Agribusiness M&A Trends: Winter 2021

Published April 21, 2021

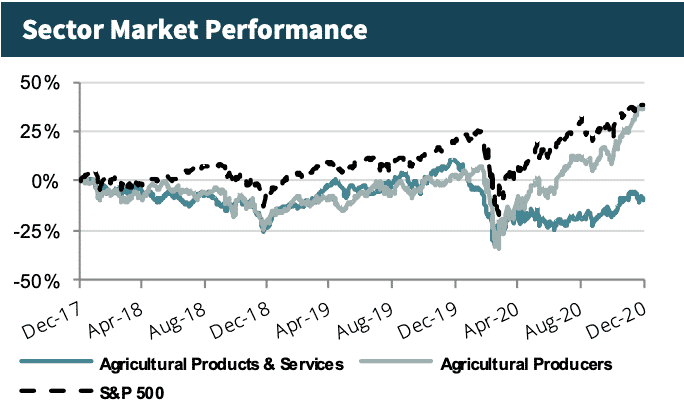

- Agricultural Producers performed well in 2020, finishing the year above 2019 levels

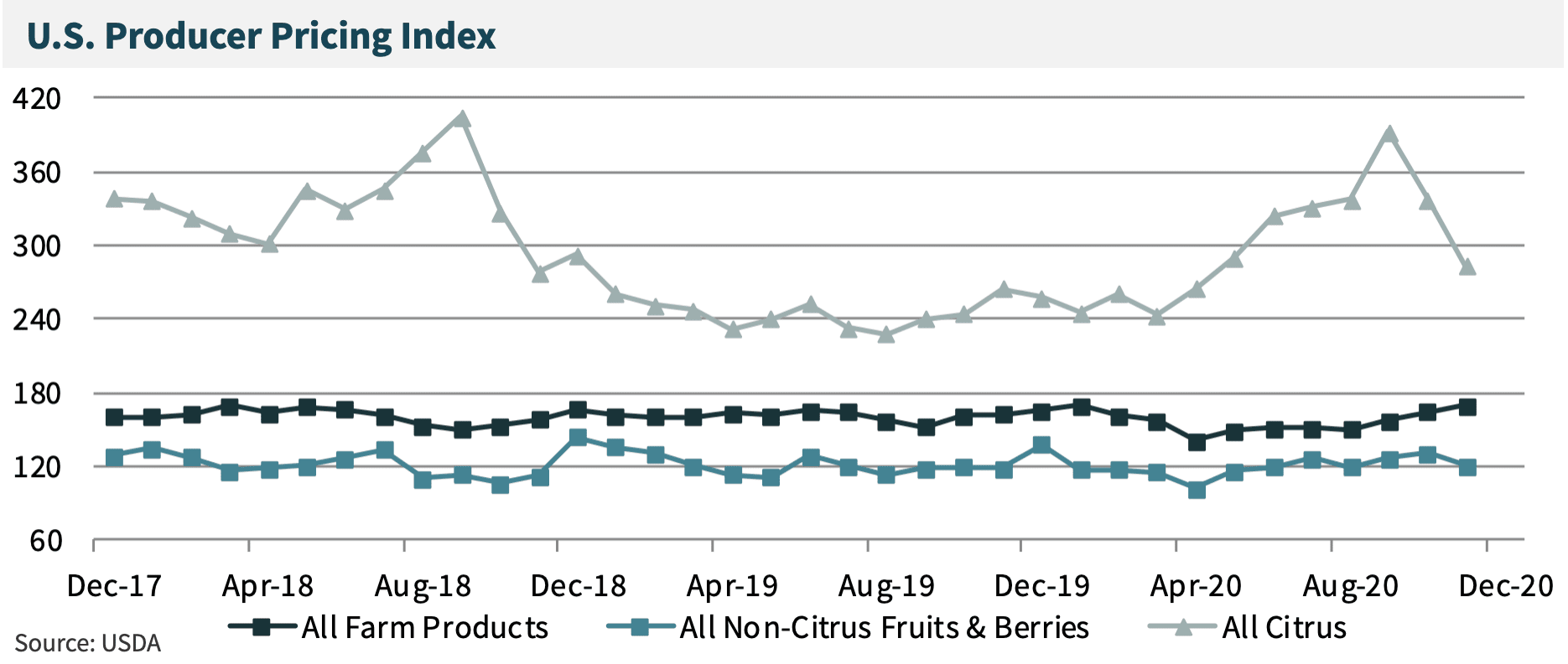

- Citrus prices returned to 2018 levels, as Florida citrus groves recovered from hurricane damage

