Engineering, Construction & Building Products M&A Trends: Spring 2022

Published February 22, 2022

KEY INSIGHTS

- Construction materials & labor availability remain a focal point in 2022

- Overall, materials prices are expected to see continued volatility in 2022

- Total construction spending is expected to exceed $1.7 trillion in 2022, a nearly 4% increase from 2021

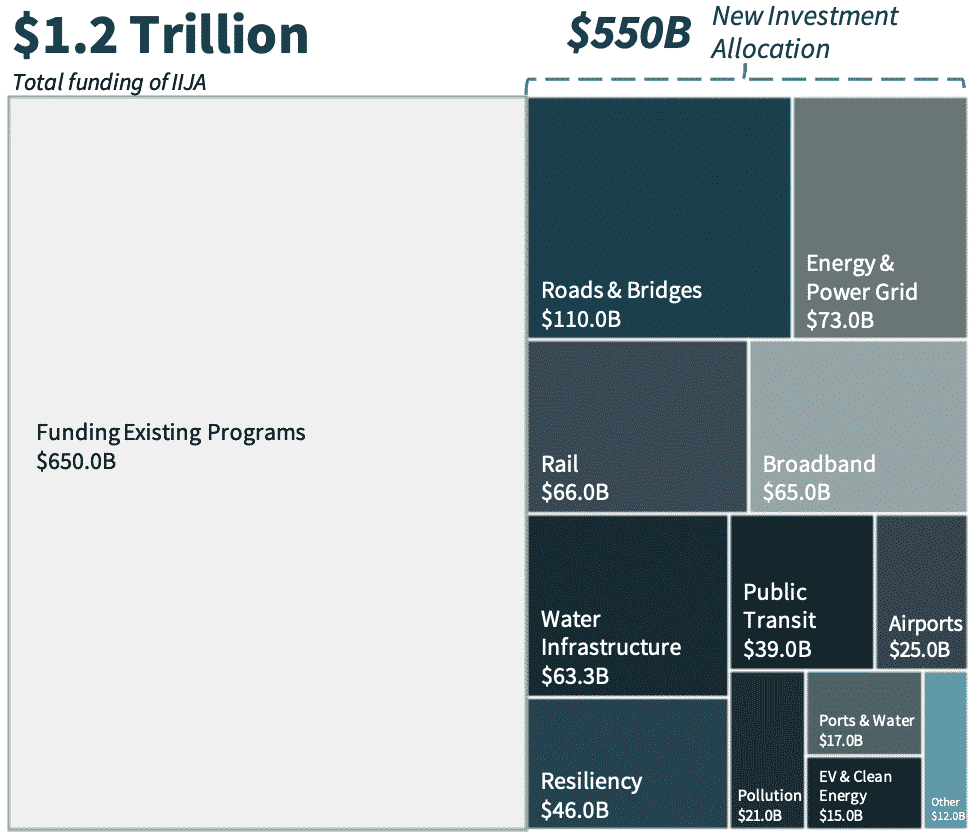

- President Biden signed the Infrastructure Investment and Jobs Act (IIJA) into legislation in November 2021

- Rollout of funds is expected to start in 2022 with established programs and formula-based allocations moving the quickest

