Technology Services: M&A Trends: Spring 2023

Published April 6, 2023

Key Insights

- IT Services Activity and Trends

- Ecosystem-Driven IT Services M&A Activity

- Select Ecosystem Consolidation Activity:

- Cloud services: The cloud services industry, with a small number of large technology providers, has led to a bifurcated partner ecosystem, with smaller firms offering niche or platform-specific service offerings and large consolidators offering a broad range of cloud services for any of the major platforms.

- Enterprise software: Given the diverse range of applications for enterprise software, many service providers specialize in end markets and tailor their partner networks to their customers’ specific needs. Consolidators look to acquisitions to expand their scope of services or penetrate new customer end markets.

- Cybersecurity: Cybersecurity is a rapidly developing space in which customer needs can change quickly, driven by emerging threats and external factors, such as the March 2023 SEC proposal to force financial firms to significantly bolster their cybersecurity protection & reporting standards.

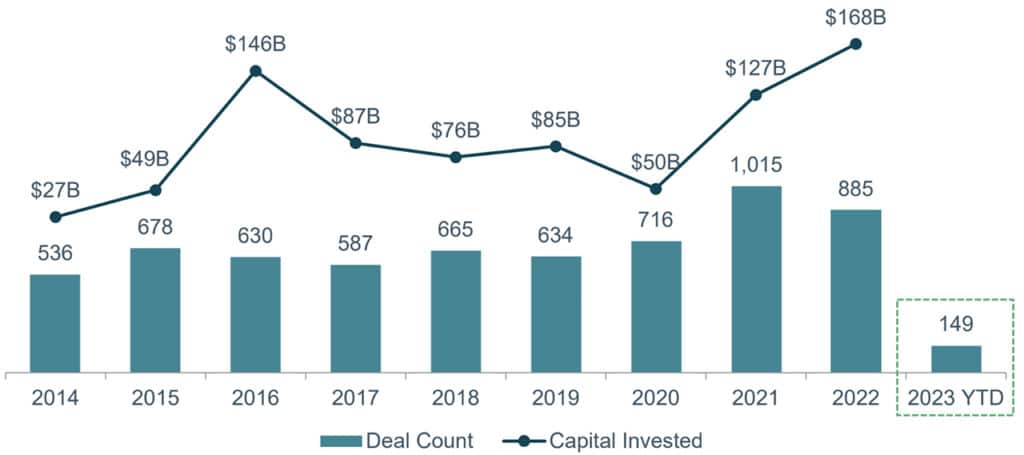

IT Services Activity and Trends

- As the US faces an unclear macroeconomic outlook amid rising interest rates, the work IT service providers deliver maintains strong demand due to their mission-critical support of enterprise infrastructure that enables economic resilience. With the continuing transition from legacy systems to the cloud, and the growth in the use of IoT devices, and hybrid and multi-cloud solutions, IT service providers will continue to find new ways to provide value-add solutions to their customers in 2023 and beyond.

- It has become clear that there are distinct benefits to diversifying applications and cloud infrastructure across more than one cloud provider. Embracing a multi-cloud infrastructure can protect businesses from the risk of relying exclusively on one platform to build applications and solutions and can increase flexibility across an enterprise. The increased complexity of hybrid and multi-cloud solutions provide IT partners an opportunity to contribute additional expertise.

- Increased demand for advanced security solutions has led to consolidation in the cybersecurity industry, with 40+ deals so far in 2023. The emergence of IoT connectivity solutions has increased the risk of cyber-attacks and data breaches. According to IBM’s latest annual “Cost of a Data Breach” report, victims experienced a record-high loss of $9.4 million per breach in 2022.

Recent US IT Services M&A Transaction Activity

IT Services Valuation Summary

| Enterprise Value Range ($M) | Enterprise Value ($M) | Revenue ($M) | TTM Rev Growth % | EBITDA Margin % | Enterprise Value / Rev | Enterprise Value / EBITDA |

|---|---|---|---|---|---|---|

| 10 – 25 | 17.2 | 23.6 | 17.5 | 18.1 | 1.3x | 6.9x |

| 25 – 50 | 33.9 | 53.0 | 7.6 | 15.4 | 1.1x | 6.5x |

| 50 – 250 | 82.0 | 24.7 | 17.3 | 33.7 | 3.3x | 10.3x |

| Total | 34.3 | 32.2 | 14.6 | 20.3 | 1.6x | 7.4x |

2023A: As of March 28, 2023

Sources: PitchBook, MergerMarket, GF Data, Company Press Releases, Meridian Research

Sector Highlight: Ecosystem-Driven IT Services M&A Activity

- M&A activity within the IT services space is being driven by an increase in “partner ecosystem” consolidation. Partner ecosystems are networks of 3rd party companies that have been designated by a technology platform as a preferred partner for customers to use as providers of integration, consulting, or implementation services for their products.

