Aerospace & Defense M&A Trends: Summer 2021

Published July 14, 2021

Key Insights

- Growing Defense Budget Provides Industry Tailwinds

- Defense M&A Remains Strong Driven by Investments in Technology

- Corporate Divestitures Offer Investors Attractive Acquisition Assets and Sellers with Liquidity

- Increasing Use of Advanced Manufacturing Technologies Across the Defense Supply Chain

- Strong SPAC Interest in Innovative Technologies Surrounding the A&D Industry

The defense market has proven resilient and weathered the disruptions caused by the COVID-19 pandemic, largely driven by the U.S. government’s continued execution and funding of military programs.

Transactions in the Command, Control, Communications, Computers, Intelligence, Surveillance and Reconnaissance (“C4ISR”) are expected to increase as firms seek further access into the enabling technology markets in military air, land, sea and space platforms following the Department of Defense’s first enterprise data strategy.

Following the consolidation experienced in the defense industry in recent years, 2021 has seen several major strategic players divest business divisions in order to reshape their portfolios and focus on their respective core business strategies. These divested assets have created attractive assets for both private equity platform investments and strategics’ portfolio expansion.

The defense industry is well positioned to benefit from advancements in additive manufacturing and advanced materials as participants continue to seek light-weight, stronger materials. Additive manufacturing and advanced materials has been an active space for start-ups and early-stage companies seeking to disrupt the manufacturing supply chain with new technology.

Sectors operating tangential to defense, providing innovative technologies with defense applications have drawn strong interest from Special Purpose Acquisition Companies (“SPACs”) including the space, satellites, and additive manufacturing sectors over the past several months.

Defense Market Insights

Growing Defense Budget Provides Industry Tailwinds

- The defense market has proven resilient and weathered the disruptions caused by the COVID-19 pandemic, largely driven by the U.S. government’s continued execution and funding of military programs.

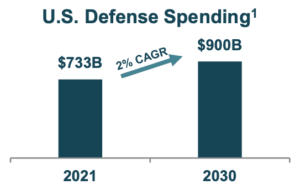

- The White House announced that its Fiscal Year 2022 budget will seek $753B for national defense, a 1.7% increase over the FY 2021 enacted budget, that includes $715B for the Defense Department. With an expected defense spend of $733B in 2021, U.S. defense spending is forecasted to grow at a CAGR of 2% from 2021 – 2030 and reach $900B.

- Global defense markets are expected to trend in line with the U.S. as most countries have not significantly reduced defense budgets and remain committed to sustaining military capabilities.

- Key spending areas include (1) planned procurement of advanced military equipment to replace aging equipment currently in service; (2) increasing investments in the development of advanced technologies like additive manufacturing; and (3) AI integration for C4ISR applications and improved lethality of weapon stations.

