Meridian’s COVID-19 Business Toolkit for Proactive CEOs & Business Owners

Published April 29, 2020

COVID-19 Business Toolkit For Proactive CEOs & Business Owners

COVID-19 has profoundly altered the business landscape

The COVID-19 pandemic has brought about unprecedented challenges to businesses of all sizes. Its swift and widespread effects have upended normal business operations, requiring business owners to act quickly to mitigate short-term disruption, while also contending with an uncertain long-term outlook.

Businesses must reshape their strategies accordingly

At Meridian Capital, we encourage business leaders to transition their response to the pandemic from a defensive to an offensive strategy. The most pressing problems that businesses face right now are operational challenges and near-term financial health. In the mid- to long-term, business owners can use a proactive strategy to position themselves for success in the post-coronavirus environment. Meridian Capital’s expertise in capital markets, strategic growth, and corporate finance can help you get there.

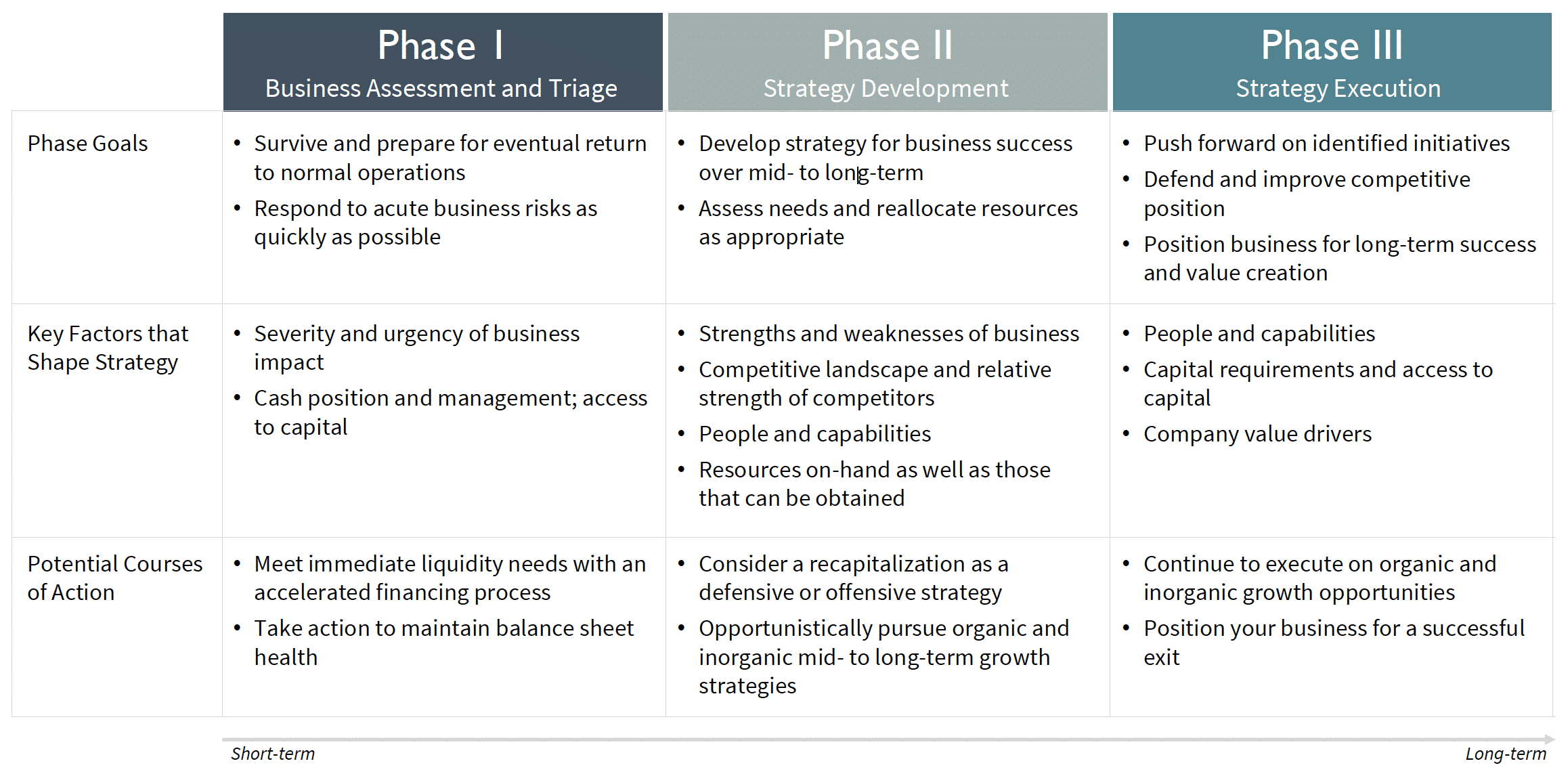

Meridian Capital’s Three-Phase Coronavirus Response Model:

- Business Assessment and Triage – Identify and rapidly mitigate the most urgent near term risks

- Strategy Development – Identify opportunities to improve market position and outperform competitors in the mid to long term

- Strategy Execution – Obtain and deploy the necessary resources to generate long term value creation

Meridian Capital’s focus has always been helping middle market business owners and management teams achieve their financial, business, and personal goals We want to help our clients address the challenges that have been caused by COVID 19 and the changes it has produced in the middle market finance landscape.

