Engineering, Construction & Building Products M&A Trends: Spring 2021

Published June 21, 2021

Key Insights

- Biden Administration unveils $2 Trillion infrastructure spending plan, including $932 Billion allocated for transportation, water, electrical, and telecom infrastructure.

- Building materials prices continue to rise fueled by limited housing supply, and the surge in home improvement projects.

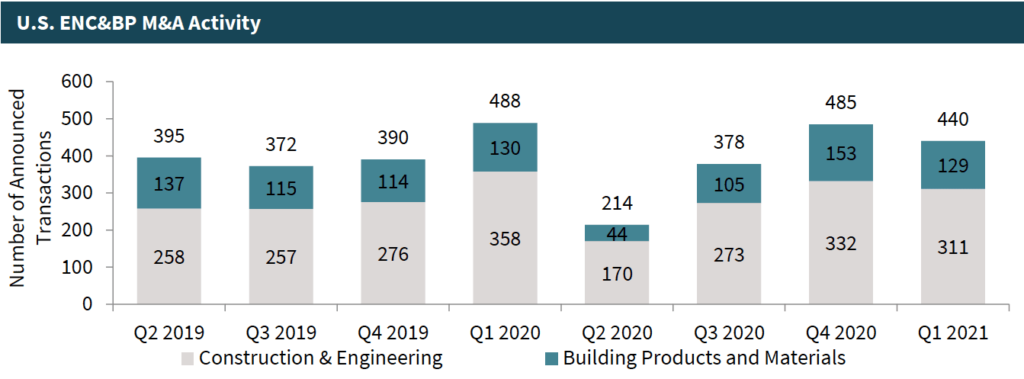

- Merger and Acquisition activity in the sector remained high, with total deal volume increasing 5% YOY in Q4 2020 and Q1 2021.

Highlights

- The Biden infrastructure plan is expected to drive demand for construction services, particularly in the transportation, utilities and green energy markets. The plan calls for modernizing the nations aging transportation, water, and electrical infrastructure over the next 5-7 years. The plan outlines $111 Billion of new spending for water infrastructure including the removal and replacement of all lead drinking pipes.

- Lumber prices skyrocketed by as much as 10% per week during 2020 and 2021 and have increased over 200% YoY. Housing starts are up approximately 30% YoY and are continuing to trend in an upward direction as demand continues to outstrip supply. Supply constraints at lumber mills and high demand for finished lumber driven by home improvement and new housing starts have been the primary drivers of the surge in lumber prices.

- M&A activity in the ENC&BP sector is expected to continue to accelerate over the next twelve months as firms see favorable economic forecasts, the threat of a new tax regime and increased public sector infrastructure spending. Increasing costs for skilled labor is expected to provide additional upward momentum for M&A activity as firms make acquisitions and investments in technology and automation to reduce labor and overhead costs.

ENC&BP Market Insights

Large-Scale Infrastructure Spending on the Horizon

- The current administration has identified the need for larger-scale infrastructure spending as a means of providing the creation and sustainment of private sector growth across the United States.

- President Biden announced the first part of his two-part infrastructure package in late March of 2021, with an initial proposal for $2T in infrastructure spending.

- The infrastructure plan lays out approximately $621B for transportation upgrades including highways, ports, airports, and transport systems. Large-scale civil contractors and ancillary service providers across the U.S. are expected to benefit from this spending over the next 5-7 years.

- Approximately $111B is set aside for water infrastructure, aiming to modernize municipal water systems including the removal and replacement of all lead pipes for drinking water.

- Spending for updates to the electrical grid and broadband network represents approximately $200B, including plans to bring high speed internet access to the 35 percent of rural Americans who lack broadband access at minimally acceptable speeds.

