Aerospace M&A Update – Summer 2017

Published June 30, 2017

Key Trends in Aerospace & Defense for 2017

Meridian Capital’s Aerospace and Defense M&A Update focuses on consolidation in the supply chain, continued interest in proprietary content and cross border acquisitions, and Boeing’s potential impact on the maintenance repair and overhaul market.

M&A Trends, Activity and Public Comps

Aerospace M&A Activity Remains Strong During First Half of 2017

- In the first half of 2017, aerospace and defense M&A volume remained well above the historical 10-year average despite slowing order activity and continued cost pressures on the supply chain.

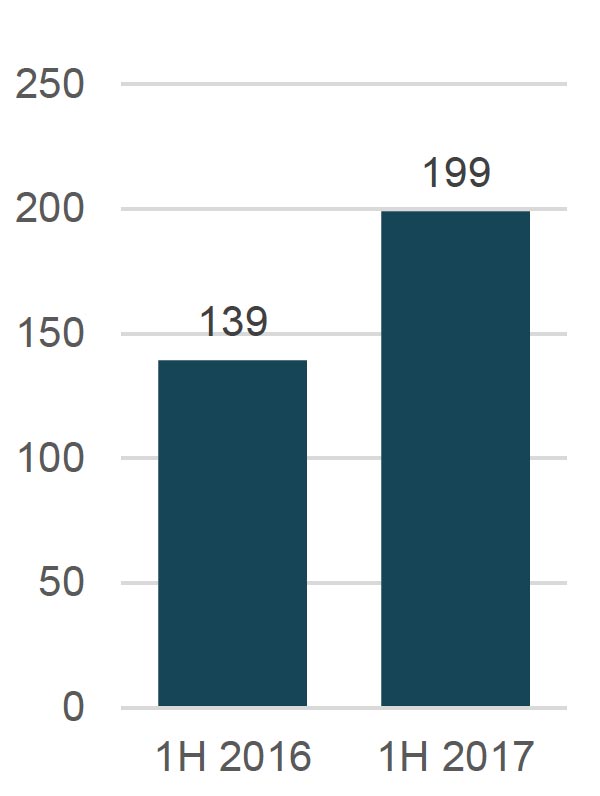

- During the first six months of 2017, aerospace and defense transaction volume was down slightly from the second half of 2016, with 199 transactions compared to 227. However, year-over-year, transaction volume was up 43% compared to the first half of 2016. Strong activity across the commercial components/subsystems and composites segments have served as transaction drivers.

- Near-term M&A activity in the industry will likely benefit from the positive momentum established during the Paris Air Show, where order activity for both narrow body commercial and defense aircraft was stronger than expected.

- Given recent order momentum, in addition to strong long-term air traffic and build rate forecasts, we expect several trends to drive continued industry consolidation activity in the second half of 2017.

YoY Transaction Volume

OEM Build Rate Increases Continue to Stress Supply Chain

- Both Boeing and Airbus continue to look for ways to aggressively cut costs and increase build rates on key platforms. The price and order competition on comparable platforms such as the 737 vs. A320 and 787 vs. A350 remains fierce. After several years of embracing an expanded supplier base, both OEMs are driving their respective supply chains to consolidate so they can regain control over technological capabilities, cost, and capacity.

- As a result, suppliers are faced with the challenge of substantially building production capacity while simultaneously providing near-term price reductions. This is driving key suppliers to make significant investments in equipment, systems, and acquisitions to expand capabilities and/or enhance automation.

- While large Tier I suppliers such as Spirit, Safran, and Triumph have the resources to support these demands, the competitive dynamic presents a challenge for small to mid-sized Tier I and Tier II suppliers with more limited financial resources.

M&A Interest Focused on Proprietary Content and Cross Border Activity

- Key strategic investors and industry focused private equity firms continue to communicate a strong M&A appetite. In particular, as the commercial build-to-print market has become increasingly competitive, investors are aggressively seeking opportunities that offer proprietary content, an MRO offering, or unique manufacturing capabilities.

- Several well-established, Tier I Airbus suppliers based in Europe and Asia are seeking U.S. acquisitions with direct relationships with North American OEMs.