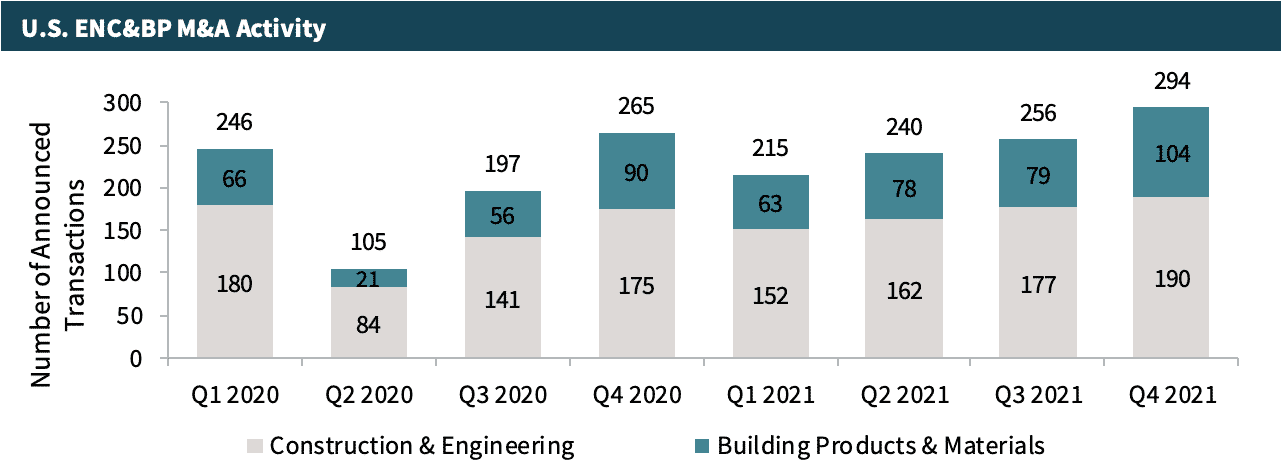

Q4 2021 M&A transaction activity finished the year strong with a record 294 transactions, contributing to over 1,000 ENC&BP transactions in 2021. Q1 2022 has seen continued momentum with 118 M&A Transactions YTD. Robust sector activity is fueled by the $1.2T federal infrastructure package as corporations and private equity firms look for investments that can benefit from the tailwinds of increased government spending.

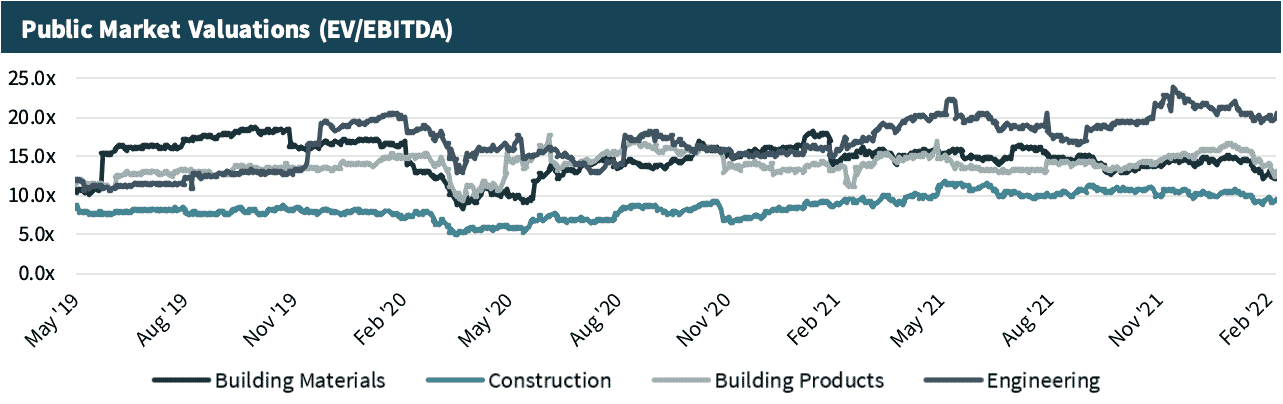

Due to continued record levels of dry power, a positive industry outlook, and available, inexpensive debt options, M&A is expected to remain a key strategic focus for investors in 2022. After the infrastructure package was originally passed by the house in late July, sector valuations shot up ~6% above pre-pandemic levels, with an average EV/EBITDA multiple of 14.4x, led by a ~13% multiple expansion of engineering firms.

Due to the recent market downturn and as the market continues to gain a deeper understanding of the infrastructure package, multiples have moved back to pre-pandemic levels with an average EV/EBITDA multiple of 13.6x.

