Aerospace & Defense M&A Update: Winter 2019

Published January 23, 2019

Key Trends in Aerospace & Defense

For over two decades Meridian Capital has served as a trusted advisor to leading middle market companies on areas such as complex corporate finance and M&A challenges. We have over $6B in transaction experience, which offers us deep industry insight and a holistic industry coverage. Our seasoned professionals focus on businesses with $20M to $400M+ in enterprise value. Meridian Capital’s Aerospace and Defense M&A Update focuses on activity within the aerospace aftermarket, the impact of trade tensions, and consolidation among tier I suppliers and defense contractors.

Exceptional Results Delivered

- Over 5 B in transaction experience

- Trusted advisor to leading middle market companies

- Focus on businesses with 20 M to 500 M+ in enterprise value

- 20 years experience with complex corporate finance and M&A challenges

- 22 seasoned professionals with finance, operational, and legal backgrounds

Deep Industry Insights

- Dedicated Industry Teams

- Holistic Industry Coverage

- Deep Buyer Relationships

Transaction Expertise

- M&A

- Growth Capital

- Strategic Advisory

Customized Processes

- High Touch Approach

- Multidisciplinary Deal Team

- End to end Service

Aerospace & Defense Expertise

- Aerospace Components

- Defense

- MRO Components and Services

- Automation and Tooling

- Avionics

- Composites

- Precision Machining and Assembly

- Sub-assemblies

Global M&A

Meridian Capital is a founding member of Global M&A Partners, a global partnership of independent, middle-market investment banking firms. Established in 1999, the partnership includes 34 investment banks with more than 200 M&A professionals transacting in over 50 countries. Combined the partnership has successfully completed over 1,500 transactions with combined value in excess of $50 billion over the past five years. Meridian is a leading member of the partnership’s Aerospace Coverage Team.

A&D Coverage Team Highlights

- Significant aerospace operational and transaction experience

- Global coverage across key geographic markets (50+ countries)

- Unmatched strategic relationships and investor access across aerospace industry

- Leading research and thought leadership

M&A Trends, Activity, and Public Comps

Twice a year, Meridian Capital publishes its Aerospace and Defense M&A Update, which focuses on key trends in the aerospace and defense M&A market. The Winter edition focuses on activity within the aerospace aftermarket, the impact of trade tensions, and consolidation among tier I suppliers and defense contractors.

Overall, 2018 is proving to be another strong year in aerospace and defense M&A activity. Total deal value reached $30.3 billion through Q3 of 2018, representing a 48 percent increase over the 10-year average for the same period. With 290 total transactions, deal volume also remained higher than the 10-year average.1

Continued Focus and Activity within the Aerospace Aftermarket

- The Maintenance, Repair, and Overhaul (“MRO”) market is projected to achieve consistent growth over the next 10 years, growing at a CAGR of 4.0%.2 Both Boeing and Airbus have announced strategic plans to make MRO products and services a key growth focus. Boeing has specifically set a $50 billion goal for aftermarket service revenue by 2028; a number that would triple its current revenue from the aftermarket.

- Strategic focus and investments by Boeing and Airbus are expected to drive significant consolidation and valuation premiums within the MRO segment over the next three to five-plus years.

- Private equity investors have taken notice of the attractiveness and growth within the MRO sector and are actively looking to gain exposure. In July, Vance Street Capital made a platform investment in Seattle-based Jet Parts Engineering, a manufacturer of PMA parts for the aftermarket. Veritas Capital is planning a sale of StandardAero Aviation, the worlds largest MRO provider, to The Carlyle Group that could fetch over$5 billion.3 Veritas is a prime example of a private equity investor that could secure a large return on an MRO investment. TAT Group also announced that it will divest a majority stake of MRO specialist, Sabena Technics, to a consortium of private equity firms. The acquisition is expected to be finalized in the second quarter of 2019, subject to regulatory approvals.