- These investment rationales, coupled with the pricing and build-rate pressures outlined above, are likely to lead to continued industry consolidation over the next 12 months.

OEM Build Rate Increases Continue to Stress Supply Chain

- Boeing has set the stage for the launch of its new Global Services business that aims to capture a large share of the global maintenance, repair, and overhaul (“MRO”) market. Specifically, Boeing is aggressively targeting to reach $50 billion in MRO revenue within the next 10 years.

- Historically, the MRO market has been highly fragmented with airlines valuing characteristics such as flexibility, responsiveness, and competitive pricing often associated with smaller, independent companies. Boeing intends to address these customer needs through an internal reorganization as well as through selective acquisitions.

- Boeing’s rejuvenated commitment to the MRO market will likely drive consolidation at all levels as companies look to position themselves to protect market share and expand differentiated capabilities.

Source: CapitalIQ

Select Transaction Case Studies

Target Description: Offers repair, troubleshooting, and maintenance of turbine engine and aircraft.

Investment Rationale: Further positions Kellstrom Aerospace Group as a global leader in the aircraft lifecycle solutions industry and builds upon the Company’s diverse service offerings.

Buyer Quote: “With Vortex Aviation joining Kellstrom Aerospace Group, our range of technical services is greatly enhanced.” – Jeff Lund, CEO of Kellstrom Aerospace Group.

Target Description: A leading manufacturer of metallic aerostructure parts and subassemblies.

Investment Rationale: Allows Wipro to gain access to North American OEMs and to capitalize on global supply chain trends.

Buyer Quote: “We see cross-synergies in customer relationships, products and technology that can be leveraged to strengthen our presence in the growing Aerospace sector and become a partner of choice for global OEMs and Tier-1s.“ – Sunil Rajagopalan, business head (Aerospace) of Wipro.

Target Description: Washington-based designer, engineer, and manufacturer of digital in-flight entertainment and cabin management systems (IFE/CMS) for the corporate, private, and VIP aircraft industry.

Investment Rationale: The addition of CCC furthers Astronics’ commitment to be the global leader in the global aerospace advanced technologies market as it recovers in the coming years.

Buyer Quote: “We believe the cooperative pursuits of PGA and CCC working together will provide best-in-class technology and innovation to our customers.“ – Peter Gundermann, CEO of Astronics Corporation.

Target Description: Engages in the designing, manufacturing, and distribution of aerospace, defense, medical, and industrial composites.

Investment Rationale: Liberty Hall seeks to build a fully-integrated, diversified composites supplier through organic investments and strategic acquisitions.

Buyer Quote: “Composites represent one of the fastest growing, and evolving, segments within the aerospace industry.” – Rowan Taylor, Founding Partner of Liberty Hall Capital Partners.

Notable Recent Transactions

| Date | Target | Buyer | Segment | EV ($M) | EV/ Revenue | EV/ EBITDA |

|---|---|---|---|---|---|---|

| Jul-17 | Vector Aerospace Corporation | DAE Aviation Holdings, Inc. | MRO | – | – | – |

| Jun-17 | Vortex Aviation Inc. | Kellstrom Aerospace, LLC | MRO | – | – | – |

| Jun-17 | Space-Lok, Inc. | Novaria Fastening Systems LLC | Components & Subsystems | – | – | – |

| Jun-17 | Aernnova Aerospace S.A. | TowerBrook Capital Partners L.P.; Torreal, | Aerostructures | – | – | – |

| SCR, S.A.; Peninsula Capital Advisors LLP | ||||||

| Jun-17 | Dunlop Aircraft Tyres Limited | Liberty Hall Capital Partners, L.P. | Components & Subsystems | 135.0 | – | – |

| Jun-17 | Halo Industires, Inc. | Elite Aerospace Group, Inc. | Machined Parts | – | – | – |

| Jun-17 | Fore Machine Company, Inc. | P4G Capital Management, LLC | Components & Subsystems | – | – | – |

| Jun-17 | Aero Components Inc. | P4G Capital Management, LLC | Components & Subsystems | – | – | – |