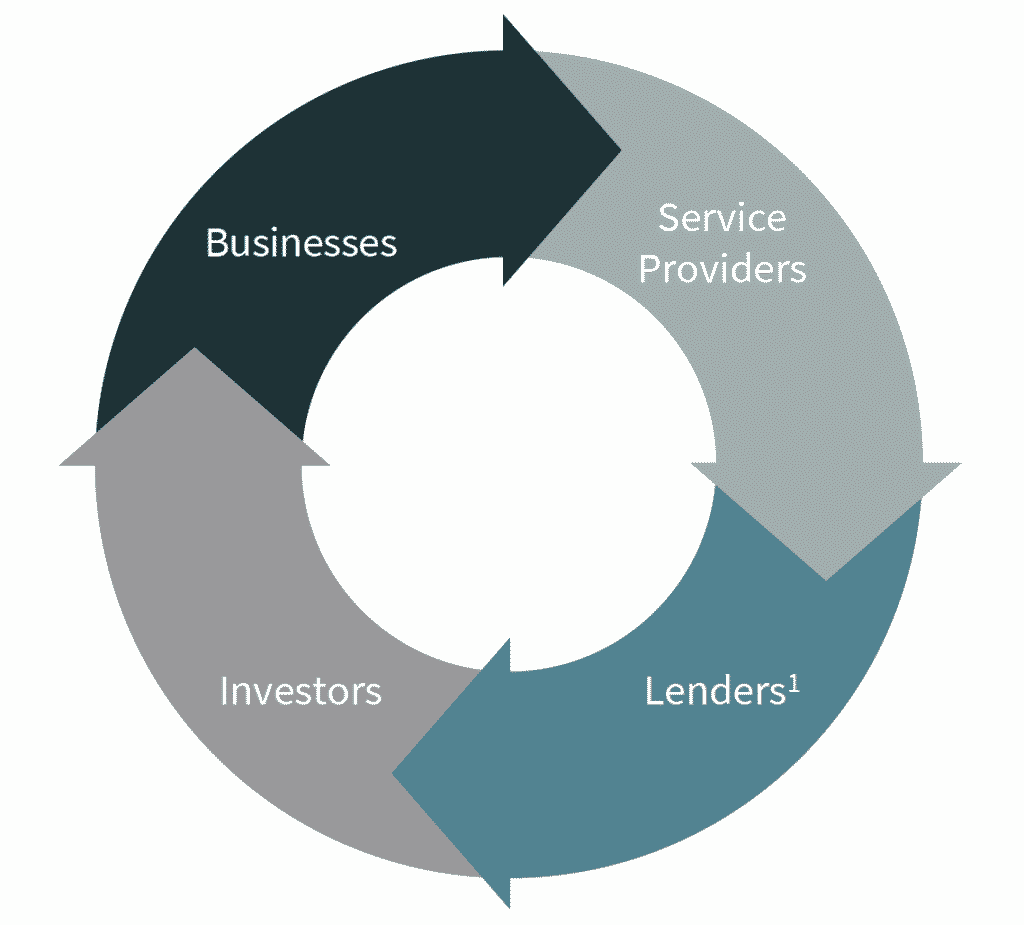

What Are We Hearing In The Market?

Broad-based impact to businesses and the M&A environment

Businesses

- Deep, widespread challenges arising from a confluence of factors that impact supply chains, customers, and working arrangements

- The pandemic’s swift escalation has forced business owners to work quickly to adapt their operations to a changed landscape

- Sell side process launches being put on hold, but business owners and advisors continue to prepare for market when the time is right

Service Providers

- Shifting client priorities are impacting projects and workstreams

- Relying on virtual collaboration and client interaction in lieu of traditional in person meetings

- Many remain optimistic about recovery in the second half of the year

Lenders

- Tightening lending standards, increasing cost of debt, and declining maximum leverage

- Borrowers drawing down available credit lines, building cash balances to weather the storm

- Significant workload administering government / SBA assistance programs

- Foresee a higher number of distressed companies needing help

Investors

- Top priority is preparing portfolio companies for upcoming challenges

- Distraction, uncertainty, and state of lending markets dampening appetite for M&A

- Many but not all investors on temporary acquisition holds; proactive contact to Meridian from those that are still evaluating and making investments

- Private equity and debt funds both maintain record levels of undeployed capital

Mid to Long Term Middle Market Finance Outlook

We are optimistic amid the constantly evolving situation, though the timing and exact nature of an eventual recovery remain unknown

Business Operations

- Procedures being put in place now to maintain business continuity and de risk operations will have long run benefits

- Global supply chains in earliest impacted regions are showing signs of returning to normal course operations

Economic Fundamentals

- Core fundamentals of a strong economy including investment in innovation and steady labor force participation rates remain intact

- Mid term impact on consumer sentiment will depend on the duration and severity of the crisis globally

Investors

- Private equity and debt funds, with record levels of dry powder, are well positioned to make investments

- So far, we do not see investors materially changing their mid to long term investment strategies

Monetary Policy

- Reduction of interest rates to near zero will help drive deal activity once the impact from COVID 19 begins to wane

- Recently announced no limits bond buying program aims to support smooth functioning of financial markets in the near term

Components of a Proactive Strategy

Because every business will be impacted in a unique way, the timing of the phases will vary for each company. Meridian’s services can help support short term as well as mid to long term strategies

Meet Immediate Liquidity Needs With an Accelerated Financing Process

In an economic disruption, swift access to liquidity can be critical to protecting your business

Business Strategies Supported

- Quickly obtain additional liquidity to fund overhead expenses in the case of a revenue drop, or to boost inventory in the case of a demand surge

