Engineering, Construction & Building Products M&A Trends: Fall 2022

Published September 8, 2022

KEY INSIGHTS

- Backlog growth creates optimism amid continued labor and materials volatility

- Increased demand for environmental services and disaster recovery firms

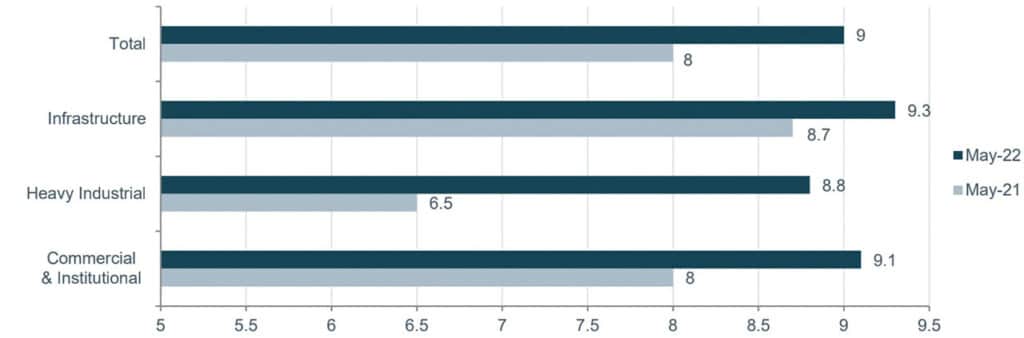

- Construction backlog indicator by industry (months)

ENC&BP M&A COMMENTARY

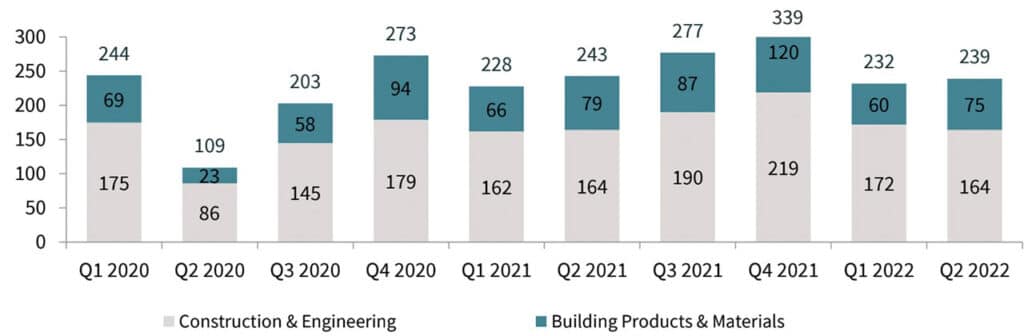

Q1 and Q2 2022 ENC&BP M&A transaction activity has remained steady with 2021 volume over the same period, highlighting continued momentum and growth in 2022. The continued strength of M&A deal flow is driven by both strategic buyers with growing backlogs backed by the federal infrastructure package and financial buyers sitting on record highs of dry powder. M&A is expected to remain a key strategic focus for ENC&BP investors through the second half of 2022.

ENC&BP Market Insights

Backlog Growth Creates Optimism Amid Continued Labor and Materials Volatility

- Material prices have remained volatile in the first half of 2022. Lumber prices returned to nearly 2021 prices in Q1 2022 while decreasing significantly through Q2 and into Q3 2022.

- Overall, construction materials experienced YoY price increases of nearly 11% in the first half of 2022.

- As labor shortages continue to be a focal point – especially for service firms in the industry – the overarching sentiment continues to be the disproportionate amount of work to people.

- An Associated General Contractors of America (AGC) analysis of federal employment data finds construction job openings have exceeded hires for five consecutive months in 2022.

- Backlogs generally continue to grow across industry sectors and US Regions. On average, the industry has nine months of backlog to date – according to Engineering News-Record.

- Overall, there is a general sense of optimism on the industry outlook due to current backlog levels and future federal funding opportunities, despite concerns around material pricing and delays due to labor constraints.

Increased Demand for Environmental Services and Disaster Recovery Firms

- Increased cadence of detrimental weather and climate disasters have created a perpetual need for environmental and disaster recovery services.

- In 2021, the U.S. faced four separate weather events exceeding the $20 billion economic loss threshold.

- In July 2022, the US Senate signed the 2022 Water Resources Development Act (WRDA), a legislation authorizing $34 billion for 30 Army Corps of Engineers flood and hurricane, ecosystem restoration, and disaster relief projects.

