Aerospace, Defense & Space M&A Trends: Fall 2023

Published October 24, 2023

Key Insights

- Engineered Components and Aftermarket Remain M&A Priorities

- Increased Military Spending Favors C4ISR Segment

- Improving Air Travel and Order Momentum Supporting Positive Outlook for Commercial Market

Supported by strong underlying fundamentals, the aerospace, defense, and space market continues to be an attractive sector for investors. Assets providing engineered products, aftermarket exposure, or diversification opportunities remain at the forefront of investment strategies and have benefitted from competitive processes.

Market Insights

Engineered Components and Aftermarket Remain M&A Priorities

- Both strategic and private equity investors have continued to show a strong preference for acquisitions of companies with a highly engineered product portfolio or meaningful exposure to aftermarket sales.

- Engineered products, either proprietary components or design-to-spec, offer more protected revenue streams with high barriers to entry as a result of the significant investment in R&D, testing, and certification of the products. In the rising cost environment, investors are seeking these companies that are able to command stronger gross margins and are better insulated from the customer pricing pressures due to the lack of available alternatives.

- Companies providing aftermarket parts and services supporting key platforms benefit from recurring or predictable revenue streams due to the large in-service fleets and regular maintenance needs. In recent years, given depressed build rates on commercial aircraft, investors have favored companies serving the large existing fleet addressable market as opposed to those tied to new production rates. With the recent strength of passenger air traffic, the commercial market has benefited from strong customer demand, creating even more favorable tailwinds for investors. Additionally, aftermarket providers can better control pricing and margin due to necessity of customers to minimize time that aircrafts are inoperable, which can be leveraged in times of strong demand and constrained capacity.

- As a result of these dynamics and the strong investor interest in these assets, transactions in the space have generally benefited from more competitive processes and higher average valuations.

Increased Military Spending Favors C4ISR Segment

- The C4ISR segment has seen favorable tailwinds with the U.S. DoD allocating an increasing portion of the budget towards military technology development as the U.S. military becomes increasingly focused on electronic warfare, cybersecurity, and modernization. The 2024 RDT&E budget request of $145B was 12% higher than the 2023 request, representing the largest figure in department history.1

- Increased government funding is expected to drive growth in the sector with companies competing for long-term contract awards and a focus on R&D and new technology development.

- Strategic and financial investors alike have been active, seeking to capitalize on the significant funding and the related proprietary technology that is being developed.

- Notable strategic transactions in the sector include General Atomics’ acquisition of EO Vista and Saab’s acquisition of Blue Bear Systems. On the financial investor side, Arlington Capital has been active in the space this year with acquisitions of Verus Technology and PRKK as well as Highlander Partners with acquisitions of Black Sage Technologies and DZYNE Technologies.

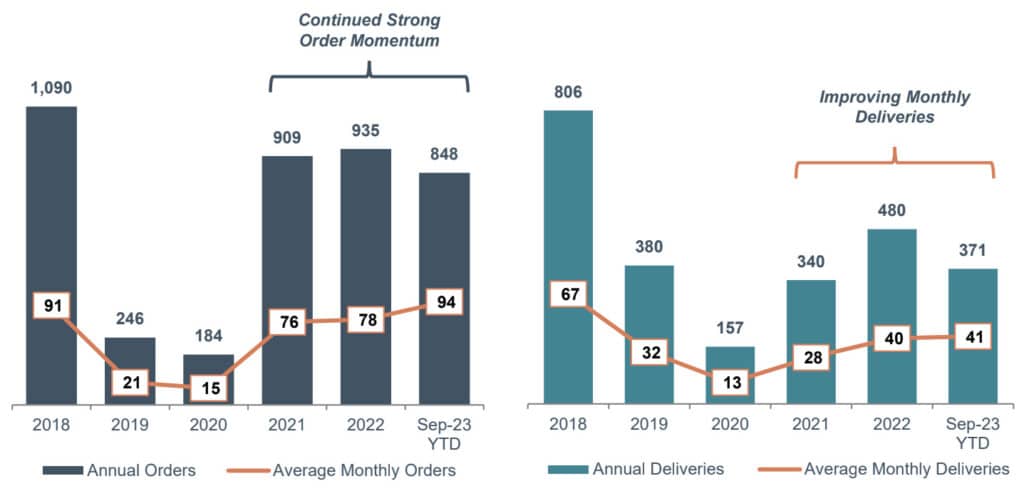

Improving Air Travel and Order Momentum Supporting Positive Outlook for Commercial Market

- Commercial air travel has been strong through 2023. In the U.S., the average number of daily passengers has reached levels comparable to pre-pandemic 2019 and is up 12% from the same period last year.2

- The recovery in air travel has resulted in increasing demand for maintenance, repair, and overhaul (“MRO”) needs. MRO companies are being challenged with skilled workforce availability and decreasing availability of aftermarket components as OEMs increase production goals.

- With strong demand for aftermarket services and parts, companies may seek outside investment to help add capacity, enhance resources to help with hiring and procurement, or pursue consolidation opportunities to realize synergies and economies of scale.