- As Boeing prepares for the 2025 launch of its new 797 family aircraft, it is positioning to change its business model with the new aircraft to provide more aftermarket services. The newest mid-range jet is expected to achieve the majority of its revenue from life-cycle management services.4

1) PwC

2) Oliver Wyman

3) Wall Street Journal

4) CAPA – Centre for Aviation

Forecasted Global Commercial MRO Industry Growth ($B)2

Industry M&A Trends

Growing Trade Tensions Impact on the Aerospace M&A Market

- With increasing tariffs on key materials, the already stressed aerospace supply chain is expected to feel increased pressures from rising cost inputs. Mylene Scholnick, the Senior Advisor at international consulting firm ICF, believes that aircraft manufacturers have not yet felt the impact of tariffs stating, “the aerospace industry consumed about $13 billion of raw materials in 2017; 9% being steel, 22% aluminum, and 30% titanium. The industry has not felt yet the change in policy but may in the upcoming months.”

- Tariffs on production inputs are expected to impact the supply chain at all levels starting with Boeing. To offset this pressure, CFRA analyst Jim Corridore predicts that Boeing will push for lower costs from its key suppliers, encouraging consolidation down the supply chain to help combat cost increases.

- Ongoing trade disputes between the U.S. and China have already directly impacted cross-border transactions which require Chinese regulatory approval. United Technologies’ $30 billion acquisition of Rockwell Collins took longer than expected due to issues receiving Chinese approval. Additionally in the United States, the CFIUS approval process has presented a hurdle for Chinese direct investment in U.S. aerospace among other industries.

Consolidation Continues Amongst Major Tier I Suppliers

- Aerospace M&A activity in 2018 has been highlighted by a number of megadeals, with multiple transactions in excess of $1 billion. Most recently, in October TransDigm Group announced intentions to acquire Bellevue-based Esterline Technologies for $4 billion. The acquisition expands TransDigm’s platform and fits well with its strategy of reducing supply chain pressures by acquiring companies that are sole suppliers of proprietary parts. Large acquisitions by tier I suppliers in 2018 are a continued trend from the prior year. In early 2017, Safran Group announced plans to acquire Zodiac Aerospace for $8.2 billion which completed in late 2018. Also announced in 2017 was United Technologies’ plan to acquire Rockwell Collins for $30 billion. The deal closed in late November, 2018 and gave United Technologies enough scale to split off its aerospace business as a standalone company.

- Looking forward, these large transactions are expected to drive consolidation further down the supply chain as suppliers aim to differentiate themselves in a highly competitive environment.

Boeing Holds Private Conference with Suppliers

- In October, Boeing hosted a supplier conference to discuss potential new contract terms for companies that want to bid on jet interior deals. The meeting’s intention was to streamline the bidding process to increase supply chain efficiencies for all future programs as well as encourage suppliers to accept new terms and conditions with price concessions.

- As Boeing continues to pressure suppliers for lower prices and increased build rates, proactive suppliers are making significant investments to train and expand their workforce and upgrade equipment to further optimize their cost structure. This pattern is driving numerous sub-$100 million revenue suppliers to pursue strategic acquisitions, partnerships, or outside investments to provide incremental capital, manufacturing capabilities, and capacity necessary to meet Boeing’s demand.

- Notable examples of suppliers making strategic acquisitions in response to supply chain pressures include Consolidated Precision Products’ acquisition of Oregon-based Selmet and Cadence Aerospace’s acquisition of Perfekta.

Source: Boeing, Airbus, Pitchbook, PwC, Thomson Reuters, Forbes, Press Releases, Puget Sound Business Journal

