Diversified Industrials M&A Trends: Spring 2021

Published May 13, 2021

Key Insights

- Manufacturing activity growth driven by hard-goods consumption and fiscal stimulus

- Raw material and supply chain disruptions lead to increased costs

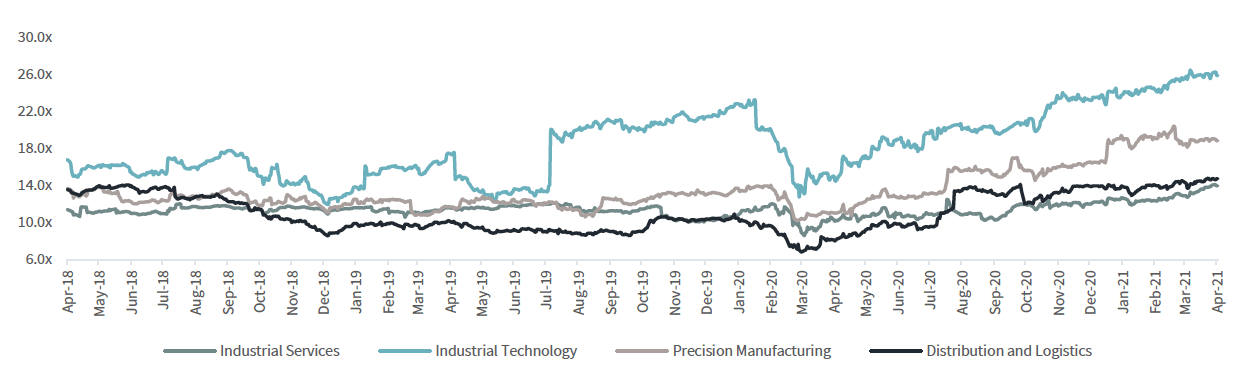

- Industrial Services, Industrial Technology, Distribution & Logistics, and Precision Manufacturing M&A was strong through Q1 2021

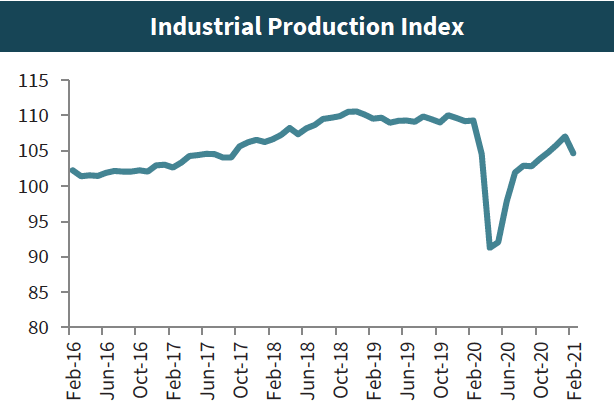

As the U.S. turns the corner on the pandemic, manufacturing activity has returned, driven by fiscal stimulus and consumers turning to hard-goods. In February 2021, the Institute for Supply Chain Management manufacturing index reached a 3yr high, tying levels reached in February 2018.

Increased manufacturing activity coupled with challenged supply chains has led to shortages and price increases among raw materials and other necessary components. Steel, lumber, semiconductors, and other necessary raw materials have seen large-scale shortages and as a result, increased prices.

