Diversified Industrials M&A Trends: Winter 2022

Published December 6, 2021

KEY INSIGHTS

- Stretched supply chain and commodity shortages constrain manufacturing

- Despite supply chain woes, industrial M&A activity continues at a frenzied pace

- Labor shortage creates a unique M&A environment in industrial automation

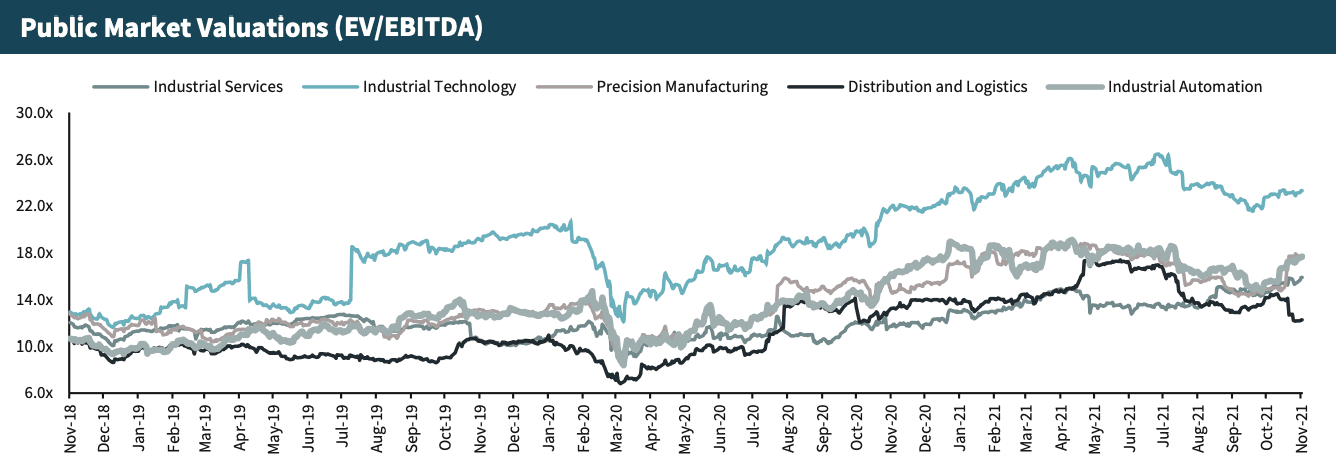

- Continued strong investor interest in industrial automation

With extreme port congestion and unprecedented lead times for raw materials, manufacturing activity has slowed in 3Q 2021, where the U.S. economy showed the lowest levels of growth in over a year.

In light of supply chain disruption, industrial manufacturing and distribution companies have continued to prioritize M&A strategies focused on near shoring and reshoring initiatives. In response to increased demand for their services, distributors of industrial automation equipment have been especially active in 2021, seeking to expand the scope of their technology offerings.

Many manufacturers, not expecting a near-term fix to the labor shortages, are investing in robotics and automation technologies to reduce labor requirements.

The industrial automation space continues to show responsive momentum, driven by a pandemic-fueled acceleration of e-commerce, multichannel distribution, the emergence of autonomous mobile robots for expedited delivery, and ongoing labor shortages.

