Aerospace, Defense & Space M&A Trends: Spring 2022

Published March 1, 2022

KEY INSIGHTS

- Aerospace & Defense M&A recovery expected to continue in 2022

- Space attracts significant investments

- Attractive investment dynamics for PMA manufacturers

- PNAA Conference key takeaways

- Aerospace, Defense, & Space M&A activity

Market Insights

Aerospace & Defense M&A Recovery Expected to Continue in 2022

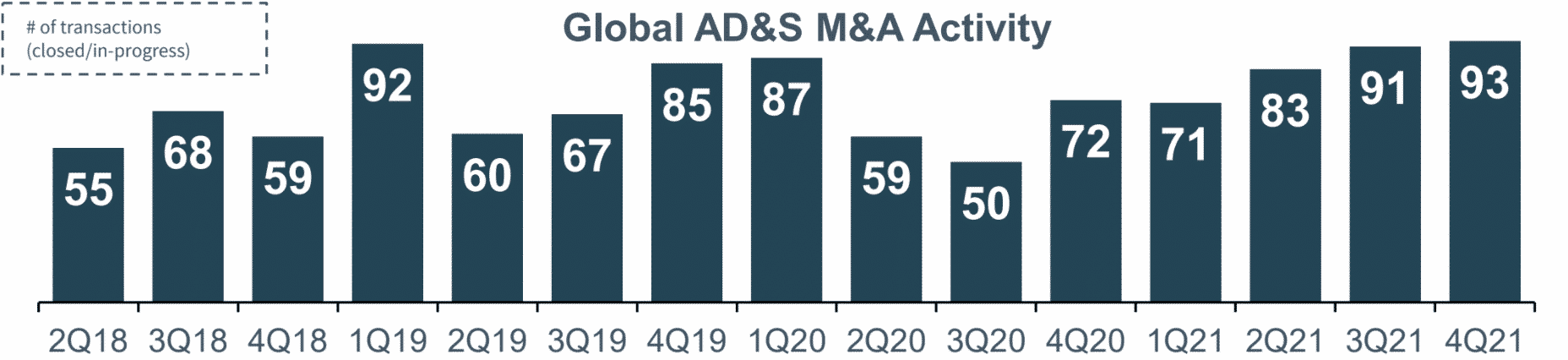

- The aerospace & defense sector experienced an uptick in M&A activity in Q4 of 2021, with 93 transactions completed, the highest volume quarter of 2021. Overall, aerospace & defense M&A deal volume increased over 26% from 2020 to 2021.

- Aerospace OEMs are providing suppliers guidance of increased production forecasts as commercial air travel continues to recover towards pre-pandemic levels, increasing the likelihood of supply chain acquisition activity in 2022. Buyer activity in the sector is expected to continue to be led by financial sponsors and financially stable strategics looking to best position themselves with greater levels of content on rate-increasing platforms.

- Deal activity is expected to focus on emerging technologies, new capabilities, growth, and access to new geographic markets. A recent example of this trend is Collins Aerospace’s acquisition of Dutch Thermoplastic Components (“DTC”), a leader in the development and fabrication of light-weight aircraft components, to further Collins’ commitment of weight reduction and sustainability in its products. The trend of international strategics looking to gain access to the Boeing supply chain through acquisition in the U.S. is expected to drive cross-border deal activity, Meridian’s ADS team is in discussions with several strategics looking to execute on this strategy.

- With almost a 40% YoY uptick in 2021 defense M&A volume, deal momentum is expected to continue through 2022 and beyond, driven by Biden’s 2022 Defense Budget and an increase in global defense spending, among other factors.

Space Attracts Significant Investments

- 2021 saw strong strategic and financial investor interest across the commercial space segment with launch systems, satellites, electronics, and analytics among the most active sub-segments. The global satellite manufacturing and launch market is projected to reach $390B by 2027, representing a 2021-2027 CAGR of 3.7%. While the space launch services market is projected to reach $32B by 2027, representing a 2020-2027 CAGR of 15.7%.2

- The Space Force received its first dedicated budget in 2021 and had a 2022 budget request of $17.4B, including procurement of new equipment, RDT, and launch services, providing new contract opportunities for companies operating in the segment.

- Existing aerospace and defense suppliers that can leverage their manufacturing expertise and sophisticated quality management systems are able to further diversify their revenue into the space supply chain through new contract opportunities, new OEM relationships, including Space-X and Blue Origin, as well as a universe of Tier 1 and Tier 2 suppliers to the OEMs.

- Large A&D strategics have been actively acquiring to gain proprietary technology and a foothold in the space sector. Examples include Lockheed Martin’s acquisition of Aerojet, Raytheon Technologies’ acquisitions of Blue Canyon and Seakr Engineering, and BAE Systems’ acquisition of In-Space Systems.

