SaaS M&A Trends: Winter 2019 Update

Published March 12, 2020

Technology, Software, SaaS M&A Report

Meridian Capital publishes its Technology M&A Update, which focuses on key trends in the technology M&A market. The Winter 2019 edition focuses on the Software-as-a-Service sector.

Bolstered by increasing customer demand and the continued development of more robust offerings, SaaS continued to experience strong tailwinds in 2019. This strong momentum has garnered interest from both private equity and corporate/strategic investors that are attracted by the inherent business model scalability and potential long-term recurring revenue streams. During 2019 there were over 1,200 SaaS deals with an aggregate deal value of $204B.

Meridian’s Technology Practice

Leading the Northwest in Technology M&A

Thought Leadership

Committed to tracking current industry valuation trends, M&A rationale, and investor criteria

- Actively tracking 100+ technology, business services, & telecom-focused PE firms

- Ongoing correspondence with acquisitive strategic investors

Technology Areas of Expertise

- SaaS

- Hardware

- Consulting and Staffing

- Healthcare Technology

2019 By The Numbers

- 4 Closed Transactions

- 2 Engagements under LOI

- 3 Active Engagements

Conference, Panel, and Interview Participation

Recent Meridian Technology and SaaS Transactions

Key Technology M&A Trends

Bolstered by increasing customer demand and the continued development of more robust offerings, SaaS continued to experience strong tailwinds in 2019. This strong momentum has garnered interest from both private equity and corporate/strategic investors that are attracted by the inherent business model scalability and potential long-term recurring revenue streams. During 2019 there were over 1,200 SaaS deals with an aggregate deal value of $204B. Meridian has identified several key trends it believes will continue to play a role in the SaaS industry moving forward.

Increasing Adoption of and Competition in SaaS

- Given strong interest from investors and customers, coupled with a stable economy, new SaaS solutions have proliferated over the years, causing a strong increase in competition for SaaS providers. SaaS solutions are now seen to compete with an average of nine other solutions providing similar products. The result is a marketplace that requires that SaaS companies have a strong focus on their pricing, brand, and product capabilities, as well as providing the best customer satisfaction to keep churn at a minimum

- This increase in competition has sharpened private equity interest in strong metrics and tightly bound valuation multiples to meeting key metrics

Significant Private Equity Interest

- 2019 was marked by several blockbuster deals attributed to large private equity funds, a prime example of private equity rolling up fragmented industries to capture wallet share

- Evolving financing terms have made private equity funds increasingly interested in SaaS companies. Though traditional financing relied on hard assets in order to leverage transactions, a new crop of SaaS-friendly lenders have provided financing solutions that comfortably rely on recurring revenue streams to service debt instruments

- Key SaaS metrics attractive to private equity:

