EdTech M&A Trends: Fall 2020

Published April 20, 2021

COVID-19 has deeply affected the way the world approaches educational curriculum. With the pandemic necessitating social distancing, remote-learning has surged among K-12 schools, corporations, and academia at large. This has brought on the challenge of how to provide successful educational programs in a virtual environment – EdTech has embraced this challenge. The over $8B market is expected to accelerate to over $34B by 2025 as the sector addresses newfound demand1.

Supporting this growth, many high-profile corporations have elected to remain virtual well into 2021 or beyond, forcing them to increase their commitment to or entirely embrace new remote learning options that support long-term corporate learning strategies.

Like the knowledge workers stuck at home, billions of students across the globe have started this school year like none other – first days of school often occurred at home and the “classroom” is viewed through a computer screen or tablet. This fall, 52% will go to school virtually exclusively, largely by leveraging EdTech in the form of digital learning platforms, live-streamed classes, or one-on-one online learning sessions2. This shift was seen across all levels of education, from K-12 to universities and graduate programs.

At Meridian Capital, we cover the Technology industry in which EdTech will see continued adoption. While fundraising may grow more competitive, those well-positioned in the market can take advantage as corporations, school districts, and universities search for means of facilitating remote learning. This accelerated adoption has created a tangible impact that many are feeling, especially students, teachers, and parents.

What We’re Reading

The K-12 Edtech Market Is At an Inflection. But Where Is It Going? – EdSurge

Takeaway: With kids at home, there has been a coupling of EdTech platforms and parental satisfaction, particularly given EdTech platforms are eating “a much larger share of a parents’ out-of-pocket expenses”.

Ed-Tech Vendors Confront Sudden Opportunity and Risk – Inside Higher Ed

Takeaway: The coronavirus has a caused a monumental shift in the way higher ed instruction takes place that will result in rising tides for some EdTech players but leave some behind

The Growing Demand for EdTech During Coronavirus Lockdown – Credit Suisse

Takeaway: EdTech has been one of the few industries that has seen a tremendous surge in demand forcing institutions previously shy to shift towards online learning to adopt EdTech platforms

Impact Of COVID-19 On the Future Of EdTech – Entrepreneur

Takeaway: With consumers spending more time online and looking for access to services of all kinds from home, EdTech adoption will be accelerated as students look to access learning without sacrificing convenience

1. Markets and Markets

2. CNBC

Market Impacts of COVID-19 on Edtech Sector

Accelerated Digital Transformation of Educational Institutions and Corporate Learning Programs

- COVID-19 has caused the closure of nearly 124,000 school facilities forcing the shift to online instruction

- Institutions and enterprises, already likely to have adopted EdTech platforms for some forms of training, are faced with a choice of converting critical live training or learning programs to virtual solutions

Institutions and Enterprises Look to Enhance Digital Learning Experience

- Enterprises and institutions will have to continue to push forward learning initiatives, but these entities will have to adapt to create more engagement from their participants

- Enterprises and institutions should consider using breakout rooms, polling, and other immersive digital tools to create more engagement for its participants

Funding for EdTech Startups Will Become More Competitive

- Strong industry dynamics and accelerated adoption have continued to create investor interest in EdTech

- With EdTech startups seeing large growth in users and traffic more have sought out funding to scale their platforms effectively causing more firms to compete for the same investors