ENC&BP Market Insights

Construction Materials & Labor Availability Remain a Focal Point in 2022

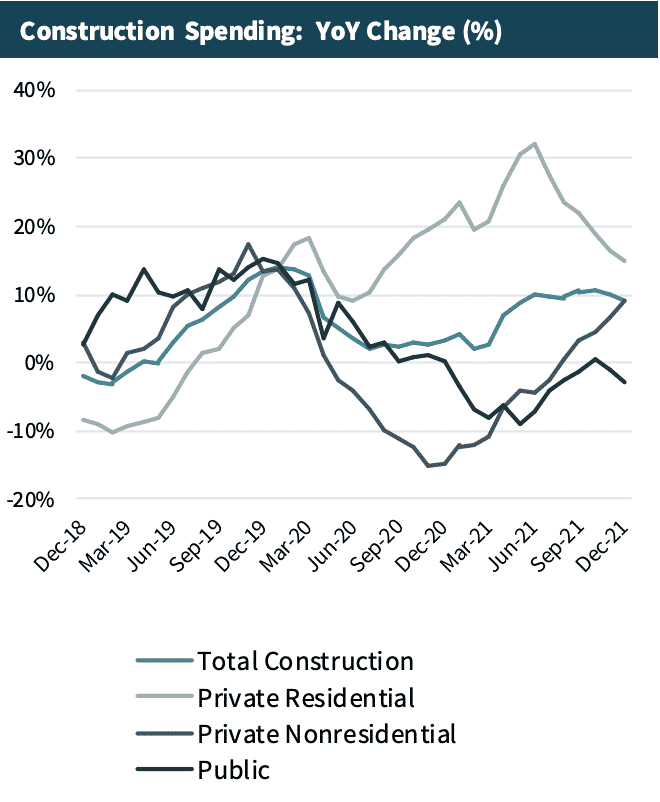

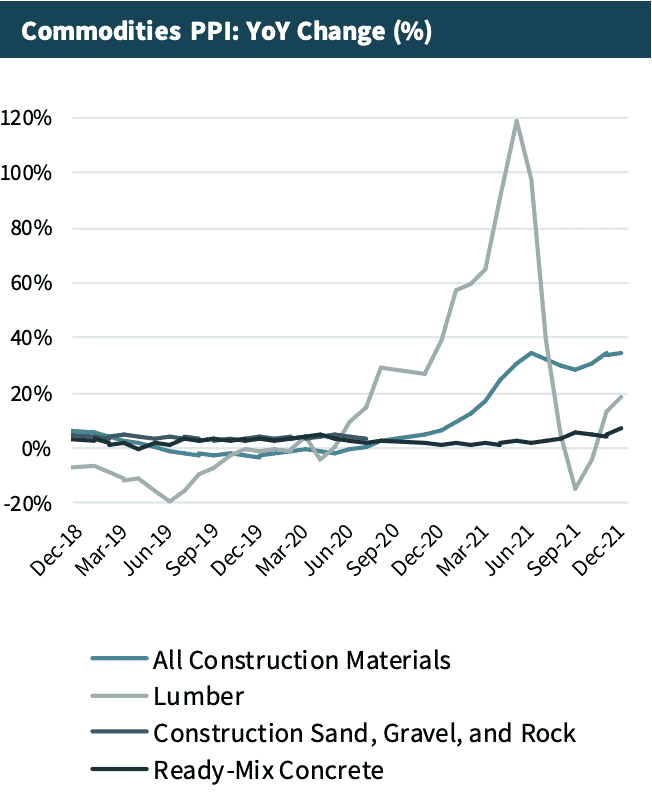

- While the prices of some raw materials declined in December, overall construction materials increased nearly 20% in 2021 according to the Associated General Contractors of America (AGC).

- Lumber was one of the most impacted materials and experienced YoY price increases of nearly 28% in 2021. Lumber prices declined later in the year as production increased, and the Linesight Commodities Report expects price inflation in 2022 to moderate at nearly 5%.

- Overall, materials prices are expected to see continued volatility in 2022. But total construction spending is expected to exceed $1.7 trillion in 2022, a nearly 4% increase from 2021.

- According to the U.S. Bureau of Labor Statistics most recently published report, the construction industry employed over 7.5M seasonally adjusted jobs as of November 2021, nearing a return to the 7.6M employed in March 2020 (pre-pandemic).