- Provide flexibility to weather potential continued business disruption

- Stay current on existing debt and avoid covenant breaches

Market Insights & Considerations

- In addition to potential for additional liquidity from current lender, several options exist that should be explored in parallel

- Tightening lending standards particularly among commercial banks and increasing cost of debt

- Flexibility on loan structure and terms may be necessary depending on current capital structure

- Record levels of capital available for deployment at debt funds

- Resources such as the SBA’s Economic Injury Disaster Program and the Paycheck Protection Program can help support liquidity

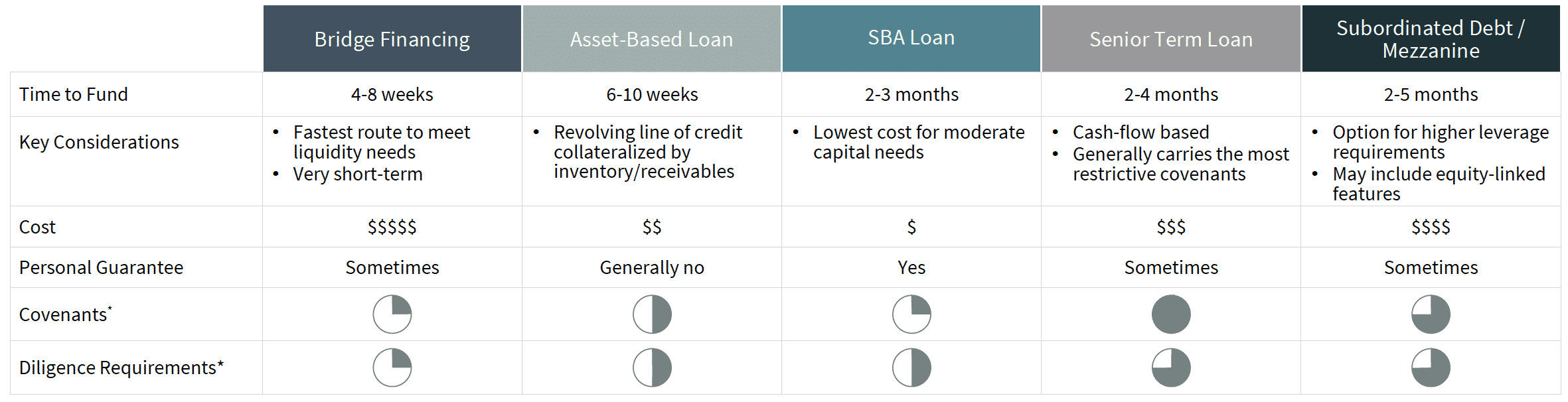

Overview of Financing Options

Case Study: Ellenos Greek Yogurt

Meet Immediate Liquidity Needs With an Accelerated Financing Process

Situation Overview

- Manufacturer of premium artisanal Greek yogurt with strong regional leadership in the Pacific Northwest

- All branded sales with high velocity and sell through rates across key retailers and channels

- Immediate need for additional cash due to challenged balance sheet following a delayed capital intensive plant expansion

Meridian Capital Approach

- Positioned Ellenos as an iconic premium branded, high-margin product with a loyal consumer following

- Facilitated bridge financing through outreach to 15 debt lenders and family offices, with the goal of obtaining more permanent equity financing thereafter

Outcome

- Closed bridge funding in two months and a minority equity transaction 1 ½ months later at a highly attractive valuation with minimal shareholder dilution

- With the proceeds from the bridge loan, the Company was able to complete its plant expansion while maintaining balance sheet strength

Take Action to Maintain Balance Sheet Health

Efficient working capital management and cash conservation are essential to weather the current storm and position your business for long-term financial health

Business Strategies Supported

- Plan for near-term liquidity needs

- Maintain sufficient cash reserves

- Protect business continuity

- Improve creditworthiness and ability to repay debt

- Drive longer-term shareholder value

Market Insights & Considerations

- With tightening lending standards and increased cost of debt, prudent cash management is vital to maintaining financial health

- Slowing receivables collection and inventory movement present additional challenges to balance sheet cash management

- Resources such as the SBA’s Economic Injury Disaster Program and the Paycheck Protection Program can help support liquidity

