Aerospace & Defense M&A Trends: Winter 2021

Published April 21, 2021

- Industry Headwinds Force Supply Chain to Face Declining Aircraft Orders and Build Rates

- Well Positioned Commercial Suppliers Poised to Capitalize on Expected Recovery

- Diversification at the Forefront of M&A Strategy

- Active M&A Market for Defense and Space Technologies

The commercial aircraft industry has faced significant challenges over the past two years resulting from the grounding of the 737MAX and the reduction in air traffic demand caused by the COVID-19 pandemic. In response, suppliers are looking to diversify their customer and aircraft platform exposure, as well as expand their capabilities to increase their value proposition to OEMs.

Air travel is expected to recover over the next two to three years providing the opportunity for suppliers with long-term agreements to benefit from the anticipated ramp in build rates. Healthy companies will be well positioned to pursue acquisitions to gain new customers, LTAs, and expand their service offering.

Diversification will become increasingly important for aerospace suppliers. The M&A market is expected to see acquisitions by traditionally commercial focused aerospace suppliers of companies with greater defense exposure as well as companies operating in alternative supply chains including the medical, industrial, life sciences, and semiconductor industries, among others, as they ultimately look outside of A&D altogether.

Defense and space technology has proven to be an attractive segment for M&A for both strategic and financial investors through 2020 and so far in early 2021. Investors have been pursuing acquisitions to gain access to proprietary technologies, expand product portfolios, and further diversify end-market exposure.

Aerospace and Defense Market Insights

Industry Headwinds Force Supply Chain to Face Declining Aircraft Orders and Build Rates

- The commercial aircraft industry has faced significant challenges over the past two years resulting from the grounding of the 737MAX and the reduction in air traffic demand caused by the COVID-19 pandemic.

- Commercial air travel continues to undergo a slow recovery with passenger traffic not expected to return to 2019 levels for an estimated 2-3 years.1

- In particular, the pandemic has significantly dampened the demand for long-haul, international air travel and shorter domestic routes are expected to lead the recovery.

- Consequently, the weakened demand for air travel has directly impacted airline demand for new aircraft and ongoing MRO services creating ripple effects through the commercial aircraft supply chain.

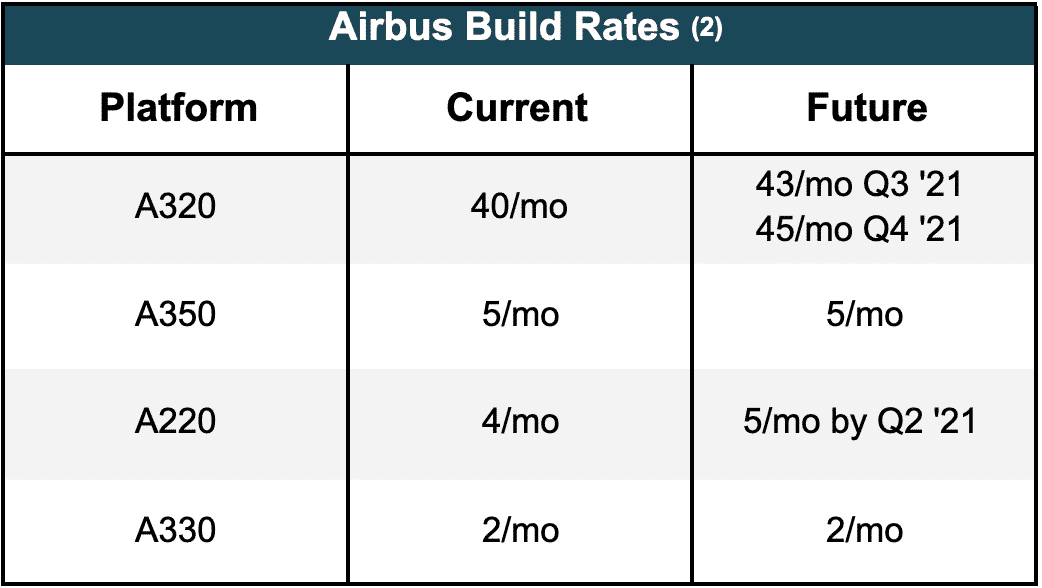

- The impact on demand was demonstrated in OEMs new aircraft orders for 2020, where Airbus and Boeing recorded gross new orders of only 383 and 184 aircrafts, respectively. In comparison, over the past ten years, Airbus and Boeing have averaged ~1,200 and ~1,000 gross new orders per year, respectively.2,3

- In response, suppliers are looking to diversify their customer and aircraft platform exposure, as well as expand their capabilities to increase their value proposition to OEMs.