- The Agribusiness sector continues to look towards automation and technology for growth

Stock prices for agricultural producers rose significantly during the second half of 2020 allowing the sector to close out the year 34% higher than its December 2019 levels. Due to the essential nature of the sector, companies performed well despite operational and end-market challenges created by COVID .

With an expected rebound in the export market, industry trends towards organic and better-for-you food products and continued consolidation within certain industry sectors, the M&A outlook for 2021 for the sector is positive with an expected return to prior years activity levels.

Labor shortages was the most frequently cited issue within the Agribusiness sector in 2020. Producers and packers who made investments in technology and PPE early in the pandemic separated themselves from competitors during the later-half of 2020. The success of large, automated producers during the crisis will likely accelerate the pace of consolidation in the industry.

Agribusiness Market Insights

Agribusiness Gains Footing Heading into 2021

- The essential nature of the Agribusiness sector caused it to perform well relative to other sectors of the economy as Agribusiness companies adapted quickly to a wide range of operational and end-market challenges in 2020 created by the COVID-19 pandemic.

- The export market in 2020 was soft for most crop and food types, but exports are expected to rebound to some degree in 2021. It is expected that many companies will continue to strengthen and improve their domestic operations and opportunistically pursue export opportunities in 2021.

- Products sold into grocery and ‘good-for-you’ channels experienced strong demand and pricing bumps throughout 2020, including citrus and berries. These trends are expected to continue as we move through 2021 and its crop seasons.

Social Distancing and Labor Shortages Accelerate Automation

- Labor shortage was the most frequent issue within the Agribusiness sector with more than 45% of companies reporting that their workforce was affected as a result of the virus1.

- Producers and packers who made investments in technology and PPE early in the pandemic separated themselves from competitors during the later half of 2020.

- Reduced capacity within packing facilities due to social distancing requirements accelerated demand for automated processes and new technologies in 2020, including computer vision and sorting, machine learning, robotics, and remote monitoring. This trend is expected to accelerate in 2021.

- For processes such as fruit picking, which requires delicacy in handling, as well as judgement on readiness to harvest, automation remains a challenge. Instead, fruit and vegetable packers and producers are choosing to focus on using technology to increase yield, reduce crop inputs, and preserve produce for longer after harvest.

1 Source: Agribusiness Global

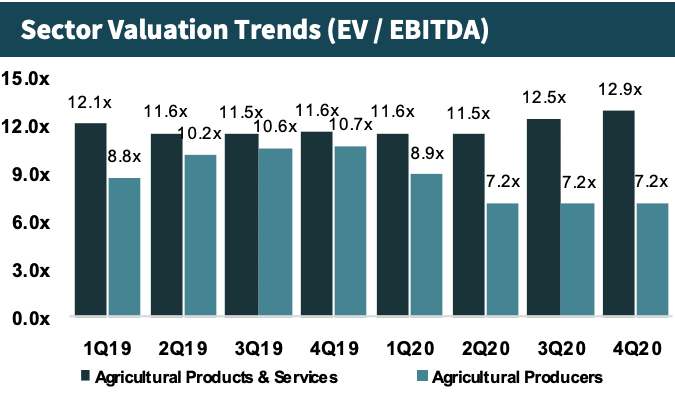

Consolidation Expected to Continue Within Niche Sectors in 2021

- Many companies within Agribusiness are focusing on portfolio diversification and growth via acquisition.

- Large legacy Agribusiness companies looking to increase their organic, better-for-you, and branded offerings have increasingly sought to consolidate smaller companies that have well-established offerings in market.

- Some fragmented segments with multiple niche players, including farm distribution and retail, farming inputs, and ingredient processors, are facing challenges stemming from their lack of scale, financial reserves, and portfolio diversity. These segments are expected to experience significant M&A volumes in 2021.

