Valuations (EV/EBITDA)

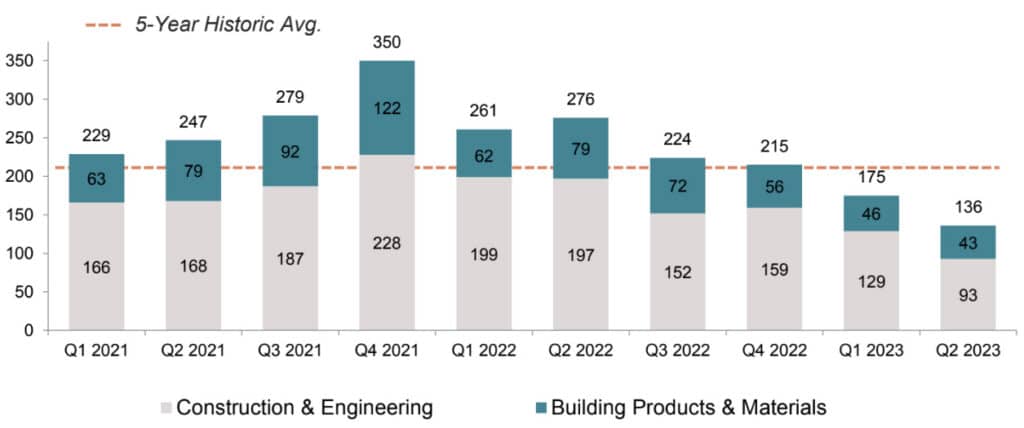

U.S. ENC&BP M&A Activity

ENC&BP M&A Commentary

- Throughout 1H 2023, many strategic acquirers pivoted towards internal initiatives in the face of rising interest rates and overall market uncertainty, leading to lower M&A volume in the sector.

- M&A activity saw a noticeable uptick towards the end of Q2 as inflation began to show signs of easing and the Federal Reserve paused interest rate hikes – demonstrating increased investor confidence.

- M&A is expected to remain a key strategic focus for ENC&BP financial investors and strategics through the second half of 2023.

- Construction aggregates M&A activity remains strong as established strategics continue to expand offerings and geographic presence through consolidation.

- Financial buyers continue to deploy capital in platform investments across certain service sectors, like architecture and engineering services to replicate HVACR roll-up strategies.

Source: PitchBook Data, MergerMarket, Company Press Releases, Marcum National Construction Survey, and Meridian 4

Research

Industry Spotlight – Roofing Services

Roofing Industry Trends

The Roofing Services sector remains highly fragmented and began to experience consolidation by larger players. Geographic expansion and pursuit of economies of scale have created attractive M&A conditions for established strategic platforms.

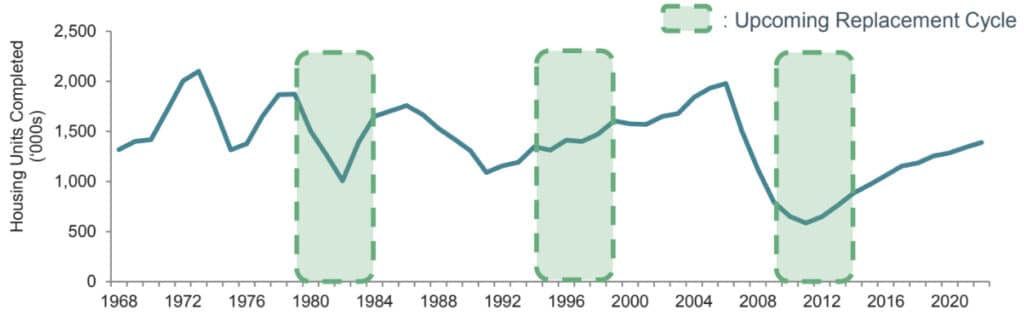

U.S. Roofing Replacement Cycles

- Roofing replacement, repair, and maintenance occurs on highly predictable 15 to 20-year cycles, creating an attractive recurring revenue stream.

- As the U.S. housing stock ages, multiple generations of homes will require roofing services in the upcoming years, as highlighted above. This compounding effect of increased total number of homes is expected to drive stable industry growth for the foreseeable future.