- Private equity-backed portfolio companies have been leading consolidation in the space through acquisitions as they acquire designated service partners to immediately establish or expand an offering in a particular technology or end market. Acquiring “partner” companies for a specific technology platform allows platform portfolio companies to immediately enter a space with the reputation and implied expertise of their inherited partner designation.

- Mature sectors like cloud services have already seen large amounts of consolidation. Other emerging segments, like identity management and workforce enablement, have yet to see the same level of acquisition activity. As newer sectors begin to mature, ecosystems will likely begin to see increased levels of M&A activity as growth slows and competition for market share heats up among larger players.

- Portfolio company preferences for add-on acquisitions are dependent on both the specific niches, sectors, and end markets each platform currently occupies and desires to penetrate. The most attractive acquisition targets will have diversified customer bases, strong EBITDA margins, and specific technologic expertise in a niche, difficult-to-penetrate end market.

Select Ecosystem Consolidation Activity:

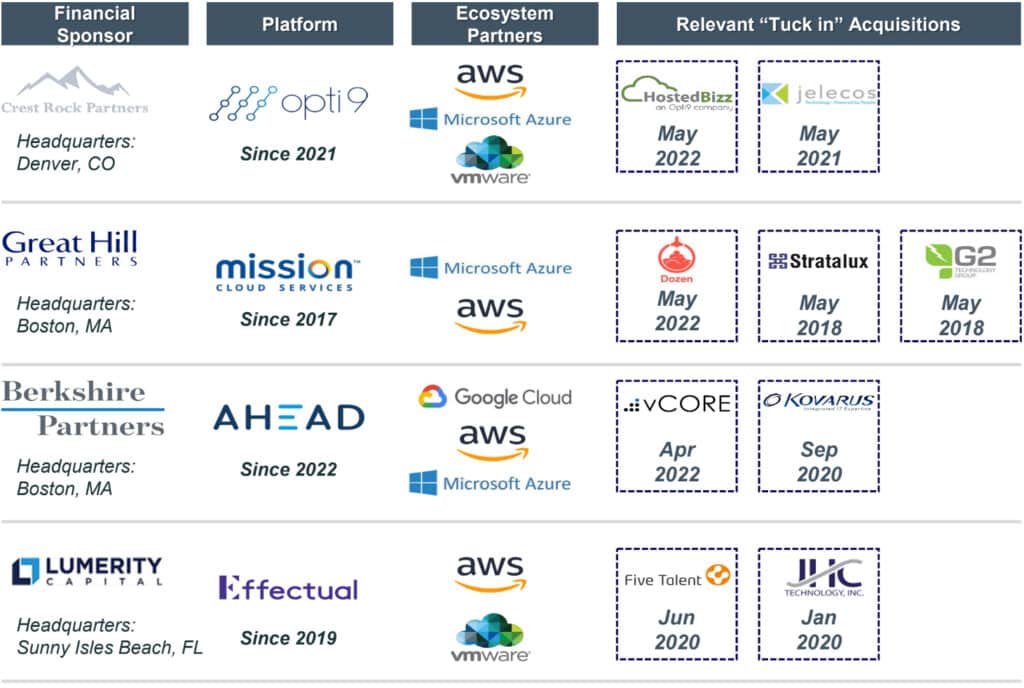

Cloud Services Partner Ecosystem Consolidation

The cloud services industry, with a small number of large technology providers, has led to a bifurcated partner ecosystem, with smaller firms offering niche or platform-specific service offerings and large consolidators offering a broad range of cloud services for any of the major platforms.

