Food & Agribusiness M&A Trends: Winter 2024

Published February 12, 2024

Key Insights

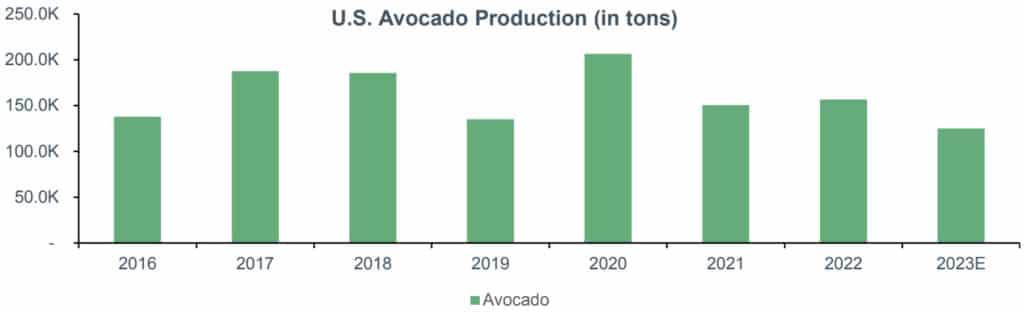

- Avocado Supply Shifts to South American Focus as Domestic Production Slows

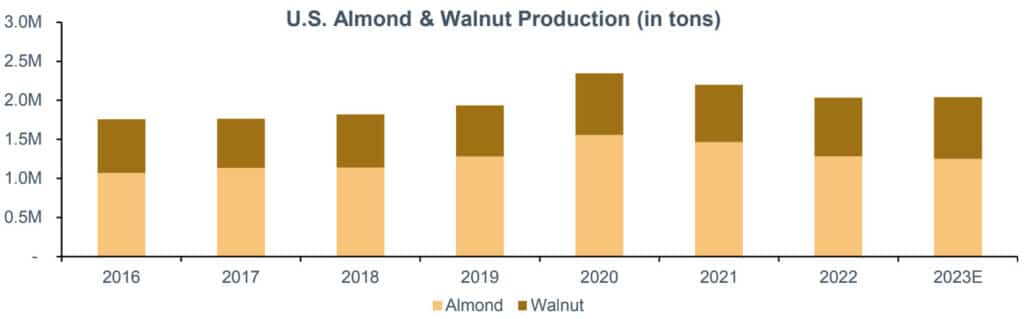

- YoY Growth in Tree Nuts Leading to Strong 2024 Outlook

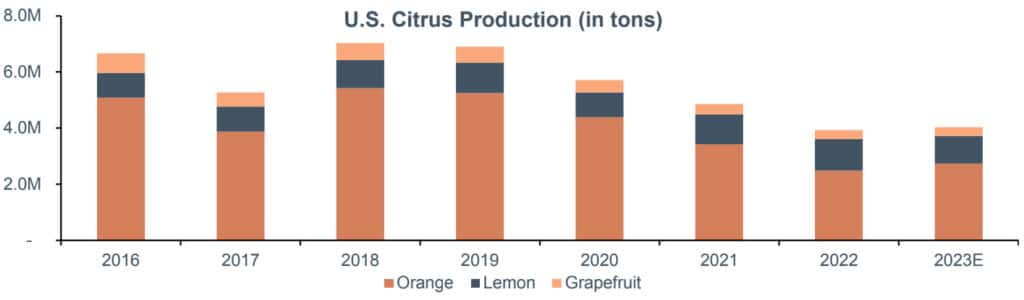

- Anticipated Rebound in Domestic Citrus Production

- Blueberry Uptick Continues Alongside Consumer Demand

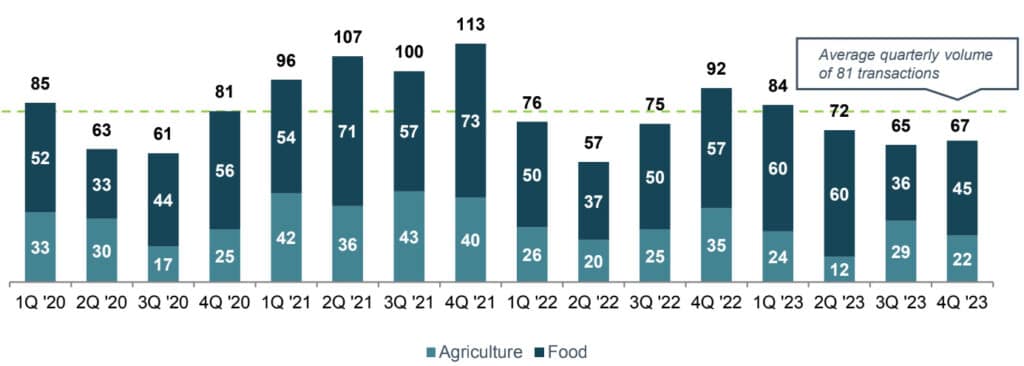

M&A activity in the food and agribusiness sector continues to be driven by food production transactions, which has remained prevalent as far back as Q1 2020. This trend is expected to continue into 2024 as business owners positively change their sentiment towards the overall economy and M&A landscape. As 2024 continues to move forward, an uptick in M&A activity can be expected.

Food & Agribusiness Market Insight

Avocado Supply Shifts to South American Focus as Domestic Production Slows

- The U.S. avocado market continues to experience growth in consumption, reflecting the popularity of avocados among American consumers. However, domestic avocado producers in California, Florida, and Hawaii are encountering challenges that diminish their competitiveness, such as water shortages and a labor deficit of agricultural workers.

- In recent years, in response to the challenges faced by domestic producers, the US has become increasingly dependent on avocado imports. This shift benefits countries like Mexico and Peru with favorable climatic conditions enabling a year-round avocado cultivation.

- While Mexico has historically been the largest supplier to the U.S. avocado market, the increased diversification of sourcing location will likely offer more consistent pricing and availability for consumers.

YoY Growth in Tree Nuts Leading to Strong 2024 Outlook

- Despite challenging weather conditions in early 2023 and Hurricane Hillary, tree nut production is expected to be virtually flat compared to 2022. Farmers are expecting a high-quality crop vis-à-vis favorable growing conditions, substantial snowpack, and increased rainfall recently.

