Business Services M&A Trends: Spring 2021

Published April 22, 2021

- Cloud Consulting projected to make up 14.2% of the total global IT enterprise spending market in 2024, up from 9.1% in 2020

- A study shows more than 20% of the workforce could work remotely three to five days a week as effectively as they could if working from an office

- The global professional services market is expected to grow from $5.2 trillion in 2020 to $5.4 trillion in 2021

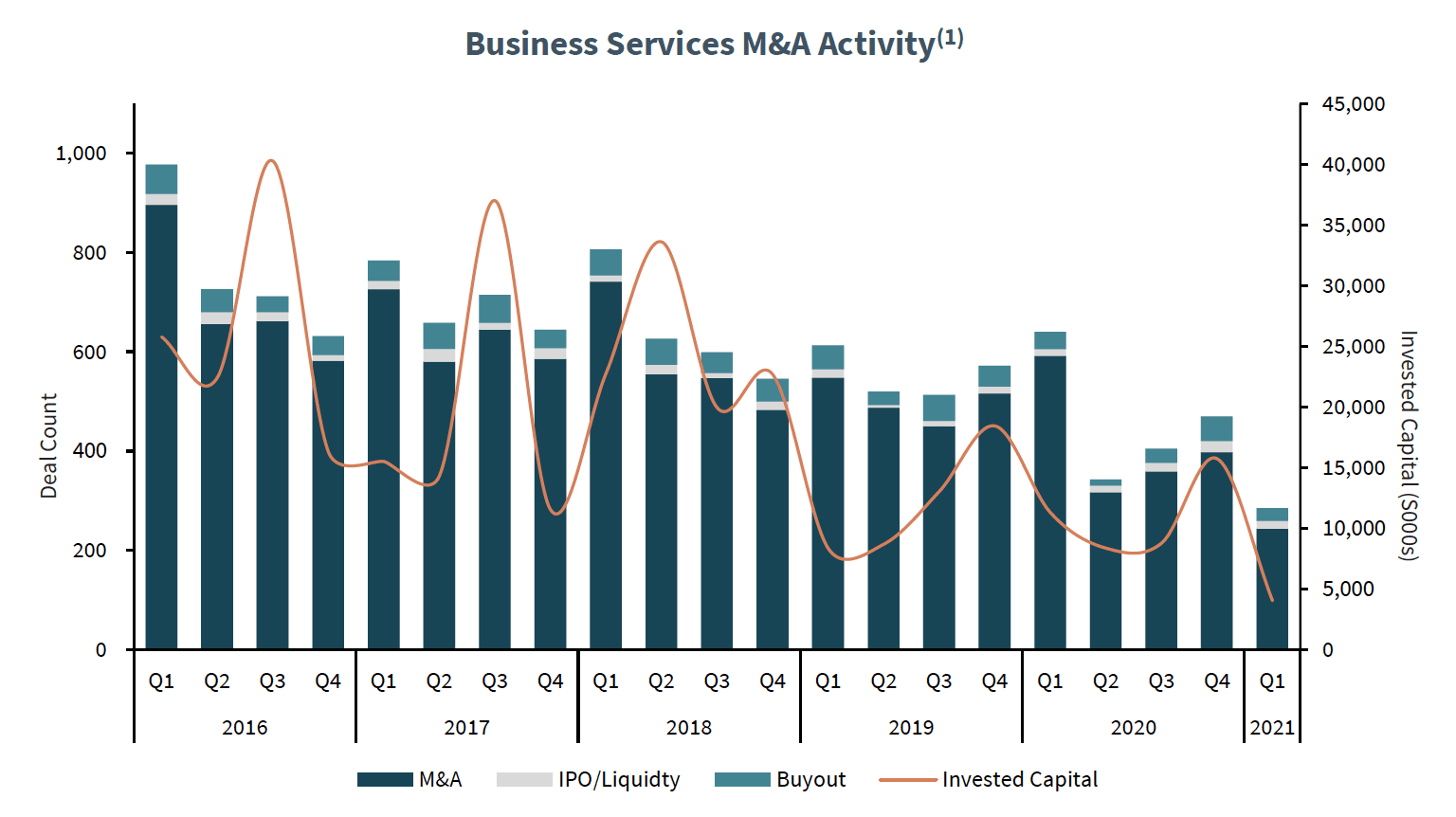

While total M&A activity in the space decreased approximately 16% in 2020 as compared to 2019, activity is expected to rebound in 2021. Several factors are expected to influence M&A activity, including the increased desire to own a full-service, business services platform, future tax uncertainty with the new Administration in Washington, and a buildup of dry powder on investor’s balance sheets caused by the cash preservation strategies adopted by many during the pandemic.