Diversified Industrials Market Insights

Stretched Supply Chain and Commodity Shortages Constrain Manufacturing

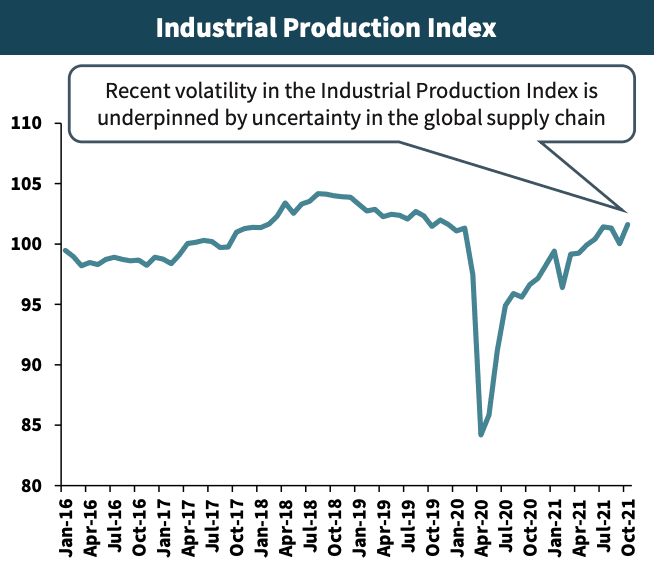

- With extreme port congestion and unprecedented lead times for raw materials, manufacturing activity has slowed in 3Q 2021, where the U.S. economy showed the lowest levels of growth in over a year.

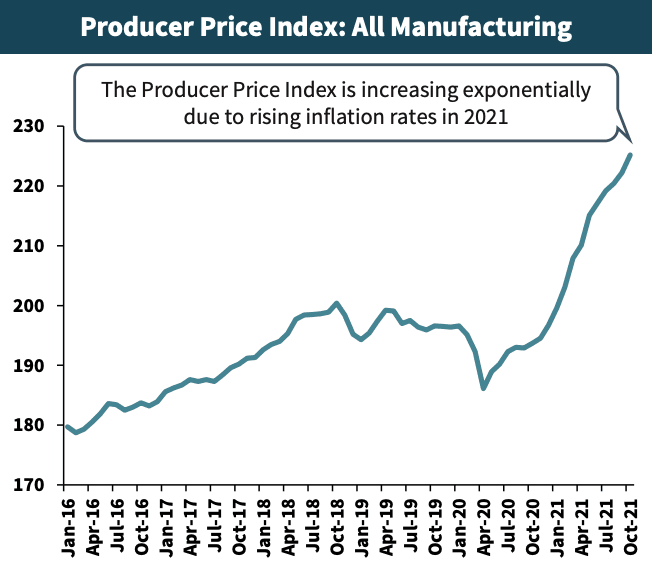

- Increased transportation costs, ongoing shipment delays, and continued strong demand has driven input cost inflation for raw materials to record levels, which creates inflationary pressures through the entire U.S. manufacturing supply chain.

- While businesses are still facing workforce shortages, especially for skilled labor, September and October saw an improvement with two consecutive months of employment growth.

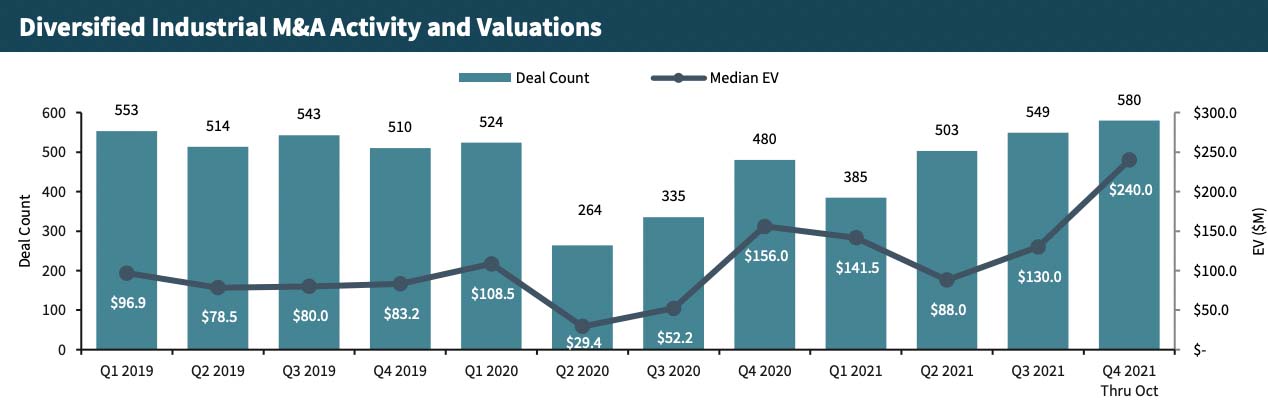

Despite Supply Chain Woes, Industrial M&A Activity Continues at a Frenzied Pace

- In light of supply chain disruption, industrial manufacturing and distribution companies have continued to prioritize M&A strategies focused on near shoring and reshoring initiatives.