| Jun-17 | Graco Suppply Company Inc., Ball Ground Aircraft Sealand Repackaging Business | Royal Adhesives & Sealants, LLC | Composites | – | – | – |

| Jun-17 | Three Add On Aerospace Product Lines | TransDigm Group Incorporated (NYSE:TDG) | Controls | 100.0 | 3.1x | – |

| May-17 | SMTC SAS | Aircraft Interior Products | Composites | – | – | – |

| May-17 | Classic Precision Inc. | Hosco Finishing LLC | Engines | – | – | – |

| May-17 | BEI Precision Systems & Space Co. Inc. | J.F. Lehman & Company, Inc. | Components & Subsystems | – | – | – |

| May-17 | Dallas Aeronautical Services, LLC | West Star Aviation, Inc. | MRO | – | – | – |

| May-17 | PolyAero Inc. | Apollo Aerospace Components Limited | Components & Subsystems | 10.5 | – | – |

| Apr-17 | Whitcraft LLC | Greenbriar Equity Group LLC | Machined Parts | – | – | – |

| Apr-17 | Custom Control Concepts | Astronics Corporation (NASDAQ:ATRO) | Components and Subsystems | 10.7 | – | – |

| Mar-17 | Kineco Kaman Composites – India Private Limited | Kaman Aerospace Group, Inc. | Composites | – | – | – |

| Mar-17 | Aircraft Fasteners International, LLC | Audax Group, Inc. | Components & Subsystems | – | – | – |

| Mar-17 | Sumitomo Precision Products Co., Ltd. (TSE:6355) | Sumitomo Corporation (TSE:8053) | Controls | 377.1 | 0.8x | 9.3x |

| Mar-17 | TP Aerospace Solutions Aps | CataCap Management Aps | Components & Subsystems | – | – | – |

| Feb-17 | H.R. Givon Ltd | WiPro Enterprises Limited | Components & Subsystems | – | – | – |

| Feb-17 | LMI Aerospace, Inc. | Sonaca SA | Aerostructures | 429.8 | 1.2x | 12.5x |

| Feb-17 | Brek Manufacturing Company | Aernnova Aerospace S.A. | Components & Subsystems | – | – | – |

| Feb-17 | Quatro Composites, LLC | AIM Aerospace, Inc. | Composites | – | – | – |

| Jan-17 | Zodiac Aerospace (ENXTPA:ZC) | Safran SA (ENXTPA:SAF) | Components & Subsystems | 9,228.6 | 1.6x | 34.0x |

| Jan-17 | Starport USA, Inc | Constant Aviation, LLC | MRO | – | – | – |

| Dec-16 | Universal Aerospace Co., Inc. | Strength Capital; Patriot Capital, L.P. | Machined Parts | – | – | – |

| Dec-16 | AD Industrie SAS | Stirling Square Capital Partners LLP | Components & Subsystems | – | – | – |

| Dec-16 | Ascent Aviation Services Corp. | Marana Aerospace Solutions, Inc. | MRO | – | – | – |

| Nov-16 | Gardner Group Limited | Chengdu Aerospace Superalloy Technology Co., Ltd. | Machined Parts | 405.6 | 2.2x | – |

| Nov-16 | Flanagan Industries Limited Partnership | EDAC Technologies Corporation | Components & Subsystems | – | – | – |