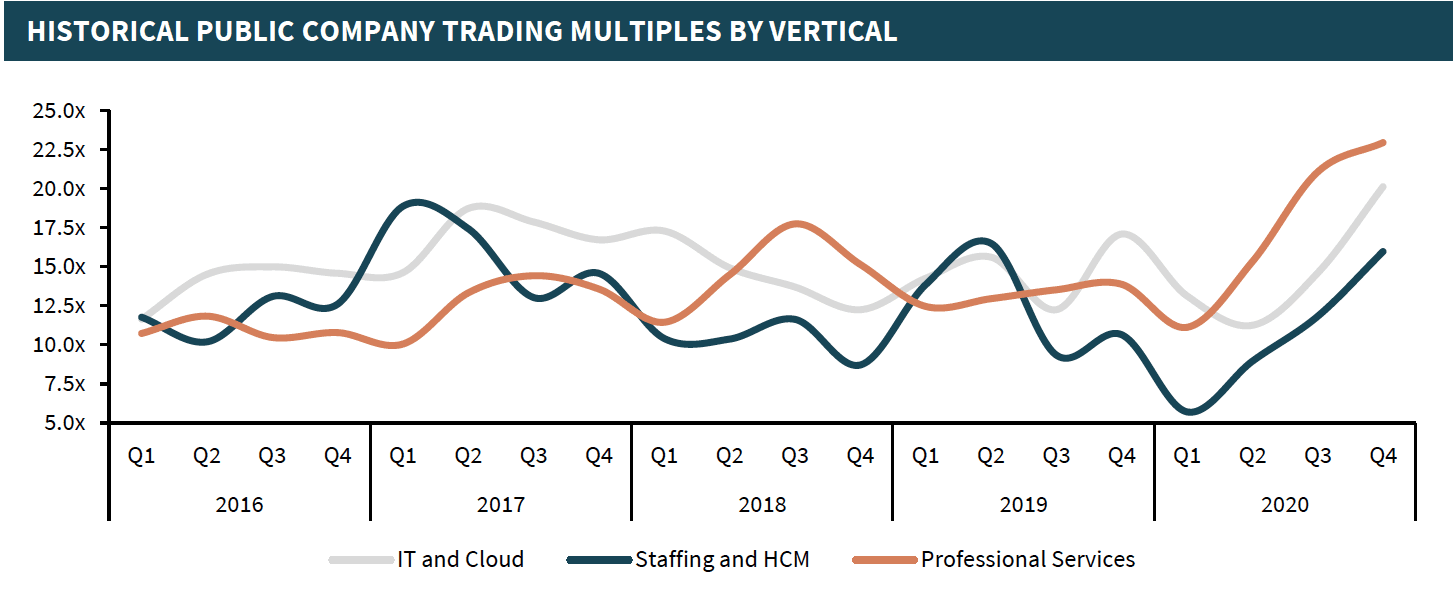

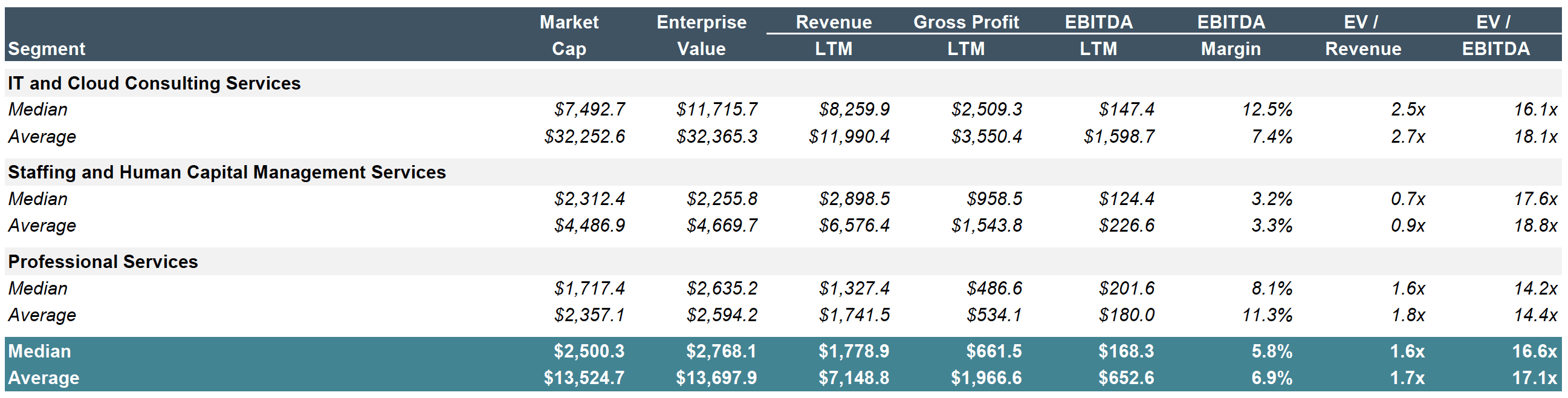

Although valuations increased in late fall 2020 due to COVID-19 resiliency and other market factors, the markets are expected to normalize in 2021. Companies in the business services sector will begin to trade at Enterprise Value/EBITDA (“EV/EBITDA”) multiples consistent with where they were pre-pandemic. Public company valuations have risen during the pandemic and public companies now trade at average multiples of 14.4x to 18.8x.

Business Services Market Insights

IT and Cloud Consulting Services

- The proportion of IT spending that is shifting to cloud will accelerate in the aftermath of the COVID-19 crisis, with cloud projected to make up 14.2% of the total global IT enterprise spending market in 2024, up from 9.1% in 2020.

- A recent survey indicates that almost 70% of organizations using cloud services today plan to increase their cloud spending in the wake of the disruption caused by COVID-19. With a shift towards remote learning and workspaces, the need for IT and Cloud integration across all business is at an all-time high.

Staffing and Human Capital Management Services

- Providers of staffing solutions and executive searches have transitioned to long-term strategic planning for a digital ecosystem, hoping to serve businesses that stick with remote operations, as well as in-person operations. The expectation is employment and placement firms will need to build or acquire technology tools that analyze talent pools efficiently based on the new work environment.

- A study shows more than 20% of the workforce could work remotely three to five days a week as effectively as they could if working from an office. If remote work took hold at that level, that would imply three to four times as many people working from home than before the pandemic.

Professional Services