- Supported by continued new commercial aircraft order momentum, Boeing has indicated it remains on track to raise production rates across its platforms and is actively working to transition the 737 rate from 31 aircraft per month to 38.3

- The stability of the supply chain will remain the critical factor in Boeing’s ability to increase rates. Companies with existing LTAs and excess capacity are expected to benefit from production ramp providing organic, near-term growth.

- Investors have been watching the commercial supply chain through the pandemic recovery, evaluating opportunities where they can help companies capitalize on the market rebound. With air travel recovering, good order momentum, and forecasted near-term rate increases, Meridian expects an increasing investor appetite for the sector.

Boeing Commercial Aircraft Orders and Deliveries3

Sources: Pitchbook, MergerMarket, Company Press Releases, Business Wire, Meridian Research

Footnote 1: Department of Defense

Footnote 2: Transportation Security Administration

Footnote 3: Boeing

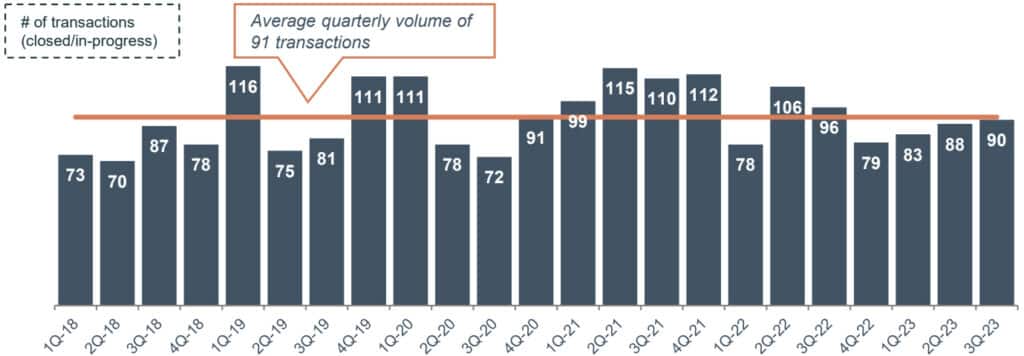

Aerospace, Defense & Space Market Activity

Global AD&S M&A Activity

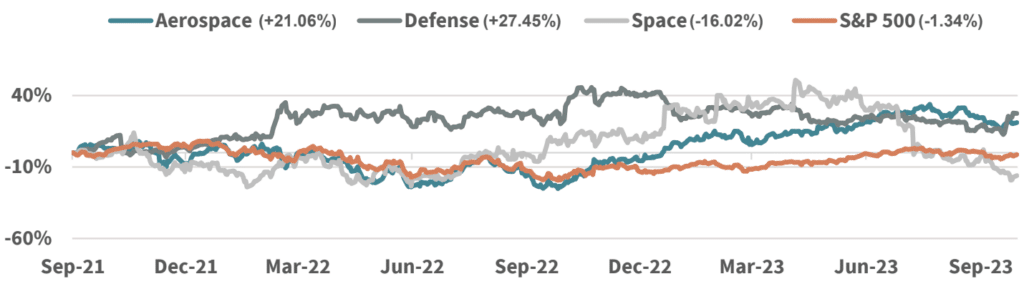

Stock Index Performance4

Select AD&S Transaction Case Studies

Target Description:

Developer of ice protection and drag reduction technology intended to serve the aviation sector.

Transaction Rationale:

The acquisition allows Loar to provide a full offering of de-icing and ice protection solutions expanding its portfolio of proprietary solutions for its customers.

Target Description:

Provider of aerospace aftermarket component manufacturing, distribution, and MRO services.

Transaction Rationale:

Wencor will join Heico’s growing flight support group which provides complementary design, engineering, manufacturing, repair, overhaul, and distribution services.

Target Description:

Provider of aero-engine component manufacturing and repair services for engine OEMs, Tier 1 suppliers, and MRO providers.

Transaction Rationale:

The acquisition expands Barnes Group’s ability to support AD&S customers, from new product development and manufacturing to OEM-approved repair services.

Sources: Pitchbook, MergerMarket, Company Press Releases, Meridian Research

Footnote 4: Individual components of AD&S Indices can be found on page 6. Indices weighted by Market Capitalization.

Notable Investor Profiles — Engineered Products

| HQ | Cleveland, Ohio |

| Ownership | Public (NYSE:TDG) |

| Market Cap ($B) | 48 |

| Acquisitions | 53 |

| EBITDA Margin | 47.1% |

Business Description

Manufacturer and provider of diverse sets of components and parts for commercial and military aircraft and is a leading global designer, producer, and supplier of highly engineered aircraft components.