- While pending final legislative approval, the 2022 WRDA includes $55 billion of federal and non-federal funds.

- Highly acquisitive players in the space include WSP Global Inc. with a total of seven acquisitions in YTD 2022 including both, Wood Group’s Environmental Unit and Greencap.

Construction Backlog Indicator by Industry (Months)

Source: US Census, Engineering News Record (“ENR”), Association of General Contractors, SBA, PitchBook Data, Mergermarket, IBISWorld, Company Press Releases, Yale Climate Connections, Marcum National Construction Survey, and Meridian Research

ENC&BP Middle Market M&A Activity and Trends

U.S. ENC&BP M&A Activity

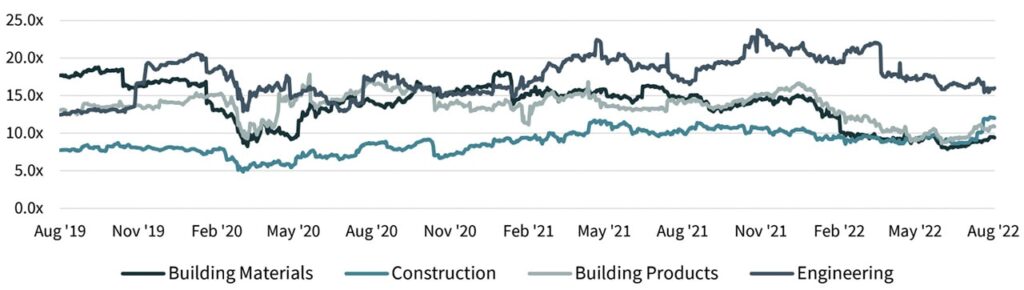

Public Market Valuations (EV/EBITDA)

ENC&BP M&A Commentary

- Q1 and Q2 2022 ENC&BP M&A transaction activity has remained steady with 2021 volume over the same period, highlighting continued momentum and growth in 2022.

- The continued strength of M&A deal flow is driven by both strategic buyers with growing backlogs backed by the federal infrastructure package and financial buyers sitting on record highs of dry powder. M&A is expected to remain a key strategic focus for ENC&BP investors through the second half of 2022.

- Strategic acquirers are targeting acquisitions of lower and middle-market companies to navigate labor shortages and pool purchasing power, amidst material cost volatility.

- Residential services M&A activity remains strong as established regional platforms continue to expand service capacity and geographic presence while new platforms compete for attractive tuck-in acquisitions.

- Due to the increase of economic loss from weather events, both federal and non-federal funding dedicated towards environmental protection efforts has increased. These efforts have led to additional M&A activity in the E&C Service Industry, specifically Environmental Engineering Services.

Source: PitchBook Data, Mergermarket, Company Press Releases, Marcum National Construction Survey, and Meridian Research

CM Heating Acquired by Air Pros USA

Deal Represents the Largest Acquisition of Any HVAC Provider North of Seattle

Meridian Capital LLC (“Meridian”), a Seattle-based leading middle market investment bank and M&A advisory firm is pleased to announce the successful acquisition of its client, CM Heating Inc. (“CM” or the “Company”) by Air Pros USA (“Air Pros”).

Founded in 1983 and headquartered in Everett, Washington, CM Heating is a top-rated HVAC services provider in Washington, providing installation, maintenance, and repair services across Snohomish, Skagit, and King Counties. The Company has proudly built an established customer base of over 25,000+ residential customers and prides itself in providing the best quality service, top-rated products, and comprehensive HVAC expertise.

CM Heating will continue to further grow and operate under its recognized brand and reputation in Washington State while leveraging Air Pros’ operational and sales resources to accelerate growth. CM customers will continue to receive best-in-class HVAC services throughout the North Puget Sound. Co-owners John and James will remain as leaders of the business.

James Garner, President and co-owner of CM, shared, “The partnership with Air Pros is an exciting next step for CM’s continued growth, allows us to further our growth opportunities, and continue to do right by our customers and employees.”

“Our customers trust us with their homes and comfort, so finding the right culture fit in a partner was a critical element for us,” said John Giacomi, Co-owner and General Manager of CM Heating. “We had a number of different choices of strategic partners, and we felt Air Pros will be able to best support our customers and our people.”

James and John commented, “As a multi-generational business that puts its people first, it was of utmost importance to find a partner that not only maintains and aligns with our culture, but also brings resources to accelerate growth. Meridian did an exceptional job identifying potential partners that were strongly aligned with CM’s culture and strategy, and ultimately helping us navigate a transaction with Air Pros that achieved all of our objectives.”