Well Positioned Commercial Suppliers Poised to Capitalize on Expected Recovery

- As air travel recovers over the coming years, commercial aircraft suppliers with long-term agreements (“LTAs”) can expect to benefit organically from the anticipated ramp in build rates on the 737MAX.

- Suppliers that have weathered the COVID-19 pandemic and 737MAX grounding are expected to benefit on new LTA opportunities as their struggling counterparts may not be able to bid as competitively on new programs and part packages.

- Further, healthy A&D companies are well positioned to pursue acquisitions of companies that have become financially challenged over the past year, presenting opportunities to gain new customers and LTAs as well as expand service offerings and capabilities to increase competitive positioning.

- In efforts to maintain a strong supply chain, Boeing has been selectively offering to extend LTAs but often with a negotiated discount, providing longer-term revenue visibility and access to the anticipated build-rate ramp.

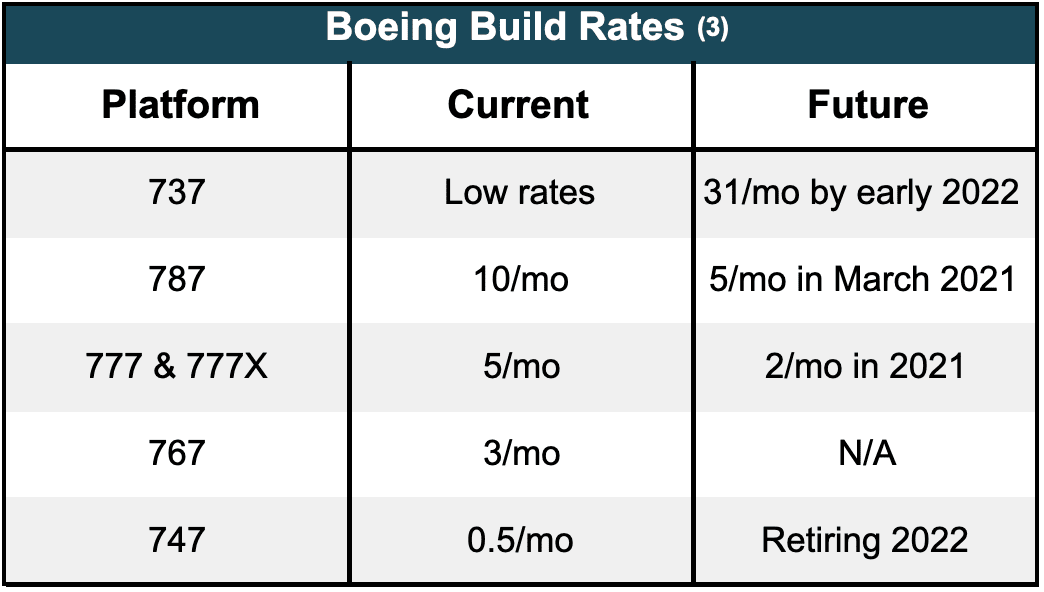

- A bright spot in commercial aerospace was the recertification of the Boeing 737MAX in November, which has led to an uptick in new orders for the aircraft. Production of the 737MAX resumed in May of 2020 at a low production rate with a targeted gradual increase to 31 aircraft per month by the beginning of 2022.3

Commercial Aircraft Build Rate Forecasts

Sources: Pitchbook, company press releases, Meridian research

1) IATA, COVID-19 June Data and Revised Air Travel Outlook

2) Airbus

3) Boeing

Diversification at the Forefront of M&A Strategy

- Diversification has been a key strategy for A&D companies as suppliers seek to lessen their overall exposure to commercial aerospace which has been dramatically impacted by the reduction in air travel resulting from the COVID-19 pandemic.

- The M&A market is expected to see acquisitions by traditionally commercial focused aerospace suppliers of companies with greater defense exposure or ultimately look outside of A&D altogether and acquire companies operating in alternative supply chains including the medical, industrial, life sciences, and semiconductor industries, among others.

- Within the A&D industry, the diversification of OEM customer bases continues to be a focal point for suppliers in order to gain broader platform exposure and decrease customer concentration risk; M&A can provide expedited access to new OEMs by acquiring established relationships and contracts.