- Farmers are expressing positivity regarding the 2024 crop, buoyed by favorable harvest conditions, a limited overhang from the preceding harvest, and a decreased impact from tariffs. This optimism marks a contrast to the challenges faced in 2022 when unprecedented heatwaves and sluggish demand led to historically low returns for growers.

- Tree nut prices for the 2022 harvest plummeted to multi-decade historic lows, with the average real price, adjusted for inflation, aligning closely with 1999 levels. Yet, as we enter 2024, growers are experiencing a significant upturn, with prices now standing 40% higher than the preceding year.

Sources: U.S. Department of Agriculture, Fresh Fruit Portal, ProducePay, Valley Voice

Anticipated Rebound in Domestic Citrus Production

- Overall, citrus production levels remained consistent year over year compared to 2022, with a handful of citrus commodities in the West Coast exceeding expectations.

- The fresh market in the U.S. experienced a significant rise in both the volume and market dominance of domestically grown citrus fruits. This growth was driven mainly by larger harvests of navel oranges, tangerines, and lemons in California compared to the previous season.

- After years of domestic production decline, according to USDA projections released in October 2023, there is an uptick in anticipated production for the current citrus season, especially for grapefruit and specialty fruits, which suggests a potential rebound from the lows of 2022-2023.

- Due to citrus greening disease in the previous harvest seasons, there have been significant investments in developing disease-resistant citrus varieties in addition to alternative pest control methods.

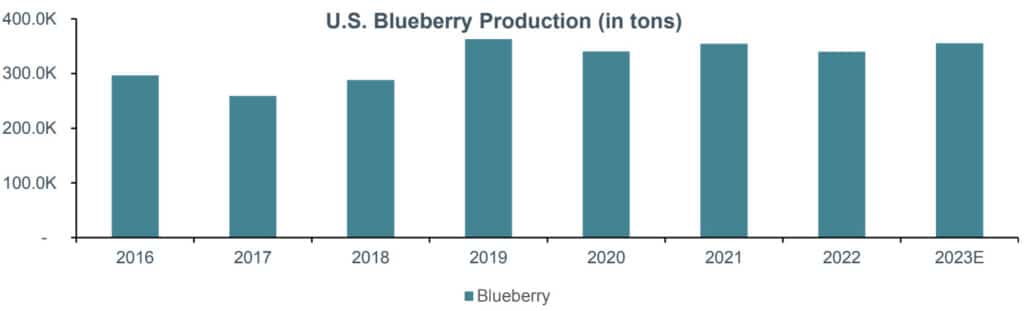

Blueberry Uptick Continues Alongside Consumer Demand

- Overall, the US saw an uptick in blueberry production, continuing momentum from the 2018 – 2019 production growth. Regions like Georgia, North Carolina, and Michigan saw significant increases in production.