- The regionalized nature of the roofing industry across the country creates fragmented industry dynamics, ripe for consolidation under larger platforms.

- The last 24 months have seen a sharp increase in investor interest in the sector, with numerous acquisitions and the establishment of multiple new private equity-backed platforms.

Notable Platforms

ENC&BP Middle Market Selected M&A Activity

Highlighted AEC Services M&A Transaction

GI Partners Acquires Atlas Technical Consultants

April 2023

EV

$1,041M

EV/EBITDA

NA

Target Description: Atlas, headquartered in Austin, Texas, is a leading provider of infrastructure and environmental solutions, partnering with clients to improve performance and extend the lifecycle of built and natural infrastructure assets stressed by climate, health, and economic impacts.

Investment Rationale: Under private ownership and in partnership with GI Partners, Atlas will accelerate its growth and drive greater value to customers.

Highlighted Construction Aggregates M&A Transaction

Heidelberg Materials Acquires The SEFA Group

April 2023

EV

NA

EV/EBITDA

NA

Target Description: The SEFA Group Inc., the largest fly ash recycling company in the United States and currently supplies quality fly ash to more than 800 concrete plants in 13 states.

Investment Rationale: With this transaction, Heidelberg Materials reaches another milestone in its continued focus on portfolio optimization and moves forward with positioning the Company as the front runner on the path to carbon neutrality and circular economy in the construction materials industry.

Highlighted Building Products M&A Transaction

Holcim Acquires Duro-Last Roofing Systems

March 2023

EV

$1,293M

EV/EBITDA

11.9x

Target Description: Duro-Last is a leading manufacturer of custom-fabricated thermoplastic single-ply roofing systems based in Saginaw, Michigan.

Investment Rationale: This acquisition advances Holcim’s “Strategy 2025 – Accelerating Green Growth” with the goal to expand its Solutions & Products business to 30% of Group net sales by 2025, entering the most attractive construction segments, from roofing and insulation to repair and refurbishment.

Highlighted Construction Tech / Environmental Services M&A Transaction

Xylem Acquires Evoqua Water Technologies

May 2023

EV

$7,500M

EV/EBITDA

NA

Target Description: Evoqua is a leader in mission-critical water treatment solutions and services.

Investment Rationale: The combination creates the world’s most advanced platform of capabilities to address customers’ and communities’ critical water challenges. The President and CEO noted, “Our combination with Evoqua creates a transformative global platform to solve these critical water challenges at an even greater scale.”

Small & Mid-Cap Company Valuations

| Construction | Market Cap | E/V | LTM Rev | LTM EBITDA | LTM Margin EBITDA | EV / LTM Rev | EV / LTM EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Quanta Services, Inc. | $ 28,520 | $ 32,693 | $ 17,537 | $ 1,452 | 8.3% | 1.9x | 22.5x | 56 % |

| MasTec, Inc. | 9,303 | 12,662 | 10,408 | 660 | 6.3% | 1.2x | 19.2x | 64 % |

| EMCOR Group Inc. | 8,786 | 9,008 | 11,374 | 733 | 6.4% | 0.8x | 12.3x | 79 % |

| Comfort Systems USA, Inc. | 5,873 | 6,149 | 4,430 | 356 | 8.0% | 1.4x | 17.3x | 95 % |

| Dycom Industries, Inc. | 3,333 | 4,154 | 3,978 | 414 | 10.4% | 1.0x | 10.0x | 21 % |

| MYR Group Inc. | 2,311 | 2,323 | 3,184 | 178 | 5.6% | 0.7x | 13.1x | 60 % |

| Granite Construction Inc. | 1,801 | 1,760 | 3,125 | 131 | 4.2% | 0.6x | 13.4x | 36 % |

| Sterling Infrastructure, Inc. | 1,718 | 1,982 | 1,763 | 216 | 12.2% | 1.1x | 9.2x | 154 % |

| Primoris Services Corporation | 1,624 | 2,860 | 4,893 | 325 | 6.6% | 0.6x | 8.8x | 39 % |

| Great Lakes Dredge & Dock Company, LLC | 542 | 968 | 612 | (3) | -0.4% | 1.6x | nm | (37)% |