- The global professional services market is expected to grow from $5.2 trillion in 2020 to $5.4 trillion in 2021 at a compound annual growth rate (“CAGR”) of 7. 9%. The market is expected to reach $7.1 trillion in 2025 at a CAGR of 7%.

- North America was the largest region in the global professional services market, accounting for 36% of the market in 2020. Western Europe was the second largest region accounting for 31% of the global professional services market.

Business Services M&A Activity

M&A Activity and Market Trends

M&A Activity Commentary

- While total M&A activity in the space decreased approximately 16% in 2020 as compared to 2019, activity is expected to rebound in 2021. Several factors are expected to influence M&A activity, including the increased desire to own a full-service, business services platform, future tax uncertainty with the new Administration in Washington, and a buildup of dry powder on investor’s balance sheets caused by the cash preservation strategies adopted by many during the pandemic.

- Increased government spending under a Biden-Harris administration compels strategic acquirers to remain active and seek new opportunities in both the public and private sectors.

- Although valuations increased in late fall 2020 due to COVID-19 resiliency and other market factors, the markets are expected to normalize in 2021. Companies in the business services sector will begin to trade at Enterprise Value/EBITDA (“EV/EBITDA”) multiples consistent with where they were pre-pandemic. Public company valuations have risen during the pandemic and public companies now trade at average multiples of 14.4x to 18.8x.

Recent Transaction Spotlights

Cognizant Technology Solutions acquired Magenic

Closed February 2021

- Magenic is a privately-held custom software development services company headquartered in Minneapolis, Minnesota. The Company works across a range of industries, including financial services, professional services, insurance, pharmaceutical, and manufacturing.