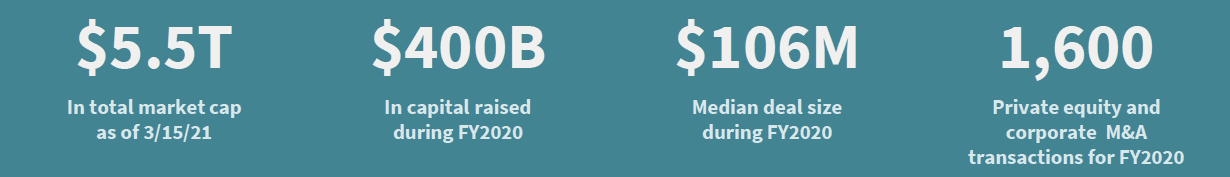

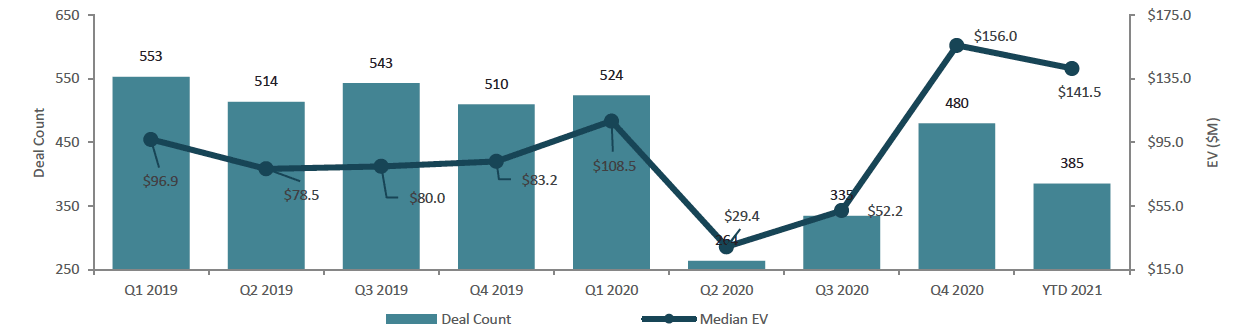

M&A activity in the space has also seen a resurgence, with Q4 2020 M&A volume increasing 80% since Q2 2020 lows. With 385 deals through March 2021, the year is on track to return to pre-pandemic deal volume.

Diversified Industrials Market Insights

Return of Manufacturing Activity

- U.S. manufacturing activity reached a three year high in February 2021, with the Institute for Supply Management manufacturing index reading 60.8%; this level ties that last reached in February 2018 and is the highest since May 2004 when the reading was 61.4%

- U.S. consumers are turning to hard-goods produced by the U.S. manufacturing industry as industrial activity begins to recover from COVID troughs and consumers continue to receive direct stimulus payments

- The sentiment of those in the U.S manufacturing sector has continued to improve as well; the ISM manufacturing survey found a 5:1 positive to cautious comments ratio among its survey participants

Raw Materials Shortages Lead to Increased Costs

- Increased manufacturing activity coupled with challenged supply chains has led to shortages and price increases among raw materials and other necessary components

- Manufacturers have seen mounting pressure on raw materials including steel, lumber, semiconductors, and plastic resin; polypropylene plastic resin prices have increased 22% in just one month

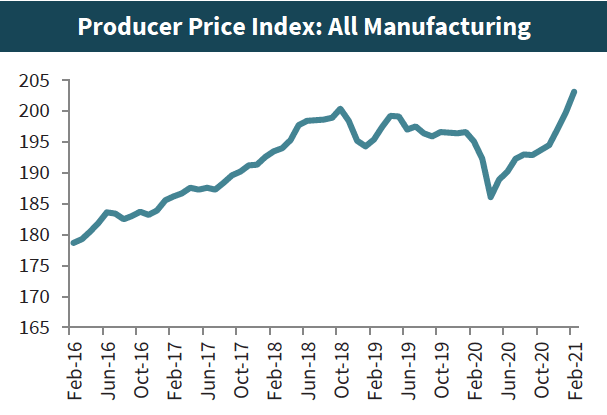

- With growing pressure on margins, manufacturers are attempting to pass along price increases to customers – the Producer Price Index, a measurement of prices received for outputs, has soared in recent months, reaching all-time highs

- Supply chains, specifically ones involved in ‘just-in-time’ inventory management, are further complicated as global ports are experiencing as much as 31% YoY increases in the volume of ships resulting in lengthy delays

Capital Markets Activity – By the Numbers

Diversified Industrials Middle Market M&A Activity

M&A Activity and Market Trends

Public Market Valuations (EV/EBITDA)

Recent Transaction Spotlights

Description: FLIR is a leading provider of intelligent sensing solutions for defense and industrial applications. The Company is focused on design and production of thermal imaging cameras, sensors, and systems.

Rationale: The acquisition brings together FLIR and Teledyne’s suite of sensing technologies. The combined entities now cover the full-range of domains and applications.

Description: Louisville, KY-based ORR Safety is an industrial safety product distributor, specializing in personal protective equipment and related safety services.