- With the looming threat of potential tax hikes driving increased interest in selling among middle market business owners, many industrial distributors have taken the opportunity to aggressively pursue consolidation strategies including in the waterworks, electrical, MRO, and automation sectors.

- Distributors have renewed their commitment to accelerating technology and warehouse automation in order to drive additional value and speed out of the portion of the supply chain in their control.

- In response to increased demand for their services, distributors of industrial automation equipment have been especially active in 2021, seeking to expand the scope of their technology offerings.

Labor Shortage Creates Unique M&A Environment in Industrial Automation

- The continued impact of the COVID-19 pandemic on supply chains and ongoing labor shortages has driven increased inflation rates in 2021.

- Many manufacturers, not expecting a near-term fix to the labor shortages, are investing in robotics and automation technologies to reduce labor requirements.

- As a result, M&A activity in the precision control and automation sector is booming as companies look to augment existing technologies and gain new capabilities.

Sources: St.Louis Federal Reserve, PitchBook, Meridian Research, NPR, IBIS World, Wall Street Journal

Diversified Industrials Middle Market M&A Activity

Recent Transaction Spotlights

Description: EFC International

is a value-added distributor of fasteners and specialized component solutions serving the automotive, industrial and distribution marketplaces.

Rationale: New financial partner will help drive EFC International continued organic and inorganic market share growth strategy both domestically and abroad.

Description: Integro Technologies

is a vision integrator and inspection company. Integro Technologies develops turn-key productivity solutions through machine vision and robotics.

Rationale: The acquisition represents a strategic opportunity for Kaman Distribution to deepen its solution suite with expanded engineering expertise and services in machine vision.

Description: DWFritz Automation is a provider of precision metrology. The Company designs, builds and supports non-contact metrology solutions and automation systems.

Rationale: The acquisition allows Sandvik to continue to grow its offerings in the advanced manufacturing space with added industrial metrology products and services.

Industry Spotlight – Industrial Automation

Industrial Automation Growth Trends

Warehouse automation technology encompasses automation solutions to more efficiently and cost effectively perform repetitive and time-consuming tasks that are commonly performed by manual labor. Solutions include both software, such as warehouse management software, as well as hardware ranging from simple conveyors to complex robotic systems and artificial intelligence that can replace traditional human workflows.

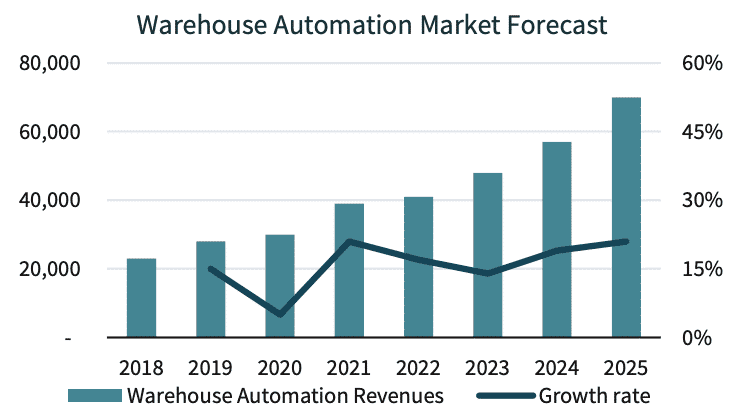

The Warehouse Automation market is projected to grow at a CAGR of 14% between 2020 and 2026 with the global market expected to reach $69B by 2025.1 The continuous growth of the market has been driven by a pandemic-fueled acceleration of e-commerce, multichannel distribution, the emergence of autonomous mobile robots for expedited delivery, and ongoing labor shortages.

