Business Services M&A Trends: Spring 2020

Published May 29, 2020

Meridian Capital’s Business Services M&A Update covers the market impacts of COVID-19 on business consulting, professional services, IT consulting & staffing.

Introduction

A well-known technology columnist, once said, “Consultants must find a niche and stick to it. If you can’t find one, create one.”

The era of COVID-19 is creating new problems and re-prioritizing existing ones. Many companies are facing both economic challenges and operational challenges and are needing to navigate them quickly and virtually. Unique dynamics like the current one can often leave an open door to problem solvers and refreshed service offerings that might not have received the appropriate amount of attention previously.

At Meridian, we continue to believe that the consulting and professional services industry, particularly firms focused on digital transformation, will be well positioned as the business environment moves toward an eventual recovery. While many clients’ priorities will shift, causing canceled or delayed projects, many projects will continue to move forward with more priority than before. Professional services firms that have already embraced digital transformation as part their offerings, will continue to be very well positioned.

On the client side, the surge in demand that COVID-19 has created on cloud infrastructure, remote working solutions, and ‘connectivity technology’ generally has exposed potential inefficiencies and shortcomings. Companies undergoing digital transformations are responding quickly to the short-term impacts of the slowdown but remain largely committed to longer-term plans or initiatives. In a survey regarding new technology investments, ISG Research reported over 60% of companies have merely delayed technology rollouts 90 days and nearly a third of respondents indicated no change to plans at all.

We anticipate that professional service firms and consultancies with established solutions across digital transformation services will continue to remain attractive to buyers, both financial and strategic.

What We’re Reading

The CEO of BCG Shares how Consulting Firms Can Become ‘Bionic Companies’ that Easily Adapt to Any Crisis, Business Insider

Takeaway: Consultants are learning that a lot of client work can be done without being in the same room, which will reduce the amount of annual travel. He sees future consulting work focus around implementing digital solutions and localizing supply chains.

How COVID-19 is changing IT spending priorities for CIOs in India, CIO.com

Takeaway: IT spending priorities have changed, moving away from reach technologies like AI and data analytics to impactful tools such as cybersecurity, collaboration, and cloud.

World’s Largest Staffing Firms Form Industry Alliance for Safe Return to Work, Staffing Industry Analysts

Takeaway: Three of the world’s biggest staffing firms are collaborating with diverse stakeholder groups to share best practices and health protocols for employers and employees to follow upon the return to work.

Market Impacts Of COVID-19 on Consulting and Professional Services

Transparent Need for Technology Investment Once Recovery Begins

- Industry growth will be driven by emergent need for cloud infrastructure and increased spending on specialized software that can enhance output

- Remote work emphasizes the importance of sound IT infrastructure, communications equipment, and fast networks to sustain and support remote workforce

Consulting May Slow but Opportunities Available for Growth

- The U.S. consulting market is projected to decline from $160B in 2019 to $130B in 2020

- Near-term opportunities in restructuring or cost-cutting projects are available; BCG CEO expects that helping companies relieve short-term pressure points will persist after the crisis

- Long-term momentum created for regulatory and compliance-focused businesses, as rules and regulations develop following the crisis

- Dot Com Era: Sarbanes-Oxley (2002)

- The Great Recession: Dodd-Frank (2010)

- COVID-19 Pandemic: Potential New Regulation (20??)