1. Mordor Intelligence – U.S. Defense Market

2. 3D Printing Industry

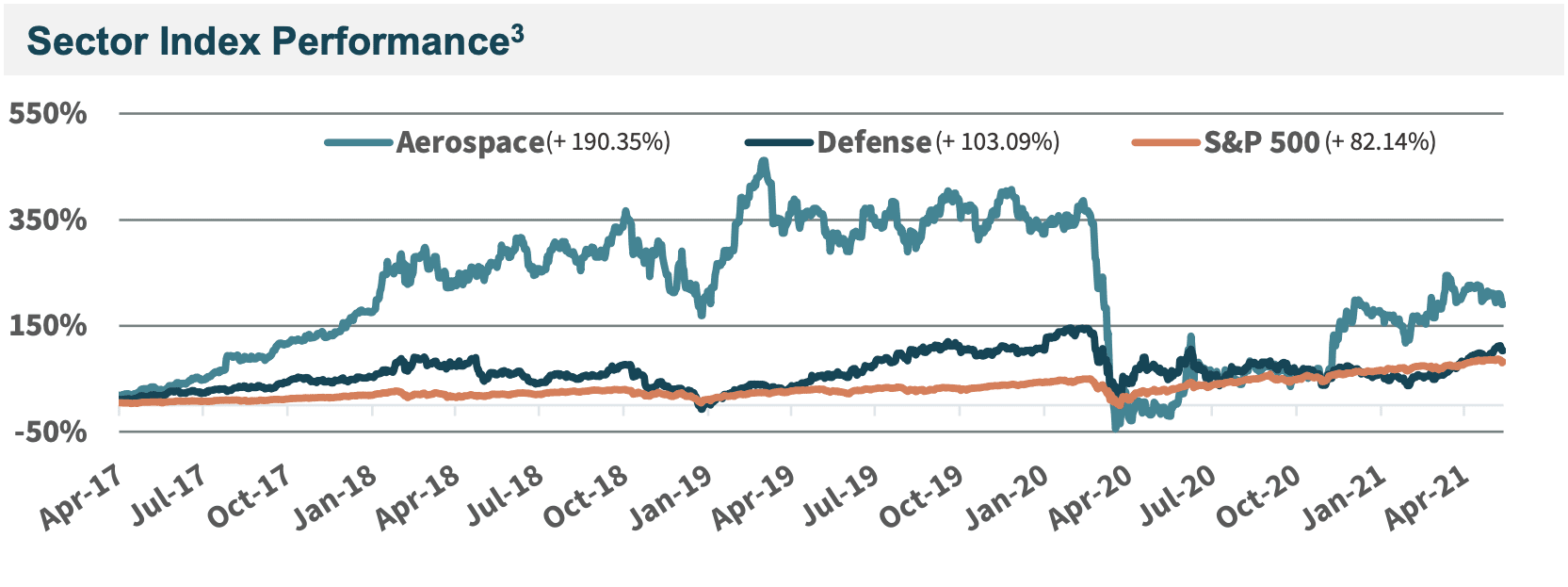

3. Individual components of Aerospace and Defense Indices can be found on page 5. Indices weighted by Market Capitalization.

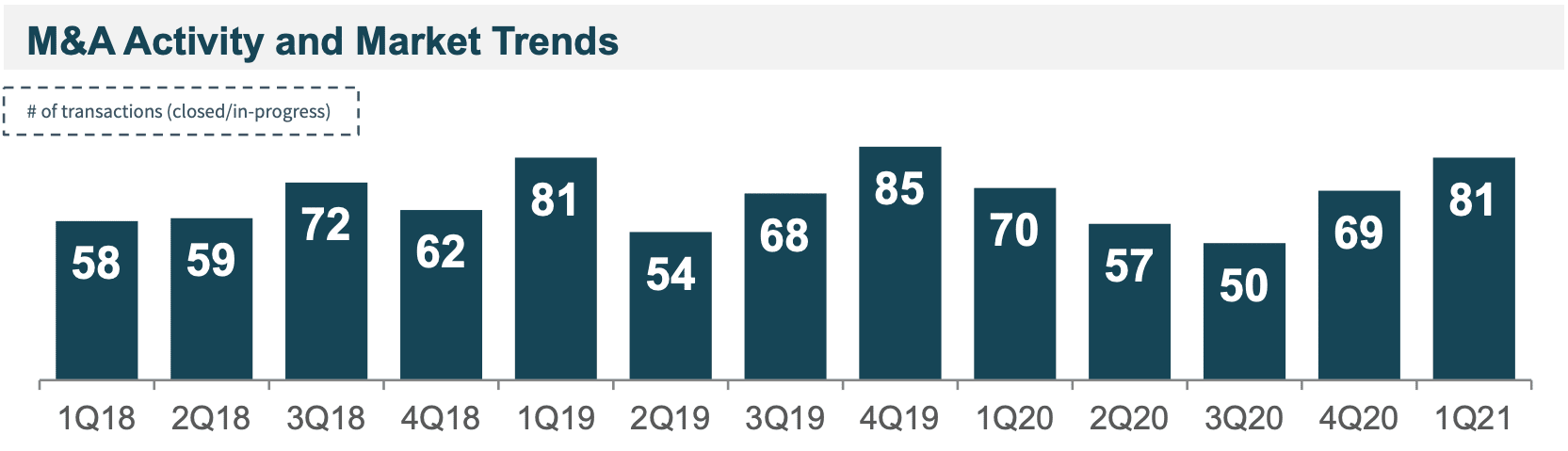

Defense M&A Remains Strong Driven by Investments in Technology

- M&A in the defense industry has remained relatively active through 2020 and has been notably more active since last November’s presidential election. Through Q1 2021, the total value of deals announced for defense transactions in excess of $100M exceeded 2020’s total figure of $13.3B, led by Veritas Capital’s $3B acquisition of Cubic.