- As a recent example of these trends, in October Consolidate Machine & Tool (“CMTH”), a portfolio company of White Wolf Capital, announced the acquisition of Delva Tool & Machine, bringing Delva’s blue-chip customer base in the defense industry to CMTH (further discussed on page 3).

Active M&A Market for Defense and Space Technologies

- Defense and space technology has proven to be an attractive segment for M&A for both strategic and financial investors through 2020 and so far in early 2021. Investors have been pursuing acquisitions to gain access to proprietary technologies, expand product portfolios, and further diversify end-market exposure.

- The defense industry benefited from strong budget growth under the Trump administration and global defense spending is expected to grow 2.8% in 2021,4 providing favorable dynamics for continued M&A activity in the segment.

- Recent acquisitions by major defense OEMs include Raytheon Technologies’ acquisition of the satellite and spacecraft component manufacturer, Blue Canyon Technologies; Lockheed Martin’s acquisition of Aerojet Rocketdyne, a manufacturer of rocket and missile propulsion systems; and Teledyne Technologies’ acquisition of FLIR Systems, a provider of sensory technologies for defense and industrial applications (further discussed on page 3).

- On the financial investor side AE Industrial Partners has been active with its acquisitions of Oakman Aerospace and LoadPath, while KPS Capital Partners acquired AM General.

- Further consolidation is expected through the value chain as companies look to increase their value proposition to customers and create competitive barriers with intellectual property and sole-source positions.

Meridian’s Perspective on M&A Trends

- Expected reduction in valuation multiples for suppliers with substantial OEM or platform concentration. Companies with concentration will see valuation multiples return to the historical norm while well diversified companies will be more strongly valued.

- Consolidation will begin to accelerate in the second half of 2021 as companies seek to best position themselves to benefit from the expected recovery.

- Vertical integration will prove increasingly valuable. Suppliers that can expand their in-house capabilities including processing and assembly, will be viewed as a more valuable supplier by OEMs and a more valuable asset by investors.

- Downside risk on purchase order release rates compared to the forecasted build rates given the level of parked aircraft, excess inventory in supply chain, and ongoing aircraft order demand.

Sources: Pitchbook, company press releases, Meridian research

4) Deloitte 2021 Aerospace and Defense Industry Outlook

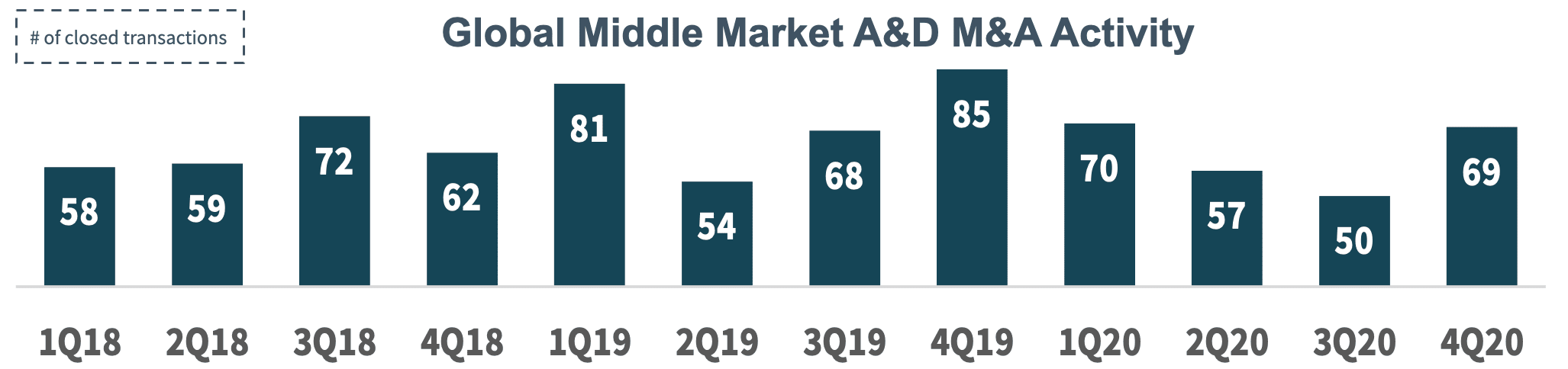

Aerospace & Defense M&A Activity

M&A Activity and Market Trends

Description: Consolidated Machine & Tool Holdings (“CMTH”) has acquired Delva Tool & Machine Corp., a provider of machining, fabrication, and assembly services for the A&D industry.

