Aerospace & Defense M&A Trends: Summer 2020

Published August 25, 2020

Meridian Capital is pleased to share with you our Summer 2020 Aerospace & Defense M&A Update. The Summer 2020 edition spotlights the commercial and defense segments of the UAV and Drone industry, and specifically covers M&A and venture capital deals, trends, and public company valuations within the industry. A few of the takeaways from our newsletter are included below.

- M&A activity has decreased 12.5% from Q1 to Q2 2020; Meridian expects M&A to pick up in the coming quarters due to:

- Growing adoption of UAV use cases within the commercial market

- Many A&D focused investors are shifting focus away from commercial aviation to UAV / drone opportunities

- Venture capital investors seeking to realize their investments

- As overall drone M&A heats up, demand for drone components and related technologies such as sensors, cameras, AI, transmitters, and avionics are expected to increase

- Early stage private equity and venture capital remains active, nearly doubling from Q1 to Q2 2020 as companies seek cash infusions to weather the pandemic

- Global spending on drones is expected to be driven largely by defense spending, with R&D and procurement spending expected to rise from $11.1B in 2020 to $14.3B by 2029

We welcome the opportunity to discuss Aerospace & Defense trends and what we are seeing in the market.

UAV and Drone Market Insights

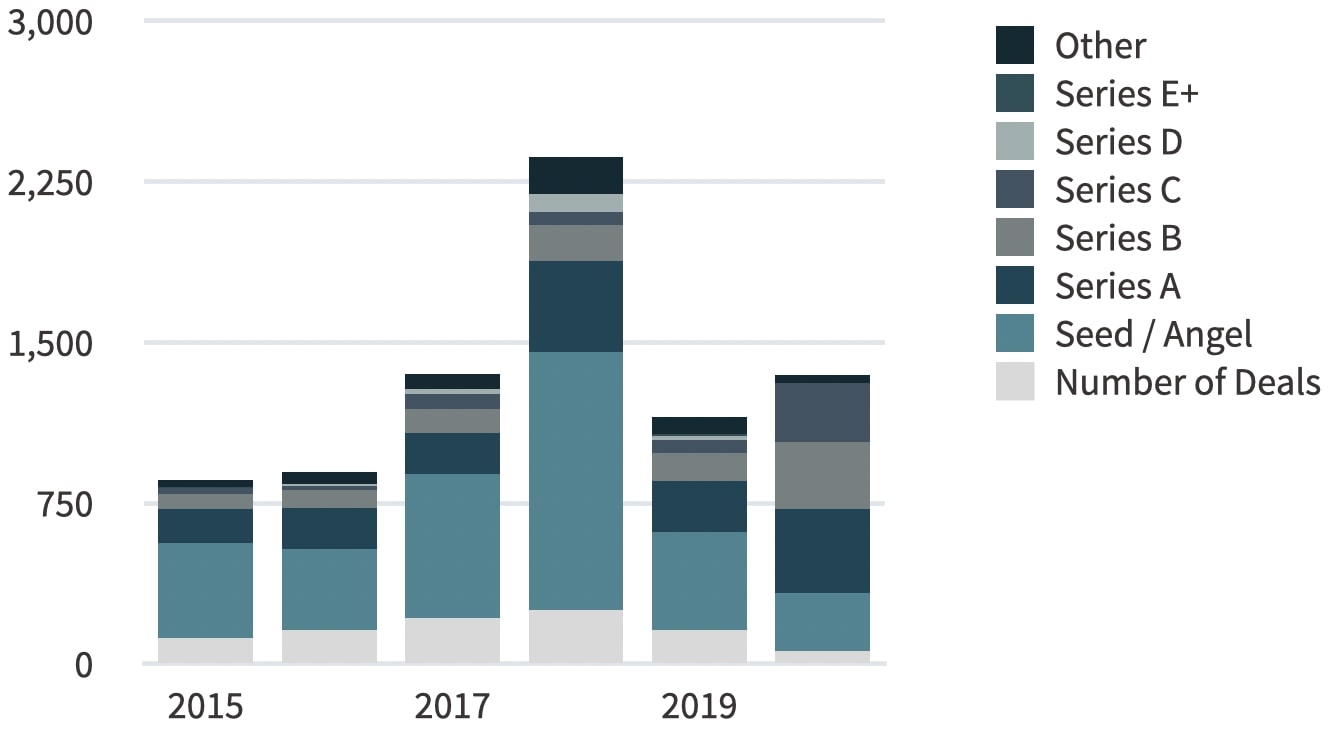

Early Stage Private Equity and Venture Capital Remains Active

- M&A has decreased 12.5% from Q1 to Q2 2020 while the number of fundraising deals doubled due to companies seeking cash infusions to weather the pandemic

- Drone industry is still maturing, with early stage investments accounting for 51% of completed transactions YTD 2020*

- The Drone industry has raised a total of $1.3B in venture capital funding in YTD 2020, already surpassing the total amount of $994M in 2019

- Both VC mega rounds in YTD 2020 went to drone manufacturers. Joby Aviation raised a $590M Series C and Skydio raised a $100M Series C. Joby’s Series C makes it the second highest funded Drone company, behind DJI Innovations

Commercial and Civil Markets Gain Traction

- The commercial sector is the fastest growing drone market with farming and agriculture, media and telecommunications, insurance, construction, and mining all benefiting from usage of drones

- The commercial drone market is anticipated to grow significantly as FAA regulations in the US continue to loosen and government agencies adopt new technologies