Representative Platform Ecosystems

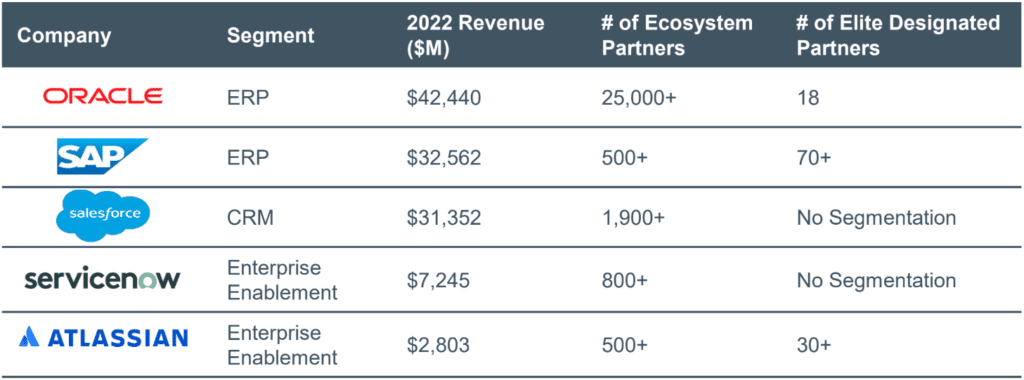

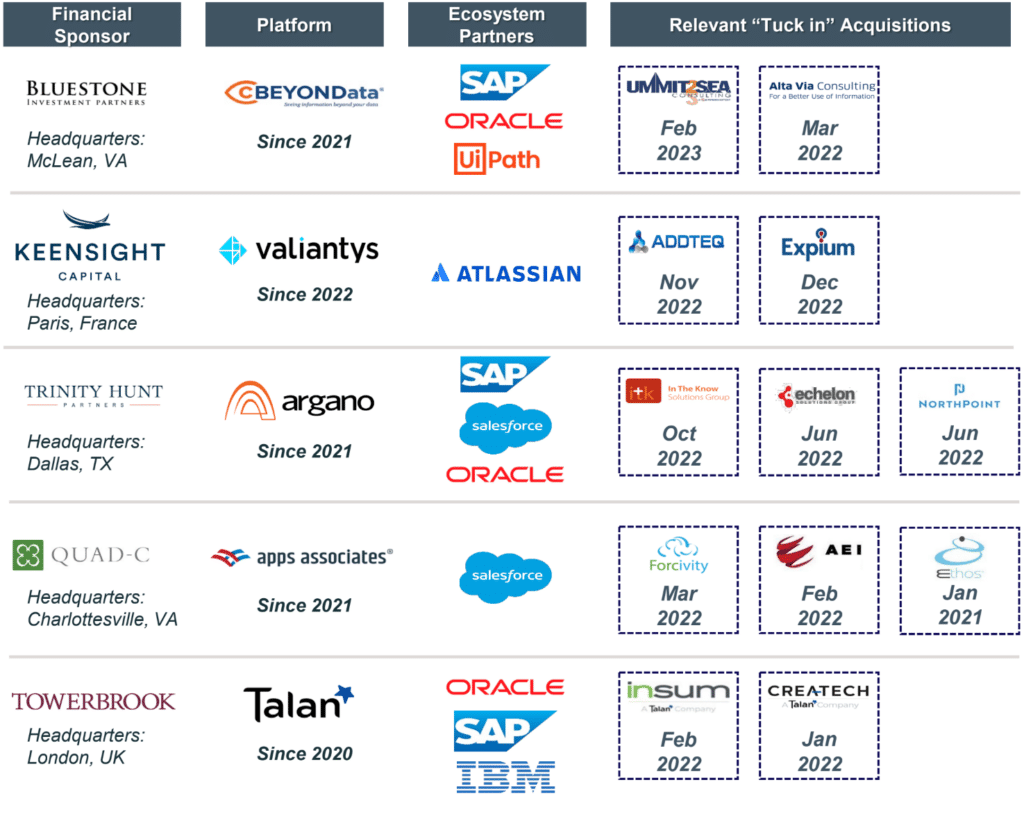

Enterprise Software Ecosystem Consolidation

Given the diverse range of applications for enterprise software, many service providers specialize in end markets and tailor their partner networks to their customers’ specific needs. Consolidators look to acquisitions to expand their scope of services or penetrate new customer end markets.

Representative Platform Ecosystems

Cybersecurity Ecosystem Consolidation

Cybersecurity is a rapidly developing space in which customer needs can change quickly, driven by emerging threats and external factors, such as the March 2023 SEC proposal to force financial firms to significantly bolster their cybersecurity protection & reporting standards.

