Engineering, Construction & Building Products M&A Trends: Fall 2021

Published October 18, 2021

Key Insights:

- The proposed $1 trillion infrastructure bill is short on details and long on delays

- Creative solutions to rapidly rising materials & labor prices

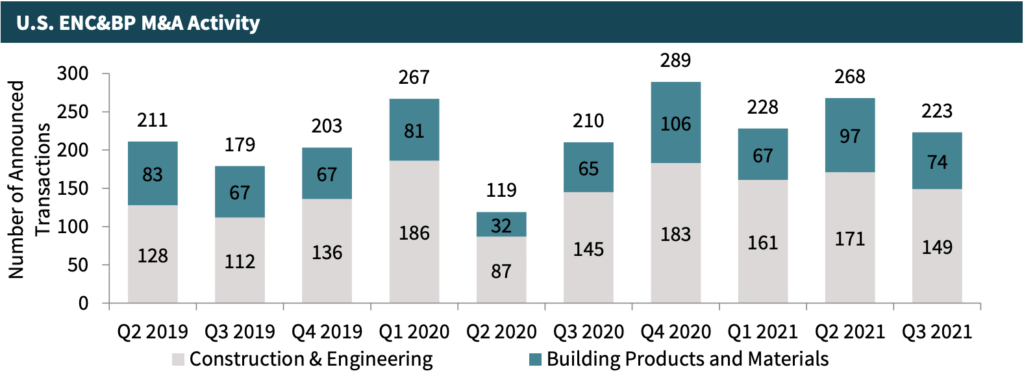

- 2021 M&A transaction activity remains high with 223 transactions in Q3

- Private Equity firms continue to invest in the industry, shown by a record number of private equity-backed deals

- The M&A markets are likely to stay highly active

Highlights:

- The Proposed $1 trillion infrastructure bill proposed by congress over the summer indicated bi-partisan progress on a major stimulus for the infrastructure industry; the proposal recently has been tied to a much broader and more expensive bill that will likely cause the infrastructure bill’s passing to continue to be delayed.