- Recreational drone use has risen as input prices continue to decline

Global Spending on Drones Expected to be Driven by Defense

- Global defense research and development and procurement spending on drones is expected to rise from a projected $11.1B in 2020 to $14.3B by 2029

- Despite early usage of drone systems primarily focusing on intelligence, surveillance, and reconnaissance, militaries are now expanding usage for armed missions

Drone Deliveries Gain Momentum During the Pandemic

- Mentions of autonomous and contactless deliveries have soared on public company earnings calls as businesses look for ways to minimize contact amid the pandemic

- There have been several recent partnerships, such as CVS’ partnerships with Nuro and UPS to deliver prescriptions as well as Rouses Markets’ partnership with Deuce Drone

What We’re Reading

Drone deliveries are making their case in a crisis– engadget

Takeaway: Drone deliveries are shining and proving their value during the pandemic as companies seek to minimize the spread of infection.

Autonomous drone maker Skydio shifts to military and enterprise with its first folding drone– The Verge

Takeaway: Skydio, long known for its consumer drones, is entering the commercial drone market with the release of its new X2 model drone; the move showcases that drones are much more than hobby toys and have a plethora of use cases.

The infusion of artificial intelligence into drones opens up a whole new world of opportunities– eWeek

Takeaway: During the past couple of years, the rise of more intelligent drones has expanded their use cases. For example, adding automation software allows businesses with large-scale operations to use drones to collect data while adhering to compliance and safety regulations.

*2020 YTD is the year-to-date period from Jan. 1 to Jul. 22, 2020

Source: CB Insights, U.S. Small Business Administration, PitchBook Data, IBISWorld, Company Press Releases

Drone Annual Financing Amount ($M) and Share by Stage

- Joby Aviation’s $590M Series C round in January leads the pack with the largest funding round, giving 2020 levels a significant lift from 2019

- Early stage Seed and Series A rounds represent 51% of all deals YTD 2020, indicating that the industry is still maturing

Drone Annual M&A & IPO Deal Count

- M&A activity has slowed down in Q2 as timelines and diligence processes have extended due to the pandemic

- M&A is likely to pick up in Q4 2020 and Q1 2021 as VC and private investors in well-funded drone companies seek to realize their investments

