Key Satellite Platforms and Space M&A Trends: April 2023

Published April 21, 2023

Key Insights:

As the cost of satellite production and launches continue to decrease, the space and satellite sector continues to accelerate its growth trajectory with the global satellite manufacturing and launch market expected to reach $24.2B by 2030(1).

The space sector has served as an attractive opportunity for both traditional commercial or defense focused suppliers to diversify end-market and customer exposure utilizing existing capabilities and capacity as well as acquire new technologies through M&A to gain access to the growing market.

Understanding of exposure to the various space platforms and their respective outlooks will become increasingly important for companies and investors in the industry.

Footnote 1: Global Industry Analysts Report

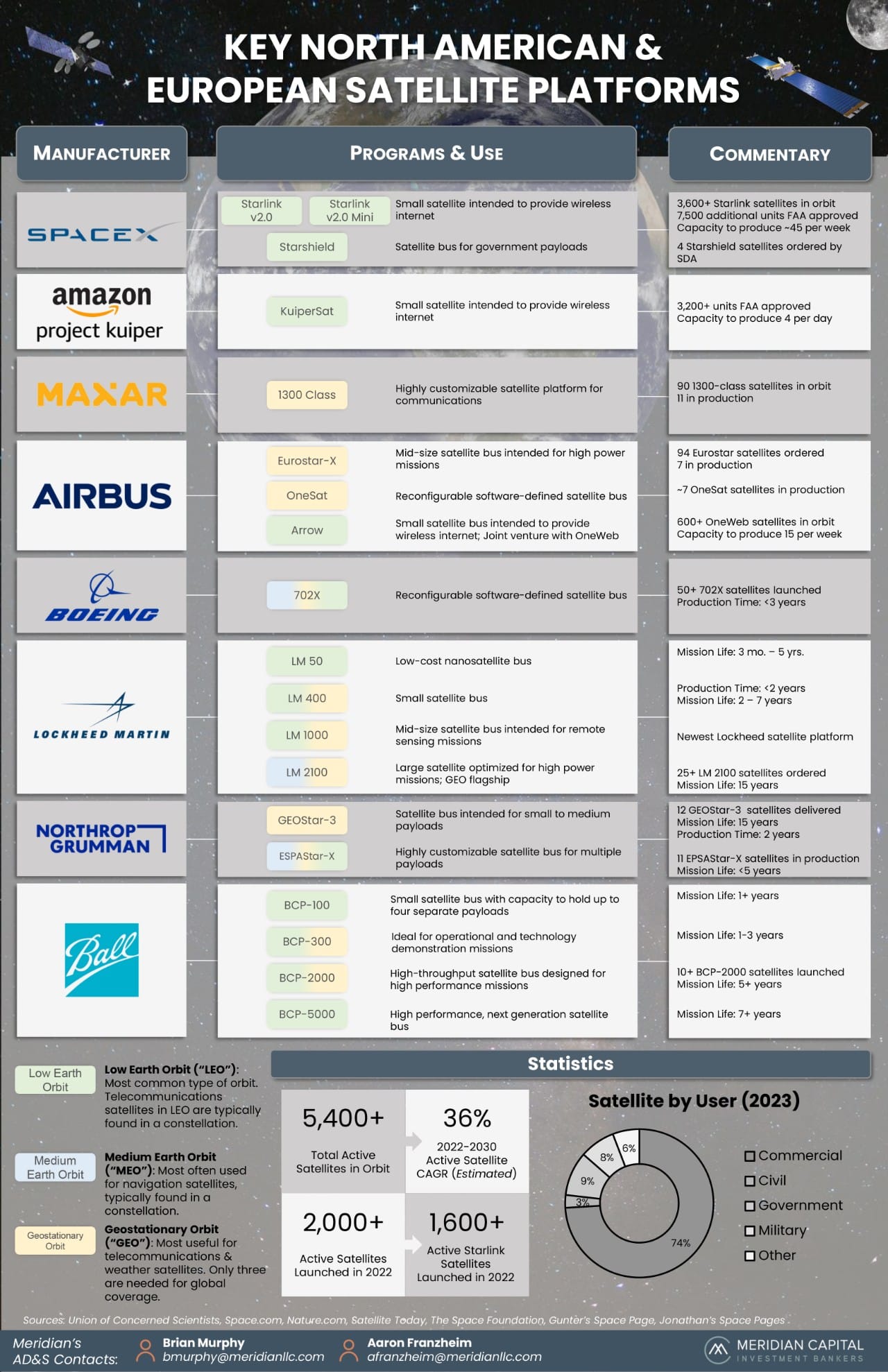

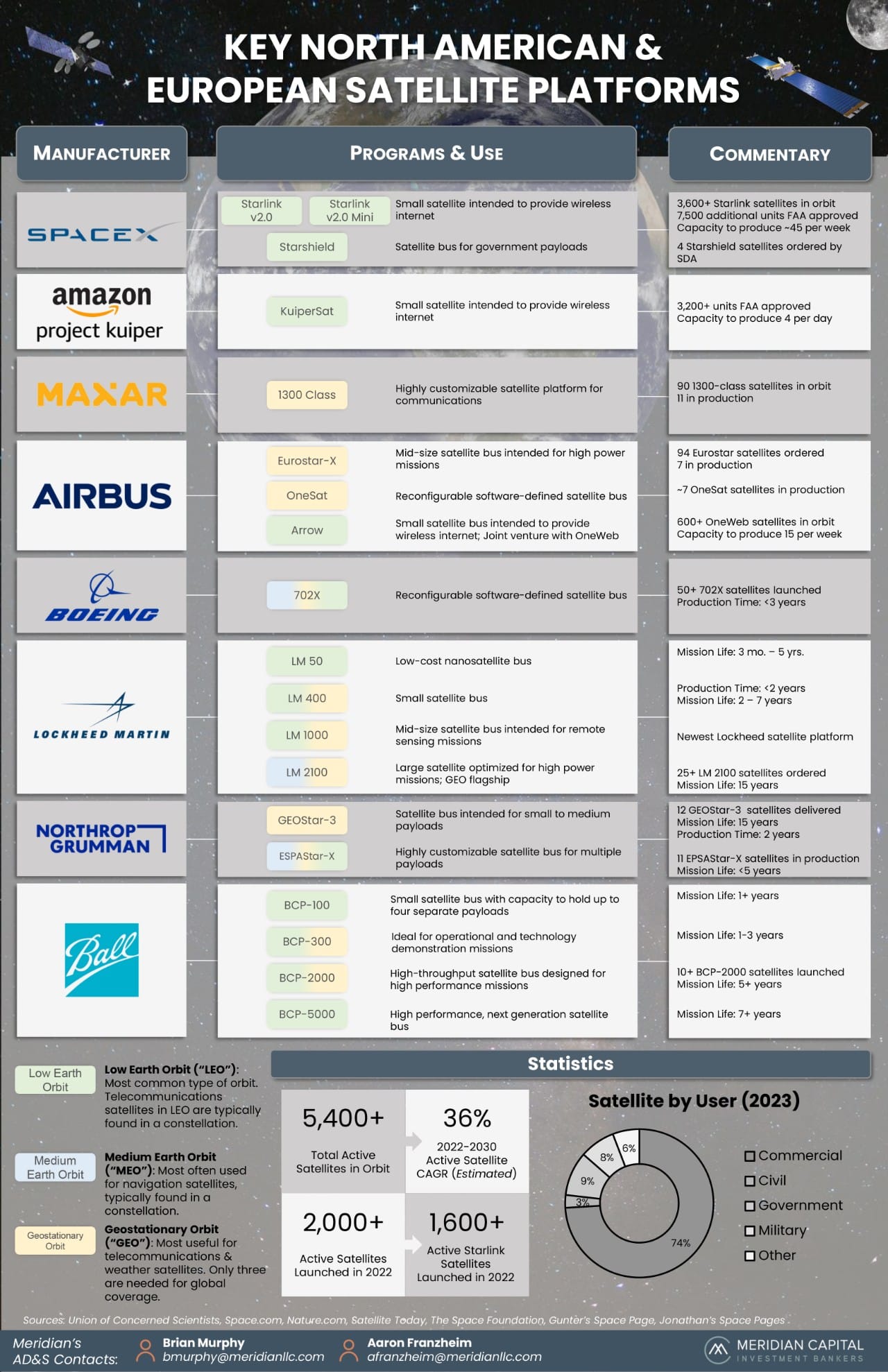

Key North American & European Satellite Platforms

| Manufacturer | Program & Use | Orbit | Use | Commentary |

|---|---|---|---|---|

| Starlink v2.0 / Starlink v2.0 Mini | LEO | Small satellite intended to provide wireless internet | 3,600+ Starlink satellites in orbit 7,500 additional units FAA approved Capacity to produce ~45 per week | |