Rationale: The acquisition represents a strategic opportunity for Wurth Industry to expand its market share in safety solutions across new markets such as rail, auto, and government in North America.

Description: SPM is a precision manufacturer of components, assemblies, and accessories utilized in the robotic surgery and other industries requiring complex metal components with tight tolerances.

Rationale: The acquisition represents Vander-Bend’s continued efforts to become a leading platform for manufacturing med-tech and datacenter infrastructure components.

Source: PitchBook, Company Press Releases, Meridian Research

Industry Spotlight – Additive Manufacturing

Additive Manufacturing Themes and Applications

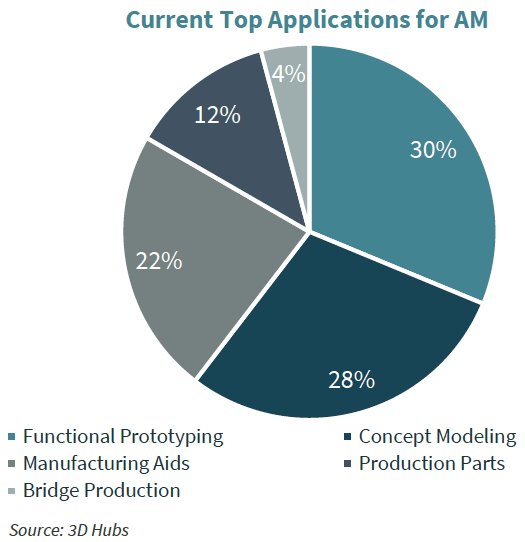

- Additive manufacturing (“AM”), the industrial production name for 3D printing layers of materials, has been widely adopted by many manufacturers and is radically changing the way new product development is done

- As new additive manufacturing methods and technologies are created, organizations across virtually every industry have sought use of the technology

- The market has grown from $2B in 2012 to an estimated $18B in 2021, and is expected to continue to grow to $118B by 2029, driven by the maturation of technologies and supply chain consolidation

- 2021 is on-track for a record year of capital raised by additive manufacturing companies, with nearly ~$1.5B raised in Q1 2021 alone