Rationale: The acquisition of Delva provides CMTH with its blue-chip, defense customer base, expanded manufacturing capabilities, and incremental capacity.

Description: Seattle-based, Jet Parts Engineering (“JPE”) acquired Aerospares, a designer and manufacturer of proprietary aftermarket aircraft components.

Rationale: The acquisition represents JPEs second strategic acquisition and expands JPEs catalogue of Parts Manufacturing Approvals (“PMA”) and portfolio of proprietary component repair services.

Description: Teledyne Technologies has entered into a definitive agreement to acquire Oregon-based FLIR Systems, Inc.

Rationale: The acquisition provides the combined entity with a complementary portfolio of imaging sensor technologies across a broad range of applications and end-markets.

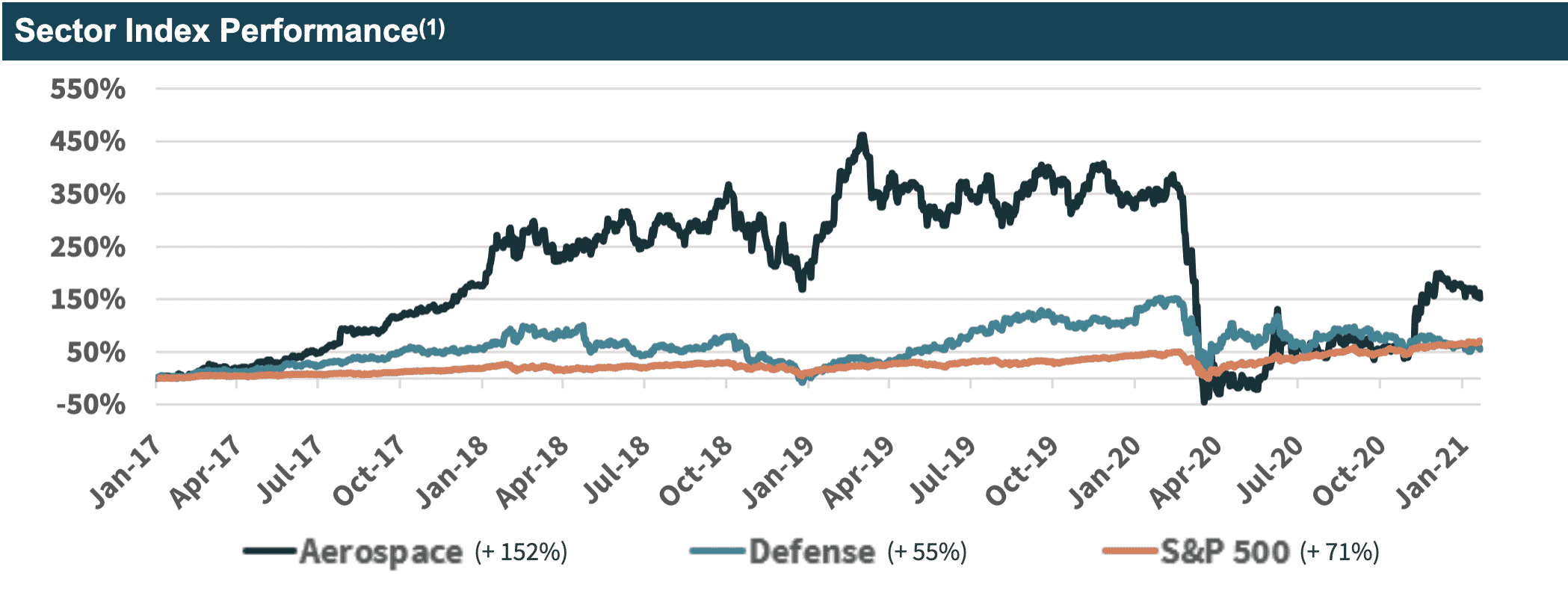

(1) Individual components of Aerospace and Defense Indices can be found on Slide 4.Indices weighted by Market Capitalization.