James Rothenberger, Managing Director at Meridian stated, “James, John, and the management team at CM Heating have built an incredible company that is the leading brand and provider north of Seattle. As part of the Air Pros platform, CM Heating will continue its strategic growth plans for many years to come. We are excited for what the future holds for CM Heating and Air Pros. Overall, HVAC M&A volume continues to be quite robust for providers of any scale; for those of scale, like CM, the valuation multiples and activity are attractive.”

ENC&BP Middle Market Selected M&A Activity

Highlighted Engineering and Construction M&A Transactions

MasTec to Acquire IEA (ANNOUNCED)

August 2022

EV

1,199M

EV/EBITDA

11.1x

Target Description: Infrastructure and Energy Alternatives (“IEA”) is a diversified infrastructure construction company with specialized energy and heavy civil expertise throughout the United States.

Investment Rationale: The acquisition allows MasTec to expand service capabilities, scale, and expertise providing critical infrastructure to support the nation’s energy transition to secure and sustainable renewable sources.

Primoris Services Corporation Acquires PLH Group

August 2022

EV

$470M

EV/EBITDA

8.7x

Target Description: PLH Group Inc. is a leading utility-focused specialty contractor with concentration in fast growing electric power and pipeline markets.

Investment Rationale: The acquisition aligns with Primoris’s

strategic focus on high growth and high margin segments across Power Delivery, Communications, and Gas Utilities. PLH allows Primoris to nearly double its Power Delivery business and increase its Utilities segment to over 50% of pro forma revenue.

Highlighted Residential Services M&A Transaction

Freeman Spogli Acquires NearU

August 2022

EV

N/A

EV/EBITDA

N/A

Target Description: Founded in 2018 and headquartered in Charlotte, North Carolina, NearU has quickly become a leading multi-regional provider of essential home services, including HVAC, plumbing, and electrical.

Investment Rationale: The investment allows NearU to accelerate growth in existing footprint, as well as find expand to new geographies. Also plans to improve compensation training and technology.

Highlighted Building Products M&A Transaction

Saint-Gobain Acquires Kaycan Building Products

May 2022

EV

$928M

EV/EBITDA

11.2X

Target Description: Kaycan is a leading manufacturer and distributor of exterior building materials intended for professionals or homeowners, specializing in external siding of all types across Canada and the United States.

Investment Rationale: With this acquisition, Saint-Gobain reinforces its worldwide leadership in light and sustainable construction by becoming the top siding player in Canada and expanding its vinyl offer across the United States with complementary solutions in aluminum and engineered wood.

Source: PitchBook, Mergermarket, Company Press Releases, Meridian Research

Small & Mid-Cap Company Valuations

| Construction Firms | Ticker | Market Cap | E/V | LTM Rev | LTM EBITDA | LTM EBITDA Margin | EV/Rev | EV/EBITDA | 52-Week |

|---|---|---|---|---|---|---|---|---|---|

| Quanta Services, Inc. | NYSE:PWR | $20,448 | $24,447 | $15,474 | $1,305 | 8.4% | 1.6x | 18.7x | 47% |

| MasTec, Inc. | NYSE:MTZ | 6,212 | 8,612 | 8,470 | 715 | 8.4% | 1.0x | 12.0x | (11)% |

| EMCOR Group Inc. | NYSE:EME | 5,990 | 6,279 | 10,462 | 633 | 6.0% | 0.6x | 9.9x | 2% |

| Comfort Systems USA, Inc. | NYSE:FIX | 3,873 | 4,324 | 3,593 | 289 | 8.1% | 1.2x | 14.9x | 42% |

| Dycom Industries, Inc. | NYSE:DY | 3,291 | 4,004 | 3,279 | 261 | 8.0% | 1.2x | 15.3x | 54% |

| MYR Group Inc. | NAS:MYRG | 1,665 | 1,735 | 2,601 | 167 | 6.4% | nm | nm | 1% |

| Granite Construction Inc. | NYSE:GVA | 1,390 | 1,336 | 2,692 | 89 | 3.3% | 0.5x | 15.1x | (23)% |

| Primoris Services Corporation | NAS:PRIM | 1,183 | 1,932 | 3,605 | 266 | 7.4% | 0.5x | 7.3x | (14)% |

| Sterling Construction Company, Inc. | NAS:STRL | 790 | 1,208 | 1,786 | 167 | 9.4% | 0.7x | 7.2x | 15% |