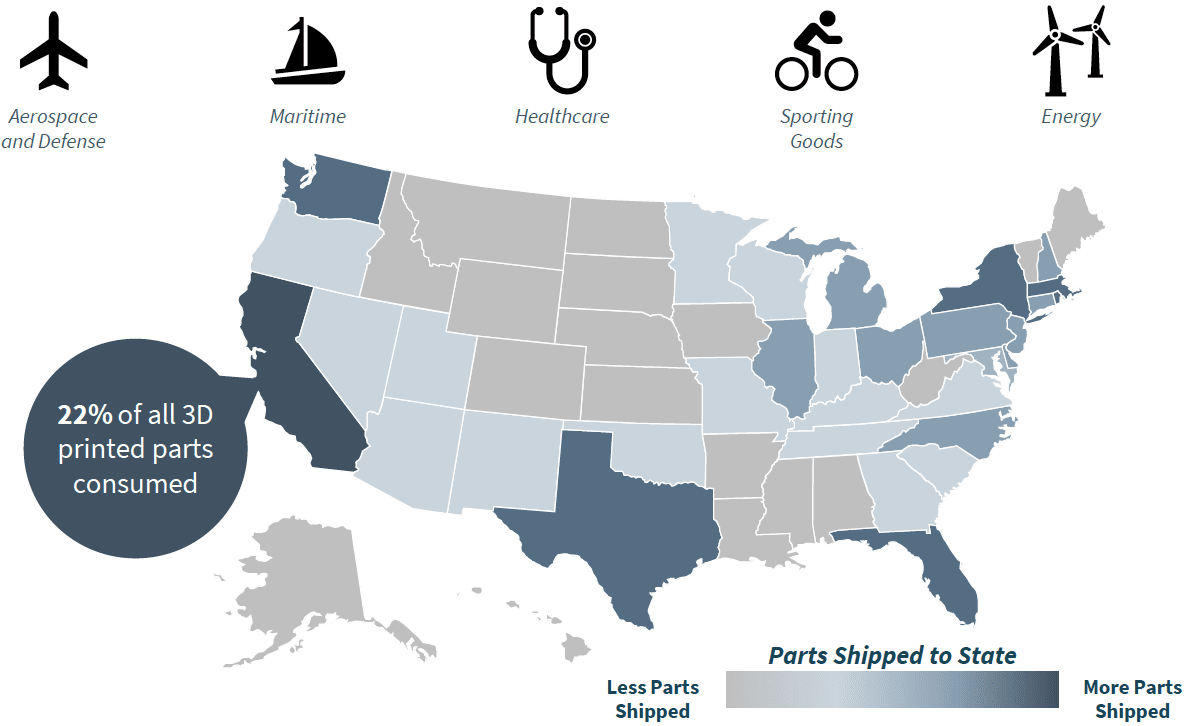

Additive Manufacturing Demand Continues to Grow Across the U.S.

Early Adopters of Additive Manufacturing

Source: PitchBook, Company Press Releases, Meridian Research, 3D Hubs, Stratesys, GrandviewResearch

Meridian Capital Recent Deal Spotlight

Shields Manufacturing Acquired by Precinmac Precision Machining

Meridian Capital LLC (“Meridian”), a Seattle-based middle market corporate finance and M&A advisory firm is pleased to announce the successful acquisition of one of its clients, Shields Manufacturing, Inc. (“Shields” or the “Company”) by Precinmac Precision Machining (“Precinmac”), a portfolio company of Pine Island Capital Partners, LLC, Bain Capital Credit, LP, and Compass Partners Capital.

Founded in 1991 and located in Tualatin, Oregon, Shields serves the semiconductor, life sciences and aerospace markets providing precision CNC machined components and complex assemblies. The Company specializes in complex mechanical and optical assemblies with extensive metal and plastic machining capabilities.

Bill and Ruthie Shields, co-owners of Shields, shared, “Meridian acted as a committed and thoughtful advisor throughout the entire transaction, helping Shields and its shareholders reach an outstanding outcome in a challenging environment. We’re excited for Shields to join the Precinmac family with a strong alignment on culture and capabilities that the combination brings to Shields’ customers.”

Pacific Consolidated Industries Recapitalized by TJM Capital Partners

Meridian Capital LLC’s diversified industrials team is excited to announce the successful recapitalization of one of its clients, Pacific Consolidated Industries, LLC (“PCI” or the “Company”), a portfolio Company of Main Street Capital Corporation (NYSE: MAIN), by TJM Capital Partners (“TJM”).

Founded in 1984 and based in Riverside, California, PCI is a leading provider of deployable, onsite, liquid and gaseous oxygen and nitrogen generating systems. PCI’s products serve applications where it is inefficient to utilize distributed industrial gases including aerospace and defense, medical, water and wastewater treatment, oil & gas, and general industrial end-markets.

Bob Eng, CEO of PCI shared “On behalf of PCI Gases, we’re very excited to partner with TJM’s partners and investors to drive further growth on a broader scale by expanding our market reach and value-added offerings and solutions to new and existing customers, particularly in the medical and industrial oxygen markets.”

Public Diversified Industrials Metrics

Source: PitchBook, Company Press Releases, Meridian Research. As of April 21st, 2021

Industrial Services

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| WM Intellectual Property Holdings, L.L.C. | $56,921 | $70,180 | $15,218 | $3,989 | 4.6x | 17.6x | 26.2% | 37 % |

| Cintas Corporation, Inc. | $35,897 | $38,047 | $6,934 | $1,610 | 5.5x | 23.6x | 23.2% | 73 % |

| Republic Services, Inc. | $33,498 | $42,639 | $10,154 | $2,652 | 4.2x | 16.1x | 26.1% | 35 % |

| Quanta Services, Inc. | $13,077 | $14,351 | $11,203 | $916 | 1.3x | 15.7x | 8.2% | 72 % |

| ADT Inc. | $7,267 | $16,555 | $5,315 | $1,843 | 3.1x | 9.0x | 34.7% | 158 % |

| ABM Industries, Inc. | $3,449 | $3,921 | $5,867 | $256 | 0.7x | 15.3x | 4.4% | 67 % |