- Riding the tails of Biden’s infrastructure bill, construction firms are optimistic and foresee growing demand for projects in 2022. According to AGC, 74% of firms plan to expand in 2022 despite supply chain and labor challenges.

- The influx of civil spending from the infrastructure bill is expected to significantly increase demand in a tight labor environment, further driving up construction wages through 2022.

Source: US Census, Engineering News Record (“ENR”), Association of General Contractors, U.S. Small Business Administration, PitchBook Data, IBISWorld, Company Press Release, and Meridian Research

$1.2T Infrastructure Bill Passes! What Now?

- On the back of strong bipartisan support, President Biden signed the Infrastructure Investment and Jobs Act (IIJA) into legislation in November 2021.

- Rollout of funds is expected to start in 2022 with established programs and formula-based allocations moving the quickest. Highway and road improvement and EPA water projects will be among the first funds distributed.

- The five-year fund distribution timeline (and future maintenance requirements) is expected to drive meaningful growth & M&A across ENCBP sectors, as companies focus on adding scale, expanding end markets served, and geographic reach.

Sources: katko.house.gov, National Association of Counties, Engineering News Record (“ENR”), Association of General Contractors, U.S. Small Business Administration, PitchBook Data, IBISWorld, Company Press Release, and Meridian Research

ENC&BP Middle Market M&A Activity and Market Trends

Source: PitchBook Data, Company Press Releases, and Meridian Research.

Commentary

- Q4 2021 M&A transaction activity finished the year strong with a record 294 transactions, contributing to over 1,000 ENC&BP transactions in 2021.

- Q1 2022 has seen continued momentum with 118 M&A Transactions YTD(1).

- Robust sector activity is fueled by the $1.2T federal infrastructure package as corporations and private equity firms look for investments that can benefit from the tailwinds of increased government spending.

- Due to continued record levels of dry power, a positive industry outlook, and available, inexpensive debt options, M&A is expected to remain a key strategic focus for investors in 2022.

- After the infrastructure package was originally passed by the house in late July, sector valuations shot up ~6% above pre-pandemic levels, with an average EV/EBITDA multiple of 14.4x, led by a ~13% multiple expansion of engineering firms.

- Due to the recent market downturn and as the market continues to gain a deeper understanding of the infrastructure package, multiples have moved back to pre-pandemic levels with an average EV/EBITDA multiple of 13.6x.

1) YTD as of February 16, 2022

Shoemaker Manufacturing acquired by CSW Industrials

Meridian Capital LLC (“Meridian”), a leading Seattle-based middle market investment bank and M&A advisory firm, is pleased to announce the successful acquisition of one of its clients, Shoemaker Manufacturing (“Shoemaker” or the “Company”), by CSW Industrials (“CSWI”) (NASDAQ: CSWI).

Based in Cle Elum, Washington, Shoemaker Manufacturing is a leading manufacturer of grilles, registers, and diffusers (“GRDs”) for commercial, residential, and industrial HVAC applications. Shoemaker’s success is driven by its technical capabilities, broad product offerings, and customized solutions.

This strategic acquisition further expands CSWI’s HVAC/R product offering with customizable GRDs for commercial and residential markets and increases regional exposure to the Northwest.

John Hein, former shareholder and President of Shoemaker, said, “Meridian exceeded all expectations on their commitment to finding us a partner that will honor the Company’s legacy and provide the necessary resources to accelerate our growth trajectory. Meridian’s understanding of our industry was instrumental during the process, as they were able to clearly understand our business model and effectively message our position to the market. I’m extremely excited about our new partnership with CSWI and look forward to capitalizing on the complementary nature of our product lines.”

Claire Nicholls, former shareholder and Vice President of Shoemaker, commented, “As a multi-generational family business with a strong 75-year track record, finding a partner as culturally aligned as CSWI was of prime importance in this transaction. Meridian’s consistent focus on the ultimate goals of our shareholders resulted in an efficient and personalized process that led to a successful outcome for all parties.”