Acquisition Commentary

TransDigm’s strategy is to drive private equity like returns to its shareholders. The Company is focused on acquiring aerospace product companies that have proprietary, engineered products with significant aftermarket exposure. It targets opportunities in the small and mid-size range.

| HQ | Hollywood, Florida |

| Ownership | Public (NYSE:HEI) |

| Market Cap ($B) | 20 |

| Acquisitions | 56 |

| EBITDA Margin | 26.4% |

Business Description

Provider of commercial, non-OEM, FAA-approved aircraft replacement parts, aircraft accessories component repair & overhaul services, and manufacturer of other critical aircraft parts.

Acquisition Commentary

HEICO is focused on acquiring niche A&D businesses with strong margins and limited competition resulting from proprietary or engineered products. The Company targets transactions between $50M to $1B in EV and companies generating a min $10M – $15M EBIT and operating margins in excess of 20%. Management has indicated a preference for opportunities where owners and management teams like to participate as minority shareholders and typically pay valuations of between 8x – 10x EBIT.

| HQ | Bristol, Connecticut |

| Ownership | Public (NYSE: B) |

| Market Cap ($B) | 2 |

| Acquisitions | 19 |

| EBITDA Margin | 15.1% |

Business Description

Manufacturer and provider of aircraft engines, engineered products, and airframes intended to serve turbine manufacturers, commercial airlines, and the military.

Acquisition Commentary

Barnes Group remains active in the M&A market and has stated a preference for larger transactions in the A&D space rather than pursuing multiple smaller deals. The Company’s acquisitions are focused on opportunities with complementary technical capabilities and footprint that can expand relationships with OEMs and increase aftermarket exposure.

| HQ | White Plains, New York |

| Ownership | PE-Backed |

| Acquisitions | 15 |

| EBITDA Margin | Data not provided |

Business Description

Manufacturer of engineered components, systems, and assemblies intended for the aerospace and defense sectors.

Acquisition Commentary

Loar Group has continued its strategy of acquiring companies that can add niche capabilities and proprietary products to its portfolio of customer solutions. The Company also looks for acquisitions with aftermarket opportunities that have the ability to leverage Loar’s experience.

Sources: Pitchbook, MergerMarket, Company Press Releases, Meridian Research

Public Aerospace, Defense & Space Companies

Aerospace Companies

| Company Name | Ticker | Market Cap | Enterprise EV | LTM Rev | LTM EBITDA | EV/LTM REV | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|

| Boeing Co. | NYSE: BA | $111,955 | $150,485 | $73,608 | $555 | 2.0x | NM | 0.8% | 35.1 % |

| Airbus SE | PAR: AIR | $102,067 | $95,065 | $64,473 | $7,506 | 1.5x | 12.7x | 11.6% | 32.8 % |

| Safran SA | PAR: SAF | $66,103 | $66,516 | $22,996 | $4,461 | 2.9x | 14.9x | 19.4% | 45.2 % |

| TransDigm Group, Inc. | NYSE: TDG | $47,633 | $64,334 | $6,243 | $3,184 | 10.3x | 20.2x | 51.0% | 59.8 % |

| HEICO Corporation | NYSE: HEI | $20,069 | $20,979 | $2,641 | $710 | 7.9x | 29.6x | 26.9% | 11.6 % |

| Textron Inc. | NYSE: TXT | $15,822 | $17,608 | $13,162 | $1,557 | 1.3x | 11.3x | 11.8% | 27.7 % |

| MTU Aero Engines AG | ETR: MTX | $9,532 | $9,695 | $6,230 | $997 | 1.6x | 9.7x | 16.0% | 2.5 % |

| Hexcel Corporation | NYSE: HXL | $5,666 | $6,341 | $1,706 | $363 | 3.7x | 17.5x | 21.3% | 19.5 % |

| Spirit AeroSystems Inc. | NYSE: SPR | $1,810 | $5,250 | $5,393 | ($136) | 1.0x | NA | NA | (30.3)% |

| Barnes Group Inc. | NYS: B | $1,703 | $2,203 | $1,303 | $207 | 1.7x | 10.7x | 15.9% | 1.2 % |

| Ducommun, Inc. | NYSE: DCO | $690 | $983 | $743 | $100 | 1.3x | 9.9x | 13.4% | 8.6 % |

| Triumph Group, Inc. | NYSE: TGI | $569 | $2,101 | $1,357 | $222 | 1.5x | 9.5x | 16.4% | (19.2)% |

| Kaman Corporation | NYSE: KAMN | $563 | $1,117 | $759 | $107 | 1.5x | 10.4x | 14.2% | (36.3)% |

| Median | $9,532 | $9,695 | $5,393 | $555 | 1.6x | 11.3x | 15.9% | 11.6% | |

| Average | $29,552 | $34,052 | $15,432 | $1,526 | 2.9x | 14.2x | 18.2% | 12.2% |