- ARR > $10M

- YoY Growth > 40%

- High Gross Margin Profiles

- Enterprise Solution-Oriented Models

Source: Pitchbook

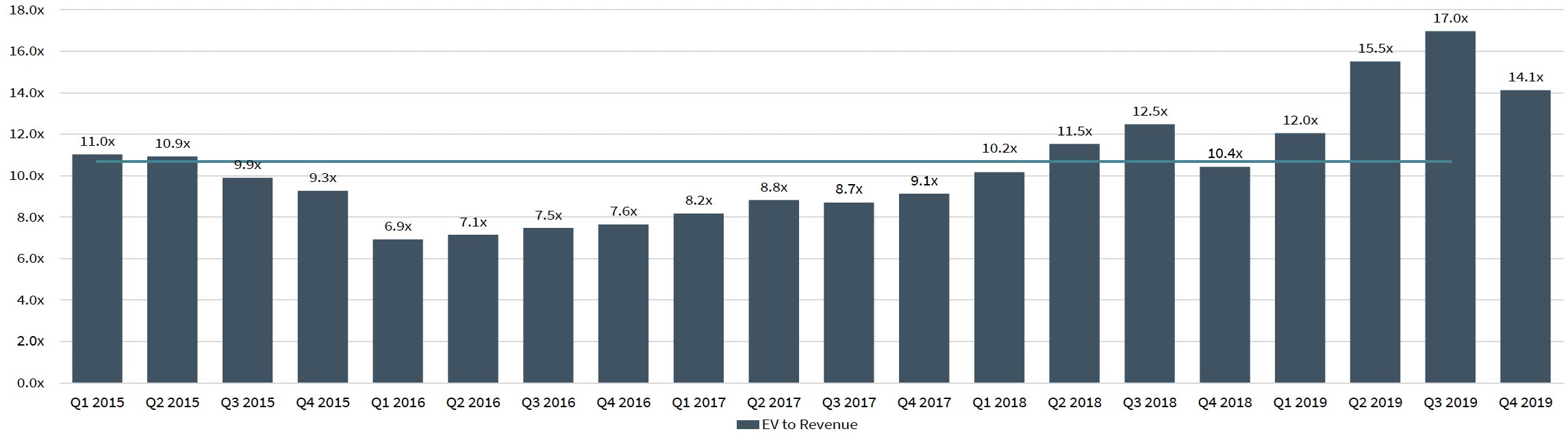

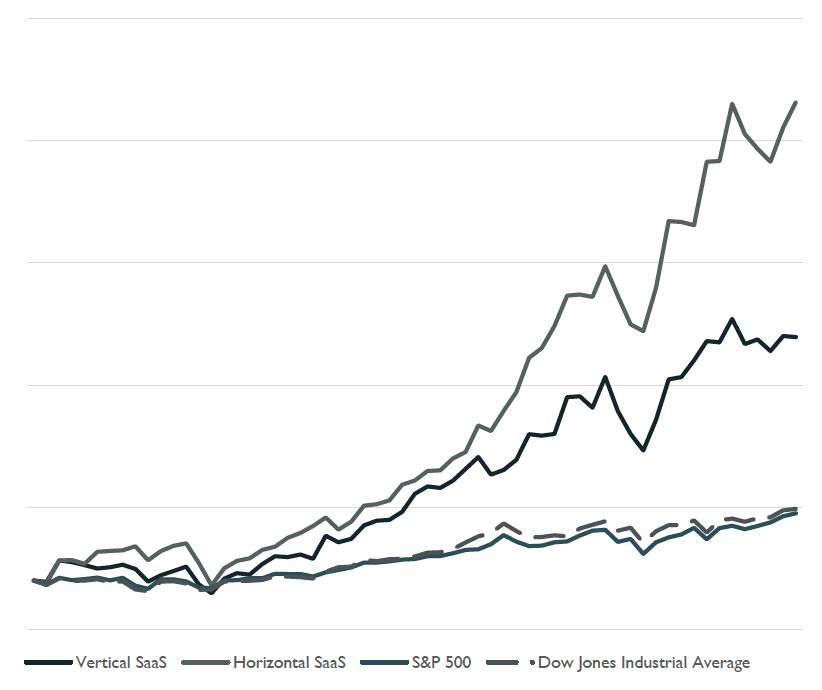

Strong Continued Performance of Public SaaS Companies

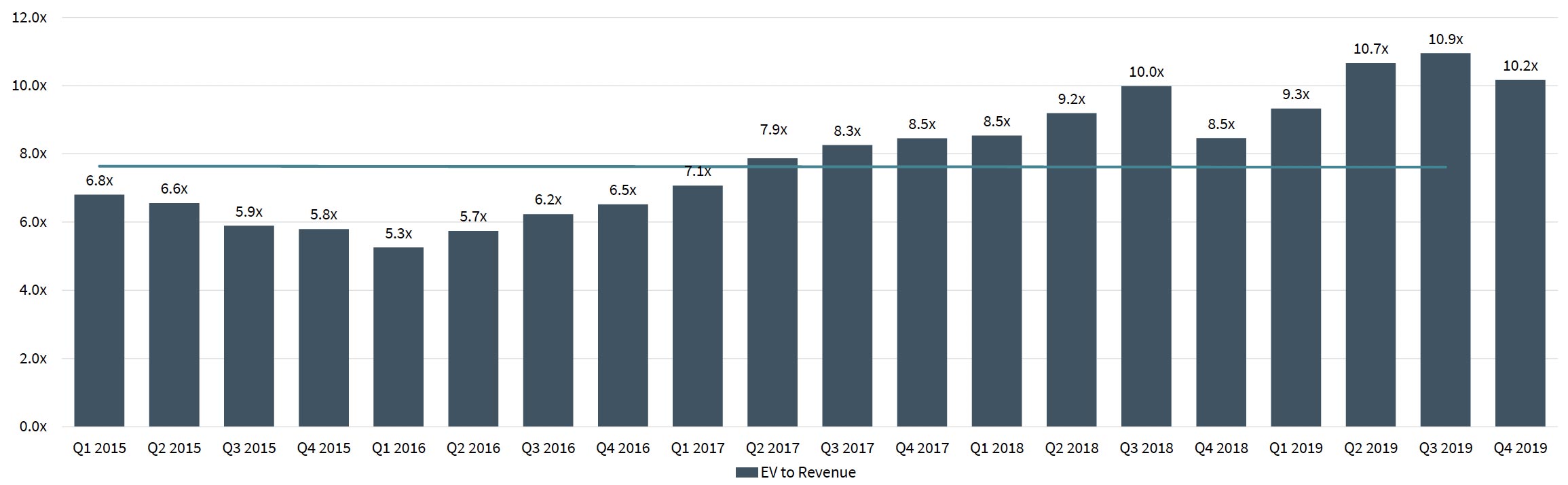

- Public SaaS Enterprise Value to Revenue multiples have significantly increased over the past three quarters. Horizontal SaaS multiples have increased from 12.2x in Q3 2018 to 15.9x Q4 2019, while Vertical SaaS multiples increased from 8.3x to 10.9x over the same period