- With record “dry powder” and available capital to invest, look for financial and institutional investors to continue to seek investments throughout 2021 in the highly fragmented Agribusiness market.

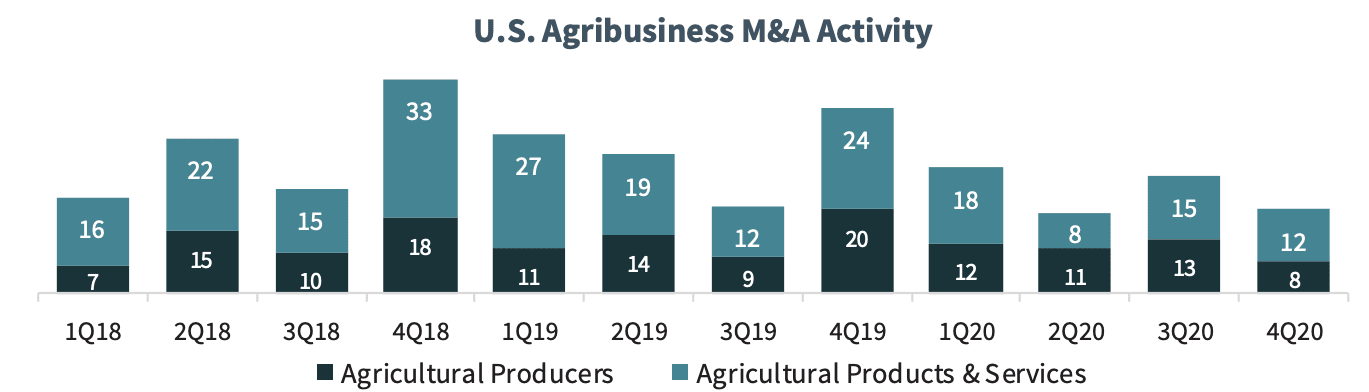

Agribusiness M&A Activity

M&A Activity and Market Trends

Recent Transaction Spotlights

Description: SiteOne, a wholesale landscape supply and irrigation distributor, has acquired Spokane, WA based Wittkopf Landscape Supplies

Rationale: The acquisition expands SiteOne’s offerings in the region from the Company’s 2018 purchase of Auto-Rain

Description: Lineage Logistics a portfolio company of Bay Grove Capital has agreed to acquire Washington based Henningsen Cold Storage Co.

Rationale: The acquisition strengthens Lineage’s leading network of CA storage located across 12 countries globally

Description: Rose Acre Farms and Weaver Eggs have agreed to purchase AGR Partners entire interest in Opal Foods

Rationale: The egg industry has a positive future with high-protein diet trends, and Opal Foods has a favorable specialty and cage-free asset base

