Agribusiness M&A Trends: Fall 2021

Published November 17, 2021

Key Insights

- Agribusiness M&A surges in 2021 with M&A volume up 86% year over year

- Supply chain cost pressures and disruptions are wreaking havoc

- Meridian Capital expects to be the leading agribusiness M&A advisor in 2021

Highlights

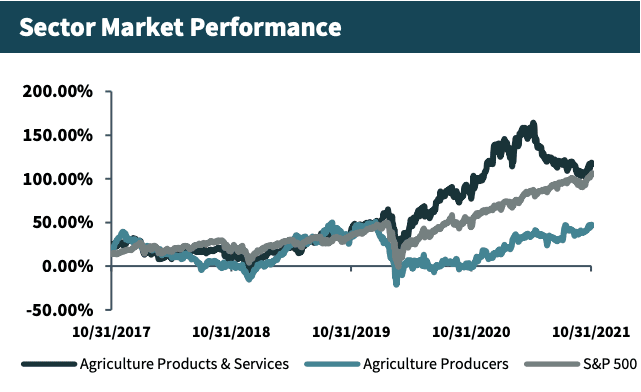

Agribusiness M&A continues at a surging and record setting pace. Interest from buyers and investors in agribusiness companies varies by subsegment, but broader interest and thematic trends include:

- Size and scale of the industry

- Fragmentation in the industry

- Aging ownership of agribusiness companies

- The industry proposes a natural inflation hedge

- Resilience through recessions

- Increased automation in the agribusiness supply chain

- The economic benefits of helping agribusiness companies scale more quickly through added investment

Much of the agribusiness sector has been roiled in 2021 with rapidly increasing input prices and logistical disruptions to the industry’s supply chain. Providers in the industry also site rapidly rising wages, approaching double digit increases in some markets. In reaction, agribusiness companies have made swift and decisive technology and automation improvements. Meridian Capital expects 2021 to be a banner year for its agribusiness M&A clients, with closed transactions and transactions under LOI nearing $1 billion in total value.

Agribusiness Market Insights

Agribusiness M&A Surges in 2021 with M&A Volume Up 86% Year Over Year

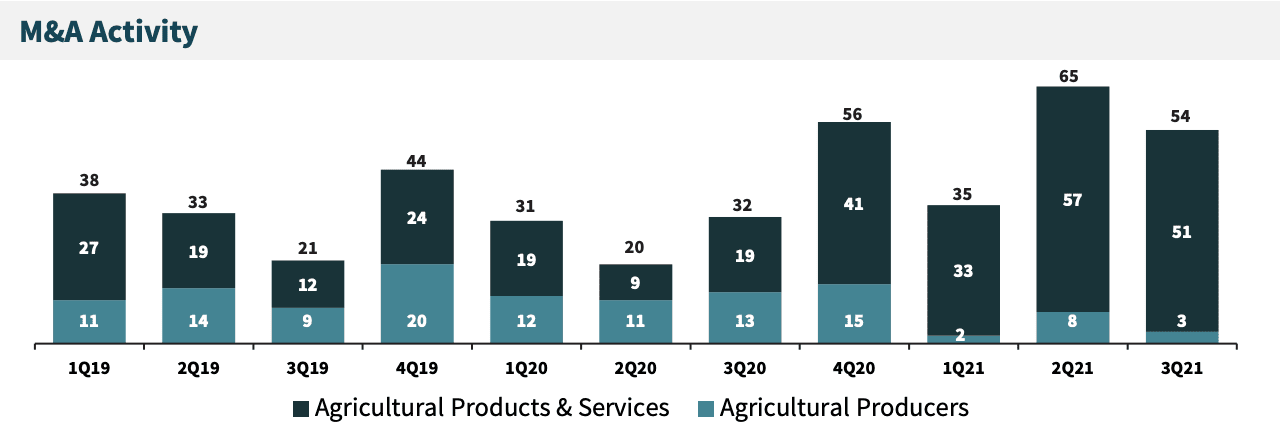

- With 154 transactions through Q3 2021, compared to 83 over the same period in 2020 and 92 over the same period in 2019, Agribusiness M&A continues at a surging and record setting pace.

- Interest from buyers and investors in Agribusiness companies varies by subsegment, but broader interest and thematic trends include: size and scale of the industry, fragmentation in the industry, aging ownership of agribusiness companies, industry proposes a natural inflation hedge, resilience through recessions, increased automation in the agribusiness supply chain, and the economic benefits of helping agribusiness companies scale more quickly through added investment.