- Access to new and advanced technologies continues to be a driving force for defense M&A activity. Transactions in the Command, Control, Communications, Computers, Intelligence, Surveillance and Reconnaissance (“C4ISR”) are expected to increase as firms seek further access into the enabling technology markets in military air, land, sea and space platforms following the Department of Defense’s first enterprise data strategy. The strategy declares seven goals around digital modernization aimed at transforming the Pentagon into a data-centric organization.

- Government services, space technologies, and cybersecurity have also attracted strong investment interest from both financial and strategic investors. As a recent example, in May, Noblis acquired McKean Defense and its affiliates Mikros Systems and Cabrillo Technologies, further expanding Noblis’ scale and capabilities of their Defense Mission offering.

- Access to proprietary technology and intellectual property is expected to continue to drive M&A activity across these segments.

Corporate Divestitures Offer Investors Attractive Acquisition Assets and Sellers with Liquidity

- Following the consolidation experienced in the defense industry in recent years, 2021 has seen several major strategic players divest business divisions in order to reshape their portfolios and focus on their respective core business strategies. These divested assets have created attractive assets for both private equity platform investments and strategics’ portfolio expansion.

- Effective May 7, 2021, Triumph Group announced the sale of its composites business and three aerostructure fabrication facilities to Arlington Capital Partners. Arlington Capital will form a new company, Qarbon Aerospace, and fabricate structural and engine components and assemblies for both commercial aircraft and military uses.

- L3Harris Technologies has signed definitive agreements to sell its Combat Propulsion Systems business to RENK AG and its Military Training business to CAE for a combined $1.45B. Additionally, Northrop Grumman divested its IT Services Business to Peraton, an affiliate of Veritas Capital for $3.4B.

- Divestitures will provide industry strategics with incremental cash on the balance sheet to focus on R&D initiatives, balance sheet restructuring, and pursue new M&A opportunities that are more aligned with their core business focus.

Increasing use of Advanced Manufacturing Technologies Across the Defense Supply Chain

- The defense industry is well positioned to benefit from advancements in additive manufacturing and advanced materials as participants continue to seek light-weight, stronger materials. Further, the rapid production capabilities can significantly improve product lead times and reduce supply chain costs.

- In January, the U.S. Department of Defense released an additive manufacturing strategy which seeks to pave the way for the use of additive manufacturing within the Nation’s defense program, highlighting the importance of incorporating these technologies into practice. Advanced manufacturing is already being deployed on several initiatives and used in the production of spare parts throughout the U.S. military.2

- Tier 1 defense suppliers are increasing their focus on advanced manufacturing to develop the technology and expertise to better and more competitively serve the needs of their defense customer base. Lockheed Martin and Northrop Grumman, among others, have been focusing on developing these technologies in-house.

- Additive manufacturing and advanced materials has also been an active space for start-ups and early-stage companies seeking to disrupt the manufacturing supply chain with new technology. These emerging market entrants may serve as attractive acquisition candidates for Tier 1’s looking to gain a competitive advantage.

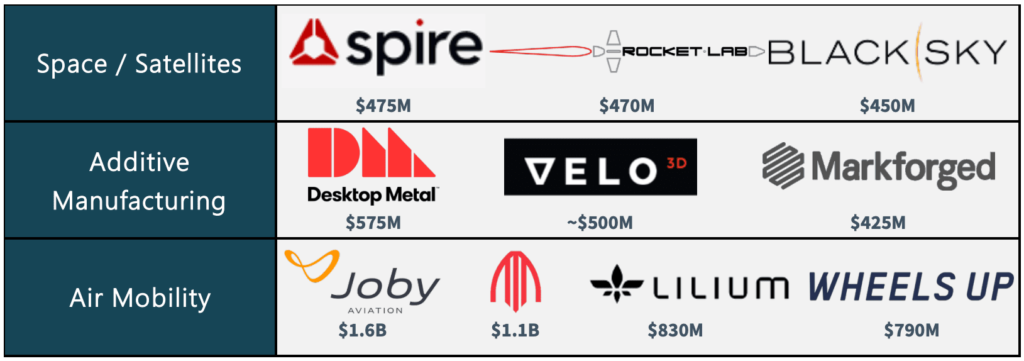

Strong SPAC Interest in Innovative Technologies Surrounding the A&D Industry

- Sectors operating tangential to defense, providing innovative technologies with defense applications have drawn strong interest from Special Purpose Acquisition Companies (“SPACs”) including the space, satellites, and additive manufacturing sectors. The Air Mobility sector has also attracted significant SPAC investments with a mix of both commercial and defense aerospace applications.