Warehouse Automation

Global Warehouse Automation market is expected to reach $69 billion by 2025

- Automatic Guided Vehicles (“AGVs”) and Autonomous Mobile Robots (“AMRs”), guided vehicles used to transport goods through a facility, are expected to be the most widely adopted automation systems over the next five years. The AGV/AMR market is expected to reach $13.2B alone by 20262 and capture greater than 18% of the market share in the total warehouse automation market3.

- In addition to manufacturers, system integrators that can design and implement automation systems are expected to benefit from the growth trends as warehouses of varying sizes will look to efficiently integrate both hardware and software solutions. Integrators and distributors will play a critical role in facilitating broad adoption especially among small- to mid-size warehouse operations.

- With the increasing adoption and complexity of automation systems, integrators can benefit from ongoing service, maintenance, and consulting offerings on the growing install base. In 2020, integrators generated $4.3B in aftermarket service revenues, which is expected to exceed $8B by 20254. Industrial automation integrators have seen continued consolidation in the space with broad investments across diverse applications and integrations to complement conventional automation systems5.

Notable Transactions

Public Diversified Industrials Metrics

Industrial Services

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| WM Intellectual Property Holdings (NYS: WM) | $66,951.5 | $79,884.5 | $17,320.0 | $4,558.0 | 4.6x | 17.5x | 26.3% | 32.3% |

| Cintas Corporation (NASDAQ: CTAS) | $45,174.7 | $47,878.9 | $7,266.7 | $1,465.3 | 6.6x | 32.7x | 20.2% | 20.2% |

| Quanta Services (NYS: PWR) | $17,071.4 | $18,573.2 | $11,968.9 | $1,056.7 | 1.6x | 17.6x | 8.8% | 82.9% |

| ADT (NYSE: ADT) | $7,479.6 | $17,025.4 | $5,222.8 | $1,905.3 | 3.3x | 8.9x | 36.5% | 23.0% |

| Comfort Systems (NYS: FIX) | $3,571.0 | $3,864.9 | $2,916.5 | $262.5 | 1.3x | 14.7x | 9.0% | 104.6% |

| ABM Industries (NYS: ABM) | $3,212.8 | $3,514.4 | $6,017.6 | $314.5 | 0.6x | 11.2x | 5.2% | 20.0% |

| NV5 (NAS: NVEE) | $1,716.0 | $1,785.2 | $663.7 | $63.3 | 2.7x | 28.2x | 9.5% | 82.5% |

| Median | $7,479.6 | $17,025.4 | $6,017.6 | $1,056.7 | 2.7x | 17.5x | 9.5% | 32.3% |

| Average | $20,739.6 | $24,646.6 | $7,339.5 | $1,375.1 | 2.9x | 18.7x | 16.5% | 52.2% |

Industrial Distribution

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Fastenal Company (NAS:FAST) | $33,491.8 | $33,859.6 | $5,837.0 | $1,350.0 | 5.8x | 25.1x | 23.1% | 26.6% |

| W.W. Grainger. (NYS: GWW) | $24,468.9 | $26,802.9 | $12,604.0 | $1,611.0 | 2.1x | 16.6x | 12.8% | 22.3% |

| J.B. Hunt Transport Services (NAS:JBHT) | $20,448.3 | $21,218.4 | $11,409.0 | $1,481.1 | 1.9x | 14.3x | 13.0% | 56.6% |

| XPO Logistics (NYS:XPO) | $9,128.7 | $13,275.7 | $18,436.0 | $1,555.0 | 0.7x | 8.5x | 8.4% | 37.7% |

| WESCO International (NYS: WCC) | $6,853.2 | $11,601.7 | $17,494.4 | $870.1 | 0.7x | 13.3x | 5.0% | 143.5% |

| MSC Industrial Direct Co. (NYS: MSM) | $4,743.1 | $5,549.9 | $3,243.2 | $371.7 | 1.7x | 14.9x | 11.5% | 9.5% |