In Addition to Lumber, Building Materials Prices Continue to Rise

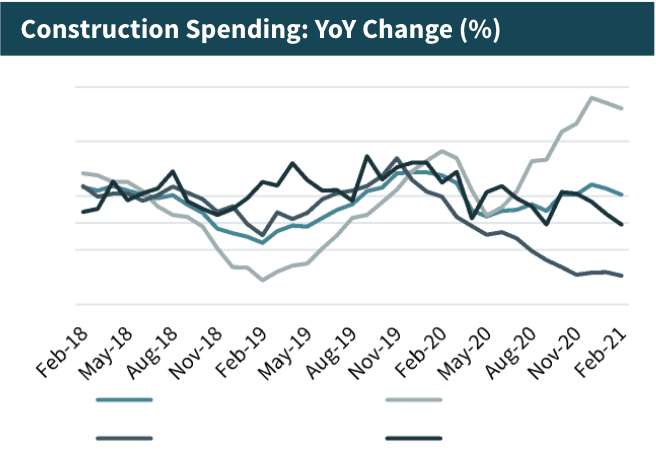

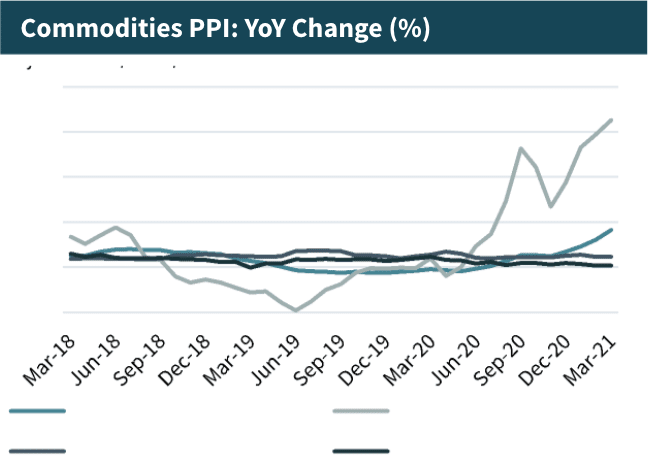

- Lumber prices and other building materials prices have increased over the past year as demand for new housing, industrial and mixed-use properties increases, and COVID roiled supply chains struggle to keep up.

- Lumber prices skyrocketed by as much as 10% per week during 2020 and 2021 and have increased over 200% YoY. Housing starts are up approximately 30% YoY and are continuing to trend in an upward direction as demand continues to outstrip supply.

- The increase in commodity prices is not just limited to lumber; all construction materials including concrete, aggregates, and metals are experiencing significant YOY price changes. The supply/demand mismatch is expected to continue for the foreseeable future.

- The increase in commodity prices combined with low mortgage rates have resulted in higher prices for homes; lumber inflation alone has led to a $24,000 price increase per house. Despite this, consumers remain undeterred with 39% of homes in March 2021 selling at or above their listing price

Source: US Census, Engineering News Record (“ENR”), Association of General Contractors, U.S. Small Business Administration, PitchBook Data, IBISWorld, Company Press Release,, and Meridian Research

ENC&BP Middle Market M&A Activity and Market Trends

Commentary

- Transaction activity continues to rebound with Q1 2021 M&A activity on-par with Q1 2020 and up 105% since the lows seen during the onset of the pandemic in Q2 2020.

- The continued strong economic performance of the ENC&BP sector and a build up of dry powder on investor balance sheets have been the primary drivers of the increased M&A activity.

- M&A activity is expected to continue to accelerate over the next twelve months as firms see favorable economic forecasts, the threat of a new tax regime and increased public sector infrastructure spending.

- With the cost of skilled labor and building materials continuing to increase, Engineering, Construction, & Building Products firms are looking to invest in technologies that improve efficiency. Firms that have made technology investments including vis-a-vis acquisitions are best positioned to cope with rising construction costs.

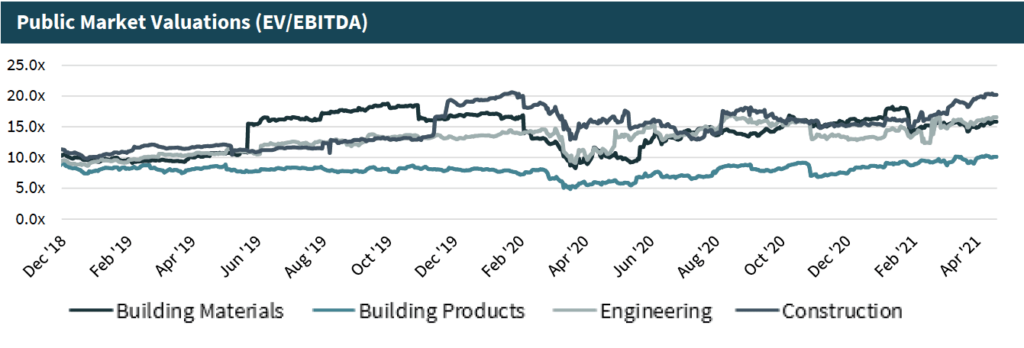

- Sector valuations have also seen a rebound from their lows in March 2020 during the onset of the COVID-19 pandemic. Building materials firms are currently seeing the highest valuations with an average EV/LTM EBITDA multiple of 18.5x as of April 2021.