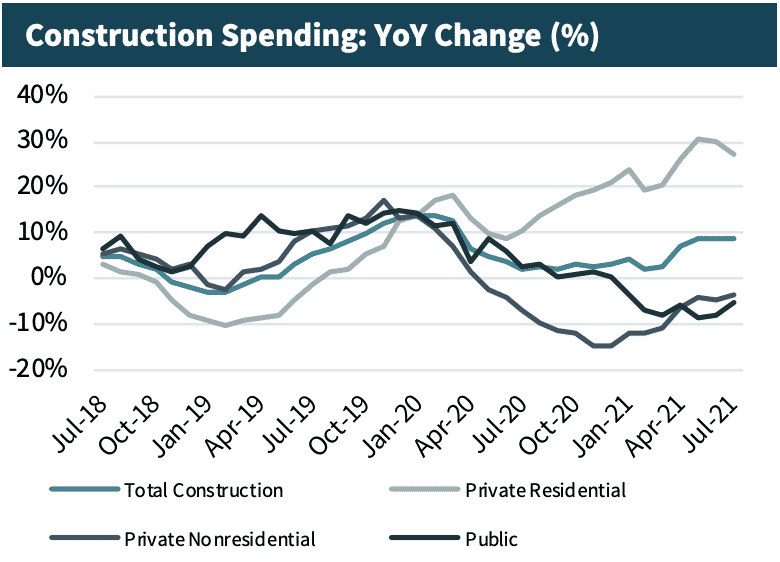

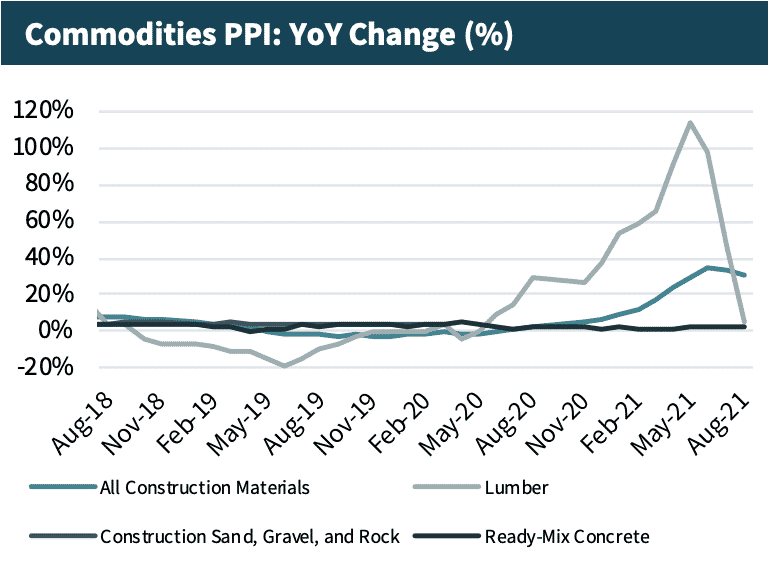

- Through 2021 there has been much discussion around the construction, building, and materials cost indices increasing at double-digit YOY rates. Materials, Steel, Lumber and Labor are the primary culprits.

- The almost 40% year-over-year increase in private equity-backed deals highlights investors anticipating elevated government spending and will likely cause continued consolidation within the industry.

- Alongside the additional M&A activity from Private Equity firms, the M&A markets are likely to stay highly active as investors look to deploy record levels of dry powder, strategic companies accelerate their inorganic growth plans to compete in a consolidating market, and increased public sector infrastructure spending remains on the horizon.

ENC&BP Market Insights

Proposed $1 Trillion Infrastructure Bill Short on Details and Long on Delays

- The Proposed $1 Trillion infrastructure bill proposed by congress over the summer indicated bi-partisan progress on a major stimulus for the infrastructure industry; the proposal recently has been tied to a much broader and more expensive bill that will likely cause the Infrastructure bill’s passing to continue to be delayed.

- While overall there is optimism and alignment that investment in infrastructure is needed, the scope and timeline continues to be uncertain.

- Overall, based on the initial proposal it is expected the broader infrastructure supply chain will experience a longer-term growth opportunity over the next 10-15 years, and product, materials, and services providers serving the space are expected to experience greater growth rates than experienced over the past 5 years.

- The private equity industry has recently increased its investment in the infrastructure supply chain and it is expected that this buyer/investor cohort will continue to expand its experience and exposure to certain segments of the industry.

Creative Solutions to Rapidly Rising Materials & Labor Prices

- Through 2021 there has been much discussion around the construction, building, and materials cost indices increasing at double-digit YOY rates. Materials, Steel, Lumber and Labor are the primary culprits.

- Many companies are resorting to creative solutions to access labor and materials at manageable prices.

- There is a substantial increase in acquisitions of providers of construction products that save labor, including unified thermal moisture wrapping solutions, pre-insulated wall components, and modular and pre-fabricated construction components.

- Further, Companies have emphasized formal collaboration between the development-design-construction-facility services supply chain, including the use of Joint-Ventures, to share labor burdens across a larger pool of contributors to the construction market’s success.

- Near-shoring and on-shoring of the supply chain continues to be an active trend in 2021 as demand/supply mismatches and international trade pressures will continue to roil supply chains for the foreseeable future.

Source: US Census, Engineering News Record (“ENR”), Association of General Contractors, U.S. Small Business Administration, PitchBook Data, IBISWorld, Company Press Release, and Meridian Research

ENC&BP Middle Market M&A Activity And Market Trends

Commentary

- Q3 2021 M&A transaction activity remains high with 223 transactions in Q3 2021, representing a strong rebound from the lows seen during the onset of the pandemic in Q2 2020.