- Between December 2014 and December 2019, vertically focused SaaS companies gained nearly 200% compared to 391% for horizontally focused SaaS companies(based on an index of representative companies). During the same period, the S&P 500 and Dow Jones Industrial Average grew 52% and 57%, respectively

- Market sentiment towards the business model has remained positive despite a slight dip in revenue multiples earlier in the year

Rise of Specialty Lenders Focused on SaaS

- Increasingly there has been a shift away from traditional means of financing SaaS startups: a niche has been carved out for financing solutions that provide more freedom compared to venture capital

- Lenders have begun offering lines of credit, term loans, and revenue-based financing catered to SaaS companies

- Revenue-based financing solutions are entrepreneur friendly and allow business owners to fuel growth while not diluting ownership

Source: Pitchbook

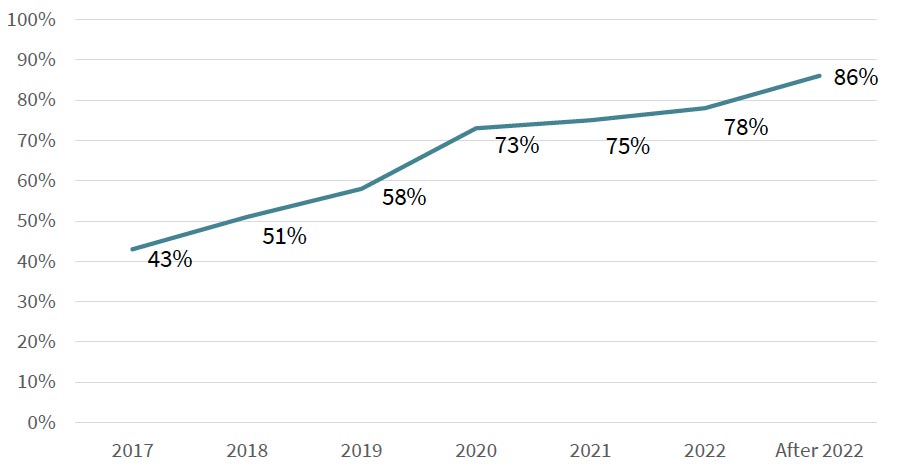

Percentage of Organization Running Purely on SaaS

Private Equity Interest by the Numbers

- > $84B Capital Invested by PE into SaaS YTD Dec. 2019

- 609 PE SaaS Acquisitions in 2019

5-Year SaaS Stock Performance Exceeds Market

Revenue Based Financing Characteristics

- Flexible Payments

- No dilution of ownership

- Quick access to follow on rounds

Pacific Northwest Transaction Spotlight

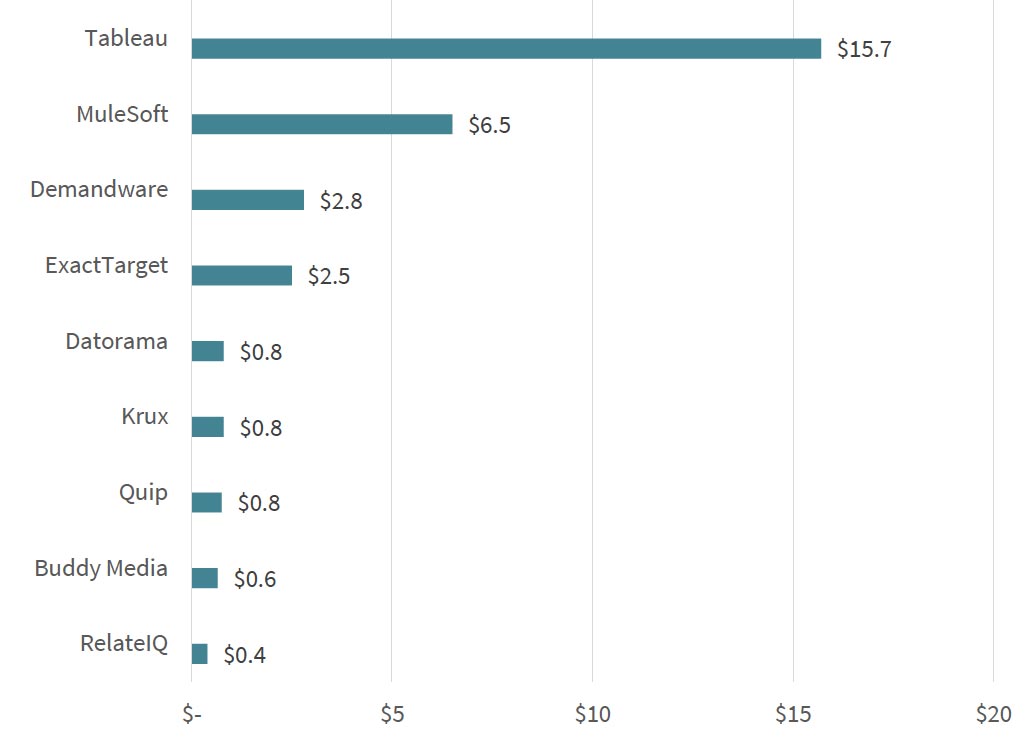

Salesforce acquires Tableau

Deal Metrics

Deal Size: $15.7 Bn

EV/Rev: 11.7x

EV/EBITDA: NM

Source: Pitchbook

Investment Rationale

The acquisition of Tableau will complement Salesforce’s offering by providing customers with an integrated analytics and CRM platform allowing customers to unlock greater value from their data