Representative Platform Ecosystems

Sources: PitchBook, MergerMarket, Company Press Releases, Meridian Research

Representative Cloud “Partner” Ecosystems

Cloud Integration Service Provider Ecosystem Roll-Up Activity

Representative Enterprise Software “Partner” Ecosystems

Enterprise Software IT Service Provider Ecosystem Roll-Up Activity

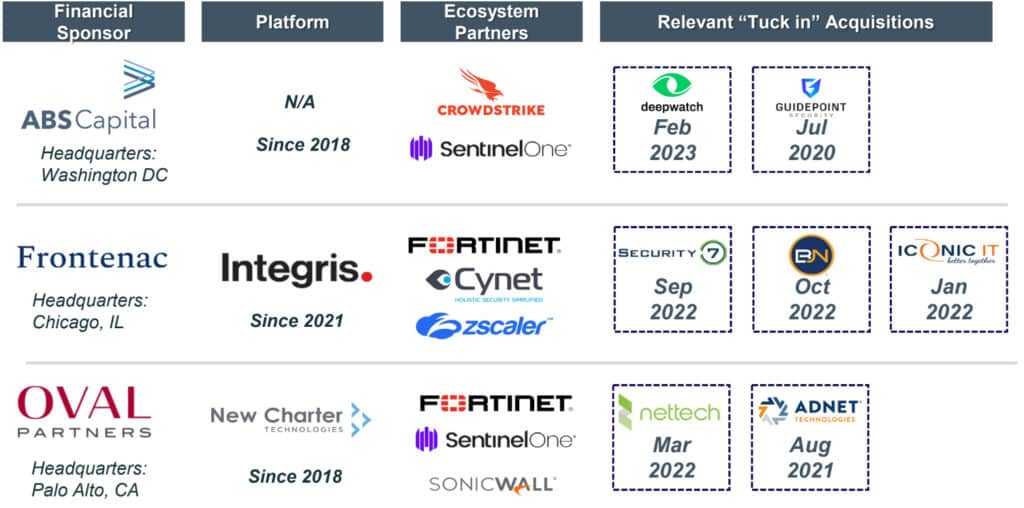

Representative Cybersecurity “Partner” Ecosystems

Cybersecurity IT Service Provider Ecosystem Roll-Up Activity

Sources: PitchBook, MergerMarket, Company Press Releases, Meridian Research

Select IT Services M&A Transactions

| Deal Date | Company | Investor | Description | EV ($ in M) | EV/ Revenue | EV/ EBITDA |

|---|---|---|---|---|---|---|

| Mar-23 | ClearShark | Optiv | Provider of customized and integrated IT services intended to offer secure networks to public sector companies | – | – | – |

| Mar-23 | ACT Business Machines | Trivest | Provider of IT services offering document management, managed technology solutions, and business communication services | – | – | – |

| Feb-23 | Quant Systems | Sonata Software | Provider of information technology services catering to enterprises | $160 | – | – |

| Feb-23 | HyperVelocity Consulting | Isos Technology | Provider of business consulting services intended to offer full-service Atlassian consulting | – | – | – |

| Feb-23 | Sigmaways | HeartCore | Operator of an IT consulting and services company | $1 | – | 7.3x |

| Jan-23 | Cross Application Consulting | Norvestor | Provider of IT consulting services intended for application services linked to SAP | $10 | 1.7x | 9.9x |

| Jan-23 | Cprime | Everstone Capital | Provider of IT consulting services focused on the digital transformation of businesses | $360 | – | – |

| Dec-22 | Phreedom Technologies | Nuvodia | Provider of managed services, technology services, support service, and cloud services | – | – | – |

| Dec-22 | Myers Network Solutions | Xobee Networks | Provider of IT services intended to serve small and medium business owners across different industries | $2 | – | – |

| Dec-22 | Blended Perspectives | Contegix | Provider of a full range of technical consulting services built on Atlassian products | – | – | – |

| Nov-22 | R Systems International | Blackstone | Provider of IT services and solutions | $644 | 3.4x | 24.6x |

| Nov-22 | Wilco Source | Bain Capital | Provider of IT consulting and implementation services catering specifically to the healthcare and life sciences industries | – | – | – |

| Oct-22 | QVine | Godspeed Capital | Provider of agile software development services intended to serve critical intelligence community customers | $40 | – | – |

| Sep-22 | AHEAD (Chicago) | Berkshire Partners | Provider of consulting and enterprise cloud services intended to create a platform for digital businesses | $3,000 | 1.2x | 13.0x |

| Sep-22 | Rahi | WESCO International | Provider of complete IT services catering to equip enterprises | $217 | – | – |

| Sep-22 | Trust-It | InfraCom Group | Provider of IT services to assist companies with application management and Microsoft 365 | $5 | 1.0x | 7.0x |

| Jul-22 | GlideFast Consulting | ASGN | Provider of IT consulting and development services | $352 | 3.7x | – |

| Apr-22 | Creative Breakthroughs | Converge Technology Solutions | Provider of IT risk management services intended to keep bulk organization data secure, confidential and compliant | $47 | 0.5x | 6.5x |

| Mar-22 | Data Glove | Persistent Systems | Provider of information technology consulting services | $91 | 1.9x | – |

| Jan-22 | Paragon Development Systems | Converge Technology Solutions | Provider of information technology services | $56 | 0.3x | 6.2x |

| Median | $73 | 1.4x | 7.3x | |||

| Average | $356 | 1.7x | 10.6x |

As of March 27, 2023

Source: PitchBook Data, Mergermarket, Company Press Releases, Meridian Research