- Private Equity firms continue to invest in the industry, shown by a record number of private equity-backed deals. The almost 40% year-over-year increase in private equity-backed deals highlights investors anticipating elevated government spending and will likely cause continued consolidation within the industry.

- Alongside the additional M&A activity from Private Equity firms, the M&A markets are likely to stay highly active as investors look to deploy record levels of dry powder, strategic companies accelerate their inorganic growth plans to compete in a consolidating market, and increased public sector infrastructure spending remains on the horizon.

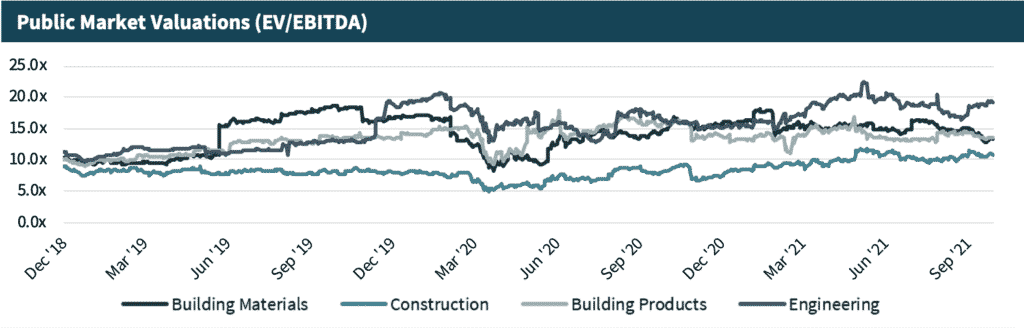

- Sector valuations have remained near record highs since the COVID-19 pandemic, with Engineering firms seeing the highest September 2021 EV/LTM EBITDA multiple of 19.3x. Construction firms have seen the biggest rise in EV/LTM EBITDA multiples since the COVID pandemic in March 2020, with valuations rising 70% to 10.4x EV/LTM EBITDA in September 2021.

GE Johnson Joins DPR Family Of Companies

Meridian Capital LLC (“Meridian”), a Seattle-based middle market corporate finance and M&A advisory firm is pleased to announce the successful agreement of its client GE Johnson to join DPR Construction and its family of companies (“DPR”).

The agreement offers both companies strategic growth and employee development opportunities. GE Johnson will continue to further its presence in the Mountain States by leveraging DPR’s global customer relationships. At the same time, employees of both firms will see increased career and growth opportunities.

For customers, it will be business as usual with GE Johnson. GE Johnson and H.W. Houston Construction will maintain their brands, and GE Johnson will continue to operate as its own contracting entity. President & CEO Jim Johnson will remain in his role along with other GE Johnson leaders.

“Even as we’ve grown successfully into new markets, we wanted to engage with a global firm that supports our culture and people and aligns with our values,” Johnson said. “We are elated to announce that we are joining the DPR family of companies. This will continue to provide long-term financial assurance, continued leverage of our self-perform capabilities, career opportunities for staff and craft, and access to the latest in technology and delivery methods.” Johnson added “Meridian Capital was great in terms of managing us through this process and we are pleased with our new partner in DPR.”

“We welcome GE Johnson to the DPR family and are excited to be able to better support our customers in the locations where GE Johnson has established itself as one of the best builders,” said George Pfeffer, who serves on DPR’s management committee. “Both our firms see ourselves as builders first. It’s exciting to know that our talented people at both companies will have more opportunities to share their passion for building.”

James Rothenberger, Managing Director at Meridian stated, “Jim and the senior leadership team of GE Johnson have built an incredible company that many customers want to work with on a deeper basis. As part of the DPR family, GE Johnson will continue its strategic growth for many years to come. We are excited for what the future holds for DPR and GE Johnson.”

Highly Acquisitive Roll-ups Consolidating the Highly Fragmented ENC&BP Market

U.S. LBM Holdings (Backed by Bain Capital)

Description: One of the largest buildings product distributors in the United States with over 400 locations across the United States.