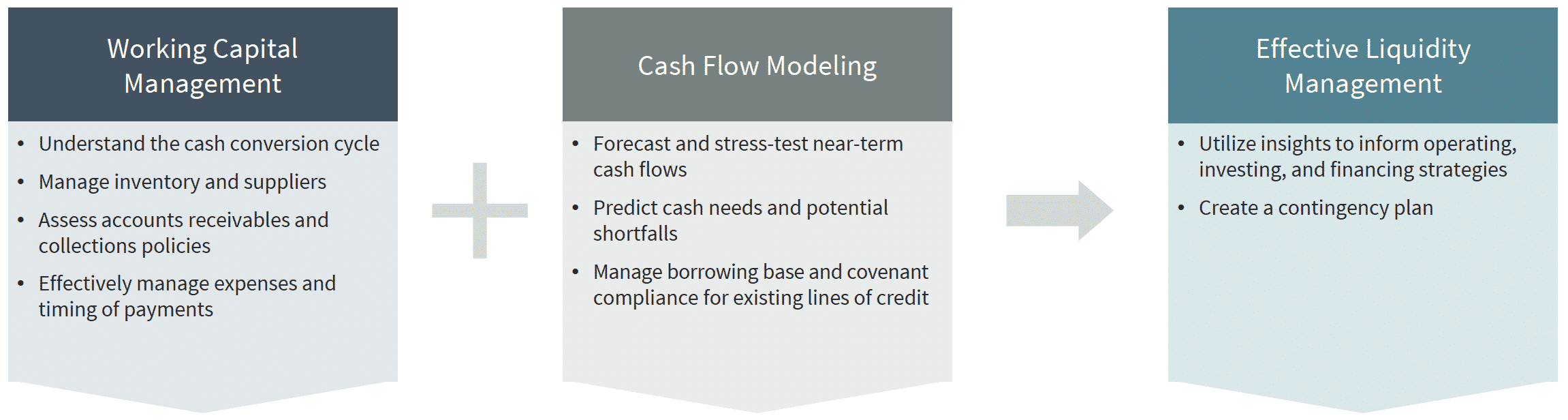

Working Capital Optimization and Cash Flow Planning

Case Study: MTM Robotics

Take Action to Maintain Balance Sheet Health

Situation Overview

- Engineer and manufacturer of advanced robotics and mobile tooling solutions for leading aerospace and defense OEMs and tier I suppliers

- Recent transition from an engineering firm to a robotics production firm created significant revenue opportunities and cash flow requirements

- Shareholders seeking incremental balance sheet strength and liquidity to facilitate business model transition and procurement of new robotics production programs

Meridian Capital Approach

- Developed detailed cash flow and capital investment model to identify capital needs

- Pursued a debt solution to maximize equity retained by shareholder

- Received multiple alternative debt solutions

Outcome

- Secured incremental liquidity and debt capital via Craft3

- Additional funding allowed MTM to more aggressively expand manufacturing capacity and pursue new customer relationships and product opportunities

- After achieving growth plan, MTM Robotics sold to Airbus in 2019 in order to accelerate R&D and product development initiatives

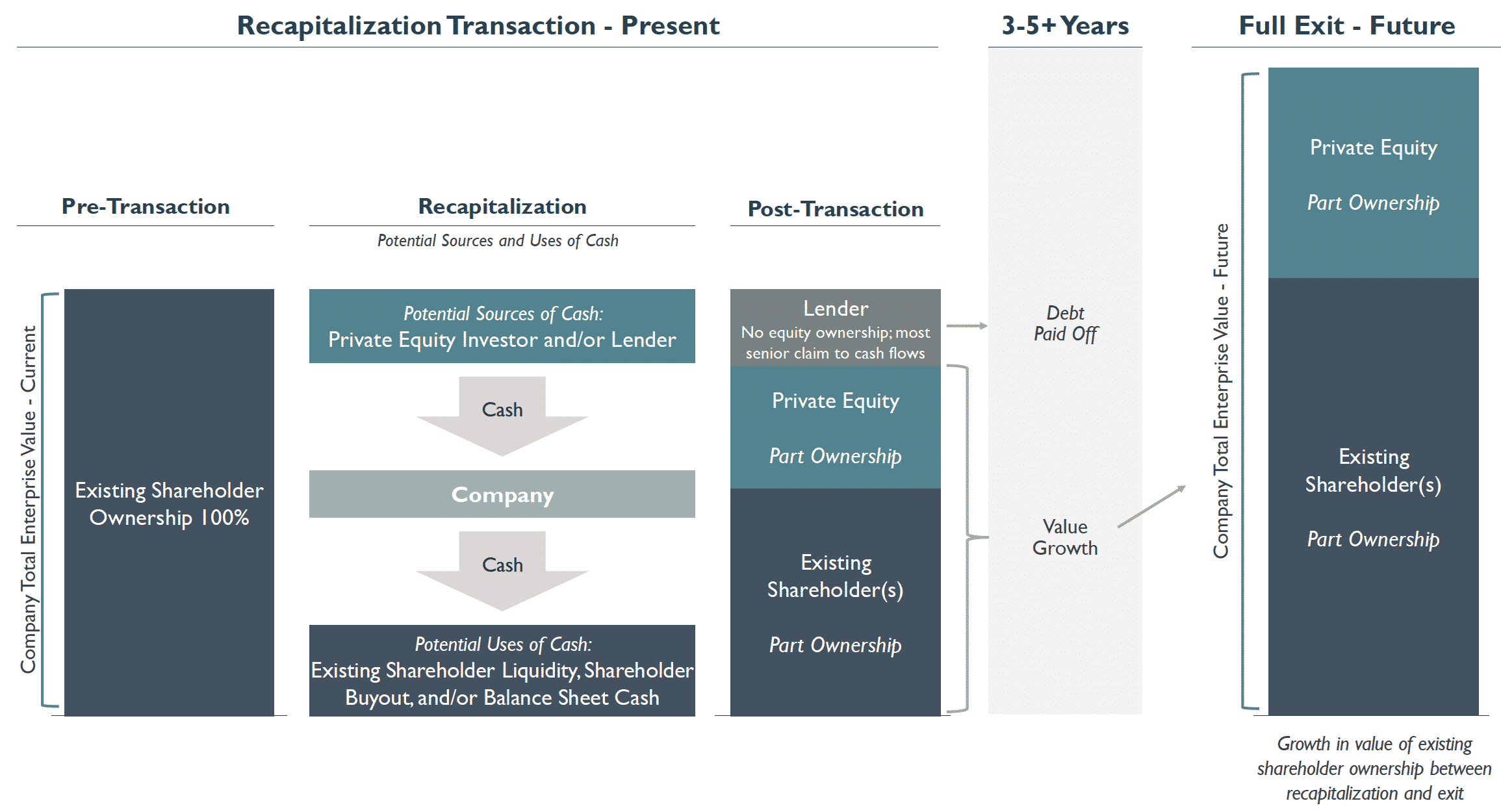

Consider a Recapitalization as a Defensive or Offensive Strategy

A debt or equity recapitalization allows for shareholder liquidity now with future upside potential

