Diversified Industrials M&A Trends: Spring 2020

Published May 24, 2020

Personal Protective Equipment (PPE) and Value-Added Distribution Companies Well-Positioned to Benefit Long-Term

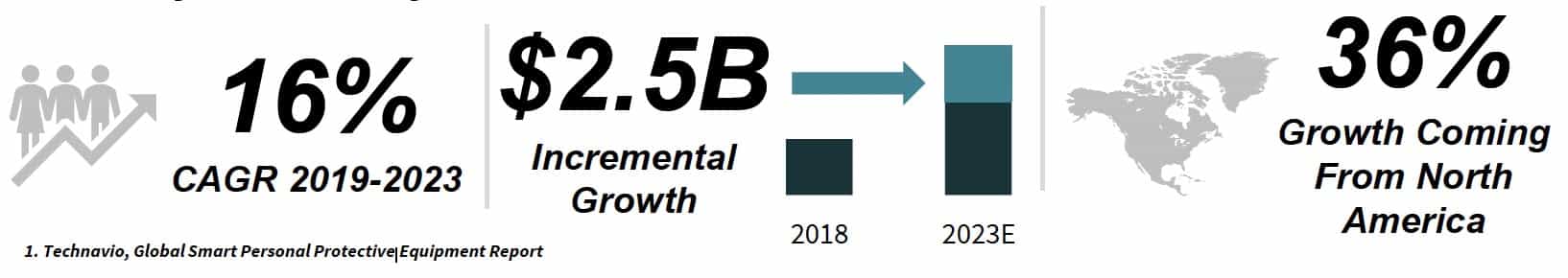

Companies in PPE and value-added distribution are uniquely positioned to thrive in the post-COVID 19 economy. By taking steps now, PPE manufacturers and value-added distributors can position themselves to capture market share and capitalize with ongoing consolidation strategies, while strengthening their competitive advantage. Groceries and other essential commodities have seen increased fulfillment through value-added distributors indicative of an overall shift in consumer behavior towards door-to-door services likely to extend past the bulk of the pandemic. COVID-19 has also highlighted the need for organizations to be prepared with safety equipment vital to disaster plans – the result for the PPE segment is an expected 16% CAGR through 2023. Players that optimize supply chains now, re-allocate resources as appropriate, and defend their competitive position can weather the pandemic and emerge stronger.

Introduction

The emergence and rapid global spread of COVID-19 has triggered substantial disruption to the economy and financial markets. With widespread government stay-at-home orders and shutdowns of non-essential businesses, both global and domestic trade have been delivered a shock. It is clear all industrial subsegments will be impacted to some extent but based on end-market exposure some markets may be more resilient or experience a lesser impact while others may face a longer-term return to pre-COVID normalcy.

Through discussions with business owners and investors as well as ongoing research, Meridian Capital’s Diversified Industrials team is actively tracking the impacts of COVD-19 on various subsegments within diversified industrials. In the Spring 2020 Diversified Industrials Spotlight, we are profiling the personal protective equipment (“PPE”) and value-added distribution segments. Volatile demand, variable logistics, and stressed supply chains present unique challenges for these industries that are critical in providing essential goods to both consumers and front-line workers. Companies that successfully navigate these challenges will be well positioned to capture market share and capitalize on likely consolidation strategies over the next 6-24 months.

What We’re Reading

Manufacturers’ Survey Reveals Current Industry Impact of COVID-19, National Association of Manufacturers

Takeaway: Manufacturers across the United States are seeing direct supply chain impacts due to COVID-19, resulting in extra costs, longer lead times, and a shift into emergency response mode

COVID-19: What It Means for Industrial Manufacturing, PWC

Takeaway: Industrial manufacturers are concerned over economic impacts but “Safeguarding consumer and workforce health is priority number-one among businesses”

COVID-19: Distributors Take Hit in Late March, Move to Weather Q2, mdm.com

Takeaway: With uncertainty surrounding COVID-19 remaining, distributors are seeking “a foothold from which to build a plan for business moving forward in this new reality”

A 100x Surge in Demand: The PPE Supply Chain Tries to Cope With COVID-19, GEP

Takeaway: PPE has seen an unprecedented spike in demand, requiring players to massively scale production and bolster supply chains via real-time tech-enabled systems

Impact Of COVID-19 On Global Supply Chains and Opportunities In the Post-COVID World, Entrepreneur

Takeaway: While COVID-19 is shaking supply chains in the short-term, the pandemic could accelerate digital transformation initiatives for distributors strengthening supply chains in the long-term

Market Impacts of COVID-19 – PPE and Value-Added Distribution

Unprecedented Demand for Personal Protective Equipment

- Government initiatives such as the Defense Production Act have been implemented to divert resources to support increased production levels

- Non-traditional PPE manufacturers have begun allocating resources to manufacture PPE in order to better support global demand

