Aerospace & Defense M&A Trends: Fall 2021

Published November 8, 2021

Key Insights

- Improved outlook for commercial aerospace

- M&A in defense industry remains active

- Increasing use of advanced data and analytics technologies

- Continued strong investor interest in drones / UAVs

Highlights

The outlook for the commercial aerospace industry is improving as demand for commercial air travel is expected to return to pre-pandemic levels by 2023-2024, led first by domestic flights and production of single-aisle aircraft that most commonly support domestic travel.

Defense has remained an attractive segment for M&A for both strategic and financial investors in 2021. Investor acquisition and investment strategies have been focused on defense electronics and cybersecurity and intelligence services subsegments.

The data and analytics market has seen interest from strategic investors that are looking to broaden their portfolio of products and services available to customers but also leverage the data collected to inform decisions across other areas of their business.

The Drone / UAV market has continued to show momentum, driven by an increasing portion of the defense budget focused on advanced warfare technologies and continued adoption in commercial applications.

Market Insights

Improved Outlook for Commercial Aerospace

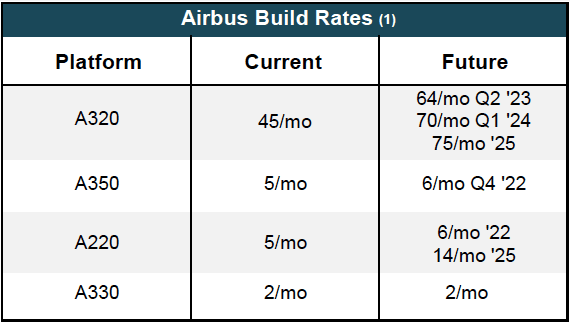

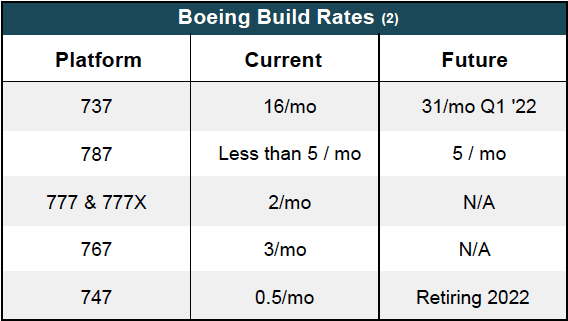

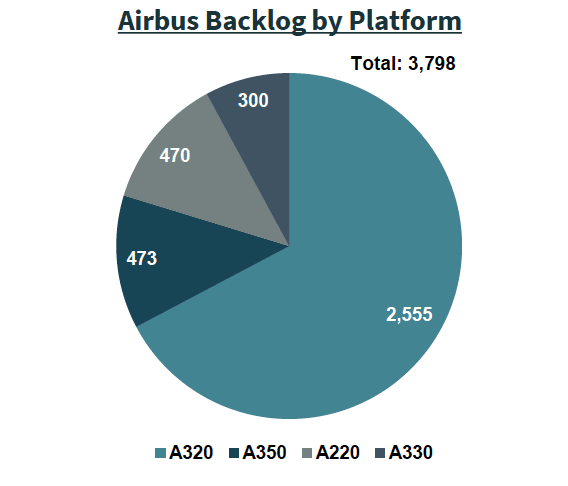

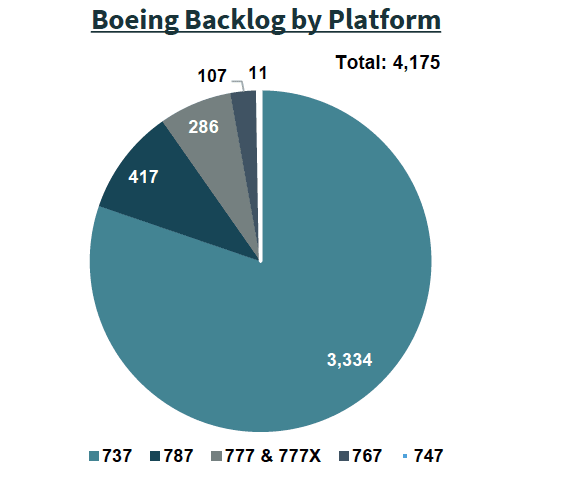

- The outlook for the commercial aerospace industry is improving as demand for commercial air travel is expected to return to pre-pandemic levels by 2023-2024, led first by domestic flights and production of single-aisle aircraft that most commonly support domestic travel. Through the first half of 2021 commercial flights have begun to rebound and are up approximately 11% over 2020, while still down over 30% from pre-pandemic levels.

- Boeing’s latest Commercial Market Outlook is calling for a fleet growth of 3.1% and traffic growth of 4.0% from 2021 to 2040, consistent with its prior outlook reinforcing the confidence in the long-term fundamentals of the industry.