- Recent SPAC transactions include:

- Post-SPAC transaction, companies are well capitalized to aggressively pursue both organic and inorganic growth opportunities. Given the strong valuations at which the initial transactions occur, accelerating growth will be a key focus area.

- Follow-on acquisitions are common strategies in SPAC mandates and can be a means to quickly fuel growth for the company. As a result, this creates a new and active investor universe for both earlier stage and well-established companies.

Aerospace & Defense M&A Activity

Recent Transaction Spotlights

Description: Essex Industries has acquired Stevens Manufacturing, a provider of precision machined OEM parts and sub-assemblies to aerospace and defense companies primarily supporting the rotorcraft market.

Rationale: The acquisition supports Essex’ business strategy of continued expansion of its aerospace and defense product portfolio.

Description: Enjet Aero has acquired Birken Manufacturing via its financial sponsor VantEdge Partners. Birken Manufacturing is a supplier of complex aeroengine components.

Rationale: The acquisition of Birken reinforces Enjet’s commitment to expanding its breadth of manufacturing capabilities and customer reach.

Description: Anduril has acquired Area-I, a developer of unmanned aircraft systems for national security.

Rationale: The acquisition expands Anduril’s portfolio of unmanned aerial systems, creating new opportunities for its software defined capabilities such as mission autonomy and intelligent teaming.

Publicly-traded Aerospace & Defense Companies

Aerospace

| Company Name | Market Cap | Enterprise Value | LTM Revenue | LTM EBITDA | EV/LTM Revenue | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Boeing Co. | $149,489 | $191,361 | $56,467 | ($7,980) | 3.4x | – | – | 39 % |

| Airbus S.A.S. | $106,240 | $104,761 | $57,950 | $2,922 | 1.8x | 35.9x | 5.0% | 67 % |

| Safran Group SA | $65,472 | $69,833 | $18,958 | $2,822 | 3.7x | 24.7x | 14.9% | 39 % |

| TransDigm Group, Inc. | $36,201 | $52,164 | $4,496 | $1,915 | 11.6x | 27.2x | 42.6% | 37 % |

| HEICO Corporation | $18,558 | $19,013 | $1,697 | $437 | 11.2x | 43.5x | 25.7% | 29 % |

| Textron Inc. | $15,472 | $17,487 | $11,753 | $1,173 | 1.5x | 14.9x | 10.0% | 85 % |

| MTU Aero Engines AG | $13,904 | $14,787 | $4,533 | $593 | 3.3x | 24.9x | 13.1% | 37 % |

| Spirit AeroSystems Holdings, Inc. | $5,426 | $7,705 | $3,228 | ($382) | 2.4x | – | – | 65 % |

| Hexcel Corporation | $5,017 | $5,847 | $1,272 | $88 | 4.6x | 66.4x | 6.9% | 34 % |

| Kaman Corporation | $1,536 | $1,614 | $749 | $94 | 2.2x | 17.2x | 12.5% | 26 % |

| Triumph Group, Inc. | $1,297 | $2,703 | $1,870 | $109 | 1.4x | 24.7x | 5.9% | 107 % |

| Senior plc | $920 | $1,201 | $940 | $77 | 1.3x | 15.5x | 8.2% | 92 % |

| Ducommun Inc | $639 | $951 | $613 | $86 | 1.6x | 11.1x | 14.0% | 43 % |

| Median | $14,787 | $3,228 | $109 | 2.4x | 24.7x | 12.5% | 39 % | |

| Mean | $37,648 | $12,656 | $150 | 3.8x | 27.8x | 14.4% | 54 % |

Defense

| Company Name | Market Cap | Enterprise Value | LTM Revenue | LTM EBITDA | EV/LTM Revenue | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Raytheon Technologies Corporation | $134,282 | $160,425 | $60,478 | $7,139 | 2.7x | 22.5x | 11.8% | 31 % |

| Lockheed Martin Corporation | $107,030 | $116,281 | $66,005 | $10,586 | 1.8x | 11.0x | 16.0% | (5)% |

| Northrop-Grumman Corporation | $59,107 | $69,750 | $37,336 | $5,688 | 1.9x | 12.3x | 15.2% | 9 % |

| General Dynamics Corporation | $54,129 | $66,808 | $38,565 | $4,431 | 1.7x | 15.1x | 11.5% | 22 % |