Defense Companies

| Company Name | Ticker | Market Cap | Enterprise EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|

| Lockheed Martin Corporation | NYSE: LMT | $111,090 | $124,962 | $67,393 | $10,702 | 1.9x | 11.7x | 15.9% | 2.2% |

| Raytheon Technologies Corporation | NYS: RTX | $107,548 | $140,687 | $70,573 | $12,549 | 2.0x | 11.2x | 17.8% | (15.4)% |

| Northrop Grumman Corp | NYSE: NOC | $73,986 | $86,170 | $37,881 | $7,479 | 2.3x | 11.5x | 19.7% | (3.5)% |

| General Dynamics Corporation | NYSE: GD | $65,877 | $76,208 | $40,859 | $5,405 | 1.9x | 14.1x | 13.2% | 1.6% |

| BAE Systems Plc | LON: BA. | $39,801 | $44,097 | $27,080 | $3,472 | 1.6x | 12.7x | 12.8% | 31.8% |

| L3Harris Technologies, Inc. | NYSE: LHX | $33,722 | $42,983 | $17,988 | $3,456 | 2.4x | 12.4x | 19.2% | (24.6)% |

| Thales SA | PAR: HO | $31,406 | $32,784 | $18,864 | $2,861 | 1.7x | 11.5x | 15.2% | 19.6% |

| Leidos Holdings, Inc. | NYSE: LDOS | $13,113 | $18,282 | $14,842 | $1,535 | 1.2x | 11.9x | 10.3% | 1.9% |

| Huntington Ingalls Industries, Inc. | NYSE: HII | $8,889 | $11,680 | $10,899 | $1,134 | 1.1x | 10.3x | 10.4% | (6.5)% |

| Elbit Systems Ltd. | TAE: ESLT | $8,652 | $10,081 | $5,703 | $536 | 1.8x | 18.8x | 9.4% | (1.3)% |

| Oshkosh Corporation | NYSE: OSK | $6,312 | $6,554 | $8,952 | $768 | 0.7x | 8.5x | 8.6% | 21.6% |

| Moog Inc. | NYS: MOG.A | $3,747 | $4,638 | $3,215 | $379 | 1.4x | 12.2x | 11.8% | 48.2% |

| Kratos Defense & Security Solutions, Inc. | NAS: KTOS | $2,269 | $2,521 | $967 | $78 | 2.6x | 32.4x | 8.0% | 73.9% |

| Median | $31,406 | $32,784 | $17,988 | $2,861 | 1.8x | 11.9x | 12.8% | 1.9% | |

| Average | $38,955 | $46,280 | $25,017 | $3,873 | 1.7x | 13.8x | 13.3% | 11.5% |

Space Companies

| Company Name | Ticker | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|

| Iridium Communications, Inc. | NAS: IRDM | $5,510 | $6,887 | $776 | $443 | 8.9x | 15.6x | 57.0% | (10.8)% |

| ViaSat, Inc. | NASDAQ: VSAT | $2,676 | $8,317 | $2,754 | $536 | 3.0x | 15.5x | 19.5% | (45.5)% |

| Rocket Lab USA, Inc. | NASDAQ: RKLB | $2,165 | $1,987 | $232 | ($68) | 8.6x | nm | (29.2)% | 3.0% |

| Gilat Satellite Networks Ltd | NASDAQ: GILT | $351 | $267 | $260 | $35 | 1.0x | 7.6x | 13.5% | 18.8% |

| Comtech Telecommunications Corp. | NASDAQ: CMTL | $290 | $590 | $528 | $47 | 1.1x | 12.5x | 9.0% | 0.8% |

| Median | $2,165 | $1,987 | $528 | $47 | 3.0x | 14.0x | 13.5% | 0.8% | |

| Average | $2,198 | $3,610 | $910 | $199 | 4.5x | 12.8x | 13.9% | (6.8)% |

($US in millions)

Sources: Pitchbook, MergerMarket, Company Press Releases, Meridian Research

Market data as of Oct 17th, 2023

Notable Transactions: Aerospace

| Deal Date | Acquirer/Investor | Target | Target Description |

|---|---|---|---|

| Pending | Gama Aviation | West Star Aviation | Provider of maintenance, repair, and overhaul services for the business aviation industry. |

| Oct-23 | ITP Aero | BP Aero | Provider of maintenance and repair services for aircraft engines in the commercial aerospace industry. |

| Oct-23 | Arcline Investment Management | Hartzell Aviation | Manufactures proprietary aircraft subsystems and aftermarket components. |

| Oct-23 | Airtec | Pax Aero Solutions | Provider of aviation maintenance services. |

| Oct-23 | JetEXE Aviation | Lancair Aerospace | Manufacturer of general aviation aircraft kits. |

| Oct-23 | ZIM Aircraft Seating | HAECO Cabin Solutions | Manufacturer of aircraft cabin products. |

| Oct-23 | Yano Special Vehicle Manufacturing | Titan Aviation | Manufacturer of refueling equipment intended for aircraft and helicopters. |

| Sep-23 | Ceratizit | Xceliron | Manufacturer of cutting tools intended to serve the aerospace industry. |

| Sep-23 | Rock West Composites | Performance Plastics | Manufacturer of aerospace parts and sub-assemblies. |

| Sep-23 | Mubea | Cyclone Manufacturing | Manufacturer of aerospace structural components. |