| DNOW (NYS:DNOW) | $1,042.6 | $762.6 | $1,519.0 | ($25.0) | 0.5x | nm | -1.6% | 73.7% |

| MRC Global (NYS: MRC) | $764.7 | $1,564.7 | $2,459.0 | $73.0 | 0.6x | 21.4x | 3.0% | 79.6% |

| Median | $7,991.0 | $12,438.7 | $8,623.0 | $1,110.1 | 1.2x | 14.9x | 9.9% | 47.2% |

| Average | $12,617.7 | $14,329.4 | $9,125.2 | $910.9 | 1.8x | 16.3x | 9.4% | 56.2% |

Precision Manufacturing

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Stryker Corporation (NYS: SYK) | $103,948.5 | $113,960.5 | $16,669.0 | $3,170.0 | 6.8x | 35.9x | 19.0% | 17.6% |

| Illinois Tool Works (NYS: ITW) | $73,275.5 | $78,840.5 | $14,251.0 | $3,957.0 | 5.5x | 19.9x | 27.8% | 9.1% |

| Emerson Electric Co. (NYS: EMR) | $58,435.0 | $62,794.0 | $17,847.0 | $3,947.0 | 3.5x | 15.9x | 22.1% | 28.1% |

| Parker-Hannifin Corporation (NYS: PH) | $42,341.8 | $48,404.4 | $14,879.9 | $3,235.3 | 3.3x | 15.0x | 21.7% | 30.3% |

| Ingersoll Rand (NYSE: IR) | $23,603.2 | $25,138.4 | $5,889.1 | $1,115.4 | 4.3x | 22.5x | 18.9% | 35.4% |

| Berry Global (NYSE: BERY) | $9,082.7 | $18,452.7 | $13,189.0 | $2,105.0 | 1.4x | 8.8x | 16.0% | 32.2% |

| AptarGroup (NYSE: ATR) | $8,599.7 | $9,681.3 | $3,162.6 | $575.2 | 3.1x | 16.8x | 18.2% | 6.1% |

| Gibraltar Industries (NASDAQ: ROCK) | $2,503.0 | $2,561.6 | $1,270.5 | $137.2 | 2.0x | 18.7x | 10.8% | 23.9% |

| EnPro Industries (NYS: NPO) | $2,162.1 | $2,380.6 | $1,137.0 | $170.2 | 2.1x | 14.0x | 15.0% | 55.5% |

| NN (NASDAQ: NNBR) | $246.6 | $486.0 | $486.2 | $21.3 | 1.0x | 22.8x | 4.4% | -8.6% |

| Median | $16,343.0 | $21,795.6 | $9,539.1 | $1,610.2 | 3.2x | 17.8x | 18.6% | 26.0% |

| Average | $32,419.8 | $36,270.0 | $8,878.1 | $1,843.4 | 3.3x | 19.0x | 17.4% | 23.0% |

Industrial Technology

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Danaher Corp (NYSE:DHR) | $215,337.7 | $239,661.7 | $28,065.0 | $9,384.0 | 8.5x | 25.5x | 33.4% | 28.9% |

| Siemens AG (ETR: SIE) | $135,141.5 | $179,816.7 | $71,681.3 | $11,317.5 | 2.5x | 15.9x | 15.8% | 22.1% |

| ABB Asea Brown Boveri (NYS: ABB) | $69,635.8 | $73,181.8 | $28,560.0 | $4,066.0 | 2.6x | 18.0x | 14.2% | 30.5% |

| Eaton Corporation PLC (NYS: ETN) | $69,244.8 | $78,034.8 | $19,517.0 | $3,864.0 | 4.0x | 20.2x | 19.8% | 53.1% |

| Roper Technologies (NYSE: ROP) | $51,529.4 | $59,506.0 | $6,274.0 | $2,332.0 | 9.5x | 25.5x | 37.2% | 25.2% |