- As the industry looks to recover, suppliers will want to be well positioned with capacity as well as production and workforce plans to support expected increases in production rates by the major OEMs. Boeing, Airbus, and key tier 1’s are requiring suppliers to demonstrate their ability to scale.

- There has been a recent increase in M&A activity by financial investors seeking platforms with defense exposure as well as companies well-positioned to capitalize on the recovery of commercial build rates. Recent examples include Angeles Equity Partners’ acquisition of Primus Aerospace, Endeavour Capital’s acquisition of Forrest Machining, Inc., and Greenbriar Equity’s acquisition of Integral Aerospace.

- In Q2, Wipro Givon USA acquired distressed Tect Aerospace, highlighting a trend that may be expected to continue by strategic investors as they look to recapitalize suppliers challenged through the 737MAX crisis and COVID-19.

Commercial Aircraft Build Rate Forecasts & Backlog

Sources: Airbus, Boeing, Pitchbook, company press releases, company websites & Meridian research

M&A in the Defense Industry Remains Active

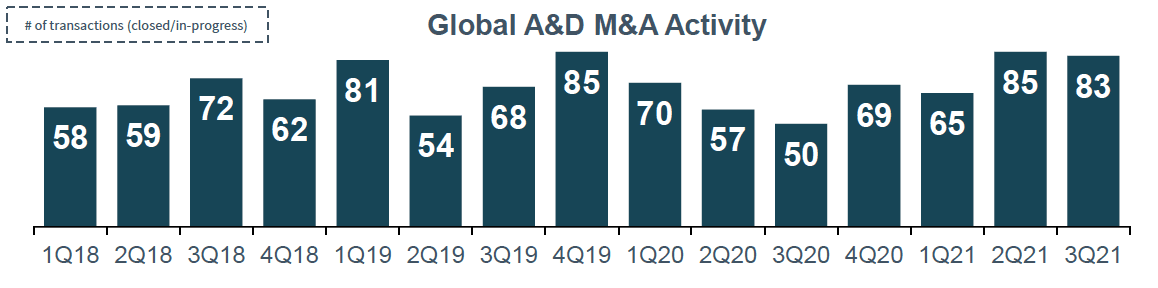

- The defense industry has remained an active sector for both financial and strategic investors in 2021 with over 134 transactions completed through Q3, representing a 5% increase over the same period last year.

- Acquisition and investment strategies focused on defense electronics, and cybersecurity and intelligence services subsegments, representing 52 transactions in H1 2021, have led the charge. Recent examples include Mercury Systems’ acquisition of Pentek, Symphony Technology Group’s acquisition of FireEye’s products business, and General Atomics’ acquisition of Synopta.

- Tier 1 defense companies have also been actively divesting business units to streamline their portfolios. In June, Moog divested its Navigation Aids Business to Thales and in September, Raytheon Technologies completed its divestiture of its Defense Training and Mission Critical Solutions Business to the PE firm, American Industrial Partners.