| Comfort Systems USA, Inc. | $2,908 | $3,186 | $2,857 | $259 | 1.1x | 12.3x | 9.1% | 166 % |

| NV5, Inc. | $1,358 | $1,614 | $659 | $90 | 2.4x | 18.0x | 13.6% | 131 % |

| Median | $15,453 | $6,400 | $1,263 | 2.8x | 15.9x | 18.4% | 72.4% | |

| Mean | $23,811 | $7,276 | $1,452 | 2.9x | 15.9x | 18.2% | 92.2% |

Industrial Technology

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Danaher Corp. | $172,455 | $191,877 | $22,284 | $6,474 | 8.6x | 29.6x | 29.1% | 53 % |

| Siemens AG | $135,002 | $165,011 | $65,585 | $9,793 | 2.5x | 16.8x | 14.9% | 97 % |

| ABB Ltd. | $65,751 | $67,801 | $26,134 | $1,945 | 2.6x | 34.9x | 7.4% | 92 % |

| Eaton Corporation PLC | $55,157 | $62,482 | $17,858 | $2,706 | 3.5x | 23.1x | 15.2% | 82 % |

| Roper Technologies, Inc. | $44,762 | $54,085 | $5,527 | $1,949 | 9.8x | 27.8x | 35.3% | 37 % |

| Rockwell Automation, Incorporated | $30,574 | $32,653 | $6,211 | $1,771 | 5.3x | 18.4x | 28.5% | 61 % |

| AMETEK, Inc. | $30,209 | $31,455 | $4,540 | $1,424 | 6.9x | 22.1x | 31.4% | 75 % |

| Teledyne Technologies Incorporated | $15,776 | $15,881 | $3,086 | $601 | 5.1x | 26.4x | 19.5% | 40 % |

| Median | $58,284 | $12,034 | $1,947 | 5.2x | 24.8x | 24.0% | 68.3% | |

| Mean | $77,656 | $18,903 | $3,333 | 5.5x | 24.9x | 22.6% | 67.2% |

Precision Machining

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Stryker Corporation | $97,254 | $108,221 | $14,351 | $2,766 | 7.5x | 39.1x | 19.3% | 42 % |

| Illinois Tool Works Inc | $70,531 | $76,278 | $12,574 | $3,320 | 6.1x | 23.0x | 26.4% | 43 % |

| Emerson Electric Co. | $54,501 | $60,507 | $16,795 | $2,845 | 3.6x | 21.3x | 16.9% | 74 % |

| Parker-Hannifin Corporation | $40,294 | $46,915 | $13,505 | $2,652 | 3.5x | 17.7x | 19.6% | 135 % |

| Ingersoll Rand Inc. | $21,081 | $23,356 | $4,910 | $593 | 4.8x | 39.4x | 12.1% | 88 % |

| AptarGroup Inc | $9,930 | $10,855 | $2,929 | $554 | 3.7x | 19.6x | 18.9% | 42 % |

| Berry Global Inc. | $8,394 | $18,099 | $12,029 | $1,450 | 1.5x | 12.5x | 12.1% | 72 % |

| Gibraltar Industries, Inc. | $2,906 | $2,986 | $1,033 | $129 | 2.9x | 23.1x | 12.5% | 106 % |

| EnPro Industries, Inc. | $1,699 | $2,019 | $1,074 | $59 | 1.9x | 34.3x | 5.5% | 109 % |

| NN, Inc. | $335 | $536 | $428 | ($63) | 1.3x | nm | -14.8% | 234 % |

| Median | $20,728 | $8,470 | $1,021 | 3.5x | 23.0x | 14.7% | 81.0% | |

| Mean | $34,977 | $7,963 | $1,430 | 3.7x | 25.6x | 12.8% | 94.6% |

Industrial Distribution and Logistics

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Fastenal Company | $29,372 | $29,695 | $5,697 | $1,317 | 5.2x | 22.6x | 23.1% | 47 % |

| W.W. Grainger, Inc. | $21,653 | $23,730 | $11,797 | $1,222 | 2.0x | 19.4x | 10.4% | 50 % |