- Financial investors have been investing heavily into emerging companies and technologies with $46.4B invested into a total of 429 companies in 2021. In comparison, 2020 saw $30.1B invested in 414 companies.1

- The Space sector has also been a very active segment for SPAC transactions with over 10 SPACs announced in the past 10 months. Following the initial SPAC transaction, many companies will look to pursue aggressive add-on strategies to accelerate growth in order to achieve projections and support the strong valuations at which they transacted. Most notably, in recent months Rocket Lab has completed three add-on acquisitions since its SPAC in August 2021.

1) Space Capital. 2) Valuates Reports, Allied Market Research. Sources: Pitchbook, company press releases, company websites & Meridian research

Attractive Investment Dynamics for PMA Manufacturers

- Parts manufacturer approval (“PMA”) is a design and production approval from the FAA for modification and replacement aircraft parts. Parts are functionally equivalent to the OEM’s but designs are allowed to have minor changes or improvements from the OEM design. PMA manufacturers design, develop, and certify parts in-house.

- Given recurring aftermarket sales exposure, company-owned intellectual property, and extensive in-house engineering capabilities, PMA part manufacturers are receiving strong investor interest from PE and strategics.

- Fragmentation in the PMA sector has led to recent consolidation, with the most notable transactions being Vance Street Capital’s roll-up of AeroSpares and Aero Parts Mart through their platform, Jet Parts Engineering.

- These dynamics make the sector prime for consolidation and investment as strategics look to expand their portfolio of PMA parts through acquisition, while financial investors will look to benefit from the attractive revenue dynamics and protected market positions from IP.

Conference Key Takeaways

The Pacific Northwest Aerospace Alliance (“PNAA”) hosted its 21st annual conference in February, bringing together hundreds of influential aerospace companies and industry analysts. The conference facilitated great discussions around industry outlook, impacts on the supply chain, and potential impacts on the M&A environment.

There were several key takeaways from the conference:

- Domestic air travel is expected to recover to pre-covid levels in 2022 but international travel may take until 2023/2024.

- Single-aisle aircraft demand is expected to recover more quickly reaching pre-pandemic levels by the end of 2022. Twin-aisle demand is not expected to recover until beyond 2030.

- The air cargo market has experienced rapid growth through the pandemic due to the rise in online shopping. Freighter conversions are expected to accelerate to keep up with demand for aircraft.

- OEM production rates may not reach pre-COVID levels until the middle of the decade. Human capital and working capital availability will be critical for suppliers in order to achieve the forecasted ramp in build rates.

- 2019 Supply chain challenges including availability of raw materials, forgings, castings, and finish processing may resurface as build rates rise.

- Defense market has remained a bright spot for the industry. The DoDs improved payment terms helped keep many suppliers afloat and defense research and development investments are at all-time highs.

- The M&A environment is expected to remain active as defense strategics are well capitalized, commercial investors will be looking to benefit from increasing build-rates, and increasing working capital needs and supply chain challenges may influence smaller suppliers to consider transacting.

Sources: Pitchbook, company press releases, company websites & Meridian research

Aerospace, Defense & Space M&A Activity

M&A Activity and Market Trends

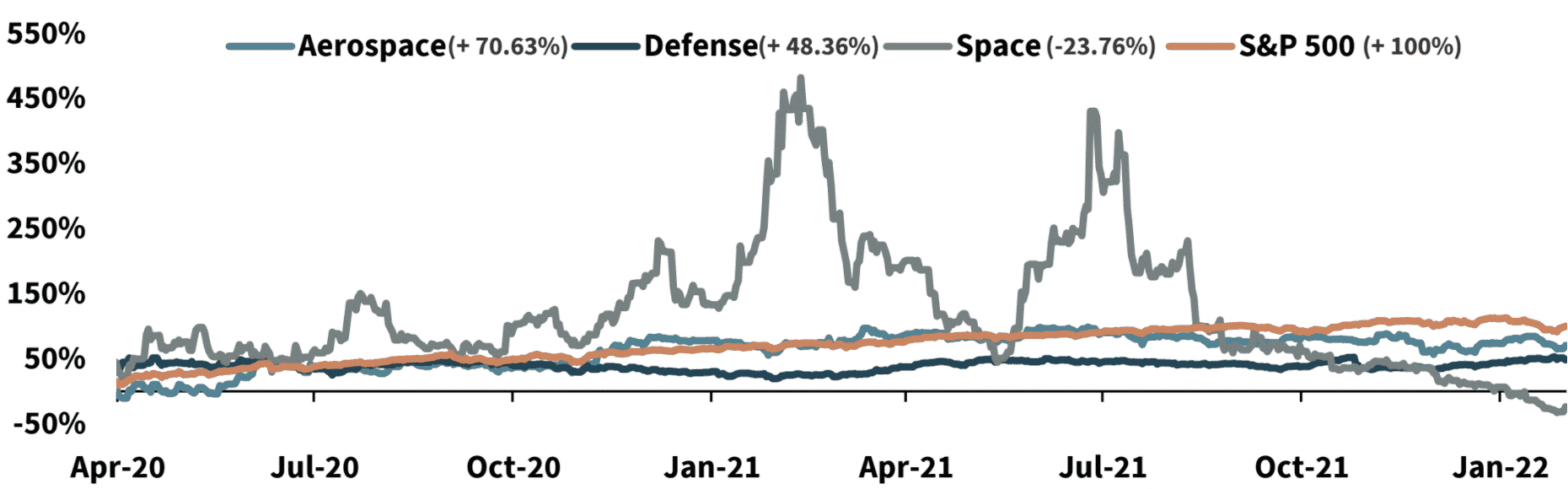

Sector Index Performance3

Recent Transaction Spotlights

Description: SK AeroSafety Group has acquired Fire-Tec Aero Systems, provider of MRO solutions to the aviation safety equipment industry.