| L3 Harris Technologies, Inc. | $44,834 | $51,790 | $18,135 | $3,538 | 2.9x | 14.6x | 19.5% | 10 % |

| BAE Systems Plc | $24,259 | $30,118 | $24,711 | $3,488 | 1.2x | 8.6x | 14.1% | 17 % |

| Thales SA | $21,961 | $25,392 | $19,366 | $2,424 | 1.3x | 10.5x | 12.5% | 22 % |

| Elbit Systems Ltd. | $5,755 | $6,791 | $4,710 | $433 | 1.4x | 15.7x | 9.2% | (13)% |

| Kratos Defense & Security Solutions Inc | $3,147 | $3,124 | $773 | $80 | 4.0x | 38.9x | 10.4% | 34 % |

| Moog Inc. | $2,921 | $3,799 | $2,785 | $168 | 1.4x | 22.6x | 6.0% | 45 % |

| Median | $40,954 | $22,038 | $3,513 | 1.7x | 14.9x | 12.2% | 19 % | |

| Mean | $53,428 | $27,286 | $3,797 | 2.0x | 17.2x | 12.6% | 17 % |

Pacific Consolidated Industries Recapitalized by TJM Capital Partners

In March 2021, Meridian Capital completed the successful recapitalization of Pacific Consolidated Industries, LLC (“PCI” or the “Company”), a portfolio Company of Main Street Capital Corporation (NYSE: MAIN), by TJM Capital Partners (“TJM”).

Founded in 1984 and based in Riverside, California, PCI is a leading provider of deployable, onsite, liquid and gaseous oxygen and nitrogen generating systems. PCI’s products serve applications where it is inefficient to utilize distributed industrial gases including aerospace and defense, medical, water and wastewater treatment, oil & gas, and general industrial end-markets.

Bob Eng, CEO of PCI shared “On behalf of PCI Gases, we’re very excited to partner with TJM’s partners and investors to drive further growth on a broader scale by expanding our market reach and value-added offerings and solutions to new and existing customers, particularly in the medical and industrial oxygen markets.”

Shields Manufacturing Acquired by Precinmac Precision Machining

In December 2020, Meridian Capital announced the successful acquisition of Shields Manufacturing, Inc. (“Shields” or the “Company”) by Precinmac Precision Machining (“Precinmac”), a portfolio company of Pine Island Capital Partners, LLC, Bain Capital Credit, LP, and Compass Partners Capital.

Founded in 1991 and located in Tualatin, Oregon, Shields serves the semiconductor, life sciences, and aerospace markets providing precision CNC machined components and complex assemblies. The Company specializes in complex mechanical and optical assemblies with extensive metal and plastic machining capabilities.

Bill and Ruthie Shields, co-owners of Shields, shared, “Meridian acted as a committed and thoughtful advisor throughout the entire transaction, helping Shields and its shareholders reach an outstanding outcome in a challenging environment. We’re excited for Shields to join the Precinmac family with a strong alignment on culture and capabilities that the combination brings to Shields’ customers.”

Notable Transactions: Defense

| Announced Date | Acquirer/Investor | Target | Target Description |

|---|---|---|---|

| May-21 | Red Cat Holdings | Skypersonic | Manufacturer of drones. |

| May-21 | Brightstar Capital Partners | Engineering Research and Consulting | Provider of engineering and consulting services. |

| May-21 | Ott Ventures | Sting Industries | Developer of modular drones. |

| May-21 | Arlington Capital Partners | Qarbon Aerospace | Provider of aerospace services. |

| May-21 | AeroVironment | Telerob | Manufacturer of remote-controlled robots. |

| May-21 | Enjet Aero | Birken Manufacturing | Manufacturer of engine assemblies/components. |

| May-21 | Noblis | McKean Defense | Provider of naval sustainment and logistics services. |

| Apr-21 | AMETEK | Abaco Systems | Provider of open architecture electronic systems. |

| Apr-21 | BDT Capital Partners | American Glass Products | Manufacturer and designer of glazing products. |

| Apr-21 | Elbit Systems | Elisra | Manufacturer of high-tech electronic devices. |

| Apr-21 | Elbit Systems | Sparton | Manufacturer of electromechanical devices. |

| Apr-21 | Nikon | Morf3D | Provider of additive manufacturing services. |

| Apr-21 | Elbit Systems | BAE Systems Rokar International | Developer of defense products. |