- Heading into 2024, experts suggest the global blueberry market will continue to show an upward trend, suggesting continued consumer demand.

- In addition to the increase consumer demand for blueberries, growers are predicting an increase in production for 2024, indicating long-term market stability.

Sources: U.S Department of Agriculture, Global Agricultural Information Network, Produce Report

Food & Agribusiness Middle Market M&A Activity

Food & Agriculture M&A Activity

- In Q4 2023, M&A transaction volume remained consistent in comparison to Q3 and overall deal volume fell by about 37% relative to Q4 2022. This most recent quarter shows signs of an initial rebound in volume going into 2024, normalizing closer to historical averages in this space.

- Despite lower activity in 2023 compared to previous years, notable transactions such as Blue Road Capital’s acquisition of NatureSweet Tomatoes and Redwood Holdings acquisition of Newly Weds Foods in H2 and general sentiment of stability driven by forthcoming interest rate cuts bodes well for overall market activity in all subsectors going forward.

- M&A activity in the food and agribusiness sector continues to be driven by food production transactions, which has remained prevalent as far back as Q1 2020. This trend is expected to continue into 2024 as business owners positively change their sentiment towards the overall economy and M&A landscape. As 2024 continues to move forward, an uptick in M&A activity can be expected.

Investor Interest in Food and Agribusiness

- On January 12th 2024, Global Ag Investing announced that Homestead Capital’s fourth Farmland Fund is nearing its target of $500M, with $460M of committed capital up to date.

- After beginning operations in May 2023, the fourth farmland fund of Homestead Capital made its first investment in August 2023 in a potato, sugar beet, corn and hay farm in Idaho.

- The fund will further Homestead Capital’s focus of investing and operating farmland throughout the Mountain West, Midwest, and Pacific Northwest.

- The Company plans on making 35-45 investments of small farms ranging from $5-30M with a ratio of 60-70% row crops and 30-40% permanent crops across the US.

Sources: Pitchbook, Mergermarket, Meridian research

Featured Food & Agribusiness M&A Transactions

Recent Transaction Case Studies

Description: Iowa Fertilizer Co., a subsidiary of OCI global, produces nitrogenous fertilizers and methanol.

Rationale: The pending acquisition will bolster Koch Ag & Energy Solutions’ portfolio of fertilizer solutions to better serve current and new customers across the region.

Description: Trimble’s Ag Technology division provides hardware and software solutions for farmers from land preparation through harvest.

Rationale: The pending acquisition will enhance AGCO’s technology stack across the crop cycle and accelerate the Company’s push into automation, connected farming, and sustainability.

Description: Newly Weds Foods is a contract manufacturer of customized breadings, batters, seasonings, sauces, and other food ingredients.

Rationale: Redwood Holdings is a family office that focuses on investments of established family-owned companies across the supply chain.

Description: Applewood Orchards is a Michigan-based grower and packer of apples across 11,000 acres of land.

Rationale: FirstFruits Farms’ acquisition expands the Company’s varietal portfolio and ability to serve customers in the Midwest and East Coast.

Highlighted Acquirer: GrubMarket

Founded in 2014 and backed by a consortium of venture capital investors, GrubMarket is a developer of SaaS solutions focused on transforming the food supply chain. The Company completed its Series F financing round in Nov-22 at an over $2B valuation to further accelerate its acquisition strategy.

GrubMarket is currently focused on downstream investments in food distribution businesses to roll-out its proprietary software suite across the supply chain. To date, the Company has made over 50 investments in agricultural producers, distributors, payment processors, and logistics providers across the U.S. and Canada.

The commercial success and investor interest in GrubMarket represents the realizable efficiencies through the integration of technology into every step of the food supply chain.