| Starshield | LEO | Satellite bus for government payloads | 4 Starshield satellites ordered by SDA | |

| KuiperSat | LEO | Small satellite intended to provide wireless internet | 3,200+ units FAA approved Capacity to produce 4 per day | |

| 1300 Class | GEO | Highly customizable satellite platform for communications | 90 1300-class satellites in orbit 1 in production | |

| Eurostar-X | GEO | Mid-size satellite bus intended for high power missions | 94 Eurostar satellites ordered 7 in production | |

| OneSat | GEO | Reconfigurable software-defined satellite bus | ~7 OneSat satellites in production | |

| Arrow | LEO | Small satellite bus intended to provide wireless internet; Joint venture with OneWeb | 600+ OneWeb satellites in orbit Capacity to produce 15 per week | |

| 702X | MEO/LEO/GEO | Reconfigurable software-defined satellite bus | 50+ 702X satellites launched Production Time: <3 years |

| LM 50 | LEO | Low-cost nanosatellite bus | Mission Life: 3 mo. – 5 yrs. | |

| LM 400 | LEO/GEO | Small satellite bus | Production Time: <2 years Mission Life: 2 – 7 years | |

| LM 1000 | LEO/GEO | Mid-size satellite bus intended for remote sensing missions | Newest Lockheed satellite platform | |

| LM 2100 | MEO/GEO | Large satellite optimized for high power missions; GEO flagship | 25+ LM 2100 satellites ordered Mission Life: 15 years | |

| GEOStar-3 | GEO | Satellite bus intended for small to medium payloads | 12 GEOStar-3 satellites delivered Mission Life: 15 years Production Time: 2 years | |

| ESPAStar-X | MEO/LEO/GEO | Highly customizable satellite bus for multiple payloads | 11 ESPAStar-X satellites in production Mission Life: <5 years | |

| BCP-100 | LEO | Small satellite bus with capacity to hold up to four separate payloads | Mission Life: 1+ years |

| BCP-300 | LEO/GEO | Ideal for operational and technology demonstration missions | Mission Life: 1-3 years |

| BCP-2000 | LEO/GEO | High-throughput satellite bus designed for high performance missions | 10+ BCP-2000 satellites launched Mission Life: 5+ years |

| BCP-5000 | LEO | High performance, next-generation satellite bus | Mission Life: 7+ years |

LEO

Low Earth Orbit (“LEO”):

Most common type of orbit. Telecommunications satellites in LEO are typically found in a constellation.

MEO

Medium Earth Orbit (“MEO”):

Most often used for navigation satellites, typically found in a constellation.

GEO

Geostationary Orbit (“GEO”):

Most useful for telecommunications & weather satellites. Only three are needed for global coverage.

Statistics

5,400+

Total Active Satellites in Orbit

36%

2022-2030

Active Satellite

CAGR (Estimated)

2,000+

Active Satellites Launched in 2022

1,600

Active Starlink Satellites Launched in 2022

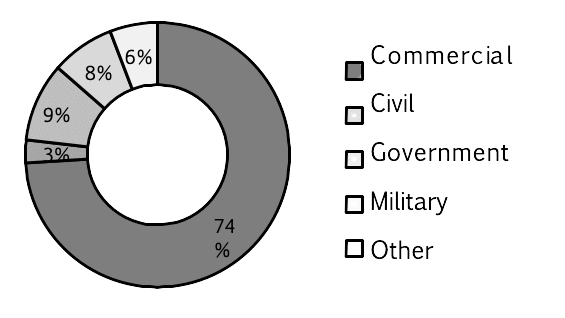

Satellite by User (2023)

Sources: Union of Concerned Scientists, Space.com, Nature.com, Satellite Today, The Space Foundation, Gunter’s Space Page, Jonathan’s Space Pages