Rationale: The acquisition of Fire-Tec builds on SK’s growing reach in the U.S. The combination will enhance SK’s customer offering and solidify its global market position.

Description: Rocket Lab has acquired SolAero, a supplier of space solar power products and precision aerospace structures.

Rationale: The acquisition gives Rocket Lab in-house access to a key supplier and further strengthens its vertically integrated business model.

Description: Mecachrome has acquired WeAre Group, a manufacturer of small and medium-sized mechanical parts.

Rationale: The merger will create a leading French multi-technology group in the aeronautics, space, defense, and automotive sectors.

3) Individual components of Aerospace and Defense Indices can be found on page 5. Indices weighted by Market Capitalization. Sources: Pitchbook, Meridian research & company press releases

Publicly-Traded Aerospace, Defense, and Space Companies

Aerospace Companies

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Boeing Co. | $115,685 | $157,964 | $62,286 | $3,907 | 2.5x | 40.4x | 6.3% | (6)% |

| Airbus S.A.S. | $96,756 | $92,442 | $65,610 | $9,309 | 1.4x | 9.9x | 14.2% | 6% |

| Safran SA | $52,149 | $55,976 | $17,283 | $3,160 | 3.2x | 17.7x | 18.3% | (11)% |

| TransDigm Group, Inc. | $36,005 | $51,013 | $4,885 | $2,279 | 10.4x | 22.4x | 46.7% | 13% |

| HEICO Corporation | $17,119 | $17,524 | $1,866 | $496 | 9.4x | 35.3x | 26.6% | 12% |

| Textron Inc. | $15,059 | $16,709 | $12,382 | $1,426 | 1.3x | 11.7x | 11.5% | 38% |

| MTU Aero Engines AG | $11,714 | $12,453 | $4,687 | $589 | 2.7x | 21.1x | 12.6% | (8)% |

| Spirit AeroSystems Inc. | $5,194 | $7,595 | $3,953 | ($14) | 1.9x | NA | NA | 15% |

| Hexcel Corporation | $4,571 | $5,266 | $1,325 | $217 | 4.0x | 24.2x | 16.4% | 1% |

| Triumph Group, Inc. | $1,517 | $2,899 | $1,540 | $200 | 1.9x | 14.5x | 13.0% | 61% |

| Kaman Corporation | $1,170 | $1,249 | $719 | $89 | 1.7x | 14.0x | 12.4% | (14)% |

| Ducommun, Inc. | $581 | $888 | $638 | $91 | 1.4x | 9.7x | 14.3% | (11)% |

| Median | $14,581 | $4,320 | $543 | 2.2x | 17.7x | 14.2% | 3% | |

| Mean | $35,165 | $14,765 | $1,813 | 3.5x | 20.1x | 17.5% | 8% |

Defense Companies

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Raytheon Technologies Corporation | $140,652 | $167,593 | $64,388 | $11,901 | 2.6x | 14.1x | 18.5% | 31% |

| Lockheed Martin Corporation | $107,762 | $115,834 | $67,044 | $9,710 | 1.7x | 11.9x | 14.5% | 20% |

| Northrop Grumman Corporation | $61,737 | $72,580 | $35,667 | $8,847 | 2.0x | 8.2x | 24.8% | 36% |

| General Dynamics Corporation | $60,685 | $72,257 | $38,469 | $5,313 | 1.9x | 13.6x | 13.8% | 34% |

| L3 Harris Technologies, Inc. | $44,832 | $51,830 | $18,124 | $3,939 | 2.9x | 13.2x | 21.7% | 26% |

| BAE Systems Plc | $25,695 | $30,388 | $26,133 | $3,827 | 1.2x | 7.9x | 14.6% | 26% |

| Thales SA | $21,271 | $24,489 | $21,053 | $2,442 | 1.2x | 10.0x | 11.6% | 5% |

| Leidos, Inc. | $13,415 | $18,406 | $13,737 | $1,510 | 1.3x | 12.2x | 11.0% | 8% |

| Huntington Ingalls Industries, Inc. | $7,677 | $10,542 | $9,524 | $1,018 | 1.1x | 10.4x | 10.7% | 9% |

| Elbit Systems Ltd. | $7,638 | $9,003 | $5,162 | $536 | 1.7x | 16.8x | 10.4% | 31% |