- 2021 has witnessed several large mergers by strategic investors including Eaton’s acquisition of Sargent Fletcher, Parker Hannifin’s acquisition of Meggitt, Huntington Ingalls acquisition of Allion Science and Technology, all transacting at over $1B in enterprise value.

- A vast majority of financial investor activity has consisted of add-on/roll-up transactions, which accounted for over 84% of the private equity defense deals in Q3 2021. Most notable roll-ups include VT Group’s (Jordan Company) acquisition of ASSETT, and Evans Capacitor Company’s (Arcline Investment Management) acquisition of BEI Precision.

Increasing use of Advanced Data and Analytics Technologies

- Aviation data and analytics are becoming increasingly important for companies in the industry in order to enhance operating efficiency, improve reliability, and reduce costs.

- The global aviation analytics market is forecasted to experience strong growth between 2020 and 2025, increasing from $1.7B to $3B, representing a CAGR of 11.5%.(1) Key subsegments include maintenance tracking, fleet management, flight planning and navigation, and training and resource management.

- The data and analytics market has seen interest from strategic investors that are looking to broaden their portfolio of products and services available to customers but also leverage the data collected to inform decisions across other areas of their business. Recent examples include Collins Aerospace’s acquisition of FlightAware, a provider of global flight tracking solutions; and Jet Support Services, Inc (backed by PE firm, GTCR) acquisition of SierraTrax, a provider of aircraft maintenance tracking software.

Continued Strong Investor Interest in Drones / UAVs

- The unmanned aerial vehicle (“UAV”) market has continued to show momentum, reflected by forecasted growth from $27.4B in 2021 to $58.4B by 2026, a 16.4% CAGR. Key growth drivers for the segment include an increasing portion of the defense budget focused on advanced warfare technologies and the continued adoption in the commercial market for applications including farming and agriculture, media and telecom, public safety, construction, and mining.(1)

- The drone and UAV industry continues to attract strong PE and VC interest with 300+ financings over the past 24 months with total funding of over $2.6B. The most active UAV investors include Andreessen Horowitz, Lockheed Martin Ventures, and Next47, accounting for a combined 48% of total capital funding.

- UAV companies have also been attractive targets for M&A with 53 transactions completed over the past 24 months. Recent transactions include: 1) Red Cat Holdings’ acquisition of Teal Drones, a leader in commercial and government UAV technology, 2) iSTAR’s (Avnon Group) acquisition of ALTI UAS, a producer of vertical take-off and landing drones (“VTOL”), and 3) Aerodome’s acquisition of FlyTech, a provider of advanced aviation services and solutions in the commercial aerospace market.

