Engineering, Construction & Building Products M&A Trends: Winter 2023

Published February 14, 2023

- Reasons for optimism in 2023: backlogs remain elevated

- Continued rollout of IIJA funding provides public sector tailwinds

- Following a record high of deal activity in 2021, ENC&BP M&A transactions returned to levels in line with healthy historical averages in 2022

The Associated Builders and Contractors (ABC) Construction Backlog Indicator remained steady through the end of the year and finished 2022 at its highest level since Q2 2019. In line with the elevated Backlog Indicator data, ABC’s Construction Confidence Index exceeded 50 at year-end, indicating expected growth in the sector over the next six months.

Public works construction is expected to be a leading market in 2023 as IIJA funding deployment accelerates. The public works sector is expected to grow by 18% in 2023, to $225B.

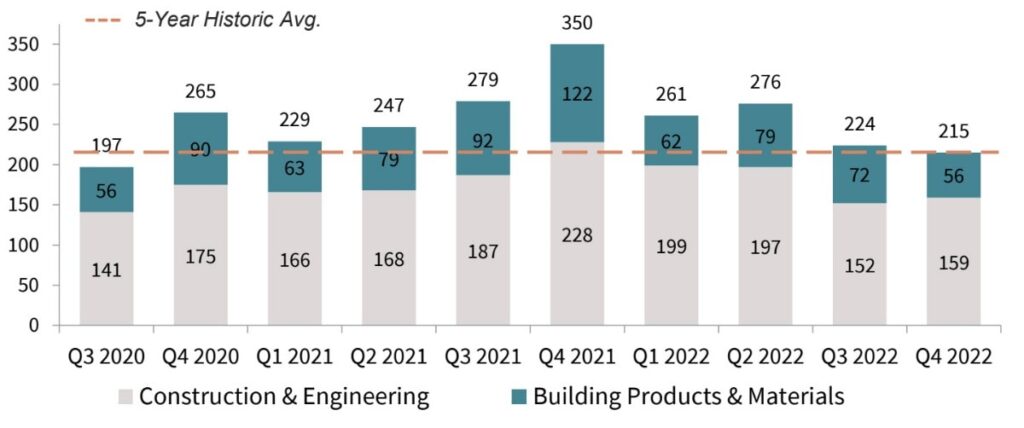

Following a record high of deal activity in 2021 ENC&BP M&A transactions returned to levels in line with healthy historical averages in 2022. 2023 M&A deal flow is expected to see sustained demand in the sector, as both strategic and financial buyers attempt to capitalize on rising demand from the federal infrastructure package.

ENC&BP Market Insights

Reasons for Optimism in 2023: Backlogs Remain Elevated

- The Associated Builders and Contractors (ABC) Construction Backlog Indicator remained steady through the end of the year and finished 2022 at its highest level since Q2 2019.

- In line with the elevated Backlog Indicator data, ABC’s Construction Confidence Index exceeded 50 at year-end, indicating expected growth in the sector over the next six months.

- New construction activity grew in 2022, as total construction starts across all sectors rose 15% over 2021 volume. Nonresidential starts grew 38% YoY, while residential starts were down 3% overall from 2021 amid rising interest rates.

- Public Works, Power / Utilities, and Data Center construction are three markets expected to lead the industry in growth throughout 2023.

- Construction job openings hit the third highest level on record in December, as 5% of open positions remained unfilled. Approximately 60% of contractors intend to increase staffing in the H1 of 2023, further increasing competitiveness in the existing labor shortage.

- Materials prices are expected to have more stability in 2023 compared to 2022. Cement and concrete products are expected to see shortages, while other materials segments are seeing supply chains stabilize.

Continued Rollout of IIJA Funding Provides Public Sector Tailwinds

Bridges & Roads

IIJA Funding

$110B

Heavy Civil Poised for Continued Growth

- Through Q3 2022, states have committed $53.5 billion to over 29,000 bridge and highway projects.

- Increased heavy civil projects are driving demand for specialized engineering & construction services – specifically geotechnical engineers, civil design engineers, and material testing firms.