| Oshkosh Corporation | $7,009 | $6,832 | $7,953 | $517 | 0.9x | 13.2x | 6.5% | (1)% |

| Moog Inc. | $2,523 | $3,193 | $2,892 | $333 | 1.1x | 9.6x | 11.5% | 2% |

| Kratos Defense & Security Solutions Inc | $2,282 | $2,288 | $812 | $83 | 2.8x | 27.6x | 10.2% | (33)% |

| Median | $24,489 | $18,124 | $2,442 | 1.7x | 12.2x | 11.6% | 20% | |

| Mean | $45,018 | $23,920 | $3,844 | 1.7x | 13.0x | 13.8% | 15% |

Space Companies

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Rocket Lab USA, Inc. | $4,460 | $3,792 | $51 | NM | NM | NM | NM | (5)% |

| Virgin Galactic Holdings, Inc. | $2,323 | $1,720 | $9 | NM | NM | NM | NM | (76)% |

| Astra Space, Inc. | $873 | $504 | $29 | NM | NM | NM | NM | (74)% |

| AST SpaceMobile, LLC | $352 | $260 | $103 | NM | 2.5x | NM | NM | (37)% |

| Maryland Aerospace, Inc. | $312 | $312 | $51 | NM | 6.2x | NM | NM | (57)% |

| Redwire Aerospace | $306 | $105 | $36 | NM | 3.0x | NM | NM | (77)% |

| BlackSky Global LLC | $301 | $184 | $3 | NM | NM | NM | NM | (76)% |

| Median | $312 | $36 | NM | 3.0x | NM | NM | (74)% | |

| Mean | $982 | $40 | NM | 3.9x | NM | NM | (58)% |

Sources: Pitchbook

Notable Transactions: Aerospace

| Announced Date | Acquirer/Investor | Target | Target Description |

|---|---|---|---|

| Feb-22 | CGI Automated Manufacturing, CORE Industrial Partners | Richlind Metal Fabricators | Provider of precision sheet metal fabrication and machining services specializing in complex, tight tolerance parts and assemblies. |

| Feb-22 | Daher | Triumph Group (Stuart Aero Structures Business) | Manufacturer of aero-structures intended to specialize in assembly of large, complex metallic structures. |

| Jan-22 | Dorilton Capital, Versa Integrity Group | Avion Commercial | Provider of unmanned aircraft systems in Huntsville, Alabama. |

| Jan-22 | Levine Leichtman Capital Partners | Fire-TEC Aero Systems | Provider of maintenance, repair and overhaul (MRO) solutions to the aviation safety equipment industry. |

| Jan-22 | INDIE | Totalshield | Manufacturer of transparent blast shielding products used by industrial and aerospace customers to keep their employees safe. |

| Jan-22 | Curtiss-Wright | Safran Aerosystems Arresting | Designer and manufacturer of aircraft emergency arresting systems intended to optimize aircraft performance and flight safety. |

| Jan-22 | Cutter Aviation | GTU Jet FBO | Operator of hangers and provider of FBO services based in Georgetown, Texas. |

| Jan-22 | Prototek Rapid Prototyping | Sac EDM & Waterjet | Provider of cutting and machining services intended for aerospace, medical, architectural, semiconductor, energy and commercial industries. |

| Jan-22 | Titus Group | Precision Plastics | Manufacturer of engineered molded components intended for a variety of industries. |

| Jan-22 | Ridgewood Infrastructure | APP Jet Center | Operator of a fixed-base operator intended to provide essential aviation infrastructure. |

| Jan-22 | Plansee | Mi-Tech Tungsten Metals | Manufacturer of precision tungsten alloys and tungsten composites intended to serve the aerospace, defense, medical, oil and gas and machining industries. |

| Jan-22 | Jackson Jet Center | Swift Aviation Group | Provider of aviation services based in Phoenix, Arizona. |

| Jan-22 | Cargo Repair | Aviation Inflatables | Manufacturer and supplier of repair, overhaul and maintenance of emergency evacuation devices for the aviation industry. |

| Jan-22 | FlightSafety International | Frasca International | Manufacturer of flight stimulators intended to improve aviation safety. |

| Jan-22 | Elevate Holdings | Keystone Aviation | Provider of aircraft management services based in Salt Lake City, Utah. |

| Jan-22 | StandardAero | PTS Aviation | Supplier of aviation equipment to domestic and international companies. |

| Jan-22 | Cutter Aviation | AeroJet FBO | Provider of fixed-base operator services based in Georgetown, Texas. |

| Dec-21 | ADB SAFEGATE | DBT Transportation Services | Provider of transportation technology and services intended for the aviation industry. |

| Dec-21 | Motion Industries | Kaman Distribution Group | Distributor of highly engineered products and provider of related services across the United States and Puerto Rico. |

| Dec-21 | Yellowstone Acquisition | Sky Harbour | Operator of private airplane hangars based in White Plains, United States. |

| Dec-21 | Transcat | Tangent Labs | Provider of instrument calibration services based in Indianapolis, Indiana. |