Headquarters: Buffalo Creek, IL

Acquisitions: 19 acquisitions since 2019 and 11 in 2021

Investment Thesis: LBM combines the scale and operational advantage of a national platform with a local go-to-market strategy through its national network of locations across the country. They are actively consolidating across a portfolio of products throughout the United States.

Recent Acquisitions

Tecta America (Backed by Atlas and Leonard Green & Partners)

Description: Largest commercial roofing contractor and consolidator in the United States with more than 85 locations and 4,500 roofing professionals nationwide.

Headquarters: Rosemont, IL

Acquisitions: 8 acquisitions since 2019 and 2 in 2021

Investment Thesis: Tecta’s proven track record of organic and acquisition execution has allowed them to undergo multiple transactions with multiple different private equity groups. Tecta acquires businesses in strategic geographic markets with strong management teams to provide the support of a national firm.

Recent Acquisitions

American Elevator Group (Backed by Arcline Investments)

Description: American Elevator Group is a collection of established elevator service companies that operate across the United States.

Headquarters: New York, NY

Acquisitions: 10 acquisitions in 2021

Investment Thesis: The Company is actively seeking to increase its range of niche elevator offerings and presence in the Northeast and Mid-Atlantic regions through strategic acquisitions.

Recent Acquisitions

Surveying and Mapping, LLC. (Backed by Austin Ventures)

Description: One of the nation’s largest geospatial and construction services firms providing surveying, utility engineering, aerial mapping, and building modeling.

Headquarters: Austin, TX

Acquisitions: 8 acquisitions since 2019 and 4 in 2021

Investment Thesis: SAM looks to grow its industry leading technology-enabled infrastructure and construction services to new geographies by acquiring businesses with diversified end markets and complementary offerings.

Recent Acquisitions

Small & Mid-Cap Company Valuations

Construction Firms

| Construction Firms | Ticker | Market Cap | Enterprise Value | LTM Rev | LTM EBITDA | LTM Margin EBITDA | EV / LTM Rev | EV / LTM EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|

| Quanta Services, Inc. | NYSE:PWR | $15,545 | $16,948 | $11,636 | $790 | 6.8% | 1.5x | 21.4x | 90% |

| MasTec, Inc. | NYSE:MTZ | $6,441 | $7,770 | $7,073 | $931 | 13.2% | 1.1x | 8.3x | 91% |

| EMCOR Group Inc. | NYSE:EME | $6,355 | $6,230 | $9,225 | $636 | 6.9% | 0.7x | 9.8x | 66% |

| Comfort Systems USA, Inc. | NYSE:FIX | $2,786 | $2,974 | $2,797 | $257 | 9.2% | 1.1x | 11.6x | 33% |

| Dycom Industries, Inc. | NYSE:DY | $2,101 | $2,804 | $3,076 | $251 | 8.1% | 0.9x | 11.2x | 7% |

| Granite Construction Inc. | NYSE:GVA | $1,819 | $1,645 | $3,645 | $38 | 1.0% | nm | nm | 104% |

| MYR Group Inc. | NAS:MYRG | $1,727 | $1,690 | $2,458 | $154 | 6.3% | 0.7x | 11.0x | 138% |

| Primoris Services Corporation | NAS:PRIM | $1,336 | $2,004 | $3,540 | $272 | 7.7% | 0.6x | 7.4x | 27% |

| Great Lakes Dredge & Dock Corp. | NAS:GLDD | $959 | $1,152 | $696 | $107 | 15.3% | 1.7x | 10.8x | 39% |

| Sterling Construction Company, Inc. | NAS:STRL | $663 | $914 | $1,448 | $131 | 9.0% | 0.6x | 7.0x | 54% |

| Matrix Service Co. | NAS:MTRX | $273 | $216 | $673 | -$24 | -3.6% | 0.3x | nm | 25% |

| Orion Group Holdings, Inc. | NYSE:ORN | $156 | $206 | $659 | $33 | 5.0% | 0.3x | 6.3x | 61% |