Water Infrastructure

IIJA Funding

$63B

Major Investments in Water Infrastructure

- The largest investment in water by the federal government to date was provided by the IIJA, with the goal of improving the United States’ wastewater, drinking water, and stormwater infrastructure.

- Deployment of funds has begun – in early Feb 2023, Philadelphia announced $340M in EPA loans through the Water Infrastructure Finance & Innovation Program, along with $160M through the IIJA.

Renewable Energy

IIJA Funding

$34B

Renewable Energy Trends

- The construction industry continues to see growth in sustainable products and services offerings.

- This is expected to be amplified by the Aug 2022 Inflation Reduction Act (IRA), which provides $369B for clean energy and climate programs, the largest investment passed by Congress to date.

Source: Association of General Contractors, ABC, Conexpo, Construction Dive, Dodge Data Analytics, Engineering News Record (“ENR”), US White House, US Senate, PitchBook Data, Mergermarket, ARTBA, Company Press Releases, and Meridian Research

ENC&BP Middle Market M&A Activity and Trends

Public Market Valuations (EV/EBITDA)

U.S. ENC&BP M&A Activity

ENC&BP M&A Commentary

- Following a record high of deal activity in 2021, ENC&BP M&A transactions returned to levels in line with healthy historical averages in 2022.

- Deal activity in the space saw a slight decline in H2 2022, primarily due to concerns about rising inflation and interest rate levels.

- 2023 M&A deal flow is expected to see sustained demand in the sector, as both strategic and financial buyers attempt to capitalize on rising demand from the federal infrastructure package.

- Strategic acquirers are expected to continue using acquisitions as a strategy to address labor and supply chain shortages, thereby increasing their ability to execute on increased backlog levels.

- Certain service sectors, like HVACR contractors, endured all-time historical highs in M&A volume in 2022, as financial buyers continue their roll-up strategies in a nod to the sector’s defensibility.

Source: PitchBook Data, MergerMarket, Company Press Releases, Marcum National Construction Survey, and Meridian Research

Industry Spotlight – Solar Installation Services

Solar Installation Services Growth Trends

The Solar Installation Services sector remains highly fragmented and ripe for consolidation in 2023. Geographic expansion in underpenetrated markets amidst localized industry maturation creates attractive M&A conditions for established strategic platforms.

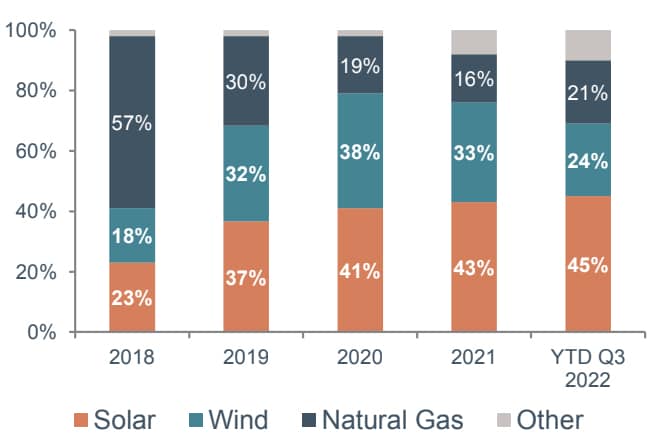

US Electricity Generation Additions by Type

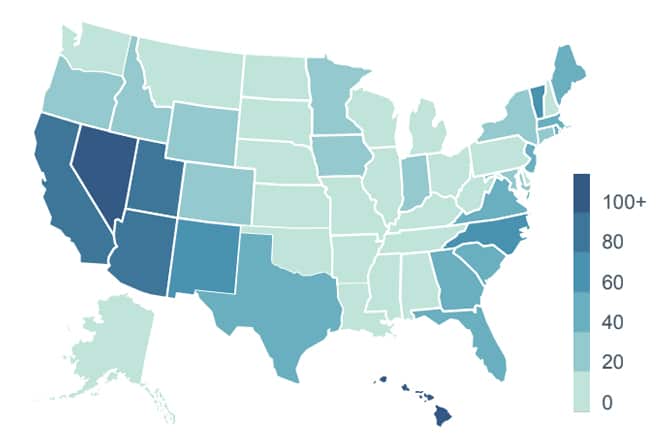

Solar Capacity (in MW) per 100,000 Residents

- The United States Solar Installation Services market is projected to grow at an average of 21% per year between 2023 and 2027. The sustained growth of the industry is largely driven by the decreasing costs of new solar installations compared to other forms of electricity generation and tailwinds from new and expanded state and federal incentives.