Sources: Pitchbook, Mergermarket, Company Press Releases, Meridian research

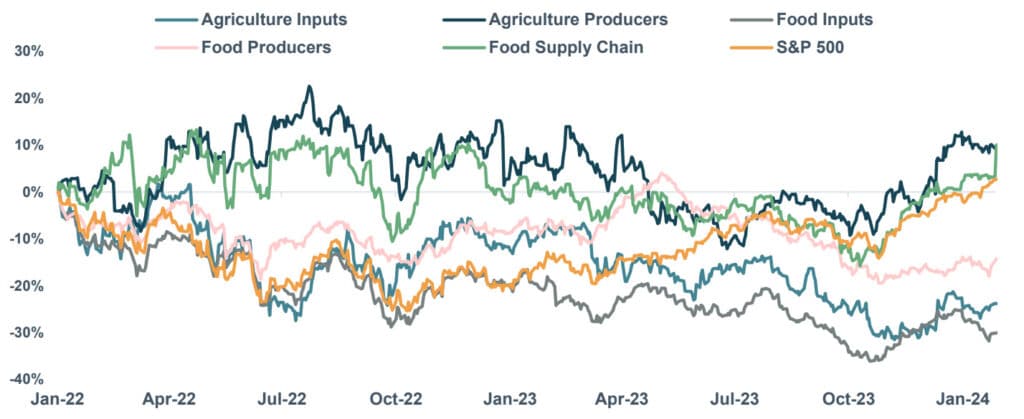

Public Food & Agribusiness Trading Metrics

Stock Index Performance

Agricultural Inputs

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV / LTM Rev | EV / LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Nutrien Ltd. | $25,361.6 | $39,845.6 | $30,925.0 | $7,078.0 | 1.3x | 5.6x | 22.9% | (38)% |

| CF Industries Holdings, Inc. | $14,787.8 | $17,358.8 | $7,668.0 | $3,464.0 | 2.3x | 5.0x | 45.2% | (9)% |

| The Mosaic Co. | $10,386.8 | $13,836.2 | $15,027.9 | $2,712.6 | 0.9x | 5.1x | 18.1% | (36)% |

| The Toro Company | $9,759.0 | $10,729.0 | $4,553.2 | $900.4 | 2.4x | 11.9x | 19.8% | (16)% |

| AGCO Corporation | $9,304.6 | $10,777.7 | $14,510.6 | $1,828.7 | 0.7x | 5.9x | 12.6% | (11)% |

| FMC Corp. | $7,172.4 | $10,987.9 | $4,962.7 | $1,155.4 | 2.2x | 9.5x | 23.3% | (57)% |

| SiteOne Landscape Supply, Inc. | $7,128.5 | $7,969.1 | $4,226.2 | $401.7 | 1.9x | 19.8x | 9.5% | 3 % |

| Darling Ingredients Inc. | $7,110.4 | $11,696.9 | $6,942.1 | $1,210.8 | 1.7x | 9.7x | 17.4% | (34)% |

| The Scotts Company LLC | $3,240.3 | $6,114.6 | $3,551.3 | $446.9 | 1.7x | 13.7x | 12.6% | (29)% |

| Lindsay Corporation | $1,479.0 | $1,439.9 | $659.3 | $125.3 | 2.2x | 11.5x | 19.0% | (15)% |

| Titan International, Inc. | $934.5 | $1,154.8 | $1,941.4 | $220.0 | 0.6x | 5.2x | 11.3% | (9)% |

| CVR Partners LP | $756.4 | $1,216.7 | $752.1 | $365.5 | 1.6x | 3.3x | 48.6% | (24)% |

| Titan Machinery, Inc. | $624.5 | $1,407.4 | $2,489.3 | $186.3 | 0.6x | 7.6x | 7.5% | (38)% |

| Intrepid Potash, Inc. | $257.2 | $255.7 | $289.1 | $57.6 | 0.9x | 4.4x | 19.9% | (41)% |

| Ceres Global Ag Corp. | $50.1 | $177.0 | $992.6 | $14.5 | 0.2x | 12.2x | 1.5% | (13)% |

| Median | $7,110.4 | $7,969.1 | $4,226.2 | $446.9 | 1.6x | 7.6x | 18 % | (24)% |

| Average | $6,556.9 | $8,997.8 | $6,632.7 | $1,344.5 | 1.4x | 8.7x | 19 % | (25)% |