- M&A Activity is expected to continue at or near record levels in 2022 with a number of high-profile producer transactions taking shape in the next several months.

Supply Chain Cost Pressures and Disruptions Wreaking Havoc

- Much of the agribusiness sector has been roiled in 2021 with rapidly increasing input prices and logistical disruptions to the industry’s supply chain.

- Growers and processors state 25% to 75% increases in key input prices in 2021, including packaging, chemicals, and storage fees. Providers in the industry also site rapidly rising wages, approaching double digit increases in some markets.

- Suppliers in the industry note long delays at the Company’s ports and inconsistent supply.

- The aforementioned labor and input material issues have caused agribusiness companies to react with swift and decisive technology and automation improvements, and in some cases, have caused companies to vertically or horizontally acquire companies to gain control over their supply chain.

- 2022 is expected to be no different, with agribusiness companies expected to invest more dollars into automation and acquisitions than ever before.

Meridian Capital Expects to be the Leading Agribusiness M&A Advisor in 2021

- Meridian Capital expects 2021 to be a banner year for its agribusiness M&A clients, with closed transactions and transactions under LOI nearing $1 billion in total value.

- Companies across the agribusiness supply chain are working through generational transitions and weighing those transitions with the increasing capital needs and complexities of their businesses.

- While a majority of agribusiness M&A is negotiated on a one-off basis, Meridian Capital believes helping companies prepare for an eventual exit along with developing an organized and competitive transaction process, leads to successful transaction outcomes for its clients.

- “Both experienced and new investors are entering the agribusiness industry at significant levels. The due diligence processes these investors undertake to complete an investment is substantial. It is important that companies are prepared for the process and know what to expect”, says James Rothenberger, Managing Director at Meridian Capital and the Agribusiness Industry Group Lead.

Source: Pitchbook, and Meridian Research

Agribusiness Market Activity

Recent Transaction Spotlights

Description: Bear Flag Robotics is a developer of self-driving technology for tractors designed to lower the cost of farming through automation.

Rationale: The acquisition aligns with John Deere’s long-term strategy to create smarter machines with advanced technology to support individual customer needs.

Description: Ametza is a producer of forage pellets intended to serve the livestock and companion animal industries.

Rationale: The acquisition enables Wilbur-Ellis to expand its forage business.

Description: WISErg uses its proprietary harvester technology to capture food scraps from grocery stores and transform the materials to produce fertilizers and other agricultural products.

Rationale: The acquisition supports Plant Response’s strategy of building a robust platform of biological and nutrient efficiency technologies.

Boyer Fertilizer & Pacific Coast Ag Join Nutrien Ag Solutions

Meridian Capital LLC (“Meridian”), a Seattle-based middle market corporate finance and M&A advisory firm is pleased to announce the successful acquisition of two of its clients, Boyer Fertilizer (“Boyer”) and Pacific Coast Ag (“PCA”) by Nutrien Ag Solutions (“Nutrien”).

A second-generation family business, Boyer is a processor, blender and distributor of branded, specialty and private label commercial fertilizers to the agricultural market. Boyer has differentiated itself by providing custom fertilizer blends that fit the specific needs of each customer’s growing operation, soil types and environmental considerations. PCA, a first-generation, entrepreneur-led business, coordinates logistics, application and custom blending of pre-plant soil amendments for vegetable and berry row crops. PCA maintains the exclusive distribution rights of organic and conventional fertilizers for Grow More™, AgroThrive™ and BioGro™.

Dave Willoughby, President of Boyer, shared, “We never could have imagined this much work would go into getting a transaction completed. We couldn’t be happier with the outcome and are very thankful we had Meridian Capital leading us through this transaction.” As part of a multi-stage transaction process, Meridian Capital assisted Boyer and PCA in completing a “virtual merger”, positioned the combined Boyer and PCA operation to the market, identified prospective buyers and assisted both companies in navigating the challenges and uncertainties of the deal.

Nutrien looks for companies that have a similar go-to-market approach, with partnerships ultimately resulting in bringing added value to their collective customers. Boyer and PCA have demonstrated through consistent growth, unique fertilizer and service offerings, and a loyal customer base, that they will be an integral part of Nutrien Ag Solutions.