- The Inflation Reduction Act, signed into law in August 2022, expands the Investment Tax Credit in amount and duration, decreasing the overall cost of a new solar installation by up to 30% through 2032.

- Legacy solar states like California, Arizona, and Nevada have produced established solar installation market participants who are seeking higher growth rates in emerging markets such as North Carolina and Georgia. While most near-term installations are expected to be in legacy markets, entry into a smaller market by an established platform is likely to drive future growth.

- With over 90% of solar installers in emerging markets generating less than $5M in annual revenue, there is an attractive opportunity for industry consolidation for larger platforms to spur growth with more established lead generation and financing capabilities.

Source: Solar Energy Industries Association, Solar Power Investor, Company Press Releases, and Meridian Research

Selected ENC&BP Roll-ups

Highlighted Construction Materials Roll-up

Description: Global provider of sustainable construction, with services lines including building solutions and materials such as cement, aggregates, and concrete.

Holcim

Highlighted Residential Services Roll-up

Description: Provider of residential plumbing, electrical, heating, ventilation and air conditioning replacement and maintenance services primarily in the Midwest region.

Heartland Home Services

Highlighted Building Products Roll-up

Description: Distributor of interior and exterior building supplies. The Company is the country’s largest wholesaler distributor of roofing supplies and one of the largest distributors of siding and windows.

ABC Supply Company

Source: PitchBook, MergerMarket, Company Press Releases, Meridian Research

Small & Mid-Cap Company Valuations

| Construction Firms | Ticker | Market Cap | E/V | LTM Rev | LTM EBITDA | LTM Margin EBITDA | Total Debt / EBITDA | EV/LTM Rev | EV/LTM EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|---|

| Quanta Services, Inc. | NYSE:PWR | $ 21,748 | $ 25,700 | $ 16,581 | $ 1,370 | 8.3% | 3.0x | 1.5x | 18.8x | 48 % |

| MasTec, Inc. | NYSE:MTZ | 7,722 | 10,108 | 8,579 | 649 | 7.6% | 3.8x | 1.2x | 15.6x | 13 % |

| EMCOR Group Inc. | NYSE:EME | 7,065 | 7,375 | 10,766 | 644 | 6.0% | 1.1x | 0.7x | 11.5x | 26 % |

| Comfort Systems USA, Inc. | NYSE:FIX | 4,328 | 4,752 | 3,879 | 306 | 7.9% | 1.6x | 1.2x | 15.5x | 36 % |

| Dycom Industries, Inc. | NYSE:DY | 2,819 | 3,648 | 3,652 | 326 | 8.9% | 2.7x | 1.0x | 11.2x | 10 % |

| Granite Construction Inc. | NYSE:GVA | 1,862 | 1,737 | 2,828 | 141 | 5.0% | 2.3x | 0.6x | 12.3x | 17 % |

| MYR Group Inc. | NAS:MYRG | 1,644 | 1,730 | 2,791 | 165 | 5.9% | 0.7x | 0.6x | 10.5x | 4 % |

| Primoris Services Corporation | NAS:PRIM | 1,413 | 2,666 | 3,976 | 268 | 6.7% | 5.1x | 0.7x | 10.0x | 1 % |

| Sterling Infrastructure, Inc. | NAS:STRL | 1,104 | 1,457 | 1,879 | 187 | 9.9% | 2.7x | 0.8x | 7.8x | 37 % |

| Great Lakes Dredge & Dock Company | NAS:GLDD | 455 | 825 | 712 | 88 | 12.4% | 4.6x | 1.2x | 9.4x | (50)% |