Sources: Pitchbook, company press releases, company websites & Meridian research

1) Markets and Markets Report

Aerospace & Defense M&A Activity

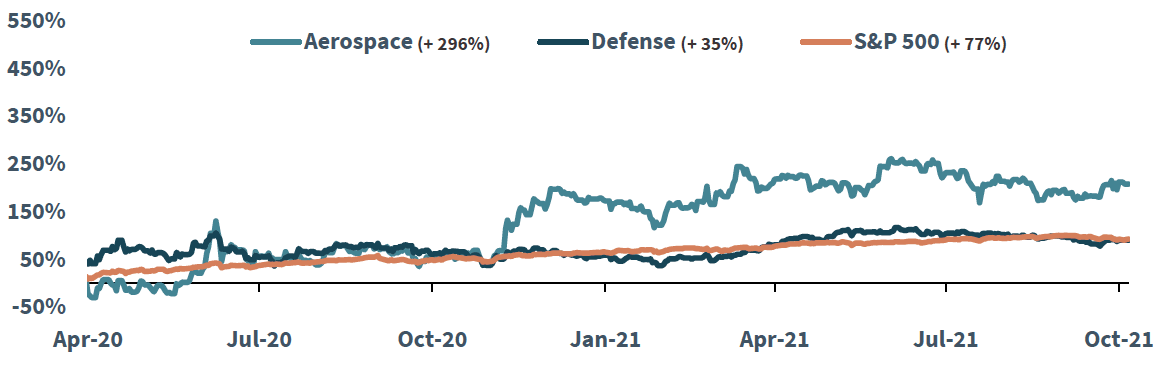

M&A Activity and Market Trends

Sector Index Performance2

Recent Transaction Spotlights – PE-Backed Strategics with Add-on Acquisitions

Description: Cassavant Machining has acquired Systems 3, a manufacturer and supplier of flight critical components to the aerospace and defense industries.

Rationale: The acquisition will enhance Cassavant’s scale, technical capabilities, and customer relationships.

Description: Jet Support Services has acquired SierraTrax, a manufacturer and provider of aircraft maintenance tracking.

Rationale: The acquisition will enable JSSI to deliver a full suite of highly complementary services to the market that will simplify and optimize the aircraft maintenance experience.

Description: UAV Factory has acquired Jennings Aeronautics, a provider of innovative Small Unmanned Aerial Systems (“SUAS”).

Rationale: Jennings Aeronautics brings an experienced team of engineers and technicians to the UAV Factory platform as well as best-in-class SAUS products for diverse applications.

2) Individual components of Aerospace and Defense Indices can be found below. Indices weighted by Market Capitalization.

Sources: Pitchbook, Meridian research & company press releases

Publicly-traded Aerospace & Defense Companies

Aerospace

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Boeing Co. | $122,153 | $164,751 | $62,797 | ($3,409) | 2.6x | NA | NA | 44% |

| Airbus S.A.S. | $102,092 | $97,777 | $65,610 | $9,309 | 1.5x | 10.5x | 14.2% | 78% |

| Safran Group SA | $56,473 | $60,301 | $17,283 | $3,160 | 3.5x | 19.1x | 18.3% | 25% |

| TransDigm Group, Inc. | $34,632 | $50,119 | $4,692 | $2,050 | 10.7x | 24.4x | 43.7% | 32% |

| HEICO Corporation | $17,935 | $18,310 | $1,782 | $469 | 10.3x | 39.0x | 26.3% | 34% |

| Textron Inc. | $16,311 | $17,901 | $12,727 | $1,449 | 1.4x | 12.4x | 11.4% | 103% |

| MTU Aero Engines AG | $11,576 | $12,315 | $4,687 | $589 | 2.6x | 20.9x | 12.6% | 27% |

| Hexcel Corporation | $4,725 | $5,496 | $1,260 | $176 | 4.4x | 31.2x | 14.0% | 68% |

| Spirit AeroSystems Holdings, Inc. | $4,382 | $6,800 | $3,586 | ($82) | 1.9x | NA | NA | 128% |

| Triumph Group, Inc. | $1,295 | $2,668 | $1,771 | $170 | 1.5x | 15.7x | 9.6% | 204% |

| Kaman Corporation | $1,025 | $1,127 | $753 | $97 | 1.5x | 11.6x | 12.9% | (7)% |

| Ducommun Inc | $567 | $876 | $626 | $89 | 1.4x | 9.9x | 14.2% | 45% |

| Median | $15,108 | $4,137 | $323 | 2.3x | 17.4x | 14.1% | 44% | |

| Mean | $36,537 | $14,798 | $1,172 | 3.6x | 19.5x | 17.7% | 65% |

Defense

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Raytheon Technologies Corporation | $133,498 | $160,472 | $63,763 | $10,482 | 2.5x | 15.3x | 16.4% | 64% |

| Lockheed Martin Corporation | $91,393 | $100,340 | $66,347 | $9,445 | 1.5x | 10.6x | 14.2% | (5)% |

| Northrop-Grumman Corporation | $56,858 | $66,950 | $37,240 | $5,854 | 1.8x | 11.4x | 15.7% | 24% |