| Dec-21 | Aircraft Fasteners International | Calco Aerospace | Distributor of fasteners and hardware for the aerospace and defense industry. |

| Dec-21 | VBG Group | The Carlyle Johnson Machine Company | Manufacturer of motion control components and products for medical, aerospace, industrial and defense industry. |

| Dec-21 | New State Capital Partners | AVEX US | Provider of sales and maintenance service for the Daher TBM turboprop aircraft in North America. |

| Dec-21 | Steribite | Precision Manufacturing Group | Provider of contract manufacturing services intended to serve clients in the medical and aerospace industries. |

| Dec-21 | Mecachrome | WeAre Group | Provider of industrial manufacturing and machining services intended for aerospace, defense, transport and energy sectors. |

| Dec-21 | Modern Aviation | Hill Aviation | Provider of private aviation services operating as a fixed-based operator based in San Juan, Puerto Rico. |

| Dec-21 | Broadstone Acquisition | Vertical Aerospace | Vertical Aerospace Ltd is engaged in making air travel personal, on-demand, and carbon-free. |

| Dec-21 | N/A | EDMO Distributors | Provider of aviation products and services intended to serve customers in the fixed-wing and rotor markets. |

| Dec-21 | Tikehau Ace Capital | Rossi Aero | Manufacturer of structural parts, equipment and systems intended for the aerospace industry. |

| Dec-21 | Signature Flight Support | Vail Valley Jet Center | Provider of operational, technical and other aeronautical business services at airports. |

| Dec-21 | Sabena Aerospace | Lufthansa Technik Brussels & Maintenance International | Provider of aircraft maintenance services intended to serve the aerospace industry. |

| Dec-21 | ACI Groupe | Mécanic Centre Aéroptic – M.C.A | Manufacturer of mechanical parts and sub-assemblies for the aeronautics and defense sector. |

| Dec-21 | Triginta Capital | Precision Mechanics Group | Designer and manufacturer of complex precision components intended for the aerospace industry. |

| Nov-21 | CPI International | L3 Essco | Manufacturer of metal space frame ground radomes intended to support air defense, weather radar, air traffic control and satellite telemetry and tracking. |

| Nov-21 | Jet Access | Eagle Creek Aviation | Operator of an airport sector intended to offer private aviation services. |

| Nov-21 | Collins Aerospace | Dutch Thermoplastic Components | Manufacturer of structural parts for aerostructures. |

| Nov-21 | Collins Aerospace | FlightAware | Operator of a digital aviation company and data tracking platform serving aircraft and airport operators as well as other aviation organizations. |

| Nov-21 | Ichor Systems | Integrated Manufacturing Group | Provider of design, engineering and manufacturing services intended for the semiconductor, medical and aerospace and defence industries. |

| Nov-21 | Tikehau Ace Capital, WeAre Group | Gamma-TiAL | Manufacturer of titanium parts using the Wax Perdue process for the aeronautics industry. |

| Oct-21 | JW Hill Capital | Performance Plastics Inc. | Manufacturer and distributor of precision-engineered aerostructure components and sub-assemblies to major aerospace OEMs and tier-one suppliers. |

| Oct-21 | Vance Street Capital | Mcfarlane Aviation Products | Manufacturer of aircraft products based in Baldwin City, Kansas. |

| Oct-21 | TopBuild | Distribution International | Distributor of commercial and industrial insulation, tools and safety-related products intended for maintenance, repair and operations. |

| Oct-21 | Aircraft Fasteners International | Stealth Aerospace | Distributor of aerospace electrical and electro-mechanical components based in Canoga Park, California. |

| Oct-21 | FIMI Opportunity Funds | Ashot | Ashot- Ashkelon Industries Ltd produces metal products, aviation parts, armored combat vehicle systems, and heavy metal products. |

| Oct-21 | Fortress Investment Group | GDC Technics | Operator of an aircraft cabin completion and refurbishment company based in Fort Worth, Texas. |

| Sep-21 | Bain Capital | Industria de Turbo Propulsores | Developer and manufacturer of aircraft engine components and gas turbines. |

| Sep-21 | Latecoere | Shimtech de Mexico | Manufacturer of engineered structural composite assemblies and components. |

| Sep-21 | AE Industrial Partners | Jennings Aeronautics | Manufacturer of unmanned aircraft vehicles intended for the government and private companies including navy and aerospace. |

| Sep-21 | Montana Aerospace | ASCO Industries | Manufacturer and supplier of structural parts and assemblies for the aerospace industry. |