Defense Market Strength Drives Private Equity Interest

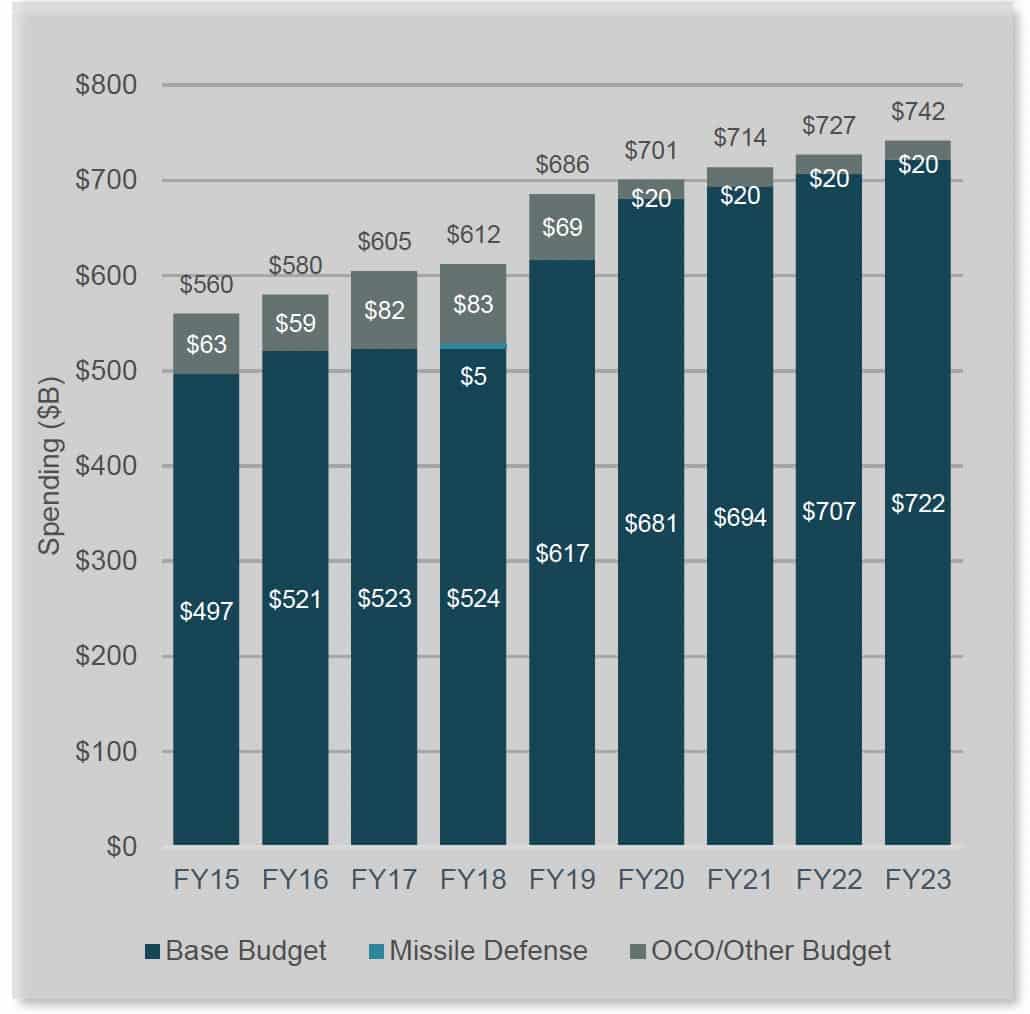

- In early 2018, the Trump administration released its second full defense budget request. The proposed budget for FY19 is $686 billion, representing a 12% YoY increase.

- The positive spending outlook for the defense industry combined with its historically low levels of cyclicality make it an attractive segment for private equity and strategic investors.

- With a decreasing in-theater presence, defense spending is being focused on cybersecurity, IT services, and C4ISR.

- The cybersecurity and engineered services and products subsectors attracted strong private equity interest in 2018. Notable deals included Arlington Capital Partners’ acquisition of Dependable Global Solutions as well as Veritas Capital’s portfolio company, Alion Science & Technology, announcing intentions to acquire MacAulay-Brown. The engineered services and products subsector saw investments from AE Industrial Partners with its purchase of Gryphon Technologies as well as Argosy Private Equity with its acquisition of Capewell Aerial Systems.

- Private equity firms have been expanding their defense industry coverage to better position themselves within the sector. In 2018, private equity firms Gemspring Capital and Liberty Hall Capital Partners both appointed four-star generals as advisors to further strengthen their defense expertise.

U.S. Department of Defense Budget

Consolidation Among Large Defense Contractors Focused on Technology

- As a key part of its strategy to improve defense capabilities, the U.S. military has put considerable emphasis on investment in defense technology. The latest defense budget indicated a 24% increase in Research, Development, Test, and Evaluation (“RDT&E”) spend between FY17 and FY19.

- With the Department of Defense outlining its highest priorities relating to technological advancements, major defense contractors are looking to enhance technological capabilities through acquisition, driving consolidation within the industry. In October the merger between Harris and L3 Technologies was announced, creating the seventh largest defense contractor in the world. As two of the industry’s largest R&D spenders, the new entity is expected to emphasize the development of high-tech products. Other notable defense technology acquisitions include Northrop Grumman’s $7.8 billion acquisition of Orbital ATK in September along with General Dynamics’ $9.7 billion acquisition of CSRA.