Agricultural Producers

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | LTM EBITDA | EV / LTM EBITDA | LTM Margin EBITDA | LTM Margin EBITDA |

|---|---|---|---|---|---|---|---|---|

| Pilgrim’s Pride Corp. | $6,573.3 | $9,658.9 | $16,961.3 | $787.6 | 0.6x | 12.3x | 4.6% | 13 % |

| Cal-Maine Foods, Inc. | $2,722.9 | $2,152.7 | $2,668.8 | $661.7 | 0.8x | 3.3x | 24.8% | (3)% |

| Fresh Del Monte Produce Inc. | $1,205.1 | $1,746.3 | $4,352.0 | $259.4 | 0.4x | 6.7x | 6.0% | (12)% |

| Adecoagro S.A. | $1,099.4 | $2,212.9 | $1,406.5 | $261.1 | 1.6x | 8.5x | 18.6% | 22 % |

| Mission Produce, Inc. | $722.2 | $956.7 | $953.9 | $48.4 | 1.0x | 19.8x | 5.1% | (19)% |

| Farmland Partners Inc | $549.8 | $1,078.7 | $57.7 | $33.9 | 18.7x | 31.8x | 58.8% | (12)% |

| Calavo Growers, Inc. | $488.4 | $589.7 | $974.3 | $33.9 | 0.6x | 17.4x | 3.5% | (16)% |

| Limoneira Company | $334.3 | $398.2 | $179.9 | ($0.2) | 2.2x | nm | -0.1% | 29 % |

| Alico, Inc. | $228.5 | $361.5 | $39.8 | ($16.1) | 9.1x | nm | -40.3% | 10 % |

| Median | $722.2 | $1,078.7 | $974.3 | $48.4 | 1.0x | 12.3x | 5 % | (3)% |

| Average | $1,547.1 | $2,128.4 | $3,066.0 | $230.0 | 3.9x | 14.2x | 9 % | 1 % |

Food Inputs

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV / LTM Rev | EV / LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Archer Daniels Midland Co | $29,869.4 | $38,224.4 | $96,896.0 | $6,566.0 | 0.4x | 5.8x | 6.8% | (33)% |

| International Flavors & Fragrances Inc. | $20,677.6 | $31,177.6 | $11,620.0 | $1,960.0 | 2.7x | 15.9x | 16.9% | (29)% |

| McCormick & Company, Inc. | $18,551.9 | $22,999.4 | $6,662.2 | $1,295.6 | 3.5x | 17.8x | 19.4% | (8)% |

| Kerry Group plc | $15,549.6 | $17,450.4 | $9,245.4 | $1,272.8 | 1.9x | 13.7x | 13.8% | (6)% |

| Symrise AG | $14,518.4 | $17,221.4 | $4,993.1 | $849.4 | 3.4x | 20.3x | 17.0% | (2)% |

| IMCD N.V. | $8,652.6 | $9,303.3 | $4,782.6 | $575.1 | 1.9x | 16.2x | 12.0% | (4)% |

| Ingredion Inc. | $7,122.9 | $9,241.9 | $8,226.0 | $1,137.0 | 1.1x | 8.1x | 13.8% | 6 % |

| Darling Ingredients Inc. | $7,110.4 | $11,696.9 | $6,942.1 | $1,210.8 | 1.7x | 9.7x | 17.4% | (34)% |

| Balchem Corporation | $4,608.2 | $4,930.9 | $926.3 | $227.4 | 5.3x | 21.7x | 24.5% | 5 % |

| Sensient Technologies Corporation | $2,670.6 | $3,310.0 | $1,455.9 | $253.2 | 2.3x | 13.1x | 17.4% | (18)% |

| Olam Group Limited | $2,556.3 | $12,161.1 | $37,471.5 | $1,575.6 | 0.3x | 7.7x | 4.2% | (44)% |

| MGP Ingredients Inc | $1,951.1 | $2,250.9 | $812.6 | $181.5 | 2.8x | 12.4x | 22.3% | (9)% |

| Median | $7,887.8 | $11,929.0 | $6,802.1 | $1,173.9 | 2.1x | 13.4x | 17 % | (9)% |

| Average | $11,153.2 | $14,997.3 | $15,836.1 | $1,425.4 | 2.3x | 13.5x | 15 % | (15)% |

Food Producers

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV / LTM Rev | EV / LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Nestlé S.A. | $306,728.4 | $368,932.8 | $101,701.8 | $21,390.8 | 3.6x | 17.2x | 21.0% | (5)% |

| Kraft Heinz Foods Co | $45,811.2 | $64,819.2 | $27,161.0 | $6,400.0 | 2.4x | 10.1x | 23.6% | (8)% |

| The Hershey Company | $40,363.9 | $45,124.6 | $11,160.2 | $3,074.8 | 4.0x | 14.7x | 27.6% | (12)% |

| General Mills Inc. | $37,111.6 | $49,421.6 | $20,200.0 | $4,178.4 | 2.4x | 11.8x | 20.7% | (16)% |