Pacific Northwest Impact

The acquisitions further cements Seattle’s position as a leading technology hub. Salesforce joins tech behemoths such as Amazon, Facebook, Google, and Apple who have made significant headcount increased in the Pacific Northwest

Buyer Quote

“We are bringing together the world’s #1 CRM with the #1 analytics platform. Tableau helps people see and understand data, and Salesforce helps people engage and understand customers. It’s truly the best of both worlds for our customers – bringing together two critical platforms that every customer needs to understand their world” – Marc Benioff, CEO

Salesforce Acquisition History ($Bn)

Select Horizontal SaaS Case Studies

Source: Pitchbook, Press Releases

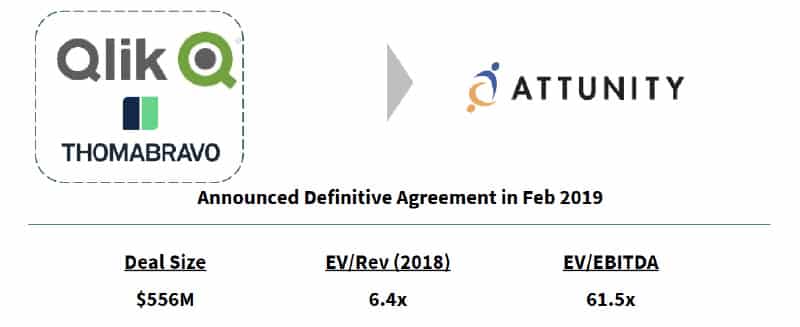

Qlik, backed by ThomaBravo, acquires Attunity

Target Description: Attunityprovides big data management software and data integration applications

Investment Rationale: The acquisition combines Attunity’sdata integration and management capabilities with Qlik’s data analytics platform, providing a single-source software platform to unlock the value of data

Buyer Quote: “Attunity’s strength in real-time data delivery across complex cloud environments will uniquely position Qlik to help customers lead with data and align their enterprise analytics strategy”–Mike Capone, CEO of Qlik

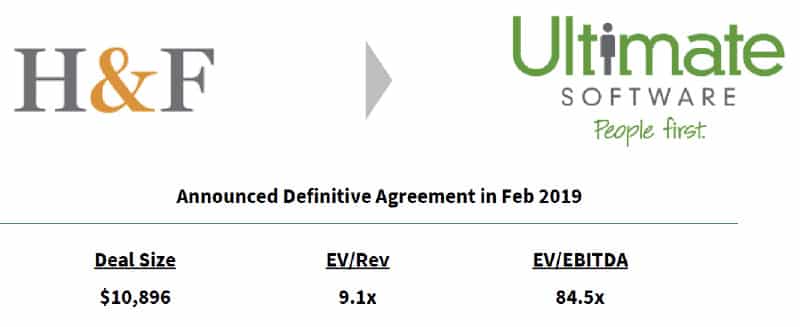

Hellman & Friedman acquires Ultimate Software

Target Description: Ultimate Software Group provides a SaaS based people management software product

Investment Rationale: The acquisition will provide a platform with many opportunities for growth, both through organic initiatives and strategic add-ons

Buyer Quote: “Ultimate’s market leadership in the human capital management segment and the company’s impressive track record of growth are built on the outstanding quality of its software and its dynamic and motivated employees. The company deeply understands the essence of human capital management, having itself been recognized with numerous best workplace awards from leading publications for its exceptional mission-driven culture. We look forward to building on Ultimate’s successes” –David Tunnell, Hellman & Friedman

Select Vertical SaaS Case Studies

Source: Pitchbook, Press Releases

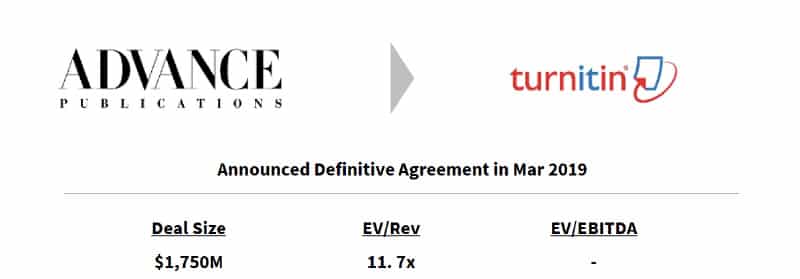

Advance Publications acquires Turnitin

Target Description: Turnitin is a software platform that uses machine learning, computer vision, and advanced A.I. to scan students’ writing and code to identify plagiarism