Notable Transactions: Defense

| Announced Date | Acquirer/Investor | Target | Target Description |

|---|---|---|---|

| Jan-22 | RSC2 | TriMech Services | Provider of systems engineering, modeling, and simulation services catering to the Department of Defense. |

| Jan-22 | Enlightenment Capital | Boecore | Provider of aerospace and defense engineering services dedicated to ensuring customer’s mission success. |

| Jan-22 | Federal Advisory Partners | FTC | Provider of information technology solutions that deliver digital transformation for Federal Government partners across the civilian, defense and intelligence landscape. |

| Jan-22 | Sagewind Capital, Sigma Defense System | Solute | Operator of technology and engineering firm focused on serving U.S. Department of Defense (DoD). |

| Jan-22 | Godspeed Capital | Exceptional Software Strategies | Provider of information technology solutions intended to serve the intelligence community and department of defense agencies. |

| Jan-22 | Rheinmetall | EMT | Developer of an aircraft center intended to shape the future of unmanned aircraft systems (UAS) for civilian use. |

| Jan-22 | Simulator Product Solutions | Panel Products | Designer and manufacturer of simulation displays and lighted panels catering to aerospace and military industries. |

| Jan-22 | Volex | TCP Cable | Manufacturer of wire harnesses designed for military equipment manufacturers. |

| Jan-22 | ESAM, VergePointe Capital | Englander Enterprises | Provider of electronic and electromechanical solutions for aerospace, defense, and homeland security applications intended to serve in Clearwater, Florida. |

| Dec-21 | CACI International | ID Technologies | Developer of cloud-based information technology systems catering to government agencies across the defense, intelligence and federal civilian communities. |

| Dec-21 | Giga-Tronics | Gresham Worldwide | Manufacturer of electronics intended to support the defense and aerospace industry. |

| Dec-21 | NowVertical Group | Allegient Defense | Provider of technical contracting services to the federal government as well as aerospace and defense through data analysis and assessment. |

| Dec-21 | AE Industrial Partners | Crestwood Technology Group | Distributor of parts and materials intended for the government as well as defense and commercial aviation industries. |

| Dec-21 | Tevano Systems Holdings | Illuria Security | Developer of cyber-deception automation and threat intelligence technology intended to reduce time-to-detection and incident response. |

| Dec-21 | RF Industries | Microlab | Manufacturer of radio frequency components developed for broadband applications in infrastructure, military and aerospace markets. |

| Dec-21 | Ducommun | Magnetic Seal | Manufacturer of magnetic sealing products intended to serve the aerospace and defense industry. |

| Dec-21 | Exaktera | ProPhotonix | Designer and manufacturer of light-emitting diode systems and laser modules based in Salem, New Hampshire. |

| Dec-21 | Vishay Intertechnology | Barry Industries | Manufacturer and designer of passive electronics and resistors designed for communication, defense and medical applications. |

| Dec-21 | ManTech International | Gryphon Technologies | Provider of advanced digital and systems engineering services intended for the defense industry. |

| Dec-21 | Mustang Survival | Stearns | Manufacturer of protective and flotation equipment for water rescue professionals, military elites and commercial and industrial mariners. |

| Dec-21 | Arcline Investment Management, Fairban | Welin Lambie | Manufacturer of davits intended for the shipyard, defense and commercial marine customers. |

| Dec-21 | American Industrial Partners | Raytheon Technologies (Defense Training and Mission Critical Solutions) | Provider of training and sustainment services intended for the defense and commercial aerospace industries. |

| Dec-21 | Thales Group | Moog (Navigation Aids Business in Salt Lake City, Utah) | Designer and manufacturer of ship-based radio frequency navigation beacons and related antennas catering to military and civilian applications. |

| Dec-21 | Fonds de Consolidation et de Developpe | Bertin Technologies | Developer and manufacturer of technical equipment intended to serve the defense, security, aerospace, energy and environment sectors. |

| Dec-21 | The Albers Group | Heritage Aviation | Provider of custom metal fabrication and wire assembly services for aviation, space, military and defense industries. |

| Nov-21 | Cherokee Federal | Preting | Provider of national security services catering to businesses and government clients and partners. |

| Nov-21 | Aircraft Fasteners International | Unical Defense | Provider of aftermarket component parts and logistics services intended for government contractors, military fleet managers and defense procurement divisions. |

| Nov-21 | Interconnect Solutions Company | Tri-Tek Electronics | Manufacturer of electronic wiring products intended for the aerospace and defense industries. |

| Nov-21 | Longacre Group, Pyroban | Euro Access | Manufacturer of ground support equipment designed specifically for the maintenance of aircraft. |

| Nov-21 | Mercury Systems | Avalex Technologies | Designer and manufacturer of avionics and electronic products for defense, law enforcement, search and rescue and commercial operators both in the US and globally. |

| Nov-21 | Arlington Capital Partners | Citadel Defense | Developer of counter-unmanned aircraft system (cUAS) intended for military, government and commercial end-users. |

| Nov-21 | ESCO Technologies | Networks Electronic Company | Manufacturer of mini-pyrotechnic devices and ordnance products intended to serve the aerospace and defense industries. |

| Nov-21 | BAE Systems | Bohemia Interactive Simulations | Developer of gaming technology for military training and interactive simulation software serving defense, emergency and mission-critical customers. |

| Oct-21 | JW Hill Capital | Angeles Composite Technologies | Manufacturer and supplier of structural composite assemblies and components to serve global commercial and military aerospace markets. |