| Matrix Service Co. | 159 | 152 | 790 | (23) | -2.9% | 0.2x | nm | 19 % |

| Orion Group Holdings, Inc. | 90 | 173 | 733 | 13 | 1.7% | 0.2x | 13.6x | 26 % |

| Median | $ 2,056 | $ 2,591 | $ 3,581 | $ 270 | 6.4% | 0.9x | 13.2x | 47 % |

| Average | $ 5,338 | $ 6,240 | $ 5,236 | $ 371 | 5.5% | 0.9x | 13.9x | 51 % |

| Engineering | Market Cap | E/V | LTM Rev | LTM EBITDA | LTM Margin EBITDA | EV / LTM Rev | EV / LTM EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Teledyne Technologies Incorporated | $ 19,341 | $22,500 | $ 5,521 | $ 1,344 | 24.3% | 4.1x | 16.7x | 8 % |

| Jacobs Engineering Group, Inc. | 15,081 | 18,766 | 15,585 | 1,437 | 9.2% | 1.2x | 13.1x | (6)% |

| Aecom Technology Corporation | 11,772 | 13,653 | 13,540 | 883 | 6.5% | 1.0x | 15.5x | 29 % |

| KBR, Inc. | 8,830 | 10,400 | 6,553 | 684 | 10.4% | 1.6x | 15.2x | 32 % |

| Tetra Tech, Inc. | 8,716 | 9,789 | 3,846 | 479 | 12.5% | 2.5x | 20.4x | 18 % |

| CACI International Inc. | 7,769 | 9,744 | 6,642 | 680 | 10.2% | 1.5x | 14.3x | 19 % |

| Stantec, Inc. | 7,246 | 8,619 | 4,357 | 516 | 11.8% | 2.0x | 16.7x | 49 % |

| Fluor Corporation | 4,240 | 3,111 | 14,373 | 49 | 0.3% | 0.2x | 63.5x | 26 % |

| VSE Corporation | 705 | 1,087 | 974 | 87 | 8.9% | 1.1x | 12.5x | 49 % |

| Tutor Perini Corp. | 369 | 1,053 | 3,615 | (214) | -5.9% | 0.3x | nm | (20)% |

| Perma-Fix Environmental Services, Inc. | 149 | 150 | 75 | 0 | 0.3% | 2.0x | nm | 114 % |

| Median | $ 7,769 | $ 9,744 | $ 5,521 | $ 516 | 9.2% | 1.5x | 15.5x | 26 % |

| Average | $ 7,656 | $ 8,988 | $ 6,826 | $ 540 | 8.1% | 1.6x | 20.9x | 29 % |

| Building Products | Market Cap | E/V | LTM Rev | LTM EBITDA | LTM Margin EBITDA | EV / LTM Rev | EV / LTM EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Builders FirstSource, Inc. | $ 17,408 | $ 20,967 | $ 20,929 | $ 3,895 | 18.6% | 1.0x | 5.4x | 137 % |

| Masco Corporation | 12,916 | 16,278 | 8,458 | 1,262 | 14.9% | 1.9x | 12.9x | 11 % |

| Owens-Corning Inc | 11,759 | 14,259 | 9,746 | 2,341 | 24.0% | 1.5x | 6.1x | 68 % |

| Trex Company, Inc. | 7,133 | 7,530 | 1,006 | 254 | 25.3% | 7.5x | 29.6x | 16 % |

| UFP Industries, Inc. | 6,026 | 6,000 | 8,960 | 968 | 10.8% | 0.7x | 6.2x | 40 % |

| Simpson Manufacturing Company, Inc. | 5,910 | 6,275 | 2,157 | 517 | 24.0% | 2.9x | 12.1x | 35 % |

| Armstrong World Industries, Inc. | 3,314 | 3,918 | 1,261 | 376 | 29.8% | 3.1x | 10.4x | (3)% |

| Gibraltar Industries, Inc. | 1,913 | 1,973 | 1,365 | 150 | 11.0% | 1.4x | 13.2x | 57 % |

| Quanex Building Products Corp | 885 | 1,022 | 1,167 | 137 | 11.8% | 0.9x | 7.4x | 15 % |