Source: Pitchbook, Press Releases, Department of Defense FY 2019 Budget Proposal, Davis Wright Tremaine

Select Transaction Case Studies

Target Description: Leading provider of highly engineered, proprietary components and subsystems for the aerospace and defense industries.

Investment Rationale: Firstmark will be a part of Ontic, BBA’s Aftermarket Services business. The acquisition will provide access to a range of growth opportunities across various established strategic platforms.

Buyer Quote: “This acquisition fully supports the strategic growth of Ontic by expanding the portfolio of proprietary products on established civil and military aircraft platforms and by adding footprint on the U.S. East Coast.” – Mark Johnstone, CEO of BBA

Target Description: Leading manufacturer of small and medium size titanium castings for the aerospace sector.

Investment Rationale: With the acquisition of Selmet, CPP will expand its offering to include titanium castings.

Buyer Quote: “We have long admired Selmet’s world-class technical capabilities, longstanding customer relationships, strong management team, and track record of growth.” – James Stewart, CEO of CPP

Target Description: Producer of high-precision mechanical parts made from hard metals such as titanium, stainless steel, and inconel.

Investment Rationale: By joining the Mecadaq Group, Hirschler Manufacturing brings its customer portfolio, a recognized know-how in producing critical, complex parts, and high quality service.

Buyer Quote: “It is quite an accomplishment for our company with the opportunity to accelerate our growth in North America and also to work directly with ‘The Boeing Company’ as a tier 1 supplier of detail parts.” –Julien Dubecq, President of Mecadaq Group

Target Description: Leading designer of proprietary OEM-alternative parts and repair services for the commercial aerospace industry.

Investment Rationale: The recapitalization is Vance Street’s fifth platform investment in their latest fund. They will leverage their expertise in aerospace and highly-engineered components.

Buyer Quote: “The JPE transaction embodies all of the key characteristics our firm looks for in a deal – the opportunity to partner with a world-class management team, a business with a strong position in a growing market, and a business model that is 100% proprietary and aftermarket.” – Richard Crowell, Managing Partner at Vance Street

Notable Recent Transactions – Aerospace

| Date | Target | Buyer | Segment | EV ($M) | EV / Revenue | EV /EBITDA |

|---|---|---|---|---|---|---|

| Announced | Sabena Technics | Bpifrance; TowerBrook; Sagard | MRO | – | – | – |

| Nov-18 | Magellan Distribution (A&D Division) | Electronic Connector Company | MRO | – | – | – |

| Nov-18 | Silver Wings Aerosapce | Wencor Group | MRO | – | – | – |

| Nov-18 | Bombardier Inc. (Dash 8 Program) | Longview Aviation | Aircraft | $300.00 | – | – |

| Nov-18 | Voyager Jet Center | Lynx FBO Network | MRO | – | – | – |

| Oct-18 | Aries Alliance | Astorg Partners | Machined Parts | – | – | – |

| Oct-18 | Carmel Forge | Bet Shemesh Engines | Components and Subsystems | – | – | – |

| Oct-18 | PenAir | Ravn Alaska | Airline | $12.30 | – | – |

| Oct-18 | Aspect Aircraft Maintenance | Textron Aviation | MRO | – | – | – |

| Oct-18 | PDQ Airspares | Aircraft Fasteners International | MRO | – | – | – |

| Oct-18 | KLX Aerospace Solutions | Boeing | Components and Subsystems | $3,922.30 | 2.0x | 12.6x |

| Oct-18 | Esterline Technologies | TransDigm Group | Avionics and Controls | $3,649.00 | 1.8x | 12.6x |

| Oct-18 | The Atlas Group | Forming and Machining Industries | Components and Subsystems | – | – | – |

| Oct-18 | Compania Espanola de Sistemas Aeronauticos | Heroux-Devtek | Components and Subsystems | $206.10 | – | – |

| Sep-18 | Firstmark | BBA Aviation | Components and Subsystems | $97.00 | 3.6x | – |

| Sep-18 | AOG Aviation Spares | Desser Tire & Rubber | MRO | – | – | – |

| Sep-18 | GE (Aircraft Component Unit) | ST Engineering | Components and Subsystems | $630.00 | – | – |

| Sep-18 | Triumph Processing | Valence Surface Technologies | MRO | – | – | – |

| Aug-18 | Future Tech Metals | Avem Partners | Machined Parts | – | – | – |

| Aug-18 | Selmet | Consolidated Precision Products | Machined Parts | – | – | – |