| General Dynamics Corporation | $56,573 | $68,747 | $38,658 | $5,395 | 1.8x | 12.7x | 14.0% | 54% |

| L3 Harris Technologies, Inc. | $45,017 | $50,848 | $18,358 | $3,920 | 2.8x | 13.0x | 21.4% | 39% |

| BAE Systems Plc | $24,287 | $29,608 | $26,133 | $3,827 | 1.1x | 7.7x | 14.6% | 49% |

| Thales SA | $19,890 | $23,108 | $21,053 | $2,442 | 1.1x | 9.5x | 11.6% | 43% |

| Elbit Systems Ltd. | $6,897 | $8,194 | $4,933 | $449 | 1.7x | 18.3x | 9.1% | 38% |

| Kratos Defense & Security Solutions Inc | $2,684 | $2,674 | $808 | $90 | 3.3x | 29.6x | 11.2% | 15% |

| Moog Inc. | $2,479 | $3,308 | $2,835 | $206 | 1.2x | 16.0x | 7.3% | 23% |

| Median | $40,228 | $23,593 | $3,873 | 1.7x | 12.9x | 14.1% | 38% | |

| Mean | $51,425 | $28,013 | $4,211 | 1.9x | 14.4x | 13.6% | 34% |

Weatherhaven Global Resources Ltd. Acquired by White Wolf Capital

In September 2021, Meridian Capital completed the successful acquisition of Weatherhaven Global Resources, Ltd. (“Weatherhaven” or the “Company”), by White Wolf Capital (“White Wolf”).

Weatherhaven is recognized as one of the world’s leading suppliers of rapid and redeployable mobile infrastructure – from military operations in the desert to climate research stations in ultra-cold Antarctica to sophisticated medical, humanitarian and disaster relief solutions. Headquartered in British Columbia, Canada, the Company’s collective engineering, product design and project management capabilities allow Weatherhaven to deliver scalable, full lifecycle solutions to their customers in over 95 countries and all seven continents.

Ray Castelli, CEO of Weatherhaven shared, “We are excited about what the future holds as part of the White Wolf family of investments.”

Pacific Consolidated Industries Recapitalized by TJM Capital Partners

In March 2021, Meridian Capital completed the successful recapitalization of Pacific Consolidated Industries, LLC (“PCI” or the “Company”), a portfolio Company of Main Street Capital Corporation (NYSE: MAIN), by TJM Capital Partners (“TJM”).

Founded in 1984 and based in Riverside, California, PCI is a leading provider of deployable, onsite, liquid and gaseous oxygen and nitrogen generating systems. PCI’s products serve applications where it is inefficient to utilize distributed industrial gases including aerospace and defense, medical, water and wastewater treatment, oil & gas, and general industrial end-markets.

Bob Eng, CEO of PCI shared “On behalf of PCI Gases, we’re very excited to partner with TJM’s partners and investors to drive further growth on a broader scale by expanding our market reach and value-added offerings and solutions to new and existing customers, particularly in the medical and industrial oxygen markets.”

Notable Transactions: Aerospace

| Announced Date | Acquirer/Investor | Target | Target Description |

|---|---|---|---|

| Sep-21 | Bain Capital | Industria de Turbo Propulsores | Developer and manufacturer of aircraft engine components and gas turbines |

| Sep-21 | Latecoere | Shimtech de Mexico | Manufacturer of engineered structural composite assemblies and components |

| Sep-21 | Montana Aerospace | ASCO Industries | Manufacturer and supplier of structural parts and assemblies for the aerospace industry |

| Aug-21 | Latecoere | Technical Airborne Components Industries | Designer and manufacturer of rods and struts |

| Aug-21 | Collins Aerospace | FlightAware | Operator of a digital aviation company and data tracking platform |

| Aug-21 | Accel-KKR | Aircraft Technical Publishers | Provider of maintenance, operations, inventory, repetitive defect analysis |