| Oct-21 | Noble Supply & Logistics | Federal Resources Supply | Supplier of chemical, nuclear and explosive detection and protection products and services intended for the military and federal government. |

| Oct-21 | Arcline Investment Management | Onboard Systems International | Designer and manufacturer of external cargo handling equipment intended for civil and military helicopters. |

| Oct-21 | The AIRO Group | Jaunt | Manufacturer of next-generation aircraft intended to meet the growing demands for enhanced travel times over urban and regional areas. |

| Oct-21 | Arlington Capital Partners | Systems Planning and Analysis | Provider of professional services intended to address the nation’s critical security concerns. |

| Oct-21 | DarkPulse Technologies | TerraData Unmanned | Manufacturer of unmanned aircraft system (UAS) and provider remotely operated vehicle (ROV) services. |

| Sep-21 | HEICO | RH Laboratories | Manufacturer and designer of RF and microwave integrated assemblies catering to military OEMs, the US government and major commercial companies. |

| Sep-21 | Anduril | Copious Imaging | Developer of infrared imaging technology products intended to meet the urgent needs of the United States Department of Defense, maritime, and commercial sectors. |

| Sep-21 | Crestview Aerospace | Kemco Aerospace | Manufacturer of machine components and assemblies intended to solve complex engineering challenges. |

| Sep-21 | AE Industrial Partners | Jennings Aeronautics | Manufacturer of unmanned aircraft vehicles. |

| Sep-21 | Arcline Investment Management | Hunt Valve Company | Manufacturer and designer of fluid power engineering components and parts. |

| Sep-21 | Cassavant | Systems 3 | Supplier and manufacturer of flight critical components. |

| Sep-21 | Osprey Technology | BlackSky | Provider of real-time geospatial intelligence, imagery, and data analytics services. |

| Sep-21 | Genstar Capital | Envisage Technologies | Developer of software intended to automate complex training operations for federal agencies, first responders, law enforcement and the military. |

| Sep-21 | White Wolf Capital | Weatherhaven Global Resources | Supplier of rapid and redeployable mobile infrastructure. |

| Sep-21 | Ares Capital Corporation BDC | CoreHog | Provider of core cutting tools. |

| Sep-21 | Red Cat Holdings | Teal | Developer of small unmanned vehicle systems. |

Notable Transactions: Space

| Announced Date | Acquirer/Investor | Target | Target Description |

|---|---|---|---|

| Jan-22 | Breeze Holdings Acquisition | D-Orbit | Developer of a decommissioning device designed to dispose of satellites at the end of their lifespan. |

| Jan-22 | Blue Origin | Honeybee Robotics | Developer and manufacturer of robotic systems intended for space and other extreme environments. |

| Jan-22 | Allianz Group | Intelsat | Operator of integrated satellite and terrestrial network providing communications services for telecommunications operators, media companies, and internet service providers. |

| Jan-22 | Rocket Lab | SolAero Technologies | Manufacturer of solar cells and solar panels for satellite and spacecraft applications. |

| Jan-22 | Paragon | Final Frontier Design | Manufacturer and supplier of spacesuits and ancillary components intended to serve the aerospace industry. |

| Dec-21 | NextGen Acquisition II | Virgin Orbit Holdings | Provider of satellite launch services intended to make space accessible to everyone. |

| Dec-21 | dMY Technology Group IV | Planet Labs (NYS: PL) | Planet Labs PBC is an Earth imaging company. It provides daily satellite data that helps businesses, governments, researchers, and journalists understand the physical world. |

| Dec-21 | J.F. Lehman & Company | Narda-MITEQ | Designer and manufacturer of custom radiofrequency, microwave subsystems and components for defense and commercial end markets. |

| Dec-21 | Inertial Labs | Memsense | Developer of inertial measurement units in South Dakota, United States. |

| Dec-21 | Rocket Lab | Planetary Systems | Developer of mechanical separation systems and satellite dispensers intended to serve the aerospace industry. |

| Nov-21 | Raytheon Technologies | Seakr Engineering | Developer of high end electronic assemblies designed for space applications based in Centennial, Colorado. |

| Nov-21 | Beach Point Capital Management | Terran Orbital | Provider of small satellites intended to offer cost-effective end-to-end new space aerospace services. |

| Nov-21 | Voyager Space | Space Micro | Manufacturer and designer of communications, electro-optic and digital systems intended to focus on technology advancement and product implementation for satellite electronics. |

| Nov-21 | Redwire | Techshot | Developer of spaceflight equipment and space bioprinting products. |

| Oct-21 | Edgewater Capital Partners | SemiGen | Manufacturer of radiofrequency / microwave electronic devices intended for defense, satellite communication, space and advanced communications market. |

| Oct-21 | Rocket Lab | Advanced Solutions | Developer of space software designed to deliver mission simulation, test systems, guidance, navigation, and control solutions. |

| Oct-21 | Voyager Space | Valley Tech Systems | Operator of an aerospace engineering company intended to help solve pressing technology challenges for aerospace and defense missions. |