- This acquisition will broaden Cognizant’s global software product engineering network, adding hundreds of engineers in the U.S. and Philippines.

Falfurrias Capital acquired Crosslake Technologies

Closed December 2020

- Crosslake is a technology consulting firm that specializes in providing end-to-end services to private equity, from tech due diligence prior to acquisitions to value creating projects with portfolio companies, all the way through sell-side diligence prior to exit.

- Falfurrias partnered with Crosslake to provide capital for organic and inorganic growth opportunities, allowing the owner an opportunity to participate in a second exit.

Cognizant Technology Solutions acquired Collaborative Solutions

Closed June 2020

- Collaborative Solutions is a global consultancy specializing in Workday enterprise cloud applications for finance and human resources. Services include strategy development, organizational change management, and the deployment and management of finance, HR, planning, and higher education solutions.

- This acquisition of Collaborative Solutions will add new finance and HR advisory and implementation services to Cognizant’s cloud offerings.

Accenture acquired Yesler

Closed April 2020

- Yesler is a global provider of digital marketing, managed services, and strategic resourcing solutions to high-tech, enterprise clients.

- This acquisition represents Accenture’s appetite to expand their marketing services to better meet changing client needs and buy logos from a smaller player.

Century Park Capital Partners acquired Accelalpha

Closed April 2020

- Accelalpha is an IT consulting firm that provides enterprise software implementation services.

- Align with a private equity partner to facilitate a roll-up strategy to become the go-to partner for Oracle cloud logistics deployments.

Source: S&P Capital IQ, Company Press Releases, Meridian Research

Select Recent Transactions

| Date | Buyer | Target | Target Description |

|---|---|---|---|

| Feb-21 | Cognizant Technology Solutions | Magenic | Provider of digital technology consulting services. |

| Feb-21 | Bluvault Solutions | CrossCountry Consulting | Management consulting and technology company. |

| Feb-21 | Magenic | Cognizant Technology Solutions | Provider of digital technology consulting services intended to get the clients digital products to market faster. |

| Jan-21 | Horizon Capital | Pioneer B1 | Provider of ERP consulting and implementation. |

| Jan-21 | Market Performance Group | Insignia Capital | Provider of sales strategy, account management, data and analytics, distribution / order to cash, and consulitng services. |

| Dec-20 | Falfurrias Capital Partners | Crosslake Technologies | Provider of due diligence and consulting services. |

| Oct-20 | AmberLeaf Partners | Mastech Digital | Provider of digital transformation IT services. |

| Aug-20 | Valeo Networks | Network Management Services | Provider of IT consultancy services include cybersecurity, cloud computing, and data insights. |

| Aug-20 | YFM Equity Partners | Explorer UK | Provider of Oracle consulting services. |

| Aug-20 | Mach49 | Next 15 Communications Group | Operator of a growth incubator company for global businesses. |

| Jul-20 | Velvet Consulting | WPP (Wunderman Thompson) | Customer experience consultancy, combining marketing, data science and technology. |

| Jun-20 | Cognizant Technology Solutions | Collaborative Solutions | Provider of cloud-based business consultancy services. |

| May-20 | Launch Consulting, TA Group Holdings | Level 11 Consulting, LLC | Designer, developer and provider of technology consultation and solutions. |

| May-20 | Parabellum Capital, The Acacia Group | Column Technologies | Provider of technology consulting, systems, and services. |

| Apr-20 | Waterleaf International | Barquin Solutions | Provider of full-service IT consulting services to government |

| Apr-20 | Saalex Information Technology | Valeo Networks | IT consultancy primarily focused on managed IT, cloud solution, and cybersecurity services. |

| Apr-20 | Yesler | Accenture | Strategic resourcing solutions, digital marketing and managed services. |

| Mar-20 | Century Park Capital Partners | Accelalpha | Provider of Oracle cloud implementations. |

| Feb-20 | Accenture | Icon Integration | Technology consulting firm for SAP digital supply chain solutions. |

| Feb-20 | BG Staffing | EdgeRock Technologies, LLC | IT consultancy primarily focused on ERP, business intelligence, analytics, and cloud services. |