Select Drone Public Company Valuations

| Company Name | Price as of 7/22/2020 | % of 52-week high | Market Cap. | Enterprise Value | LTM Revenue | LTM EBITDA | LTM Margin | FY 2020E Revenue | FY 2020E EBITDA | FY 2020E Margin | EV / Revenue LTM | EV / Revenue FY 2020E | EV / Revenue FY 2021E | EV /EBITDA LTM | EV /EBITDA FY 2020E | EV /EBITDA FY 2021E |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| FLIR Systems | $42.83 | 72% | $5,604 | $6,135 | $1,893 | $328 | 17% | $1,895 | $437 | 23% | 3.2x | 3.2x | 3.1x | 18.7x | 14.0x | 13.0x |

| AeroVironment | $85.81 | 99% | $2,065 | $1,772 | $367 | $58 | 16% | $356 | $58 | 16% | 4.8x | 5.0x | 4.4x | 30.7x | 30.7x | 27.6x |

| Ambarella | $46.01 | 63% | $1,580 | $1,178 | $236 | -$28 | -12% | $229 | -$13 | -6% | 5.0x | 5.2x | 5.5x | NM | NM | NM |

| EHang | $9.90 | 61% | $542 | $511 | $19 | -$6 | -32% | $68 | NA | NA | 27.3x | 7.5x | 1.7x | NM | NA | NA |

| Autonomous Control Systems Laboratory | $20.77 | 55% | $216 | $181 | $12 | $2 | 20% | $13 | NA | NA | 15.4x | 14.0x | 12.7x | 76.4x | NA | NA |

| Parrot Drones | $3.46 | 67% | $103 | -$26 | $85 | -$32 | -38% | $95 | -$31 | -33% | NM | NM | NM | 0.8x | 0.9x | NM |

2020 YTD is the year-to-date period from Jan. 1 to Jul. 22, 2020

Terms: NA = “Not Available” NM = “Not Meaningful” LTM= “Last Twelve Months”