Nutrien Ag Solutions is the retail division of Nutrien Ltd., the world’s largest crop inputs company. Nutrien provides full-acre solutions through a network of trusted crop consultants at more than 1,700 global locations. Nutrien helps growers achieve the highest yields with the most sustainable solutions possible, offering a wide selection of products, including our proprietary brands: Loveland Products, Inc.®, Proven® Seed and Dyna-Gro® Seed, and a diverse array of services, including application, soil testing, and precision agriculture services.

Nutrien’s acquisition of Boyer and PCA represents continued momentum for Meridian’s Agribusiness Practice. Other recent transactions include Gar Tootelian’s acquisition of Bennett Water Systems and International Farming Corp’s acquisition of Legacy Fruit Packers.

Royal Ridge Fruits & Cold Storage in New Partnership

Meridian Capital LLC (“Meridian”), a leading Seattle-based middle market investment bank and M&A advisory firm is pleased to announce the successful acquisition of its clients, Royal Ridge Fruits & Cold Storage and Dorsing Farms (“Royal Ridge,” “Dorsing Farms,” or the “Company”) by Arable Capital Partners (“ACP”). Through the transaction, ACP will invest in the processing and farming assets of Royal Ridge and Dorsing Farms. Meridian Capital served as the exclusive financial advisor to Royal Ridge and Dorsing Farms on the transaction.

Royal Ridge is a leader in the processing of organic and conventional dried and IQF fruits, with recognized retail offerings under the Stoneridge™ Orchards brand. The Company is a national leader in growing and processing of organic dried tart cherries for uses in trail mix, granola, baked goods and fruit and nut bars.

Located in Washington’s Columbia Basin, Dorsing Farms grows sweet and tart cherries, blueberries, and apples on over 2,500 acres of high-quality farmland. From humble beginnings in 1962, when Karl Dorsing won 160 acres of prairie-land through a state-sponsored lottery, the third-generation family farm has grown to become one of the largest tart cherry growers in the Western United States.

“Meridian’s unwavering commitment and exceptional effort throughout this complex transaction was instrumental in achieving a successful outcome. We are excited about the next chapter for Royal Ridge in partnership with Arable, and the opportunity it provides for our customers and our management team,” said Kevin Dorsing, CEO of Royal Ridge. “The Meridian team took extra care in their process to find a partner who fits with our family values and culture. The resulting partnership with Arable honors the family legacy and positions us for future success,” stated Scott Dorsing, President of Dorsing Farms.

Michael Barber, Managing Director and Head of Consumer and Food & Beverage for Meridian stated, “We are very happy with the tremendous outcome for Kevin, Scott, Bryce, and Patrick Dorsing, and the entire organization in partnering with Arable. We thank the Dorsing family for entrusting the Meridian team to advise them on this transformational event for the family and Company. The Company’s vertical integration along with their unique farming assets positions them for long-term growth as a preferred partner to regional, national, and global commercial and retail customers.”

This transaction represents continued momentum for Meridian’s Food, Beverage, and Agribusiness practice. Other recent transactions include Boyer Fertilizer’s acquisition by Nutrien, Harbor Wholesale’s acquisition of Rich & Rhine, Harbor Wholesale’s acquisition of a significant portion of Food Services of America’s Seattle business, and nutpods growth capital investment from VMG Partners.

Publicly-traded Agribusiness Companies

Agriculture Products & Services

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EBITDA Margin | NTM Sales Growth | EV/LTM Rev | EV/LTM EBITDA |

|---|---|---|---|---|---|---|---|---|

| The Mosaic Company | $13,949 | $17,447 | $10,974 | $2,739 | 25.0% | 29.4% | 1.6x | 6.4x |

| CF Industries Holdings | 13,684 | 19,336 | 5,100 | 2,072 | 40.6% | 46.5% | 3.8x | 9.3x |

| FMC Corporation | 13,395 | 16,637 | 4,784 | 1,232 | 25.7% | 9.8% | 3.5x | 13.5x |

| SiteOne Landscape Supply | 11,140 | 11,623 | 3,346 | 377 | 11.3% | 9.7% | 3.5x | 30.8x |

| The Toro Company | 10,776 | 11,008 | 3,840 | 623 | 16.2% | 16.6% | 2.9x | 17.7x |