Source: CapitalIQ, and Meridian Research

Produce Prices Stabilize

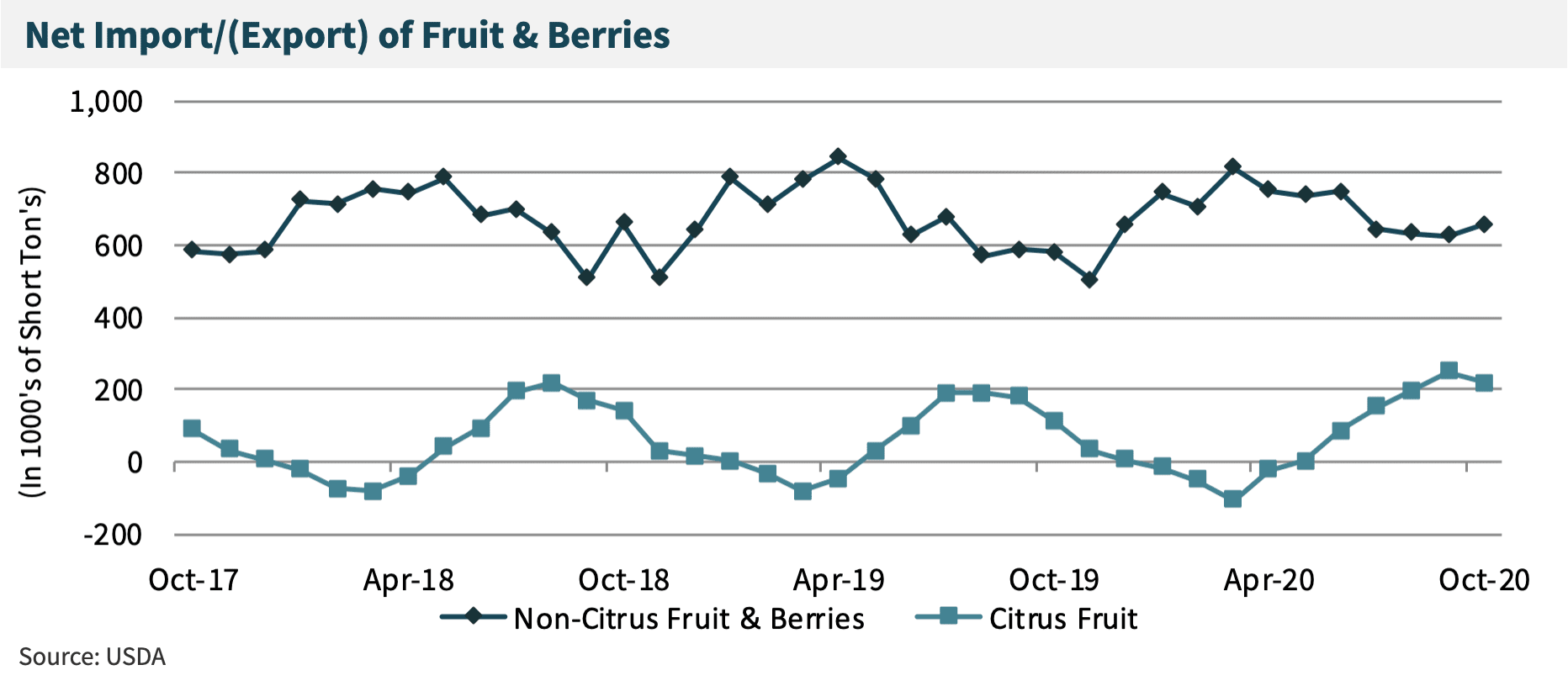

- Prices for non-citrus fruits & berries have recovered most of the ground they lost in Apr-20 at the beginning of the COVID-19 pandemic as market visibility has increased. During 2020, citrus experienced its largest increase in price since 2018 as Florida groves recovered from hurricanes and domestic demand increase.

- Domestic pricing for agricultural products and produce has increased as customers seek to reduce risk in their supply chains and put greater value on domestic production.

- Producers with larger, highly automated facilities were best suited to deal with the COVID-19 pandemic as less automated producers dealt with virus-related shutdowns. The success of large automated producers during the crisis will likely accelerate the pace of consolidation in the industry.

Demand for Fruit & Berries Remains High

- Demand for imported fruit and berries was higher than previous years as producers continue to deal with disruptions in domestic production stemming from the COVID-19 pandemic.

Publicly-traded Agribusiness Companies

Agriculture Products & Services

| Company Name | Market Cap | Enterprise Value | TTM Sales | TTM EBITDA | TTM EBITDA Margin | NTM Est. Growth Sales | EV / TTM Sales | EV / TTM EBITDA |

|---|---|---|---|---|---|---|---|---|

| FMC Corporation | $15,006 | $18,138 | $4,687 | $1,280 | 27.3% | 6.4% | 3.9x | 14.2x |

| Scotts Miracle-Gro | 11,141 | 12,832 | 4,132 | 696 | 16.9% | 4.2% | 3.1x | 18.4x |

| The Toro Company | 10,172 | 10,565 | 3,379 | 523 | 15.5% | 7.4% | 3.1x | 20.2x |

| The Mosaic Company | 8,867 | 13,094 | 8,301 | 1,085 | 13.1% | 6.8% | 1.6x | 12.1x |

| CF Industries Holdings | 8,052 | 14,396 | 4,071 | 1,539 | 37.8% | 6.2% | 3.5x | 9.4x |

| AGCO Corporation | 7,706 | 8,996 | 8,946 | 838 | 9.4% | 6.2% | 1.0x | 10.7x |

| SiteOne Landscape Supply | 6,810 | 7,259 | 2,564 | 224 | 8.7% | 10.4% | 2.8x | 32.4x |