| J.B. Hunt Transport Services, Inc. | $17,792 | $18,540 | $9,637 | $1,240 | 1.9x | 14.9x | 12.9% | 68 % |

| XPO Logistics, Inc. | $15,057 | $22,129 | $16,252 | $1,233 | 1.4x | 17.9x | 7.6% | 123 % |

| Bunzl plc | $11,806 | $14,209 | $12,961 | $1,142 | 1.1x | 12.4x | 8.8% | 68 % |

| MSC Industrial Direct Co., Inc. | $4,998 | $5,726 | $3,141 | $384 | 1.8x | 14.9x | 12.2% | 56 % |

| WESCO International, Inc. | $4,226 | $9,083 | $12,326 | $471 | 0.7x | 19.3x | 3.8% | 284 % |

| MRC Global, Inc. | $920 | $1,763 | $2,560 | ($209) | 0.7x | nm | -8.2% | 141 % |

| DXP Enterprises, Inc. | $546 | $804 | $1,005 | ($4) | 0.8x | nm | -0.4% | 122 % |

| Median | $14,209 | $9,637 | $1,142 | 1.4x | 17.9x | 8.8% | 68.4% | |

| Mean | $13,965 | $8,375 | $755 | 1.7x | 17.4x | 7.8% | 106.5% |

Select Diversified Industrials M&A Transactions

Source: PitchBook, Company Press Releases, Meridian Research. As of April 21st, 2021

Industrial Services

| Date | Target | Buyer | Description |

|---|---|---|---|

| Mar-21 | R&D Mechanical Services, Inc. | Rogers Mechanical Contractors, Inc. | Provider of commercial HVAC preventive maintenance, repair, and retrofit/replacement services |

| Mar-21 | AI Fire | Snow Phipps Group | Provider of fire and life safety services |

| Feb-21 | SKM Service Oy | Bravida | Provider of industrial pipelines and project services based in Docuscan, Finland. |

| Feb-21 | Valcourt Building Services | Littlejohn & Co. | Provider of building maintainence and ancillery repair services |

| Feb-21 | Pitchard Industries | Individual FoodService, Kelso Private Equity | Provider of building and facility maintainence services |

| Feb-21 | Carter’s Fire Sprinkler Maintenance & Piping, Inc. | The Riverside Company | Provider of fire fighting and mitigation services based in Lebanon, Oregon. |

| Jan-21 | Environmental Products and Services of Vermont | Miller Environmental Group, GenNX360 | Provider of environmental and industrial services |

| Jan-21 | Travis Industries, LLC. | AXIS Industrial Services, Carr’s Hill Partners | Provider of specialty services to industrial customers based in Mukilteo, Washington. |

| Dec-20 | Aegis Fire Protection, LLC | Century Fire Protection | Operator of an open shop fire safety contractor intended to protect lives and businesses. |

| Nov-20 | Incorp, Inc. | Construction Safety Group | Provider of specialty multi-craft plant maintenance and capital services to the power generation, pulp and paper, food and beverage, and manufacturing end markets. |

| Oct-20 | Silver (UK) Ltd. | Kings Security Systems | Provider of fire safety systems, smoke ventilation and security technology solutions as per the client’s needs. |

Industrial Technology

| Date | Target | Buyer | Description |

|---|---|---|---|

| Mar -21 | Pacific Consolidated Industries | TJM Capital Partners | Manufacturer of ruggedized onsite liquid, gaseous oxygen, and nitrogen generators |

| Feb-21 | MarkForged, Inc. | One (SPAC) | Provider of industrial 3D printing services intended to simplify the manufacturing process for 3D printing. |

| Jan-21 | Autotech Robotics Limited | Belgrave | Manufacturer and integrator of robotic systems and processes across various industrial sectors. |

| Jan-21 | FLIR Systems, Inc. | Teledyne Technologies | Manufacturer of thermal imaging systems intended to offer intelligent sensing solutions for defense and industrial applications. |

| Dec-20 | Origin | Stratasys Ltd. | Producer of a manufacturing grade 3D printer for additive manufacturing |

| Dec-20 | Boston Dynamics, Inc. | Hyundai Motor | Developer and manufacturer of robots specializing in building dynamic robots and software for human simulation. |