| Aug-21 | Hunting | Cumberland Additive | Manufacturer of 3D printed metal and plastic parts intended for aerospace, defense, space, oil, and gas industries |

| Aug-21 | Platinum Equity | Unical Aviation | Provider of aircraft parts and components to the global commercial aerospace market |

| Aug-21 | Endeavour Capital | Forrest Machining | Manufacturer and supplier of critical structural components and assemblies for the aerospace and defense industry |

| Aug-21 | CAE | Global Jet Services | Provider of aviation maintenance, safety, and leadership training services |

| Aug-21 | Greenbriar Equity Group | Integral Aerospace | Manufacturer of flight-critical products intended for the aerospace and defense markets |

| Aug-21 | Parker Hannifin | Meggitt | Producer of extreme environment components and smart sub-systems designed to deliver breakthrough performance |

| Aug-21 | Gemini Investors | Aero Bending | Manufacturer of specialty tube assemblies for aerospace and defense programs |

| Aug-21 | McCarthy Capital | CPaT Global | Provider of distance learning services intended for the aviation industry |

| Jul-21 | Lisi Aerospace | B&E Manufacturing | Manufacturer of hydraulic tube fittings catering to aerospace, commercial, and military applications |

| Jul-21 | Aerodrome | FlyTech | Specializes in providing advanced aviation services and solutions in the commercial market |

| Jul-21 | StandardAero | Signature Aviation | Provider of global aviation support and aftermarket services based in London, United Kingdom |

| Jun-21 | GTCR | SierraTrax | Developer of maintenance tracking software for the aviation industry |

| Jun-21 | Jet Aviation Services Gmbh | ExecuJet Zurich FBO Hangar Operations | Provider of business aviation services for individuals, companies and governments |

| Jun-21 | HEICO Corporation | Operating Assets of Camtronics | Provider of aircraft maintenance, repair and overhaul services |

| Jun-21 | Flight Support Group | Camtronics | Provider of aircraft maintenance, repair and overhaul services intended to serve the aviation industry |

| Jun-21 | Blackhawk Modifications, Inc. | Columbia Avionics & Aircraft Services, Inc | Provider of avionics equipment and maintenance services |

| Jun-21 | Integrated Polymer Solutions Group | Swift Textile Metalizing | Manufacturer and designer of highly engineered metalized fabrics |

| Jun-21 | GLOBAL Systmes Asia Sdn Bhd | RUAG (Swiss Maintenance, Repair and Overhaul) | Owner and operator of a space equipment manufacturing |

| Jun-21 | Airpas Aviation GmbH | FuelPlus Worldwide | Developer of fuel administration and cost management software intended for the aviation industry |

| Jun-21 | Agile Space Industries Inc. | Tronix3D | Provider of industrial 3D printing and product development services headquartered in Mount Pleasant, Pennsylvania |

| Jun-21 | Broadstone Acquisition Corp | Vertical Aerospace | Developer of an eVTOL aircraft intended for more efficient transportation in urban environments |

| Jun-21 | Angeles Equity Partners, LLC | Primus Metals | Provider of complex precision component manufacturing for the aerospace, defense and space sectors |

| Jun-21 | Airbus Helicopters | ZF Luftfahrttechnik | Manufacturer of helicopter transmission systems intended to provide turn-key solutions for gearbox and rotor test stands |

| Jun-21 | KKR & Co. Inc. | Atlantic Aviation FBO | Provider of a wide range of aircraft ground handling and corporate flight support service |

| Jun-21 | HCI Equity Partners | Eagle Electronics | Manufacturer of printed circuit boards focused on high-performance applications |

| Jun-21 | Eaton | Sargent Fletcher | Manufacturer and supplier of aircraft equipment and parts |

| May-21 | Wipro Enterprise | TECT Aerospace | Manufacturer of complex aerostructure components, parts and assemblies |