Source: CB Insights, PitchBook Data

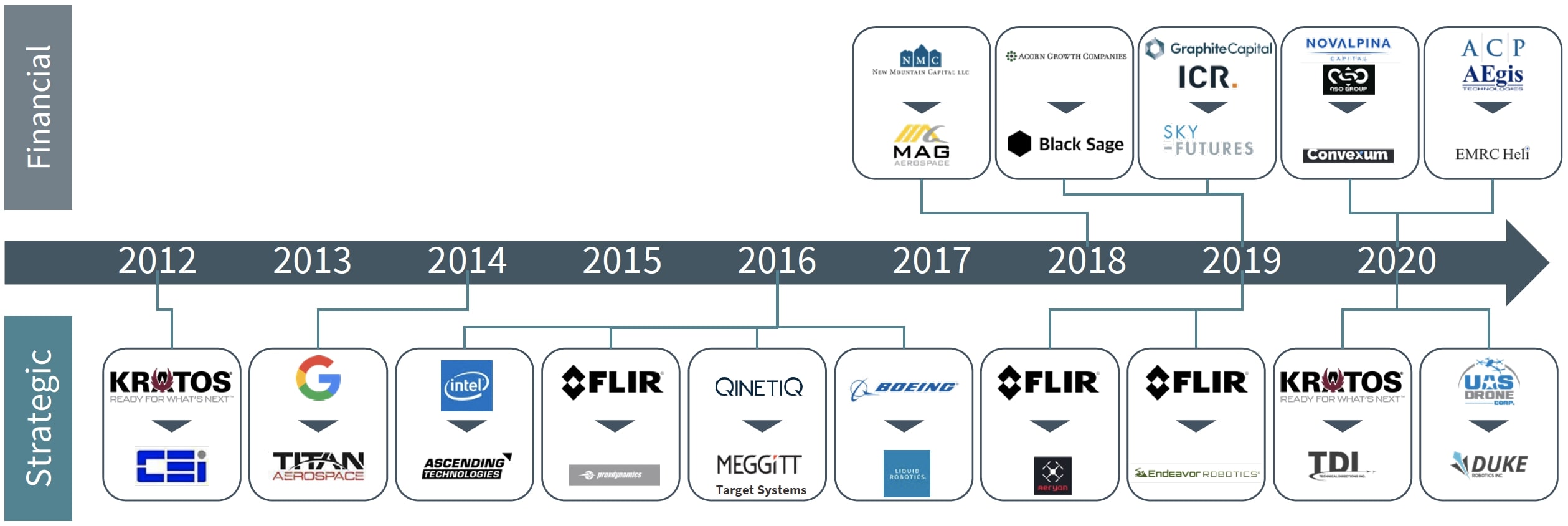

Notable Drone M&A Transactions

Select Recent Drone M&A Transactions

| Date | Target | Buyer | Target Description | EV ($M) |

|---|---|---|---|---|

| Jul-20 | Duke Robotics | UAS Drone | Provider of an advanced military UAS drone with stabilization technology. | ND |

| Jun-20 | DataWing Global | B3Bar Holdings | Provider of unamanned air system information services. | ND |

| Jun-20 | Effective Space | Astroscale | Manufacturer of space drones and life extension systems. | ND |

| May-20 | Tethers Unlimited | Amergint | Developer of new products and technologies for space, sea, and air applications. | ND |

| Apr-20 | Dronelogics Systems | Draganfly | Provider of integrator solutions for custom robotics. | $1 |

| Apr-20 | EMRC Heli | Aegis Technologies Group (Arlington Capital Partners) | Manufacturer of small unmanned aerial systems designed for government and commercial customers. | ND |

| Apr-20 | AeroVista Innovations | DroneUp | Provider of drone aerial mapping and imagery training solutions. | ND |

| Mar-20 | Hybroid | HII Technical Solutions | Manufacturer of Autonomous Underwater Vehicles (AUVs). | ND |

| Mar-20 | Viking UAS | Skyfire Consulting | Provider of aircraft engineering services for aircraft and drone industry. | ND |

| Mar-20 | RoBird | AERIUM Analytics | Provider of unmanned aircraft systems and specializes in bird control and aerial inspections. | ND |

| Mar-20 | Neva Ridge Technologies | General Atomics | Provider of Synthetic Aperture Radar (SAR) data processing technology and services. | ND |

| Feb-20 | Technical Directions | Kratos Defense & Security Solutions | Developer of expendable turbojet engine applications and other UAVs. | $10 |

| Feb-20 | Flight Pros | ISight RPV Services | Provider of drone services designed to manage projects efficiently. | ND |

| Feb-20 | Convexum | NSO Group Technologies (Novalpina Capital) | Developer of a cyber-security platform designed for taking over and landing rogue or malicious drones. | $60 |

| Jan-20 | Wesii | DXT Commodities | Developer of drone technology with multispectral sensors and processing algorithms. | ND |

| Dec-19 | PAE ISR | American Aerospace Technologies | Provider of UAS and has significant experience in system integration and evaluation. | ND |

| Dec-19 | Asteria Aerospace | Reliance Industries | Developer of drone-based solutions intended to provide actionable intelligence from aerial data. | $21 |

| Dec-19 | Measure UAS | Aerodyne Group | Operator of a first and largest Drone as a Service company in the United States. | ND |

| Nov-19 | VR Technologies | Tawazun Economic Council | Manufacturer and designer of helicopters and unmanned aerial vehicles. | $887 |

| Sep-19 | Prismatic | BAE Systems | Developer of autonomous aerospace and space products. | $7 |

Select Drone Funding Transactions YTD 2020*

| Date | Company | Amount ($M) | Select Investors | Round | City | Country |

|---|---|---|---|---|---|---|

| Jul-20 | Azur Drones | $2.90 | Undisclosed Investors | Series B – II | Merignac | France |

| Jul-20 | Propeller Aerobotics | $18.00 | Sequoia Capital China, Blackbird Ventures | Series B | Surry Hills | Australia |

| Jul-20 | Civdrone | ND | Drone Fund | Series A | Tel Aviv | Israel |

| Jul-20 | Skydio | $100.00 | Playground Global, Accel, NVIDIA GPU Ventures, Andreessen Horowitz, Institutional Venture Partners | Series C | Redwood City | United States |