PPE Industry Trends By the Numbers

Increased Reliance on Value-Added Distribution in Select End-Markets

- Level of impact is highly variable by end-market based on regulations and demand

- Grocery and essential commodities have realized large spikes from stocking / panic buys while traditional retail and foodservice distribution had been negatively impacted from shelter in place orders; stocking / panic buy demand has begun to normalize

- Supply chain, transportation, and logistical challenges have led to an increased reliance on value-add distribution partners

- Increasing use of e-commerce is further driving the demand for established and optimized distribution networks

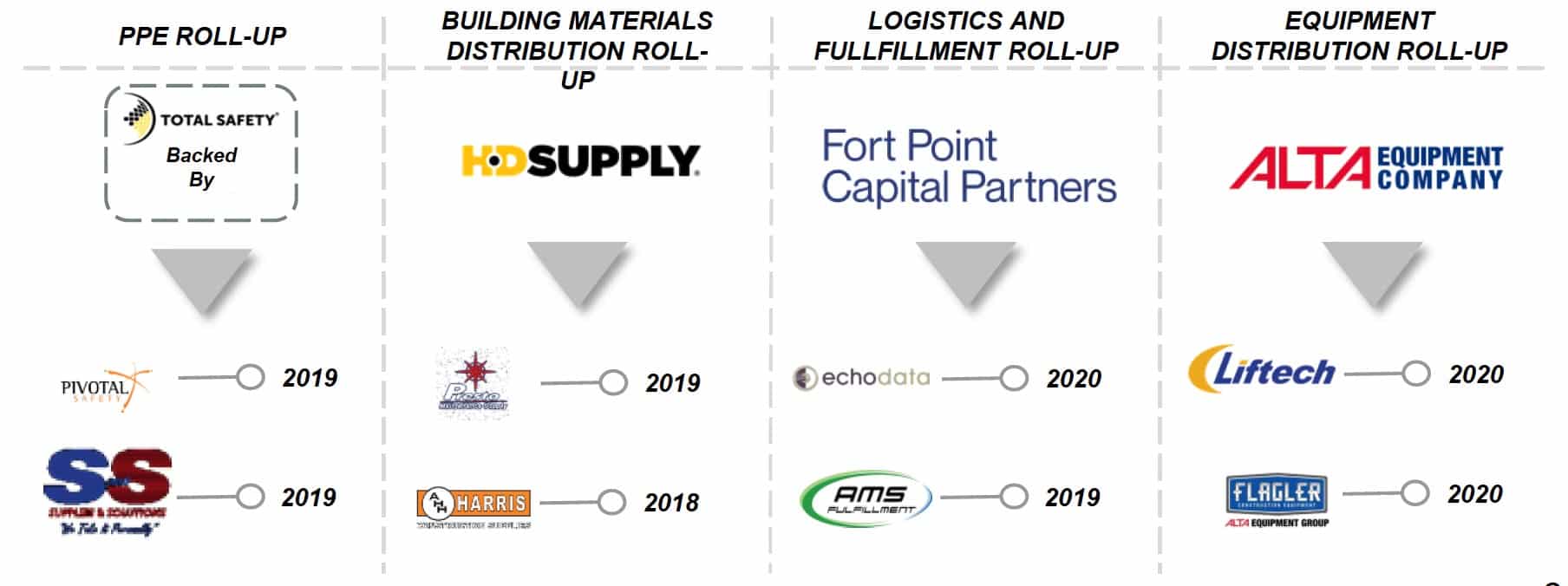

Recent Consolidation Strategies Expected to Continue and Accelerate

Recent PPE Transactions

| Date | Target | Buyer | Description |

|---|---|---|---|

| Feb-20 | ArcOne Inc. | ONCAP, Onex, Walter Surface Technologies | Manufacturer of industrial safety products based in Taunton, Massachusetts. |

| Dec-19 | Boss Canada, Inc. | Audax Group, Protective Industrial Products | Distributor of personal protection equipment. |

| Jul-19 | DSI Safety Inc. | Audax Group, Protective Industrial Products | Manufacturer of personal protective equipment in Canada. |

| Feb-19 | Liberty Glove & Safety, Inc. | Bunzl | Manufacturer of personal protection equipment, principally gloves, based in the city of Industry, California. |

| Dec-18 | Kimberly-Clark (Wilson Brand) | SureWerx, The Riverside Company | Brand of personal protective equipment (PPE) products for the industrial sector. |

| Nov-18 | Ontario Glove & Safety Inc | Delta Plus Group | Manufacturer and designer of full line of personal protective products. |

| Mar-18 | Gloves, Inc. | Xeros | Provider of PPE cleaning and repair services in Austell. |