| Great Lakes Dredge & Dock Company | NAS:GLDD | 696 | 1,020 | 722 | 119 | 16.5% | 1.4x | 8.6x | (30)% |

| Matrix Service Co. | NAS:MTRX | 150 | 140 | 682 | (70) | -10.2% | 0.2x | nm | (50)% |

| Orion Group Holdings, Inc. | NYSE:ORN | 84 | 159 | 672 | 7 | 1.1% | 0.2x | 22.1x | (51)% |

| Median | $1,527 | $1,833 | $2,986 | $214 | 7.7% | 0.7x | 13.5x | (5)% | |

| Average | $3,814 | $4,600 | $4,503 | $329 | 6.1% | 0.8x | 13.1x | (1)% |

| Engineering Firms | Ticker | Market Cap | EV | LTM Rev | LTM EBITDA | LTM EBITDA Margin | EV/Rev | EV/EBITDA | 52-Week |

|---|---|---|---|---|---|---|---|---|---|

| Teledyne Technologies Incorporated | NYSE:TDY | $18,836 | $22,643 | $5,364 | $1,286 | 24.0% | 4.2x | 17.6x | (12)% |

| Jacobs Engineering Group, Inc. | NYSE:J | 17,035 | 21,024 | 14,628 | 1,148 | 7.9% | 1.4x | 18.3x | (3)% |

| Aecom Technology Corporation | NYSE:ACM | 10,738 | 12,671 | 13,076 | 823 | 6.3% | 1.0x | 15.4x | 21% |

| Tetra Tech, Inc. | NAS:TTEK | 8,023 | 8,282 | 3,493 | 354 | 10.1% | 2.4x | 23.4x | 8% |

| KBR, Inc. | NYSE:KBR | 7,376 | 8,970 | 7,672 | 479 | 6.2% | 1.2x | 18.7x | 34% |

| CACI International Inc. | NYSE:CACI | 6,734 | 8,735 | 6,203 | 631 | 10.2% | 1.4x | nm | 13% |

| Stantec, Inc. | TSX:STN | 5,609 | 7,165 | 3,983 | 435 | 10.9% | 1.8x | 16.5x | 6% |

| Fluor Corporation | NYSE:FLR | 3,764 | 3,018 | 12,682 | 222 | 1.8% | 0.2x | 13.6x | 57% |

| VSE Corporation | NAS:VSEC | 560 | 893 | 884 | 77 | 8.7% | 1.0x | 11.6x | (8)% |

| Tutor Perini Corp. | NYSE:TPC | 366 | 1,067 | 4,386 | 283 | 6.4% | 0.2x | 3.8x | (50)% |

| Perma-Fix Environmental Services, Inc. | NAS:PESI | 70 | 74 | 68 | (6) | -8.3% | 1.1x | nm | (10)% |

| Median | $6,734 | $8,282 | $5,364 | $435 | 7.9% | 1.2x | 16.5x | 6% | |

| Average | $7,192 | $8,595 | $6,585 | $521 | 7.6% | 1.4x | 15.4x | 5% |

| Building Products Firms | Ticker | Market Cap | EV | LTM Rev | LTM EBITDA | LTM EBITDA Margin | EV/Rev | EV/EBITDA | 52-Week |

|---|---|---|---|---|---|---|---|---|---|

| Masco Corporation | NYSE:MAS | $12,503 | $15,903 | $8,779 | $1,362 | 15.5% | 1.8x | 11.7x | (12)% |

| Builders FirstSource, Inc. | NYS:BLDR | 10,872 | 14,760 | 22,751 | 4,205 | 18.5% | 0.6x | nm | 35% |

| Owens Corning Corporation | NYSE:OC | 8,695 | 11,110 | 9,291 | 2,172 | 23.4% | 1.2x | 5.1x | (7)% |

| Trex Company, Inc. | NYSE:TREX | 6,349 | 6,369 | 1,365 | 383 | 28.1% | 4.7x | nm | (47)% |

| UFP Industries, Inc. | NAS:UFPI | 5,525 | 5,837 | 9,501 | 1,009 | 10.6% | 0.6x | 5.8x | 20% |

| Simpson Manufacturing Company, Inc. | NYSE:SSD | 4,598 | 5,079 | 1,902 | 494 | 25.9% | 2.7x | 10.3x | (6)% |