| Apr-21 | Panta Holdings | Fokker Services | Provider of aircraft maintenance services. |

| Apr-21 | Anduril | Area-I | Designer and developer of unmanned aircraft systems. |

| Mar-21 | Prudent American Technologies | CAM Military | Manufacturer of military equipment. |

| Mar-21 | J.F. Lehman & Company | Trillium Engineering | Manufacturer of engineered camera gimbals. |

| Mar-21 | TJM Capital Partners | Pacific Consolidated Industries | Manufacturer of ruggedized onsite liquid, gaseous oxygen, and nitrogen generators. |

| Mar-21 | Waterland Private Equity Investments | Celestia Technologies Group | Provider of technology products, systems and services. |

| Mar-21 | BlackSoil | ideaForge | Developer of aerial vehicles and drones. |

| Mar-21 | OpenGate Capital | TREALITY Simulation Visual Systems | Manufacturer and seller of aerospace/defense products. |

| Mar-21 | VSE | HAECO Special Services | Provider of fully integrated MRO support solutions. |

| Mar-21 | General Atomics Europe | Ruag Aerospace Services | Provider of maintenance services. |

| Mar-21 | CAE | L3Harris Technologies | Provider of defense training and simulation technology. |

| Mar-21 | ComSovereign | Sky Sapience | Developer of fielded tethered aerial rotorcraft platforms. |

| Mar-21 | Renk | L3Harris Technologies | Manufacturer of motors and generators. |

| Feb-21 | AE Industrial Partners | Deployable Space Systems | Manufacturer of deployable space systems. |

| Feb-21 | AeroVironment | Arcturus UAV | Manufacturer/integrator of unmanned aerial systems. |

| Feb-21 | FDS Avionics | Calculex | Manufacturer of data recording and routing systems. |

| Feb-21 | Essex Industries | Stevens Manufacturing Company | Manufacturer of precision machined OEM parts. |

| Feb-21 | Infosys | ideaForge | Developer of aerial vehicles and drones. |

| Feb-21 | QuantiTech | Millennium Engineering and Integration | Provider of engineering services. |

| Feb-21 | Aeronautics | Magal Security Systems | Provider of security solutions. |

| Feb-21 | Peraton, Veritas Capital | Northrop Grumman (Federal IT Business) | Provider of federal IT and mission support services. |

| Jan-21 | HarbourVest Partners, Hermetic Solutions Group | Cristek | Manufactures specialty connector products. |

| Jan-21 | Teledyne Technologies | FLIR Systems | Designs and develops detection technology. |

| Dec-20 | Commerce West Bank (Debt Financing & Growth Capital) | Pacific Consolidated Industries | Manufacturer of ruggedized onsite liquid, gaseous oxygen, and nitrogen generators. |

| Dec-20 | Lockheed Martin | Aerojet Rocketdyne Holdings | Manufactures launch systems and space applications. |

| Dec-20 | Raytheon Technologies | Blue Canyon Technologies | Manufactures spacecraft and components. |

| Dec-20 | Moog | Genesys Aerosystems | Provides military autopilot systems and components. |

| Dec-20 | Charger Investment Partners | Advanced Composite Products and Technology | Manufactures engineered composite structures. |

| Dec-20 | AE Industrial Partners, Redwire | LoadPath | Develops deployable structures and thermal products. |

| Nov-20 | Lockheed Martin | i3 | Develops hypersonic missiles. |

| Nov-20 | Kratos Defense & Security Solutions | 5-D Systems | Provides military and engineering services. |

Notable Transactions: Aerospace

| Date | Acquirer/Investor | Target | Target Description |

|---|---|---|---|

| May-21 | Arlington Capital Partners | Qarbon Aerospace | Provider of aerospace services. |

| May-21 | Experience Investment | Blade Urban Air Mobility | Operator of a digitally powered aviation company. |

| Apr-21 | J&E Precision Tool | Alloy Specialties | Manufacturer of engine components. |

| Apr-21 | Spirit AeroSystems Holdings | Applied Aerodynamics | Provider of aircraft maintenance services. |

| Apr-21 | Greenbriar Equity Group | PCX Aerostructures | Manufacturer of large structural airframe assemblies. |

| Apr-21 | Kepler Capital, Warburg Pincus | Aquila Air Capital | Operator of a commercial aerospace company. |

| Apr-21 | Searchlight Capital Partners | Technical Airborne Components Industries | Designer and manufacturer of rods and struts. |