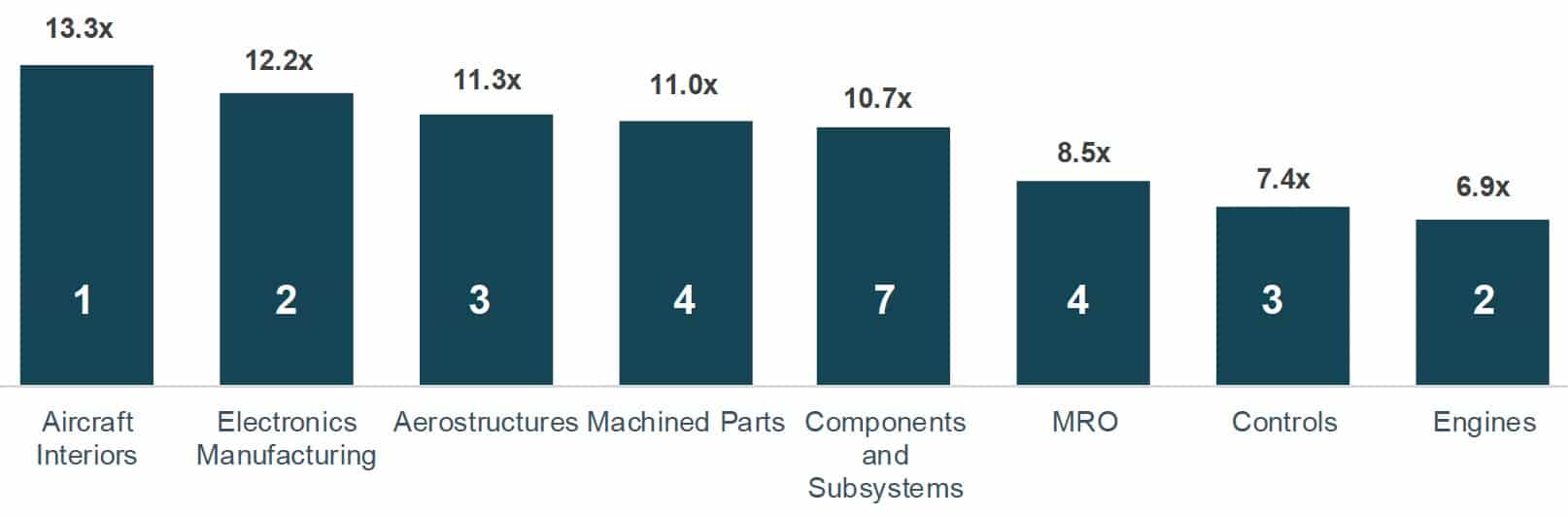

Transaction Multiple by Segment and Volume

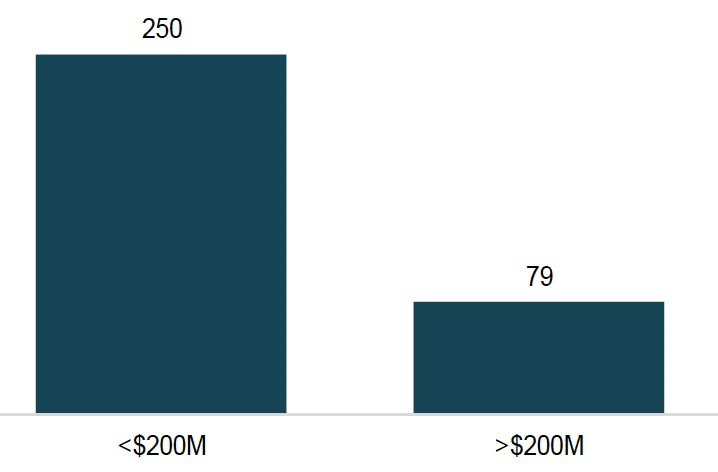

Transaction Volume by EV

Select Public Aerospace Companies

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Airbus SE (ENXTPA:AIR) | 66,054 | 67,599 | 77,883 | 1,844 | 0.9x | 36.7x | 2.4% | 56.0% |

| Bombardier Inc. (TSX:BBD.B) | 4,529 | 13,220 | 15,784 | 404 | 0.8x | 32.7x | 2.6% | 76.4% |

| Ducommun Incorporated (NYSE:DCO) | 340 | 502 | 552 | 52 | 0.9x | 9.7x | 9.4% | 90.3% |

| Embraer S.A. (BOVESPA:EMBR3) | 3,975 | 5,582 | 6,484 | 464 | 0.9x | 12.0x | 7.2% | 43.9% |

| Esterline Technologies Corporation (NYSE:ESL) | 2,555 | 3,068 | 2,014 | 312 | 1.5x | 9.8x | 15.5% | 47.0% |

| HEICO Corporation (NYSE:HEI) | 6,629 | 7,268 | 1,432 | 353 | 5.1x | 20.6x | 24.6% | 66.2% |