| Median | $ 6,026 | $ 6,275 | $ 2,157 | $ 517 | 18.6% | 1.5x | 10.4x | 35 % |

| Average | $ 7,474 | $ 8,691 | $ 6,116 | $ 1,100 | 18.9% | 2.3x | 11.5x | 42 % |

| Building Materials | Market Cap | E/V | LTM Rev | LTM EBITDA | LTM Margin EBITDA | EV / LTM Rev | EV / LTM EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Vulcan Materials Company | $ 29,997 | $ 34,304 | $ 7,424 | $ 1,591 | 21.4% | 4.6x | 21.6x | 58 % |

| Martin Marietta, Inc. | 28,610 | 33,816 | 6,284 | 1,903 | 30.3% | 5.4x | 17.8x | 56 % |

| Eagle Materials Inc. | 6,621 | 7,726 | 2,148 | 762 | 35.5% | 3.6x | 10.1x | 66 % |

| Boral Ltd | 2,943 | 3,252 | 2,172 | 214 | 9.9% | 1.5x | 15.2x | 50 % |

| United States Lime & Minerals, Inc. | 1,189 | 1,047 | 252 | 87 | 34.3% | 4.2x | 12.1x | 97 % |

| Median | $ 6,621 | $ 7,726 | $ 2,172 | $ 762 | 30.3% | 4.2x | 15.2x | 58 % |

| Average | $ 13,872 | $ 16,029 | $ 3,656 | $ 912 | 26.3% | 3.8x | 15.3x | 65 % |

As of June 30th, 2023

Note: Mid-cap defined as market capitalization between $2 billion and $25 billion. Not meaningful (NM) if EV/Sales or EV/EBIT is a significant outlier. NA if denominator is 0 or not available.

Select ENC&BP M&A Transactions

| Announced Date | Target | Acquirer/Investor | Target Description |

|---|---|---|---|

| Pending | Arconic (NYS: ARNC) | Apollo Global Management, Irenic Capital Management | Manufacturer of aluminum and other architectural products for the building and construction end-market. |

| Jun-23 | Pro-Tech Air Conditioning & Plumbing | Southern HVAC Corporation (Gryphon Investors) | Provider of residential plumbing and HVAC services. |

| Jun-23 | Syracuse Glass | Oldcastle BuildingEnvelope (KPS Capital Partners) | Provider of glass and metal fabrication services. |

| Jun-23 | Spectrum Brands (Hardware & Home Improvement) | Assa Abloy (STO: ASSA B) | Distributor of hardware and home improvement products. |

| Jun-23 | AXIS GeoSpatial | SAM Companies (Peak Rock Capital) | Provider of mapping services utilizing remote sensing and measurement technologies. |

| Jun-23 | Cardinal Roofing and Restoration | Northpoint Roofing Systems (Halmos Capital) | Provider of residential roof replacement and repair services. |

| Jun-23 | Infrastructure Engineers | Bowman Consulting (NAS: BWMN) | Provider of engineering, environmental, geospatial, and municipal infrastructure services. |

| Jun-23 | Silver State Building Materials | Beacon (NAS: BECN) | Provider of residential roofing materials. |

| Jun-23 | Building Products of Canada Corp. | Saint-Gobain (EPA: SGO) | Manufacturer of residential roofing shingles and insulation panels. |

| Jun-23 | Seatown Electric, Plumbing, Heating, and Air | Service Champions (Odyssey Investment Partners) | Provider of residential electrical, plumbing, and HVAC services. |

| Jun-23 | Environmental Systems Design | Stantec (NYSE: STN) | Provider of engineering services. |

| Jun-23 | American Engineers | STV Group (Pritzker) | Provider of civil engineering services. |

| Jun-23 | Arrow Plumbing | Rush Street Ventures | Provider of plumbing services. |

| Jun-23 | Riner Engineering | UES (BDT Capital Partners, Palm Beach Capital) | Provider of geotechnical engineering and construction materials testing services. |

| Jun-23 | Gladstein, Neandross & Associates | TRC (Warburg Pincus) | Provider of transportation and infrastructure consulting services. |

| May-23 | C&R Stone World | Outdoor Living Supply (Trilantic North America) | Distributor of natural stone, masonry, hardscape, and landscape products. |