| Jul-18 | Precision Aviation Group | GenNx360 | MRO | – | – | – |

| Jul-18 | Jet Parts Engineering | Vance Street Capital | MRO | – | – | – |

| Jul-18 | Northern Aerospace | Gardner Group | Machined Parts | $77.10 | – | – |

| Jul-18 | Berry Aviation | Acorn Growth Companies | MRO | – | – | – |

| Jul-18 | Perfekta | Cadence Aerospace | Machined Parts | – | – | – |

| Jul-18 | CAD Enterprises | Hickok | Machined Parts | $21.00 | 0.7x | – |

| Jun-18 | L-3 Communications Vertex Aerospace | American Industrial Partners | MRO | $540.00 | – | – |

| May-18 | Hirschler Manufacturing | Mecadaq Group | Components and Subsystems | – | – | – |

| May-18 | Worthington Aviation Parts | Air T | Components and Subsystems | $3.50 | – | – |

| Apr-18 | Blair-HSM | Magaghi Aeronautica | Machined Parts | – | – | – |

| Apr-18 | Universal Avionics Systems | Elbit Systems | Avionics and Controls | $120.00 | – | – |

| Apr-18 | AeroCision | Bromford Industries | Components and Subsystems | – | – | – |

| Mar-18 | Blast Deflectors | Hanover Partners | Ground Support Equipment | – | – | – |