Brian Murphy, President and Managing Director at Meridian, said, “Shoemaker’s broad product landscape, coupled with its unique product customization and assembly capabilities, allows the Company to provide an unmatched product offering to its clients. The Company’s current position in the marketplace and reputation throughout the industry will allow it to see continued growth during its partnership with CSWI. It was an honor to work with John, Claire, and the entire Shoemaker team to steward the legacy of the Company and provide a complementary growth partner.”

AHR Expo in Las Vegas: Key Takeaways

The Meridian ENC&BP team attended the AHR Expo in Las Vegas this year. The turnout was outstanding, and people and companies were very engaged in a dialogue about future growth, strategic direction and potential M&A transactions. There were several key themes that emerged from the show:

- Building automation continues to be a rapidly growing and attractive sector for investment

- HVAC component suppliers are experiencing an elevated revenue growth rate

- Near-shoring production continues to be a solution to easing supply chain disruptions

Highly Acquisitive Roll-ups Consolidating the Highly Fragmented HVACR Market

Comfort Systems USA

Description: Comfort Systems is a leading provider of commercial, industrial, and institutional HVAC and electrical contracting services nationwide.

Ownership: NYS: FIX

Headquarters: Houston, TX

Acquisitions: 26 platform acquisitions (7 in the past 24 months)

Investment Thesis: Comfort Systems continues to invest in platforms and complementary operations that expand geographic reach and capabilities.

Recent Acquisitions

CoolSys

Description: CoolSys is a group of businesses that provide national HVACR services to the retail, commercial, and industrial end-markets.

Ownership: Ares Private Equity (March 2019)

Headquarters: Brea, CA

Acquisitions: 24 platform acquisitions (8 in the past 24 months)

Investment Thesis: The Company is actively seeking to expand its geographic market presence through strategic acquisitions within its core HVACR product focus to become the market leading operating platform.

Recent Acquisitions

Service Champions

Description: Service Champions is Southern California’s largest residential plumbing and HVAC company.

Ownership: Odyssey Investment Partners (December 2020)

Headquarters: Brea, CA

Acquisitions: 12 platform acquisitions (11 in the past 24 months)

Investment Thesis: Service Champions aims to diversify its geographic end markets through acquisitions of leading brands in key markets, specifically targeting the western & southern U.S. Markets.

Recent Acquisitions

Source: PitchBook, Company Press Releases, Meridian Research

Small & Mid-cap Company Valuations

Construction Firms

| Construction Firms | Ticker | Market Cap | EV | LTM Rev | LTM EBITDA | LTM Margin EBITDA | EV / LTM Rev | EV / LTM EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|

| Quanta Services, Inc. | NYSE:PWR | $15,143 | $16,645 | $11,969 | $1,057 | 8.8% | 1.4x | 15.8x | 39% |

| MasTec, Inc. | NYSE:MTZ | $7,018 | $8,500 | $7,779 | $949 | 12.2% | 1.1x | 9.0x | 8% |

| EMCOR Group Inc. | NYSE:EME | $6,256 | $6,155 | $9,545 | $640 | 6.7% | 0.6x | 9.6x | 23% |

| Comfort Systems USA, Inc. | NYSE:FIX | $3,226 | $3,520 | $2,917 | $262 | 9.0% | 1.2x | 13.4x | 40% |

| Dycom Industries, Inc. | NYSE:DY | $2,809 | $3,447 | $3,120 | $239 | 7.7% | 1.1x | 14.4x | 2% |

| Granite Construction Inc. | NYSE:GVA | $1,668 | $1,426 | $3,642 | $166 | 4.6% | nm | nm | 15% |

| MYR Group Inc. | NAS:MYRG | $1,593 | $1,546 | $2,460 | $160 | 6.5% | 0.6x | 9.7x | 57% |

| Primoris Services Corporation | NAS:PRIM | $1,440 | $2,095 | $3,511 | $277 | 7.9% | 0.6x | 7.6x | -15% |