Investment Rationale: The acquisition supports Advance’s efforts to diversify their existing business beyond traditional media

Buyer Quote: “We admire Chris Caren and his team, and Turnitin’s outstanding track record of enhancing integrity in written work at schools, universities, and publishers worldwide through cutting-edge technology” – Steve Newhouse, Chairman, Advance Publications

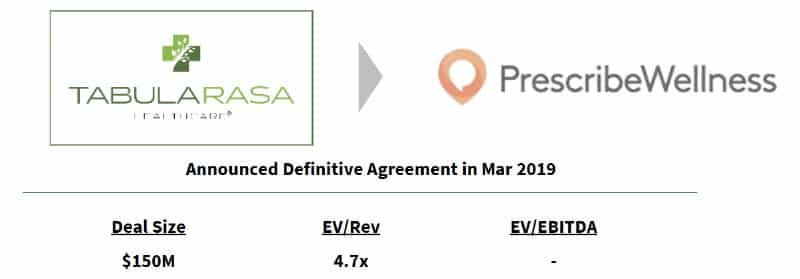

Tablula Rasa Healthcare acquires PrescribeWellness

Target Description: PrescribeWellness provides patient relationship management software that facilitates the collaboration between patients, payers, and providers

Investment Rationale: The acquisition helps Tabula Rasa expand its risk mitigation programs in community pharmacies and provides community pharmacists with clinical revenue opportunities

Buyer Quote: “The mission of PrescribeWellness, to deliver technology-enabled services solutions to help community pharmacies improve patient care and thrive economically, is very much aligned with TRHC’s mission. We welcome the PrescribeWellness team of over 150 employees and congratulate them on what they have accomplished” – Calin H. Knowlton, CEO, Tabula Rasa Healthcare

Select Recent Transactions –Vertical SaaS

| Date | Target | Buyer | Description | Enterprise Value ($ in M) | EV / Revenue | EV / EBITDA |

|---|---|---|---|---|---|---|

| Nov-19 | Carbonite, Inc.* | OpenText | Provider of online data protection and backup services to mainstream computer users. | $1,321 | 3.3x | |

| Oct-19 | Medidata Solutions, Inc. | Dassault Systemes | Provider of a cloud-based service for the life sciences industry. | $5,800 | 9.1x | |

| Oct-19 | 6 River Systems, Inc. | Shopify | Developer of a collaborative mobile robot with a modern cloud-based software designed to redefine fulfillment automation for e-commerce and retail operations. | $450 | ||

| Oct-19 | Radixx International, Inc. | Sabre Corporation | Developer of passenger services system (PSS) software. | $110 | ||

| Sep-19 | Real Factors, Inc. | 7Park Data | Provider of real estate software for commercial real estate investors. | |||

| Sep-19 | Waystar, Inc. | Canada Pension Plan Investment | Developer of medical claims management and patient payment software intended | $2,700 | ||

| Sep-19 | LTD Software, LLC* | Endurance International Group | Operator of a cloud-based e-commerce automation software intended to offer back-end operations for e-commerce sellers. | $10 | ||

| Sep-19 | Online School Management Systems Inc. | Bratenahl Capital Partners | Developer of online software for K-12 school districts intended to make online school management easier. | |||

| Jul-19 | OnLink | Deere & Company | Developer of cloud based golf course management platform. | |||

| Jun-19 | EPAC Software Technologies, Inc. | JDM Technology Group | Developer of maintainence services software. | |||

| Jun-19 | Pathfinder Health Innovations, Inc. | CentralReach, Insight Partners | Developer of a cloud-based software designed to provide treatment for autism and cognitive disorders. | |||

| Jun-19 | BankSight Software Systems, Inc. | Bottomline Technologies | Provider of a cloud-based customer engagement software intended to help regional and community banks engage with their customers. | $5 | ||

| May-19 | Envisiontel LLC | Remote-Learner US | Developer of SaaS-based educational e-commerce and cloud integration applications designed to simplify online training. | |||

| May-19 | eFront S.A. | BlackRock | Developer of financial software in France. | $1,300 | 18.7x | |

| May-19 | Ultimate Software Group, Inc. | Hellman & Friedman | Developer and provider of SaaS based people management software product. | $10,896 | 9.1x | 84.5x |

| Apr-19 | test IO GmbH | EPAM Systems | Provider of a self-service crowdtesting platform designed to help in agile software development. | $17 | ||

| Apr-19 | Club Speed, Inc. | Bellwether Financial Group | Developer of a cloud-based venue management software. | $43 | ||

| Apr-19 | Xevo, Inc. | Lear | Provider of a SaaS based automotive technology designed to seamlessly connect drivers and their vehicles to mobile applications, content and services. | $320 | ||

| Mar-19 | OpenALPR Technology, Inc. | Novume Solutions | Developer of cloud API software that enables automatic license plate and vehicle recognition through virtually any IP camera. | $12 | ||