| Lindsay Corporation | 1,356 | 1,361 | 475 | 74 | 15.5% | 0.2% | 2.9x | 18.5x |

| Titan Machinery Inc. | 424 | 828 | 1,326 | 59 | 4.5% | 3.5% | 0.6x | 14.0x |

| Titan International, Inc. | 271 | 683 | 1,234 | 24 | 1.9% | 11.4% | 0.6x | 28.9x |

| Pure Cycle Corporation | 255 | 233 | 26 | 5 | 18.0% | NM | 9.0x | NM |

| Intrepid Potash, Inc. | 209 | 258 | 150 | 26 | 17.2% | 24.3% | 1.7x | 10.0x |

| CVR Partners, LP | 163 | 760 | 346 | 79 | 22.8% | -1.1% | 2.2x | 9.6x |

| AgroFresh Solutions, Inc. | 141 | 539 | 167 | 71 | 42.6% | 5.3% | 3.2x | 7.6x |

| Ceres Global Ag Corp. | 95 | 241 | 627 | 12 | 2.0% | NM | 0.4x | 19.7x |

| Median | $79 | 15.5% | 6.2% | 2.8x | 14.1x | |||

| Average | $436 | 16.9% | 7.0% | 2.6x | 16.1x |

Agriculture Producers

| Company Name | Market Cap | Enterprise Value | TTM Sales | TTM EBITDA | TTM EBITDA Margin | NTM Est. Growth Sales | EV / TTM Sales | EV / TTM EBITDA |

|---|---|---|---|---|---|---|---|---|

| Tyson Foods, Inc. | $23,651 | $34,231 | $43,185 | $5,013 | 11.6% | NA | 0.8x | 6.8x |

| Darling Ingredients Inc. | 9,129 | 10,746 | 3,412 | 462 | 13.5% | 6.7% | 3.1x | 23.3x |

| Pilgrim’s Pride Corporation | 4,796 | 6,958 | 12,038 | 617 | 5.1% | NA | 0.6x | 11.3x |

| Sanderson Farms, Inc. | 2,943 | 2,959 | 3,564 | 182 | 5.1% | NA | 0.8x | 16.3x |

| Cal-Maine Foods, Inc. | 1,783 | 1,593 | 1,403 | 99 | 7.1% | NA | 1.1x | 16.1x |

| Calavo Growers, Inc. | 1,273 | 1,369 | 1,117 | 51 | 4.5% | NA | 1.2x | 27.0x |

| Fresh Del Monte Produce Inc. | 1,192 | 1,956 | 4,225 | 174 | 4.1% | NA | 0.5x | 11.2x |

| Mission Produce | 991 | 1,142 | 887 | 95 | 10.7% | 1.3% | 1.3x | 12.0x |

| Adecoagro S.A. | 742 | 1,671 | 854 | 294 | 34.4% | -2.7% | 2.0x | 5.7x |

| Limoneira Company | $271 | $423 | $171 | -$4 | NA | 11.7% | 2.5x | NA |

| Farmland Partners Inc. | 248 | 1,031 | 55 | 35 | 64.6% | -1.1% | NM | 29.2x |

| Alico, Inc. | 234 | 388 | 93 | 21 | 23.2% | NA | 4.2x | 18.1x |

| S&W Seed Company | 94 | 142 | 81 | -15 | NA | 8.3% | 1.7x | NA |

| Median | $99 | 10.7% | 4.0% | 1.3x | 16.1x | |||

| Average | $540 | 16.7% | 4.1% | 1.7x | 16.1x |

Notable Transactions: Agribusiness

| Announced Date | Acquirer/Investor | Target | Target Description |

|---|---|---|---|

| 11/30/2020 | Biobest USA, Inc. | Beneficial Insectary Inc. | Engages in the production and application of beneficial organisms used in biological pest control. |

| 11/23/2020 | Fortune Fish Company Inc. | Neesvigs Inc. | Manufactures and markets packed food and meat products. |

| 11/6/2020 | The Carlyle Group Inc. | Manna Pro Products, LLC | Produces animal feeds for animal health and nutrition including equines, rabbits, goats & poultry. |