Recent Transaction Spotlights

Blackstone (NYSE:BX) to Acquire Telecom Infrastructure Firm Sabre Industries

Announced April 13th, 2021

- Blackstone announced its private equity fund, Blackstone Energy Partners, has agreed to acquire Sabre Industries, Inc. from The Jordan Company. The acquisition of Sabre continues Blackstone Energy Partners’ focus on ESG investing by adding portfolio companies that support the transition to cleaner, more affordable energy.

- Sabre is a leading designer and manufacturer of highly engineered, mission-critical steel poles and towers for the electrical utility and telecommunications end-markets. Sabre’s products are key to strengthening U.S. electrical transmission and expansion of the 5G wireless telecom infrastructure. Electrical and telecom infrastructure have both been identified as key areas for investment in the Biden Administration’s $2T infrastructure spending plan unveiled at the beginning of Apr-21.

- The investment builds upon Blackstone Energy Partners prior investments in utility related businesses including their acquisitions of GridLiance and Customer Truck One Source. The acquisition provides Sabre with a strategic partner to accelerate the growth and modernization of the U.S. electrical grid.

Investcorp and Trilantic North America to Acquire RoadSafe Traffic Systems

Announced April 12th, 2021

- Investcorp, a leading global provider and manager of alternative investment products, and Trilantic North America, a growth-focused middle market private equity firm, today announced that they have agreed to acquire RoadSafe Traffic Systems from ORIX Capital Partners.

- RoadSafe is the nation’s largest provider of traffic control and pavement marking services for roadway construction, state transportation, railroad, and utility customers. The Company has more than 50 locations and over 1,600 employees.

- Investcorp sees attractive tailwinds in the road-marking industry given the wide-spread rollout of 5G networks and the need to re-mark the U.S.’s aging roads to support future technologies.

- The acquisition will allow RoadSafe to continue to expand geographically and will provide a strategic partner to help create value via add-on acquisitions in this fragmented market.

American Construction Source has Acquired Foley Lumber and Milaca Building Center

Announced April 2nd, 2021

- American Construction Source (“ACS”), a leading national building materials distribution platform for custom home builders and repair and remodel contractors, has acquired Foley Lumber and Milaca Building Center. ACS is backed by Angeles Equity Partners, LLC and Clearlake Capital Group, L.P. and has made nine acquisitions under their sponsorship.

- Founded in 1932, Foley Lumber and Milaca Building Center have provided building materials to customers across the Midwest, primarily serving builders and contractors. Foley and Milaca will continue to operate under their established brands in Minnesota.

- The acquisition will provide Foley Lumber and Milaca a partner for accelerated growth via delivering more value-added products and an expanded portfolio of services.

Source: PitchBook, Company Press Releases, Meridian Research

Small & Mid Cap Company Valuations

Construction Firms

| Company Name | Market Cap | EV | LTM / Rev | LTM / EBITDA | LTM Margin EBITDA | EV/LTM Rev | EV/LTM EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Quanta Services, Inc. | $12,608 | $13,882 | $11,203 | $916 | 8.2% | 1.2x | 15.2x | 172 % |

| MasTec, Inc. | $7,209 | $8,282 | $6,321 | $783 | 12.4% | 1.3x | 10.6x | 150 % |

| EMCOR Group Inc | $6,261 | $5,894 | $8,797 | $366 | 4.2% | 0.7x | 16.1x | 80 % |

| Dycom Industries, Inc. | $2,792 | $3,427 | $3,199 | $265 | 8.3% | 1.1x | 12.9x | 205 % |

| Comfort Systems USA, Inc. | $2,714 | $2,992 | $2,857 | $259 | 9.1% | 1.0x | 11.5x | 98 % |

| Primoris Services Corp. | $1,801 | $2,002 | $3,491 | $248 | 7.1% | 0.6x | 8.1x | 98 % |

| Granite Construction Inc. | $1,783 | $1,559 | $3,562 | ($32) | -0.9% | 0.4x | nm | 132 % |

| MYR Group Inc. | $1,235 | $1,265 | $2,247 | $132 | 5.9% | 0.6x | 9.6x | 185 % |