| Mar-19 | Prescribe Wellness LLC | Tabula Rasa Healthcare | Developer of a cloud-based patient relationship management software designed to collect data for pharmacies. | $150 | 4.7x | |

| Mar-19 | Turnitin, LLC | Advance Publications | Provider of a software platform that uses machine learning, computer vision, and A.I. to scan students’ writing and code to identify plagiarism | $1,750 | 11.7x | |

| Feb-19 | Mindbody, Inc. | Vista Equity Partners | Developer of business management software for yoga and pilates studios, fitness facilities, spas, salons, and other retail clients. | $1,900 | 8.3x | 271.4x |

| Feb-19 | Bloombox LLC* | Nabis Holdings | Provider of retail cannabis software. | $2 | ||

| Jan-19 | Qualtrics International Inc. | SAP | Developer of an enterprise data collection and analysis software intended to survey employees, markets, and customers. | $8,000 | 20.0x | |

| Jan-19 | Infinite Cohesion, Ltd. | Education Management Systems | Developer of a content management system intended to build Websites for K-12 schools. | |||

| Median | $385 | 9.1x | 9.5x | |||

| Mean | $1,933 | 10.6x | 64.6x |

As of 12/31/19; * indicates announced transaction

Select Recent Transactions –Horizontal SaaS

| Date | Target | Buyer | Description | Enterprise Value ($ in M) | EV / Revenue | EV / EBITDA |

|---|---|---|---|---|---|---|

| Dec-19 | LogMeIn | Francisco Partners | Provider of cloud-based collaboration and connectivity products | $4,181 | 3.4x | 13.0x |

| Dec-19 | VersaPay | Great Hill Partners | Provider of cloud-based accounts recievable software | $95 | 16.3x | |

| Nov-19 | Docker Enterprise | Mirantis | Developer of container platform designed to help businesses build, share, and run applications. | |||

| Nov-19 | Scout RFP Inc. | Workday | Developer of a SaaS RFP and sourcing platform designed to help organizations source faster and achieve better business outcomes. | $540 | ||

| Nov-19 | Jask Labs, Inc. | Sumo Logic | Developer of cyber-security analytics software designed to modernize security operations. | |||

| Oct-19 | Intrinsyc Technologies Corporation* | Lantronix | Developer of IoT products and provider of embedded computing hardware development services. | $12 | 0.5x | |

| Oct-19 | StatPro Group plc | Confluence Technologies | Developer of financial software and provider of cloud based portfolio analysis services. | $198 | 2.7x | 23.3x |

| Oct-19 | Cloud Conformity Pty Ltd | Trend Micro | Developer of a cloud security software platform. | $70 | ||

| Oct-19 | Optima Diagnostics Limited | Ideagen | Developer of a compliance system designed to help in workplace health and safety management. | $2 | ||

| Oct-19 | Carbon Black, Inc. | VMware | Provider of endpoint security software designed to transform security in the cloud. | $2,100 | 9.1x | |

| Oct-19 | Asure Software (Workspace Management Business)* | Accel-KKR | Developer of workplace software designed to make daily tasks easier. | $120 | ||

| Oct-19 | SignalFx, Inc | Splunk | Developer of a cloud monitoring platform designed to accelerate problem detection and troubleshooting in real-time. | $1,050 | ||

| Oct-19 | Hedvig, Inc. | CommVault Systems | Developer of a software-defined storage platform designed to improve the economics of storing and managing data. | $225 | ||

| Sep-19 | BetterCloud, Inc. | Dropbox | Developer of an operations management platform intended to empower IT to define, remediate, and enforce management and security policies for SaaS applications. | |||

| Sep-19 | Zingle, Inc. | Medallia | Developer of communication software designed to help businesses to communicate with customers via texting and other mobile messaging channels. | $42 | ||

| Sep-19 | Servicefriend | Developer of an interactive text response system designed to offer a consistent messaging experience at massive scale. | ||||

| Sep-19 | Semmle Ltd. | GitHub | Provider of software engineering analytics services designed to help customers achieve engineering excellence. | $410 | ||

| Sep-19 | Axioma, Inc. | Deutsche Börse Group | Developer and marketer of risk management, portfolio construction, and risk and regulatory reporting tools. | $876 | ||

| Aug-19 | Pivotal Software, Inc. | VMware | Provider of cloud platform tools and methodologies intended to help companies deliver better user experiences. | $2,492 | 3.5x | NM |

| Aug-19 | Jaggaer, Inc. | Cinven | Developer of a web-based e-procurement, supply and materials management software. | $1,600 | ||

| Aug-19 | WeDo Technologies B.V. | Audax Group, Mobileum | Developer of an expert consultancy platform designed to be used for fraud management. | $97 | ||

| Aug-19 | Internet Pipeline, Inc.* | Roper Technologies | Developer of a cloud based software platform designed for sales distribution through its on-demand service. | $1,625 | ||