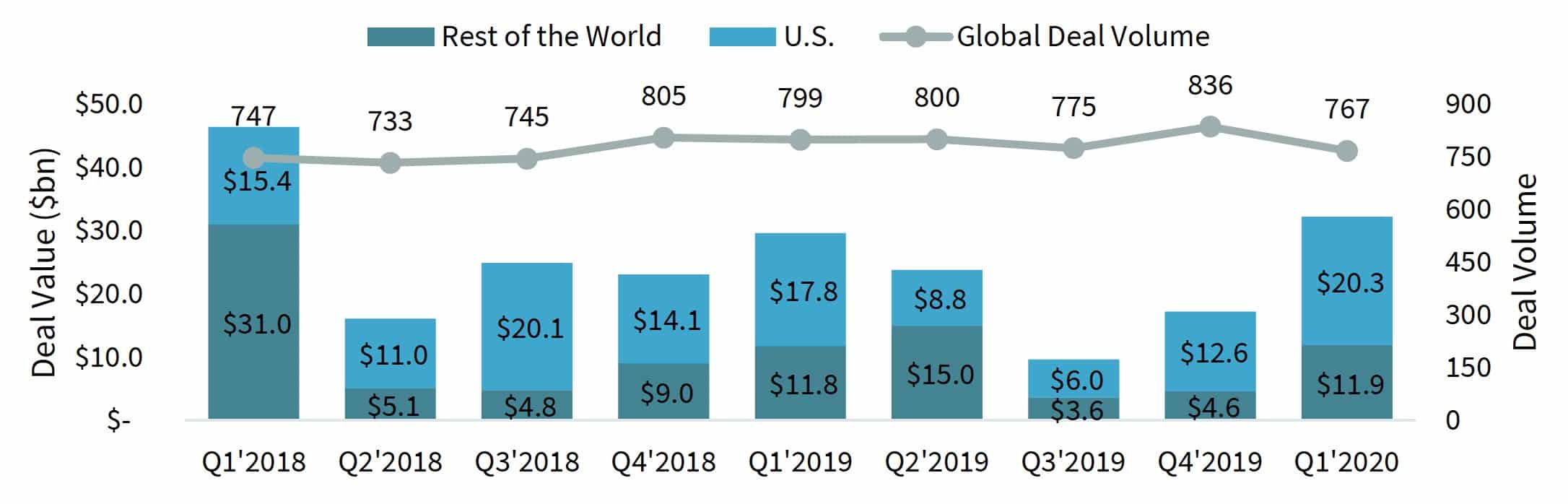

Consulting and Professional Services M&A Activity: 2018 Q1– 2020 Q2

IT Consulting Index Metrics

| Company | 52 wk. High | 52 wk. Low | Enterprise Value | TTM Revenue | TTM EBITDA | Enterprise Value / Revenue | Enterprise Value / EBITDA |

|---|---|---|---|---|---|---|---|

| Accenture PLC | $216 | $137 | $116,450 | $44,656 | $7,808 | 2.6x | 14.9x |

| Cognizant Technology Solutions Corp | $75 | $40 | $28,277 | $16,898 | $2,855 | 1.7x | 9.9x |

| DXC Technology Company | $67 | $8 | $11,945 | $20,042 | $833 | 0.6x | 14.3x |

| Wipro Limited | $4 | $2 | $12880 | $8,555 | $1812 | 1.5x | 7.1x |

| Perficient, Inc. | $54 | $19 | $1277 | $577 | $78 | 2.2x | 16.4x |

Staffing Index Metrics

| Company | 52 wk. High | 52 wk. Low | Enterprise Value | TTM Revenue | TTM EBITDA | Enterprise Value / Revenue | Enterprise Value / EBITDA |

|---|---|---|---|---|---|---|---|

| Randstad Holding nv | $62 | $30 | $8,729 | $25,974 | $1,240 | 0.3x | 7.0x |

| Adecco Group AG | $64 | $32 | $7,810 | $25,473 | $765 | 0.3x | 10.2x |

| ASGN Incorporated | $73 | $29 | $3841 | $3991 | $387 | 1.0x | 9.9x |

| Kforce Inc. | $43 | $21 | $708 | $1356 | $79 | 0.5x | 9.0x |

| TrueBlue, Inc. | $26 | $12 | $583 | $2311 | ($81) | 0.3x | -7.2x |

Notable Business Services Acquisitions

Recent Business Services Transactions

| Date | Target | Description | EV ($ in M) | EV / Revenue |

|---|---|---|---|---|

| Mar-20 | IntelliCorp Records Inc. Cisive / CIP Capital | Provider of background checks and employment screening solutions. | – | – |

| Mar-20 | Talavant, Inc. Baker Tilly International | Operates a data analytics based management consulting firm. | – | – |

| Mar-20 | LegalPartners, LLC Eureka Equity Partners | Offers temporary and permanent legal staffing services for law firms and corporate law departments. | – | – |

| Mar-20 | Disys LNC Partners | Provider of managed services and staffing. | – | – |

| Mar-20 | Accelalpha Century Park Capital Partners | Accelalpha is a global leader in Oracle logistics suite implementation and consulting services. | – | – |

| Mar-20 | Context Information Security Accenture | Provider of specialist technical consultancy services for the cyber security market. | $138 | |

| Feb-20 | Segue Technologies Tetra Tech | IT management consulting firm for Federal agencies. | – | – |

| Feb-20 | Kalypso LP Rockwell Automation | Providers of digital transformation for industrial companies. | – | – |

| Feb-20 | The Armada Group Eliassen Group | Provider of IT staffing services. | – | – |

| Feb-20 | EdgeRock Technology BG Staffing | IT consultant offering full life-cycle project delivery, consulting, system integration and managed services. | $22 | 0.5x |

| Jan-20 | Incentive Technology Group ICF International | Provider of digital consulting services. | $255 | 2.8x |

| Jan-20 | Blackstone Federal ASGN Inc | Provider of app development, IT, cybersecurity, and user experience design services to government sectors. | $85 | 1.9x |

| Jan-20 | Sumo.cumo Sapiens International | Provider of digital advertising and consulting services. | $35 | 2.1x |