| Scotts Miracle-Gro | 9,763 | 11,813 | 4,925 | 846 | 17.2% | 0.8% | 2.4x | 14.0x |

| AGCO Corporation | 9,276 | 10,555 | 10,700 | 1,218 | 11.4% | 9.0% | 1.0x | 8.7x |

| Lindsay Corporation | 1,710 | 1,701 | 568 | 73 | 12.8% | 13.5% | 3.0x | 23.3x |

| CVR Partners, LP | 821 | 1,352 | 434 | 137 | 31.6% | NM | 3.1x | 9.9x |

| Titan Machinery Inc. | 711 | 981 | 1,548 | 81 | 5.2% | 11.7% | 0.6x | 12.1x |

| Intrepid Potash, Inc. | 590 | 566 | 199 | 50 | 25.3% | 10.4% | 2.8x | 11.3x |

| Titan International, Inc. | 513 | 947 | 1,619 | 111 | 6.9% | 13.0% | 0.6x | 8.5x |

| Pure Cycle Corporation | 376 | 356 | 17 | 7 | 41.1% | NM | NM | NM |

| AgroFresh Solutions, Inc. | 108 | 478 | 162 | 52 | 32.3% | 8.0% | 3.0x | 9.1x |

| Ceres Global Ag Corp. | 106 | 268 | 784 | 28 | 3.6% | NM | 0.3x | 9.6x |

| Median | $137 | 17.2% | 11.1% | 2.9x | 10.6x | |||

| Average | $643 | 20.4% | 14.9% | 2.3x | 13.2x |

Agriculture Producers

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EBITDA Margin | NTM Sales Growth | EV/LTM Rev | EV/LTM EBITDA |

|---|---|---|---|---|---|---|---|---|

| Tyson Foods, Inc. | $30,328 | $39,091 | $45,698 | $5,145 | 11.3% | NA | 0.9x | 7.6x |

| Darling Ingredients Inc. | 12,788 | 14,328 | 4,451 | 774 | 17.4% | 5.0% | 3.2x | 18.5x |

| Pilgrim’s Pride Corporation | 7,081 | 10,098 | 13,857 | 1,050 | 7.6% | NA | 0.7x | 9.6x |

| Sanderson Farms, Inc. | 4,178 | 3,964 | 4,336 | 601 | 13.9% | NA | 0.9x | 6.6x |

| Cal-Maine Foods, Inc. | 1,771 | 1,682 | 1,388 | 26 | 1.9% | NA | 1.2x | NM |

| Mission Produce | 1,449 | 1,555 | 862 | 85 | 9.9% | 19.0% | 1.8x | 18.2x |

| Fresh Del Monte Produce Inc. | 1,392 | 2,113 | 4,237 | 204 | 4.8% | NA | 0.5x | 10.4x |

| Adecoagro S.A. | 1,116 | 2,108 | 1,033 | 451 | 43.7% | 4.0% | 2.0x | 4.7x |

| Calavo Growers, Inc. | 718 | 823 | 1,017 | 32 | 3.1% | NA | 0.8x | 26.1x |

| Farmland Partners Inc. | 571 | 1,322 | 49 | 22 | 45.7% | 10.8% | NM | NM |

| Limoneira Company | 284 | $431 | $162 | $0 | 0.3% | 20.1% | 2.7x | NM |

| Alico, Inc. | 283 | 388 | 109 | 30 | 27.0% | NA | 3.5x | 13.1x |

| S&W Seed Company | 139 | 188 | 86 | (16) | NA | (3.8%) | 2.2x | NA |

| Median | $85 | 10.6% | 7.9% | 1.5x | 10.4x | |||

| Average | $646 | 15.5% | 9.2% | 1.7x | 12.8x |

Notable Transactions: Agribusiness

| Date | Acquirer/Investor | Target | Target Description |

|---|---|---|---|

| Pending | Deveron | Agronomic Solutions | Operator of digital agronomy company intended to serve coops, retailers, seed businesses, growers, landowners, and farm managers |

| Pending | Frutura | Dayka & Hackett | Producer and importer of fruits |

| Pending | ADM | Deerland Probiotics & Enzymes | Contract manufacturer of probiotic, prebiotic and enzyme-based ingredients |

| Pending | CGC Ventures | Sanderson Farms | Poultry processing company |

| Nov 21 | Sentera | Insight Sensing | Developer of a remote sensing technology designed to offer actionable information to help agronomists manage the variability found in the fields |