| Dec-20 | Desktop Metal, Inc. | Trine Acquisition | Manufacturer of three-dimensional metal and carbon fiber 3D printers designed to make printing accessible to all engineers, designers, and manufacturers. |

| Dec-20 | Artesyn Biosolutions Ireland LTD | Repligen | Manufacturer and provider of single-use solutions designed for the biotech industry. |

| Oct-20 | Alluxa, Inc | EnPro Industries | Manufacturer of optical filters and thin-film coatings in Santa Rosa, California. |

| Oct-20 | Codian Robotics B.V. | ABB | Manufacturer of delta robots, which are used primarily for high precision pick and place applications |

Precision Machining

| Date | Target | Acquirer/Investor | Target Description |

|---|---|---|---|

| Mar-21 | Douglas Machining Services, LLC | Compass Precision, LLC (Main Street Capital) | Leading manufacturer of precision metal components |

| Feb-21 | Aurotek TSB, Inc. | Auburn Bearing & Manufacturing Inc | Manufacturer of thin section bearings for a broad array of industries |

| Dec-20 | Majestic Metals | Core Industrial Partners | Manufacturer of precision sheet metals serving numerous end markets |

| Dec-20 | Shields Manufacturing, Inc. | Precinmac | Provider of computer numerical control (CNC) machining, tuning, and complex optical assemblies |

| Dec-20 | Viper Northwest, Inc. | Precinmac | Manufacturer of precision fabricated, machined parts, and assemblies |

| Dec-20 | Swiss Precision Machining, Inc. | Vander-Bend Manufacturing (Aterian Investment Partners) | Manufacturer of consumable instrument components utilized in robotic surgery and other high technology end-markets |

| Nov-20 | Elkhart Plastics, Inc. | Myers Industries, Inc. | Manufacturer of engineered products for the recreational vehicle, marine, agriculture and construction industry |

| Oct-20 | Larkin Precision Machining, Inc. | IMG Companies, LLC | Manufacturer for complex, close-tolerance components for defense, aerospace, and medical sectors |

| Oct-20 | Non-Metallic Solutions, Inc. | Repligen | Manufacturer of plastic fabrication, assembly, standard thermoplastic tanks, and rotational molding |

Industrial Distribution and Logistics

| Date | Target | Acquirer/Investor | Target Description |

|---|---|---|---|

| Apr-21 | AFC Industries, Inc. | Bertram Capital | Fastener distributor and provider of supply chain management services to OEMs |

| Mar-21 | Flow Control Group | KKR | Distributor of flow control and industrial automation products |

| Mar-21 | ORR Safety | Wurth Industries | Distributor of industrial safety products |

| Mar-21 | Jon-Don | Incline Equity | Supplier of disaster restoration equipment |

| Jan-21 | Wilco Supply | Fluid Power Holdings, Inc. (JMH Capital Partners) | Independent distributor of hydraulic hoses, industrial hoses, fittings, and fabrication |

| Jan-21 | Jackson Newell | Imperial Dade (Bain Capital) | Distributor of janitorial and paper sanitation supplies |

| Jan-21 | Kimco Distributing | Hisco / Specialty Tools | Distributor of products, services and equipment to the manufacturing, testing and repair environments |

| Jan-21 | SafetyNetwork | Affiliated Distributors | Buying group comprised of safety distributors |

| Jan-21 | Bison Transport Inc. | James Richardson & Sons | Provider of cartage services |

| Jan-21 | SEKO Worldwide | Ridgemont Equity Partners | Provider of non-asset based third-party logistics services |

| Jan-21 | Diversified Air Systems | Motion & Control Enterprises (Frontenac Co.) | Distributor of air compressors and related products |

| Dec-20 | Black Horse Carriers | Penske Logistics | Trucking and fleet services for the food, consumer, and manufacturing industries |

| Dec-20 | Atlas Welding Supply | AEA Investors | Distributor of gases and welding supplies. |

| Nov-20 | Vesso Holdings | Gryphon Investors | Distributor of process, flow control, pumps and automation equipment and services |

| Nov-20 | Care Supply Co. | Colony Hardware (Audax Group) | Distributor of construction and industrial supplies |