| Great Lakes Dredge & Dock Corp. | NAS:GLDD | $909 | $1,109 | $688 | $105 | 15.2% | 1.6x | 10.6x | -9% |

| Sterling Construction Company, Inc. | NAS:STRL | $860 | $1,082 | $1,528 | $144 | 9.4% | 0.7x | 7.5x | 32% |

| Matrix Service Co. | NAS:MTRX | $173 | $132 | $653 | -$52 | -7.9% | 0.2x | nm | -51% |

| Orion Group Holdings, Inc. | NYSE:ORN | $102 | $165 | $609 | $23 | 3.8% | 0.3x | 7.1x | -44% |

| Median | $1,630 | $1,820 | $3,018 | $203 | 7.8% | 0.7x | 9.6x | 12% | |

| Average | $3,433 | $3,819 | $4,035 | $331 | 7.0% | 0.9x | 10.5x | 8% |

Engineering Firms

| Engineering Firms | Ticker | Market Cap | EV | LTM Rev | LTM EBITDA | LTM Margin EBITDA | EV / LTM Rev | EV / LTM EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|

| Teledyne Technologies Incorporated | NYSE:TDY | $20,165 | $23,790 | $4,048 | $853 | 21.1% | 5.9x | 27.9x | 11% |

| Jacobs Engineering Group, Inc. | NYSE:J | $16,506 | $19,924 | $14,091 | $859 | 6.1% | 1.4x | 23.2x | 15% |

| Aecom Technology Corporation | NYSE:ACM | $10,550 | $12,443 | $13,294 | $677 | 5.1% | 0.9x | 18.4x | 41% |

| Tetra Tech, Inc. | NAS:TTEK | $8,230 | $8,526 | $3,307 | $310 | 9.4% | 2.6x | 27.5x | 14% |

| KBR, Inc. | NYSE:KBR | $6,383 | $7,672 | $6,306 | $260 | 4.1% | 1.2x | 29.5x | 45% |

| Stantec, Inc. | TSX:STN | $6,098 | $7,102 | $3,571 | $399 | 11.2% | 2.0x | nm | 42% |

| CACI International Inc. | NYSE:CACI | $6,017 | $8,359 | $6,093 | $643 | 10.6% | 1.4x | 13.0x | 8% |

| Fluor Corporation | NYSE:FLR | $3,138 | $2,367 | $14,057 | -$79 | -0.6% | 0.2x | nm | 25% |

| VSE Corporation | NAS:VSEC | $629 | $950 | $691 | $48 | 6.9% | 1.4x | 19.9x | 42% |

| Tutor Perini Corp. | NYSE:TPC | $600 | $1,390 | $4,955 | $360 | 7.3% | 0.3x | 3.9x | -31% |

| Perma-Fix Environmental Services, Inc. | NAS:PESI | $77 | $72 | $83 | $3 | 3.0% | 0.9x | 28.5x | -11% |

| Median | $6,098 | $7,672 | $4,955 | $360 | 6.9% | 1.4x | 23.2x | 15% | |

| Average | $7,127 | $8,418 | $6,409 | $394 | 7.6% | 1.6x | 21.3x | 18% |

Building Products Firms

| Building Products Firms | Ticker | Market Cap | EV | LTM Rev | LTM EBITDA | LTM Margin EBITDA | EV / LTM Rev | EV / LTM EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|

| Masco Corporation | NYSE:MAS | $14,532 | $17,032 | $8,375 | $1,117 | 13.3% | 2.0x | 15.2x | 10% |

| Builders FirstSource, Inc. | NYS:BLDR | $13,688 | $16,342 | $17,790 | $2,410 | 13.5% | 0.9x | nm | 67% |

| Trex Company, Inc. | NYSE:TREX | $10,754 | $10,737 | $1,121 | $334 | 29.8% | 9.6x | 32.1x | -8% |

| Owens Corning Corporation | NYSE:OC | $9,392 | $11,614 | $8,292 | $1,900 | 22.9% | 1.4x | nm | 10% |

| Simpson Manufacturing Company, Inc. | NYSE:SSD | $5,291 | $5,027 | $1,449 | $349 | 24.1% | 3.5x | 14.4x | 30% |