Business Strategies Supported

- Achieve near-term shareholder liquidity

- Cushion balance sheet cash

- Secure capital for investment in business

- Bring on a partner to provide strategic guidance and capital backing for longer-term organic and inorganic growth

- Effect a buyout of a minority shareholder to address differing risk tolerances and objectives

- Retain control over business

- Preserve shareholder upside opportunity in future business exit

Market Insights & Considerations

- Recapitalization can involve debt, equity, or a combination of both

- Equity and debt funds both in possession of record levels of dry powder that needs to be deployed

- Proactive contact to Meridian from private equity and debt funds that are still evaluating and making investments

- Increased interest in minority transactions among private equity

- Potentially less favorable shareholder rights and consents than historically “market” terms for minority equity recapitalizations

- Tightening lending standards and higher cost of debt vs. pre-pandemic

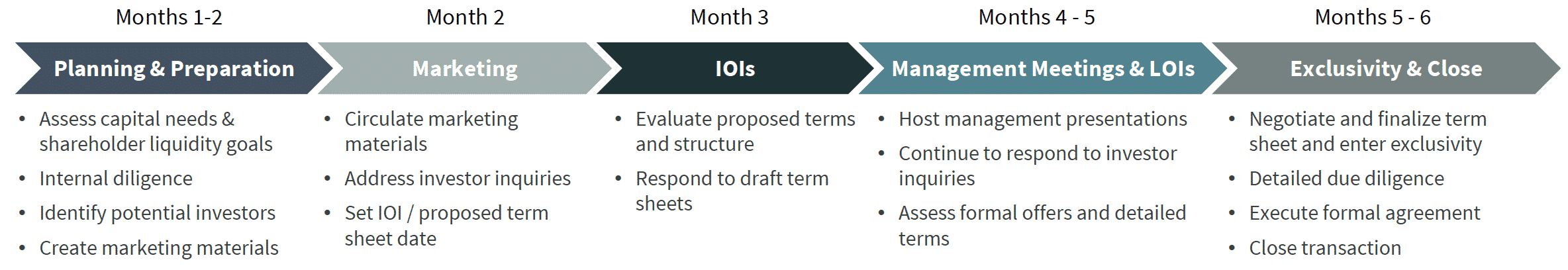

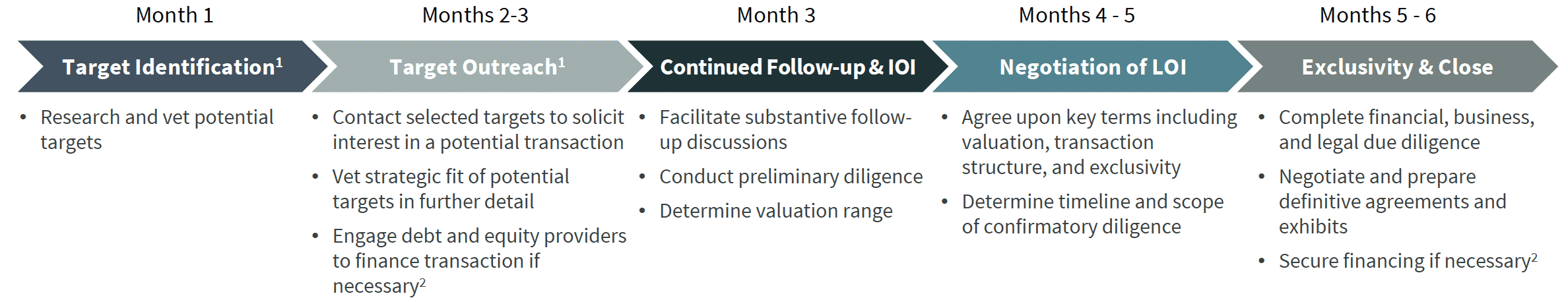

Process Steps & Timeline*

*Debt only – shorter timeline and less intensive investor due diligence

Mechanics of a Recapitalization

Case Study: nutpods

Consider a Recapitalization as a Defensive or Offensive Strategy

Situation Overview

- Manufacturer of premium, shelf stable and refrigerated, non-dairy coffee creamer products with loyal consumer following and rapid growth

- Founder and CEO seeking to raise capital to support continued growth and channel expansion, and for shareholder liquidity

- Shareholders wanted a value-add partner who would be a steward of the brand with flexibility to inject future capital

Meridian Capital Approach

- Positioned nutpods as a high-growth asset benefitting from strong industry tailwinds

- Emphasized strength and unique value proposition of nutpods brand

Outcome

- Identified ultimate partner who had industry expertise, held a shared vision for nutpods, and had experience creating $100M+ brands