| Hexcel Corporation (NYSE:HXL) | 4,781 | 5,557 | 1,954 | 442 | 2.8x | 12.6x | 22.6% | 36.3% |

| Kaman Corporation (NYSE:KAMN) | 1,382 | 1,788 | 1,772 | 161 | 1.0x | 11.1x | 9.1% | 30.7% |

| MTU Aero Engines AG (XTRA:MTX) | 7,439 | 8,594 | 5,831 | 745 | 1.5x | 11.5x | 12.8% | 52.0% |

| Safran SA (ENXTPA:SAF) | 39,891 | 38,999 | 19,548 | 4,237 | 2.0x | 9.2x | 21.7% | 41.2% |

| Senior plc (LSE:SNR) | 1,474 | 1,708 | 1,256 | 143 | 1.4x | 11.9x | 11.4% | 73.4% |

| Spirit AeroSystems Holdings, Inc. (NYSE:SPR) | 8,305 | 8,696 | 6,802 | 739 | 1.3x | 11.8x | 10.9% | 74.8% |

| Textron Inc. (NYSE:TXT) | 13,005 | 16,071 | 13,773 | 1,492 | 1.2x | 10.8x | 10.8% | 36.9% |

| The Boeing Company (NYSE:BA) | 140,436 | 140,944 | 90,899 | 10,735 | 1.6x | 13.1x | 11.8% | 95.1% |

| TransDigm Group Incorporated (NYSE:TDG) | 14,554 | 24,711 | 3,470 | 1,621 | 7.1x | 15.2x | 46.7% | 44.8% |

| Triumph Group, Inc. (NYSE:TGI) | 1,340 | 2,584 | 3,421 | 401 | 0.8x | 6.4x | 11.7% | 77.1% |

| United Technologies Corporation (NYSE:UTX) | 94,255 | 113,655 | 58,108 | 10,145 | 2.0x | 11.2x | 17.5% | 27.8% |

| Zodiac Aerospace (ENXTPA:ZC) | 7,914 | 9,466 | 6,047 | 292 | 1.6x | 32.4x | 4.8% | 50.9% |

| Median | $7,034.00 | $8,645.00 | $5,939.00 | $453.00 | 1.4x | 11.8x | 11.6% | 51.5% |

| Mean | $23,270.00 | $26,112.00 | $17,613.00 | $1,921.00 | 1.9x | 15.5x | 14.1% | 56.7% |

Select Public Defense Companies

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| BAE Systems plc (LSE:BA.) | 24,481 | 26,696 | 23,831 | 2,464 | 1.1x | 10.8x | 10.3% | 32.2% |

| Elbit Systems Ltd. (TASE:ESLT) | 5,606 | 5,883 | 3,302 | 409 | 1.8x | 14.4x | 12.4% | 38.0% |

| Kratos Defense & Security Solutions, Inc. (NasdaqGS:KTOS) | 1,084 | 1,391 | 701 | 20 | 2.0x | 69.2x | 2.9% | 148.9% |

| L3 Technologies, Inc. (NYSE:LLL) | 14,193 | 17,221 | 10,895 | 1,322 | 1.6x | 13.0x | 12.1% | 29.0% |

| Lockheed Martin Corporation (NYSE:LMT) | 88,068 | 99,983 | 49,045 | 6,231 | 2.0x | 16.0x | 12.7% | 35.0% |

| Northrop Grumman Corporation (NYSE:NOC) | 47,019 | 52,717 | 25,194 | 3,802 | 2.1x | 13.9x | 15.1% | 32.9% |

| Raytheon Company (NYSE:RTN) | 51,688 | 54,507 | 24,519 | 3,708 | 2.2x | 14.7x | 15.1% | 36.2% |

| Rockwell Collins, Inc. (NYSE:COL) | 20,383 | 27,590 | 6,074 | 1,346 | 4.5x | 20.5x | 22.2% | 63.5% |

| Thales S.A. (ENXTPA:HO) | 23,674 | 21,293 | 17,887 | 1,913 | 1.2x | 11.1x | 10.7% | 30.5% |

| Median | $23,674.00 | $26,696.00 | $17,887.00 | $1,913.00 | 2.0x | 14.4x | 12.4% | 35.0% |

| Mean | $30,688.00 | $34,142.00 | $17,939.00 | $2,357.00 | 2.1x | 20.4x | 12.6% | 49.6% |