| Median | $1,773 | $1,847 | $2,936 | $202 | 7.3% | 0.7x | 10.3x | 58% | |

| Average | $3,347 | $3,713 | $3,910 | $298 | 7.1% | 0.9x | 10.5x | 61% |

Engineering Firms

| Engineering Firms | Ticker | Market Cap | Enterprise Value | LTM Rev | LTM EBITDA | LTM Margin EBITDA | EV / LTM Rev | EV / LTM EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|

| Teledyne Technologies Incorporated | NYSE:TDY | $19,984 | $24,166 | $3,485 | $689 | 19.8% | 6.9x | 35.1x | 32% |

| Jacobs Engineering Group, Inc. | NYSE:J | $17,233 | $20,540 | $14,026 | $873 | 6.2% | 1.5x | 23.5x | 33% |

| Aecom Technology Corporation | NYSE:ACM | $9,194 | $11,174 | $13,556 | $723 | 5.3% | 0.8x | 15.5x | 38% |

| Tetra Tech, Inc. | NAS:TTEK | $8,278 | $8,532 | $3,075 | $286 | 9.3% | 2.8x | 29.8x | 50% |

| CACI International Inc. | NYSE:CACI | $6,275 | $8,347 | $6,044 | $665 | 11.0% | 1.4x | 12.6x | 24% |

| KBR Inc | NYSE:KBR | $5,879 | $7,264 | $5,842 | $249 | 4.3% | 1.2x | nm | 66% |

| Stantec, Inc. | TSX:STN | $5,340 | $6,408 | $3,526 | $396 | 11.2% | 1.8x | 16.2x | 57% |

| Fluor Corporation | NYSE:FLR | $2,294 | $1,490 | $13,634 | $117 | 0.9% | 0.1x | 12.7x | 47% |

| Tutor Perini Corp. | NYSE:TPC | $673 | $1,418 | $5,218 | $375 | 7.2% | 0.3x | 3.8x | -8% |

| VSE Corporation | NAS:VSEC | $600 | $900 | $656 | $47 | 7.2% | 1.4x | 19.2x | 57% |

| Perma-Fix Environmental Services, Inc. | NAS:PESI | $94 | $90 | $98 | $4 | 4.0% | 0.9x | 23.2x | -1% |

| Median | $5,879 | $7,264 | $5,218 | $375 | 7.2% | 1.4x | 17.7x | 38% | |

| Average | $6,895 | $8,212 | $6,287 | $402 | 7.8% | 1.7x | 19.1x | 36% |

Building Products Firms

| Building Products Firms | Ticker | Market Cap | Enterprise Value | LTM Rev | LTM EBITDA | LTM Margin EBITDA | EV / LTM Rev | EV / LTM EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|

| Masco Corporation | NYSE:MAS | $13,876 | $16,458 | $7,992 | $1,188 | 14.9% | 2.1x | 13.9x | -3% |

| Trex Company, Inc. | NYSE:TREX | $12,052 | $12,135 | $1,017 | $288 | 28.3% | 11.9x | nm | 33% |

| Builders FirstSource, Inc. | NYS:BLDR | $11,011 | $13,415 | $14,577 | $1,602 | 11.0% | 0.9x | 8.4x | 55% |

| Owens Corning Corporation | NYSE:OC | $9,154 | $11,594 | $7,983 | $1,802 | 22.6% | 1.5x | nm | 17% |

| Simpson Manufacturing Company, Inc. | NYSE:SSD | $4,761 | $4,489 | $1,416 | $340 | 24.0% | 3.2x | 13.2x | 16% |

| Armstrong World Industries, Inc. | NYSE:AWI | $4,601 | $5,201 | $1,017 | $260 | 25.6% | 5.1x | 20.0x | 39% |

| UFP Industries, Inc. | NAS:UFPI | $4,370 | $5,023 | $7,405 | $654 | 8.8% | 0.7x | 7.7x | 18% |