| Matrix Service Co. | NAS:MTRX | 218 | 243 | 748 | (26) | -3.5% | -1.5x | 0.3x | nm | 8 % |

| Orion Group Holdings, Inc. | NYSE:ORN | 92 | 168 | 714 | 17 | 2.4% | 4.7x | 0.2x | 9.9x | (10)% |

| Median | $ 1,753 | $ 2,201 | $ 3,240 | $ 227 | 7.2% | 2.7x | 0.7x | 11.2x | 11 % | |

| Average | $ 4,206 | $ 5,034 | $ 4,759 | $ 345 | 6.5% | 2.6x | 0.8x | 12.0x | 12 % |

| Engineering Firms | Ticker | Market Cap | E/V | LTM Rev | LTM EBITDA | LTM Margin EBITDA | Total Debt / EBITDA | EV/LTM Rev | EV/LTM EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|---|

| Teledyne Technologies Incorporated | NYSE:TDY | $ 19,886 | $ 23,171 | $ 5,416 | $ 1,316 | 24.3% | 3.1x | 4.3x | 17.6x | 0 % |

| Jacobs Engineering Group, Inc. | NYSE:J | 15,643 | 19,344 | 14,923 | 1,273 | 8.5% | 3.3x | 1.3x | 15.2x | (5)% |

| Aecom Technology Corporation | NYSE:ACM | 12,126 | 13,883 | 13,148 | 827 | 6.3% | 3.4x | 1.1x | 16.8x | 25 % |

| Tetra Tech, Inc. | NAS:TTEK | 8,278 | 8,556 | 3,504 | 387 | 11.1% | 1.2x | 2.4x | 22.1x | 10 % |

| CACI International Inc. | NYSE:CACI | 7,243 | 8,990 | 6,481 | 649 | 10.0% | 2.9x | 1.4x | 13.8x | 25 % |

| KBR, Inc. | NYSE:KBR | 7,029 | 8,642 | 7,455 | 497 | 6.7% | 4.0x | 1.2x | 17.4x | 14 % |

| Stantec, Inc. | TSX:STN | 5,740 | 7,129 | 4,185 | 451 | 10.8% | 3.3x | 1.7x | 15.8x | (2)% |

| Fluor Corporation | NYSE:FLR | 5,222 | 4,158 | 11,935 | 207 | 1.7% | 5.6x | 0.3x | 20.1x | 67 % |

| VSE Corporation | NAS:VSEC | 703 | 1,023 | 926 | 80 | 8.6% | 4.0x | 1.1x | 12.8x | 7 % |

| Tutor Perini Corp. | NYSE:TPC | 472 | 1,093 | 3,921 | 33 | 0.9% | 28.8x | 0.3x | nm | (24)% |

| Perma-Fix Environmental Services, Inc. | NAS:PESI | 55 | 57 | 71 | (3) | -4.5% | -1.2x | 0.8x | nm | (29)% |

| Median | $ 7,029 | $ 8,556 | $ 5,416 | $ 451 | 8.5% | 3.1x | 1.2x | 16.8x | 7 % | |

| Average | $ 7,490 | $ 8,731 | $ 6,542 | $ 520 | 7.7% | 2.8x | 1.4x | 16.8x | 8 % |

| Building Products Firms | Ticker | Market Cap | E/V | LTM Rev | LTM EBITDA | LTM Margin EBITDA | Total Debt / EBITDA | EV/LTM Rev | EV/LTM EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|---|

| Masco Corporation | NYSE:MAS | $ 11,998 | $ 15,339 | $ 8,779 | $ 1,333 | 15.2% | 2.7x | 1.7x | 11.5x | (16)% |

| Builders FirstSource, Inc. | NYS:BLDR | 11,730 | 15,334 | 23,004 | 4,367 | 19.0% | 0.8x | 0.7x | 3.5x | 14 % |

| Owens-Corning Inc | NYSE:OC | 9,033 | 11,499 | 9,607 | 2,398 | 25.0% | 1.3x | 1.2x | 4.8x | 7 % |