| Associated British Foods Plc | $22,921.3 | $25,806.8 | $24,189.5 | $2,899.1 | 1.1x | 8.9x | 12.0% | 31 % |

| Kellanova Co | $18,937.9 | $25,751.9 | $15,866.0 | $1,834.0 | 1.6x | 14.0x | 11.6% | (14)% |

| Hormel Foods Corporation | $16,777.1 | $19,337.2 | $12,110.0 | $1,375.4 | 1.6x | 14.1x | 11.4% | (32)% |

| Lamb Weston Holdings, Inc. | $14,944.0 | $18,495.6 | $6,345.9 | $1,411.8 | 2.9x | 13.1x | 22.2% | 4 % |

| The J.M.Smucker Co., LLC | $14,110.8 | $17,992.0 | $8,194.9 | $1,653.4 | 2.2x | 10.9x | 20.2% | (13)% |

| Conagra Brands, Inc. | $14,072.5 | $23,150.8 | $12,171.9 | $2,536.6 | 1.9x | 9.1x | 20.8% | (20)% |

| Campbell Soup Company | $13,319.1 | $17,936.1 | $9,300.0 | $1,736.0 | 1.9x | 10.3x | 18.7% | (14)% |

| Post Holdings, Inc. | $5,728.4 | $11,876.8 | $6,991.0 | $1,233.4 | 1.7x | 9.6x | 17.6% | (1)% |

| Simply Good Foods USA Inc | $3,883.7 | $4,034.4 | $1,250.5 | $246.8 | 3.2x | 16.4x | 19.7% | 7 % |

| TreeHouse Foods, Inc. | $2,348.0 | $4,049.9 | $3,634.4 | $380.1 | 1.1x | 10.7x | 10.5% | (11)% |

| Sovos Brands Intermediate, Inc. | $2,238.1 | $2,534.3 | $990.5 | $147.1 | 2.6x | 17.2x | 14.9% | 66 % |

| The Hain Celestial Group, Inc. | $978.7 | $1,852.6 | $1,782.3 | $1.7 | 1.0x | nm | 0.1% | (48)% |

| B&G Foods, Inc. | $813.0 | $3,008.7 | $2,107.4 | $324.9 | 1.4x | 9.3x | 15.4% | (29)% |

| Median | $14,110.8 | $18,495.6 | $9,300.0 | $1,653.4 | 1.9x | 11.4x | 19 % | (12)% |

| Average | $33,005.2 | $41,419.1 | $15,597.5 | $2,989.7 | 2.2x | 12.3x | 17 % | (7)% |

Food Supply Chain

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV / LTM Rev | EV / LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Sysco Corporation | $40,763.3 | $52,803.9 | $77,512.3 | $4,050.3 | 0.7x | 13.0x | 5.2% | 4 % |

| US Foods Holding Corp. | $11,493.6 | $16,047.6 | $35,176.0 | $1,521.0 | 0.5x | 10.6x | 4.3% | 21 % |

| Performance Food Group, Inc. | $11,475.6 | $16,577.4 | $57,474.0 | $1,392.5 | 0.3x | 11.9x | 2.4% | 18 % |

| Aramark Corp. | $7,669.4 | $14,341.2 | $18,853.9 | $1,606.7 | 0.8x | 8.9x | 8.5% | (9)% |

| The Chefs’ Warehouse, Inc | $1,290.7 | $2,152.8 | $3,274.6 | $184.3 | 0.7x | 11.7x | 5.6% | (16)% |

| United Natural Foods, Inc. | $903.0 | $4,459.0 | $30,292.0 | $7,898.0 | 0.1x | 0.6x | 26.1% | (64)% |

| SpartanNash Company | $788.7 | $1,590.6 | $9,793.1 | $250.9 | 0.2x | 6.3x | 2.6% | (28)% |

| HF Foods Group Inc | $281.6 | $467.8 | $1,159.5 | $28.3 | 0.4x | 16.5x | 2.4% | (15)% |

| Amcon Distributing Co | $126.0 | $301.9 | $2,619.0 | $35.9 | 0.1x | 8.4x | 1.4% | 14 % |

| Median | $1,290.7 | $4,459.0 | $18,853.9 | $1,392.5 | 0.4x | 10.6x | 4 % | (9)% |

| Average | $8,310.2 | $12,082.5 | $26,239.4 | $1,885.3 | 0.4x | 9.8x | 7 % | (8)% |

(US$ in millions)