Source: Pitchbook, Meridian research & company press releases

Publicly-traded Aerospace & Defense Companies

Aerospace

| Company Name | Market Cap | Enterprise Value | LTM Revenue | LTM EBITDA | EV/LTM Revenue | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Boeing Co. | $114,042 | $152,276 | $60,765 | -$4,197 | 2.5x | – | – | -38% |

| Airbus S.A.S. | $78,962 | $84,751 | $60,970 | -$2,021 | 1.4x | – | – | -34% |

| Safran Group SA | $53,282 | $57,639 | $23,981 | $1,934 | 2.4x | 29.8x | 8.1% | -24% |

| TransDigm Group, Inc. | $31,045 | $46,341 | $5,103 | $2,052 | 9.1x | 22.6x | 40.2% | -11% |

| HEICO Corporation | $15,236 | $15,835 | $1,787 | $467 | 8.9x | 33.9x | 26.1% | -5% |

| MTU Aero Engines AG | $12,410 | $13,176 | $4,904 | $916 | 2.7x | 14.4x | 18.7% | -24% |

| Textron Inc. | $10,377 | $11,938 | $12,019 | $841 | 1.0x | 14.2x | 7.0% | -11% |

| Hexcel Corporation | $3,719 | $4,542 | $1,771 | $273 | 2.6x | 16.7x | 15.4% | -40% |

| Spirit AeroSystems Holdings, Inc. | $3,672 | $5,270 | $4,488 | -$421 | 1.2x | – | – | -47% |

| Kaman Corporation | $1,425 | $1,574 | $837 | $31 | 1.9x | 51.3x | 3.7% | -20% |

| Bombardier, Inc. | $1,256 | $12,750 | $14,831 | -$823 | 0.9x | – | – | -57% |

| Empresa Brasileira De Aeronautica S.A. | $1,196 | $3,175 | $4,432 | -$211 | 0.7x | – | – | -62% |

| Triumph Group, Inc. | $618 | $2,199 | $2,375 | -$146 | 0.9x | – | – | -47% |

| Ducommun Inc | $593 | $884 | $658 | $71 | 1.3x | 12.5x | 10.8% | 30 % |

| Senior plc | $541 | $836 | $1,183 | -$69 | 0.7x | – | – | -41% |

| Median | $11,938 | $4,488 | $31 | 1.4x | 19.6x | 13.1% | -34% | |

| Mean | $27,546 | $13,340 | -$87 | 2.5x | 24.4x | 16.2% | -29% |

Source: Pitchbook, As of 2/2/2021

Defense

| Company Name | Market Cap | Enterprise Value | LTM Revenue | LTM EBITDA | EV/LTM Revenue | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Raytheon Technologies Corporation | $101,693 | $127,951 | $83,559 | $8,606 | 1.5x | 14.9x | 10.3% | -30% |

| Lockheed Martin Corporation | $90,762 | $99,794 | $65,398 | $10,116 | 1.5x | 9.9x | 15.5% | -25% |

| Northrop-Grumman Corporation | $48,733 | $59,430 | $36,799 | $5,588 | 1.6x | 10.6x | 15.2% | -19% |

| General Dynamics Corporation | $42,304 | $52,478 | $38,217 | $5,081 | 1.4x | 10.3x | 13.3% | -18% |

| L3 Harris Technologies, Inc. | $36,467 | $42,843 | $18,334 | $2,673 | 2.3x | 16.0x | 14.6% | -22% |

| BAE Systems Plc | $20,703 | $25,336 | $23,685 | $3,110 | 1.1x | 8.1x | 13.1% | -24% |

| Thales SA | $19,251 | $23,910 | $19,865 | $1,641 | 1.2x | 14.6x | 8.3% | -17% |

| Elbit Systems Ltd. | $5,740 | $6,778 | $4,606 | $446 | 1.5x | 15.2x | 9.7% | -15% |

| Kratos Defense & Security Solutions Inc | $3,316 | $3,301 | $726 | $66 | 4.5x | 50.0x | 9.1% | 43 % |

| Moog Inc. | $2,408 | $3,278 | $2,814 | $113 | 1.2x | 29.1x | 4.0% | -19% |

| Median | $42,843 | $23,685 | $3,110 | 1.5x | 14.6x | 13.1% | -19% | |

| Mean | $49,091 | $32,354 | $4,147 | 1.9x | 16.6x | 12.1% | -14% |

Source: Pitchbook, As of 2/2/2021

Shields Manufacturing Acquired by Precinmac Precision Machining

Meridian Capital LLC (“Meridian”), a Seattle-based middle market corporate finance and M&A advisory firm is pleased to announce the successful acquisition of one of its clients, Shields Manufacturing, Inc. (“Shields” or the “Company”) by Precinmac Precision Machining (“Precinmac”), a portfolio company of Pine Island Capital Partners, LLC, Bain Capital Credit, LP, and Compass Partners Capital.