| Trex Company, Inc. | NYSE:TREX | 5,785 | 5,891 | 1,218 | 306 | 25.1% | 0.4x | 4.8x | 19.2x | (45)% |

| UFP Industries, Inc. | NAS:UFPI | 5,766 | 5,749 | 9,730 | 1,082 | 11.1% | 0.4x | 0.6x | 5.3x | 16 % |

| Simpson Manufacturing Company, Inc. | NYSE:SSD | 4,563 | 4,975 | 2,059 | 518 | 25.1% | 1.4x | 2.4x | 9.6x | (6)% |

| Armstrong World Industries, Inc. | NYSE:AWI | 3,535 | 4,168 | 1,211 | 355 | 29.3% | 2.0x | 3.4x | 11.8x | (21)% |

| Gibraltar Industries, Inc. | NAS:ROCK | 1,659 | 1,777 | 1,411 | 149 | 10.5% | 0.9x | 1.3x | 12.0x | (2)% |

| Quanex Building Products Corp | NYSE:NX | 860 | 893 | 1,222 | 152 | 12.5% | 0.6x | 0.7x | 5.9x | 18 % |

| Median | $ 5,766 | $ 5,749 | $ 2,059 | $ 518 | 19.0% | 0.9x | 1.3x | 9.6x | (2)% | |

| Average | $ 6,103 | $ 7,292 | $ 6,471 | $ 1,184 | 19.2% | 1.2x | 1.9x | 9.3x | (4)% |

| Building Materials Firms | Ticker | Market Cap | E/V | LTM Rev | LTM EBITDA | LTM Margin EBITDA | Total Debt / EBITDA | EV/LTM Rev | EV/LTM EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|---|

| Masco Corporation | NYSE:MAS | $ 11,998 | $ 15,339 | $ 8,779 | $ 1,333 | 15.2% | 2.7x | 1.7x | 11.5x | (16)% |

| Builders FirstSource, Inc. | NYS:BLDR | 11,730 | 15,334 | 23,004 | 4,367 | 19.0% | 0.8x | 0.7x | 3.5x | 14 % |

| Owens-Corning Inc | NYSE:OC | 9,033 | 11,499 | 9,607 | 2,398 | 25.0% | 1.3x | 1.2x | 4.8x | 7 % |

| Trex Company, Inc. | NYSE:TREX | 5,785 | 5,891 | 1,218 | 306 | 25.1% | 0.4x | 4.8x | 19.2x | (45)% |

| UFP Industries, Inc. | NAS:UFPI | 5,766 | 5,749 | 9,730 | 1,082 | 11.1% | 0.4x | 0.6x | 5.3x | 16 % |

| Simpson Manufacturing Company, Inc. | NYSE:SSD | 4,563 | 4,975 | 2,059 | 518 | 25.1% | 1.4x | 2.4x | 9.6x | (6)% |

| Armstrong World Industries, Inc. | NYSE:AWI | 3,535 | 4,168 | 1,211 | 355 | 29.3% | 2.0x | 3.4x | 11.8x | (21)% |

| Gibraltar Industries, Inc. | NAS:ROCK | 1,659 | 1,777 | 1,411 | 149 | 10.5% | 0.9x | 1.3x | 12.0x | (2)% |

| Quanex Building Products Corp | NYSE:NX | 860 | 893 | 1,222 | 152 | 12.5% | 0.6x | 0.7x | 5.9x | 18 % |

| Median | $ 5,766 | $ 5,749 | $ 2,059 | $ 518 | 19.0% | 0.9x | 1.3x | 9.6x | (2)% | |

| Average | $ 6,103 | $ 7,292 | $ 6,471 | $ 1,184 | 19.2% | 1.2x | 1.9x | 9.3x | (4)% |

| Building Materials Firms | Ticker | Market Cap | E/V | LTM Rev | LTM EBITDA | LTM Margin EBITDA | Total Debt / EBITDA | EV/LTM Rev | EV/LTM EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|---|

| Vulcan Materials Company | NYSE:VMC | $ 24,366 | $ 29,003 | $ 7,190 | $ 1,540 | 21.4% | 3.1x | 4.0x | 18.8x | (4)% |