| Sep-21 | Karman Systems | Systima Technologies | Manufacturer of energetic components and integrated systems intended for supporting the defense, space and commercial markets. |

| Sep-21 | BAE Systems | In-Space Missions | Developer and operator of satellites intended for new space and traditional space companies, institutions and government agencies. |

| Sep-21 | Osprey Technology | BlackSky | Provider of real-time geospatial intelligence, imagery, and data analytics services intended to deliver intelligence into the hands of decision-makers. |

| Sep-21 | Genesis Park Acquisition | Redwire | Engaged in mission-critical space solutions and reliable components for the next generation space economy. |

| Aug-21 | Industrial Growth Partners | AEM | Explorer, developer and producer of mineral properties in Canada, Finland, and Mexico intended to build a growing, high-quality, low risk, sustainable business. |

| Aug-21 | Vector Acquisition | Rocket Lab | Manufacturer of commercial rocket launchers intended to provide frequent satellite launch opportunities to lower Earth orbit and remove barriers to commercial space. |

| Aug-21 | NextGen Acquisition II | Virgin Orbit | Provider of satellite launch services intended to make space accessible to everyone. |

| Aug-21 | Phantom Space | Micro Aerospace Solutions | Developer of space communications, propulsion systems and electrical hardware design for spacecraft and rockets. |

| Aug-21 | NavSight Holdings | Spire | Provider of satellite-powered data and analytics solutions intended to offer real-time global coverage of every point on Earth. |

| Aug-21 | Stable Road Acquisition | Momentus | Developer of in-space transportation and infrastructure technology intended to enable enterprise and human existence to flourish in space. |

| Jul-21 | dMY Technology Group IV | Planet | Developer of a satellite imaging platform designed to image the entire Earth every day and make global change visible, accessible, and actionable. |

| Jul-21 | Astra | Apollo Fusion | Manufacturer of electric propulsion systems intended to supply power to small satellites. |

| Jun-21 | Holicity | Astra | Manufacturer of space-rocket equipment intended to provide routine access to earth’s orbit. |

| Jun-21 | GLOBAL Systmes Asia Sdn Bhd | RUAG (Malaysia Operations) | Owner and operator of a space equipment manufacturing. |

| Jun-21 | General Atomics Corp. | Synopta | Manufacturer of complex optoelectronic instrumentation for space and terrestrial applications. |

| May-21 | Voyager Space Holdings | NanoRacks | Operator of commercial space station company intended to create space microgravity environment for various studies and projects. |

| Mar-21 | Calspan | ACENT Laboratories | Developer of aerospace propulsion and power technology intended to provide clean energy services. |

| Feb-21 | AE Industrial Partners | Deployable Space Systems | Manufacturer of deployable space systems for the global space market. |

| Feb-21 | AeroVironment | Progeny Systems | Provider of technology engineering services intended to drive down overall cost of combat system upgrades. |

| Feb-21 | AeroVironment | Arcturus UAV | Manufacturer and an integrator of unmanned aerial systems, intended to serve the defense industry. |

| Feb-21 | Axient | Millennium Engineering and Integration | Provider of engineering services for space, defense, cyber, intelligence and aviation sectors. |

| Feb-21 | General Atomics | Tiger Innovations | Developer of spacecraft and space-related systems for a broad range of US Government customers. |

| Jan-21 | AE Industrial Partners | Oakman Aerospace | Developer of space technologies specializing in rapid and responsive, modular and open-architecture space systems. |

| Dec-20 | AAC Clyde Space | SpaceQuest | Provider of advanced satellite technology systems intended for government, university and commercial entities. |

| Dec-20 | Lockheed Martin | Aerojet Rocketdyne Holdings | Manufactures launch systems and space applications. |

| Dec-20 | Raytheon Technologies | Blue Canyon Technologies | Manufactures spacecraft and components. |

| Dec-20 | AE Industrial Partners | LoadPath | Designer and developer of payload adapters, deployable structures, and thermal products for the space industry. |

| Nov-20 | Parsons | Braxton Technologies | Provider of spacecraft command and control products and services for government and commercial applications. |

| Nov-20 | Charger Investment Partners | Advanced Composite Products and Technology | Manufacturer of engineered composite structures for defense, space, automotive, marine, industrial machinery and subsea telecom applications. |

| Oct-20 | BlueHalo | Applied Technology Associates | Provider of advanced technology products intended to tackle sensing, measurement and controls problems. |

| Sep-20 | Arotech, Greenbriar Equity Group | Aldetec | Provider of integrated microwave assemblies (IMAs) and radio frequency amplifier equipment for the commercial, military, and space flight industry sectors. |

| Jul-20 | Voyager Space Holdings | Pioneer Astronautics | Operator of a space research laboratory intended to explore new technologies that have the potential to advance the nation’s space program. |

| Jun-20 | Mitsui & Co. | Spaceflight | Provider of launch mission services intended for the aerospace industry. |

Sources: Pitchbook, company press releases, company websites & Meridian research