| Aug-19 | Cxense ASA* | Piano Software | Provider of web-based services designed for global data and personalization technology. | -$8 | -0.4x | 1.3x |

| Aug-19 | AIM Software GmbH | SimCorp | Developer of enterprise data management software. | $60 | ||

| Aug-19 | Tableau Software, Inc. | Salesforce | Developer of analytics and visualization software. | $15,700 | 11.7x | NM |

| Jul-19 | BlueTalon, Inc. | Microsoft | Provider of a data-centric security software designed to protect data at all times while allowing it to flow freely and securely anywhere. | |||

| Jul-19 | Bitfusion.io, Inc.* | VMware | Developer of an AI Infrastructure disaggregation platform intended to scale heterogeneous computing. | |||

| Jul-19 | QualiTest Ltd* | Bridgepoint Advisers | Provider of quality assurance and software testing services. | $420 | ||

| Jul-19 | Amber Road, Inc. | Insight Partners | Provider of global trade management software for importers, exporters and logistics service providers. | $532 | 6.2x | NM |

| Jun-19 | Dude Solutions Inc. | Clearlake Capital Group | Developer of a cloud-based operations management software. | $500 | 5.0x | |

| May-19 | Cloudability | Apptio | Provider of a cloud cost management platform that improves visibility, optimization, and governance across cloud environment. | |||

| May-19 | Bonobot Technologies Ltd.* | Salesforce | Developer of a conversational intelligence platform designed to help organizations know their customers and grow their customer relationships at scale. | $45 | ||

| May-19 | Magnitude Software, Inc. | 3i Group | Developer of enterprise information management software. | $340 | 3.4x | |

| May-19 | GitPrime, Inc. | Pluralsight | Developer of productivity analytics software designed to bring visibility into the software development process. | $170 | ||

| Apr-19 | Attunity, Inc. | Thoma Bravo | Provider of data integration and big data management software applications. | $556 | 6.4x | 61.5x |

| Apr-19 | Breezy HR, Inc. | Learning Technologies Group | Developer of a recruiting software designed to modernize the recruiting process. | $31 | 8.5x | |

| Apr-19 | Samanage Ltd | SolarWinds | Developer of a service management platform designed to simplify complex tasks and automate services. | $350 | ||

| Apr-19 | Determine, Inc. | Corcentric | Provides enterprise contract management and configure price quote software. | $28 | 1.1x | NM |

| Apr-19 | Nvoicepay, Inc. | FleetCor Technologies | Developer of cloud-based payment automation software. | $219 | ||

| Mar-19 | Aptean, Inc. | TA Associates Management, Vista Equity Partners | Provider of enterprise resource planning software. | $1,000 | ||

| Mar-19 | AgileCraft, LLC | Atlassian | Provider of an all-in-one agile management suite for scaled agile software services. | $166 | ||

| Mar-19 | Arxspan LLC | Bruker | Provider of cloud-based scientific software and workflow solutions. | $17 | ||

| Mar-19 | Kyriba Corp. | Bridgepoint Advisers | Developer of a cloud-based treasury and cash management software designed to help in supply chain finance, payments, and risk management operations. | $1,200 | 10.6x | |

| Feb-19 | ConnectWise, LLC | Thoma Bravo | Developer of a remote monitoring and management (RMM) platform. | $1,500 | ||

| Feb-19 | Reverie Language Technologies Pvt. Ltd* | Reliance Industries | Developer of a communication software designed to make text communication possible in any language on digital platforms. | $32 | ||

| Feb-19 | Cylance, Inc. | Blackberry | Developer of cloud based cybersecurity platform designed to predict and prevent the execution of advanced threats and malware. | $1,400 | ||

| Feb-19 | AppRiver, LLC | Zix | Provider of cloud-based cybersecurity and productivity software and services. | $275 | ||

| Feb-19 | JN Projects, Inc. | Dropbox | Developer of an e-signature platform. | $230 | ||

| Feb-19 | Athenahealth, Inc. | Veritas Capital | Developer of a SaaS platform intended to offer medical practice automation and claims management services. | $5,397 | 4.1x | 17.8x |

| Feb-19 | Intive Gmbh | Mid Europa Partners | Operator of a digital strategy and software development company. | $148 | ||

| Feb-19 | Canvas Solutions, Inc. | K1 Investment Management | Provider of mobile platform designed to help companies automate outdated processes. | $150 | 7.5x | |

| Jan-19 | Qualtrics International Inc. | SAP | Developer of enterprise data collection and analysis software intended to survey employees, markets, and customers. | $8,000 | 20.0x | |

| Jan-19 | BOARD International S.A. | Grafton Capital, Nordic Capital | Operator of performance management and business intelligence application software. | $500 | 8.5x | |

| Jan-19 | Veracode Inc. | Thoma Bravo | Provider of a cloud-based application security platform designed to find and fix security-related defects at all points in the software development lifecycle. | $950 | ||