| Martin Marietta, Inc. | NYSE:MLM | 22,330 | 27,639 | 6,181 | 1,707 | 27.6% | 3.2x | 4.5x | 16.2x | (8)% |

| Eagle Materials Inc. | NYSE:EXP | 5,267 | 6,301 | 2,091 | 723 | 34.6% | 1.5x | 3.0x | 8.7x | (1)% |

| Boral Ltd | ASX: BLD | 2,678 | 2,988 | 2,172 | 214 | 9.9% | 3.1x | 1.4x | 13.9x | (45)% |

| United States Lime & Minerals, Inc. | NAS:USLM | 861 | 743 | 224 | 74 | 33.0% | 0.1x | 3.3x | 10.0x | 22 % |

| Median | $ 5,267 | $ 6,301 | $ 2,172 | $ 723 | 27.6% | 3.1x | 3.3x | 13.9x | (4)% | |

| Average | $ 11,100 | $ 13,335 | $ 3,572 | $ 852 | 25.3% | 2.2x | 3.2x | 13.5x | (7)% |

Select ENC&BP M&A Transactions

| Announced Date | Target | Acquirer/Investor | Target Description |

|---|---|---|---|

| Jan-22 | Bulks | Outdoor Living Supply | Distributor of landscape materials. |

| Pending | Atlas Technical Consultants (NASDAQ: ATCX) | GI Partners | Provider of infrastructure and environmental testing, inspection, engineering, and consulting services. |

| Pending | U.S. LBM Standalone Wallboard Division | ABC Supply Co. | Five U.S. LBM brands comprising its standalone wallboard division. |

| Jan-23 | Marsh Building Products | SRS Distribution (Leonard Green, Berkshire Partners) | Distributor of residential and commercial building products based in Kentucky. |

| Jan-23 | SRI Holdings | TopBuild (NYSE: BLD) | Provider of residential insulation, garage doors, and specialty building products based in Ohio. |

| Jan-23 | Clean Water Environmental | Valicor Environmental Services | Provider of wastewater treatment and recycling services based in California. |

| Jan-23 | Patrick Engineering | RINA | Provider of engineering, design, and construction management services. |

| Jan-23 | 3 Mountains Plumbing | Any Hour Services (Knox Lane) | Provider of residential HVAC services based in Oregon. |

| Jan-23 | Nevada Heating, Cooling, Plumbing, Fireplace | Goettl (Cortec Group) | Provider of residential HVAC services based in Nevada. |

| Jan-23 | Trans Ash | NorthStar Group Holdings (J.F. Lehman, PhenixFIN BDC) | Provider of civil construction and environmental services based in Ohio. |

| Jan-23 | Nicem | Holcim (SWX: HOLN) | Provider of crushed calcium carbonate based in Italy. |

| Jan-23 | Amerhart | U.S. Lumber Group (The Jordan Company) | Distributor of building materials and home improvement centers throughout the Midwest. |

| Jan-23 | Gannett Fleming | OceanSound Partners | Provider of engineering and infrastructure solutions based in Pennsylvania. |

| Jan-23 | Hudson Design Group | Tower Engineering Professionals (Aldine Capital Partners) | Provider of engineering and architectural services throughout New England. |

| Jan-23 | Chrono Chape | Holcim (SWX: HOLN) | Provider of on-site self-leveling screeds based in France. |

| Jan-23 | Amyx | Tetra Tech (NASDAQ: TTEK) | Provider of enterprise technology services and management consulting based in Virginia. |

| Jan-23 | Vortex Glass | Guardian Glass | Manufacturer of laminated and insulated glass based in Florida. |

| Jan-23 | Xcel Engineering | MartinFederal | Provider of civil and environmental engineering and consulting services based in Tennessee. |

| Jan-23 | Carmichael Engineering | Universal Engineering Sciences (BDT Capital) | Provider of geotechnical, environmental, and construction monitoring and testing services based in Alabama. |

| Jan-23 | Anston-Greenlees | WGI | Provider of mechanical, electrical, plumbing, and fire protection engineering services based in Florida. |