| Great Lakes Dredge & Dock Corp. | $967 | $1,140 | $734 | $151 | 20.6% | 1.6x | 7.5x | 69 % |

| Sterling Construction Company, Inc. | $626 | $946 | $1,427 | $127 | 8.9% | 0.7x | 7.4x | 135 % |

| Matrix Service Co. | $362 | $292 | $794 | ($3) | -0.4% | 0.4x | nm | 36 % |

| Orion Group Holdings, Inc. | $182 | $264 | $710 | $60 | 8.5% | 0.4x | 4.4x | 162 % |

| Median | $5,894 | $6,321 | $366 | 8.3% | 1.1x | 12.9x | 150 % | |

| Mean | $6,895 | $6,475 | $518 | 8.4% | 1.1x | 13.3x | 141 % |

Engineering Firms

| Company Name | Market Cap | EV | LTM / Rev | LTM / EBITDA | LTM Margin EBITDA | EV/LTM Rev | EV/LTM EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Vulcan Materials Company | $22,408 | $24,898 | $4,857 | $1,261 | 26.0% | 5.1x | 19.7x | 49 % |

| Martin Marietta, Inc. | $21,002 | $23,883 | $4,730 | $1,401 | 29.6% | 5.0x | 17.0x | 62 % |

| Eagle Materials Inc. | $5,757 | $6,665 | $1,631 | $317 | 19.4% | 4.1x | 21.0x | 108 % |

| Boral Ltd | $5,493 | $6,980 | $3,724 | ($440) | -11.8% | 1.9x | nm | 178 % |

| United States Lime & Minerals, Inc. | $788 | $707 | $161 | $53 | 33.3% | 4.4x | 13.2x | 48 % |

| Median | $6,980 | $3,724 | $317 | 26.0% | 4.4x | 18.4x | 62 % | |

| Mean | $12,626 | $3,021 | $518 | 19.3% | 4.1x | 17.8x | 89 % |

Building Products Firms

| Company Name | Market Cap | EV | LTM / Rev | LTM / EBITDA | LTM Margin EBITDA | EV/LTM Rev | EV/LTM EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Masco Corp. | $15,514 | $17,397 | $7,188 | $1,408 | 19.6% | 2.4x | 12.4x | 51 % |

| Trex Company, Inc. | $10,977 | $10,890 | $881 | $252 | 28.6% | 12.4x | 43.3x | 121 % |

| Owens Corning Corporation | $10,159 | $12,762 | $7,055 | $369 | 5.2% | 1.8x | 34.6x | 120 % |

| Builders FirstSource, Inc. | $9,692 | $11,173 | $8,559 | $660 | 7.7% | 1.3x | 16.9x | 212 % |

| UFP Industries, Inc. | $4,872 | $4,823 | $5,154 | $421 | 8.2% | 0.9x | 11.5x | 92 % |

| Armstrong World Industries, Inc. | $4,549 | $5,168 | $937 | ($19) | -2.0% | 5.5x | nm | 13 % |

| Simpson Manufacturing Company, Inc. | $4,539 | $4,311 | $1,268 | $291 | 22.9% | 3.4x | 14.8x | 57 % |

| Gibraltar Industries, Inc. | $2,813 | $2,892 | $1,033 | $129 | 12.5% | 2.8x | 22.4x | 92 % |

| Quanex Building Products Corporation | $898 | $1,021 | $885 | $111 | 12.5% | 1.2x | 9.2x | 122 % |

| Median | $11,173 | $7,055 | $421 | 8.2% | 1.8x | 16.9x | 120 % | |

| Mean | $11,409 | $5,767 | $622 | 13.9% | 3.8x | 23.7x | 119 % |

Building Materials Firms

| Company Name | Market Cap | EV | LTM / Rev | LTM / EBITDA | LTM Margin EBITDA | EV/LTM Rev | EV/LTM EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Jacobs Engineering Group, Inc. | $17,100 | $18,463 | $13,589 | $785 | 5.8% | 1.4x | 23.5x | 62 % |

| Teledyne Technologies Incorporated | $15,366 | $15,472 | $3,086 | $601 | 19.5% | 5.0x | 25.7x | 27 % |

| Aecom Technology Corporation | $9,753 | $11,642 | $13,318 | $665 | 5.0% | 0.9x | 17.5x | 100 % |

| Tetra Tech, Inc. | $7,500 | $7,890 | $2,962 | $269 | 9.1% | 2.7x | 29.4x | 75 % |