| AMETEK (NYS: AME) | $32,239.8 | $34,710.2 | $5,241.7 | $1,519.3 | 6.6x | 22.8x | 29.0% | 22.2% |

| Teledyne Technologies (NYS: TDY) | $20,605.3 | $24,625.3 | $4,047.9 | $853.0 | 6.1x | 28.9x | 21.1% | 21.3% |

| Median | $69,244.8 | $73,181.8 | $19,517.0 | $3,864.0 | 6.1x | 22.8x | 21.1% | 25.2% |

| Average | $84,819.2 | $98,505.2 | $23,341.0 | $4,762.3 | 5.7x | 22.4x | 24.4% | 29.0% |

Industrial Automation

| Company Name | Market Cap | EV | LTM Rev | LTM EBITDA | EV/LTM Rev | EV/LTM EBITDA | LTM Margin EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|

| Honeywell International (NAS:HON) | $155,397.7 | $164,789.7 | $34,635.0 | $8,606.0 | 4.8x | 19.1x | 24.8% | 14.6% |

| Schneider Electric SE (PAR:SU) | $99,505.3 | $113,224.1 | $32,612.5 | $6,089.1 | 3.5x | 18.6x | 18.7% | 26.6% |

| Rockwell Automation (NYS:ROK) | $38,924.3 | $42,854.5 | $6,759.6 | $2,091.2 | 6.3x | 20.5x | 30.9% | 31.7% |

| Mitsubishi Electric Corporation (TKS:6503) | $28,892.5 | $25,522.8 | $41,307.6 | $4,916.7 | 0.6x | 5.2x | 11.9% | 2.6% |

| Teradyne (NAS:TER) | $23,454.7 | $22,355.9 | $3,576.8 | $1,275.1 | 6.3x | 17.5x | 35.6% | 41.7% |

| Omron Corporation (TKS:6645) | $20,444.8 | $18,399.6 | $6,546.3 | $947.1 | 2.8x | 19.4x | 14.5% | 27.9% |

| Applied Industrial Technologies (NYS:AIT) | $3,968.0 | $4,539.4 | $3,379.8 | $283.7 | 1.3x | 16.0x | 8.4% | 48.1% |

| Median | $28,892.5 | $25,522.8 | $6,759.6 | $2,091.2 | 3.5x | 18.6x | 18.7% | 27.9% |

| Average | $52,941.0 | $55,955.1 | $18,402.5 | $3,458.4 | 3.7x | 16.6x | 20.7% | 27.6% |

Select Diversified Industrials M&A Transactions

Industrial Services

| Date | Target | Acquirer/Investor | Description |

|---|---|---|---|

| Oct-21 | Paragon Energy Solutions | Windjammer Capital | Provider of parts and services for existing utility nuclear power generation facilities |

| Oct-21 | Howard Air | Service Champions (Odyssey Investment Partners) | Provider of heating, ventilation, and air conditioning services |

| Oct-21 | Integrated Power Services | Searchlight Capital Partners | Provider of repair and maintenance services intended to serve the power generation, petrochemicals, metals, mining, and cement industries |

| Oct-21 | Frakes-PumpWorx | Fischer Process Industries | Provider of primary pump and rotating equipment company |

| Oct-21 | AIR TECHNOLOGIES | Fidelity Building Services Group (Oaktree Capital Management) | Provider of mechanical and HVAC services for commercial and industrial buildings |

| Sep-21 | Summit Companies | BlackRock | Provider of fire and life safety service and installation services designed to protect buildings, assets and people |

| Sep-21 | Sonic Systems International | Boyne Capital Partners | Provider of support services, reactor maintenance, and engineering management for commercial nuclear power companies |

| Sep-21 | Explosive Professionals | Groome Industrial Service Group (Argosy Private Equity) | Provider of industrial cleaning services specializing in industrial and heat recovery steam generator (HRSG) cleaning |

| Aug-21 | Nelbud Services Group | Halton Group | Provider of commercial kitchen fire prevention and equipment maintenance services |

| Jul-21 | Capstone Mechanical | Reedy Industries (Audax Group) | Operator of engineering, contracting and services company specializing in the fields of HAVC, refrigeration, plumbing, process heating and cooling |