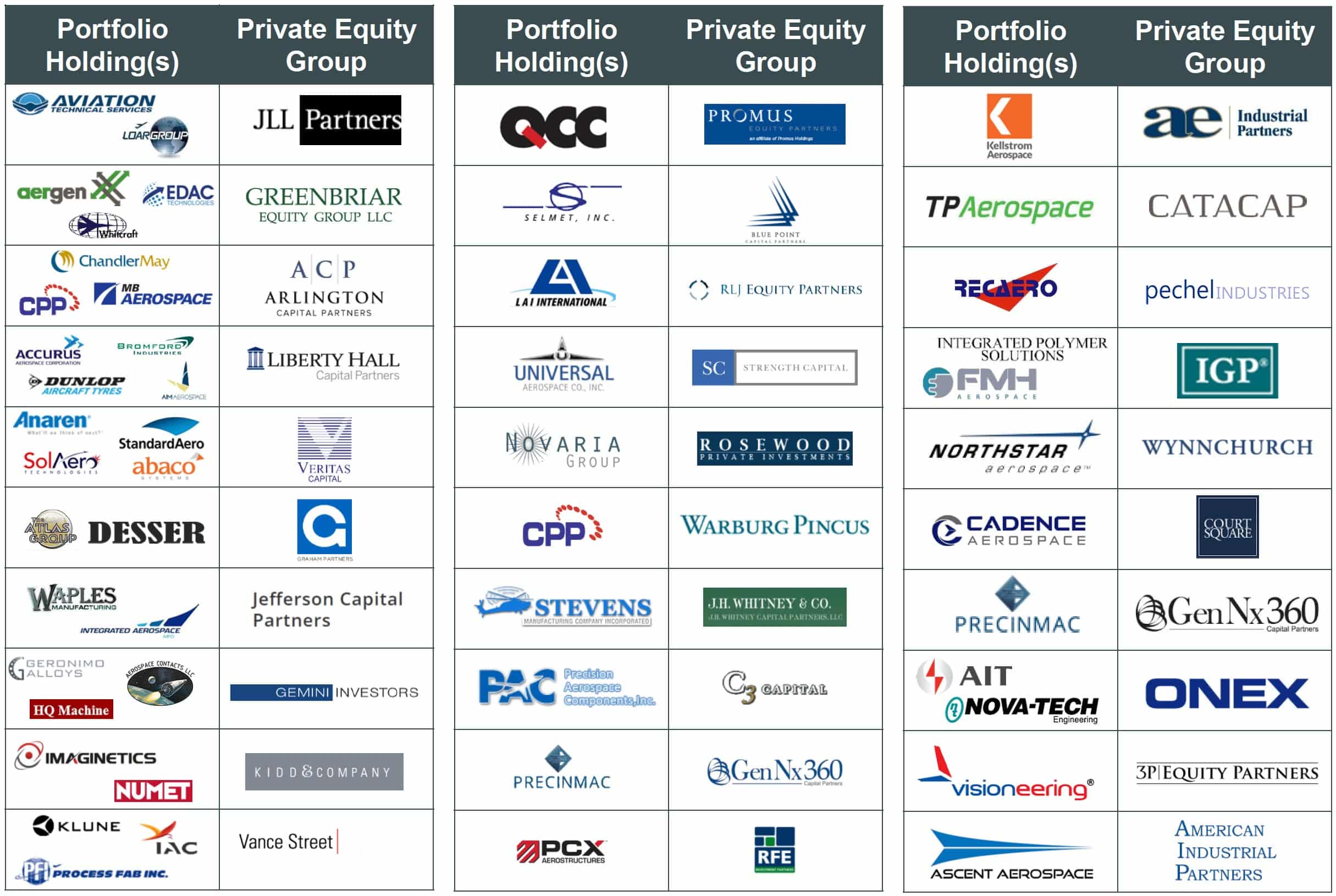

Selected Private Equity Investments in Sector