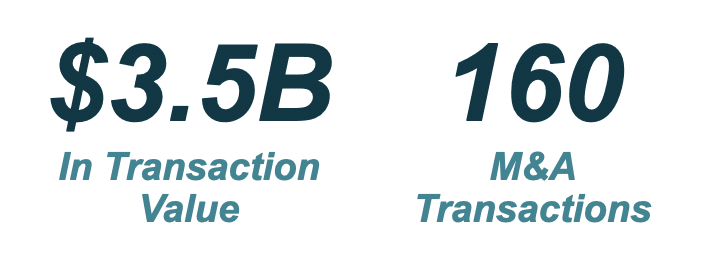

Q1 2020 EdTech Deal Metrics

Source: PitchBook Data, Inc

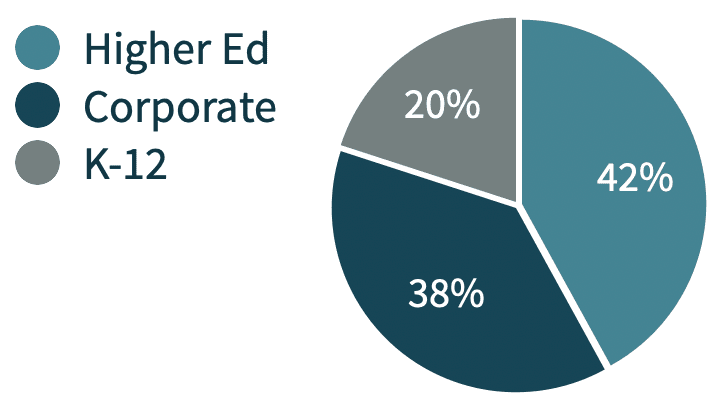

Q1 2020 Transaction Activity by EdTech Subsector

EdTech Public Comps

| Company | 52 wk. High | 52 wk. Low | Enterprise Value | TTM / Revenue | TTM / EBITDA | Enterprise Value / TTM Revenue | Enterprise Value / TTM EBITDA |

|---|---|---|---|---|---|---|---|

| Chegg, Inc. | $90 | $26 | $12,477 | $644 | $128 | 19.4x | 97.6x |

| Pluralsight, Inc. | $23 | $7 | $6,619 | $392 | NA | 8.4x | NM |

| John Wiley & Sons, Inc. | $50 | $30 | $4,046 | $1,880 | $159 | 2.2x | 25.5x |

| 2U, Inc. | $49 | $12 | $2,646 | $775 | NA | 3.4x | NM |

| Career Education Corporation | $20 | $7 | $792 | $687 | $158 | 1.2x | 5.0x |

| Learning Technologies Group plc | $2 | $1 | $1,489 | $170 | $56 | 8.8x | 26.7x |