As of 01/31/2024

Sources: Pitchbook, Mergermarket, Meridian research

Select Food & Agribusiness M&A Transactions

Agricultural Inputs

| Date | Target | Acquirer | Description |

|---|---|---|---|

| Pending | Iowa Fertilizer Company | Koch Ag & Energy Solutions | Manufacturer of nitrogen fertilizer |

| Jan-24 | Star Seed | NativeSeed (Heartwood Partners) | Producer and supplier of conservation and farm seeds |

| Jan-24 | Monticello Farm Service | Ceres Solutions Cooperative | Provider of crop management solutions |

| Jan-24 | Advance Grass Solutions | Agrovista UK | Provider of fertilizers, seeds, wetting agents, and herbicides |

| Jan-24 | Big W Sales | Fairbank Equipment | Manufacturer of spray and fertilizer equipment |

| Dec-23 | Verdant Specialty Solutions | Samyang | Manufacturer of chemical surfactants |

| Dec-23 | Fertiglobe | Abu Dhabi National Oil | Producer of ammonia and gas-based fertilizers |

| Dec-23 | Abribios Italiana | Yara Italia | Manufacturer and distributor of organic fertilizers |

| Dec-23 | Newsom Seed | SiteOne Landscape Supply | Distributor of agronomic products in the DMV |

| Dec-23 | Agro-K | Rovensa Group (Bridgepoint) | Provider of sustainable agricultural inputs |

| Dec-23 | Incitec Pivot (Ammonia Plant) | CF Industries | Manufacturer of ammonia crop input products |

| Nov-23 | Envirem Organics | Convertus (Convent Capital) | Manufacturer of organic fertilizers and soil products |

| Nov-23 | Sanipina | Grupo Agris | Distributor of agricultural products |

| Nov-23 | Atlas Agro | Macquarie | Manufacturer of green fertilizer |

| Nov-23 | Blomstra | Pagnol Gruppen | Provider of plant nutrition products |

Agriculture Producers

| Date | Target | Acquirer | Description |

|---|---|---|---|

| Pending | Costa Group | Paine Schwartz Partners | Grower and packer of fresh produce |

| Jan-24 | Confidential Target | Confidential Buyer | Grower, packer, and marketer of fruits |

| Jan-24 | Battlefield Farms | Costa Farms | Grower and annuals and perennials |

| Jan-24 | Sociedad Exportadora Verfrut | Unifrutti | Producer of fresh fruits |

| Jan-24 | Calavo Growers (Fresh Cut Division) | F&S Fresh Foods | Grower of avocado and value-added food |

| Jan-24 | Jong Fruit | SurExport | Grower of fresh berries |

| Jan-24 | Planasa Group | EW Group | Grower, packer, and shipper of fresh fruits and vegetables |

| Dec-23 | Bonaire DailyFresh | Edward van Wonderen | Producer of fresh vegetables |

| Dec-23 | Applewood Fresh | FirstFruit Farms | Grower, packer, and marketer of fresh apples |

| Dec-23 | Padova Agricultura | Vectr Braila | Producer of rice grains |

| Nov-23 | Galinta Group | Invalda INVL | Producer of buckwheat grains |

| Nov-23 | Innoliva | Fiera Comex | Grower of olives and almonds |

| Oct-23 | Solana Fruits | Alantra Partners | Producer of red berries |

| Oct-23 | Sun Belle | Frutura | Grower, packer, and marketer of fruits and vegetables |

| Oct-23 | Chapman Fruit | Lipman Family Farms | Grower and packer of fruits and vegetables |

Food Inputs

| Date | Target | Acquirer | Description |

|---|---|---|---|

| Jan-24 | Sterling Food Flavorings | Brookside Flavors & Ingredients | Manufacturer of flavoring systems |

| Jan-24 | Solo Foods | Saco Foods (Fengate) | Manufacturer of specialty baking ingredients |

| Jan-24 | Om Mushroom Superfood | Meaningful Partners | Manufacturer of mushroom powder nutraceuticals |

| Jan-24 | Saco Foods | Fengate Private Equity | Shelf-stable private label food product manufacturer |

| Jan-24 | The Perfect Puree of Napa Valley | PNC Riverarch | Producer of fruit and vegetable purees |

| Jan-24 | TLC Ingredients | Gemspring Capital | Distributor of food ingredients |

| Dec-23 | Evolva | Danstar Ferment | Manufacturer of specialty food ingredients |