| Oct 21 | Hortifrut | Atlantic Blue | Producer of berries and cherries intended to serve the food industry |

| Oct 21 | Profile Products | Florikan | Manufacturer and distributor of controlled-release fertilizers dedicated to evolving plant nutrition through advanced fertilizer technologies |

| Oct 21 | Universal Corporation | Shank’s Extracts | Producer of specialty ingredients, extracts, flavors and colors intended for the food and beverage industry |

| Sep 21 | Tide Rock Holdings | Summit Seed Coatings | Producer of seed coatings intended to enhance seed productivity and yield |

| Sep 21 | Casella Waste Systems | Grow Compost of Vermont | Manufacturer of compost intended to offer healthy soils for gardens and farmlands |

| Aug 21 | Taylor Farms | Pure Green Farms | Grower, packer, and shipper of hydroponic-grown lettuce |

| Aug 21 | Organics By Gosh | WRK Enterprises | Manufacturer of compost and soil products intended to serve the landscaping needs of Austin and the surrounding communities |

| Aug 21 | Deere | Bear Flag Robotics | Developer of self-driving technology for tractors designed to lower the cost of farming through automation |

| Aug 21 | Easy Bio | Furst-McNess | Manufacturer of animal feed intended for the North American livestock industry |

| Aug 21 | Brenntag SE | JM Swank, LLC | Supplier of food ingredients including spices, dairy, grain, sweeteners, fats & oils, texturants, flavors & colors, starches, cocoa, and inclusions |

| Jul 21 | GrubMarket | Terminal Produce | Distributor and importer of tropical fruits, vegetables and fish intended to serve in New York and New Jersey |

| Jul 21 | Wilbur-Ellis Nutrition | Ametza | Producer for forage pellets intended to serve the livestock and companion animal farmers |

| Jul 21 | BrightFarms | Lēf Farms | Producer of fresh greens for grocery stores, hospitality sector, schools, restaurants and food service providers |

| Jun 21 | Indianapolis Fruit Company | Valley Produce | Distributor of fresh produce and specialty products to foodservice customers |

| Jun 21 | Gulftech International | Verdant Technologies | Developer of perishable supply chain technology intended to reduce global waste and increase sustainability |

| Jun 21 | GrubMarket | Sierra Produce | DIstributor of fresh fruit products to grocery stores, supermarkets, online grocers and others across the U.S. |

| Jun 21 | Arable Capital Partners | Royal Ridge Fruit and Cold Storage | Processor of organic and conventional dried and IQF fruits |

| Jun 21 | Benford Capital Partners | Nutrition Service Company | Manufacturer of livestock nutrition products intended for the agricultural industry |

| Jun 21 | Ideanomics | Solectrac | Manufacturer of battery-powered electric tractors intended to power tractors by using the sun, wind, and other clean renewable sources of energy |

| Jun 21 | Semios | Altrac | Developer of an agriculture automation platform designed for agricultural equipment |

| Jun 21 | Hormel Foods | Kraft Heinz (Planters Peanuts & Snacks Business) | Producer of cashew nut and assorted nut snacks based in the United States |

| Jun 21 | Nutrien Ag Solutions | Boyer Fertilizer & Pacific Coast Ag | Processor, blender and distributor of branded, specialty and private label commercial fertilizers to the agricultural market |

| Jun 21 | MGP Ingredients | Inclusion Technologies | Manufacturer of alternatives and functional sensory ingredients |

| May 21 | Apeel | ImpactVision | Developer of a food security and quality software platform designed to build a transparent and secure global food system and prevent food waste |

| May 21 | Synergy Flavors | Innova Flavors | Manufacturer of flavors, enhancers, and taste modifiers |

| May 21 | Agrauxine | Advanced Biological Marketing | Manufacturer and distributor of agricultural biologicals and farm treatment products intended to increase yields and improve farm productivity |

| Apr 21 | Tilia Holdings | NutriScience Innovations | Manufacturer of fine quality nutritional and functional food ingredients |

| Apr 21 | Global Clean Energy Holdings | Agribody Technologies | Developer of yield-enhancing genetic technology designed to promote crop resistance and yields |

| Apr 21 | AppHarvest | Root AI | Developer of AI-powered robotics technology with a focus on indoor farming |