| K12 Inc. | $53 | $15 | $1,410 | $1,273 | $117 | 1.1x | 12.0x |

| Rosetta Stone Inc. | $31 | $9 | NA | $189 | NA | NM | NM |

| Franklin Covey Co. | $42 | $13 | $381 | $188 | $15 | 2.0x | 25.4x |

| Kahoot! AS | NA | NA | NM | NM |

Source: PitchBook Data, Inc, As of 9/29/20

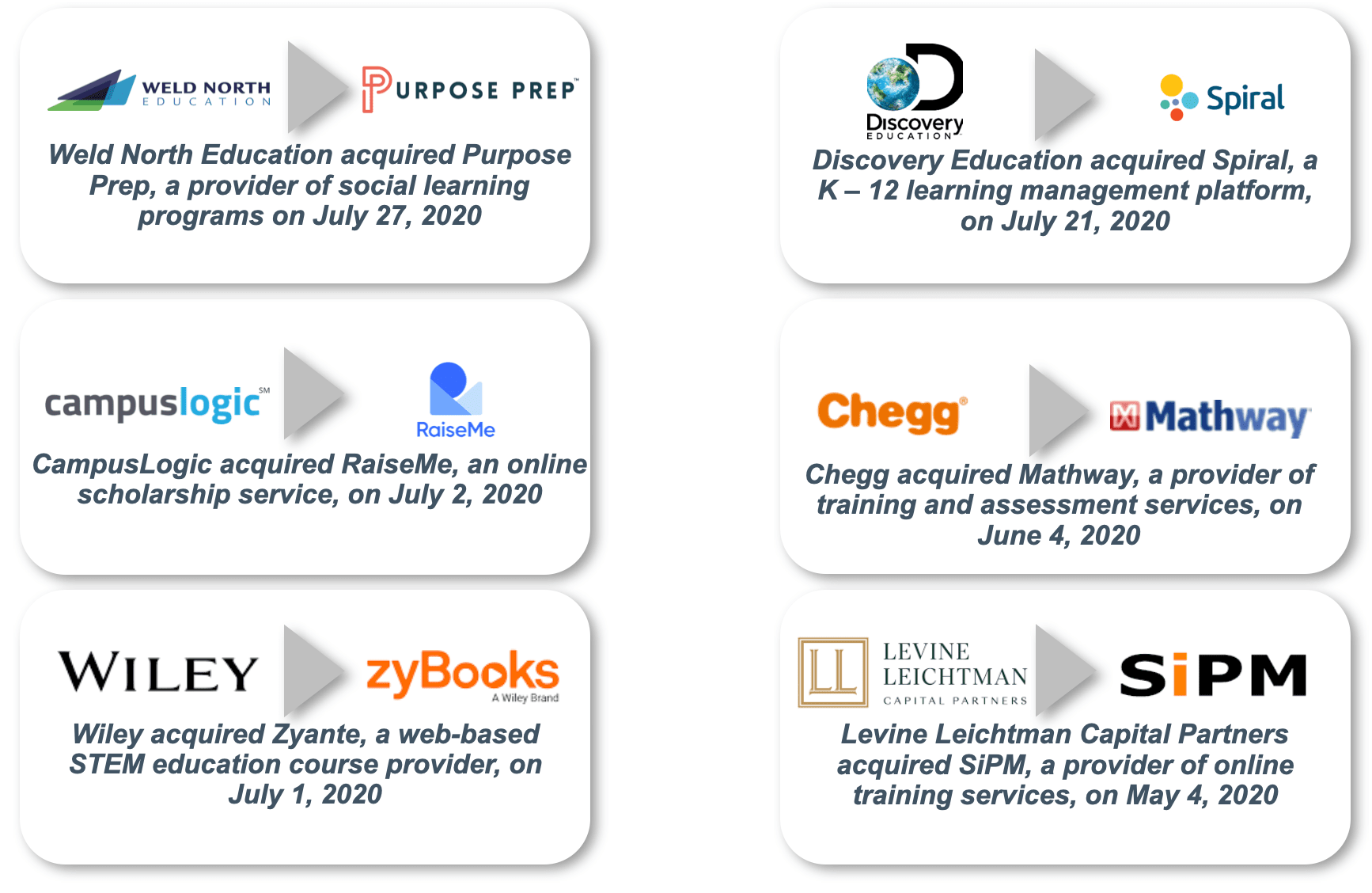

Notable EdTech Acquisitions

Recent EdTech M&A Transactions

| Date | Target | Buyer | Description | EV ($ in M) | EV / Revenue |

|---|---|---|---|---|---|

| Sep-20 | Scientific Learning Corp. | CIP Capital | Provider of educational software to support literacy, reading, and language skills. | ||

| Aug-20 | Rosetta Stone Ltd. | Veritas Capital | Developer of interactive language-learning software. | $761 | 4.0x |

| Aug-20 | Triple Creek Associates, Inc | MentorcliQ | Developer of a collaborative learning software intended to motivate employees and increase productivity. | ||

| Aug-20 | LearningMate Solutions Pvt. Ltd. | Accent Equity Partners | Provider of electronic learning (e-learning) services. | ||

| Jul-20 | Raise Labs Inc. | CampusLogic | Developer of an education management platform to provide online services that aggregate scholarship opportunities. | ||

| Jun-20 | Mathway, LLC | Chegg | Operator of an educational website committed to offering unique mathematics education to students. | $115 | 8.8x |

| May-20 | SiPM Group NV | Levine Leichtman Capital Partners | Provider of e-learning and digital training services in Belgium. | ||

| May-20 | Cengage Learning, Inc. | Apollo Global Management | Provider of learning products and services intended to provide online test preparation and training. | ||

| May-20 | ScootPad Corporation | ACT | Provider of an adaptive learning platform created to help the world’s youth enhance their learning potential. | ||

| Apr-20 | SelectQ Corporation | Thinkster Math | Provider of online education and training services based in Sunnyvale, California. | ||

| Apr-20 | SC eLearning, LLC | eLearning Brothers | Developer of eLearning software. | ||

| Mar-20 | Instructure, Inc. | Thoma Bravo | Developer of a cloud-based learning management platform designed to make teaching and learning easier. | $1,883 | 7.3x |

As of 9/29/20