| Dec-23 | Graffiti Foods | New Horizons Baking | Producer of soups, sauces, and sides |

| Dec-23 | Ever Fresh Fruit Supply | Tilia Partners | Provider of premier fruit and flavor ingredient solutions |

| Dec-23 | Fuerst Day Lawson | ADM | Manufacturer of food ingredient solutions |

| Dec-23 | Frosty Boy Global | KENT | Producer of desserts, beverages, ingredients, and wellness solutions |

| Dec-23 | Renshaw Baking | Bakels | Producer of specialty baking ingredients |

| Dec-23 | Newly Weds Food | Redwood Holdings | Producer of seasonings, flavors, and custom formulations |

| Dec-23 | Summit Hill Foods | Eagletree Capital | Producer and supplier of food ingredients |

| Nov-23 | TRUFF | SKYY Partners | Branded manufacturer of flavors, ingredients, and sauces |

Food Producers

| Date | Target | Acquirer | Description |

|---|---|---|---|

| Jan-24 | Ajinomoto (Italian Food Portfolio) | Seviroli Foods (Mill Point Capital) | Manufacturer of italian foods |

| Jan-24 | Dirty Dough | Craveworthy Brands | Producer of cookies and other treats |

| Jan-24 | G.L Industry | DDC Enterprise | Contract manufacturer of Asian ready to eat meals |

| Jan-24 | Patriot Pickle | H.I.G Capital | Manufacturer and distributor of refrigerated pickles |

| Jan-24 | Pouch Alliance | Systematic Growth | Contract manufacturer of nutritional liquids and energy gels |

| Jan-24 | Wickles Pickles | Fenwick Foods | Manufacturer and distributor of pickles |

| Jan-24 | Weaver Popcorn Manufacturing | AUA Private Equity Partners | Contract manufacturer of popcorn and other snacks |

| Jan-24 | Horizon Organic | Platinum Equity | Producer of premium dairy products |

| Dec-23 | Salm Partners | Johnsonville | Contract manufacturer of sausage and meat products |

| Dec-23 | Yai’s Thai | DDC Enterprise | Manufacturer of authentic Thai food products |

| Dec-23 | Choco Support | Menken Orlando | Private label manufacturer of chocolate-based products |

| Dec-23 | Shearer’s Foods | Clayton, Dubliner, & Rice | Contract manufacturer of private label snack supplier |

| Dec-23 | Revela Foods | ADM | Private label manufacturer of dairy products |

| Dec-23 | March Foods | IBC Simply | Contract manufacturer and co-packer of foods |

| Oct-23 | Dietary Pros | Lallemand | Contract manufacturer of dietary supplements |

Food Supply Chain

| Date | Target | Acquirer | Description |

|---|---|---|---|

| Date | Target | Acquirer | Description |

| Jan-24 | B&B Foods Distributos | Raydia Food Group | Provider of food distribution services |

| Jan-24 | Diamond Foods | GS Foods Group (A&M Capital) | Distributor of food and grocery products |

| Jan-24 | Chowbus | Fantuan (GrubMarket) | Provider of food delivery services |

| Jan-24 | Farmer’s Edge | Fairfax Financial | Agriculture company focusing on e-commerce of agricultural products |

| Jan-24 | J.A Kirsch | Atalanta | Importer of specialty food products |

| Jan-24 | J.C Cheyne | GrubMarket | Distributor of fresh produce in the Bay Area |

| Jan-24 | Campus Cooks | Upper Crust (Copley Equity Partners) | Provider of contract food services to college campuses |

| Dec-23 | A&B Tropical Products | GrubMarket | Distributor of tropical produce |

| Dec-23 | KT Produce | Bratenahl Capital Partners | Distributor of fruits and vegetables across the Southern US |

| Nov-23 | World Fresh Produce | EOS Partners | Supplier and distributor of fruits based in New Jersey |

| Nov-23 | FreshDirect | Getir | Operator of online retail platform selling food and groceries |

| Nov-23 | Saladinos Food Service | US Foods | Provider of foodservice distribution services |

| Nov-23 | Greenberg Fruit Company | Freshedge (Wind Point Partners) | Provider of produce distribution services |

| Sep-23 | Mendez International | GrubMarket | Distributor of tropical fruit and vegetables |

| Sep-23 | Lamm Food Service | GS Foods Group (A&M Capital) | Provider of full-line food distribution |

Sources: Pitchbook, Mergermarket, Meridian research, Produce Blue Book