| May-21 | GenNx360 Capital Partners | Keystone Turbine Services | Provider of OEM-approved aftermarket maintenance, repair and overhaul services based in Coatesville, Pennsylvania |

| May-21 | Desktop Metal, Inc. | Adaptive 3D Technologies | Supplier of premium additive manufacturing polymer resins |

| May-21 | South Middleton Township Municipal Authority | Stobart Air | Operator of regional airlines and aircraft leasing business in Dublin, Ireland |

| May-21 | Arlington Capital Partners | Qarbon Aerospace | Provider of complex structural components and asemblies for aircrafts |

| May-21 | Experience Investment | Blade Urban Air Mobility | Operator of a digitally powered aviation company |

| May-21 | AMETEK, Inc. | Nearfield Systems | Developer of microwave antenna based measurement systems and products |

| May-21 | Ross Aviation Operations LLC | FBO and MRO Businesses of Silverhawk Aviation | Provider of aircraft chartering services |

| Apr-21 | J&E Precision Tool | Alloy Specialties | Manufacturer of engine components |

| Apr-21 | Spirit AeroSystems Holdings | Applied Aerodynamics | Provider of aircraft maintenance services |

| Apr-21 | Greenbriar Equity Group | PCX Aerostructures | Manufacturer of large structural airframe assemblies |

| Apr-21 | Alinda Capital Partners LLC | ACL AirShop | Manufacturer and provider of ULD cargo control products, logistics solutions and leasing for the air cargo industry |

Notable Transactions: Defense

| Announced Date | Acquirer/Investor | Target | Target Description |

|---|---|---|---|

| Oct-21 | Arlington Capital Partners | Stellant Systems (Subsidiary of L3 Harris Technologies) | Designer and manufacturer of electron devices and related products |

| Sep-21 | Cassavant | Systems 3 | Supplier and manufacturer of flight critical components |

| Sep-21 | AE Industrial Partners | Jennings Aeronautics | Manufacturer of unmanned aircraft vehicles |

| Sep-21 | Raytheon Technologies | Seakr Engineering | Developer of high end electronic assemblies designed for space applications based in Centennial, Colorado |

| Sep-21 | Arcline Investment Management | Hunt Valve Company | Manufacturer and designer of fluid power engineering components and parts |

| Sep-21 | American Industrial Partners | Raytheon Technologies | Operator of an aerospace and defense holding company intended to provide advanced systems and services |

| Sep-21 | Osprey Technology | BlackSky | Provider of real-time geospatial intelligence, imagery, and data analytics services |

| Sep-21 | White Wolf Capital | Weatherhaven Global Resources | Supplier of rapid and redeployable mobile infrastructure |

| Sep-21 | Ares Capital Corporation BDC | CoreHog | Provider of core cutting tools |

| Sep-21 | Red Cat Holdings | Teal | Developer of small unmanned vehicle systems |

| Aug-21 | iSTAR | ALTI UAS | Designer and developer of unmanned aerial aircraft |

| Aug-21 | The Jordan Company | ASSETT | Developer of undersea warfare and unmanned systems |

| Aug-21 | NextGen Acquisition II | Virgin Orbit | Provider of satellite launch services intended to make space accessible to everyone |

| Aug-21 | Huntington Ingalls Industries | Alion Science and Technology | Provider of engineering, information technology and operational services for DoD |

| Aug-21 | Arcline Investment Management | BEI Precision | Designer and manufacturer of precision parts and systems |

| Aug-21 | Arcline Investment Management | Seal Science | Manufacturer and designer of engineered elastomeric sealing solutions |

| Jul-21 | Nexus Capital Management | HDT Global | Manufacturer of highly engineered, mission-capable infrastructure solutions |

| Jun-21 | Arcline Investment Management | Union Technologies Corporation | Manufacturer, designer and developer of multilayer ceramic capacitors and assemblies |