- Closed minority equity recapitalization transaction at a premium valuation

- Achieved significant shareholder liquidity while maintaining control stake

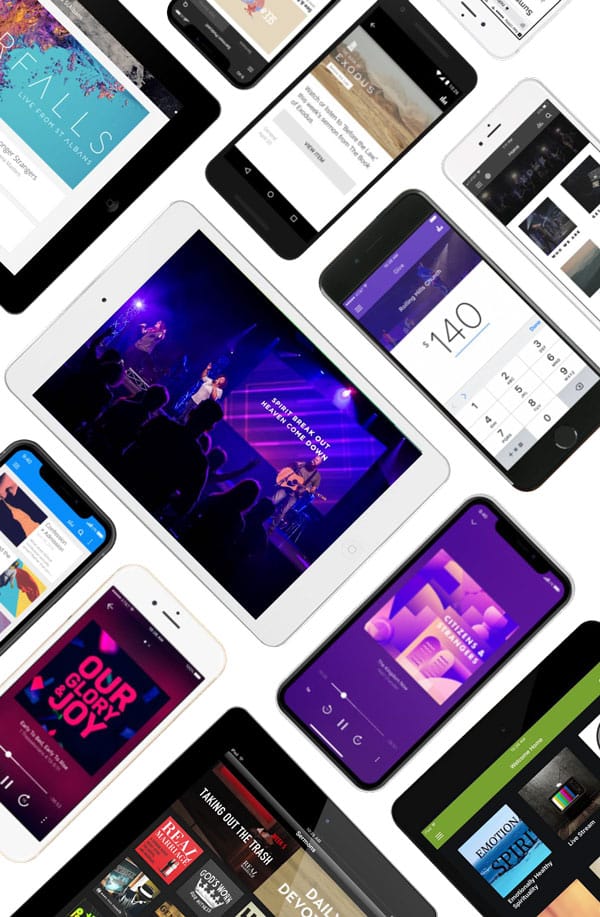

Case Study: Subsplash

Consider a Recapitalization as a Defensive or Offensive Strategy

Situation Overview

- Subsplash offers a comprehensive mobile and internet platform that engages and connects communities including leading churches, ministries, and other for-profit and not-for-profit entities worldwide

- Having recently enhanced its platform with integrated giving capabilities, Subsplash was seeking a partner that could support continued growth initiatives

- It was crucial that the partner share the Company’s vision and values and that the Founder and CEO remain a key decision-maker

Meridian Capital Approach

- Identified and thoroughly vetted a wide universe of prospects, including financial, strategic, and faith-based organizations

- Highlighted Subsplash’s best-in-class technology platform, loyal and growing customer base, and strong unit economics

Outcome

- Completed an equity placement with a financial sponsor at an extremely attractive valuation, providing shareholder liquidity and financial backing for future initiatives

- Founder and CEO retained a significant level of ownership and control

- The Company is successfully pursuing a growth-through-acquisitions strategy and is well-equipped to further its goal of helping churches enhance their reach, engage their communities, and fuel their mission

Capitalize on a Strong Financial & Market Position With Buy -Side M&A

Companies with strong capital positions are now able to take advantage of buyer-friendly market dynamics

Business Strategies Supported

- Opportunistically pursue affordable, accretive acquisitions

- Defend and improve competitive position

- Position business to outperform competition post-pandemic

- Pursue longer-term strategic initiatives such as diversifying product/service offerings or achieving vertical integration

- Targeted approach as well as broad searches for potential targets

Market Insights & Considerations

- Prices generally more affordable than pre-pandemic, particularly for otherwise good businesses that are now struggling or distressed

- Acquisition financing more difficult and expensive to obtain; equity comprising a larger portion of the purchase price

- Social distancing adding logistical difficulties to M&A processes

- Managing internal bandwidth/balancing time required for M&A initiatives with ongoing business management