| Aug-23 | RBC Bearings | Specline | Manufacturer of precision bearings intended for the commercial and defense aerospace markets. |

| Aug-23 | Ampaire | Talyn | Developer of vertical take-off and landing electric aircraft. |

| Aug-23 | HEICO | Wencor Group | Provider of aerospace aftermarket component manufacturing and distribution and MRO services. |

| Aug-23 | D&S Manufacturing | Technical Metal Specialties | Manufacturer of metal products and provider of fabrication services. |

| Aug-23 | Flexjet | Flying Colours | Provider of aviation services intended for mid and large-sized business aircraft. |

| Jul-23 | Safran | Collins Aerospace (Flight Control and Actuation Business) | Manufacturer of aerospace components and systems. |

| Jun-23 | VSE | Desser Aerospace | Distributor and retreader of specialty aviation tires and other aircraft components. |

| Jun-23 | Tinicum | Penn Manufacturing Industries | Manufacturer of specialty components intended for aerospace and defense. |

| Jun-23 | Lockheed Martin | Sintavia | Manufacturer of advanced mechanical systems. |

| Jun-23 | HC Private Investments | Vulcan Machine | Manufacturer of tight tolerance precision machined parts. |

| Jun-23 | Marubeni | DASI | Supplier of aircraft inventory parts and equipment intended for major aircraft platforms. |

| Jun-23 | New State Aviation Holdings New State Capital Partners | Finnoff Aviation | Provider of proprietary engine and propeller upgrades. |

| Jun-23 | AE Industrial Partners | Yingling Aviation | Provider of maintenance, repair, and overhaul, and fixed-base operator services. |

| Jun-23 | FCAH Aerospace O2 Investment Partners | Cobalt Aero Services | Provider of aircraft repair services intended for the aerospace industry. |

| Jun-23 | KKR & Co. Inc. | Circor International | Manufacturer of mission-critical flow control products for industrials and aerospace and defense customers. |

| Deal Date | Acquirer/Investor | Target | Target Description |

|---|---|---|---|

| Jun-23 | Barnes Group | MB Aerospace | Manufacturer of critical engine components for the aerospace and defense markets. |

| May-23 | Graco Roberts | Pacific Coast Composities | Distributor of composite materials catering to aerospace, automotive, sports and recreation, education, and medical industries. |

| May-23 | John Bean Technologies | JBT AeroTech | Distributor of aviation and aerospace components. |

| May-23 | Loar Group | AOG Aviation Spares | Provider of aircraft component and repair services. |

| May-23 | AIM MRO | Geraly Poly Mouldings | Manufacturer of masking products for aerospace and gas turbine engines. |

| Apr-23 | FDH Aero Audax | BJG Electronics Group | Manufacturer of electronic components intended to serve the defense, commercial aerospace, and business aviation industries. |

| Apr-23 | FCAH Aerospace O2 Investment Partners | Air Cargo Equipment | Specializes in the repair, overhaul, exchange, and sale of on-aircraft cargo systems and parts. |

| Apr-23 | Audax Private Equity | Krayden, inc. | Distributor of specialty adhesives, sealants, and coatings intended to serve the aerospace, electronics, transportation, and general industrial end markets. |

| Apr-23 | BICO Steel | RE Metal Finishing | Provider of steel peening and metal finishing services to a variety of industrial customers. |

| Apr-23 | Vance Street Capital | Aero Group Holdings | Owns a portfolio of leading brands who are focused on designing and manufacturing proprietary FAA approved new and replacement components. |

| Mar-23 | LifePort | Aeromatrix Composites | Manufacturer of advanced and composite aerospace products intended to serve the aerospace and defense sector. |

| Mar-23 | Ducommun | BLR Aerospace | Developer of customized aerodynamic products and solutions catering to the needs of the aerospace industry. |

| Mar-23 | Ajax Defense | Whelan Machine & Tool | Provider of precision machined products and services. |

| Mar-23 | TransDigm Group | Calspan | Provider of research and testing services for the aerospace and transportation industries. |

| Mar-23 | IDAG | Ace Aeronautics | Provider of avionic and airframe services intended to serve commercial and government aviation users. |

| Mar-23 | ARCH Medical Solutions | Bettanini’s Custom Manufacturing | Contract manufacturer of precision-machined components. |

| Mar-23 | Signia Aerospace | Lifesaving Systems | Designer of helicopter hoist hooks, tethers and safety belts, and water and aviation rescue equipment. |

| Feb-23 | Cadrex Solutions | D&R Machine Company | Provider of CNC precision machining solutions for the aerospace and defense market. |

| Feb-23 | First Aviation Services | Associated Aircraft Manufacturing | Manufacturer of a variety of aircraft parts and provider of repair and overhaul services for aircraft electronics, avionics, hydraulic, and landing gear components. |

| Feb-23 | ATL Partners | Aero Accessories | Provider of aero accessories and repair services. |

| Feb-23 | TriMas | Weldmac | Designer and manufacturer of metal fabricated components and assemblies for the aerospace, defense, and space launch end-markets. |

| Feb-23 | Whitcraft | Paradigm Precision | Manufacturer of gas turbine components intended to support the commercial and military aircraft markets. |

| Feb-23 | Prince Industries | Precision Shapes | Manufacturer of precision-machined components intended for the aerospace, commercial, and defense industries. |

| Feb-23 | Wencor Group | Aero-Glen International | Distributor of aerospace structural hardware equipment. |

| Feb-23 | VSE | Precision Fuel Components | Provider of engineering specializing in small turbine engine components. |