Founded in 1991 and located in Tualatin, Oregon, Shields serves the semiconductor, life sciences and aerospace markets providing precision CNC machined components and complex assemblies. The Company specializes in complex mechanical and optical assemblies with extensive metal and plastic machining capabilities.

Bill and Ruthie Shields, co-owners of Shields, shared, “Meridian acted as a committed and thoughtful advisor throughout the entire transaction, helping Shields and its shareholders reach an outstanding outcome in a challenging environment. We’re excited for Shields to join the Precinmac family with a strong alignment on culture and capabilities that the combination brings to Shields’ customers.”

Eric Wisnefsky CEO of Precinmac said, “We are excited to grow our presence in the West Coast by adding Shields into our highly diversified portfolio. This acquisition is part of a multi-faceted strategy to expand our business through acquisition in all sectors. We are well-positioned to continue our growth trajectory as we strengthen our supply chain and continuously deliver quality parts on-time to our customers in critical industries.”

Brian Murphy, President and Managing Director at Meridian stated, “It was an honor to work with Bill, Ruthie, and the entire Shields team. Over three decades, Shields established itself as one of the leading precision component suppliers to the semiconductor industry. The combination with Precinmac provides Shields with additional capabilities and resources to continue expanding its offerings to current customers and into new markets.”

Notable Transactions: Aerospace

| Announced Date | Acquirer/Investor | Target | Target Description |

|---|---|---|---|

| Jan-21 | AE Industrial Partners, Redwire | Oakman Aerospace | Develops space technologies. |

| Jan-21 | TransDigm Group | Cobham Aerospace Connectivity | Manufactures communication and navigation systems |

| Jan-21 | The Jordan Company | Innoflight | Manufactures cryptographic and avionic systems. |

| Dec-20 | Hanwha Chemical | Cimarron Composites | Manufactures high-pressure hydrogen tanks. |

| Dec-20 | J.F. Lehman & Company | CTS Engines | Provides engine maintenance and repair services. |

| Dec-20 | American Industrial Partners | Orizon Aerostructures | Manufactures subassemblies aviation products. |

| Dec-20 | Abrams Capital Management, Loar Group | Safe Flight Instrument | Manufactures aviation safety and flight performance products. |

| Dec-20 | AerSale | Monocle Acquisition | Blank check company focused on aerospace and defense. |

| Dec-20 | Jet Parts Engineering, Vance Street Capital | AeroSpares | Supplies commercial aerospace parts and engineered repairs. |

| Dec-20 | Precinmac Precision Machining, Pine Island Capital, Bain Capital, Compass Partners Capital | Shields Manufacturing | Manufacturer of precision CNC machined components & assemblies. |

| Dec-20 | Alpine 4 Automotive Technologies | Impossible Aerospace | Manufactures high-performance electric aircrafts. |

| Dec-20 | FLIR Systems | Altavian | Manufactures unmanned aircraft systems. |

| Dec-20 | FL Technics | Wright International Aircraft Maintenance Services | Provides aircraft maintenance services. |

| Nov-20 | Bpifrance, Sabena Technics, Sagard, TowerBrook Capital Partners | Aeromecanic | Provides repair and maintenance services. |

| Oct-20 | ACE Management | Aries Alliance | Manufactures aircraft and auxiliary parts. |

| Oct-20 | DCM | Electro-Kut | Manufactures components and alloy materials. |

| Oct-20 | Honeywell | Ballard Unmanned Systems | Provides unmanned vehicle fuel cell solutions. |

| Oct-20 | AE Industrial Partners, Broadtree Partners | Seanair Machine | Manufactures precision machined parts. |

| Oct-20 | Honeywell | Rocky Research | Manufactures thermal management products. |

| Oct-20 | Inflexion Private Equity Partners, Shimtech Industries | California Screw Products | Manufactures high-strength fasteners. |

| Oct-20 | Consolidated Machine & Tool Holdings, White Wolf Capital | Delva Tool and Machine | Provides engineering and assembly services. |

| Sep-20 | Inflexion Private Equity Partners, Shimtech Industries | Fastener Innovation Technology | Manufactures and designs threaded fasteners. |