| UFP Industries, Inc. | NAS:UFPI | $4,942 | $5,216 | $8,013 | $721 | 9.0% | 0.7x | 7.2x | 29% |

| Armstrong World Industries, Inc. | NYSE:AWI | $4,679 | $5,251 | $1,063 | $354 | 33.3% | 4.9x | 14.8x | 20% |

| Gibraltar Industries, Inc. | NAS:ROCK | $1,733 | $1,792 | $1,271 | $137 | 10.8% | 1.4x | 13.1x | -46% |

| Quanex Building Products Corp | NYSE:NX | $752 | $819 | $1,072 | $125 | 11.7% | 0.8x | 6.5x | -7% |

| Median | $5,291 | $5,251 | $1,449 | $354 | 13.5% | 1.4x | 14.4x | 10% | |

| Average | $7,307 | $8,203 | $5,383 | $828 | 18.7% | 2.8x | 14.8x | 12% |

Building Materials Firms

| Building Materials Firms | Ticker | Market Cap | EV | LTM Rev | LTM EBITDA | LTM Margin EBITDA | EV / LTM Rev | EV / LTM EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|

| Vulcan Materials Company | NYSE:VMC | $25,059 | $29,455 | $5,121 | $1,375 | 26.8% | 5.8x | 21.4x | 19% |

| Martin Marietta, Inc. | NYSE:MLM | $23,902 | $27,065 | $5,097 | $1,446 | 28.4% | 5.3x | 18.7x | 21% |

| Eagle Materials Inc. | NYSE:EXP | $5,706 | $6,564 | $1,792 | $627 | 35.0% | 3.7x | 10.5x | 23% |

| Boral Ltd | ASX: BLD | $3,144 | $3,811 | $2,180 | $430 | 19.7% | 1.7x | 8.9x | -27% |

| United States Lime & Minerals, Inc. | NAS:USLM | $686 | $585 | $184 | $66 | 35.9% | 3.2x | 8.9x | -12% |

| Median | $5,706 | $6,564 | $2,180 | $627 | 28.4% | 3.7x | 10.5x | 19% | |

| Average | $11,699 | $13,496 | $2,875 | $789 | 29.2% | 3.9x | 13.7x | 5% |

As of February 9th, 2022. Note: Mid-cap defined as market capitalization between $2 billion and $25 billion. Not meaningful (NM) if EV/Sales or EV/EBIT is a significant outlier. NA if denominator is 0 or not available. NTM figures are based on the median estimate of Wall Street analysts. Source: PitchBook Data, Company Press Releases, Meridian Research

Select ENC&BP M&A Transactions

| Announced Date | Target | Acquirer/Investor | Target Description |

|---|---|---|---|

| Feb-22 | Seattle Cedar Supply | ABC Supply Co. | Distributor of roofing materials based in Seattle. |

| Feb-22 | Capital Brick & Tile | Brickworks | Distributor of architectural masonry products. |

| Feb-22 | AHF Products | Paceline Equity Partners | Manufacturer and distributor of wood flooring products. |

| Feb-22 | Woodward Landscape Supply | Outdoor Living Supply | Distributor of hardscaping materials. |

| Feb-22 | Bishop Lifting Products | Altamont Capital Partners | Manufacturer and distributor of lifting products and specialty rental equipment. |

| Feb-22 | MBTechnology | Carlisle Companies | Manufacturer of asphalt roofing membranes. |

| Feb-22 | Performa | Eppstein Uhen Architects | Provider of integrated architectural and engineering services. |

| Feb-22 | Waggoner Engineering | Trilon Group | Provider of civil engineering services. |

| Feb-22 | Pevida Highway Designers | Ardurra Group | Provider of highway design services. |

| Jan-22 | Associated Materials | Strategic Value Partners | Manufacturer and distributor of exterior residential building. |

| Jan-22 | Gala & Associates | The Austin Company | Provider of architectural engineering and project management services. |

| Jan-22 | Mid-Am Building Supply | Hardwoods Distribution | Distributor of building products. |