| Jul-20 | SLAMcore | $5.00 | Amadeus Capital Partners, MMC Ventures, Octopus Ventures, Toyota AI Ventures, Mirai Creation Fund | Series B | London | United Kingdom |

| Jul-20 | Anduril | $200.00 | Andreessen Horowitz, 8VC, Elad Gil, Founders Fund, General Catalyst, Human Capital, Lux Capital Management, Valor Equity | Series C | Irvine | United States |

| Jun-20 | Wesii | $1.12 | LigurCapital, Innovation Holding | Seed VC | Chiavari | Italy |

| Jun-20 | Neurala | $4.88 | 360 Capital Partners, Pelion Venture Partners | Unattributed VC | Boston | United States |

| Jun-20 | Blueye Robotics | $1.06 | Undisclosed Investors | Unattributed | Trondheim | Norway |

| Jun-20 | CODE42.ai | $12.38 | KTB Network, Shinhan Financial Group, LIG Nex1 | Seed | Seoul | South Korea |

| Jun-20 | DroneBase | $7.50 | Razi Ventures, Upfront Ventures, Union Square Ventures, Hearst Ventures, Pritzker Group Venture Capital, and others | Series C | Los Angeles | United States |

| Jun-20 | Aerones | $1.60 | Y Combinator, Change Ventures, Sensum | Series A | Riga | Latvia |

| Jun-20 | Lilium Aviation | $35.00 | Baillie Gifford & Co. | Series C – II | Wessling | Germany |

| Jun-20 | Betterview | $7.50 | Compound, Nationwide Mutual Insurance Company, Winklevoss Capital, Guidewire Software, and others | Series B | San Francisco | United States |

| Jun-20 | Clearpath Robotics | $29.00 | RRE Ventures, Inovia Capital, Kensington Capital Partners, Export Development Canada, BMO Capital Partners | Series C | Kitchener | Canada |

| May-20 | i-Kingtec | $23.79 | Guozhong Venture Capital Management, ZHRM Fund, BlueRun Ventures, Joinne MingYuan Venture Capital, Hongtai Capital | Series B | Beijing | China |

| May-20 | Xwing | $10.00 | R7 Partners, Alven Capital, Thales Corporate Ventures, Eniac Ventures | Series A | San Francisco | United States |

| May-20 | Aerobotics | $5.56 | Naspers | Series B | Cape Town | South Africa |

| May-20 | NewSight Imaging | $7.00 | Infinity Group (China), George So | Series A | Ness Ziona | Israel |

| May-20 | Aware Vehicles | ND | T-Mobile Accelerator | Incubator/Accelerator | Kansas City | United States |

| May-20 | Regulus Cyber | $4.00 | Sierra Ventures, btov Partners, Technion Seed, F2 Capital, SPDG, Canaan Partners Israel | Series B | Haifa | Israel |

| Apr-20 | DASH Systems | $4.48 | Undisclosed Investors | Unattributed | Hawthorne | United States |

| Mar-20 | Slingshot Aerospace | $1.50 | U.S. Air Force | Series A | El Segundo | United States |

| Feb-20 | Volocopter | $40.00 | Mitsui Sumitomo Insurance Venture Capital, TransLink Capital, DB Schenker, Lukasz Gadowski, and others | Series C – II | Bruchsal | Germany |

| Feb-20 | CerbAir | $6.04 | Boundary Holding, Smart Move Holding, MBDA, Aube Management, TechnoFounders, and others | Series A | Boulogne-Billancourt | France |

| Jan-20 | Airspace Link | $4.00 | Indicator Ventures | Seed VC – II | Plymouth | United States |

| Jan-20 | Joby Aviation | $590.00 | Intel Capital, Capricorn Investment Group, Toyota, AME Cloud Ventures, and others | Series C | Santa Cruz | United States |

| Jan-20 | Clobotics | $10.00 | Tiger Management Corp | Series A – IV | Shanghai | China |

| Jan-20 | SOS LAB | $8.00 | KDB Capital, Shinhan Capital, Korea Development Bank, Shinhan Financial Group, and others | Series A – II | Gwangju | South Korea |

Source: CB Insights