| Gibraltar Industries, Inc. | NAS:ROCK | $2,281 | $2,311 | $1,133 | $132 | 11.6% | 2.0x | 17.5x | -4% |

| Quanex Building Products Corporation | NYSE:NX | $715 | $801 | $1,036 | $127 | 12.3% | 0.8x | 6.3x | 9% |

| Median | $4,761 | $5,201 | $1,416 | $340 | 14.9% | 2.0x | 13.2x | 17% | |

| Average | $6,980 | $7,936 | $4,842 | $710 | 17.7% | 3.1x | 12.4x | 20% |

Building Materials Firms

| Building Materials Firms | Ticker | Market Cap | Enterprise Value | LTM Rev | LTM EBITDA | LTM Margin EBITDA | EV / LTM Rev | EV / LTM EBITDA | 52-Week Change |

|---|---|---|---|---|---|---|---|---|---|

| Vulcan Materials Company | NYSE:VMC | $23,180 | $25,551 | $4,914 | $1,208 | 24.6% | 5.2x | 21.2x | 12% |

| Martin Marietta, Inc. | NYSE:MLM | $22,288 | $25,543 | $4,861 | $1,473 | 30.3% | 5.3x | 17.3x | 27% |

| Eagle Materials Inc. | NYSE:EXP | $5,629 | $6,370 | $1,671 | $486 | 29.1% | 3.8x | 13.1x | 43% |

| Boral Ltd | ASX: BLD | $5,023 | $5,689 | $3,724 | -$440 | -11.8% | 1.5x | nm | 27% |

| United States Lime & Minerals, Inc. | NAS:USLM | $662 | $572 | $176 | $53 | 30.1% | 3.3x | 10.8x | 24% |

| Median | $5,629 | $6,370 | $3,724 | $486 | 29.1% | 3.8x | 15.2x | 27% | |

| Average | $11,356 | $12,745 | $3,069 | $556 | 20.5% | 3.8x | 15.6x | 27% |

As of October 8th, 2021.

Note: Mid-cap defined as market capitalization between $2 billion and $25 billion. Not meaningful (NM) if EV/Sales or EV/EBIT is a significant outlier. NA if denominator is 0 or not available. NTM figures are based on the median estimate of Wall Street analysts

Source: PitchBook Data, Company Press Releases, Meridian Research

Select ENC&BP M&A Transactions

| Announced Date | Acquirer/Investor | Target | Target Description |

|---|---|---|---|

| Sep-21 | DPR Construction | GE Johnson | General contracting construction company. |

| Sep-21 | US LBM Holdings | Northern Building Supply | Retailer of building products. |

| Sep-21 | Leonard Green & Partners | Tecta America | Rosemont, Illinois based commercial roofer. |

| Sep-21 | SigmaRoc | Gerald Harries & Sons | Operator of quarrying, asphalt, concrete and contracting projects. |

| Sep-21 | Babcock & Wilcox Enterprises | Fosler Construction Company | Offers framing, finish carpentry, installation and EPC for solar energy sector. |

| Sep-21 | US LBM Holdings | Mid-Cape Home Centers | Distributor of home improvement products and building materials. |

| Sep-21 | American Securities | Swinerton Renewable Energy | Provider of solar panel engineering, procurement and construction services. |

| Aug-21 | Surveying and Mapping, Inc. | Johnson Surveying and Mapping | Land surveying and mapping firm for construction industry. |

| Aug-21 | Webuild | Seli Overseas | Tunnel excavation specialist. |

| Aug-21 | Breakwater Management, Cherng Family Trust | Matcon (Canada) | Provides construction services for large-scale civil infrastructure / commercial markets. |

| Aug-21 | US LBM Holdings | Junior’s Building Materials | Provider of lumber and a borad mix of specialty materials. |

| Aug-21 | Wind Point Partners | Vertex | Engineering and construction management / consulting services firm. |