| Jun-21 | Thales Group | Moog | Developer of incident management platform |

| Jun-21 | DarkPulse, Inc. | TerraData Unmanned | Manufacturer of unmanned aircraft system (UAS) and provider remotely operated vehicle (ROV) services |

| Jun-21 | Battle Investment Group | Turbopower | Provider of engine and component repair and overhaul services to the military, commercial and corporate aircraft |

| Jun-21 | General Atomics Corp. | Synopta | Manufacturer of complex optoelectronic instrumentation for space and terrestrial applications |

| Jun-21 | Kitty Hawk Corporation | 3D Robotics | Developer of smart drones and drone data platform designed to provide site scanning and land mapping services |

| Jun-21 | John H Northrop And Associates | Technology Security Associates | Provider of cybersecurity and platform security services intended to protect DoD systems and information |

| Jun-21 | Broadstone Acquisition | Vertical Aerospace | Developer of an eVTOL aircraft intended for more efficient transportation in urban environments |

| Jun-21 | Angeles Equity Partners | Primus Aerospace | Provider of complex precision component manufacturing for the aerospace, defense and space sectors |

| Jun-21 | Symphony Technology Group, LCC | Products Business of FireEye | Cybersecurity firm that offers solutions for networks, endpoints, and email |

| Jun-21 | Symphony Technology Group, LCC | Novetta Solutions | Provider of scalable advanced analytics and technology services |

| May-21 | Mercury Systems, Inc. | Pentek | Manufacturer of ruggedized, commercial off-the-shelf software-defined radio, recording systems and subsystems |

| May-21 | AE Industrial Partners | Wingman Defense | Provider of artificial intelligence based defense solutions in the US market |

| May-21 | Teledyne Technologies | FLIR Systems | Manufacturer of thermal imaging systems |

| May-21 | Red Cat Holdings | Skypersonic | Manufacturer of drones |

| May-21 | Brightstar Capital Partners | Engineering Research and Consulting | Provider of engineering and consulting services |

| May-21 | Arlington Capital Partners | Qarbon Aerospace | Provider of aerospace services |

| May-21 | Ott Ventures | Sting Industries | Developer of modular drones |

| May-21 | Booz Allen Hamilton Inc. | Liberty IT Solutions | Provider of information technology services to multiple government agencies |

| May-21 | AeroVironment | Telerob | Manufacturer of remote-controlled robots |

| May-21 | Enjet Aero | Birken Manufacturing | Manufacturer of engine assemblies/components |

| May-21 | Noblis | McKean Defense | Provider of naval sustainment and logistics services |

| Apr-21 | J&E Precision Tool | Alloy Specialties | Manufacturer of engine components intended for the commercial and military gas turbine industries |

| Apr-21 | AMETEK | Abaco Systems | Provider of open architecture electronic systems |

| Apr-21 | BDT Capital Partners | American Glass Products | Manufacturer and designer of glazing products |

| Apr-21 | Elbit Systems | Elisra | Manufacturer of high-tech electronic devices |

| Mar-21 | TJM Capital Partners | Pacific Consolidated Industries | Manufacturer of ruggedized onsite liquid, gaseous oxygen, and nitrogen generators |

| Apr-21 | Raven Industries, Inc | Jaybridge Robotics | Developer of computer integrated systems |

| Apr-21 | Rotor Acquisition Corp. | Sarcos | Developer of mobile, dexterous, and teleoperated robots designed to augment worker performance |

| Apr-21 | Elbit Systems | Sparton | Manufacturer of electromechanical devices |

| Apr-21 | Nikon | Morf3D | Provider of additive manufacturing services |

| Apr-21 | Anduril | Area-I | Designer and developer of unmanned aircraft systems |

| Apr-21 | Elbit Systems | BAE Systems Rokar International | Developer of defense products |

| Mar-21 | TJM Capital Partners | Pacific Consolidated Industries | Manufacturer of ruggedized onsite liquid, gaseous oxygen, and nitrogen generators |