| Armstrong World Industries, Inc. | NYSE:AWI | 4,293 | 4,922 | 1,178 | 355 | 30.1% | 4.2x | 13.9x | (16)% |

| Gibraltar Industries, Inc. | NAS:ROCK | 1,525 | 1,621 | 1,389 | 141 | 10.2% | 1.2x | 11.5x | (34)% |

| Quanex Building Products Corp | NYSE:NX | 855 | 943 | 1,162 | 140 | 12.0% | 0.8x | 6.7x | 5% |

| Median | $5,525 | $5,837 | $1,902 | $494 | 18.5% | 1.2x | 10.3x | (7)% | |

| Average | $6,135 | $7,394 | $6,369 | $1,140 | 19.4% | 2.0x | 9.3x | (7)% |

| Building Materials Firms | Ticker | Market Cap | EV | LTM Rev | LTM EBITDA | LTM EBITDA Margin | EV/Rev | EV/EBITDA | 52-Week |

|---|---|---|---|---|---|---|---|---|---|

| Vulcan Materials Company | NYSE:VMC | $23,644 | $28,242 | $6,618 | $1,465 | 22.1% | 4.3x | 19.3x | (5)% |

| Martin Marietta, Inc. | NYSE:MLM | 23,000 | 27,685 | 5,926 | 1,646 | 27.8% | 4.7x | 16.8x | (3)% |

| Eagle Materials Inc. | NYSE:EXP | 5,098 | 6,184 | 1,947 | 652 | 33.5% | 3.2x | 9.5x | (12)% |

| Boral Ltd | ASX: BLD | 2,316 | 1,019 | 1,291 | 229 | 17.7% | 0.8x | 4.4x | (58)% |

| United States Lime & Minerals, Inc. | NAS:USLM | 615 | 510 | 210 | 68 | 32.6% | 2.4x | 7.5x | (26)% |

| Median | $5,098 | $6,184 | $1,947 | $652 | 27.8% | 3.2x | 9.5x | (12)% | |

| Average | $10,935 | $12,728 | $3,198 | $812 | 26.8% | 3.1x | 11.5x | (21)% |

As of August 15th, 2022

Note: Mid-cap defined as market capitalization between $2 billion and $25 billion. Not meaningful (NM) if EV/Sales or EV/EBIT is

a significant outlier. NA if denominator is 0 or not available. NTM figures are based on the median estimate of Wall Street analysts

Select ENC&BP M&A Transactions

| Annouced Date | Target | Acquirer/Investor | Target Description |

|---|---|---|---|

| Pending | Infrastructure & Energy Alternatives (NYS: IEA) | MasTec | Provider of construction services specializing in the energy and heavy civil sectors. |

| Pending | Hill International (NYS: HILL) | Huckabee Architects (Godspeed Capital) | Provider of construction management and other consulting services. |

| Pending | Foss Floors (Wynnchurch Capital) | Mohawk Industries | Manufacturer of flooring and specialty flooring products. |

| Pending | PLH Group | Primoris Services Corporation | Provider of utility-focused construction services. |

| Aug-22 | CM Heating | Air Pros USA (Peak Rock Capital) | Top-rated provider of HVAC services in Washington state, providing installation, maintenance, and repair services. |

| Aug-22 | NearU | Freeman Spogli | Multiregional provider of residential home services including HVAC, plumbing, and electrical. |

| Jul-22 | Foundation Support Specialists | Groundworks (Cortec Group) | Provider of building foundation repair services based in Texas. |

| Jul-22 | IBI Group (TSX: IBG) | Arcadis NV | Provider of consultancy services to urban land, transportation, and systems. |

| Jul-22 | Foxworth-Galbraith Lumber Company | US LBM | Provider of building products based in Texas. |

| Jul-22 | Kaycan | Saint-Gobain | Manufacturer and distributor of exterior building products in Canada and the United States. |

| Jul-22 | Massey Asphalt Paving | Atlantic Southern Paving & Sealcoating (Harbor Beach) | Provider of commercial asphalt services. |

| Jul-22 | Haywood Builders Supply | Southeast Building Supply Interests | Supplier of building materials based in North Carolina. |

| Jul-22 | LJB Inc. | Copley Equity Partners | Provider of civil and structural engineering services based in Ohio. |

| Jul-22 | Norristown Brick | Outdoor Living Supply (Trilantic North America) | Distributor of masonry, landscape, and hardscape materials. |

| Jul-22 | Andersen Commercial Plumbing | Seaside Equity Partners | Provider of HVAC and plumbing services. |