- Risk/reward tradeoff must be carefully considered in uncertain environment

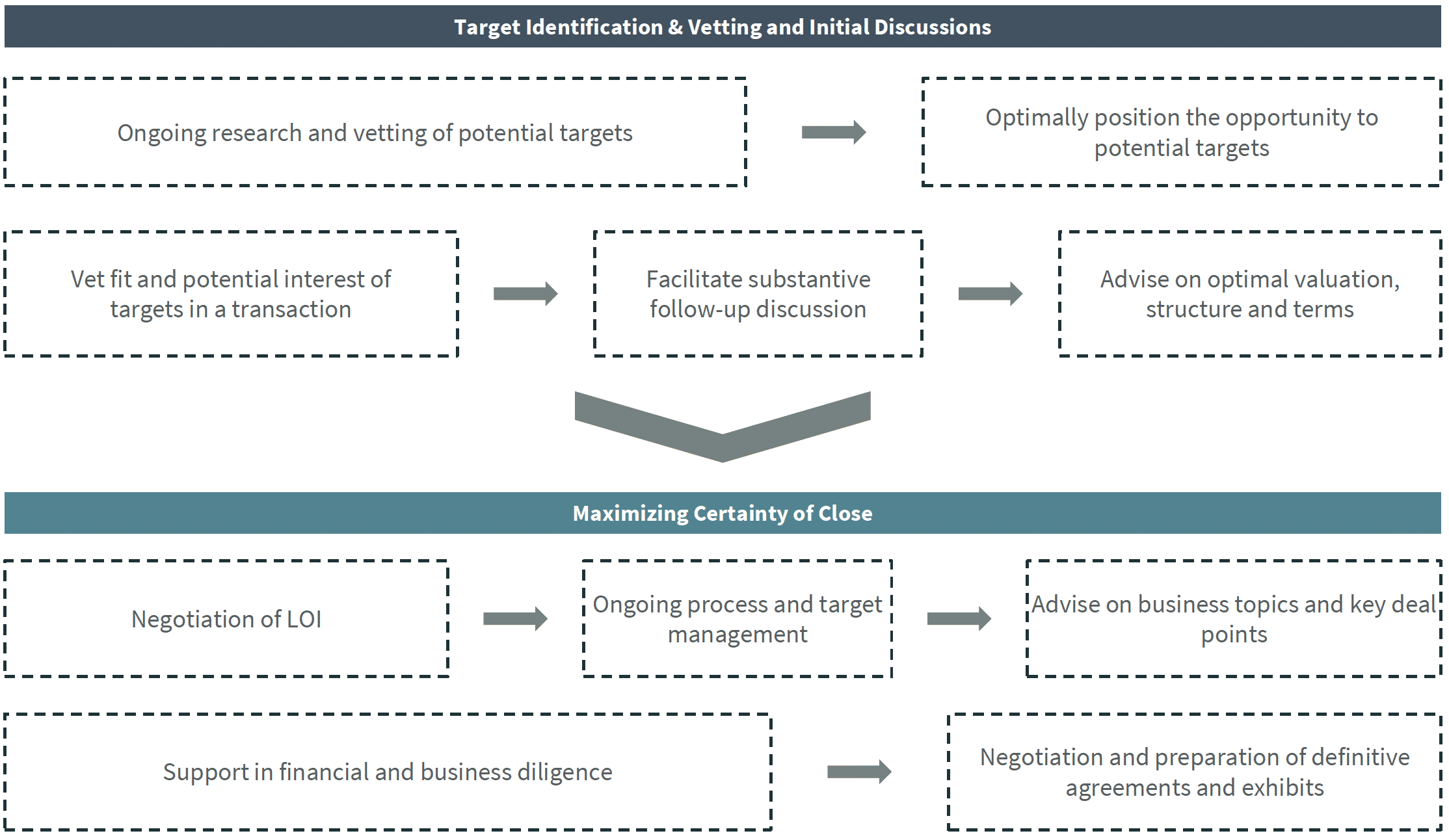

Meridian’s Customized Approach to Buy-Side M&A

End-to-End Transaction Support with a Thoughtful, Tailored Approach

Finding the Right Investment

Leverage extensive network to thoroughly vet potential targets

Strategic Advisory

Hands-on partnership in deep investment analysis and diligence

Negotiations and Legal Support

Ongoing commitment throughout negotiations and final legal flow

Meridian’s Buy-Side Advisory Role

Managing the Process to Ensure the Optimal Fit

Case Study: Harbor Wholesale Foods

Capitalize on a Strong Financial & Market Position With Buy Side M&A

Situation Overview

- Harbor Wholesale is a leading family-owned regional distributor serving foodservice and convenience store locations in the Pacific Northwest and surrounding regions

- The Company engaged Meridian to help it diversify its revenue streams by expanding its foodservice business

Meridian Capital Approach

- Engaged debt and equity providers early in the process to move quickly and determine shareholder comfort levels

- Identified key competitive dynamics within the bidding process to improve positioning and bid approach

Outcome

- Acquired high-performing Seattle division of Foodservices of America at an extremely attractive valuation

- Negotiated favorable deal terms and economics to protect Harbor against carve-out considerations and uncertainties

Proactively Position Your Business for a Successful Future Exit

Beginning preparations well in advance increases the likelihood of a successful sale process. Meridian can help you develop a multifaceted strategy to maximize the value of your business and avoid the most common seller pitfalls

Business Strategies Supported

- Reallocate underutilized resources to drive longer-term value

- Prepare business to thrive in “new normal” environment

- Defend and improve competitive position

- Optimize operations, books, and records

- Achieve mid- to long-term business and shareholder goals

Market Insights & Considerations

- Distraction, uncertainty, and logistical challenges of running M&A processes have dampened current M&A activity

- Ample availability of capital at financial and strategic buyers will support continued M&A activity post-pandemic

- Timing and specifics of M&A market recovery are unknown

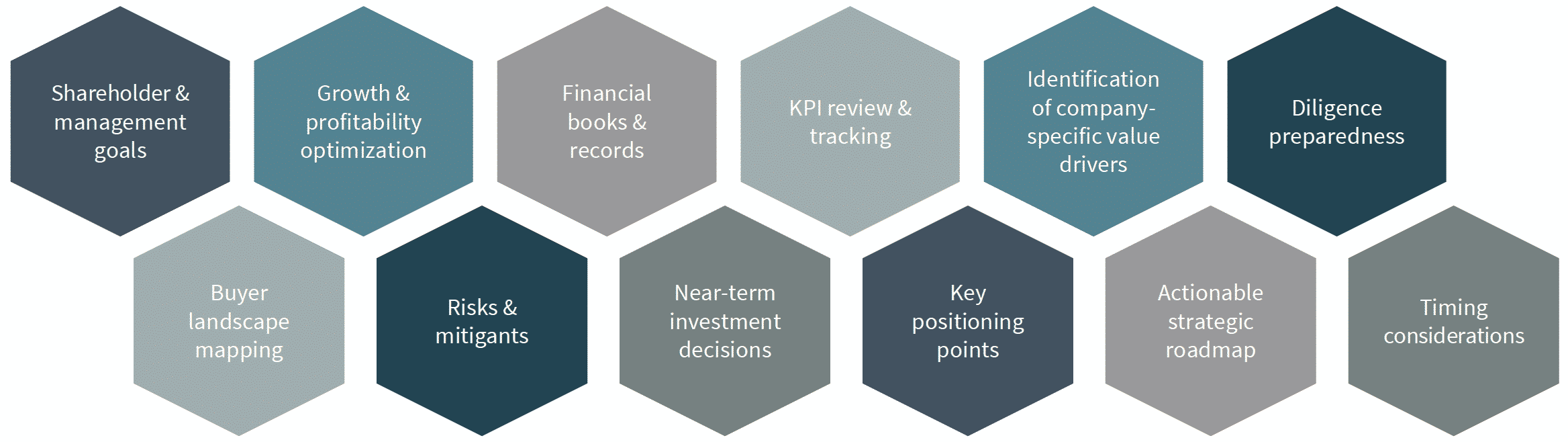

A Customized Roadmap to Value Creation

Case Study: AD Systems

Proactively Position Your Business for a Successful Future Exit

Situation Overview

- AD Systems is a leading manufacturer, designer, and marketer of high-quality custom sliding doors and interior storefront systems for healthcare and commercial uses