Distribution & Logistics

| Date | Target | Acquirer/Investor | Description |

|---|---|---|---|

| Nov-21 | EFC International | Frontenac Company | Distributor of automotive engineered fasteners |

| Nov-21 | BDP International | PSA International (Temasek Holdings) | Provider of logistics and transportation services including export freight forwarding, import customs clearance, and regulatory compliance |

| Nov-21 | Steven Engineering | Graybar Electric Company | Distributor of industrial controls and components |

| Oct-21 | Wimsatt Building Materials | SRS Distribution (Berkshire Partners) | Distributor of residential and commercial building products |

| Oct-21 | Integro Technologies | Kaman Distribution Group | Provider and distributor of machine vision and logistics solutions |

| Oct-21 | Mayer Electric | Rexel (Brunswick Group) | Distributor of electrical products and services |

| Oct-21 | Shaw Stainless & Alloy | Olympic Steel (Copper Run Capital) | Full-line distributor of stainless-steel sheet, pipe, tube, bar and angles |

| Oct-21 | Mailender | Imperial Dade (Bain Capital) | National distributor of janitorial supplies and packaging |

| Oct-21 | Merfish United | Reliance Steel & Aluminum | Distributor of carbon steel pipes, fittings and flanges |

| Sep-21 | Genesis Systems | Floworks International (Clearlake Capital Group) | Distributor of industrial automation equipment intended for the energy, petrochemical and semiconductor industry |

| Sep-21 | CES Industrial Piping Supply | Core & Main | Distributor of water, wastewater, storm drainage and fire protection products |

| Sep-21 | Clausen Supply of Iowa | Winsupply | Distributor and supplier of HVAC and sheet metal fabrication products |

| Aug-21 | Eidemiller Precision Machining | Kyowa Industrial | Distributor and supplier of precision machined parts and equipment |

| Jul-21 | GlobalTranz Enterprises | Worldwide Express Operations (Ridgemont Equity Partners) | Developer of freight management services including predictive analytics for full truckload, supply chain management, and shipping services |

| Apr-21 | UPS Freight | TFI International | Provider of logistics and delivery services |

Precision Manufacturing

| Date | Target | Acquirer/Investor | Description |

|---|---|---|---|

| Oct-21 | Rainier Industries | LFM Capital | Manufacturer of shade, shelter, and display solutions specializing in engineered, precision manufacturing capabilities |

| Oct-21 | Advanced Laser Machining | CGI Automated Manufacturing, (CORE Industrial Partners) | Provider of metals-focused contract manufacturing services serving aerospace and defense, transportation and industrials markets |

| Oct-21 | Rexnord (PMC Business) | Regal Beloit | Manufacturer of power transmission components |

| Oct-21 | CHawk Technology International | Graycliff Partners | Manufacturer of precision plastic and metal components and assemblies |

| Sep-21 | Proto Machine Works | Deshazo LLC | Provider of custom equipment designing and manufacturing services including custom-built machines with integration, servo motion, and vision systems |

| Sep-21 | Contour360 | Arch Global Precision (The Jordan Company) | Manufacturer of solid engineered solid round cutting tools |

| Sep-21 | Superior Metal Products | Midwest Growth Partners | Manufacturer of machined components and assemblies |

| Aug-21 | Hannibal Industries | Nucor | Manufacturer of steel tube and material handling products |

| Aug-21 | CGI Automated Manufacturing | CORE Industrial Partners(John May) | Manufacturer of sheet metal production parts, assemblies and custom precision sheet metal fabrication services |

| Aug-21 | FTT Manufacturing | Fairchild Capital Partners (Weco Manufacturing) | Provider of contract manufacturing service of precision machining, automation systems and assembly test components |