| Jan-19 | Cooler Screens Inc. | Microsoft | Developer of a retail point of sale platform designed to transform retail cooler surfaces into IoT-based screens. | |||

| Aug-18 | Adaptive Insights, Inc. | Workday | Provider of business planning software to help companies improve business financial performance. | $1,447 | 12.7x | NM |

| Median | $725 | 9.5x | 9.0x | |||

| Mean | $1,518 | 10.6x | 9.9x |

As of 12/31/19; * indicates announced transaction

Select Public Vertical SaaS Companies

| Company | Net Debt | Market Value of Equity | Enterprise Value | 1 Yr Rev Growth % | TTM Revenue | TTM EBITDA | Enterprise Value / TTM Revenue | Enterprise Value / TTM EBITDA |

|---|---|---|---|---|---|---|---|---|

| Autodesk, Inc. | $1,087 | $42,543 | $43,631 | 31% | $3,112 | $384 | 14.0x | 113.6x |

| Veeva Systems Inc. | -$865 | 22,001 | $21,136 | 26% | $1,025 | $337 | 20.6x | 62.6x |

| Guidewire Software Inc. | $247 | $9,333 | $9,580 | -4% | $697 | $16 | 13.7x | 609.2x |

| Avalara, Inc | $0 | $6,513 | $6,513 | 39% | $352 | NM | 18.5x | NM |

| RealPage, Inc. | $451 | $5,488 | $5,939 | 16% | $960 | $207 | 62x | 28.7x |

| Blackbaud, Inc. | $594 | $4,022 | $4,616 | 5% | $884 | $124 | 52x | 37.1x |

| Evestnet Inc | $515 | $3,704 | $4,219 | 11% | $870 | $45 | 4.8x | 93.2x |

| BlackLine, Inc. | -$133 | $3,466 | $3,333 | 26% | $271 | NM | 12.3x | NM |

| Inovalon Holdings, Inc. | $880 | $3,114 | $3,993 | 20% | $605 | $161 | 6.6X | 24.9x |

| Castlight Health | -$18 | $202 | $184 | -2% | $149 | NM | NM | |

| Median | $5,278 | 18% | $784 | $161 | 9.4x | 62.6x | ||

| Mean | $10,314 | 17% | $893 | $182 | 10.3x | 138.5x |

Select Public Horizontal SaaS Companies

| Company | Net Debt | Market Value of Equity | Enterprise Value | 1 Yr Rev Growth % | TTM Revenue | TTM EBITDA | Enterprise Value / TTM Revenue | Enterprise Value / TTM EBITDA |

|---|---|---|---|---|---|---|---|---|

| Adobe, Inc. | $1 ,928 | $168,693 | $170,621 | 24% | $10,644 | $3,570 | 16.0x | 47.8x |

| Salesforce.com, Inc. | $2,226 | 161,638 | $163,864 | 26% | $15,850 | $2,706 | 10.3x | 60.6x |

| ServiceNbw , Incw | $501 | $58,941 | $59,443 | 32% | $3,224 | $237 | 18.4x | 250.7x |

| Workday, Inc. | $640 | $41,644 | $42,283 | 31% | $3,440 | NM | 12.3x | NM |

| Square, Inc. | $449 | $29,811 | $30,260 | 45% | $4,333 | $97 | 7.0x | 310.7x |

| Splunk, Inc. | $0 | $24,637 | $24,637 | 33% | $2,190 | NM | 11.3x | NM |

| Zoom Video Connuications, Inc | $0 | $20,885 | $20,885 | $540 | $30 | 38.7x | 704.0x | |

| Paycom Sotftw are, Inc. | $0 | $17,300 | $17,300 | 31% | $695 | $248 | 24.9x | 69.7x |

| RngCentral | -$156 | $16,608 | $16,452 | 33% | $839 | $15 | 19.6x | 1091.1x |

| DocuSign | $0 | $13,016 | $13,016 | 38% | $899 | NM | 14.5x | NM |

| flogme | $0 | $12,362 | $12,362 | $570 | NM | 21.7x | NM | |

| Coupa Softw are, Inc. | $0 | $10,809 | $10,809 | 48% | $353 | NM | 30.6x | |

| Cropbox | $458 | $7,484 | $7,942 | 20% | $1,591 | $107 | 5.0x | 74.3x |

| Dynatrace, Inc. | $0 | $7,524 | $7,524 | $483 | NM | 15.6x | NM | |

| Smartsheet, Inc. | $0 | $5,317 | $5,317 | 54% | $245 | NM | 21.7x | NM |

| Ivédallia, Inc. | $0 | $4,077 | $4,077 | $379 | NM | 10.8x | NM | |

| Box, Inc. | $0 | $2,434 | $2,434 | 16% | $676 | NM | 3.6x | NM |

| Median | $16,452 | 32% | $839 | $172 | 15.6x | 162.5x | ||

| Mean | $35,837 | 33% | $2,762 | $876 | 16.6x | 326.1x |