| Jul-22 | Cochran Exteriors | IHS (North Branch Capital) | Provider of residential roofing, siding, window and gutter replacement. |

| Jul-22 | Allen’s Air Conditioning & Heating | Southern HVAC Corporation (Gryphon Investors) | Provider of HVAC services in Kentucky. |

| Jul-22 | Wholesale Sheet Metal | Munch’s Supply (Genstar Capital) | Distributor of heating, ventilation, air conditioning, and sheet metal products |

| Jul-22 | Construction Resources Holdings (Monomoy Capital) | International Designs Group (Mill Point Capital) | Distributor of building products, based in Georgia. |

| Jul-22 | Ardent Environmental Group | ENERCON Services (AE Industrial Partners) | Provider of environmental consulting services, including site assessments and remediation. |

| Jul-22 | Airforce Heating & Air | Air Pros USA (Peak Rock Capital) | Provider of HVAC services based in Georgia. |

| Jul-22 | Calvert Company | Western Forest Products | Select assets related to the manufacturing of glulam beams. |

| Jul-22 | Dema Plumbing | Mai Mechanical (Gladstone Investment) | Provider of plumbing and mechanical systems installation and services provider for residential homebuilders in Colorado. |

Select ENC&BP M&A Transactions

| Announced Date | Target | Acquirer/Investor | Target Description |

|---|---|---|---|

| Jul-22 | PPM Group | Fountainhead Consulting Corporation | Provider of construction management services. |

| Jul-22 | Evergreen Fire and Life Safety | Performance Systems Integration (Riverside) | Provider of fire and life safety system inspections, repair, and maintenance services. |

| Jul-22 | Mathers Group | Holcim (SWX:HOLN) | Quarry and asphalt assets. |

| Jun-22 | Pro Plumbing Services | Southern HVAC Corporation (Gryphon Investors) | Provider of HVAC, plumbing, and electrical services in North Carolina. |

| Jun-22 | Cornerstone Building Brands | Clayton, Dubilier, & Rice | Largest manufacturer of exterior building products in North America based in North Carolina. |

| Jun-22 | American Building Materials | L&W Supply Corporation | Distributor of drywall. |

| Jun-22 | Dempsey Wood Products | PalletOne (UFP Industries) | Provider of lumber other industrial wood products. |

| Jun-22 | Elite Fire Safety | Sciens Building Solutions (Carlyle, Huron Capital) | Provider of fire and life safety services. |

| Jun-22 | Dallas Plumbing Company | Air Pros USA (Peak Rock Capital) | Provider of HVAC and plumbing services. |

| Jun-22 | Black Diamond Paving & Concrete | Atlantic Southern Paving & Sealcoating (Harbor Beach) | Providing of paving services in Southern California. |

| Jun-22 | LP Building Solutions (NYSE:LPX) | Pacific Woodtech | Engineered wood products assets and facilities. |

| Jun-22 | Next Level Concrete Coatings | ReVamp Companies (Bertram Capital) | Provider of concrete coating services in Boston, Massachusetts. |

| Jun-22 | Coastal Plywood Company | Boise Cascasde | Provider of plywood, lumber, and treated wood products. |

| Jun-22 | C.H.I. Overhead Doors | Nucor Corporation | Manufacturer of residential and commercial overhead doors. |

| Jun-22 | Earthsavers Erosion Control | Core & Main (NYS: CNM) | Manufacturer of geosynthetics products. |

| Jun-22 | Wallace Building Supply | Southeast Building Supply Interests | Distributor of building materials in Tennessee. |

| Jun-22 | Barrette Outdoor Living | CRH | Provider of residential fencing and railing solutions. |

| May-22 | HomeServe | Brookfield Asset Management | Provider of heating, electrical, and plumbing services in the UK. |

| May-22 | Cajun Ready Mix Concrete | Holcim | Provider of concrete and service for residential, commercial, and industrial customers. |

| Apr-22 | Landmark Structures | Graycliff Partners | Manufacturer of water storage tanks. |

| Apr-22 | Oldcastle BuildingEnvelope Inc. | KPS Capital Partners | Manufacturer, fabricator, and distributor of architectural hardware, glass, and glazing systems based in Dallas, Texas. |

| Apr-22 | Builders Hardware | Trimlite (Wynnchurch Capital) | Distributor of exterior doors, door glass, and related door products for the residential and commercial end markets. |

| Mar-22 | Huttig Building Products | Woodgrain | Distributor of millwork, building materials, and wood products |