| 11/2/2020 | Producers Dairy Foods, Inc. | Umpqua Dairy Products, Inc. | The company offers a full line of dairy products distributed to retailers domestically |

| 10/1/2020 | AGR Partners | Green Plains Cattle Company LLC | Operates cattle feedlots and offers risk management and financing services to customers. |

| 9/22/2020 | Carousel Capital Partners LP | Landscape Workshop LLC | Provides grounds maintenance services for commercial properties across the Southeast. |

| 7/28/2020 | Albert City Elevator, A Cooperative | AG Partners L.L.C. | The company offers seeds, grains, and feeds; and a precision agricultural program. |

| 7/7/2020 | GrubMarket, Inc. | Cali Fresh Produce Inc | Produces and distributes fruits and vegetables. |

| 7/1/2020 | Swissgenetics Genossenschaft | New Generation Genetics, Inc. | Engages in animal breeding services. |

| 6/29/2020 | Kinderhook Industries, LLC | Prairie Dog Pet Products, LLC | Manufactures treats and antler products for pet dogs. |

| 6/19/2020 | Costa Farms, LLC | Deleon’s Bromeliads, Inc. | Grows bromeliads and orchids. |

| 6/15/2020 | West Lake Creek Company, LLC | Osage Gardens Inc. | Produces organically grown culinary herbs and vegetables. |

| 6/1/2020 | Green Garden Products LLC | Dyna-Gro, Inc. | Produces and distributes liquid plant nutrient products. |

| 5/29/2020 | Henderson Turf Farm, Inc. | Scarff’s Nursery & Landscape LLC | Owns and operates a nursery and landscape company. |

| 5/28/2020 | Lineage Logistics Holding, LLC | Henningsen Cold Storage Co. | Provides multi-temperature controlled storage and refrigerated logistics services. |

| 5/1/2020 | Hoffman Landscapes, Inc. | Kent Greenhouse & Gardens | Provides landscape design, installation, and garden maintenance services. |

| 2/27/2020 | WaterVault America, Inc. | Huerfano-Cucharas Irrigation Company | Provides landscape design, installation, and garden maintenance services. |

| 4/9/2020 | Sakata Seed America, Inc. | Vanguard Seed | Produces lettuce seed. |

| 3/26/2020 | Michael Foods of Delaware, Inc. | Henningsen Foods, Inc. | Provides specialty egg, meat, and poultry products to the food processing industry. |

| 3/25/2020 | Wm. Bolthouse Farms, Inc. | Carrot Operations of Rousseau Farming Company | Comprises carrot farming services. |

| 3/18/2020 | Silver Spring Foods, Inc. | Brede, Inc. | Processes and sells horseradish, sauces, and other vegetable crops. |

| 3/17/2020 | Sloan Implement Co., Inc. | Assets of Arends-Awe, Inc. | Comprises harvesting equipment. |

| 3/10/2020 | Gold Leaf Farming, LLC | 1,850-acre Almond Orchard in Fresno County | 1,850-acre Almond Orchard in Fresno County. |

| 2/28/2020 | K-Tec Earthmovers Inc. | Ashland Industries, Inc. | Ashland Industries manufactures earthmoving equipment and machinery for agricultural use. |

| 1/31/2020 | AGRANA | Marroquin Organic International, Inc. | Marroquin Organic International, Inc. provides organic and non-GMO ingredients. |

| 1/15/2020 | Greenville Turf & Tractor Inc | Reynolds Farm Equipment, Inc. | Reynolds Farm Equipment, Inc. operates as an equipment dealer. |

| 1/14/2020 | SiteOne Landscape Supply, Inc. | Assets and Liabilities of The Garden Dept. Corp. | The Garden Dept. Corp. provides nursery services and horticultural distribution. |

| 1/13/2020 | BrightView Holdings, Inc. | Signature Coast Holdings, LLC | Signature Coast Holdings, LLC provides commercial landscaping services. |

Meridian Capital Sector Coverage

- Cold Storage

- Crop Inputs and Consumables

- Irrigation Equipment

- Food Processors and Producers

- Growers

- Packers and Packaging

- Transportation and Logistics

- Vertically Integrated Operations