Notable Transactions: Defense

| Deal Date | Acquirer/Investor | Target | Target Description |

|---|---|---|---|

| Pending | Bernhard Capital Partners | Duotecg Services, Inc | Provider of services for radar and related systems. |

| Pending | BAE Systems | Ball Aerospace | Leading provider of mission critical space systems and defence technologies across air, land, and sea domains. |

| Oct-23 | The Jordan Company | iNRCORE | Manufacturer of catalog and magnetic components for the defense industry. |

| Oct-23 | Operational Solutions | Nexus Nine | Provider of unmanned aircraft system and counter unmanned aircraft system platform testing and support. |

| Sep-23 | A&M Capital Partners | VTG Group | Provider of modernization and digital transformation solutions to defense and intelligence community. |

| Sep-23 | Loar Group | CAV Systems Group | Developer of ice protection and drag reduction technology intended to serve the aviation sector. |

| Aug-23 | Saab | Blue Bear Systems Research | Provider of autonomous and unmanned systems. |

| Aug-23 | CBC Global Ammunition | SinterFire | Manufacturer of frangible ammunition projectiles for the military and law enforcement market. |

| Aug-23 | AeroVironment | Tomahawk Robotics | Developer of AI-enabled robotic control systems for the military. |

| Aug-23 | Enterprise Investors | Advanced Protection Systems | Developer of a multi-sensor drone detection and tracking system. |

| Aug-23 | Frontgrade | Aethercomm | Manufacturer of radiofrequency and microwave products intended to serve airborne platforms. |

| Aug-23 | Rheinmetall | EXPAL Systems | Manufacturer of weapon systems and munitions. |

| Jul-23 | L3 Harris Technologies | Aerojet Rocketdyne | Manufacturer of aerospace and defense products and systems. |

| Jul-23 | Safran | Collins Aerospace (Flight Control and Actuation Business) | Manufacturer of aerospace components and systems. |

| May-23 | Avem Partners | ASTECH Engineered Products | Supplier of welded honeycomb metallic aerostructures intended for the global aerospace and defense industry. |

| May-23 | FR Capital | Fregata Systems | Provider of innovative command, control, communication, computers, cyber, intelligence, surveillance, and reconnaissance technology services. |

| May-23 | Delta Drone | Tonner Drones | Manufacture of drones catering to military use. |

| May-23 | Reppert Capital Partners | Inertial Labs | Developer of position and orientation technologies for the aerospace and defense industry. |

| Apr-23 | Arlington Capital Partners | Verus Technology Group | Developer and manufacturer of counter unmanned aircraft systems. |

| Apr-23 | Capital Southwest BDC | Edge Autonomy | Manufacturer of unmanned aircraft systems intended for federal and private customers. |

| Mar-23 | Nexus Capital Management | Aviation Ground Equipment Corp. | Manufacturer of aviation ground support equipment. |

| Mar-23 | Raptor Scientific | King Nutronics Corporation | Developer of test and measurement instruments and equipment. |

| Jan-23 | Highlander Partners | Black Sage Technologies | Developer of defense technology systems focused on defending against unmanned systems. |

| Jan-23 | Highlander Partners | DZYNE Technologies | Manufacturer and designer of autonomous aircraft, as well as unmanned aircraft systems, intended to serve the U.S. Department of Defense. |

| Jan-23 | Micross Components | KCB Solutions | Manufacturer of radiofrequency and microwave semiconductor products intended for military, aerospace, and satellite industries. |

| Deal Date | Acquirer/Investor | Target | Target Description |

|---|---|---|---|

| Dec-22 | Forged Solutions Group | Continental Forge | Manufacturer of aluminum forgers intended for commercial aerospace, military, automotive, and marine transportation industries. |

| Nov-22 | First Aviation Services | Associated Aircraft Manufacturing | Manufacturer of a variety of aircraft parts and provider of repair and overhaul services. |

| Nov-22 | Highlander Partners | Liteye Systems | Manufacturer and integrator of multi-domain and multi-mission defense systems. |

| Nov-22 | Sparton | Logos Technologies | Provider of wide-area motion imagery technology. |

| Nov-22 | PCX Aerosystems | Timken Aerospace Drive Systems | Manufacturer and supplier of aviation drive system components and sub-assemblies intended for military and civil rotorcraft applications. |

| Oct-22 | Sky Peak Capital | Hicks Machine | Provider of tight tolerance, precision machining services intended to serve defense, commercial, medical, and microwave industries. |