| Sep-20 | AEVEX Aerospace, CoVant, Madison Dearborn Partners | Geodetics | Provides navigation and artificial intelligence technologies. |

| Sep-20 | Applied Composites Engineering | Alliance Spacesystems | Manufactures and designs composite structures. |

| Aug-20 | Main Street Capital Holdings, Quality Products & Machine | Gray Manufacturing Technologies | Manufactures machined products. |

| Aug-20 | Berks Group | IDC Precision | Manufactures precision component parts. |

| Aug-20 | Consolidated Machine & Tool Holdings, White Wolf Capital | Specialty CNC | Provides contract machining and assembly services. |

| Aug-20 | Arlington Capital Partners | Triumph Group | Provides engine composite fabrications. |

| Jul-20 | CORE Industrial Partners | Incodema3D | Provides metal 3D printing services. |

| Jul-20 | Arch Global Precision, The Jordan Company | Cling’s Aerospace | Manufactures axis precision machined parts. |

| Jun-20 | Gardner Standard | Shadin | Manufactures and designs aviation equipment and parts. |

| Jun-20 | Mitsubishi Heavy Industries | Bombardier | Operates regional jet program. |

| Jun-20 | AE Industrial Partners, Redwire | Deep Space Systems | Develops engineering solutions. |

| May-20 | Gallant Capital | Aerostar Group | Manufactures precision machined components. |

| Mar-20 | HAECO | Jet Engine Solutions | Provides engine maintenance and repair services. |

| Mar-20 | AE Industrial Partners | Redwire | Develops small satellite and cubesat components. |

Notable Transactions: Defense

| Announced Date | Acquirer/Investor | Target | Target Description |

|---|---|---|---|

| Jan-21 | HarbourVest Partners, Hermetic Solutions Group | Cristek | Manufactures specialty connector products. |

| Jan-21 | Teledyne Technologies | FLIR Systems | Designs and develops detection technology. |

| Dec-20 | Commerce West Bank | Pacific Consolidated Industries | Manufactures gaseous and cryogenic oxygen and nitrogen generators. |

| Dec-20 | Elbit Systems | Sparton | Manufactures electromechanical devices. |

| Dec-20 | Lockheed Martin | Aerojet Rocketdyne Holdings | Manufactures launch systems and space applications. |

| Dec-20 | Raytheon Technologies | Blue Canyon Technologies | Manufactures spacecraft and components. |

| Dec-20 | Moog | Genesys Aerosystems | Provides military autopilot systems and components. |

| Dec-20 | Charger Investment Partners | Advanced Composite Products and Technology | Manufactures engineered composite structures. |

| Dec-20 | AE Industrial Partners, Redwire | LoadPath | Designs and develops deployable structures and thermal products. |

| Nov-20 | Lockheed Martin | i3 | Develops hypersopnic missiles. |

| Nov-20 | Kratos Defense & Security Solutions | 5-D Systems | Provides military and engineering services. |

| Oct-20 | Ironwood Capital | Micro Precision Group | Manufactures maritime components for submarines. |

| Oct-20 | AE Industrial Partners, Redwire | Roccor | Designs and manufactres military deployable structures. |

| Oct-20 | General Atomics | Guidestar Optical Systems | Provides optical and imaging solutions. |

| Oct-20 | KPS Capital Partners | AM General | Manufactures light tactical vehicles for defense. |

| Sep-20 | DC Capital Partners | Digital Force Technologies | Manufactures engineering and development products for special operations forces. |

| Aug-20 | CACI International | Ascent Vision Technologies | Develops imging systems and software. |

| Jul-20 | BAE Systems | Collins Aerospace | Provides military global positioning systems. |

| May-20 | Leidos | L3Harris | Provides airport security and automation services. |

| May-20 | BAE Systems | Raytheon | Manufactures airborne tactical radios. |

| Apr-20 | Saab | Atmos Sistemas | Manufactures radar and defense equipment. |

| Apr-20 | Elbit Systems | Ashot Ashkelon | Produces heavy metal products and combat vehicle systems. |

Meridian Capital Sector Coverage

- Aerostructure & Interior Components

- Automation, Tooling & Engineering

- Defense Technology

- Ground Support Equipment

- MRO Services & Components

- Precision Machining, Fabrication & Sub-Assemblies

- Security Solutions & Services

- UAVs