| Aug-21 | Hensel Phelps | Hydro Construction | Provides construction of water and wastewater treatment facilities. |

| Aug-21 | Pavement Partners | Dominion Paving and Sealing | Provider of asphalt and concrete solutions. |

| Aug-21 | US LBM Holdings | Massey Builders’ Supply | Distributor of building materials. |

| Aug-21 | Surveying and Mapping, Inc. | The Whiddon Group | Provider of utility inspection and management services for engineering firms. |

| Aug-21 | Wynnchurch Capital | Trimlite | Manufacturer and distributor of specialty doors. |

| Aug-21 | Bessemer Investors | Legacy Restoration | Exterior restoration and remodeling services. |

| Aug-21 | US LBM Holdings | North Georgia Building Supply | Distributor of building materials. |

| Aug-21 | Wrench Group | Boothe’s Heating, Air and Plumbing | Provides Plumbing, Heating, and AC services to Southern Maryland. |

| Aug-21 | Cornerstone Building Brands | Cascade Windows | Manufacturer of vinyl windows and doors. |

| Jul-21 | Tecta America | Empire Roofing | Provider of roof replacement, maintenance, and repair services. |

| Jun-21 | Salas O’Brien Engineers | Sia Solutions | Provider of environmental consulting and engineering services. |

| Jun-21 | Surveying and Mapping, Inc. | Marbach, Brady and Weaver | Provider of land surveying and engineering services. |

| Jul-21 | SPO Networks | Red Line Contractors | Provider of demolition, general contracting, maintenance, and site clearing services. |

| Jul-21 | Carlisle Construction Materials | Henry Company | Manufacturer of roofing and building-envelope systems. |

| Jul-21 | Keller Group | Remedial Construction Services | Provider of environmental remediation and civil construction services. |

| Jun-21 | Salas O’Brien Engineers | PCI Skanska | Provides process mechanical analysis and engineering services. |

| Jun-21 | Hardwoods Distribution | Novo Building Products | Provider of building products to national home retail centers and building material dealers. |

| Jun-21 | Tecta America | Childers Roofing & Sheetmetal | Provider of roofing services. |

| Jun-21 | Salas O’Brien Engineers | BVH Integrated Services | Provider of building and site engineering services. |

| Jun-21 | PNC Mezzanine Capital | MST Concrete Products | Provider of engineered concrete products. |

| Jun-21 | Gryphon Investors | Comfort Masters | Provider of residential HVAC, air quality and hot water services. |

| Jun-21 | Congleton-Hacker Company | Paul Mattingly/Congleton-Hacker Constructors | Provider of construction services. |

| Jun-21 | Salas O’Brien Engineers | Girard Engineering | Provider of engineering services. |

| Jun-21 | ERW Site Solutions | Ratliff Hardscape | Provider of construction services in both the public and private sector. |

| Jun-21 | Nordisk Bergteknik | Grundia | Provider of construction services in Molndal, Sweden. |

| May-21 | Bain Capital, US LBM Holdings | American Construction Source | Specialty lumber and building materials provider. |

| May-21 | AE Industrial Partners | Cross-Fire Safety | Provides designing, engineering and installation of life safety systems for buildings. |

| May-21 | Salas O’Brien Engineers | The Leffler Group | Provides project management, construction, coordination services. |

| May-21 | Godspeed Capital | Prime Engineering | Atlanta-based architecture, engineering, and surveying firm. |

| May-21 | Bain Capital, US LBM Holdings | Higginbotham Brothers | Supplier of lumber and building products to builders and contractors. |

| Apr-21 | Emcor Group | Dallas Mechanical Group, LLC | Provider of mechanical construction and maintenance services. |

| Apr-21 | Harris Contracting Company | HVAC Controls & Specialties, Inc. | Provider of installation services catering to commercial buildings. |

| Mar-21 | Surveying and Mapping, Inc. | John F. Watson and Company | Provider of land surveying and land development services. |