| Sep-22 | Novaria Group, KKR | Stroco Manufacturing | Manufacturer of aerospace products intended for the defense and aerospace industries in both the military and commercial sectors. |

| Sep-22 | SkyePoint Decisions | SNR Government IT Services | Provider of comprehensive information technology services and defense products intended for defense and federal government customers. |

| Sep-22 | Giga-Tronics | Gresham Worldwide | Manufacturer of electronics intended to support the defense and aerospace industry. |

| Sep-22 | Ironwood Capital | Nautilus Integrated Solutions | Manufacturer of critical components intended to serve the defense, nuclear, and railroad markets. |

| Aug-22 | Bardin Hill Investment Partners MB Global Partners | MD Helicopters | Manufacturer of light single and light twin-engine helicopters. |

| Aug-22 | General Dynamics Mission Systems | Progeny Systems | Operator of an engineering company intended to drive down the overall cost of combat system upgrades. |

| Aug-22 | Cobham | Ultra Electronics | Provider of electronic and software technologies for the defense, aerospace, security, transport, and energy markets. |

| Aug-22 | By Light Professional IT Services | Veraxx Engineering Corporation | Provider of complex, high-fidelity aircraft modeling and simulation training technology services. |

| Jul-22 | Valence Surface Technologies | B&M Painting Company | Provider of corrosive fabrications and spec painting intended for the defense and aerospace industry. |

| Jul-22 | HEICO | Accurate Metal Machining | Manufacturer of high-reliability components and assemblies for the aerospace and defense industries. |

| Jul-22 | V2X | The Vertex Company | Provider of aftermarket aerospace services intended to serve the defense and commercial customers. |

| Jun-22 | Primus Aerospace | Raloid | Manufacturer of detailed mechanical components and assemblies for the defense industry. |

| Jun-22 | Precision Products Group | Breyden Products | Manufacturer of military specification lacing tapes, twines, and cords intended to serve the aerospace and defense industries. |

| Jun-22 | Allied Motion | Airex | Designer and manufacturer of precision and specialty controlled motion products and solutions. |

| Jun-22 | iNRCORE | Vanguard Electronics | Manufacturer of inductors and transformers for defense, aerospace, space, medical, down-hole, and energy industries. |

| Jun-22 | Rafael Advanced Defense Systems | PVP Advanced EO Systems | Developer and manufacturer of electro-optic EO systems catering to air, land, sea, and critical homeland security applications. |

| Jun-22 | P4G Capital Management | TIGHITCO | Designer and manufacturer of engineered components intended for aerospace and industrial applications. |

| May-22 | Allied Motion | FPH Group | Developer of technically advanced engineered products and systems designed for ground-based vehicles in the defense market. |

| May-22 | Adani Defence Systems and Technologies | General Aeronautics | Developer of advanced aerial technologies addressing the challenges of unmanned aerial vehicle design. |

Notable Transactions: Space

| Deal Date | Acquirer/Investor | Target | Target Description |

|---|---|---|---|

| Sep-23 | Avio | T4i | Manufacturer of innovative engines designed to serve small satellite platforms. |

| Sep-23 | General Atomics | EO Vista | Manufacturer of space-borne electro-optical systems. |

| Jun-23 | Anduril | Adranos | Developer of solid rocket propellant designed to enable private space exploration. |

| Jun-23 | Firefly Aerospace | Spaceflight | Provider of premier launch and space transportation services. |

| Jun-23 | York Space Systems | Emergent Space Technologies | Emergent researches, develops, integrates, and tests advanced systems and software solutions for civil, military, and commercial space missions. |

| May-23 | Advent International | Maxar Technologies | Integrated space and geospatial intelligence company with a full range of space technology solutions for commercial and government customers. |

| Mar-23 | Voyager Space | ZIN Technologies | Provider of advanced engineering services and product development solutions for launch vehicles, low-Earth orbit infrastructure projects, and spacecrafts. |

| Mar-23 | ReliaSat | Arralis | Developer of satellite communications and radar technology designed to serve the communications, satellite, aerospace, and defense markets. |

| Feb-23 | Micross Components | Infineon Technologies (HiRel DC-DC Converter Business) | Manufacturer and designer of proprietary power systems intended to serve the space, strategic defense, and aerospace industries. |

| Feb-23 | Vast Space | Launcher | Developer of a liquid propellant-based rocket designed to deliver small satellites to orbit. |

| Feb-23 | Boecore | Orbit Logic | Developer of mission planning and scheduling software intended for the aerospace and geo-intelligence communities. |

| Jan-23 | Cesium | TXMission | Developer of an off-the-shelf, end-to-end satellite communications solutions. |

| Jan-23 | Veritas Capital | Frontgrade | Provider of high-reliability electronic solutions for space, defense, healthcare, and industrial applications. |

| Jan-23 | Micross Components | KCB Solutions | Manufacturer of radiofrequency and microwave semiconductor products intended for military, aerospace, and satellite industries. |