| CACI International Inc. | $6,340 | $8,033 | $5,889 | $642 | 10.9% | 1.4x | 12.5x | 9 % |

| KBR Inc | $5,381 | $6,807 | $5,767 | $173 | 3.0% | 1.2x | 39.3x | 71 % |

| Stantec, Inc. | $4,862 | $5,671 | $3,525 | $369 | 10.5% | 1.6x | 15.4x | 54 % |

| Fluor Corporation | $3,126 | $2,872 | $15,668 | ($55) | -0.4% | 0.2x | nm | 182 % |

| Tutor Perini Corp. | $939 | $1,580 | $5,319 | $346 | 6.5% | 0.3x | 4.6x | 157 % |

| VSE Corporation | $506 | $783 | $662 | $38 | 5.8% | 1.2x | 20.6x | 117 % |

| Perma-Fix Environmental Services, Inc. | $90 | $91 | $105 | $5 | 4.6% | 0.9x | 18.8x | 23 % |

| Median | $11,642 | $5,889 | $642 | 9.1% | 1.4x | 23.5x | 62 % | |

| Mean | $12,300 | $7,769 | $592 | 10.0% | 2.3x | 21.7x | 54 % |

Select ENC&BP M&A Transactions

| Date | Buyer | Target | Description |

|---|---|---|---|

| Apr-21 | Blackstone Energy Partners | Sabre Industries | Provider of steel poles and towers for utilities and telecom end-markets. |

| Apr-21 | TJM Capital Partners | PCI Gases, LLC | Provider of mobile oxygen and nitrogen systems for military and industrial applications |

| Apr-21 | Investcorp, Trilantic North America | RoadSafe Traffic Systems | Provider of traffic control and pavement marking services. |

| Apr-21 | Platinum Equity | ACProducts, Inc. | Manufacturer and distributor of kitchen and bath cabinets |

| Apr-21 | Emcor Group | Dallas Mechanical Group, LLC | Provider of mechanical construction and maintenance services based in Dallas, United States. |

| Apr-21 | Harris Contracting Company | HVAC Controls & Specialties, Inc. | Provider of installation services catering to commercial buildings. |

| Apr-21 | American Construction Source, Angeles Equity Partners | Foley Lumber, Inc. | Manufacturer and supplier of lumber products intended to provide building materials to customers while maintaining ethical standards. |

| Apr-21 | The Frameless Hardware Company | Columbia Commercial Building Products, LLC. | Manufacturer of commercial building materials based in Rockwall, Texas. |

| Mar-21 | Tecum Capital, The Marwin Company, Validor Capital | SS Industries | Manufacturer of building products and materials for the homeowner, contractor and professional stair customers. |

| Mar-21 | Clayton, Dubilier & Rice, HD Supply White Cap | National Concrete Accessories, Inc. | Manufacturer of concrete accessories based in Edmonton, Alberta. |

| Mar-21 | Curran Contracting | G. A. Blocker Grading Contractor, Inc. | Provider of construction contracting services based in Oswego, Illinois. |

| Apr-21 | Arcosa | StonePoint Materials, LLC | Operator of a holding company with interest in construction aggregates. |

| Mar-21 | DBM Global | Banker Steel Company LLC | Provider of fabricated structural steel and erection services for the east coast commercial construction market. |

| Mar-21 | CUSITech | Peak Professional Contractors, Inc. | Provider of commercial construction services based in Colorado Springs, United States. |

| Mar-21 | Lite Access Technologies | Amec Cutting & Coring Ltd | Provider of concrete cutting and coring services in the lower mainland, Canada. |

| Mar-21 | Rogers Group | Reed Contracting Services, Inc. | Provider of construction services and supplier of concrete products based in Huntsville, Alabama. |

| Mar-21 | Rogers Mechanical Contractors | R&D Mechanical Services, Inc. | Provider of commercial heating and cooling systems services based in Ball Ground, Georgia. |

| Mar-21 | Composites One | Solvay Composites Materials Global Business | Provider of specialized materials used in a variety of vacuum-assisted composite manufacturing processes. |

| Feb-21 | Quikrete Holdings | Forterra, Inc. | Manufacturer of water and drainage pipe and products for a variety of water-related infrastructure applications. |

| Feb-21 | Fabcon Precast, Platinum Equity, Solace Capital Partners | Oldcastle Infrastructure (Building Services Division) | Manufacturer of precast products for the multifamily, commercial and student housing sectors. |