- Meridian had maintained a strong relationship with the shareholders of AD Systems for several years prior to beginning a formal sale process

- Shareholders were seeking a premium valuation and a buyer culturally and strategically aligned with the existing management team

Meridian Capital Approach

- Worked with management and shareholders to craft a compelling and actionable strategic growth plan

- Engaged in ongoing financial and KPI review to monitor Company performance and achievability of near-term growth prospects and determine the optimal time to transact

- Positioned AD Systems as a best-in-class asset among peers with a highly differentiated product offering

Outcome

- Ongoing preparation with Meridian led to a highly competitive process resulting in 13 indications of interest from investors with significant industry experience

- Completed a full sale of the Company at a premium valuation

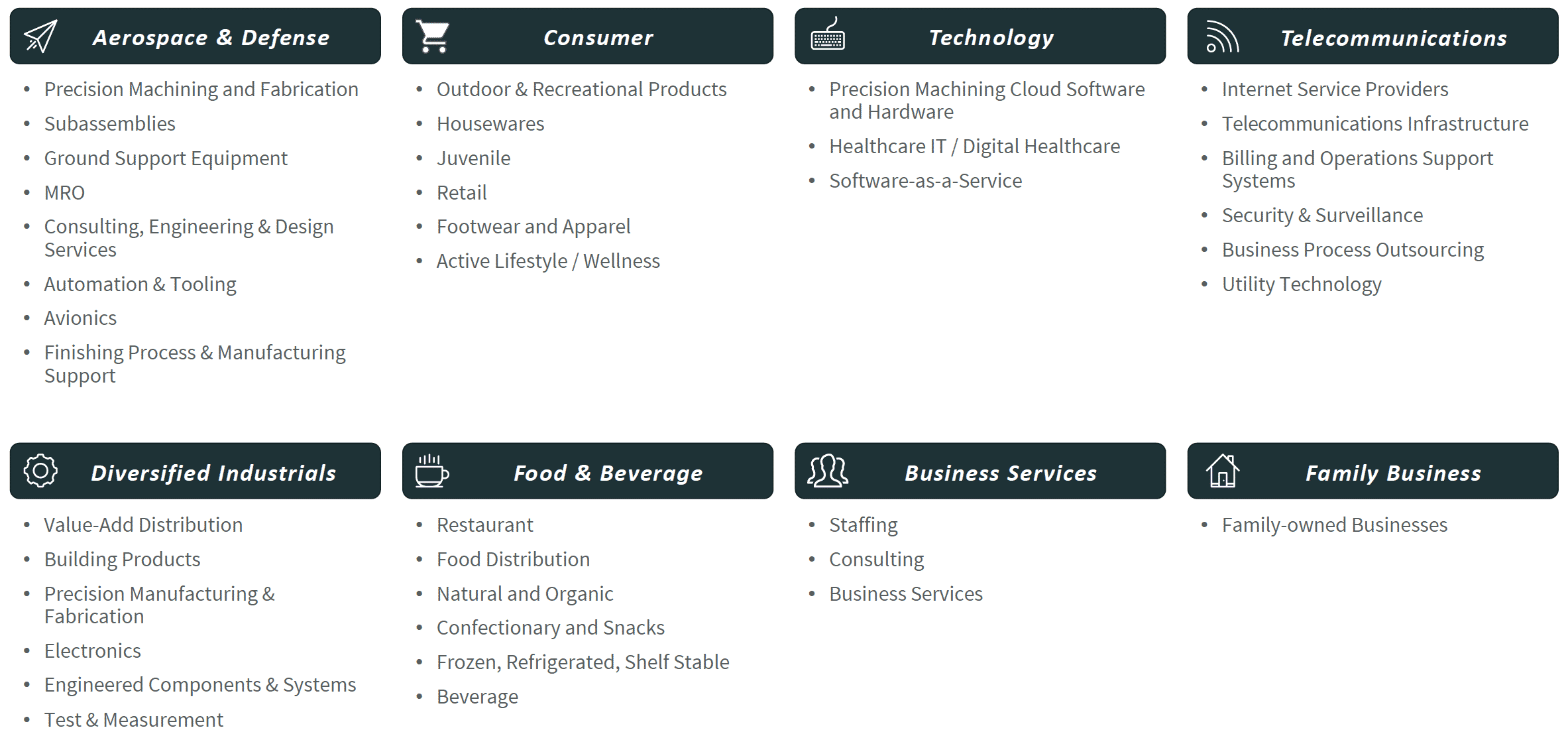

Focused Coverage Across Core Industry Sectors

Meridian Capital’s differentiated, industry focused approach gives us a deep understanding of our clients’ businesses

Meridian Capital is closely monitoring the impact of COVID-19 on the finance environment and will continue to share essential real-time insights as the situation evolves. If you have any questions related to the information included herein, including what it may mean for your business, please don’t hesitate to contact us.