| Jan-22 | Solar Innovations | Fortune Brands Home & Security | Manufacturer of doors, windows and glass structures. |

| Jan-22 | Acts 29 Consulting | CMTA | Provider of engineering consulting services. |

| Jan-22 | Perry Engineering | Bowman Consulting | Provider of civil engineering consulting and land surveying services. |

| Jan-22 | Metco Landscape | Atar Capital | Provider of landscaping services for residential and commercial properties. |

| Jan-22 | Holbert Apple Associates | Greenman-Pedersen | Provider of structural engineering consulting services. |

| Jan-22 | Bulks | Outdoor Living Supply | Distributor of landscape materials. |

| Jan-22 | Glacier Drilling | Dandelion Energy | Provider of drilling and related services. |

| Jan-22 | Mebane Lumber Building Supply | Goldsboro Builders Supply | Provider of building supply and structural lumber. |

| Jan-22 | Strain Electric | PowerVac | Provider of diversified electrical and utility contractors services. |

| Jan-22 | White Mountain Survey & Engineering | Horizons Engineering | Provider of land surveying and civil engineering services. |

| Jan-22 | Peltram Plumbing | Stellex Capital Management | Provider of plumbing and mechanical services. |

| Jan-22 | Eagle Group of Springfield | Avison Young | Provider of interior design services, cost estimation, project management and construction management services. |

| Jan-22 | LandDev Consulting | Howard R. Green Company | Provider of civil engineering services. |

| Jan-22 | Eagle Group of Springfield | Avison Young | Provider of interior design services, cost estimation, project management and construction management services. |

| Jan-22 | ProGroup Contracting | BrandPoint Services | Provider of painting and remodeling services. |

| Jan-22 | Tidewater Environmental Services | Artesian Wastewater Management | Provider of regulated wastewater utility services. |

| Jan-22 | Apex Pavement Solutions | Top Gun Facility Services | Provider of asphalt and concrete maintenance and repair services. |

| Jan-22 | Electric Power Engineers | Lime Rock New Energy | Provider of engineering services focused on the power, renewable energy, and grid modernization. |

| Jan-22 | Lambie Custom Homes | Grand Oak Builders | Provider of construction services. |

| Jan-22 | Crews Crane Training International | Carlton Scale | Provider of crane and hoist training and inspection solutions. |

| Jan-22 | Maddox Industrial Group | TransTech Energy | Provider of engineering and project management services. |

| Jan-22 | Quattuor Construction | RoadSafe Traffic Systems | Provider of traffic control and underground construction services. |

| Jan-22 | Danton Hydro blasting | TRP Construction | Provider of hydro-blasting services. |

| Jan-22 | Benton Ready-Mix of Florence | Thomas Concrete Industries | Distributor of building materials. |

| Jan-22 | Rosboro Company | One Equity Partners | Manufacturer of engineered wood products. |

| Jan-22 | Edwards Electrical & Mechanical | Comfort Systems USA | Provider of HVAC, mechanical and electrical services |

| Jan-22 | Progress Supply | Gustave A. Larson Company | Wholesaler of plumbing fixtures and supplies. |

| Jan-22 | Cowden | Aggregate Industries | Supplier of ready-mix concrete and aggregate assets. |

| Jan-22 | Holmes Drywall Supply | L&W Supply | Distributor of building products serving commercial and residential contractors. |

| Jan-22 | Interstate Block & Brick | Alley-Cassetty Companies | Manufacturer and distributor of masonry and concrete products. |

| Jan-22 | Apple Air Conditioning & Heating | Apex Service Partners | Provider of air conditioning and heating services. |

| Jan-22 | BRH-Garver Construction | Kidd & Company | Provider of micro-tunneling services. |

| Jan-22 | Crabtree Siding and Supply | Beacon Roofing Supply | Distributor of residential exterior building materials. |

| Jan-22 | Simpson Engineers & Associates | WGI | Provider of civil engineering and construction services. |

Source: PitchBook, Company Press Releases, Meridian Research