| Dec-22 | Aim MRO AE Industrial Partners | Tribologix | Developer of surface engineering chemicals and dry film lubricants intended to reduce friction and wear in extreme environments where conventional lubricants do not work. |

| Nov-22 | AE Industrial Partners | York Space Systems | Developer of small-scale spacecraft platforms designed to transform and enable next-generation space mission operations worldwide. |

| Nov-22 | Safran Group | Syrlinks | Developer of radiocommunication and radio frequency products. |

| Nov-22 | Redwire | QinetiQ Space | Provider of small space systems intended for civil and commercial space customers. |

| Oct-22 | Kongsberg Gruppen | NanoAvionics | Provider of small satellite commercial-grade platform. |

| Oct-22 | Boecore | Ascension Engineering Group | Provider of space system and satellite communications engineering services. |

| Sep-22 | Astrobotic | Masten Space Systems | Developer of space infrastructure designed for sustainable lunar access and utilization. |

| Sep-22 | PCX Aerosystems | NuSpace | Manufacturer of satellite propellant tanks and assemblies. |

| Aug-22 | Slingshot Aerospace | Seradata | Developer of a space research tool offering satellite and launch data, satellite database, and space market analysis system. |

| Aug-22 | Slingshot Aerospace | Numerica (Space Domain Awareness Division) | Developer of software intended to help protect satellites from on-orbit hazards and threats. |

| Jul-22 | TCOM | Aerostar International | Developer of stratospheric surveillance platforms designed to bridge the capability gap between aircraft and satellites. |

| Deal Date | Acquirer/Investor | Target | Target Description |

|---|---|---|---|

| Jun-22 | Yulista | Troy7 | Provider of aerospace engineering services catering to missile defense and space flight missions organizations. |

| May-22 | FCDE | Cobham Microwave | French manufacturer of microwave components and systems for space. |

| May-22 | FCDE | HOSTmi | Developer of a space mobility platform designed to simplify space mission requirements management. |

| May-22 | Emcore | L3Harris (Space and Navigation Business) | Developer of radars, antenna, acousto-optics, commercial imaging payloads, communication systems, satellites, and other space navigation products. |

| Apr-22 | AE Industrial Partners | Firefly Aerospace | Manufacturer of orbital launch vehicles designed to provide economical and convenient access to space. |

| Apr-22 | Airbus Groupo | DSI Datensicherheit | Manufacturer of cryptography and communication systems designed for space, airborne, naval, and ground systems. |

| Apr-22 | Xplore | Kubos | Developer of an open-source space flight software platform. |

| Jan-22 | Breeze Holdings Acquisition | D-Orbit | Developer of a decommissioning device designed to dispose of satellites at the end of their lifespan. |

| Jan-22 | Blue Origin | Honeybee Robotics | Developer and manufacturer of robotic systems intended for space and other extreme environments. |

| Jan-22 | Allianz Group | Intelsat | Operator of integrated satellite and terrestrial network providing communications services for telecommunications operators, media companies, and internet service providers. |

| Jan-22 | Rocket Lab | SolAero Technologies | Manufacturer of solar cells and solar panels for satellite and spacecraft applications. |

| Jan-22 | Paragon | Final Frontier Design | Manufacturer and supplier of spacesuits and ancillary components intended to serve the aerospace industry. |

| Dec-21 | NextGen Acquisition II | Virgin Orbit Holdings | Provider of satellite launch services intended to make space accessible to everyone. |

| Dec-21 | dMY Technology Group IV | Planet Labs | Planet Labs PBC is an earth imaging company. It provides daily satellite data that helps businesses, governments, researchers, and journalists understand the physical world. |

| Dec-21 | J.F. Lehman & Company | Narda-MITEQ | Designer and manufacturer of custom radiofrequency, microwave subsystems, and components. |

| Dec-21 | Inertial Labs | Memsense | Developer of inertial measurement units. |

| Dec-21 | Rocket Lab | Planetary Systems | Developer of mechanical separation systems and satellite dispensers. |

| Nov-21 | Raytheon Technologies | SEAKR Engineering | Developer of high end electronic assemblies designed for space applications. |

| Nov-21 | Beach Point Capital Management | Terran Orbital | Provider of small satellites. |

| Nov-21 | Voyager Space | Space Micro | Manufacturer and designer of communications, electro-optic, and digital systems intended to focus on technology advancement and product implementation for satellite electronics. |

| Nov-21 | Redwire | Techshot | Developer of spaceflight equipment and space bioprinting products. |

| Oct-21 | Edgewater Capital Partners | SemiGen | Manufacturer of radiofrequency / microwave electronic devices. |

| Oct-21 | Rocket Lab | Advanced Solutions | Developer of space software designed to deliver mission simulation, test systems, guidance, navigation, and control solutions. |

| Oct-21 | Voyager Space | Valley Tech Systems | Operator of an aerospace engineering company intended to help solve pressing technology challenges. |

| Sep-21 | Karman Systems | Systima Technologies | Manufacturer of energetic components and integrated systems. |

Sources: Pitchbook, MergerMarket, Company Press Releases, Meridian Research