Industrial Technology

| Date | Target | Acquirer/Investor | Description |

|---|---|---|---|

| Oct-21 | DWFritz Automation | Sandvik | Provider of precision metrology, inspection and assembly solutions focused on advanced manufacturing |

| Oct-21 | Automated Control Concepts | Sverica Capital Management | Provider of system integration services for manufacturing and utility companies |

| Oct-21 | Farrar Scientific | Trane Technologies | Manufacturer of ultra-low temperature refrigerator machines to pharmaceutical and biotechnology applications |

| Oct-21 | Colorado Automation & Design | Tension Packaging & Automation | Manufacturer of automation machinery catering to pharmacy, e-commerce, and energy industries |

| Sep-21 | Sarcos | Rotor Acquisition | Provider and developer of robotics and microelectromechanical systems |

| Aug-21 | ATI Industrial Automation | Novanta | Developer and manufacturer equipment and accessories catering to industrial and surgical robots |

| Aug-21 | American Robotics | Ondas Networks | Developer of robotic systems designed to offer industrial drones for rugged and real-world environments |

| Jul-21 | Keystone Electrical Manufacturing | ClearSky (Comvest Partners) | Manufacturer of control systems for electrical generation, transmission and distribution markets |

| Jun-21 | Systematix | Samuel, Son & Co. | Manufacturer of automation equipment intended for health science, transportation, and niche product sectors |

| May-21 | FLIR Systems | Teledyne Technologies | Designer, developer and distributor of imaging systems and detection technologies |

Industrial Automation

| Date | Target | Acquirer/Investor | Description |

|---|---|---|---|

| Sep-21 | Waypoint Robotics | Locus Robotics | Provider of industrial strength, autonomous, omnidirectional mobile robots |

| Sep-21 | House of Design | Thomas H. Lee Partners | Provider of robotic automation systems and software |

| Sep-21 | Dynamic Automation | ATC Automation | Provider of advanced automation solutions including advanced robotics & automation systems for handling, assembly, packaging and labeling |

| Sep-21 | Instrument Associates | Motion & Control Enterprises (Frontenac Company) | Distributor of instrumentation and process control products for hydraulic, pneumatic and electro-mechanical markets |

| Sep-21 | Ncc Automated Systems | ATS Automation Tooling Systems | Manufacturer of automation products and systems including pallet handling products, ophthalmic automation systems and packaging line integration |

| Sep-21 | Plex Systems | Rockwell Automation | Provider of single-instance, multi tenant SaaS manufaccturing platform including advanced manufacturing execution systems |

| Aug-21 | JMP Solutions | Crestview Partners | Provider of turnkey engineering services intended to automate manufacturing, production and distribution facilities |

| Aug-21 | Advanced Dynamics Corporation | EPIQ Machinerie | Manufacturer of custom heavy-duty material handling systems |

| Aug-21 | Rollon-iMS | Rollon | Designer and manufactureer of standard and custom machinery for the automation industry |

| Aug-21 | R.R. Floody | Applied Industrial Technologies | Provider of automation products, services and engineered solutions focused on machine vision, mobile and collaborative robotics, and motion control |

| Aug-21 | Fetch Robotics | Zebra Technologies | Manufacturer of on-demand Autonomous Mobile Robots (AMRs) for fulfillment / distribution centers and manufacturing facilities |

| Aug-21 | ASTI Mobile Robotics Group | ABB Group (Keensight Capital) | Manufacturer of autonomous mobile robots and software suite across all major applications |

| Jul-21 | Agilix Solutions | French Gerleman, IAC Supply Solutions | Distributors of electrical, industrial and automation products and services including industrial automation, electrical supply, and solar products |

| Jun-21 | BP Controls | Hy-Tek Material Handling (Dunes Point Capital) | Developer of industrial automation systems designed for warehouses and distribution centers |

| Jun-21 | Laveer Engineering | Westinghouse Electric (Brookfield Asset Management ) | Provider of custom tooling and automation services for the field execution organizations |