| Apr-21 | Panta Holdings | Fokker Services | Provider of aircraft maintenance services. |

| Mar-21 | Qell Acquisition | Lilium | Developer of electric jets. |

| Mar-21 | Waterland Private Equity Investments | Celestia Technologies Group | Provider of technology products, systems, and services. |

| Mar-21 | Jaws Spitfire Acquisition | Velo3D | Developer of metal laser sintering printing machines. |

| Mar-21 | Insight Equity | Altron | Provider of contract electronics manufacturing services. |

| Mar-21 | 24/6 Capital Partners | Senior Aerospace Connecticut | Manufacturer of precision metallic parts. |

| Mar-21 | China Science & Merchants Investment Management | Hanfei Aviation Technology | Provider of a drone and civil aviation technology service. |

| Mar-21 | OpenGate Capital | TREALITY Simulation Visual Systems | Manufacturer of aerospace and defense products. |

| Mar-21 | Vector Acquisition II | Rocket Lab | Manufacturer of commercial rocket launchers. |

| Mar-21 | Tower Arch Capital | LifePort | Designer and manufacturer of cabin components. |

| Mar-21 | NavSight Holdings | Spire | Provider of satellite-powered data and analytics solutions. |

| Feb-21 | One | MarkForged | Provider of industrial 3D printing services. |

| Feb-21 | Vance Street Capital | FDS Avionics | Manufacturer of aircraft electronic systems. |

| Feb-21 | Osprey Technology | BlackSky | Provider of real-time geospatial intelligence services. |

| Feb-21 | StandardAero | Signature Aviation | Provider of engine repair and overhaul services. |

| Feb-21 | Atlas Crest Investment | Archer Aviation | Manufacturer of renewable aircraft. |

| Feb-21 | Karman Systems, Trive Capital | AAE Aerospace | Developer of fabrication devices for the aerospace industry. |

| Feb-21 | Global Emerging Markets | Skyworks Aeronautics | Developer of aerospace technologies. |

| Feb-21 | Directional Aviation Capital, OneSky Flight | Associated Aircraft Group | Provider of helicopter charter and maintenance services. |

| Feb-21 | N/A | Kaman Composites – UK Holdings | Manufacturer of aviation tools. |

| Feb-21 | General Atomics | Tiger Innovations | Developer of spacecraft and space-related systems. |

| Feb-21 | Eaton | Sargent Fletcher | Manufacturer and supplier of aircraft equipment and parts. |

| Jan-21 | Aspirational Consumer Lifestyle | Wheels Up | Operator of a membership-based aviation company. |

| Jan-21 | Reinvent Technology Partners | Joby Aviation | Developer of vertical electric aircraft. |

| Jan-21 | AE Industrial Partners, Redwire | Oakman Aerospace | Develops space technologies. |

| Jan-21 | TransDigm Group | Cobham Aerospace Connectivity | Manufactures communication and navigation systems. |

| Jan-21 | The Jordan Company | Innoflight | Manufactures cryptographic and avionic systems. |

| Dec-20 | Hanwha Chemical | Cimarron Composites | Manufactures high-pressure hydrogen tanks. |

| Dec-20 | J.F. Lehman & Company | CTS Engines | Provides engine maintenance and repair services. |

| Dec-20 | American Industrial Partners | Orizon Aerostructures | Manufactures subassemblies aviation products. |

| Dec-20 | Abrams Capital Management, Loar Group | Safe Flight Instrument | Manufactures flight safety and performance products. |

| Dec-20 | Precinmac Precision Machining | Shields Manufacturing | Manufacturer of CNC machined components/assemblies. |

| Dec-20 | AerSale | Monocle Acquisition | Supplier of aftermarket aircraft, spare engines, flight equipment, and maintenance services. |

| Dec-20 | Jet Parts Engineering, Vance Street Capital | AeroSpares | Supplies commercial aerospace parts. |

| Dec-20 | Alpine 4 Automotive Technologies | Impossible Aerospace | Manufactures high-performance electric aircrafts. |

| Dec-20 | FLIR Systems | Altavian | Manufactures unmanned aircraft systems. |

Meridian Capital Sector Coverage

- Aerostructure & Interior Components

- Automation, Tooling & Engineering

- Defense Technology

- Ground Support Equipment

- MRO Services & Components

- Precision Machining, Fabrication & Sub-Assemblies

- Security Solutions & Services

- UAVs