| May-23 | Solar Integrated Roofing | Tribeca Energy | Provider of residential and commercial solar power and roofing services. |

| May-23 | Saint Raphael Roofing | Apple Roofing (Gauge Capital) | Provider of residential and commercial roofing services. |

| May-23 | NW Wind & Solar (SME Inc. Of Seattle) | OZZ Electric | Provider of wind and solar renewable energy solutions. |

| May-23 | Climate Pros | Saw Mill Capital | Provider of refrigeration and HVAC repair, maintenance, and construction services. |

| May-23 | Eramosa Engineering Inc. | CIMA+ | Provider of engineering services for the water and renewable energy sector. |

| May-23 | Rising Star Roofing | Northpoint Roofing Systems (Halmos Capital) | Provider of residential roofing services. |

| May-23 | Javan Engineering | CHA Consulting (First Reserve) | Provider of engineering for the industrial, chemical, and healthcare sectors. |

| Announced Date | Target | Acquirer/Investor | Target Description |

|---|---|---|---|

| May-23 | Glorieta Geoscience Inc | GZA GeoEnvironmental | Provider of consulting services for groundwater development, agriculture, and environmental science. |

| Apr-23 | Citco Water | Trivest Partners | Provider of water services for the utility and industrial sector. |

| Apr-23 | Atlas Technical Consultants (NAS: ATCX) | GI Partners | Provider of infrastructure and environmental testing, inspection, engineering, and consulting services. |

| Apr-23 | Architecutral Werks | MD Architects | Provider of architectural design services. |

| Apr-23 | Tower Engineering Professionals | H.I.G. Capital | Provider of engineering services for the telecommunications and utility industries. |

| Apr-23 | Marathon HVAC Service | Sound Partners | Provider of residential HVAC services. |

| Apr-23 | Engler, Meier & Justus | GMS (NYSE: GMS) | Distributor of drywall, acoustical ceilings, and other interior building products. |

| Apr-23 | D&D Water & Sewer | PURIS (J.F. Lehman & Company) | Provider of underground infrastructure installation and repaid services. |

| Mar-23 | Duro-Last | Holcim (SWX: HOLN) | Manufacturer of prefabricated roofing systems. |

| Mar-23 | Taney Engineering | HFW Companies (VSS Capital Partners) | Provider of civil engineering and land surveying services. |

| Mar-23 | Appalachian Truss | The Oxford Group | Manufacturer of truss systems. |

| Mar-23 | Tuscano-Maher Roofing | Tecta America (Leonard Green) | Provider of commercial roofing services. |

| Mar-23 | Tradewinds Mechanical | Sound Partners, Calico Group | Provider of commercial refrigeration and HVAC services. |

| Mar-23 | Faulkner Engineering Services | Universal Engineering Services (BDT Capital, Palm Beach Capital) | Provider of environmental services, geotechnical engineering, and construction materials testing. |

| Mar-23 | New South Construction Supply | Coloy Hardware (Audax) | Distributor of rebar, concrete, masonry and other supplies to contractors. |

| Feb-23 | Eldeco | Comfort Systems USA (NYSE: FIX) | Provider of electrical design and construction services. |

| Feb-23 | Cactus Asphalt | American Pavement Preservation (Capital Alignment Partners) | Provider of asphalt paving services. |

| Feb-23 | Northpoint Roofing Systems | Halmos Capital | Provider of roof repair and replacement services for single-family and multi-family end markets. |

| Feb-23 | Green City Demolition | Priestly Demolition | Provider of demolition services. |

| Feb-23 | New South Construction Supply | Colony Hardware (Audax Group, Tailwind Capital) | Distributor of jobsite construction materials. |

| Feb-23 | Weeks Service Company | Strikepoint Group (New Mountain Capital) | Provider of residential and commercial HVAC services. |

| Feb-23 | Apex Companies (Sentinel Capital Partners) | Morgan Stanley Capital Partners | Provider of water resource management and environmental services. |

| Feb-23 | Groundworks (Cortec Group) | KKR | Provider of foundation repair and water management services. |

Source: PitchBook, MergerMarket, Company Press Releases, Meridian Research