| Jan-23 | First Coastal Exteriors | Beacon Roofing Supply (NAS: BECN) | Distributor of building products based in Alabama. |

| Jan-23 | WorldTech Engineering | Tighe & Bond | Provider of civil engineering and consulting services for the public sector based in Massachusetts. |

| Jan-23 | Weeks Marine | Kiewit | Provider of construction services for the marine sector based in New Jersey. |

| Dec-22 | Infinity Home Services | LightBay Capital, Freeman Spogli | Provider of roofing replacement and other exterior home services for residential and commercial clients based in Wisconsin. |

| Announced Date | Target | Acquirer/Investor | Target Description |

|---|---|---|---|

| Dec-22 | Hill International (NYS: HILL) | Global Infrastructure Solutions | Provider of construction management and site supervision services. |

| Dec-22 | CM Rubber Technologies | Holcim (SWX: HOLN) | Provider of tire recycling services based in Michigan. |

| Dec-22 | ABS Insulating | Installed Building Products (NYS: IBP) | Provider of insulation and gutters based in North Carolina. |

| Dec-22 | TTL Associates | CT Consultants | Provider of environmental and geotechnical engineering and materials testing services based in Ohio. |

| Dec-22 | Diamond Home Improvement | Kodiak Building Partners (Court Square Capital Partners) | Distributor of building products based in Oregon. |

| Dec-22 | Gonzalez Companies | Trilon Group (Alpine Investors) | Provider of civil engineering and construction management services based in Missouri. |

| Dec-22 | Northwest Geotech | RMA Group (OceanSound Partners) | Provider of geotechnical engineering, environmental consulting and construction inspection services based in Oregon. |

| Dec-22 | East Coast Mechanical | Air Pros USA (Peak Rock Capital) | Provider of HVAC services based in Florida. |

| Dec-22 | Midcoast Construction Enterprises | MarineMax (NYSE: HZO) | Provider of marine construction services based in Florida. |

| Dec-22 | Cal Engineering & Geology | Haley & Aldrich | Provider of geotechnical engineering consultancy services based in California. |

| Nov-22 | Mountain Air | Wrench Group (Leonard Green & Partners) | Provider of HVAC services based in Utah. |

| Nov-22 | RGM Kramer | Cumming Group (New Mountain Capital) | Provider of construction services for the education sector based in California. |

| Nov-22 | Wrench Group (Leonard Green) | TSG Consumer Partners, Oak Hill Capital | Provider of home repair, replacement, and maintenance services based in Georgia (Minority investment). |

| Nov-22 | Carbocia | Holcim (SWX: HOLN) | Producer of limestone fillers based in France. |

| Nov-22 | Monarch Group of Companies | ABC Supply Co. | Supplier of siding, roofing, and select exterior building materials. |

| Nov-22 | Georgia Truss | US LBM Holdings (Bain Capital) | Manufacturer of roof and floor trusses. |

| Oct-22 | Kaycan (US Distribution Business) | ABC Supply Company | Manufacturer and distributor of exterior building products. |

| Oct-22 | Matthews Design Group | DCCM (White Wolf Capital) | Provider of civil engineering services based in Florida. |

| Oct-22 | Infrastructure & Energy Alternatives (NYS: IEA) | MasTec | Provider of construction services specializing in the energy and heavy civil sectors. |

| Oct-22 | Dana Wallboard | L&W Supply (ABC Supply Co.) | Distributor of drywall and plaster for residential construction based in Massachusetts. |

| Oct-22 | Mercurio’s Heating & Air Conditioning | TurnPoint Services (OMERS Private Equity, Ares Management) | Provider of HVAC services based in Washington. |

| Oct-22 | Vandermeer Forest Products | BlueLinx Holdings (NYSE: BXC) | Distributor of building products based in Washington. |

| Sep-22 | IBI Group (TSX: IBG) | Arcadis NV | Provider of technology-driven architecture, engineering, and planning services. |

Source: PitchBook, MergerMarket, Company Press Releases, Meridian Research