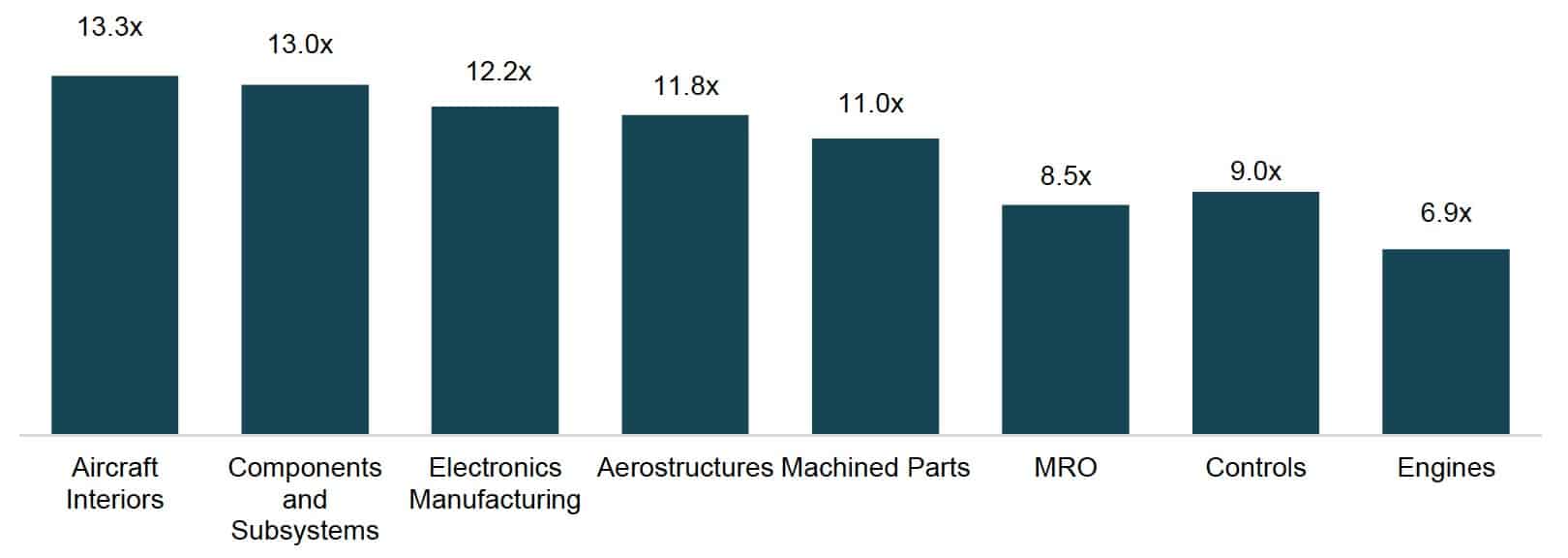

Transaction Multiple by Segment*

*Transactions completed since 2010 with an EV/EBITDA multiple reported

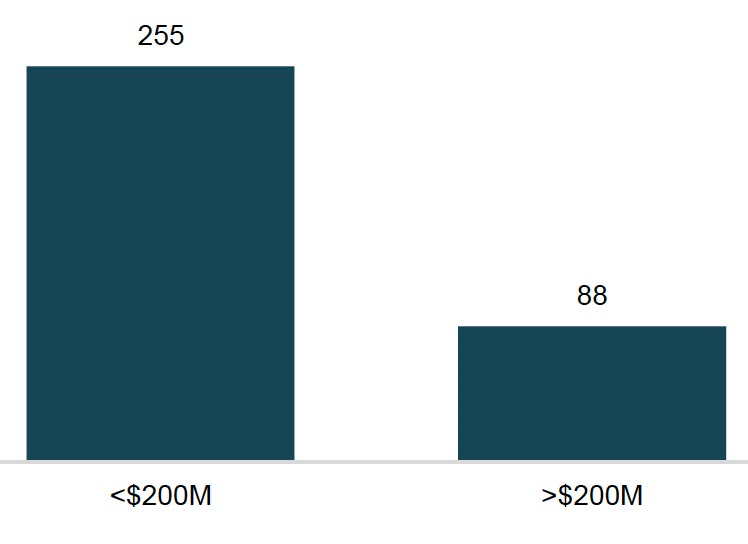

Transaction Volume by EV*

Source: Pitchbook

Notable Recent Transactions – Defense

| Date | Target | Buyer | Segment | EV ($M) | EV / Revenue | EV / EBITDA |

|---|---|---|---|---|---|---|

| Dec-18 | Navistar Defense | Cerberus Capital Management | Vehicles | – | – | – |

| Nov-18 | Israel Military Industries | Elbit Systems | Weapons | $522.0 | – | – |

| Oct-18 | L3 Technologies; Harris | Merger of Equals (L3 Harris Technologies) | Defense Technology | – | – | – |

| Sep-18 | STAPP | Pamica | Military Training Equipment | – | – | – |

| Sep-18 | Gryphon Technologies | AE Industrial Partners | Engineering Services | – | – | – |

| Sep-18 | Capewell Aerial Systems | Argosy Private Equity | Aerial Delivery Products | – | – | – |

| Sep-18 | Axon Enterprise | Ladenburg Thalmann Financial Services | Electronic Devices | – | – | – |

| Aug-18 | Ausley Associates | MAG Aerospace, New Mountain Capital | Security Services | – | – | – |

| Aug-18 | MacAulay-Brown | Alion Science & Technology, Veritas Capital | Engineering and Cybersecurity | – | – | – |

| Aug-18 | General Dynamics (Systems Engineering and Acquisition Support Services Business Unit) | CACI International | Systems Engineering | $84.0 | – | – |

| Jul-18 | Dependable Global Solutions | Arlington Capital Partners | Cybersecurity | – | – | – |

| Jul-18 | Effectiva | BMT Group | Engineering Services | – | – | – |

| Jul-18 | Aitech Rugged Group | FIMI Opportunity Funds | Computing Technologies | $30.0 | 0.9x | 7.5x |

| Jun-18 | WeWi Applied Research | Utopya Innovations | Research and Development | – | – | – |

| Jun-18 | Orbital ATK | Northrop Grumman | Aircraft Technology | $7,800.0 | 1.8x | 13.0x |

| May-18 | Cubic Global Defense Services | Valiant Integrated Services | Training | $138.0 | – | – |

| May-18 | LinQuest | CoVant, Madison Dearborn Partners | Technology Services | – | – | – |

| May-18 | Enertec Systems | Coolisys Technologies | Electronic Systems | $9.1 | 1.1x | – |

| Apr-18 | CSRA | General Dynamics | Technology Services | $9,700.0 | 1.9x | 12.6x |