| Feb-21 | Cemex | Beck Readymix Concrete Co. LTD | Supplier of concrete products for residential, commercial, and governmental jobs in San Antonio, Texas. |

| Jan-21 | American Construction Source, Angeles Equity Partners, Clearlake Capital Group | Builder’s Resource Group, Inc. | Supplier of building materials and lumber products across western Wisconsin and the greater Twin Cities. |

| Jan-21 | Oshkosh | Pratt & Miller Engineering & Fabrication, Inc. | Provider of engineering and product development services in New Hudson, Michigan. |

| Jan-21 | Primoris Services | Future Infrastructure, LLC | Provider of infrastructure development and maintenance services to the telecommunications, regulated utility gas, pipeline, transportation, and civil infrastructure customers throughout the southern regions of the United States. |

| Jan-21 | Huron Capital | Sunland Asphalt and Construction, Inc. | Provider of asphalt paving services serving the government agencies, commercial, retail, residential communities, education and industrial facilities. |

| Jan-21 | Gryphon Investors, Shermco Industries | Ready Engineering Corporation | Operator of a specialty engineering business catering to a diverse range of sectors. |

| Apr-21 | Holcim Participations Master Retirement Trust | Firestone Building Products Company, LLC | Manufacturer of high performing roofing systems designed to provide building and roofing products for commercial, industrial and residential roofing applications. |

| Jan-21 | Milestone Contractors | Wabash Valley Asphalt Co. LLC | Provider of the asphalt pavement contracting services in Wabash Valley, United States. |

| Jan-21 | Comfort Systems USA | Tennessee Electric Company, Inc. | Provider of construction and industrial services in Kingsport, Tennessee. |

| Jan-21 | Curtis Lumber Co. | Wiley Bros., Inc. | Supplier of lumber, hardware and building materials intended to complete any construction project with accuracy and efficiency. |

| Jan-21 | Builders Firstsource | BMC Stock Holdings, Inc. | Provider of building materials and construction services, intended to serve professional home builders and contractor in the United States. |

| Jan-21 | Goodman Global Group | Robinson Plumbing and Heating Supply Co., Inc. | Supplier and distributor of plumbing fixtures and heating equipment based in Fall River, Massachusetts. |

| Jan-21 | Oroco Capital | Shimmick Construction Co., Inc. | Provider of construction and engineering services based in Oakland, California. |

| Jan-21 | Kingmakers | Roof Master & Construction, LLC | Provider of roofing and construction services located in Wolfforth, Texas. |

| Dec-20 | Kelso Private Equity, US LBM Holdings | Jennings Builders Supply & Hardware | Supplier of building materials to the construction industry. |

| Dec-20 | BMC Stock Holdings | TWP Enterprises Inc | Distributor of building materials serving the Washington, DC and Baltimore areas and outlying suburbs. |

| Dec-20 | Clearlake Capital Group | PrimeSource Building Products, Inc. | Distributor of construction fasteners and non-lumber building products in North America. |

| Dec-20 | Lithko Contracting | Capitol Concrete Contracting, LLC | Provider of concrete contracting services based in Liberty Hill, Texas. |

| Dec-20 | Lithko Contracting, The Pritzker Organization | Pikus Concrete and Construction, LLC | Provider of concrete cast services based in American Fork, Utah. |

| Dec-20 | The Jordan Company | U.S. LUMBER GROUP, LLC | Distributor of specialty building products. |

| Dec-20 | Bain Capital | US LBM Holdings, LLC | Distributor of specialty building materials to residential and commercial construction end markets. |

| Nov-20 | Kyocera Industrial Tools, Inc. | Manor Hardware, Inc. | Distributor of construction tools and other hardware. |

| Sep-20 | Gryphon Investors | Right Time Heating and Air Conditioning Canada | Provider of HVAC services and maintainence |

| Sep-20 | GRO-WELL Environmental Partners | Pacific Topsoils Inc. | Supplier of landscape materials including mixed topsoils for landscape construction materials like topsoil, bark, mulch, and aggregate rock. |

| Sep-20 | Court Square, Kodiak Building Partners | Carpenter Contractors of America, Inc. | Manufacturer of prefabricated building components based in Florida, Illinois and North Carolina. |

| Aug-20 | Haley & Aldrich | Hart Crowser, | Provider of geo-technical and environmental consulting services. |