Recent Value-Added Distribution Transactions

| Date | Target | Buyer | Description |

|---|---|---|---|

| Apr-20 | H&R Construction Parts and Equipment, Inc. | All States Ag Parts, Kinderhook Industries | Distributor of new and used heavy equipment parts, headquartered in in Buffalo, New York. |

| Apr-20 | Performance Team, LLC | A.P. Møller-Mærsk | Provider of transportation and logistics services. |

| Mar-20 | Summit Food Service Distributors Inc. | Flanagan Foodservice | Distributor of food products serving Ontario and Western Quebec. |

| Mar-20 | Foothills Industrial Ltd | Wall, C R and Co | Provider of gas delivery products based in Calgary, Canada. |

| Mar-20 | Gateway Distribution, Inc. | Brixey & Meyer Capital | Provider of distribution services. |

| Mar-20 | Saccani Distributing Co. | Reyes Holdings | Distributor of alcoholic and non-alcoholic beverages based in Sacramento, California. |

| Feb-20 | Liftech Equipment Companies, Inc. | Alta Equipment Company | Distributor of industrial machinery based in New York. |

Select PPE Public Comps

| Company Name | Market Cap | Enterprise Value | Revenue LTM | Share Price Δ% Since COVID-19 | EBITDA LTM | EV / Revenue | EV / EBITDA |

|---|---|---|---|---|---|---|---|

| The 3M Company | $88,389 | $107,279 | $32,136 | 11.24% | $7,673 | 3.3x | 14.0x |

| E. I. du Pont de Nemours and Co. | $32,155 | $48,631 | $21,512 | 25.09% | $3,334 | 2.3x | 14.6x |

| MSA Safety, Inc. | $3,875 | $4,074 | $1,402 | -10.72% | $231 | 2.9x | 17.6x |

| UniFirst Corporation | $3,139 | $2,789 | $1,863 | -0.05% | $325 | 1.5x | 8.6x |

| Avon Rubber p.l.c. | $1,047 | $988 | $229 | 23.04% | $38 | 4.3x | 26.2x |

| Lakeland Industries, Inc. | $120 | $109 | $108 | -13.68% | $8 | 1.0x | 14.5x |

| Median | $3,507 | $3,431 | $1,633 | 5.60% | $278 | 2.6x | 14.5x |

| Average | $21,454 | $27,311 | $9,542 | 5.80% | $1,935 | 2.6x | 15.9x |

Select Value-Added Distribution Public Comps

| Company Name | Market Cap | Enterprise Value | Revenue LTM | Share Price Δ% Since COVID-19 | EBITDA LTM | EV / Revenue | EV / EBITDA |

|---|---|---|---|---|---|---|---|

| Sysco Corporation | $27,927 | $36,989 | $60,461 | 18.63% | $3,313 | 0.6x | 11.2x |

| Fastenal Company | $21,106 | $21,644 | $5,391 | 8.42% | $1,218 | 4.0x | 17.8x |

| AmerisourceBergen Corporation | $18,691 | $19,741 | $182,061 | -0.52% | $1,382 | 0.1x | 14.3x |

| LKQ Corporation | $7,006 | $11,948 | $12,506 | -3.65% | $1,211 | 1.0x | 9.9x |

| Arrow Electronics, Inc. | $4,619 | $7,345 | $28,917 | 4.12% | $282 | 0.3x | 26.1x |

| HD Supply, Inc. | $4,599 | $7,104 | $6,146 | -6.15% | $836 | 1.2x | 8.5x |

| Median | $12,848 | $15,845 | $20,711 | 1.80% | $1,215 | 0.8x | 12.7x |

| Average | $13,991 | $17,462 | $49,247 | 3.47% | $1,374 | 1.2x | 14.6x |

Components of a Proactive Response Strategy

Because every business will be impacted in a unique way, the timing of the phases will vary for each company. Meridian’s services can help support short-term as well as mid-to long-term strategies

Phase I – Business Assessment and Triage

Phase Goals

- Survive and prepare for eventual return to normal operations

- Respond to acute business risks as quickly as possible

Key Factors that Shape Strategy

- Severity and urgency of business impact

- Cash position and management; access to capital

Potential Courses of Action

- Meet immediate liquidity needs with an accelerated financing process

- Take action to maintain balance sheet health

Phase 2 – Strategy Development

Phase Goals

- Develop strategy for business success over mid- to long-term

- Assess needs and reallocate resources as appropriate

Key Factors that Shape Strategy

- Strengths and weaknesses of business

- Competitive landscape and relative strength of competitors

- People and capabilities

- Resources on-hand as well as those that can be obtained

Potential Courses of Action

- Consider a recapitalization as a defensive or offensive strategy

- Opportunistically pursue organic and inorganic mid- to long-term growth strategies

Phase 3 – Strategy Execution

Phase Goals

- Push forward on identified initiatives

- Defend and improve competitive position

- Position business for long-term success and value creation

Key Factors that Shape Strategy

- People and capabilities

- Capital requirements and access to capital

- Company value drivers

Potential Courses of Action

- Continue to execute on organic and inorganic growth opportunities

- Position your business for a successful exit