Select Public Companies – Aerospace

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| The Boeing Company (NYSE:BA) | 200,242 | 202,208 | 96,943 | 12,955 | 2.1x | 15.6x | 13.4% | 5.0% |

| United Technologies Corporation (NYSE:UTX) | 95,326 | 123,739 | 64,137 | 11,489 | 1.9x | 10.8x | 17.9% | (19.5%) |

| Airbus SE (ENXTPA:AIR) | 80,312 | 82,830 | 82,301 | 9,214 | 1.0x | 9.0x | 11.2% | (7.3%) |

| Safran SA (ENXTPA:SAF) | 52,055 | 57,046 | 21,854 | 4,492 | 2.6x | 12.7x | 20.6% | 10.8% |

| TransDigm Group Incorporated (NYSE:TDG) | 18,456 | 29,260 | 3,538 | 1,778 | 7.7x | 16.5x | 50.3% | 19.5% |

| Textron Inc. (NYSE:TXT) | 11,643 | 14,216 | 14,239 | 1,935 | 1.0x | 7.3x | 13.6% | (20.2%) |

| MTU Aero Engines AG (XTRA:MTX) | 10,011 | 10,763 | 6,212 | 928 | 1.7x | 11.6x | 14.9% | 7.2% |

| HEICO Corporation (NYSE:HEI) | 9,305 | 10,014 | 1,778 | 453 | 5.6x | 22.1x | 25.5% | 26.7% |

| Spirit AeroSystems Holdings, Inc. (NYSE:SPR) | 8,237 | 9,449 | 7,101 | 1,044 | 1.3x | 9.0x | 14.7% | (19.6%) |

| Hexcel Corporation (NYSE:HXL) | 5,199 | 6,142 | 2,140 | 488 | 2.9x | 12.6x | 22.8% | (6.0%) |

| Kaman Corporation (NYSE:KAMN) | 1,607 | 1,885 | 1,848 | 101 | 1.0x | 18.6x | 5.5% | (5.3%) |

| Senior plc (LSE:SNR) | 1,141 | 1,336 | 1,395 | 169 | 1.0x | 7.9x | 12.1% | (32.5%) |

| Triumph Group, Inc. (NYSE:TGI) | 685 | 2,280 | 3,360 | (273) | 0.7x | NM | (8.1%) | (53.1%) |

| Ducommun Incorporated (NYSE:DCO) | 425 | 651 | 607 | 39 | 1.1x | 16.6x | 6.4% | 25.2% |

| Median | 9,658 | 10,388 | 4,875 | 986 | 1.5x | 12.6x | 14.1% | (5.7%) |

| Mean | 35,332 | 39,416 | 21,961 | 3,201 | 2.3x | 13.1x | 15.8% | (4.9%) |

Select Public Companies – Defense

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Lockheed Martin Corporation (NYSE:LMT) | 78,928 | 92,816 | 54,283 | 7,793 | 1.7x | 11.9x | 14.4% | -17.4% |

| General Dynamics (NYSE:GD) | 48,104 | 60,175 | 34,092 | 4,889 | 1.8x | 12.3x | 14.3% | -22.2% |

| Raytheon Company (NYSE:RTN) | 45,413 | 48,393 | 26,481 | 3,778 | 1.8x | 12.8x | 14.3% | -19.4% |

| Northrop Grumman Corporation (NYSE:NOC) | 44,735 | 57,396 | 28,290 | 4,866 | 2.0x | 11.8x | 17.2% | -18.8% |

| Thales S.A. (ENXTPA:HO) | 25,442 | 23,011 | 19,238 | 2,208 | 1.2x | 10.4x | 11.5% | 8.3% |

| BAE Systems plc (LSE:BA.) | 20,097 | 22,846 | 23,642 | 2,006 | 1.0x | 11.4x | 8.5% | -22.0% |

| L3 Technologies, Inc. (NYSE:LLL) | 13,630 | 16,550 | 9,573 | 1,245 | 1.7x | 13.3x | 13.0% | -16.2% |

| Elbit Systems Ltd. (TASE:ESLT) | 5,279 | 5,828 | 3,615 | 428 | 1.6x | 13.6x | 11.8% | -13.2% |

| Kratos Defense & Security Solutions, Inc. (NasdaqGS:KTO) | 1,498 | 1,605 | 769 | 14 | 2.1x | NM | 1.9% | 30.5% |

| Median | $25,442.00 | $23,011.00 | $23,642.00 | $2,208.00 | 1.7x | 12.1x | 13.0% | -17.4% |

| Mean | $31,458.00 | $36,513.00 | $22,220.00 | $3,025.00 | 1.7x | 12.2x | 11.9% | -10.0% |