| Feb-20 | Svoboda Capital Partners | Kenway Consulting | IT and management consultancy with deep knowledge of core business processes, technical architecture, and data analytics. |

| Jan-20 | ICF International | Incentive Technology Group | Provider of software consulting and management consulting solutions. |

| Jan-20 | Itelligence | ISS Consulting | SAP cloud and software consulting services. |

| Jan-20 | Sales Benchmark Index | CIP Capital | Management consulting firm focused on growing enterprise sales. |

| Dec-19 | Tieto | EVRY | Provider of software, IT, and consulting services. |

| Dec-19 | Qvartz | Bain & Co. | Leading management consultant in Denmark. |

| Nov-19 | Alaris Royalty | Stride Consulting, LLC. | Provider of agile software development consultancy services. |

| Nov-19 | Caiman Consulting | Sia Partners | Provider of advisory and implementation services. |

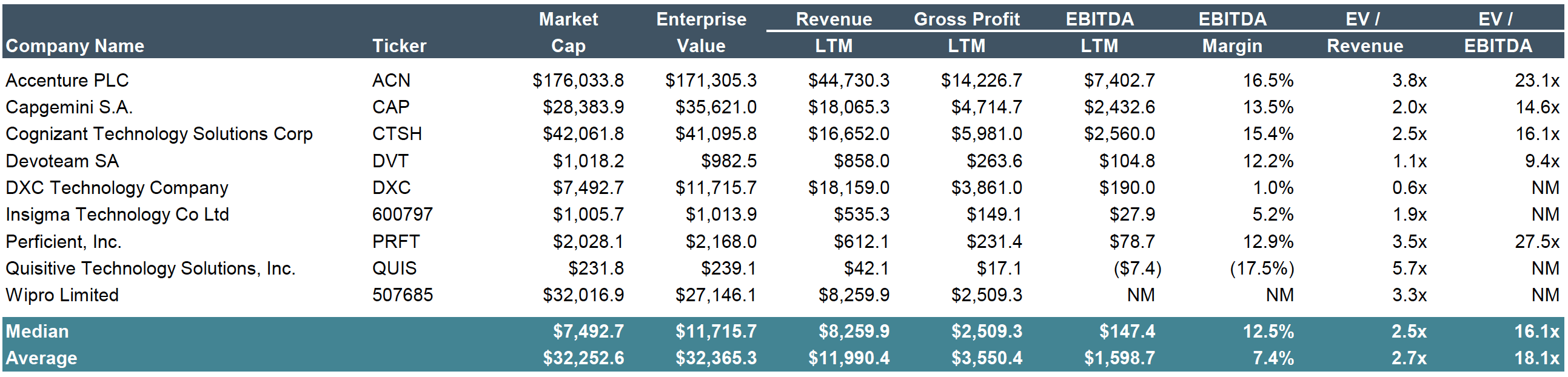

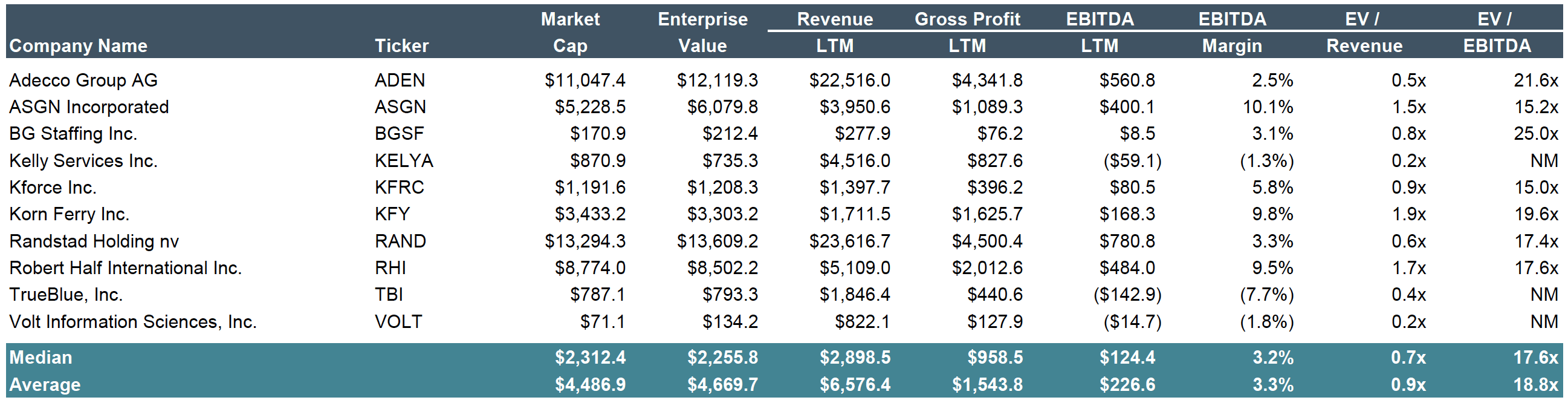

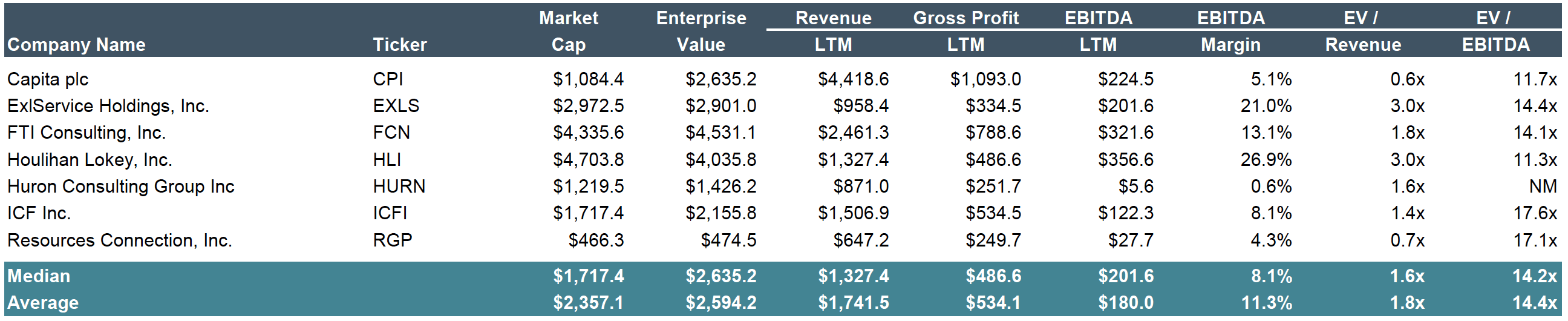

Public Company Valuations and Key Financial Data

Industry Summary

IT and Cloud Consulting Services

Staffing and Human Capital Management Services

Professional Services

As of March 15, 2021; USD unless otherwise specified

Source: Public company filings and Pitchbook; Extreme outliers were removed from the EV/EBITDA multiple calculation

Crosslake Technologies Acquired by Falfurrias Capital Partners

In late 2020, Meridian Capital’s Business Services team advised Crosslake Technologies (“Crosslake”) on its successful acquisition by Falfurrias Capital Partners (“FCP”).

Founded in 2008 and located in Kirkland, Washington, Crosslake Technologies performs technical due diligence work on behalf of private equity firms and supports portfolio companies after an investment to enhance technology-related processes and accelerate growth. Core value creation services include support of carve-out and integration initiatives, product strategy, interim leadership, organization and development optimization, architecture roadmaps and development, and security assessments and programs.

Crosslake was founded by Russ Albright, a founding member of the Engineering Excellence team at Microsoft, which was mandated directly by Bill Gates to find better ways to develop, secure, deploy and operate software in an ever-changing and competitive environment. Since 2008, Albright has built a team composed of former CTOs, CIOs and executives with extensive software development expertise who help improve the deployment of new platforms and drive product development.

Crosslake Technologies currently maintains more than 300 active client relationships, having worked with more than 100 private equity firms and asset managers around the world. In 2020, the Company completed more than 400 technical due diligence projects and more than 100 post-close value creation projects. As part of the investment, FCP executives Joe Price and Wilson Sullivan will serve as board members.

Meridian Capital Sector Coverage

- Consulting and Professional Services

- Staffing and Human Capital Management

- Consumer Services

- Outsourcing and BPO

- Business Analytics

- Information Services

- Education and Training

- Media and Marketing Services